Continuous Blood Glucose Monitoring Market Synopsis

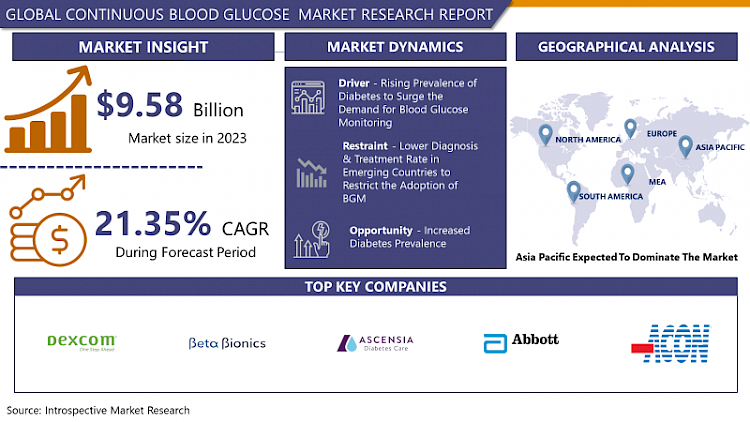

Continuous Blood Glucose Market Size Was Valued at USD 9.58 Billion in 2023 and is Projected to Reach USD 54.67 Billion by 2032, Growing at a CAGR of 21.35 % From 2024-2032.

Continuous glucose monitoring means using a device to automatically estimate your blood glucose level, also called blood sugar, throughout the day and night. The continuous blood glucose monitoring (CGM) market was experiencing rapid growth, driven by increasing diabetes prevalence, advancements in CGM technology, and a growing awareness of the benefits of continuous glucose monitoring.

- CGM devices are minimally invasive and offer an easy and effective way to manage diabetes. They can also detect drastic changes in blood glucose levels, thereby preventing hypoglycemic conditions. The CGM devices facilitate the analysis of blood glucose levels at different time intervals with the help of a sensor. Respective readings fed into diabetes management software through a wireless network allow patients to understand the disease better, thereby helping them to manage it more effectively.

- In addition to high blood pressure and high cholesterol, common risk factors for diabetes complications include smoking, obesity, inactivity, and being overweight. According to the International Diabetes Federation, there will be 536.6 million people with diabetes worldwide in 2021.

- Through the use of CGM devices, patients can receive information on their food intake, medication use, physical activity, and illnesses. Connecting with diabetes patients has become simpler for CGM device manufacturers thanks to the development of digital therapeutics. Numerous apps on the market combine CGM data for future trend analysis and lifestyle adjustments that the patient needs to make. All of these elements are anticipated to have a positive impact on the expansion of the market for continuous glucose monitoring devices.

The Continuous Blood Glucose Monitoring Market Trend Analysis

Rising Prevalence of Diabetes to Surge the Demand for Blood Glucose Monitoring

- The rising prevalence of diabetes is primarily caused by several factors, including rapid urbanization and the rising trend toward a sedentary lifestyle in emerging and developed nations. For instance, the International Diabetes Federation reported that in 2021, there were an estimated 537 million adults worldwide who had diabetes, with China, India, the United States, Brazil, and Mexico making up an estimated 51.6% of those individuals. The number of people with type 1 or insulin-dependent type 2 diabetes has significantly increased, which has accelerated the adoption of these systems internationally.

- For instance, according to the data published by the International Diabetes Federation, in 2021, it was estimated that the incidence of type 1 diabetes was 149.5 per 1,000 in children and adolescents aged (0-19) years and the global prevalence was around 9.8% among the total population. Thus, the presence of a large diabetic population suffering from insulin-dependent diabetes, new product introduction by market players, and favorable reimbursement are fueling the demand and adoption of diabetes monitoring products such as BGMs.

Increased Diabetes Prevalence

- The escalating global prevalence of diabetes provides a significant and enduring opportunity for Continuous Blood Glucose Monitoring (CGM) manufacturers. This trend is primarily propelled by a convergence of factors, including aging populations, sedentary lifestyles, and unhealthy dietary habits. As the world's population ages, the incidence of diabetes rises since the elderly are more susceptible to this condition. This demographic shift creates a sustained demand for effective glucose-monitoring solutions.

- The prevalence of sedentary lifestyles and poor dietary choices has led to an upsurge in type 2 diabetes cases, even among younger age groups. CGM can play a pivotal role in managing this form of diabetes, offering manufacturers an opportunity to cater to a broader spectrum of patients.

- Furthermore, the increasing recognition of the benefits of proactive diabetes management underscores the importance of CGM. Tight glucose control is crucial in preventing complications, and CGM systems empower individuals to make informed decisions about their diabetes management in real-time.

Continuous Blood Glucose Monitoring Market Segment Analysis

Continuous Blood Glucose Monitoring market segments cover the Product, application, and end-users. By Product, the Sensors segment is anticipated to dominate the Market over the Forecast period.

- Sensors are the most sophisticated part of CGM devices and consist of a metallic filament, thinner than a needle, which is inserted into the fatty layer just below the skin. The technology used in sensors is slightly different than the one used in transmitters and receivers. These components use glucose oxidase to detect blood sugar levels.

- Continuous glucose monitoring (CGM) sensors are portable devices that allow measuring and visualizing the glucose concentration almost continuously (usually every 1–5 min) for several days (so far up to seven days). CGM sensors are composed of three main elements: (i) a needle-based sensor, which is usually inserted in the abdominal subcutis and measures an electrical signal proportional to the glucose concentration present in the interstitial fluid; (ii) a transmitter, which is applied over the sensor and is aimed at transmitting the signal; and (iii) a portable device, which receives the signal and visualizes it on a monitor.

- In particular, the final signal is a glucose concentration, and it is obtained by converting the raw electrical signal measured by the sensor via a calibration procedure that exploits one or more reference blood glucose (BG) values collected using a portable self-monitoring BG (SMBG) device. Note that the calibration can take place either in the transmitter or in the receiver.

Continuous Blood Glucose Monitoring Market Regional Analysis

North America is expected to dominate the Market over the Forecast period.

- The countries in the North American region depict a high prevalence of diabetes. Due to the large pool of patients and wider acceptance of advanced technologies, the United States held the largest share of the glucose monitoring market in 2019. According to the International Diabetes Federation (IDF), approximations, in 2019, 463 million adults (aged 20-79) around the world had diabetes, including 31 million in the United States.

- Besides, other factors, such as new advancements and innovations, give many conveniences in measuring blood glucose levels. The innovations from start-up companies in the U.S., having around 2.9 billion in funding in the diabetes industry like Glooko, OneDrop, verily, Vacate, Insulet, Noom, Bigfoot Biomedical, Virta Health, Diabeloop, Orgenesis, etc., drive the United States market.

- The emergence of CGM has revolutionized the blood sugar monitoring process, as CGM-based devices monitor blood sugar every few minutes through a tiny sensor inserted under the patient's skin and relay results wirelessly to a pump, tablet, or other units.

Top Key Players Covered in The Continuous Blood Glucose Monitoring Market

- Abbott (U.S.)

- ACON Laboratories (US)

- ARKRAY (Japan)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- B. Braun Melsungen AG (Germany)

- Beta Bionics, Inc. (US)

- Dexcom, Inc. (U.S.)

- Echo Therapeutics Inc. (US)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GlySens Incorporated (US)

- Integrity Applications Inc.

- LifeScan IP Holdings, LLC (U.S.)

- Medisana AG (Germany)

- Medtronic (Ireland)

- Metronom Health Inc. (US)

- Nipro (Japan)

- Nova Biomedical (US)

- OrSense Ltd. (Israel)

- PKvitality (France)

- Prodigy Diabetes Care (US)

- Sanofi (France)

- Senseonics (U.S.)

- Siren Care, Inc. (US)

- Terumo Corporation (Japan)

- Ypsomed (Switzerland), and other major players.

Key Industry Developments in the Continuous Blood Glucose Monitoring Market

- In March 2023, Abbott is thrilled to announce the U.S. FDA has approved our FreeStyle Libre 2 and FreeStyle Libre 3 integrated Continuous Glucose Monitoring (CGM) sensors to be seamlessly integrated with automated insulin delivery systems. This milestone marks a significant advancement in diabetes care, empowering patients with enhanced control and convenience. Abbott remains committed to innovation in diabetes management.

- In September 2023, Nemaura Medical Inc. announced its strategic partnership with Eversana for the introduction of Nemaura's cutting-edge diabetes management system in the United States. This collaboration promises to revolutionize diabetes care, providing innovative solutions to patients nationwide. Together, we are committed to improving the lives of those living with diabetes.

|

Continuous Blood Glucose Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.35% |

Market Size in 2032: |

USD 54.67 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Testing Site |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY PRODUCT (2017-2032)

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RECEIVERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SENSORS

- INSULIN PUMP

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY TESTING SITE (2017-2032)

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FINGERTIP TESTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ALTERNATE SITE TESTING

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY END-USER (2017-2032)

- CONTINUOUS BLOOD GLUCOSE MONITORING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOME CARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIAGNOSTICS CENTRES

- HOSPITALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- CONTINUOUS BLOOD GLUCOSE MONITORING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABBOTT (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ACON LABORATORIES (US)

- ARKRAY (JAPAN)

- ASCENSIA DIABETES CARE HOLDINGS AG (SWITZERLAND)

- B. BRAUN MELSUNGEN AG (GERMANY)

- BETA BIONICS, INC. (US)

- DEXCOM, INC. (U.S.)

- ECHO THERAPEUTICS INC. (US)

- F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

- GLYSENS INCORPORATED (US)

- INTEGRITY APPLICATIONS INC.

- LIFESCAN IP HOLDINGS, LLC (U.S.)

- MEDISANA AG (GERMANY)

- MEDTRONIC (IRELAND)

- METRONOM HEALTH INC. (US)

- NIPRO (JAPAN)

- NOVA BIOMEDICAL (US)

- ORSENSE LTD. (ISRAEL)

- PKVITALITY (FRANCE)

- PRODIGY DIABETES CARE (US)

- SANOFI (FRANCE)

- SENSEONICS (U.S.)

- SIREN CARE, INC. (US)

- TERUMO CORPORATION (JAPAN)

- YPSOMED (SWITZERLAND), AND OTHER MAJOR PLAYERS.

- COMPETITIVE LANDSCAPE

- GLOBAL CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Testing Site

- Historic And Forecasted Market Size By End-Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Continuous Blood Glucose Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.35% |

Market Size in 2032: |

USD 54.67 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Testing Site |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET COMPETITIVE RIVALRY

TABLE 005. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET THREAT OF NEW ENTRANTS

TABLE 006. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET THREAT OF SUBSTITUTES

TABLE 007. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY PRODUCT

TABLE 008. RECEIVERS MARKET OVERVIEW (2016-2030)

TABLE 009. SENSORS MARKET OVERVIEW (2016-2030)

TABLE 010. INSULIN PUMP MARKET OVERVIEW (2016-2030)

TABLE 011. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY TESTING SITE

TABLE 012. FINGERTIP TESTING MARKET OVERVIEW (2016-2030)

TABLE 013. ALTERNATE SITE TESTING MARKET OVERVIEW (2016-2030)

TABLE 014. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET BY END-USER

TABLE 015. HOME CARE MARKET OVERVIEW (2016-2030)

TABLE 016. DIAGNOSTICS CENTRES MARKET OVERVIEW (2016-2030)

TABLE 017. HOSPITALS MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 019. NORTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 020. NORTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 021. N CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 022. EASTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 023. EASTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 024. EASTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 025. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 026. WESTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 027. WESTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 028. WESTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 029. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 030. ASIA PACIFIC CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 031. ASIA PACIFIC CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 032. ASIA PACIFIC CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 033. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 034. MIDDLE EAST & AFRICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 037. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 038. SOUTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY PRODUCT (2016-2030)

TABLE 039. SOUTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY TESTING SITE (2016-2030)

TABLE 040. SOUTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY END-USER (2016-2030)

TABLE 041. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET, BY COUNTRY (2016-2030)

TABLE 042. ABBOTT (U.S.): SNAPSHOT

TABLE 043. ABBOTT (U.S.): BUSINESS PERFORMANCE

TABLE 044. ABBOTT (U.S.): PRODUCT PORTFOLIO

TABLE 045. ABBOTT (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ACON LABORATORIES (US): SNAPSHOT

TABLE 046. ACON LABORATORIES (US): BUSINESS PERFORMANCE

TABLE 047. ACON LABORATORIES (US): PRODUCT PORTFOLIO

TABLE 048. ACON LABORATORIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ARKRAY (JAPAN): SNAPSHOT

TABLE 049. ARKRAY (JAPAN): BUSINESS PERFORMANCE

TABLE 050. ARKRAY (JAPAN): PRODUCT PORTFOLIO

TABLE 051. ARKRAY (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ASCENSIA DIABETES CARE HOLDINGS AG (SWITZERLAND): SNAPSHOT

TABLE 052. ASCENSIA DIABETES CARE HOLDINGS AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 053. ASCENSIA DIABETES CARE HOLDINGS AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 054. ASCENSIA DIABETES CARE HOLDINGS AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. B. BRAUN MELSUNGEN AG (GERMANY): SNAPSHOT

TABLE 055. B. BRAUN MELSUNGEN AG (GERMANY): BUSINESS PERFORMANCE

TABLE 056. B. BRAUN MELSUNGEN AG (GERMANY): PRODUCT PORTFOLIO

TABLE 057. B. BRAUN MELSUNGEN AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BETA BIONICS: SNAPSHOT

TABLE 058. BETA BIONICS: BUSINESS PERFORMANCE

TABLE 059. BETA BIONICS: PRODUCT PORTFOLIO

TABLE 060. BETA BIONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. INC. (US): SNAPSHOT

TABLE 061. INC. (US): BUSINESS PERFORMANCE

TABLE 062. INC. (US): PRODUCT PORTFOLIO

TABLE 063. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. DEXCOM: SNAPSHOT

TABLE 064. DEXCOM: BUSINESS PERFORMANCE

TABLE 065. DEXCOM: PRODUCT PORTFOLIO

TABLE 066. DEXCOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. INC. (U.S.): SNAPSHOT

TABLE 067. INC. (U.S.): BUSINESS PERFORMANCE

TABLE 068. INC. (U.S.): PRODUCT PORTFOLIO

TABLE 069. INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ECHO THERAPEUTICS INC. (US): SNAPSHOT

TABLE 070. ECHO THERAPEUTICS INC. (US): BUSINESS PERFORMANCE

TABLE 071. ECHO THERAPEUTICS INC. (US): PRODUCT PORTFOLIO

TABLE 072. ECHO THERAPEUTICS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. F. HOFFMANN-LA ROCHE LTD (SWITZERLAND): SNAPSHOT

TABLE 073. F. HOFFMANN-LA ROCHE LTD (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 074. F. HOFFMANN-LA ROCHE LTD (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 075. F. HOFFMANN-LA ROCHE LTD (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GLYSENS INCORPORATED (US): SNAPSHOT

TABLE 076. GLYSENS INCORPORATED (US): BUSINESS PERFORMANCE

TABLE 077. GLYSENS INCORPORATED (US): PRODUCT PORTFOLIO

TABLE 078. GLYSENS INCORPORATED (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. INTEGRITY APPLICATIONS INC.: SNAPSHOT

TABLE 079. INTEGRITY APPLICATIONS INC.: BUSINESS PERFORMANCE

TABLE 080. INTEGRITY APPLICATIONS INC.: PRODUCT PORTFOLIO

TABLE 081. INTEGRITY APPLICATIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. LIFESCAN IP HOLDINGS: SNAPSHOT

TABLE 082. LIFESCAN IP HOLDINGS: BUSINESS PERFORMANCE

TABLE 083. LIFESCAN IP HOLDINGS: PRODUCT PORTFOLIO

TABLE 084. LIFESCAN IP HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. LLC (U.S.): SNAPSHOT

TABLE 085. LLC (U.S.): BUSINESS PERFORMANCE

TABLE 086. LLC (U.S.): PRODUCT PORTFOLIO

TABLE 087. LLC (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. MEDISANA AG (GERMANY): SNAPSHOT

TABLE 088. MEDISANA AG (GERMANY): BUSINESS PERFORMANCE

TABLE 089. MEDISANA AG (GERMANY): PRODUCT PORTFOLIO

TABLE 090. MEDISANA AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. MEDTRONIC (IRELAND): SNAPSHOT

TABLE 091. MEDTRONIC (IRELAND): BUSINESS PERFORMANCE

TABLE 092. MEDTRONIC (IRELAND): PRODUCT PORTFOLIO

TABLE 093. MEDTRONIC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. METRONOM HEALTH INC. (US): SNAPSHOT

TABLE 094. METRONOM HEALTH INC. (US): BUSINESS PERFORMANCE

TABLE 095. METRONOM HEALTH INC. (US): PRODUCT PORTFOLIO

TABLE 096. METRONOM HEALTH INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. NIPRO (JAPAN): SNAPSHOT

TABLE 097. NIPRO (JAPAN): BUSINESS PERFORMANCE

TABLE 098. NIPRO (JAPAN): PRODUCT PORTFOLIO

TABLE 099. NIPRO (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. NOVA BIOMEDICAL (US): SNAPSHOT

TABLE 100. NOVA BIOMEDICAL (US): BUSINESS PERFORMANCE

TABLE 101. NOVA BIOMEDICAL (US): PRODUCT PORTFOLIO

TABLE 102. NOVA BIOMEDICAL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. ORSENSE LTD. (ISRAEL): SNAPSHOT

TABLE 103. ORSENSE LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 104. ORSENSE LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 105. ORSENSE LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. PKVITALITY (FRANCE): SNAPSHOT

TABLE 106. PKVITALITY (FRANCE): BUSINESS PERFORMANCE

TABLE 107. PKVITALITY (FRANCE): PRODUCT PORTFOLIO

TABLE 108. PKVITALITY (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. PRODIGY DIABETES CARE (US): SNAPSHOT

TABLE 109. PRODIGY DIABETES CARE (US): BUSINESS PERFORMANCE

TABLE 110. PRODIGY DIABETES CARE (US): PRODUCT PORTFOLIO

TABLE 111. PRODIGY DIABETES CARE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. SANOFI (FRANCE): SNAPSHOT

TABLE 112. SANOFI (FRANCE): BUSINESS PERFORMANCE

TABLE 113. SANOFI (FRANCE): PRODUCT PORTFOLIO

TABLE 114. SANOFI (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. SENSEONICS (U.S.): SNAPSHOT

TABLE 115. SENSEONICS (U.S.): BUSINESS PERFORMANCE

TABLE 116. SENSEONICS (U.S.): PRODUCT PORTFOLIO

TABLE 117. SENSEONICS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. SIREN CARE: SNAPSHOT

TABLE 118. SIREN CARE: BUSINESS PERFORMANCE

TABLE 119. SIREN CARE: PRODUCT PORTFOLIO

TABLE 120. SIREN CARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. INC. (US): SNAPSHOT

TABLE 121. INC. (US): BUSINESS PERFORMANCE

TABLE 122. INC. (US): PRODUCT PORTFOLIO

TABLE 123. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. TERUMO CORPORATION (JAPAN): SNAPSHOT

TABLE 124. TERUMO CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 125. TERUMO CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 126. TERUMO CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. YPSOMED (SWITZERLAND): SNAPSHOT

TABLE 127. YPSOMED (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 128. YPSOMED (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 129. YPSOMED (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 129. AND OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 130. AND OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 131. AND OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 132. AND OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY PRODUCT

FIGURE 012. RECEIVERS MARKET OVERVIEW (2016-2030)

FIGURE 013. SENSORS MARKET OVERVIEW (2016-2030)

FIGURE 014. INSULIN PUMP MARKET OVERVIEW (2016-2030)

FIGURE 015. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY TESTING SITE

FIGURE 016. FINGERTIP TESTING MARKET OVERVIEW (2016-2030)

FIGURE 017. ALTERNATE SITE TESTING MARKET OVERVIEW (2016-2030)

FIGURE 018. CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY END-USER

FIGURE 019. HOME CARE MARKET OVERVIEW (2016-2030)

FIGURE 020. DIAGNOSTICS CENTRES MARKET OVERVIEW (2016-2030)

FIGURE 021. HOSPITALS MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA CONTINUOUS BLOOD GLUCOSE MONITORING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Automotive Logistics Market research report is 2024-2032.

Abbott (U.S.), ACON Laboratories (US), ARKRAY (Japan), Ascensia Diabetes Care Holdings AG (Switzerland), B. Braun Melsungen AG (Germany), Beta Bionics, Inc. (US), Dexcom, Inc. (U.S.), Echo Therapeutics Inc. (US), F. Hoffmann-La Roche Ltd (Switzerland), GlySens Incorporated (US), Integrity Applications Inc., LifeScan IP Holdings, LLC (U.S.), Medisana AG (Germany), Medtronic (Ireland), Metronom Health Inc. (US), Nipro (Japan), Nova Biomedical (US), OrSense Ltd. (Israel), PKvitality (France), Prodigy Diabetes Care (US), Sanofi (France), Senseonics (U.S.), Siren Care, Inc. (US), Terumo Corporation (Japan), Ypsomed (Switzerland), and other major players.

The Continuous Blood Glucose Monitoring Market is segmented into Product, Testing Site, End-User, and region. By Product, the market is categorized into Receivers, Sensors, and Insulin pumps. By Testing Site, the market is categorized into Fingertip testing and alternate Site Testing. By End-User, the market is categorized into Home Care, Diagnostics Centres, and Hospitals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Continuous glucose monitoring means using a device to automatically estimate your blood glucose level, also called blood sugar, throughout the day and night. The continuous blood glucose monitoring (CGM) market was experiencing rapid growth, driven by increasing diabetes prevalence, advancements in CGM technology, and a growing awareness of the benefits of continuous glucose monitoring.

Continuous Blood Glucose Market Size Was Valued at USD 9.58 Billion in 2023 and is Projected to Reach USD 54.67 Billion by 2032, Growing at a CAGR of 21.35 % From 2024-2032.