Cloud Security Market Synopsis

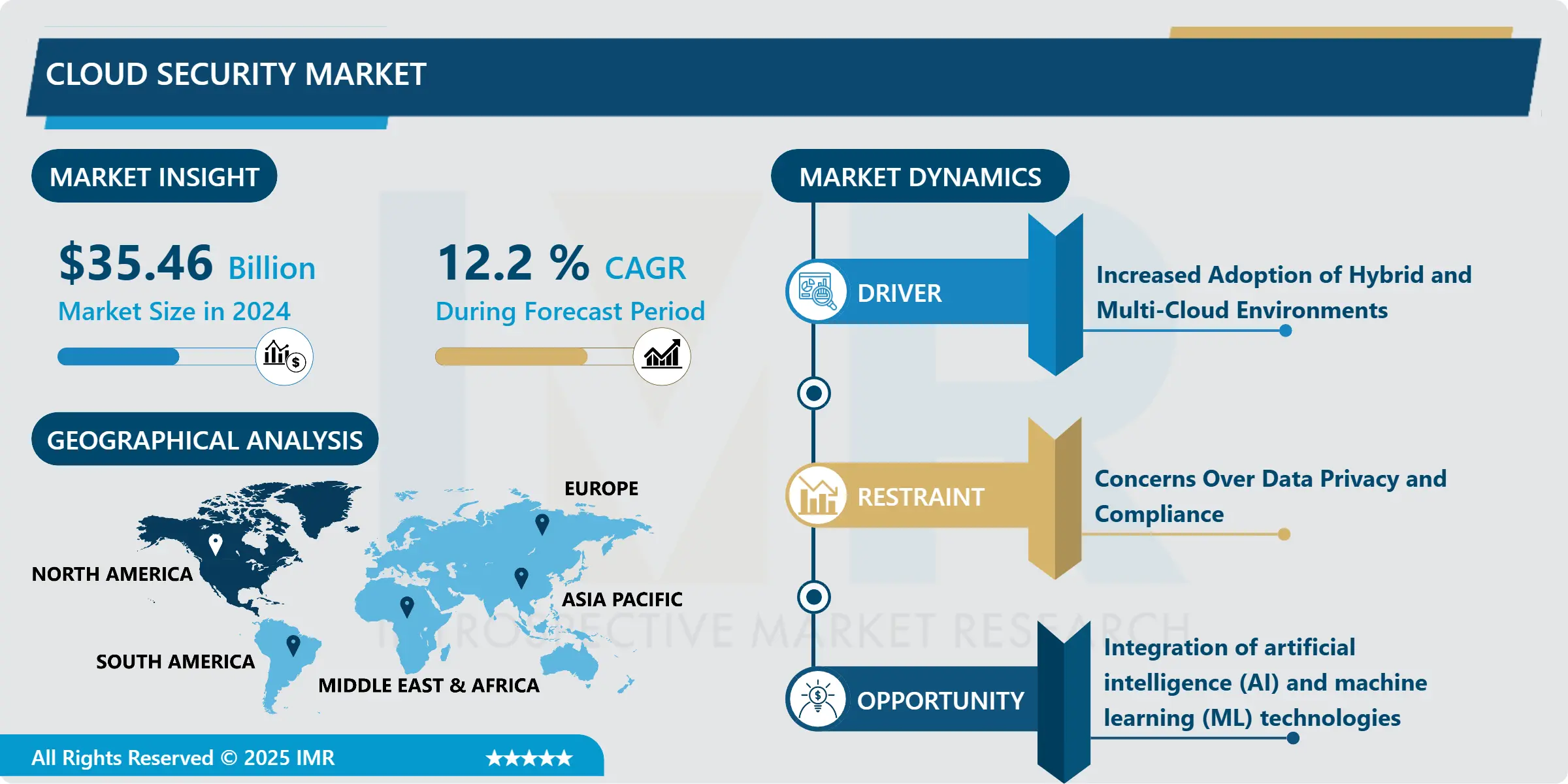

Cloud Security Market Size Was Valued at USD 35.46 Billion in 2024, and is Projected to Reach USD 89.06 Billion by 2032, Growing at a CAGR of 12.2% From 2025-2032.

Cloud security entails the resolutions, measures, features, and strategies that are used to enhance safety and security of data, applications, and infrastructures connected with cloud computing. It includes intervention strategies directed at the protection of identity, entity, and accessibility of cloud resources. The main subfields in cloud security are IAM, data encryption, network security, threat detection, threat prevention, and regulations. Due to the existence of threats to the security of cloud services, efficient security approaches include the architectural design of cloud services, observation and tracking, assessment and confirmation of service security, and timely response to new threats with strategies that will help manage and reduce the risks affecting cloud-based services.

The global cloud security market also continues to evolve and grow due to the steadily growing perception of cloud computing services by various-sized organizations. There is a high demand for advanced security solutions when organizations and their operations move to the cloud due to issues to do with security and data privacy as well as compliance with laid down laws. This section of the market includes cloud access security brokers (CASBs), secure web gateways (SWGs. ), identity and access management (IAM) solutions, encrypted tools, threat detection solutions, and other services specially designed for cloud environments.

Prominent factors that will drive the cloud security market include increased threats on cloud infrastructure and data, the emergence of regulatory standards like (GDPR AND CCPA), and the need for highly mobile security solutions that are flexible enough to fit the rapidly changing cloud environments. The major market participants involve the existing cybersecurity companies together with the cloud vendors providing solutions with integrated security. Thus, as cloud adoption grows across the world, the cloud security market is likely to shift its developments with AI threat detection, zero-trust architecture, and improved compliance solutions to address the existing and emerging security concerns of organizations that operate in the cloud environment.

Cloud Security Market Trend Analysis

Cloud Security Market Growth Drivers- Increasing adoption of Hybrid and Muliti-Cloud Environments

- In the sphere of cloud security, there is a trend that has gained popularity recently – the usage of Zero Trust Security. In the past, network security was focused on the outside world as everything inside the network was considered safe. However, the introduction of cloud services and practices such as remotely working and using mobile devices have made it almost impossible to establish a clear perimeter in an organization. This is because Zero Trust Security comes with the idea of threats that could be inside as well as outside the network perimeters.

- In Zero Trust Security, identity of users are constantly validated, access controls are granted on the basis of ‘need to know’ and the security solution continuously audits and monitors the occurrences in real time. This improves security because access to resources is only granted when needed and every attempt at accessing the resources is validated irrespective of location. Since many are turning into the cloud for their organizational solutions also considering the protection of data and compliance requirements that have to be met, frameworks such as Zero Trust Security have become paramount in managing risks in relation to the access of sensitive data.

Cloud Security Market Opportunities- Integration of artificial intelligence (AI) and machine learning (ML) technologies

- An important prospect in the sphere of cloud security is the use of artificial intelligence (AI) and Machine Learning (ML). These technologies have the potential of augmenting security solutions by providing more timely information for threat identification, instantaneous response, and custom security attributes. AI and ML have an advantage of processing big data from different sources in real-time, looking for signs of threats or irregularities that may be unnoticed by conventional security mechanisms.

- Further, automation of security through artificial intelligence can help in easing the burden on the security department while at the same time improving the speed of recognizing new security threats. Using AI and ML improves the efficiency of threat detection and mitigation, enhances the organization’s security, and strategically prepares it for future cyber threats in cloud systems.

- Spend on AI-based security solutions are likely to increase in the coming periods, as the organizations are keen on improving their security posture against advanced attacks besides aiming at enhancing the efficiency of security operations in cloud computing. Thus, the future brings growing opportunities for technology suppliers to increase their efforts and develop new, AI-based security options for the protection of cloud resources that can meet current and future demands for efficient, effective, and adaptive security enhancements.

Cloud Security Market Segment Analysis:

Cloud Security Market Segmented on the basis of component, deployment and end-use.

By Component, Solution segment is expected to dominate the market during the forecast period

- The current market of the cloud security predicts that solution segment is likely to surpass the market during the aforesaid period due to escalating in demand for security solutions which are hardwired to meet with the difficulties of the cloud computing. The cloud security solutions cover a broad spectrum product categories that include CASBs, IAM, data encryption, threat detection/prevention tools, and SWGs.

- Since more core business applications and data are shifting to the cloud, protecting them from cyber threats, compliant and securing sensitive information become critical needs. The solution providers are now working on devising strategies and bringing innovations in assembling the comprehensive, elastic and dynamic security solutions that can counterbalance the threats relating to the cloud adoption. This trend is forseen to propel massive investments in the cloud security solutions, thereby defining a new growth segment of the market in the next few years.

By End Use, BFSI segment expected to held the largest share

- Another area of cloud security the Banking, Financial Services, and Insurance (BFSI) sector will have the largest market share. Such a dominance is explainable by factors that are peculiar to the financial industry only: the regulations are much stricter; the information must be kept secure, especially if it is of financial nature; digital transformation is vital for the banking and other similar sectors. BFSI organizations are concentrating more and more on cloud to get cost optimizations, more agility and better customer satisfaction. However, it in brings new types of risks associated with data leakage, fraud, and compliance in the cloud environment, thus requiring reliable cloud security measures.

- Since the function of BFSI primarily relates to upholding the credibility and secrecy of its clients, this particular industry type is ready to dedicate capital toward the purchase of satisfactory cloud security solutions. Such measures generally consist of applied data encryption, robust IAM policies, technologies for real-time threat identification, and constant scrutiny. Also, the increased adoption of analytic technologies such as AI and machine learning to manage risks and prevent fraud shows the sector’s focus on innovation to counter new and emerging threats. Therefore, it is clear that, owing to the sustained BFSI institutions’ development of digital transformation strategies and adverse regulatory environments, the continued need for robust individual solutions, application, and development of cloud security solutions will be instrumental in maintaining the positive growth of the cloud security market.

Cloud Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Hence, it is estimated that the regions such as North America, which currently dominates the cloud security market, will continue to enjoy a similar path in the forecast period as well. This leadership is anchored on several factors, some of which include; The region has widely adopted cloud technologies early among enterprises cutting across the sectors. The un. HashSetted facts such as the North American region is home to a number of mature cybersecurity vendors as well as cloud service providers strengthen its market standing. Also, the payout of regulatory requirements, associated with data protection and privacy acts like the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA) urges organizations to adopt Cloud security at its best.

- In addition, the region to possess a strong foundation for the creation and enhancement of realms and clouds’ security solutions like deep learning algorithms and zero-trust mechanism. All these have bearing towards the reason why Americas region especially North America continues to dominate the cloud security market since organizations are equally sensitive to security standards and measures in respect to their cloud solutions.

Active Key Players in the Cloud Security Market

- Amazon Web Services (AWS) (USA)

- Barracuda Networks (USA)

- Check Point Software Technologies (Israel)

- Cisco (USA)

- CrowdStrike (USA)

- Fortinet (USA)

- Google Cloud (USA)

- IBM (USA)

- McAfee (USA)

- Microsoft (USA)

- Palo Alto Networks (USA)

- Proofpoint (USA)

- Sophos (United Kingdom)

- Symantec (USA)

- Trend Micro (Japan)

- Other Active Players

Key Industry Developments in the Cloud Security Market:

- In October 2023, Palo Alto Networks, Inc. has engaged into an agreement to acquire Dig Security, a provider of Data Security Posture Management (DSPM). Through this collaboration, Palo Alto Networks intends to improve security measures and safeguard against both internal and external threats.

Global Cloud Security Market Scope:

|

Global Cloud Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 35.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.2 % |

Market Size in 2032: |

USD 89.06 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud Security Market by Component (2018-2032)

4.1 Cloud Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Cloud Security Market by Deployment (2018-2032)

5.1 Cloud Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Private

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hybrid

5.5 Public

Chapter 6: Cloud Security Market by End Use (2018-2032)

6.1 Cloud Security Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail & E-commerce

6.5 IT & Telecom

6.6 Healthcare

6.7 Manufacturing

6.8 Government

6.9 Aerospace & Defense

6.10 Energy & Utilities

6.11 Transportation & Logistics

6.12 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud Security Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMAZON WEB SERVICES (AWS) (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BARRACUDA NETWORKS (USA)

7.4 CHECK POINT SOFTWARE TECHNOLOGIES (ISRAEL)

7.5 CISCO (USA)

7.6 CROWDSTRIKE (USA)

7.7 FORTINET (USA)

7.8 GOOGLE CLOUD (USA)

7.9 IBM (USA)

7.10 MCAFEE (USA)

7.11 MICROSOFT (USA)

7.12 PALO ALTO NETWORKS (USA)

7.13 PROOFPOINT (USA)

7.14 SOPHOS (UNITED KINGDOM)

7.15 SYMANTEC (USA)

7.16 TREND MICRO (JAPAN)

7.17 OTHER KEY PLAYERS

Chapter 8: Global Cloud Security Market By Region

8.1 Overview

8.2. North America Cloud Security Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Solution

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 Private

8.2.5.2 Hybrid

8.2.5.3 Public

8.2.6 Historic and Forecasted Market Size by End Use

8.2.6.1 BFSI

8.2.6.2 Retail & E-commerce

8.2.6.3 IT & Telecom

8.2.6.4 Healthcare

8.2.6.5 Manufacturing

8.2.6.6 Government

8.2.6.7 Aerospace & Defense

8.2.6.8 Energy & Utilities

8.2.6.9 Transportation & Logistics

8.2.6.10 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud Security Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Solution

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 Private

8.3.5.2 Hybrid

8.3.5.3 Public

8.3.6 Historic and Forecasted Market Size by End Use

8.3.6.1 BFSI

8.3.6.2 Retail & E-commerce

8.3.6.3 IT & Telecom

8.3.6.4 Healthcare

8.3.6.5 Manufacturing

8.3.6.6 Government

8.3.6.7 Aerospace & Defense

8.3.6.8 Energy & Utilities

8.3.6.9 Transportation & Logistics

8.3.6.10 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud Security Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Solution

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 Private

8.4.5.2 Hybrid

8.4.5.3 Public

8.4.6 Historic and Forecasted Market Size by End Use

8.4.6.1 BFSI

8.4.6.2 Retail & E-commerce

8.4.6.3 IT & Telecom

8.4.6.4 Healthcare

8.4.6.5 Manufacturing

8.4.6.6 Government

8.4.6.7 Aerospace & Defense

8.4.6.8 Energy & Utilities

8.4.6.9 Transportation & Logistics

8.4.6.10 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud Security Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Solution

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 Private

8.5.5.2 Hybrid

8.5.5.3 Public

8.5.6 Historic and Forecasted Market Size by End Use

8.5.6.1 BFSI

8.5.6.2 Retail & E-commerce

8.5.6.3 IT & Telecom

8.5.6.4 Healthcare

8.5.6.5 Manufacturing

8.5.6.6 Government

8.5.6.7 Aerospace & Defense

8.5.6.8 Energy & Utilities

8.5.6.9 Transportation & Logistics

8.5.6.10 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud Security Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Solution

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 Private

8.6.5.2 Hybrid

8.6.5.3 Public

8.6.6 Historic and Forecasted Market Size by End Use

8.6.6.1 BFSI

8.6.6.2 Retail & E-commerce

8.6.6.3 IT & Telecom

8.6.6.4 Healthcare

8.6.6.5 Manufacturing

8.6.6.6 Government

8.6.6.7 Aerospace & Defense

8.6.6.8 Energy & Utilities

8.6.6.9 Transportation & Logistics

8.6.6.10 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud Security Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Solution

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 Private

8.7.5.2 Hybrid

8.7.5.3 Public

8.7.6 Historic and Forecasted Market Size by End Use

8.7.6.1 BFSI

8.7.6.2 Retail & E-commerce

8.7.6.3 IT & Telecom

8.7.6.4 Healthcare

8.7.6.5 Manufacturing

8.7.6.6 Government

8.7.6.7 Aerospace & Defense

8.7.6.8 Energy & Utilities

8.7.6.9 Transportation & Logistics

8.7.6.10 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Global Cloud Security Market Scope:

|

Global Cloud Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 35.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.2 % |

Market Size in 2032: |

USD 89.06 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||