Global Clean Meat Market Synopsis

The Global Clean Meat Market Size Was Valued at USD 19.99 Million in 2023 and is Projected to Reach USD 77.81 Million by 2032, Growing at a CAGR of 16.3% From 2024-2032.

Cultivated meat, commonly called cultured or cell-based meat, is produced from cell cultures using a technique. At the cellular level, the meat obtained from this procedure is identical to animal meat. As a result, it can use a safer, more reliable, and sustainable production method to supply meat with the same sensory and nutritional profile as traditionally produced meat.

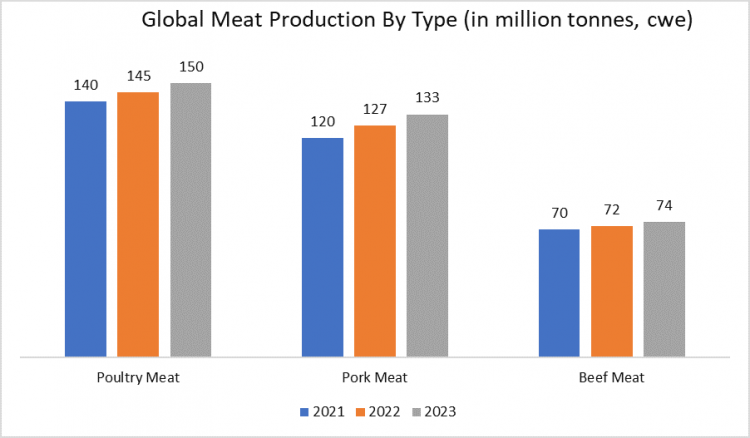

- The Food and Agriculture Organization of the United Nations (FAO) estimates that the consumption of animal meat will rise by more than 70% by the year. Expanding the current livestock system would be necessary to meet the increasing demand for nutrition based on meat.

- The need for technological advancements to meet the world's protein needs in the next ten years has increased due to the growing demand for proteins and the world's population growing quickly. The increasing technological progress in alternative protein sectors is fueling a transition towards sustainable food systems on a global scale.

- There's a rising demand for meat substitutes and alternative proteins due to factors like meat shortages caused by population growth and environmental concerns. The cultured meat industry is experiencing significant growth globally, driven by heightened awareness of environmental sustainability and a greater emphasis on ensuring stable meat supplies.

- The expansion of the vegan demographic and consumer concerns about animal welfare are anticipated to drive the expansion of cultured meat. While the market is in its infancy, significant research and development efforts are underway to enable large-scale cultured meat production. Key industry players are concentrating on securing regulatory clearances to bring cultured meat products to market.

- The backing of regulatory bodies and governmental support in select regions to encourage investment in the cultured meat sector will play a crucial role in gaining approval and facilitating the commercialization of cultivated meat.

Global Clean Meat Market Trend Analysis

Population Growth Drives A Clean Meat Market, Enhancing Animal Welfare And Safety

- Population growth is a pivotal driver propelling the clean meat market forward, ensuring its sustained growth and relevance in the marketplace.

- The clean meat industry's growth is heavily influenced by demographic shifts, underscoring its positive impact on animal welfare and food safety. Heightened ethical and environmental concerns are driving a surge in demand for sustainable protein alternatives, prompting the need for innovative solutions to cater to a growing global population.

- Modern consumers prioritize meat products devoid of antibiotics, hormones, and the risks associated with foodborne illnesses. Cultured meat, manufactured under controlled and sanitary conditions, meets these preferences, thereby stimulating market growth.

- Clean meat technology, utilizing advancements in cellular agriculture, is positioned as a strategic response to these evolving market dynamics. By reducing reliance on traditional meat production methods, clean meat not only meets consumer preferences for ethical and sustainable food choices but also elevates animal welfare and food safety standards.

Consumer Uncertainty & Cost Issues In The Cultured Meat Industry

- Consumer perception continues to be an important challenge in the emerging cultured meat sector, with continuing concerns about both safety and flavor. While innovations continue to improve the safety and quality of lab-grown meat, some customers remain unconvinced.

- Also, the existing production procedure is costly, resulting in a price difference between clean meat and conventional meat products. This cost gap presents a challenge since it may make cultured meat less accessible to general consumers. Concerns regarding the environmental effect and scalability of production increase these problems.

Growing Clean Meat Demand In Emerging Southeast Asian Markets

- In emerging Southeast Asian economies, the blend of high per capita meat consumption, substantial meat imports, and an expanding middle-class demographic offers favorable chances for clean meat producers. As traditional livestock production struggles to keep pace with increasing meat demands, cultured meat emerges as a sustainable, locally sourced alternative. The reliance on meat imports underscores the significance of affordable, enhancing food security.

- Cultured meat's alignment with consumer preferences for ethical and sustainable food aligns well with the increasing meat demand in these economies, all while addressing environmental concerns. This presents a strategic opportunity for clean meat producers to establish themselves in these dynamic markets by enhancing production efficiency, increasing capacity, and diversifying product ranges to meet evolving consumer preferences.

- Expanding the variety of clean meat products and exploring innovative formulations can further capture a broader consumer base, capitalizing on the rising demand for alternative meat options driven by evolving consumer behaviors and preferences in the meat industry.

Global Clean Meat Market Segment Analysis:

Global Clean Meat Market Segmented based on type, end-uses, distribution channel, and region.

By Type, Chicken (Poultry) Segment is Expected to dominate the Market During the Forecast Period

- Chicken, as a dominant and highly consumed meat globally, presents a significant opportunity in the meat market. Its widespread popularity addresses the growing demand for animal protein while mitigating environmental and ethical concerns linked with traditional poultry farming.

- Poultry cultured meat production is relatively simpler and cost-efficient compared to other meat varieties like beef, which involves more complex tissue engineering processes. This simplicity enables easier scaling of production and enhances cost competitiveness.

- Poultry cultured meat offers diverse applications, ranging from nuggets to burgers and sausages, meeting consumer preferences and appealing to a broad audience.

By End-Use, Burger Segment is expected to dominate the Market During the Forecast Period

- Burgers, which dominate the market and are renowned for their convenience and a wide array of flavors, are a cornerstone of the fast-food industry, enjoying global popularity. They come in various forms, offering diverse ingredients and tastes to cater to different consumer preferences. The fast-food sector has witnessed the rise of both meat and non-meat burger options, reflecting changing dietary trends and ethical concerns.

- In this circumstance, the cultured burger segment emerges as a promising player, fueled by increasing consumer interest in sustainable and ethical meat substitutes. Cultivated meat burgers offer an effective solution to address the environmental impact associated with traditional meat production, aligning with the growing emphasis on environmental sustainability.

By Distribution Channel, the Supermarkets/Hypermarket segment is expected to dominate the market

- The dominance of the supermarkets/hypermarket segment in the Global Cultured Meat market is attributed to its wide availability of various brands in a single location, catering to a large consumer base, and accommodating multiple users simultaneously.

- The extensive range of Cultured Meat end products from different brands in supermarkets or hypermarkets, combined with the rising demand for nutritional meat, including cultured meat products, among consumers, is expected to drive the segment's growth in the market.

- Also, the convenience and accessibility offered by supermarkets and hypermarkets further contribute to their importance in the distribution of cultured meat products.

Global Clean Meat Market Regional Insights:

North America emerged as the primary driver of the cultured meat market

- North America is dominating the cultured meat industry, with the region leading in advancements and adoption. Its strong infrastructure and technological capabilities position it as a leader in cultured meat innovation and production. Supported by a favorable regulatory environment and substantial investments from both public and private sectors, North America not only dominates in market share but also drives global developments in cultured meat technologies and applications.

- This dominance is further enhanced by a convergence of technological innovation and growing consumer interest in sustainability and ethical eating practices. Specifically, the United States witnessed notable investments in cultured meat startups, fostering research and development efforts.

- Also, North American consumers' increasing preference for plant-based and alternative protein options, driven by health and environmental concerns, aligns well with the sustainable attributes of cultured meat. Regulatory agencies in the region also demonstrate openness to fostering innovation in the food sector, creating a conducive environment for cultured meat companies to thrive.

Global Clean Meat Market Active Key Players

- Just Inc (US)

- Biocraft, In (US)

- Eat Just (Good Meat) (US)

- Upside Foods (US)

- Bluenalu (US)

- Finless Foods (US)

- Balletic Foods (US)

- Appleton Meats (Canada)

- Mosa Meat (Netherlands)

- Multus Biotechnology (UK)

- Hoxton Farms (UK)

- Meatable (Netherlands)

- Peace Of Meat (Belgium)

- Ochakov Food Ingredients (Russia)

- Highersteaks (UK)

- Gourmey (France)

- Nissin Foods Group (Japan)

- Avant Meats (China)

- Clear Meat (India)

- Believer Meats (Israel)

- Aleph Farms (Israel)

- Biftek (Turkey)

- Biobetter Ltd. (Israel)

- Heuros (Australia), And Other Active Players.

Key Industry Developments in the Global Clean Meat Market

- In April 2024, Mosa Meat, a frontrunner in producing cultivated beef, declared its invitation to new and current partners to collaborate in making cultivated beef accessible to consumers. This initiative is part of the €40 million raised in new funding to support the company's next developmental stage.

- In January 2023, Mandi Ventures secured £7.9 million ($9.5 million) in funding from Multus Biotechnology, an early-stage venture capital fund. This investment will enable Multus Biotechnology to establish a pioneering production growth media facility in the United Kingdom.

|

Global Clean Meat Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.99 Mn. |

|

Forecast Period 2024-30 CAGR: |

16.3 % |

Market Size in 2032: |

USD 77.81 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-use |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Just Inc (US), Biocraft.In (US), Eat Just (Good Meat) (US), Upside Foods (US), Bluenalu (US), Finless Foods (US), Balletic Foods (US), Appleton Meats (Canada), Mosa Meat (Netherlands), Multus Biotechnology (UK), Hoxton Farms (UK), Meatable (Netherlands), Peace Of Meat (Belgium), Ochakov Food Ingredients (Russia), Highersteaks (UK), Gourmey (France), Nissin Foods Group (Japan), Avant Meats (China), Clear Meat (India), Believer Meats (Israel), Aleph Farms (Israel), Biftek (Turkey), Biobetter Ltd. (Israel), Heuros (Australia), And Other Active Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GLOBAL CLEAN MEAT MARKET BY TYPE (2017-2032)

- GLOBAL CLEAN MEAT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEEF

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHICKEN

- PORK

- SEAFOOD

- GLOBAL CLEAN MEAT MARKET BY END-USE (2017-2032)

- GLOBAL CLEAN MEAT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BURGER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NUGGETS

- SAUSAGES

- HOT DOGS

- MEATBALLS

- GLOBAL CLEAN MEAT MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- GLOBAL CLEAN MEAT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SPECIALTY STORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKETS & HYPERMARKETS

- ONLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- GLOBAL CLEAN MEAT Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JUST INC (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BIOCRAFT, IN (US)

- EAT JUST (GOOD MEAT) (US)

- UPSIDE FOODS (US)

- BLUENALU (US)

- FINLESS FOODS (US)

- BALLETIC FOODS (US)

- APPLETON MEATS (CANADA)

- MOSA MEAT (NETHERLANDS)

- MULTUS BIOTECHNOLOGY (UK)

- HOXTON FARMS (UK)

- MEATABLE (NETHERLANDS)

- PEACE OF MEAT (BELGIUM)

- OCHAKOV FOOD INGREDIENTS (RUSSIA)

- HIGHERSTEAKS (UK)

- GOURMEY (FRANCE)

- NISSIN FOODS GROUP (JAPAN)

- AVANT MEATS (CHINA)

- CLEAR MEAT (INDIA)

- BELIEVER MEATS (ISRAEL)

- ALEPH FARMS (ISRAEL)

- BIFTEK (TURKEY)

- BIOBETTER LTD. (ISRAEL)

- HEUROS (AUSTRALIA), AND OTHER ACTIVE PLAYERS.

- COMPETITIVE LANDSCAPE

- GLOBAL GLOBAL CLEAN MEAT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End-use

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Clean Meat Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.99 Mn. |

|

Forecast Period 2024-30 CAGR: |

16.3 % |

Market Size in 2032: |

USD 77.81 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-use |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Just Inc (US), Biocraft.In (US), Eat Just (Good Meat) (US), Upside Foods (US), Bluenalu (US), Finless Foods (US), Balletic Foods (US), Appleton Meats (Canada), Mosa Meat (Netherlands), Multus Biotechnology (UK), Hoxton Farms (UK), Meatable (Netherlands), Peace Of Meat (Belgium), Ochakov Food Ingredients (Russia), Highersteaks (UK), Gourmey (France), Nissin Foods Group (Japan), Avant Meats (China), Clear Meat (India), Believer Meats (Israel), Aleph Farms (Israel), Biftek (Turkey), Biobetter Ltd. (Israel), Heuros (Australia), And Other Active Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CLEAN MEAT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CLEAN MEAT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CLEAN MEAT MARKET COMPETITIVE RIVALRY

TABLE 005. CLEAN MEAT MARKET THREAT OF NEW ENTRANTS

TABLE 006. CLEAN MEAT MARKET THREAT OF SUBSTITUTES

TABLE 007. CLEAN MEAT MARKET BY TYPE

TABLE 008. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 009. DUCK MARKET OVERVIEW (2016-2028)

TABLE 010. PORK MARKET OVERVIEW (2016-2028)

TABLE 011. BEEF MARKET OVERVIEW (2016-2028)

TABLE 012. SEAFOOD MARKET OVERVIEW (2016-2028)

TABLE 013. CLEAN MEAT MARKET BY APPLICATION

TABLE 014. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 015. PET FOOD MARKET OVERVIEW (2016-2028)

TABLE 016. CLEAN MEAT MARKET BY DISTRIBUTION CHANNEL

TABLE 017. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 018. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 019. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA CLEAN MEAT MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA CLEAN MEAT MARKET, BY APPLICATION (2016-2028)

TABLE 022. NORTH AMERICA CLEAN MEAT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 023. N CLEAN MEAT MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE CLEAN MEAT MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE CLEAN MEAT MARKET, BY APPLICATION (2016-2028)

TABLE 026. EUROPE CLEAN MEAT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. CLEAN MEAT MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC CLEAN MEAT MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC CLEAN MEAT MARKET, BY APPLICATION (2016-2028)

TABLE 030. ASIA PACIFIC CLEAN MEAT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 031. CLEAN MEAT MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA CLEAN MEAT MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA CLEAN MEAT MARKET, BY APPLICATION (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA CLEAN MEAT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 035. CLEAN MEAT MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA CLEAN MEAT MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA CLEAN MEAT MARKET, BY APPLICATION (2016-2028)

TABLE 038. SOUTH AMERICA CLEAN MEAT MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 039. CLEAN MEAT MARKET, BY COUNTRY (2016-2028)

TABLE 040. MOSA MEAT (NETHERLANDS): SNAPSHOT

TABLE 041. MOSA MEAT (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 042. MOSA MEAT (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 043. MOSA MEAT (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MEMPHIS MEATS (US): SNAPSHOT

TABLE 044. MEMPHIS MEATS (US): BUSINESS PERFORMANCE

TABLE 045. MEMPHIS MEATS (US): PRODUCT PORTFOLIO

TABLE 046. MEMPHIS MEATS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MEATABLE (NETHERLANDS): SNAPSHOT

TABLE 047. MEATABLE (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 048. MEATABLE (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 049. MEATABLE (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CARGILL (US): SNAPSHOT

TABLE 050. CARGILL (US): BUSINESS PERFORMANCE

TABLE 051. CARGILL (US): PRODUCT PORTFOLIO

TABLE 052. CARGILL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. JUST INC. (US): SNAPSHOT

TABLE 053. JUST INC. (US): BUSINESS PERFORMANCE

TABLE 054. JUST INC. (US): PRODUCT PORTFOLIO

TABLE 055. JUST INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TYSON FOODS INC. (US): SNAPSHOT

TABLE 056. TYSON FOODS INC. (US): BUSINESS PERFORMANCE

TABLE 057. TYSON FOODS INC. (US): PRODUCT PORTFOLIO

TABLE 058. TYSON FOODS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BIOFOOD SYSTEMS (ISRAEL): SNAPSHOT

TABLE 059. BIOFOOD SYSTEMS (ISRAEL): BUSINESS PERFORMANCE

TABLE 060. BIOFOOD SYSTEMS (ISRAEL): PRODUCT PORTFOLIO

TABLE 061. BIOFOOD SYSTEMS (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INTEGRICULTURE (JAPAN): SNAPSHOT

TABLE 062. INTEGRICULTURE (JAPAN): BUSINESS PERFORMANCE

TABLE 063. INTEGRICULTURE (JAPAN): PRODUCT PORTFOLIO

TABLE 064. INTEGRICULTURE (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SUPERMEAT (ISRAEL): SNAPSHOT

TABLE 065. SUPERMEAT (ISRAEL): BUSINESS PERFORMANCE

TABLE 066. SUPERMEAT (ISRAEL): PRODUCT PORTFOLIO

TABLE 067. SUPERMEAT (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. FINLESS FOODS (US): SNAPSHOT

TABLE 068. FINLESS FOODS (US): BUSINESS PERFORMANCE

TABLE 069. FINLESS FOODS (US): PRODUCT PORTFOLIO

TABLE 070. FINLESS FOODS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. NEW AGE MEATS (US): SNAPSHOT

TABLE 071. NEW AGE MEATS (US): BUSINESS PERFORMANCE

TABLE 072. NEW AGE MEATS (US): PRODUCT PORTFOLIO

TABLE 073. NEW AGE MEATS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SHIOK MEATS (SINGAPORE): SNAPSHOT

TABLE 074. SHIOK MEATS (SINGAPORE): BUSINESS PERFORMANCE

TABLE 075. SHIOK MEATS (SINGAPORE): PRODUCT PORTFOLIO

TABLE 076. SHIOK MEATS (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. LAB FARM FOODS (US): SNAPSHOT

TABLE 077. LAB FARM FOODS (US): BUSINESS PERFORMANCE

TABLE 078. LAB FARM FOODS (US): PRODUCT PORTFOLIO

TABLE 079. LAB FARM FOODS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. HIGHER STEAKS (UK): SNAPSHOT

TABLE 080. HIGHER STEAKS (UK): BUSINESS PERFORMANCE

TABLE 081. HIGHER STEAKS (UK): PRODUCT PORTFOLIO

TABLE 082. HIGHER STEAKS (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. ALEPH FARMS (ISRAEL): SNAPSHOT

TABLE 083. ALEPH FARMS (ISRAEL): BUSINESS PERFORMANCE

TABLE 084. ALEPH FARMS (ISRAEL): PRODUCT PORTFOLIO

TABLE 085. ALEPH FARMS (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. BLUENALU INC. (US): SNAPSHOT

TABLE 086. BLUENALU INC. (US): BUSINESS PERFORMANCE

TABLE 087. BLUENALU INC. (US): PRODUCT PORTFOLIO

TABLE 088. BLUENALU INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 089. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 090. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 091. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CLEAN MEAT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CLEAN MEAT MARKET OVERVIEW BY TYPE

FIGURE 012. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 013. DUCK MARKET OVERVIEW (2016-2028)

FIGURE 014. PORK MARKET OVERVIEW (2016-2028)

FIGURE 015. BEEF MARKET OVERVIEW (2016-2028)

FIGURE 016. SEAFOOD MARKET OVERVIEW (2016-2028)

FIGURE 017. CLEAN MEAT MARKET OVERVIEW BY APPLICATION

FIGURE 018. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 019. PET FOOD MARKET OVERVIEW (2016-2028)

FIGURE 020. CLEAN MEAT MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 021. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 022. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 023. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA CLEAN MEAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE CLEAN MEAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC CLEAN MEAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA CLEAN MEAT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA CLEAN MEAT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Clean Meat Market Market research report is 2024-2032.

Just Inc (US), Biocraft.In (US), Eat Just (Good Meat) (US), Upside Foods (US), Bluenalu (US), Finless Foods (US), Balletic Foods (US), Appleton Meats (Canada), Mosa Meat (Netherlands), Multus Biotechnology (UK), Hoxton Farms (UK), Meatable (Netherlands), Peace Of Meat (Belgium), Ochakov Food Ingredients (Russia), Highersteaks (UK), Gourmey (France), Nissin Foods Group (Japan), Avant Meats (China), Clear Meat (India), Believer Meats (Israel), Aleph Farms (Israel), Biftek (Turkey), Biobetter Ltd. (Israel), Heuros (Australia), And Other Active Players.

The Global Clean Meat Market is segmented into type, end-use, distribution channel, and region. By type, the market is categorized into beef, chicken, pork, & seafood. by end-use, the market is categorized into burgers, nuggets, sausages, hot dogs, and meatballs. By distribution channel, the market is categorized into specialty stores, supermarkets & hypermarkets, and online retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cultivated meat, commonly called cultured or cell-based meat, is produced from cell cultures using a technique. At the cellular level, the meat obtained from this procedure is identical to animal meat. As a result, it can use a safer, more reliable, and sustainable production method to supply meat with the same sensory and nutritional profile as traditionally produced meat.

The Global Clean Meat Market Size Was Valued at USD 19.99 Million in 2023 and is Projected to Reach USD 77.81 Million by 2032, Growing at a CAGR of 16.3% From 2024-2032.