Colonoscope Video Endoscope Market Synopsis

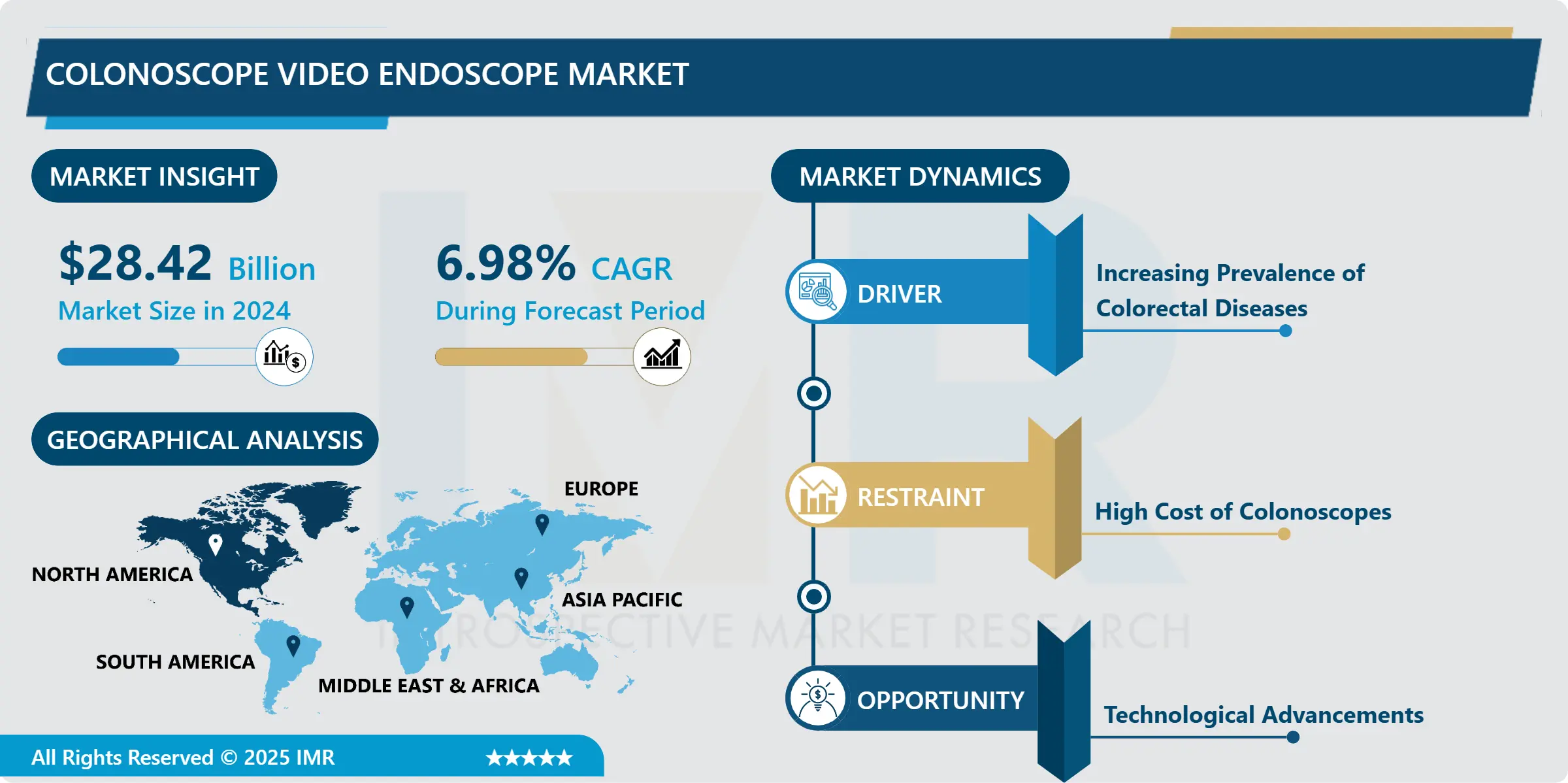

Colonoscope Video Endoscope Market Size Was Valued at USD 28.42 Billion in 2024 and is Projected to Reach USD 59.70 Billion by 2035, Growing at a CAGR of 6.98% From 2025-2035.

A colonoscopy video endoscope is a medical device used to visualize the interior of the colon (large intestine) and rectum for diagnostic and therapeutic purposes. It is a flexible endoscope, a long, thin, flexible tube with a camera and light on the end.

Video endoscopy provides several diagnostic advantages, such as enhanced clarity, higher precision, timely identification, and decreased chances of overlooking colon abnormalities.

Therapeutic advantages consist of focused treatment, less intrusive methods, and decreased risk of bleeding when removing polyps. Patients experience advantages from procedures that are less invasive, recovery times that are quicker, and an overall enhancement in their experience.

From a clinical standpoint, video endoscopy increases patient safety, offers documentation for research purposes, and assists in training healthcare professionals. From an economic standpoint, it is financially efficient, decreases hospitalization rates, and boosts productivity for healthcare professionals.

Advanced imaging capabilities, AI integration for automatic detection and diagnosis, and data analytics for research and quality improvement are some of the technological advantages of video endoscopy. In general, video endoscopy is a useful instrument in the healthcare industry that provides numerous advantages for patients and medical staff.

Colonoscope Video Endoscope Market Trend Analysis

Increasing Prevalence of Colorectal Diseases

- In 2020, global colorectal cancer (CRC) cases reached 1.9 million with 935,000 deaths, ranking it third in prevalence. Incidence is rising in low- and middle-income countries, leading to late detection and high mortality rates.

- Colonoscope Video Endoscope tech aids in screening and early detection by identifying and removing precancerous polyps. Colorectal diseases like IBD and diverticulitis are on the rise worldwide.

- The tech can also detect conditions like GI bleeding and FAP. Tech advancements and government promotions for early screening are driving demand. The aging population and awareness of colorectal diseases are increasing the need for colonoscopy exams.

- Improved Colonoscope Video Endoscope technology is enhancing precision and productivity with HD and NBI imaging. Awareness initiatives are growing to promote the necessity of screening and diagnostics.

- In 2023, it was calculated that there were 2650 deaths due to colorectal cancer among 70 to 79 year old people in Canada.

Opportunity

Technological Advancements

- The practice of colonoscopy has been transformed by advancements in Colonoscope Video Endoscope Technology. HD and 4K imaging improve visualization, leading to better polyp and lesion detection.

- NBI technology improves the detection of cancerous growths by enhancing the visibility of blood vessel patterns. AI and ML algorithms are used to analyze images instantly to detect polyps, decreasing the number of overlooked lesions.

- CAD systems help detect abnormalities, improving the efficiency of procedures. Robot-assisted technology improves accuracy and patient satisfaction, while disposable endoscopes lower the chances of infection.

- Wireless and capsule endoscopy enhance patient availability. These advancements enhance the accuracy of diagnosing, efficiency, comfort for patients, accessibility, and rates of adoption.

- Emerging business models and the integration of EHRs and analytics platforms are enhancing patient care. In general, healthcare providers and patients benefit from advancements in Colonoscope Video Endoscope technology.

Colonoscope Video Endoscope Market Segment Analysis:

The Colonoscope Video Endoscope market is segmented on the basis of Product Type, Technology, Application, and End-user.

By Product Type, Flexible Video Endoscope Segment Is Expected to Dominate the Market During the Forecast Period

There are two segments by product type such as rigid video endoscope, flexible video endoscope. Among these, flexible video endoscope segment is expected to dominate the market during the forecast period.

- Compared to rigid endoscopes, Flexible Video Endoscopes make colon navigation easier, resulting in reduced patient discomfort and complications. They offer high-quality images that allow for accurate disease diagnosis, resulting in greater use in medical facilities because of easy operation and improved patient results.

- Healthcare professionals are attracted by improved image quality due to technological advancements such as HD and 4K resolution. The increasing need for less invasive techniques such as colonoscopy has emphasized the significance of Flexible Video Endoscopes, particularly due to the increasing incidence of colon-related diseases.

- Early identification and diagnosis are essential for successful treatment outcomes and patient survival rates. Cost-effective and easy to use, Video Endoscopes with adaptable functions are increasingly popular among both healthcare professionals and patients.

By Application, Hospitals Segment Held the Largest Share In 2023

There are three segments by end-user such as hospitals, ambulatory centres, clinics. Among these, hospitals segment held the largest share in 2023.

- Hospitals conduct numerous colonoscopy procedures, leading to high demand for Colonoscope Video Endoscopes. They have a notable market share because of reasons like their developed infrastructure, skilled workers, and use of cutting-edge technology.

- Hospitals have specialized rooms for endoscopy procedures and a skilled team of gastroenterologists, endoscopists, and nurses. They are inclined to embrace sophisticated technologies such as HD and 4K resolution because they have more financial resources dedicated to it.

- By providing inpatient and outpatient care, hospitals serve a broad range of patients for both urgent and planned medical treatments. Centralized sterilization facilities are present, and they receive funding from both the government and private sources for infrastructure upgrades and buying medical equipment.

- Hospitals frequently act as educational and research centers, leading to a greater need for Colonoscope Video Endoscopes for training and research activities. Referrals from different healthcare establishments also add to the need for such devices in hospitals.

Colonoscope Video Endoscope Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- Colorectal cancer ranks third in terms of cancer diagnosis in the United States, resulting in a significant need for colonoscopy procedures and Colonoscope Video Endoscopes.

- North America, mainly the United States, boasts a robust healthcare system with cutting-edge technologies, establishing it as a center for medical advancements. Healthcare workers in the area rapidly embrace new technologies such as Colonoscope Video Endoscopes.

- Positive reimbursement policies in the United States lead to a rise in demand for colonoscopy procedures by improving access to these devices. Major firms such as Olympus Corporation and Fujifilm Holdings Corporation dedicate resources to research and development, with stringent regulations from the US FDA and Health Canada ensuring the effectiveness and safety of medical devices.

- North America can fund advanced medical technologies such as Colonoscope Video Endoscopes, with backing from groups like the American Cancer Society that encourage colon cancer screenings and drive up the need for these tools.

Colonoscope Video Endoscope Market Active Players

- Olympus (Japan)

- KARL STORZ (Germany)

- Fujifilm (Japan)

- ENDOMED (USA)

- Huger Endoscopy Instruments (USA)

- Sonoscape (China)

- EndoChoice (USA)

- ANA-MED (USA)

- Pentax Medical (Japan)

- B. Braun (Germany)

- Medtronic Xomed, Inc. (USA)

- Stryker (USA)

- COOK (USA)

- Richard Wolf GmbH (Germany)

- Henke-Sass Wolf GmbH (Germany)

- XION GmbH (Germany)

- Boston Scientific (USA)

- Endo Optiks,Inc. (USA)

- Polydiagnost (Germany)

- HOYA (Japan)

- Arthrex (USA)

- Welch Allyn (USA)

- Ottomed Endoscopy (India)

- Ambu (Denmark)

- Mindray (China), and Other Active Players.

Key Industry Developments in the Colonoscope Video Endoscope Market:

- In February 2024, PENTAX Medical, a division of HOYA Group, has received CE marks for new models of the PENTAX Medical i20c Video Endoscope Series, including the PENTAX Medical Video Colonoscope EC34-i20c, PENTAX Medical Video Upper GI Scope EG27-i20c, and R/L Knob Adaptor OE-B17. These models, along with the PENTAX Medical INSPIRA™ Video Processor EPK-i8020c, aim to enhance detection, diagnosis, and therapy for healthcare professionals.

|

Global Colonoscope Video Endoscope Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 28.42 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.98% |

Market Size in 2035: |

USD 59.70 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Colonoscope Video Endoscope Market by Product Type (2018-2032)

4.1 Colonoscope Video Endoscope Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rigid Video Endoscope

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flexible Video Endoscope

Chapter 5: Colonoscope Video Endoscope Market by Technology (2018-2032)

5.1 Colonoscope Video Endoscope Market Snapshot and Growth Engine

5.2 Market Overview

5.3 HD Colonoscopes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Narrow Band Imaging Colonoscopes

5.5 Flexible Spectral Imaging Color Enhancement Colonoscopes

5.6 AI-Assisted Colonoscopes

Chapter 6: Colonoscope Video Endoscope Market by Application (2018-2032)

6.1 Colonoscope Video Endoscope Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diagnostic Colonoscopy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Therapeutic Colonoscopy

6.5 Screening Colonoscopy

Chapter 7: Colonoscope Video Endoscope Market by End-user (2018-2032)

7.1 Colonoscope Video Endoscope Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ambulatory Centres

7.5 Clinics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Colonoscope Video Endoscope Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LANXESS AG (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MERCK KGAA (GERMANY)

8.4 BAYER AG(GERMANY)

8.5 SOLVAY S.A. (BELGIUM)

8.6 MONSANTO COMPANY (U.S.)

8.7 PARCHEM FINE & SPECIALTY CHEMICALS (U.S.)

8.8 PCC ROKITA (POLAND)

8.9 ICL (ISRAEL)

8.10 EXCEL INDUSTRIES LTD (INDIA)

8.11 ADITYA BIRLA CHEMICALS (INDIA)

8.12 UPL LIMITED (INDIA)

8.13 SANDHYA GROUP (INDIA)

8.14 XUZHOU JIANPING CHEMICAL COLTD. (CHINA)

8.15 XUZHOU YONGLI FINE CHEMICAL COLTD. (CHINA)

8.16 BINHAI HENGLIAN CHEMICAL COLTD. (CHINA)

8.17 JIANGSU ANPON ELECTROCHEMICAL COLTD. (CHINA)

8.18 HUBEI XINGFA CHEMICALS GROUP COLTD. (CHINA)

8.19 ANHUI GUANGXIN AGROCHEMICAL COLTD. (CHINA)

8.20 JIANGSU DANAI CHEMICAL COLTD. (CHINA)

8.21 TAKISAWA CHEMICAL INDUSTRY COLTD. (JAPAN)

8.22 TOKYO CHEMICAL INDUSTRY COLTD. (JAPAN)

8.23

Chapter 9: Global Colonoscope Video Endoscope Market By Region

9.1 Overview

9.2. North America Colonoscope Video Endoscope Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Rigid Video Endoscope

9.2.4.2 Flexible Video Endoscope

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 HD Colonoscopes

9.2.5.2 Narrow Band Imaging Colonoscopes

9.2.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.2.5.4 AI-Assisted Colonoscopes

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Diagnostic Colonoscopy

9.2.6.2 Therapeutic Colonoscopy

9.2.6.3 Screening Colonoscopy

9.2.7 Historic and Forecasted Market Size by End-user

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Centres

9.2.7.3 Clinics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Colonoscope Video Endoscope Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Rigid Video Endoscope

9.3.4.2 Flexible Video Endoscope

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 HD Colonoscopes

9.3.5.2 Narrow Band Imaging Colonoscopes

9.3.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.3.5.4 AI-Assisted Colonoscopes

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Diagnostic Colonoscopy

9.3.6.2 Therapeutic Colonoscopy

9.3.6.3 Screening Colonoscopy

9.3.7 Historic and Forecasted Market Size by End-user

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Centres

9.3.7.3 Clinics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Colonoscope Video Endoscope Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Rigid Video Endoscope

9.4.4.2 Flexible Video Endoscope

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 HD Colonoscopes

9.4.5.2 Narrow Band Imaging Colonoscopes

9.4.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.4.5.4 AI-Assisted Colonoscopes

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Diagnostic Colonoscopy

9.4.6.2 Therapeutic Colonoscopy

9.4.6.3 Screening Colonoscopy

9.4.7 Historic and Forecasted Market Size by End-user

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Centres

9.4.7.3 Clinics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Colonoscope Video Endoscope Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Rigid Video Endoscope

9.5.4.2 Flexible Video Endoscope

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 HD Colonoscopes

9.5.5.2 Narrow Band Imaging Colonoscopes

9.5.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.5.5.4 AI-Assisted Colonoscopes

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Diagnostic Colonoscopy

9.5.6.2 Therapeutic Colonoscopy

9.5.6.3 Screening Colonoscopy

9.5.7 Historic and Forecasted Market Size by End-user

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Centres

9.5.7.3 Clinics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Colonoscope Video Endoscope Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Rigid Video Endoscope

9.6.4.2 Flexible Video Endoscope

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 HD Colonoscopes

9.6.5.2 Narrow Band Imaging Colonoscopes

9.6.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.6.5.4 AI-Assisted Colonoscopes

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Diagnostic Colonoscopy

9.6.6.2 Therapeutic Colonoscopy

9.6.6.3 Screening Colonoscopy

9.6.7 Historic and Forecasted Market Size by End-user

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Centres

9.6.7.3 Clinics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Colonoscope Video Endoscope Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Rigid Video Endoscope

9.7.4.2 Flexible Video Endoscope

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 HD Colonoscopes

9.7.5.2 Narrow Band Imaging Colonoscopes

9.7.5.3 Flexible Spectral Imaging Color Enhancement Colonoscopes

9.7.5.4 AI-Assisted Colonoscopes

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Diagnostic Colonoscopy

9.7.6.2 Therapeutic Colonoscopy

9.7.6.3 Screening Colonoscopy

9.7.7 Historic and Forecasted Market Size by End-user

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Centres

9.7.7.3 Clinics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Colonoscope Video Endoscope Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 28.42 Bn. |

|

Forecast Period 2025-35 CAGR: |

6.98% |

Market Size in 2035: |

USD 59.70 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||