Global Composite Cans Market Synopsis

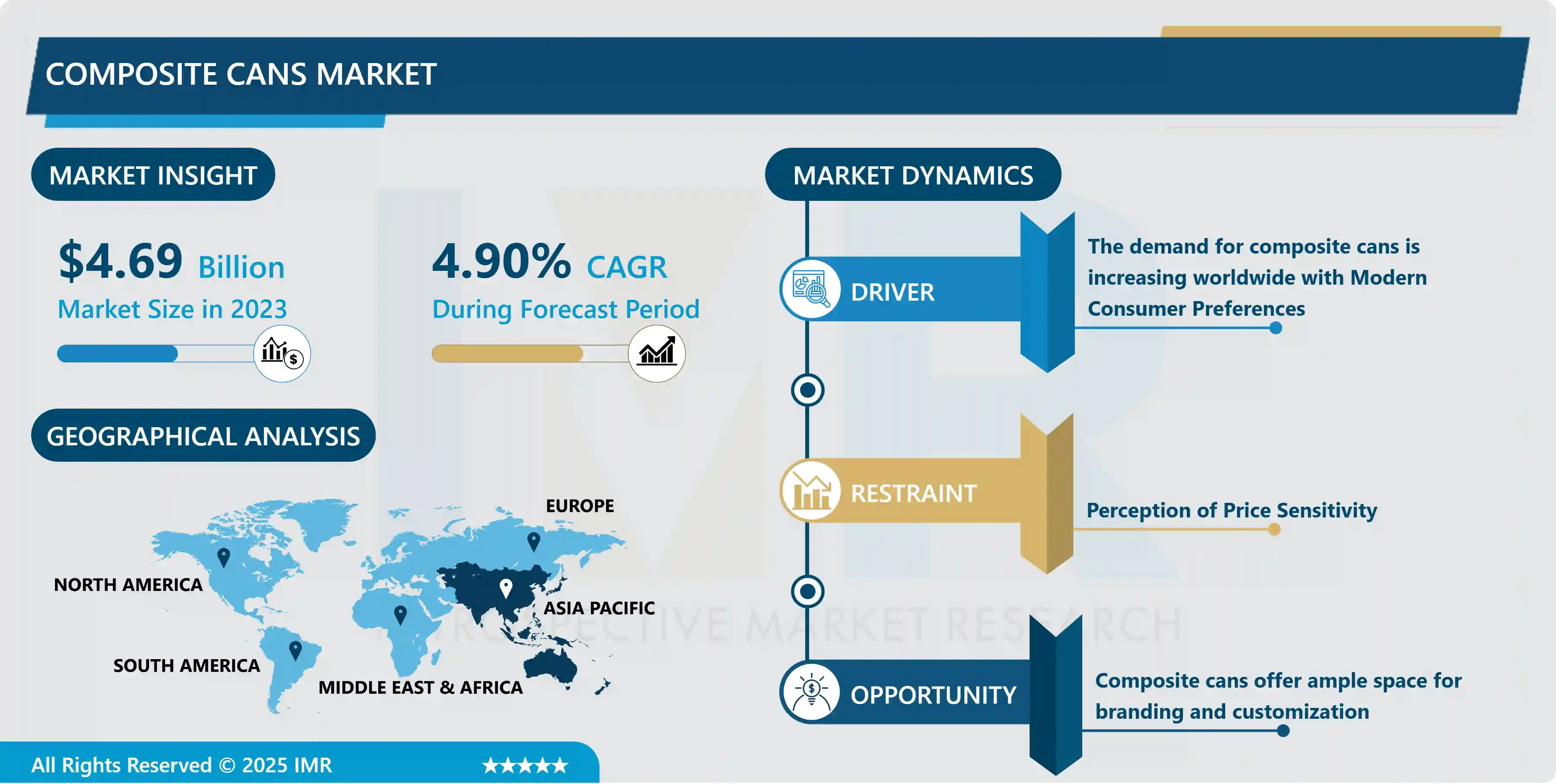

Composite Cans Market Size Was Valued at USD 4.69 Billion in 2023 and is Projected to Reach USD 7.54 Billion by 2032, Growing at a CAGR of 4.90% From 2024-2032.

Composite cans are cylindrical containers made from multiple layers of materials, designed to provide durability, strength, and versatility for packaging various products. These cans typically consist of a paperboard body and a metal or plastic base and lid, creating a robust structure that protects the contents inside. The paperboard layer serves as the primary material, providing rigidity, while the inner layers, often composed of foil or plastic, enhance the can's barrier properties, ensuring the preservation of the packaged goods by shielding them from moisture, light, and external elements.

composite cans are adaptable in different industries, ranging from food and beverages to cosmetics and industrial products. Their customizable nature allows for branding opportunities through printing high-quality graphics directly onto the can's surface, making them an effective marketing tool for companies aiming to stand out on the shelves. Additionally, composite cans are eco-friendly, as they are usually recyclable and lightweight, reducing transportation costs and environmental impact compared to heavier packaging alternatives.

These cans have gained popularity due to their convenience, functionality, and sustainability. Their versatility in size, shape, and closure options makes them suitable for a wide array of products, providing manufacturers with a reliable packaging solution that not only ensures product integrity but also appeals to consumers seeking practical and environmentally conscious packaging choices.

Composite Cans Market Trend Analysis

The Demand for Composite Cans Is Increasing Worldwide with Modern Consumer Preferences

- Composite cans have witnessed a remarkable surge in demand globally, aligning with the evolving preferences of modern consumers. These cylindrical containers, constructed from various materials like paperboard and plastic, offer a versatile packaging solution that caters to the changing needs of consumers and businesses alike.

- One significant driver behind the escalating demand is the shift in consumer preferences towards sustainability. With a growing consciousness about environmental impact, consumers are gravitating towards eco-friendly options. Composite cans, often recyclable and made from renewable materials, are seen as a more sustainable packaging choice compared to traditional alternatives like plastic or metal containers. This eco-conscious trend has spurred the adoption of composite cans across industries as brands seek to align with consumers' values.

- These containers are lightweight, durable, and customizable, making them ideal for a wide range of products, including snacks, powdered beverages, and even personal care items. Their user-friendly design, often featuring resealable lids and easy-to-handle shapes, enhances the overall consumer experience, driving their preference for such packaging solutions.

- The global market's expanding e-commerce sector has also contributed significantly to the increased demand for composite cans. With online shopping becoming more prevalent, especially in the wake of recent shifts in consumer behaviour, the need for durable and protective packaging has intensified.

- Composite cans offer robust protection for goods during transit, reducing the risk of damage while maintaining product freshness, thus appealing to both retailers and consumers.

Composite Cans Offer Ample Space for Branding and Customization

- The versatility of composite cans as a canvas for branding and customization has grown to be a strategic device for groups throughout various sectors. These cans provide extra than only a container; they function a platform for corporations to carry their logo tale and captivate clients visually. With enough floor vicinity and customizable dimensions, producers have embraced the possibility to create unique, fascinating packaging answers that stand out on cabinets crowded with competing products.

- Marking for composite cans is not limited to logos or labels; it's an opportunity to create an immersive brand experience. Companies use the full surface of these cans to display vibrant graphics, intricate designs and compelling stories that resonate with their target audience. Whether it's bold colour schemes, striking images or narrative elements, these cans become an extension of the brand and identity that leave a lasting impression on consumers.

- The power of visual appeal cannot be overstated in today's competitive market. Composite cans provide a versatile canvas for innovative packaging designs that not only attract attention, but also communicate product quality and brand values. This ability to combine functionality with aesthetics allows companies to create a distinct presence that promotes brand loyalty and recognition among consumers who are increasingly interested in memorable and visually appealing packaging.

Composite Cans Market Segment Analysis:

Composite Cans Market Segmented on the basis of type, application, and end-users.

By Product Type Convolute Winding segment is expected to dominate the market during the forecast period

- Convolute Winding cans represent a robust and durable packaging solution within the composite cans market. Their construction involves spirally winding multiple layers of materials, typically paperboard and other substrates, to create a sturdy cylindrical container. This method results in cans known for their strength and ability to withstand pressure, making them ideal for packaging heavy or bulky products that require reliable protection during storage and transit.

- Convolute Winding cans lies in their structural integrity. Their layered construction offers exceptional resistance to crushing, ensuring the safe transportation and preservation of goods, particularly those sensitive to external forces. Industries such as food, where items like snacks, powdered goods, or confectioneries require secure packaging, often rely on Convolute Winding cans for their durability and protective qualities.

By Can Diameter, 50 mm segment held the largest share of 28.9% in 2022

- Can diameters less than 50 mm play a pivotal role in packaging solutions tailored for compact and single-use items across various industries. These smaller cans find their niche in sectors such as food, where they efficiently house spices, condiments, or individual snack portions. Their compact dimensions offer practicality, catering perfectly to on-the-go consumption trends and the rising demand for portable, convenient packaging. In today's fast-paced lifestyle, consumers seek portion control and ease of use, making these smaller cans an ideal choice for products that are typically consumed in limited quantities.

- Their versatility extends beyond food items, encompassing a range of single-use products in different sectors. From beauty and personal care items to small household essentials, can diameters less than 50 mm serve as a packaging solution for items that benefit from individual, controlled portions

Composite Cans Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region has been experiencing robust economic growth for several years, leading to an increase in disposable income and consumer spending. As a result, there is a growing demand for packaged goods, including food, beverages, and personal care products, which often use composite cans for packaging. Additionally, urbanization in the region has led to changes in consumer lifestyles, driving the need for convenient, ready-to-consumer products that are often found in composite cans.

- Asia Pacific is home to a significant portion of the world's population, including large and rapidly expanding middle-class and urban populations. This demographic trend creates a substantial market for various consumer goods that utilize composite cans for packaging. Manufacturers are keen to tap into this vast consumer base, which contributes to the region's dominance in the market.

Composite Cans Market Top Key Players:

- Ace Paper Tube (US)

- Nagel Paper (US)

- Sonoco Products Company (US)

- PTS Manufacturing Co (US)

- Valk Industries, Inc. (US)

- Western Container Corp. (US)

- Chicago Mailing Tube (US)

- Paper Tubes & Sales (US)

- Crown Holdings, Inc (US)

- Silgan Holdings, Inc (US)

- Ardagh Group (Luxembourg)

- CANFAB PACKAGING INC(Canada)

- Mondi (UK)

- SAFEPACK INDUSTRIES LTD(India)

- ECO CANISTER (India)

- Apl Technopack (India)

- The Tin Factory (India)

- Ecopack Solutions (India)

- Starride Paper Tube Pvt. Ltd. (India)

- Amcor plc (Australia)

- Irwin Packaging (Australia)

- COREX Group (Belgium)

- Smurfit Kappa (Dublin)

- Kunert Gruppe (Germany)

- Can Pack S.A(Poland)

Key Industry Developments in the Composite Cans Market:

- In November, 2023, Amcor a global leader in developing and producing responsible packaging solutions, announced a Memorandum of Understanding (MOU) with leading sustainable polyethylene producer NOVA Chemicals Corporation (“NOVA Chemicals”) for the purchase of mechanically recycled polyethylene resin (rPE) for use in flexible packaging films. Increasing the use of rPE in flexible packaging applications is an important element of Amcor’s commitment to support packaging circularity.

- In April, 2024, Amcor, a global leader in developing and producing responsible packaging solutions, launched a one-liter polyethylene terephthalate (PET) bottle for carbonated soft drink (CSD) use that is made from 100% post-consumer recycled (PCR) content. This first-of-its-kind stock option will support customers as they strive to meet sustainability commitments and requirements.

| Composite Cans Market | ||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.69 Bn. |

|

|

CAGR (2024-2032): |

4.90% |

Market Size in 2032: |

USD 7.54 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Can Diameter |

|

|

||

|

By Closure Type |

|

|

||

|

By Application |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Composite Cans Market by Product Type (2018-2032)

4.1 Composite Cans Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Convolute Winding

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Linear Draw Cans

4.5 Spiral Wound Cans

Chapter 5: Composite Cans Market by Can Diameter (2018-2032)

5.1 Composite Cans Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Less than 50 mm

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 50mm-100mm

5.5 100mm and Above

Chapter 6: Composite Cans Market by Closure Type (2018-2032)

6.1 Composite Cans Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Lids

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Caps

Chapter 7: Composite Cans Market by Application (2018-2032)

7.1 Composite Cans Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Agriculture

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Consumer Goods

7.5 Food and Beverages

7.6 Industrial Goods

7.7 Personal Care and Cosmetics

7.8 Textiles and Apparel

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Composite Cans Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GM(US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CHRYSLER GROUP (US)

8.4 JACOBS (US)

8.5 BOSTON (US)

8.6 BORGWARNER (US)

8.7 GARMIN LTD (US)

8.8 BORGWARNER INC. (US)

8.9 ROBERT BOSCH (GERMANY)

8.10 CONTINENTAL AG (GERMANY)

8.11 VOLKSWAGEN (GERMANY)

8.12 BOSCH (GERMANY)

8.13 MERCEDES-BENZ (GERMANY)

8.14 SCHAEFFLER (GERMANY)

8.15 FEV (GERMANY)

8.16 DELPHI TECHNOLOGIES (UK)

8.17 EATON (IRELAND)

8.18 VALEO (FRANCE)

8.19 MAZDA (JAPAN)

8.20 TOYOTA (JAPAN)

8.21 DENSO CORPORATION (JAPAN)

8.22 HITACHI (JAPAN)

8.23 HONDA (JAPAN)

Chapter 9: Global Composite Cans Market By Region

9.1 Overview

9.2. North America Composite Cans Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Convolute Winding

9.2.4.2 Linear Draw Cans

9.2.4.3 Spiral Wound Cans

9.2.5 Historic and Forecasted Market Size by Can Diameter

9.2.5.1 Less than 50 mm

9.2.5.2 50mm-100mm

9.2.5.3 100mm and Above

9.2.6 Historic and Forecasted Market Size by Closure Type

9.2.6.1 Lids

9.2.6.2 Caps

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Agriculture

9.2.7.2 Consumer Goods

9.2.7.3 Food and Beverages

9.2.7.4 Industrial Goods

9.2.7.5 Personal Care and Cosmetics

9.2.7.6 Textiles and Apparel

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Composite Cans Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Convolute Winding

9.3.4.2 Linear Draw Cans

9.3.4.3 Spiral Wound Cans

9.3.5 Historic and Forecasted Market Size by Can Diameter

9.3.5.1 Less than 50 mm

9.3.5.2 50mm-100mm

9.3.5.3 100mm and Above

9.3.6 Historic and Forecasted Market Size by Closure Type

9.3.6.1 Lids

9.3.6.2 Caps

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Agriculture

9.3.7.2 Consumer Goods

9.3.7.3 Food and Beverages

9.3.7.4 Industrial Goods

9.3.7.5 Personal Care and Cosmetics

9.3.7.6 Textiles and Apparel

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Composite Cans Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Convolute Winding

9.4.4.2 Linear Draw Cans

9.4.4.3 Spiral Wound Cans

9.4.5 Historic and Forecasted Market Size by Can Diameter

9.4.5.1 Less than 50 mm

9.4.5.2 50mm-100mm

9.4.5.3 100mm and Above

9.4.6 Historic and Forecasted Market Size by Closure Type

9.4.6.1 Lids

9.4.6.2 Caps

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Agriculture

9.4.7.2 Consumer Goods

9.4.7.3 Food and Beverages

9.4.7.4 Industrial Goods

9.4.7.5 Personal Care and Cosmetics

9.4.7.6 Textiles and Apparel

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Composite Cans Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Convolute Winding

9.5.4.2 Linear Draw Cans

9.5.4.3 Spiral Wound Cans

9.5.5 Historic and Forecasted Market Size by Can Diameter

9.5.5.1 Less than 50 mm

9.5.5.2 50mm-100mm

9.5.5.3 100mm and Above

9.5.6 Historic and Forecasted Market Size by Closure Type

9.5.6.1 Lids

9.5.6.2 Caps

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Agriculture

9.5.7.2 Consumer Goods

9.5.7.3 Food and Beverages

9.5.7.4 Industrial Goods

9.5.7.5 Personal Care and Cosmetics

9.5.7.6 Textiles and Apparel

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Composite Cans Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Convolute Winding

9.6.4.2 Linear Draw Cans

9.6.4.3 Spiral Wound Cans

9.6.5 Historic and Forecasted Market Size by Can Diameter

9.6.5.1 Less than 50 mm

9.6.5.2 50mm-100mm

9.6.5.3 100mm and Above

9.6.6 Historic and Forecasted Market Size by Closure Type

9.6.6.1 Lids

9.6.6.2 Caps

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Agriculture

9.6.7.2 Consumer Goods

9.6.7.3 Food and Beverages

9.6.7.4 Industrial Goods

9.6.7.5 Personal Care and Cosmetics

9.6.7.6 Textiles and Apparel

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Composite Cans Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Convolute Winding

9.7.4.2 Linear Draw Cans

9.7.4.3 Spiral Wound Cans

9.7.5 Historic and Forecasted Market Size by Can Diameter

9.7.5.1 Less than 50 mm

9.7.5.2 50mm-100mm

9.7.5.3 100mm and Above

9.7.6 Historic and Forecasted Market Size by Closure Type

9.7.6.1 Lids

9.7.6.2 Caps

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Agriculture

9.7.7.2 Consumer Goods

9.7.7.3 Food and Beverages

9.7.7.4 Industrial Goods

9.7.7.5 Personal Care and Cosmetics

9.7.7.6 Textiles and Apparel

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

| Composite Cans Market | ||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.69 Bn. |

|

|

CAGR (2024-2032): |

4.90% |

Market Size in 2032: |

USD 7.54 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Can Diameter |

|

|

||

|

By Closure Type |

|

|

||

|

By Application |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||