Cold Food Packaging Market Synopsis

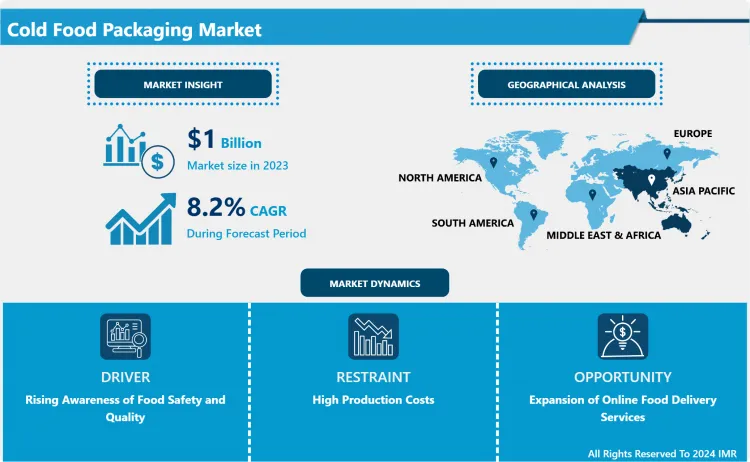

Cold Food Packaging Market Size Was Valued at USD 1.00 Billion in 2023, and is Projected to Reach USD 2.03 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.

Cold food packing means containers and packing material which are specially used for packing and transporting perishable food articles which require preservation in cold conditions. And interestingly, this type of packaging cannot be overemphasised especially for such products like the dairy products, meat products, fruits and vegetables among others as they enhance food preservation hence reducing on shelf life and at the same time ensuring the quality nutrient value of the products is preserved. Some of the materials used are plastic material, foil, and biodegradable that offers thermal insulation and barrier characteristics.

- The market for Cold Food Packaging has also experienced considerable growth in the past few years due to increased consumption of convenience foods, heightened awareness of food hygiene and fresh and perishable foods. This segment covers solutions for food packaging, with a provision for temperature maintenance of the goods, such as chilled or froz fruits, vegetables, meat products, dairy, ready to eat meals, etc. The added market factor is that the material production is rapidly evolving and is focused on using eco-friendly materials and minimizing negative impact. Biodegradable and recyclable products are slowly becoming popular because of the demand on the use of environmentally friendly products such as packaging material. Players involved in the market are focusing their efforts on research and development to produce new better materials that do not only act as insulators but those that help maintain food freshness thus reducing spoilage.

- The geographical regions of Cold Food Packaging Market are also distributed differently; North America as well as Europe have the largest shares in this market, particularly due to high standards of hygiene and increased consumption of convenience food. The Asia-Pacific region is being propelled to become a larger market due to growing urbanization and more specifically new life styles and a growing population with more disposable income. China and India are some of the countries where there has been increased demand for packaged foods and hence it has encouraged the production companies to extend their production all over these countries. Secondly, the rising popularity of e-foods which is a segment of e-commerce settles for efficient cold chain logistics and packaging. This trend is further supported by COVID-19 which has increased online grocery shopping further and thus the need to ensure that food made available is effectively packed using cold food packaging.

- Innovation wise, changes in packaging methods like the active and intelligent packaging seem to be taking root among the cold food segment. Active packaging involves the use of additives that are used to absorb or release and substances that improve the quality and safety of food products Intelligent packaging has use of indicators which give real time information of foods condition. These innovations not only assist in preservation of perishable products but also cause improvement to consumer trust on the foods they eat. The market is also experiencing the rising trend in packaging designs that are specialized to accommodate the specific needs of individual foods in terms of protection and handling.

- All in all, it can be stated that the Cold Food Packaging Market has smart global growth opportunities in the future due to the changing consumer preference, technology, and environmental consciousness. For this reason, packaging solutions will become even more relevant in the context of the ongoing shifts in consumers’ preferences and regulatory policies that affect the food industry and cold food products in particular. An investment in research and development coupled with embracing environmentally friendly practices are promising outlook that points to the future of cold food packaging methane, therefore opportunity for both domestic and new international market.

Cold Food Packaging Market Trend Analysis

Sustainable Packaging Solutions

- The global cold food packaging market is experiencing the shift of packaging solutions towards being more eco-friendly due to the growing number of customers who prefer environmentally friendly products. The trends that concern innovations with the materials are emerging more frequently: biodegradable plastics, recycled content, and plant-based substitutes are on the rise. These materials fulfil all the requirements necessary for maintaining the food safety and freshness, and at the same time they help to minimize the carbon footprint of the actual production of packaging materials. The leading industry players are channeling efforts into innovation and development of sustainable packaging that will have better leads in performance yet support the regulation conformity to offer the consumers with sustainable products that have no bearing in quality.

- In addition, innovative efforts toward sustainability in the cold food packaging market is backed by several programs designed to minimize waste at each level of the chain. They are following circular economy mechanisms especially using environmentally friendly materials, products and services that are easy to recycle or compost and good waste management system practices. This shift is also caused by government legislation that has an incentive for companies to pay attention to sustainability and increasing awareness of consumers regarding environmental problems. As the market matures, the push for more eco-friendly packaging is expected to increase due to both, regulatory and customer demand for more environmentally friendly packaging of the food products they consume.

Expansion of Online Food Delivery Services

- Cold Food Packaging Market has been effectively impacted with the increasing trend of online food delivery services in the food and beverages industry, demanding advanced and better packaging options. More people are now ordering meals online and therefore there is need for packaging that can retain the quality of the food and conform to safety standards during the transport process. This has led to new technologies to exist in the market to produce durable and better materials and designs with improved insulation characteristics and abilities to resist moisture. Moreover, new subscription meal and ready to eat food kits also demand optimum use of environment friendly packaging alternatives as consumer consciousness toward sustainability is also climbing rapidly.

- Also, given the pressures of competition into the online food delivery space, firms have focused on branding and looks on packaging. Adaptive and thin packagings not only provide good experience to the customers but also act as window dressing for those brands which wants to be message out in the market. Therefore, the Cold Food Packaging Market is experiencing a shift towards the use of advanced technologies like smart packaging that consists of monitoring the temperature of the food and sends an alert if the temperature is too low. Indeed, this evolution complements the general movement towards the application of technology in delivery services of foods where customers enjoy their meals of high quality made with safety and sustainability concerns.

Cold Food Packaging Market Segment Analysis:

Cold Food Packaging Market Segmented based on Material, Packaging Type, and Application.

By Material , Aluminum segment is expected to dominate the market during the forecast period

- The materials used in Cold Food Packaging are Plastic, Aluminum, and Paper & Paperboard, all of which have a major impact on the Market. Plastic hence continues to be the predominant material across the packaging industry as it is versatile, has lighter properties and offers excellent barrier properties that help to shield the content from moisture and contaminant. Innovations have however been adopted in bioplastics as consumers show preference in environmentally friendly products. However, plastic packaging is usually affordable, and since it enables products to be manufactured in large quantities while also maintaining the food’s freshness, especially when it comes to short shelf-life products, it is very useful as well. The use of plastics in packaging is uniformly observed in various segments such as R2E meals, frozen foods, dairy products and many others where convenience of consumption and shelf life matter.

- Similar to steel, aluminum and paper & paperboard are also on the rise in Cold Food Packaging Market due to their eco-friendly property and feature of recycling. Aluminum is gradually currently even more preferred since it can retains the product’s quality and afford the best protection from light and oxygen necessary for packaging such products as the frozen meal or the beverages. On the other hand, paper & paperboard packaging has certain benefits such as biodegradability and lower carbon foot print that influence the green consumers. They are generally concerned with increasing the efficiency of these materials as well as exercising green approaches to manufacturing their products and their sourcing. As consumers’ preferences change in the direction of sustainability, one of the emerging trends remains the usage of recyclable and compostable materials, making the cold food packaging cleaner.

By Packaging Type , Boxes segment held the largest share in 2023

- Various packaging types segment the Cold Food Packaging Market, as various types of packaging have different purposes to fulfill. Case has an extensive use where the meals need to be packed and frozen such as frozen meal and ready to eat products it gives support to the structure of the box and also acts as insulating material. Tubes and cups are common when it comes to items such as yogurts and deserts since they make it very easy to use. Cans are often used for storage purposes with foods for example soups or vegetables being placed in the cans to be protected from the outside environment and have more shelf life. In trays that are useful for holding fresh produce and ready-to-eat food items, stacking and transportation is possible while pouches and bags which have light weight, flexibility and are appropriate for snacks and frozen fruits. Films and wraps are very essential in maintaining the freshness and in preventing contamination notably when dealing with perishable foods.

- Such packaging types are in growing demand because of the changes in consumer needs for packaging that is convenient and eco-friendly. A very significant demand is currently being witnessed in pouches and bags especially because these are light weight and because recyclable material association has also grown stronger. When sustainability emerges as a key consideration, low impact packaging solutions are sought out and this means there is development in material and design. In addition, the growth of e-commerce has enriched the delivery of essential items such as food items and cooking ingredients; this has made it compulsory for these items to be packaged in a robust manner in a bid to retain their quality even after delivery. All in all, the given diversification of the Cold Food Packaging Market by a type suggests an understandable reaction of the industry to consumers’ needs for convenience, product quality, and sustainability.

Cold Food Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific held the largest Cold Food Packaging Market share in 2017 and it is further expected to grow as people are more inclined towards ready to eat foods and is convenience and ready to eat or on-the-go meals. With the increase in the growth of urbanization, and increasing complexities of people’s lives, there is the need to have convenient and effective packaging for food products that help in maintaining its freshness and safety for human consumption. The awareness about the quality food hygiene standards and preservation of the product quality during transit and storage also boost the demand for these modern cold food packs. Furthermore, innovations in material science including biodegradable and recyclable materials for packaging are expected to go down well with the market, which is sensitive to environmental issues thus boosting the market prospects.

- In addition, factors such as the growth in the retail industry with countries like China, India and Japan greatly influencing the growth of the cold food packaging market in the region. Market growth is also being helped by growth in investment in cold chain logistics and overall enhancement of the physical infrastructure for storage and transportation of chilled or frozen food merchandise. The general public is becoming environmentally conscious and demanding products that are environmentally friendly; businesses on their part are forced to conform with the current environmental standards hence the integration of sustainable strategies such as the use of green products. While food retailers and manufacturers continue looking for ways and means to increase product exposure and shelf life through packaging techniques, the cold food packaging market in the Asia Pacific region will be keenly placed to command the overall market for the forecast period.

Active Key Players in the Cold Food Packaging Market

- Amcor (Australia)

- International Paper (United States)

- Sonoco Products Company (United States)

- Mondi Group (United Kingdom)

- Alto Packaging Limited (Australia)

- Huhtamaki Group (Finland)

- Sealed Air Corporation (United States)

- Ampac Holdings, LLC (United States)

- Berry Global Inc. (United States)

- Sealstrip Corporation (United States), Others Key Player

Key Industry Developments in the Cold Food Packaging Market

- In June 2021, Mondi Group expanded its range of plastic-free e-commerce packaging with MailerBAG range of sustainable paper solutions, which is fully recyclable in existing paper waste streams and replaces the need for plastic packaging. The company also recently invested in its European plants to deliver approximately 350 million paper bags per year for the online retail industry. Also, in the same month, Mondi's paper based EcoWicketBag won gold in 2021 EUROSAC Grand Prix, for its overall performance, reduction of CO2 emissions, and convenience for the customer.

|

Global Cold Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 2.03 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cold Food Packaging Market by Material (2018-2032)

4.1 Cold Food Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Aluminum

4.5 Paper & Paperboard

Chapter 5: Cold Food Packaging Market by Packaging Type (2018-2032)

5.1 Cold Food Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Boxes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tubes & Cups

5.5 Cans

5.6 Trays

5.7 Pouches & Bags

5.8 Films & Wraps

Chapter 6: Cold Food Packaging Market by Application (2018-2032)

6.1 Cold Food Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Ready-to-Eat Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fruits and Vegetables

6.5 Meat

6.6 Poultry

6.7 & Seafood

6.8 Dairy Products

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cold Food Packaging Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMCOR (AUSTRALIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTERNATIONAL PAPER (UNITED STATES)

7.4 SONOCO PRODUCTS COMPANY (UNITED STATES)

7.5 MONDI GROUP (UNITED KINGDOM)

7.6 ALTO PACKAGING LIMITED (AUSTRALIA)

7.7 HUHTAMAKI GROUP (FINLAND)

7.8 SEALED AIR CORPORATION (UNITED STATES)

7.9 AMPAC HOLDINGS

7.10 LLC (UNITED STATES)

7.11 BERRY GLOBAL INC. (UNITED STATES)

7.12 SEALSTRIP CORPORATION (UNITED STATES)

7.13 OTHERS KEY PLAYER

Chapter 8: Global Cold Food Packaging Market By Region

8.1 Overview

8.2. North America Cold Food Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Material

8.2.4.1 Plastic

8.2.4.2 Aluminum

8.2.4.3 Paper & Paperboard

8.2.5 Historic and Forecasted Market Size by Packaging Type

8.2.5.1 Boxes

8.2.5.2 Tubes & Cups

8.2.5.3 Cans

8.2.5.4 Trays

8.2.5.5 Pouches & Bags

8.2.5.6 Films & Wraps

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Ready-to-Eat Products

8.2.6.2 Fruits and Vegetables

8.2.6.3 Meat

8.2.6.4 Poultry

8.2.6.5 & Seafood

8.2.6.6 Dairy Products

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cold Food Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Material

8.3.4.1 Plastic

8.3.4.2 Aluminum

8.3.4.3 Paper & Paperboard

8.3.5 Historic and Forecasted Market Size by Packaging Type

8.3.5.1 Boxes

8.3.5.2 Tubes & Cups

8.3.5.3 Cans

8.3.5.4 Trays

8.3.5.5 Pouches & Bags

8.3.5.6 Films & Wraps

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Ready-to-Eat Products

8.3.6.2 Fruits and Vegetables

8.3.6.3 Meat

8.3.6.4 Poultry

8.3.6.5 & Seafood

8.3.6.6 Dairy Products

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cold Food Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Material

8.4.4.1 Plastic

8.4.4.2 Aluminum

8.4.4.3 Paper & Paperboard

8.4.5 Historic and Forecasted Market Size by Packaging Type

8.4.5.1 Boxes

8.4.5.2 Tubes & Cups

8.4.5.3 Cans

8.4.5.4 Trays

8.4.5.5 Pouches & Bags

8.4.5.6 Films & Wraps

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Ready-to-Eat Products

8.4.6.2 Fruits and Vegetables

8.4.6.3 Meat

8.4.6.4 Poultry

8.4.6.5 & Seafood

8.4.6.6 Dairy Products

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cold Food Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Material

8.5.4.1 Plastic

8.5.4.2 Aluminum

8.5.4.3 Paper & Paperboard

8.5.5 Historic and Forecasted Market Size by Packaging Type

8.5.5.1 Boxes

8.5.5.2 Tubes & Cups

8.5.5.3 Cans

8.5.5.4 Trays

8.5.5.5 Pouches & Bags

8.5.5.6 Films & Wraps

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Ready-to-Eat Products

8.5.6.2 Fruits and Vegetables

8.5.6.3 Meat

8.5.6.4 Poultry

8.5.6.5 & Seafood

8.5.6.6 Dairy Products

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cold Food Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Material

8.6.4.1 Plastic

8.6.4.2 Aluminum

8.6.4.3 Paper & Paperboard

8.6.5 Historic and Forecasted Market Size by Packaging Type

8.6.5.1 Boxes

8.6.5.2 Tubes & Cups

8.6.5.3 Cans

8.6.5.4 Trays

8.6.5.5 Pouches & Bags

8.6.5.6 Films & Wraps

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Ready-to-Eat Products

8.6.6.2 Fruits and Vegetables

8.6.6.3 Meat

8.6.6.4 Poultry

8.6.6.5 & Seafood

8.6.6.6 Dairy Products

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cold Food Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Material

8.7.4.1 Plastic

8.7.4.2 Aluminum

8.7.4.3 Paper & Paperboard

8.7.5 Historic and Forecasted Market Size by Packaging Type

8.7.5.1 Boxes

8.7.5.2 Tubes & Cups

8.7.5.3 Cans

8.7.5.4 Trays

8.7.5.5 Pouches & Bags

8.7.5.6 Films & Wraps

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Ready-to-Eat Products

8.7.6.2 Fruits and Vegetables

8.7.6.3 Meat

8.7.6.4 Poultry

8.7.6.5 & Seafood

8.7.6.6 Dairy Products

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cold Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 2.03 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cold Food Packaging Market research report is 2024-2032.

Amcor (Australia),International Paper (United States),Sonoco Products Company (United States),Mondi Group (United Kingdom),Alto Packaging Limited (Australia),Huhtamaki Group (Finland),Sealed Air Corporation (United States),and Other Major Players.

The Cold Food Packaging Market is segmented into Material , Packaging Type, Appplication and Region. By Material, the market is categorized into Plastic, Aluminum, Paper & Paperboard. By Packaging Type, the market is categorized into BoxesTubes & Cups,Cans,Trays,Pouches & Bags,Films & Wraps. By Application, the market is categorized into Ready-to-Eat Products,Fruits and Vegetables,Meat, Poultry, & Seafood,Dairy Products,Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cold food packing means containers and packing material which are specially used for packing and transporting perishable food articles which require preservation in cold conditions. And interestingly, this type of packaging cannot be overemphasised especially for such products like the dairy products, meat products, fruits and vegetables among others as they enhance food preservation hence reducing on shelf life and at the same time ensuring the quality nutrient value of the products is preserved. Some of the materials used are plastic material, foil, and biodegradable that offers thermal insulation and barrier characteristics.

Cold Food Packaging Market Size Was Valued at USD 1.00 Billion in 2023, and is Projected to Reach USD 2.03 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.