Coffee Beer Market Synopsis

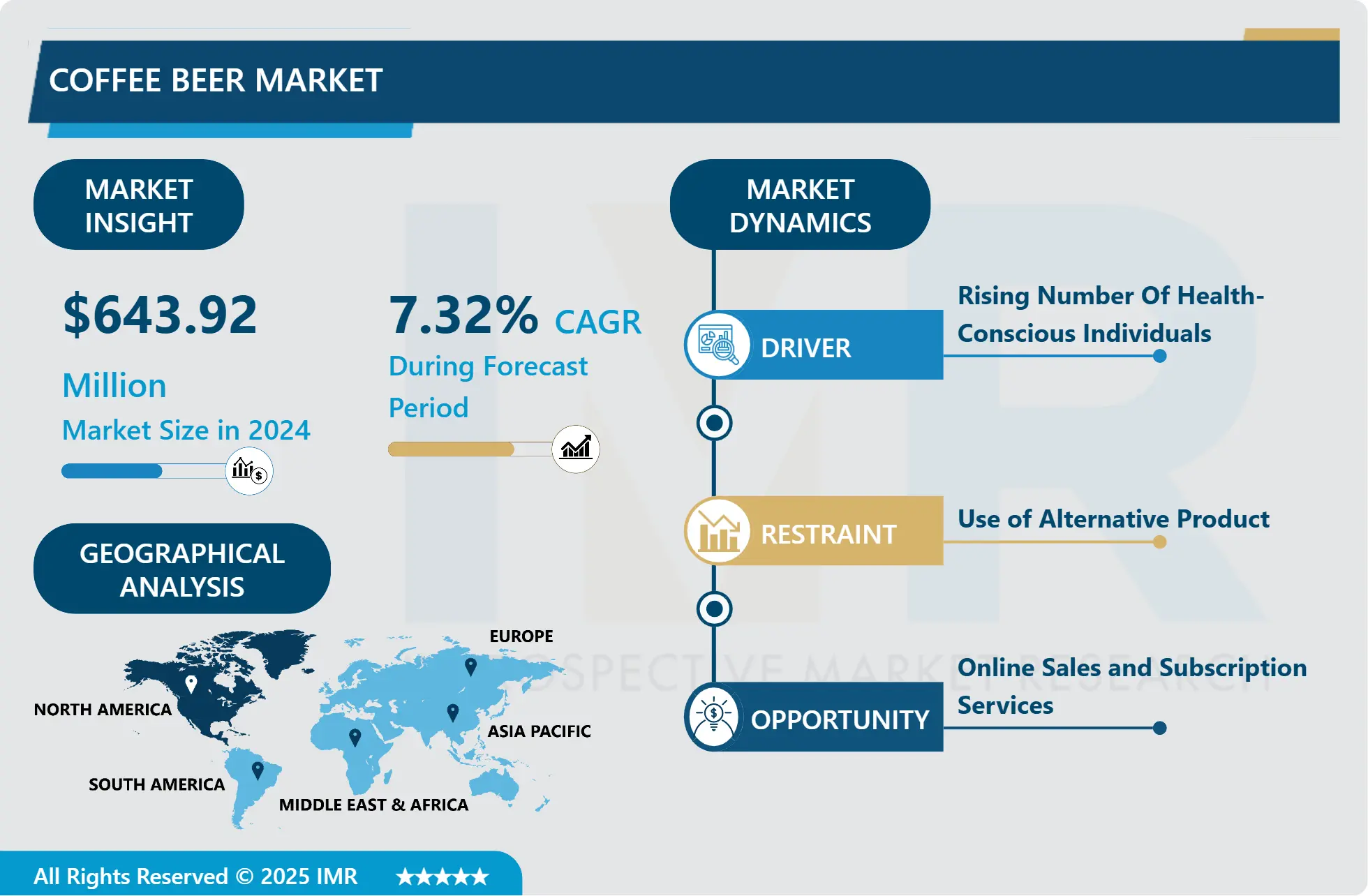

Coffee Beer Market Size Was Valued at USD 643.92 Million in 2024, and is Projected to Reach USD 1133.12 Million by 2032, Growing at a CAGR of 7.32% From 2025-2032.

Coffee Beer is essentially any beer made through the usual brewing process, though with an added, delicious infusion of coffee aroma and flavour. Coffee beer is essentially a standard beer recipe that has been infused with coffee flavour during a particular stage of the brewing process.

The coffee-beer market represents a unique and dynamic segment within the broader beverage industry, combining the robust flavors of coffee with the craft and diversity of beer. At its core, coffee beer is a category of alcoholic beverages that marries the rich, roasted notes of coffee with the malty and hoppy characteristics of beer. This fusion results in a spectrum of beer styles infused with coffee, spanning from stouts and porters to ales and lagers, each offering a distinct and often complex flavor profile. Coffee beer has gained considerable popularity in recent years, driven by the craft beer movement and a growing appreciation for the intricacies of both coffee and beer.

In recent years, the global coffee beer market has witnessed notable growth and diversification, driven by the craft beer movement and the rising popularity of specialty and artisanal beverages. While traditionally associated with stouts like the classic "coffee stout," coffee beer has expanded into other beer styles, catering to a wider range of consumer preferences. Additionally, collaborations between breweries and coffee roasters have become common, leading to innovative and premium coffee beer products.

The Coffee Beer Market Trend Analysis - Rising Number of Health-Conscious Individuals

- The coffee-beer market is experiencing significant growth, driven primarily by a rising number of health-conscious individuals who seek a balance between indulgence and responsible consumption. This intersection of two beloved beverages, coffee, and beer, has captivated consumers and is reshaping the landscape of the beverage industry.

- One of the key factors fueling the surge in coffee beer adoption is the increasing health awareness among consumers. As people become more mindful of their dietary choices and alcohol consumption, they are actively seeking alternatives that provide a more balanced drinking experience. Coffee beer, with its combination of coffee's antioxidant-rich properties and the moderate alcohol content of beer, aligns well with this trend. It offers individuals an opportunity to enjoy the flavors and aromas they love without compromising on their health-conscious goals.

- The appeal of coffee beer extends to those who appreciate the nuanced flavors and complexity of their beverages. Craft brewers have responded to this demand by producing a wide variety of coffee-infused beers, each with its distinct character. From espresso stouts to coffee-infused porters, these offerings cater to a diverse range of tastes and preferences. As a result, coffee beer has found favor among discerning consumers who seek innovative and unique flavor profiles.

Online Sales and Subscription Services:

- Online sales and subscription services present a significant opportunity in the coffee-beer market. With the rise of e-commerce and changing consumer behaviors, these strategies can enhance the market's reach and customer engagement.

- Breweries and coffee beer producers can establish a strong online presence to sell their products directly to consumers. This allows for broader geographic reach, 24/7 accessibility, and the convenience of home delivery, appealing to a wide range of customers, including those who may not have easy access to physical retail locations.

- Implementing subscription services for coffee-beer enthusiasts can create a loyal customer base. Subscription models offer regular deliveries of new and exclusive coffee beer releases, creating anticipation and engagement. It also provides brewers with a steady source of income and valuable customer data for personalized marketing.

- Coffee Beer is essentially any beer made through the usual brewing process, though with an added, delicious infusion of coffee aroma and flavour. Coffee beer is essentially a standard beer recipe that has been infused with coffee flavour during a particular stage of the brewing process.

- The coffee-beer market represents a unique and dynamic segment within the broader beverage industry, combining the robust flavors of coffee with the craft and diversity of beer. At its core, coffee beer is a category of alcoholic beverages that marries the rich, roasted notes of coffee with the malty and hoppy characteristics of beer. This fusion results in a spectrum of beer styles infused with coffee, spanning from stouts and porters to ales and lagers, each offering a distinct and often complex flavor profile. Coffee beer has gained considerable popularity in recent years, driven by the craft beer movement and a growing appreciation for the intricacies of both coffee and beer.

- In recent years, the global coffee beer market has witnessed notable growth and diversification, driven by the craft beer movement and the rising popularity of specialty and artisanal beverages. While traditionally associated with stouts like the classic "coffee stout," coffee beer has expanded into other beer styles, catering to a wider range of consumer preferences. Additionally, collaborations between breweries and coffee roasters have become common, leading to innovative and premium coffee beer products.

Rising Number of Health-Conscious Individuals

- The coffee-beer market is experiencing significant growth, driven primarily by a rising number of health-conscious individuals who seek a balance between indulgence and responsible consumption. This intersection of two beloved beverages, coffee, and beer, has captivated consumers and is reshaping the landscape of the beverage industry.

- One of the key factors fueling the surge in coffee beer adoption is the increasing health awareness among consumers. As people become more mindful of their dietary choices and alcohol consumption, they are actively seeking alternatives that provide a more balanced drinking experience. Coffee beer, with its combination of coffee's antioxidant-rich properties and the moderate alcohol content of beer, aligns well with this trend. It offers individuals an opportunity to enjoy the flavors and aromas they love without compromising on their health-conscious goals.

- The appeal of coffee beer extends to those who appreciate the nuanced flavors and complexity of their beverages. Craft brewers have responded to this demand by producing a wide variety of coffee-infused beers, each with its distinct character. From espresso stouts to coffee-infused porters, these offerings cater to a diverse range of tastes and preferences. As a result, coffee beer has found favor among discerning consumers who seek innovative and unique flavor profiles.

Online Sales and Subscription Services:

- Online sales and subscription services present a significant opportunity in the coffee-beer market. With the rise of e-commerce and changing consumer behaviors, these strategies can enhance the market's reach and customer engagement.

- Breweries and coffee beer producers can establish a strong online presence to sell their products directly to consumers. This allows for broader geographic reach, 24/7 accessibility, and the convenience of home delivery, appealing to a wide range of customers, including those who may not have easy access to physical retail locations.

- Implementing subscription services for coffee-beer enthusiasts can create a loyal customer base. Subscription models offer regular deliveries of new and exclusive coffee beer releases, creating anticipation and engagement. It also provides brewers with a steady source of income and valuable customer data for personalized marketing.

The above graph shows that there is an increase in Subscription E-commerce Sales In The United States in 2022 as compared to the previous years this factor boosts the coffee beer market.

Coffee Beer Market Segment Analysis:

Coffee Beer Market segments cover the Product Type and Distribution Channel. By Product Type, the stouts segment is Anticipated to Dominate the Market Over the Forecast period.

- The stouts segment has emerged as the dominant force in the coffee beer market, captivating the palates of consumers and reshaping the landscape of craft brewing. This segment's remarkable popularity can be attributed to several key factors that have converged to create a perfect storm of demand and innovation.

- Stouts are well-suited for infusing with coffee due to their inherent characteristics. Stout beer styles typically feature a robust and roasted malt profile, often with notes of chocolate, caramel, and coffee. This natural affinity for coffee flavors makes stouts an ideal canvas for experimentation in the realm of coffee beer. Brewers can enhance these existing notes with the addition of various coffee varieties, resulting in a harmonious fusion of rich maltiness and coffee's bold, aromatic qualities.

Coffee Beer Market Regional Insights:

North America is dominating the Market Over the Forecast Period.

- North America has firmly established itself as the dominating region in the global coffee beer market, and several key factors contribute to this regional supremacy. The growing popularity of coffee beer in North America reflects a cultural and consumer shift that has been brewing for some time. The craft beer industry, including coffee-infused beers, has been experiencing significant growth in North America.

- North America, particularly the United States, has seen a craft beer boom over the past couple of decades. Craft breweries in the region are known for their innovation and experimentation, including the creation of unique coffee beer varieties. The United States has a robust coffee culture, with a high consumption rate of coffee. This cultural affinity for coffee extends to coffee-infused beverages like coffee beer, making it a popular choice among consumers.

The above graph shows that there is an increase in Production Of Craft Beer In The United States in 2021 as compared to previous year.

Coffee Beer Market Key Player

- Carlsberg Group (Denmark)

- Anheuser-Busch InBev (Belgium)

- Samuel Adams (United States)

- Oettinger Brewery (Germany)

- Erdinger Brewery (Germany)

- Radeberger Brewery (Germany)

- Heineken (Netherlands)

- Diageo PLC (United Kingdom)

- Lasco Brewery (Europe)

- Trident Nitro (United States)

- Pabst Blue Ribbon (United States)

- Beavertown Brewery (United Kingdom)

- Lagunitas (United States), and Other Active Players .

Key Industry Developments in the Coffee Beer Market

- In Jan 2024, Third Wave Coffee and Ironhill India partnered to create a unique experience for coffee and beer lovers. The collaboration blends premium coffee and craft beer, offering customers a fresh take on both beverages. With a shared commitment to quality, the partnership aims to provide exciting new flavors and innovative offerings, pushing the boundaries of what’s possible in the world of coffee and beer.

- In Nov 2023, Stone Brewing has unveiled its new line of specialty coffees, now available for purchase online. The launch marks an exciting expansion for the brewery, offering a unique range of high-quality blends. These coffees, crafted with the same passion and dedication that goes into Stone's beers, are set to hit stores nationwide in early 2025, bringing their distinctive flavors to coffee enthusiasts across the country.

|

Coffee Beer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 643.92 Mn. |

|

Forecast Period 2025-32 CAGR: |

7.32% |

Market Size in 2032: |

USD 1133.12 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Coffee Beer Market by Type (2018-2032)

4.1 Coffee Beer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stouts

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ale

4.5 Lagers

Chapter 5: Coffee Beer Market by Distribution Channel (2018-2032)

5.1 Coffee Beer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online Channels

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Supermarket/Hypermarket

5.5 Specialty Store

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Coffee Beer Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BALLARD POWER SYSTEMS (CANADA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HYDROGENICS (CANADA)

6.4 PLUG POWER (U.S.)

6.5 NUVERA FUEL CELLS

6.6 LLC (U.S.)

6.7 FUELCELL ENERGY(U.S.)

6.8 W.L. GORE & ASSOCIATES (U.S.)

6.9 BLOOM ENERGY (U.S.)

6.10 NEXCERIS LLC (U.S.)

6.11 BOSCH (GERMANY)

6.12 ELRINGKLINGER (GERMANY)

6.13 SOLIDPOWER ITALIA (ITALY)

6.14 CERES POWER (U.K.)

6.15 AVL (AUSTRIA)

6.16 PRAGMA INDUSTRIES (FRANCE)

6.17 NEDSTACK FUEL CELL TECHNOLOGY (NETHERLANDS)

6.18 PROTON MOTOR FUEL CELL GMBH (GERMANY)

6.19 ITM POWER (U.K.)

6.20 ELCOGEN (ESTONIA)

6.21 SFS ENERGY AG (GERMANY)

6.22 BLUE WORLD TECHNOLOGIES (DENMARK)

6.23 ROLAND GUMPERT (GERMANY)

6.24 AISIN (JAPAN)

6.25 HORIZON FUEL CELL TECHNOLOGIES (SINGAPORE)

6.26 MITSUBISHI HITACHI POWER SYSTEMS (JAPAN)

6.27 CONVION (FINLAND)

Chapter 7: Global Coffee Beer Market By Region

7.1 Overview

7.2. North America Coffee Beer Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Stouts

7.2.4.2 Ale

7.2.4.3 Lagers

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Online Channels

7.2.5.2 Supermarket/Hypermarket

7.2.5.3 Specialty Store

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Coffee Beer Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Stouts

7.3.4.2 Ale

7.3.4.3 Lagers

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Online Channels

7.3.5.2 Supermarket/Hypermarket

7.3.5.3 Specialty Store

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Coffee Beer Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Stouts

7.4.4.2 Ale

7.4.4.3 Lagers

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Online Channels

7.4.5.2 Supermarket/Hypermarket

7.4.5.3 Specialty Store

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Coffee Beer Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Stouts

7.5.4.2 Ale

7.5.4.3 Lagers

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Online Channels

7.5.5.2 Supermarket/Hypermarket

7.5.5.3 Specialty Store

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Coffee Beer Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Stouts

7.6.4.2 Ale

7.6.4.3 Lagers

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Online Channels

7.6.5.2 Supermarket/Hypermarket

7.6.5.3 Specialty Store

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Coffee Beer Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Stouts

7.7.4.2 Ale

7.7.4.3 Lagers

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Online Channels

7.7.5.2 Supermarket/Hypermarket

7.7.5.3 Specialty Store

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Coffee Beer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 643.92 Mn. |

|

Forecast Period 2025-32 CAGR: |

7.32% |

Market Size in 2032: |

USD 1133.12 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||