Closed System Transfer Device Market Synopsis

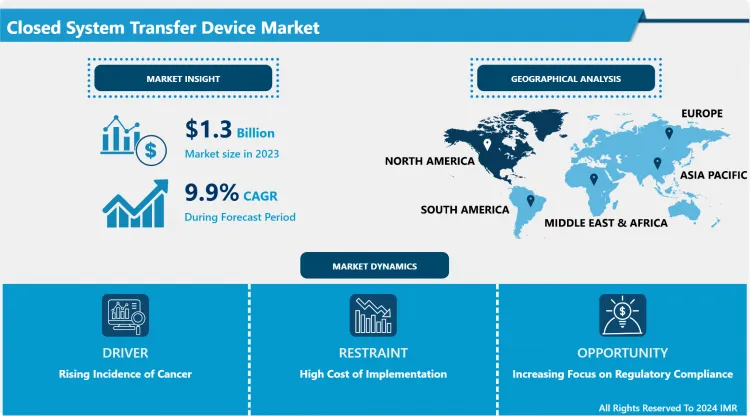

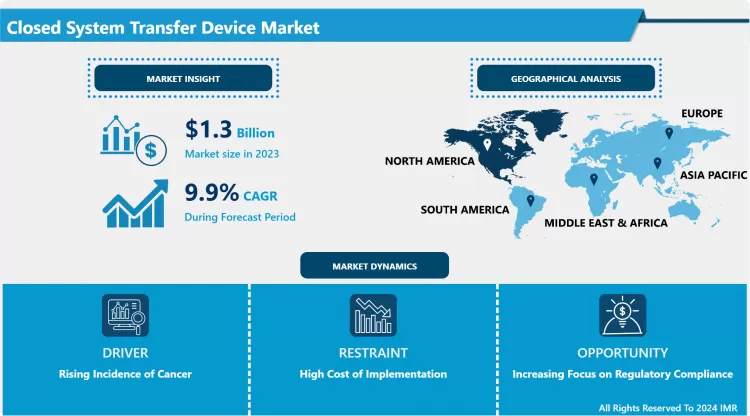

Closed System Transfer Device Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 3.0 Billion by 2032, Growing at a CAGR of 9.9% From 2024-2032.

The Closed System Transfer Device (CSTD) market includes products and devices created for protection from exposure to hazardous drugs while handling the medications, administration, and disposal. CSTDs are mainly applied in health care facilities such as hospitals, Pharacies and oncology units to address safe handling of highly risky drugs including the chemotherapy drugs. These devices form a closed airtight isolation system that makes it impossible for the formation of aerosols, vapors or liquid and thus reflect the safety of the healthcare providers, patients as well as the vironment. Standard precautions such as the use of certified CSTDs have assumed importance from the rising issues of drug contamination and occupational patient exposure.

- The Closed System Transfer Device market has expanded significantly over the last few years because of rising concerns about healthcare worker safety especially when handling cytotoxic substances. The increase in cancer incidence and the resultant increase of patients using chemotherapy has also the increase the usage of CSTDs hence being regarded as effective in controlling contamination and exposure of drugs. Also, with regulatory standards set up by the U.S. Pharmacopeia (USP) set down regarding handling of hazardous drugs, the market has also seen constant promotion. Many large companies around the world have changed the direction of the healthcare business towards safety and compliance norms especially in developed nations this has boosted the demand of the product thereby fueling the market growth.

- Also the market has posted technology trends on product designs which enhances aspects such as ease of use and safety measures. Another force behind the continuing advancements of CSTDs is the requirement to keep medications sterile and free from contamination contaminants during the usage process. This is especially valid because with rising consumer awareness of drug security, especially in the developing world, there remains significant scope for future market expansion. To reinforce their devices further into healthcare systems, manufacturers are also concentrating on diversifying their offerings so that their protective devices remain relevant with the changing list of hazardous drugs.

Closed System Transfer Device Market Trend Analysis

Technological Innovations in CSTDs

- We found out that technological factor, more specifically in the areas of Closed System Transfer Device market, have been influential in the growth of the market in the periods under consideration. For several years now, manufacturers have strived to develop devices that not only are safe but also efficient and easier to use. Technologies like drug transfer robotics, friendlier design, safety solutions including air purification technology are rapidly transforming how the hostile drugs are managed. Moreover, new generation CSTDs are being developed as disposable systems to avoid contact point contamination by washable systems. Many of these advancements have provided better conformity with the regulating standards as well as created easier handling of the hazardous drugs among the health care professionals making it a common occurrence.

Expansion into Emerging Markets

- An important future can be identified in the expansion of Closed System Transfer Device market in the emerging countries like Asia-Pacific and Latin America. These areas indicated lower utilization of CSTDs than North America and Europe are still growing quickly as the number of cancer cases rises and the need for improved safety in healthcare rises and provides a good profit for market participants. The governments in these regions are incrementally implementing effective safety measures which make CSTDs indispensable in healthcare entities. In addition, rising heath care spending along with emphasis on health safety at working place is going to create high demand in coming years. Those companies that have positioned themselves well to capture this demand have the potential of experiencing exponential growth, through increased market numbers.

Closed System Transfer Device Market Segment Analysis:

Closed System Transfer Device Market Segmented on the basis of type, Component and end user.

By Type, membrane-to-membrane systems segment is expected to dominate the market during the forecast period

- Based on the segment, the membrane-to-membrane systems segment holds the largest share of the Closed System Transfer Device (CSTD) market throughout the given period owing to the safety factor and effectiveness in avoiding exposure to hazardous drugs. These systems make it possible for there to be no contact with the outside environment as the transfer process takes place with in a closed transfer pathway from one membrane to another; thus reducing contamination. The evolving need for secure drug transfer technologies especially with oncology and chemotherapy drugs highlights membrane-to-membrane systems.

- Also, they have been able to check drug spillage, aerosol release, and vapor leakage, which has made them popular in health facilities dealing with hazardous products such as hospitals. Due to the increase of CSTDs usage resulting from the stringent rules and their implementation on CSTDs, the membrane-to-membrane systems will be highly penetrated in the global market throughout the forecast year.

By Component, Syringe Safety Devices segment expected to held the largest share

- Syringe Safety Devices is anticipated to depict the largest growth in the Closed System Transfer Device (CSTD) market in terms of component throughout the forecast period. This prevalence is due to the extensive employment of the syringes within any clinical environments especially where dangerous compounds including chemotherapy drugs are administered. Syringe safety devices are useful in contributing to the reduced threat of contaminant transfer as they also serve as a mechanism whereby medication is transferred safely, and getting rid of any dangers that may expose healthcare workers or patients to contend with.

- Furthermore, a growing concern over infection risks to practitioners and clients resulting from needle-stick incidences as well as safety ordinances in the global market have spurred enhanced use of these safety products. This ease of use with advanced safety features such as retractable needles and lockable mechanisms makes syringe safety devices unreplaceable and thus having a huge share in hospitals, clinics and pharmacies. This segment is expected to flourish in the future since the new and stringent laws are being adopted concerning safe handling of highly responsive drugs.

Closed System Transfer Device Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to remain the largest market for Closed System Transfer Device in the year 2023 due to safety measures rules, improved healthcare systems, and significant concern to the risks of exposure to hazardous drugs in the United States. The United States has been especially decisive for market growth owing to the put into operation of rules like USP <800> that require CSTDs in healthcare entities managing risky drugs. To this end, it is expected that this region accounts for over 40% of the market for CSTDs, thereby being the largest market globally. Many of these devices have been widely used in hospitals, oncological treatment centers, and pharmacies in North America where regulatory environment and concerns over risks associated with employees’ exposure to carcinogenic substances are well developed.

Active Key Players in the Closed System Transfer Device Market

- B. Braun Melsungen AG (Germany)

- BD (Becton, Dickinson and Company) (USA)

- Cardinal Health, Inc. (USA)

- Corning Incorporated (USA)

- Corvida Medical (USA)

- Equashield LLC (USA)

- Fresenius Kabi AG (Germany)

- Hanaco Medical (Israel)

- Hospira, Inc. (a Pfizer company) (USA)

- ICU Medical, Inc. (USA)

- JMS Co., Ltd. (Japan)

- Simplivia Healthcare Ltd. (Israel)

- Terumo Corporation (Japan)

- Vanguard Healthcare Solutions (United Kingdom)

- Yukon Medical (USA), Other key Players.

|

Global Closed System Transfer Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.9% |

Market Size in 2032: |

USD 3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Closed System Transfer Device Market by Type (2018-2032)

4.1 Closed System Transfer Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Needleless Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Membrane-to-Membrane Systems

Chapter 5: Closed System Transfer Device Market by Component (2018-2032)

5.1 Closed System Transfer Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Syringe Safety Devices

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Vial Access Devices

5.5 Accessories

5.6 Bag/Line Access Devices

Chapter 6: Closed System Transfer Device Market by End User (2018-2032)

6.1 Closed System Transfer Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Clinics & Oncology Centers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospitals

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Closed System Transfer Device Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 B. BRAUN MELSUNGEN AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BD (BECTON

7.4 DICKINSON AND COMPANY) (USA)

7.5 CARDINAL HEALTH INC. (USA)

7.6 CORNING INCORPORATED (USA)

7.7 CORVIDA MEDICAL (USA)

7.8 EQUASHIELD LLC (USA)

7.9 FRESENIUS KABI AG (GERMANY)

7.10 HANACO MEDICAL (ISRAEL)

7.11 HOSPIRA INC. (A PFIZER COMPANY) (USA)

7.12 ICU MEDICAL INC. (USA)

7.13 JMS COLTD. (JAPAN)

7.14 SIMPLIVIA HEALTHCARE LTD. (ISRAEL)

7.15 TERUMO CORPORATION (JAPAN)

7.16 VANGUARD HEALTHCARE SOLUTIONS (UNITED KINGDOM)

7.17 YUKON MEDICAL (USA)

7.18 OTHER KEY PLAYERS

Chapter 8: Global Closed System Transfer Device Market By Region

8.1 Overview

8.2. North America Closed System Transfer Device Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Needleless Systems

8.2.4.2 Membrane-to-Membrane Systems

8.2.5 Historic and Forecasted Market Size by Component

8.2.5.1 Syringe Safety Devices

8.2.5.2 Vial Access Devices

8.2.5.3 Accessories

8.2.5.4 Bag/Line Access Devices

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Clinics & Oncology Centers

8.2.6.2 Hospitals

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Closed System Transfer Device Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Needleless Systems

8.3.4.2 Membrane-to-Membrane Systems

8.3.5 Historic and Forecasted Market Size by Component

8.3.5.1 Syringe Safety Devices

8.3.5.2 Vial Access Devices

8.3.5.3 Accessories

8.3.5.4 Bag/Line Access Devices

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Clinics & Oncology Centers

8.3.6.2 Hospitals

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Closed System Transfer Device Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Needleless Systems

8.4.4.2 Membrane-to-Membrane Systems

8.4.5 Historic and Forecasted Market Size by Component

8.4.5.1 Syringe Safety Devices

8.4.5.2 Vial Access Devices

8.4.5.3 Accessories

8.4.5.4 Bag/Line Access Devices

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Clinics & Oncology Centers

8.4.6.2 Hospitals

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Closed System Transfer Device Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Needleless Systems

8.5.4.2 Membrane-to-Membrane Systems

8.5.5 Historic and Forecasted Market Size by Component

8.5.5.1 Syringe Safety Devices

8.5.5.2 Vial Access Devices

8.5.5.3 Accessories

8.5.5.4 Bag/Line Access Devices

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Clinics & Oncology Centers

8.5.6.2 Hospitals

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Closed System Transfer Device Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Needleless Systems

8.6.4.2 Membrane-to-Membrane Systems

8.6.5 Historic and Forecasted Market Size by Component

8.6.5.1 Syringe Safety Devices

8.6.5.2 Vial Access Devices

8.6.5.3 Accessories

8.6.5.4 Bag/Line Access Devices

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Clinics & Oncology Centers

8.6.6.2 Hospitals

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Closed System Transfer Device Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Needleless Systems

8.7.4.2 Membrane-to-Membrane Systems

8.7.5 Historic and Forecasted Market Size by Component

8.7.5.1 Syringe Safety Devices

8.7.5.2 Vial Access Devices

8.7.5.3 Accessories

8.7.5.4 Bag/Line Access Devices

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Clinics & Oncology Centers

8.7.6.2 Hospitals

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Closed System Transfer Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.9% |

Market Size in 2032: |

USD 3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Closed System Transfer Device Market research report is 2024-2032.

B. Braun Melsungen AG (Germany), BD (Becton, Dickinson and Company) (USA), Cardinal Health, Inc. (USA), Corning Incorporated (USA), Corvida Medical (USA) and Other Major Players.

The Closed System Transfer Device Market is segmented into Type, Component, End User and region. By Type, the market is categorized into Needleless Systems, Membrane-to-Membrane Systems. By Component, the market is categorized into Syringe Safety Devices, Vial Access Devices, Accessories, Bag/Line Access Devices. By End User, the market is categorized into Clinics & Oncology Centers, Hospitals, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Closed System Transfer Device (CSTD) market includes products and devices created for protection from exposure to hazardous drugs while handling the medications, administration, and disposal. CSTDs are mainly applied in health care facilities such as hospitals, Pharacies and oncology units to address safe handling of highly risky drugs including the chemotherapy drugs. These devices form a closed airtight isolation system that makes it impossible for the formation of aerosols, vapors or liquid and thus reflect the safety of the healthcare providers, patients as well as the vironment. Standard precautions such as the use of certified CSTDs have assumed importance from the rising issues of drug contamination and occupational patient exposure.

Closed System Transfer Device Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 3.0 Billion by 2032, Growing at a CAGR of 9.9% From 2024-2032.