Clinical Laboratory Services Market Synopsis:

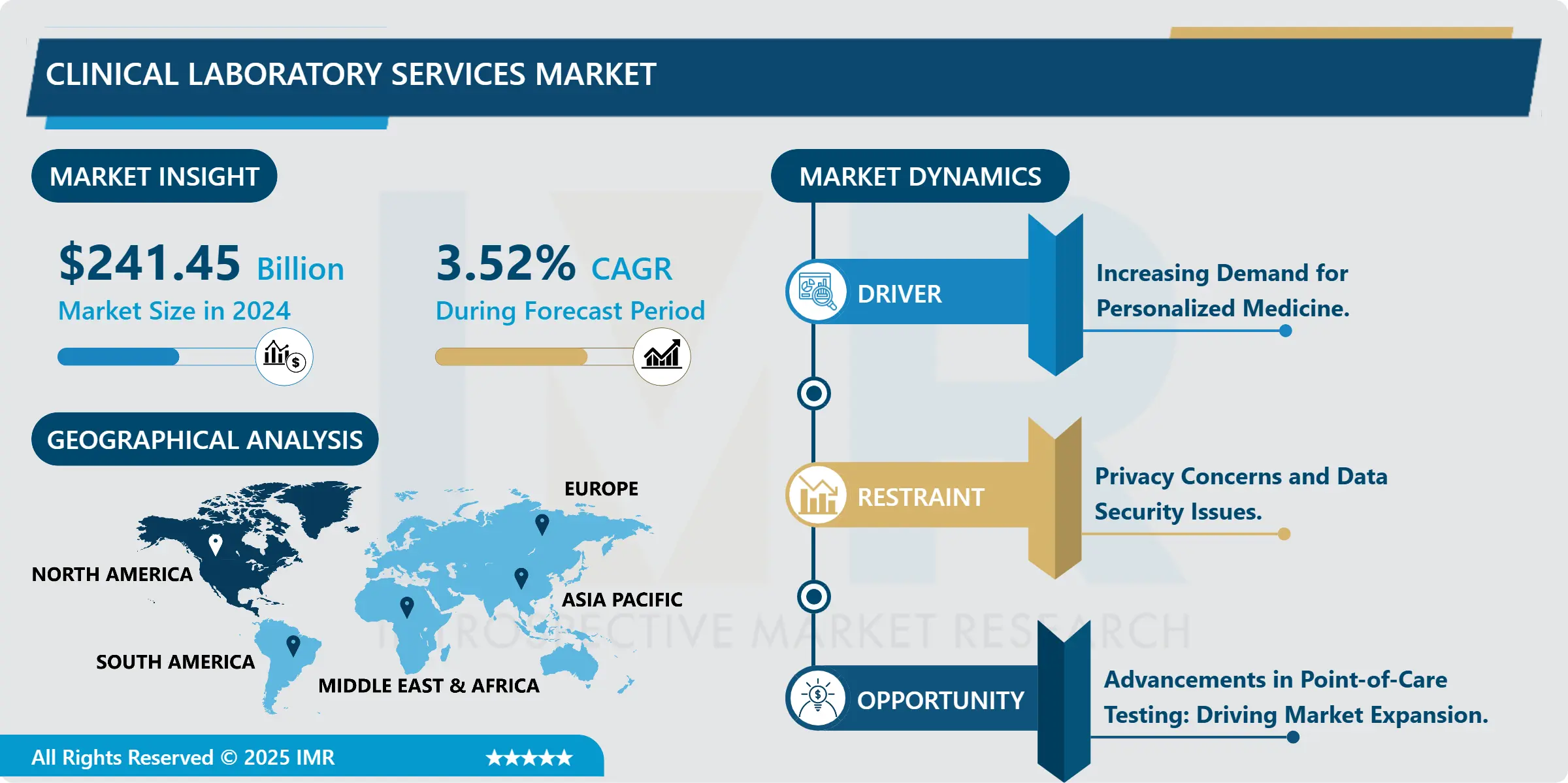

Clinical Laboratory Services Market Size is Valued at USD 241.45 Billion in 2024 and is Projected to Reach USD 353.26 Billion by 2035, Growing at a CAGR of 3.52% From 2025-2035.

The Clinical Laboratory Services Market can be defined as the industry that consists of the establishments and the services that are used for diagnosing individuals based on samples to identify, manage, and treat diseases. These services comprise clinical chemistry, microbiology, hematology, and genetics, among other laboratory diagnostic tests. They are offered by hospitals’ labs, individual facilities, and clinic-based labs and the services range from biochemistry, and oncology among others to infection disease diagnosis. It supplies hospitals, clinics, diagnostic centers, and research institutes worldwide with a major emphasis on management of health care and patients.

Clinical laboratories serve a critical role in diagnosing medical conditions and monitoring the health status of patients across the world, and the global clinical laboratory services market is boosted by a growing need for clinical diagnosis and testing and an aging global population which is more susceptible to chronic diseases. The increasing geriatric population coupled with indigenous development of diagnostics, raises consciousness towards early disease identification and preventive measures drive the market. Also, capacity development in the healthcare sector across developing countries including increasing healthcare expenditure results in the raising of demand for the clinical laboratory services.

In addition, the COVID-19 pandemic has revealed the significance of clinical laboratories in detecting and diagnosing diseases as well as in managing illnesses, which increases the growth rate of the market even more. The Hs trend of personalizing medicine and genomic testing also contributes to the market growth as laboratories introduce new tests to meet the patient’s needs. Nevertheless, certain factors like increased regulatory standards and revenue receiving mechanisms pose certain threats to the market expansion to a certain extent. In general, it might be concluded that the clinical laboratory services market is well-developed and will continue to develop in the future due to globalization, an increase in technology use, and the need for proper diagnostics for various diseases across the world.

Clinical Laboratory Services Market Trend Analysis:

Innovations Reshaping the Clinical Laboratory Landscape

- In this context, several trends have actuated the Clinical Laboratory Services Market to grow more significantly. One of them is the growing world population affected by chronic diseases, which require continuous diagnosis and monitoring, thus stimulating the need for clinical laboratories. New technologies such as molecular diagnostics and next-generation sequencing are also contributing towards the development of the market as the tests become more accurate, efficient, and capable of providing with numerous diseases associated with a variety of conditions.

- Another major trend that is noted on the market is the increased use of such concepts as personalized medicine and targeted therapies. With the trend in the modern healthcare delivery system moving toward more targeted and sensitive methodologies, there is a current need for tests like genetic tests and biomarkers that can afford highly targeted and individualized treatment plans based on the patient’s biochemical characteristics. Further, the COVID-19 pandemic has shown the centrality of clinical laboratories as being crucial to public health responses; thus, enhanced investments in laboratories have occurred globally. Consequently, it appears that the clinical laboratory services environment is highly active and the advancement of various technologies as well as the extension of testing opportunities is continuous and on-going.

Expanding Horizons, Emerging Trends in Clinical Laboratory Services

- The Clinical Laboratory Services Market is defined to have a very good market growth in the near future due to the rising need for diagnostic procedures and individualized care. Recent developments in diagnostic technologies for instance molecular diagnostics which is a widely embraced technology in laboratories as well as next-generation sequencing are enhancing the offered laboratory services. In addition, the increasing incidence of chronic diseases integrated with the elderly people worldwide has also helped to increase the demand for early diagnosis products and services, thus contributing more to the market.

- In addition, the COVID-19 pandemic proved the importance of clinical laboratories as part of the population’s health care and increased the pace of work on laboratory support and automation. Due to increased focus by healthcare systems on preventive and personalized medicine, several diagnostic solutions are heading towards integration to provide fast and precise results. New opportunities exist in Asian-Pacific and Latin American countries due to the improved healthcare expenditures and the raising awareness of health diagnostics among people. All in all, it can be said that the market of clinical laboratory services is to grow consistently due to the changes of it’s function in correspondence to the new technologies and improvement of the healthcare systems in the international level.

Clinical Laboratory Services Market Segment Analysis:

Clinical Laboratory Services Market Segmented on the basis of Test type, Service Provider, and end-users.

By Test Type,Microbiology segment segment is expected to dominate the market with around 26.43 % share during the forecast period.

- Clinical laboratory services thus include lot of routine diagnostic tests that are very compulsory in health facilities/surgeries like clinical chemistry, microbiology, hematology, immunology, genetics, cytology and histology. A method of clinical chemistry tests lies in determining chemical parameters of blood and other liquid media of the organism to define its state and pathology. Microbiology is a course that aims at diagnosing and managing diseases using microorganisms. Hematology deals with the study of blood dysfunctions or abnormalities while immunology on the other is concerned with study of immunologic reactions or dysfunctions.

- Genetic testing evaluates the inherited disease and the concept of personalized medicine with reference to the genetic difference. Cytology deals with the assessment of a sample by looking for cancer or infections at the cellular level while histology works at the number of tissues with the primary aim of diagnosing or researching diseases. All these tests are important in diagnosing, managing and following up different illnesses and diseases; therefore, they have benefited the medical field and the distinct treatment plans offered to patients.

By Service Provider,Hospital-based Laboratories platform is expected to dominate with close to 39.68% market share during the forecast period.

- The clinical laboratory services are offered through organizations such as the hospital-based laboratories, independent laboratories and those laboratories located within clinics. The independent laboratories can be found within the hospital facilities where their main responsibility is to handle diagnostic services for both inpatients and outpatients. Independent laboratories work on their own and are mainly involved in performing diagnostic tests; they may be affiliated with a number of healthcare facilities as well as serve individuals. The clinic-based laboratories are normally situated in outpatient clinics and therefore are primarily designed to address the diagnostic requirements of the clinic and the primary care services. It can be stated that all the mentioned provider types have their positive aspects and serve different populations of patients contributing to the accessibility and efficiency of the diagnostic tests in the healthcare sector.

Clinical Laboratory Services Market Regional Insights:

North America region is likely to dominate the market with approx. 31.24% share during the forecast period.

- As for North America the Clinical Laboratory Services Market is well developed and it consists of developed healthcare system and modern diagnostic tools. The region’s market is then fueled by requirement for reliable and timely diagnostic service in several medical specialties. Hospital based laboratory account for a lion share due to established health care networks and embeddedness of laboratories into large health institutions. Fixed station laboratories are also very important because of their specialized testing and outpatient services functions.

- It is evident that there is steady growth in North America’s Clinical Laboratory Service Market due to; Growing Health Care expenditure; Technological enhancements in diagnosis; and patient awareness of preventive health services. The competition is intense partly due to factors such as the companies’ drive to diversify service delivery, improve efficiency of laboratories, and integrate advanced technologies in automating procedures that lead to better diagnosis. Laws and regulations, as well as standards of services provision, contribute to the quality and safety of services, which shapes consumers’ and healthcare suppliers’ trust. Altogether, the market for clinical laboratory services in North America is still developing, as it is based on the principles of constant innovation and providing the population with high-quality healthcare services.

Active Key Players in the Clinical Laboratory Services Market:

- Laboratory Corporation of America Holdings (USA)

- QIAGEN NV (Netherlands)

- Eurofins Scientific SE (Luxembourg)

- Quest Diagnostics Incorporated (USA)

- OPKO Health, Inc. (USA)

- Siemens Medical Solutions USA, Inc. (USA)

- Neo Genomics Laboratories (USA)

- Fresenius Medical Care (Germany)

- ARUP Laboratories (USA)

- Sonic Healthcare (Australia)

- Charles River Laboratories International, Inc. (USA)

- SYNLAB International GmbH (Germany)

- Mayo Clinic Laboratories (USA)

- Unilabs (Switzerland) and Others

Key Industry Developments in the Clinical Laboratory Services Market:

- In October 2025, (Broader clinical services consolidation) Thermo Fisher announced a planned acquisition of Clario (a clinical-trial services/data company) to strengthen clinical development and data capabilities an example of large life-science firms expanding into clinical/diagnostic services.

- In July 2024, Quest Diagnostics agreed to acquire the outreach laboratory services of OhioHealth, a deal intended to broaden access to cost-effective laboratory testing in Ohio.

|

Global Clinical Laboratory Services Market: |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 241.45 Billion |

|

Forecast Period 2025-35 CAGR: |

3.52 % |

Market Size in 2032: |

USD 353.26 Billion |

|

Segments Covered: |

By Test Type |

|

|

|

By Service Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clinical Laboratory Services Market by Test Type (2018-2032)

4.1 Clinical Laboratory Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Clinical Chemistry

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Microbiology

4.5 Hematology

4.6 Immunology

4.7 Genetics

4.8 Cytology

4.9 Histology

Chapter 5: Clinical Laboratory Services Market by Service Provider (2018-2032)

5.1 Clinical Laboratory Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital-based Laboratories

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Stand-alone Laboratories

5.5 Clinic-based Laboratories

Chapter 6: Clinical Laboratory Services Market by End User (2018-2032)

6.1 Clinical Laboratory Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Diagnostic Centers

6.6 Research Institutes

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Clinical Laboratory Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LABORATORY CORPORATION OF AMERICA HOLDINGS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 QIAGEN NV (NETHERLANDS)

7.4 EUROFINS SCIENTIFIC SE (LUXEMBOURG)

7.5 QUEST DIAGNOSTICS INCORPORATED (USA)

7.6 OPKO HEALTH INC. (USA)

7.7 SIEMENS MEDICAL SOLUTIONS USA INC. (USA)

7.8 NEO GENOMICS LABORATORIES (USA)

7.9 FRESENIUS MEDICAL CARE (GERMANY)

7.10 ARUP LABORATORIES (USA)

7.11 SONIC HEALTHCARE (AUSTRALIA)

7.12 CHARLES RIVER LABORATORIES INTERNATIONAL INC. (USA)

7.13 SYNLAB INTERNATIONAL GMBH (GERMANY)

7.14 MAYO CLINIC LABORATORIES (USA)

7.15 UNILABS (SWITZERLAND)

7.16 OTHERS

7.17

Chapter 8: Global Clinical Laboratory Services Market By Region

8.1 Overview

8.2. North America Clinical Laboratory Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Test Type

8.2.4.1 Clinical Chemistry

8.2.4.2 Microbiology

8.2.4.3 Hematology

8.2.4.4 Immunology

8.2.4.5 Genetics

8.2.4.6 Cytology

8.2.4.7 Histology

8.2.5 Historic and Forecasted Market Size by Service Provider

8.2.5.1 Hospital-based Laboratories

8.2.5.2 Stand-alone Laboratories

8.2.5.3 Clinic-based Laboratories

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Diagnostic Centers

8.2.6.4 Research Institutes

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Clinical Laboratory Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Test Type

8.3.4.1 Clinical Chemistry

8.3.4.2 Microbiology

8.3.4.3 Hematology

8.3.4.4 Immunology

8.3.4.5 Genetics

8.3.4.6 Cytology

8.3.4.7 Histology

8.3.5 Historic and Forecasted Market Size by Service Provider

8.3.5.1 Hospital-based Laboratories

8.3.5.2 Stand-alone Laboratories

8.3.5.3 Clinic-based Laboratories

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Diagnostic Centers

8.3.6.4 Research Institutes

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Clinical Laboratory Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Test Type

8.4.4.1 Clinical Chemistry

8.4.4.2 Microbiology

8.4.4.3 Hematology

8.4.4.4 Immunology

8.4.4.5 Genetics

8.4.4.6 Cytology

8.4.4.7 Histology

8.4.5 Historic and Forecasted Market Size by Service Provider

8.4.5.1 Hospital-based Laboratories

8.4.5.2 Stand-alone Laboratories

8.4.5.3 Clinic-based Laboratories

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Diagnostic Centers

8.4.6.4 Research Institutes

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Clinical Laboratory Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Test Type

8.5.4.1 Clinical Chemistry

8.5.4.2 Microbiology

8.5.4.3 Hematology

8.5.4.4 Immunology

8.5.4.5 Genetics

8.5.4.6 Cytology

8.5.4.7 Histology

8.5.5 Historic and Forecasted Market Size by Service Provider

8.5.5.1 Hospital-based Laboratories

8.5.5.2 Stand-alone Laboratories

8.5.5.3 Clinic-based Laboratories

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Diagnostic Centers

8.5.6.4 Research Institutes

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Clinical Laboratory Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Test Type

8.6.4.1 Clinical Chemistry

8.6.4.2 Microbiology

8.6.4.3 Hematology

8.6.4.4 Immunology

8.6.4.5 Genetics

8.6.4.6 Cytology

8.6.4.7 Histology

8.6.5 Historic and Forecasted Market Size by Service Provider

8.6.5.1 Hospital-based Laboratories

8.6.5.2 Stand-alone Laboratories

8.6.5.3 Clinic-based Laboratories

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Diagnostic Centers

8.6.6.4 Research Institutes

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Clinical Laboratory Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Test Type

8.7.4.1 Clinical Chemistry

8.7.4.2 Microbiology

8.7.4.3 Hematology

8.7.4.4 Immunology

8.7.4.5 Genetics

8.7.4.6 Cytology

8.7.4.7 Histology

8.7.5 Historic and Forecasted Market Size by Service Provider

8.7.5.1 Hospital-based Laboratories

8.7.5.2 Stand-alone Laboratories

8.7.5.3 Clinic-based Laboratories

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Diagnostic Centers

8.7.6.4 Research Institutes

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Clinical Laboratory Services Market: |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 241.45 Billion |

|

Forecast Period 2025-35 CAGR: |

3.52 % |

Market Size in 2032: |

USD 353.26 Billion |

|

Segments Covered: |

By Test Type |

|

|

|

By Service Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||