Canned Black Beans Market Synopsis

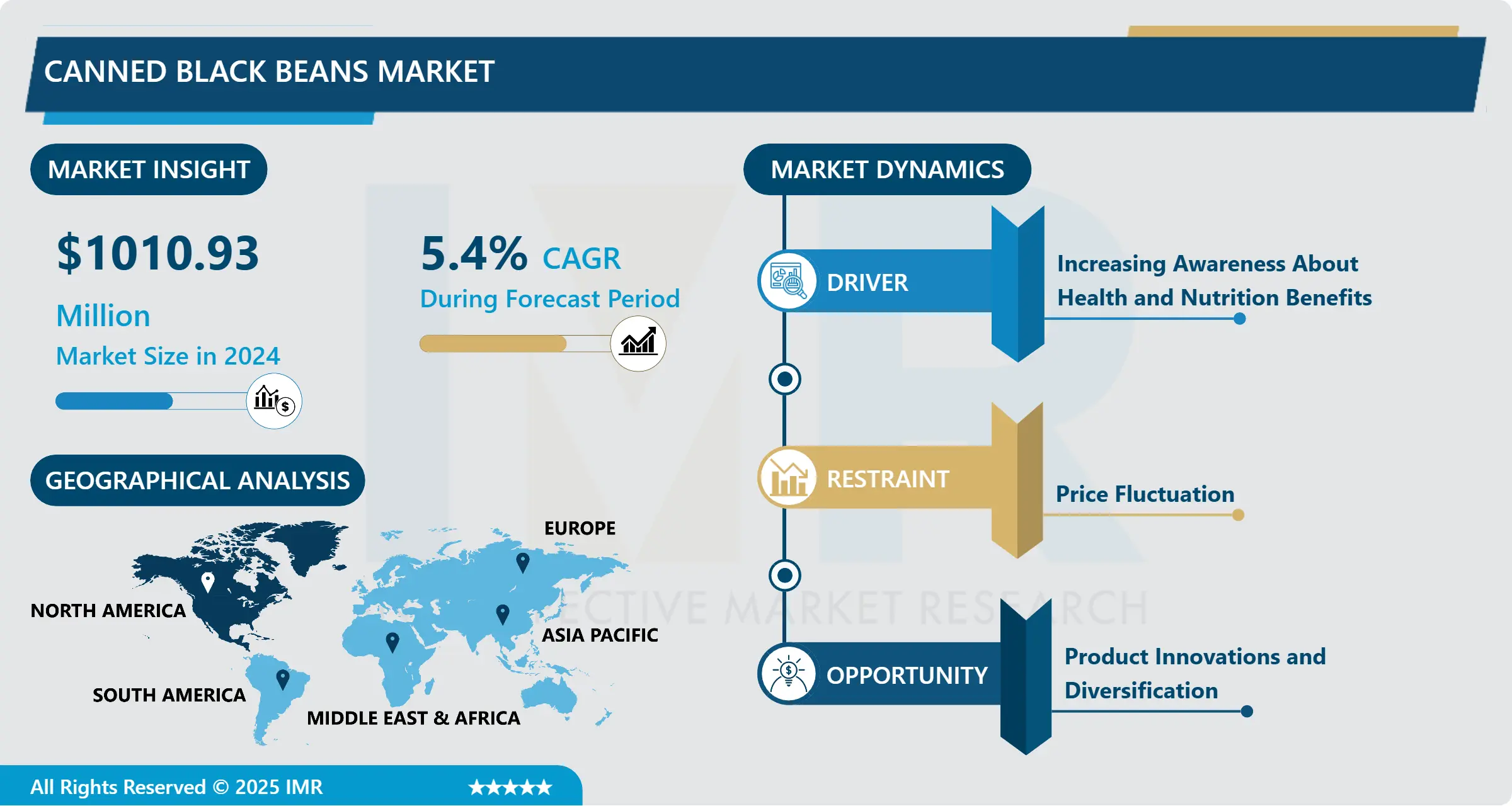

Canned Black Beans Market Size Was Valued at USD 1010.93 Million in 2024, and is Projected to Reach USD 1539.74 Million by 2032, Growing at a CAGR of 5.4% From 2025-2032.

Canned Black beans also known as turtle beans because of their hard, shell-like appearance. There are various types of soluble and insoluble fibre are presents in black beans. Black beans are good for digestion and keeping blood sugar level in check

Consumers increasing focus on health and wellness has propelled the demand for nutritious and protein-rich foods like black beans. These beans are packed with Fiber, vitamins, and minerals, appealing to health-conscious individuals and those following vegetarian or vegan diets. Canned black beans offer ready-to-use solutions, reducing cooking time and effort, which resonates with busy lifestyles. Their versatility in various cuisines, including Hispanic, Caribbean, and South American dishes, further enhances their appeal.

Canned black beans offer convenience to consumers by eliminating the need for soaking and cooking dried beans. This convenience factor appeals to busy individuals and families looking for quick meal solutions. The rapid uptake of online platforms for buying Canned Black Beans is packaging solutions and advancements in materials are becoming crucial in addressing environmental issues within the industry.

Consumers are becoming more discerning about food labels and ingredients. They prefer products with clean labels, minimal additives, and transparent sourcing practices. Brands that emphasize these attributes gain a competitive edge in the canned black beans market.

Canned Black Beans Market Trend Analysis

Canned Black Beans Market Growth Drivers- Increasing Awareness About Health and Nutrition Benefits

- Consumers' growing interest in healthier food choices is boosting the popularity of canned black beans, to their rich protein, Fiber, and nutrient profiles. Health-conscious individuals are integrating black beans into their meals for a well-rounded and nourishing diet. Busy lifestyles and the need for convenient meal solutions are fuelling the demand for canned black beans. They offer the advantage of being pre-cooked and ready to use, saving consumers time in meal preparation without compromising on nutritional value.?

- The growing number of people following vegan and vegetarian diets is a significant trend in the canned black beans market. Black beans serve as an important source of plant-based protein for individuals who avoid animal products, driving demand for canned varieties. ?

- There is a growing emphasis on sustainable packaging solutions within the food industry, including the canned black beans segment. Consumers are increasingly concerned about the environmental impact of packaging materials, leading companies to explore eco-friendly packaging options and reduce their carbon footprint.

Canned Black Beans Market Opportunity- Product Innovations and Diversification

- Companies are introducing innovative packaging solutions such as easy-open cans, resealable lids, and portion-controlled packaging to enhance convenience for consumers and ensure freshness. Manufacturers are offering ready-to-eat black beans and meal kits that include black beans as a key ingredient. These kits may contain other complementary ingredients like grains, vegetables, and sauces, providing consumers with convenient and complete meal options.

- To appeal to diverse taste preferences, manufacturers are developing flavoured black beans with various seasoning blends and spices. These flavoured options add excitement and versatility to dishes, catering to consumers looking for different culinary experiences. Companies are launching health-focused black bean products such as low-sodium versions, organic black beans, and those free from artificial additives or preservatives. These products align with the growing demand for healthier food options.

- Some manufacturers are introducing canned black beans that require minimal or no cooking, making them ideal for quick meal preparation and time-saving cooking solutions. Innovations include black bean products fortified with additional nutrients such as vitamins, minerals, and protein enhancements. These value-added benefits appeal to health-conscious consumers seeking enhanced nutritional content.

Canned Black Beans Market Segment Analysis:

Canned Black Beans Market is Segmented on The Basis of Product Type, Distribution Channel, Packaging Type and Region.

By Type, Wet Beans Segment Is Expected to Dominate the Market During the Forecast Period

- In the canned black beans market, wet (canned) beans typically dominate over dry beans in terms of sales and consumer preference. Canned black beans are pre-cooked and ready to use, saving consumers time and effort compared to dry beans that require soaking and cooking.

- Canned black beans are widely available in supermarkets, grocery stores, and online platforms, making them more accessible to consumers than dry beans, which may require a trip to specialty stores or bulk food sections. Canned black beans have a longer shelf life compared to dry beans, which can spoil if not stored properly or used within a certain timeframe

- Canned black beans offer consistency in texture and taste, as they are processed and cooked under controlled conditions, whereas the quality of cooked dry beans can vary based on cooking methods and time.

By Distribution Channel, Supermarket and Hypermarket Segment Held the Largest Share In 2024

- Supermarkets and hypermarkets dominate the canned black beans market in terms of distribution. These retail outlets have a wide reach, offer diverse product selections, and attract a large number of consumers regularly. Supermarkets and hypermarkets typically stock a wide variety of canned black bean brands, flavours, and variants. This variety allows consumers to choose products that suit their taste preferences, dietary requirements, and budget.

- These retail establishments provide a one-stop shopping experience where consumers can purchase canned black beans along with other grocery items, making it convenient for busy shoppers. Supermarkets often run promotions, discounts, and special offers on canned goods, including black beans. This attracts price-conscious consumers and encourages bulk purchases.

- Supermarkets and hypermarkets are easily accessible, located in urban and suburban areas, and have extended operating hours, making it convenient for consumers to shop at their convenience. Many supermarkets offer loyalty programs, rewards, and discounts to frequent shoppers, encouraging repeat purchases of canned black beans and other products.

Canned Black Beans Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, United states mainly play crucial role in canned black beans market. Cultural Preferences like black beans are widely used in Mexican, Caribbean, and Latin American cuisines, which have a significant influence on food preferences in the United States and Canada. There is a growing awareness of the nutritional benefits of black beans, such as their high protein, Fiber, and nutrient content. Health-conscious consumers in North America seek convenient and nutritious food options, making canned black beans a popular choice.

- Canned black beans offer convenience as they are pre-cooked and ready to use, saving time and effort in meal preparation. This convenience factor resonates with busy lifestyles in North American households. Black beans are versatile and can be used in various recipes such as soups, stews, salads, burritos, and side dishes. This versatility contributes to their popularity and widespread consumption. Major food companies and brands in North America actively market and promote canned black beans, highlighting their nutritional benefits, convenience, and usage ideas. Effective marketing campaigns increase consumer awareness and drive sales.

Canned Black Beans Market Key Players:

- Bush Brothers & Company (United States)

- Goya Foods, Inc. (United States)

- Conagra Brands, Inc. (United States)

- Eden Foods, Inc. (United States)

- La Preferida, Inc. (United States)

- Truitt Brothers, Inc. (United States)

- Westbrae Natural (United States)

- Kuner's Foods (United States)

- Del Monte Foods, Inc. (United States)

- Amy's Kitchen, Inc. (United States)

- Heinz (United States)

- BUSH'S BEST (United States)

- Jack Daniel's (United States)

- Whole Foods Market (United States)

- La Costeña (Mexico)

- La Sierra (Mexico)

- La Gloria (Mexico)

- FRIOSA (Mexico)

- Primo Foods (Sydney)

- Bonduelle Group (France)

- La Doria (Italy)

- Sanmartín (Spain)

- La Asturiana (Spain)

- Cirio (Italy)

- Princes Group (United Kingdom)

- Other Active Players

Key Industry Developments in the Canned Black Beans Market:

- In March 2024, Turn a can of black beans into enfrijoladas, a saucy vegetarian supper. Beans and tortillas are a classic pairing served in numerous configurations, usually with the beans served in or on the tortilla. But for Oaxacan enfrijoladas, lightly fried tortillas are dipped into and completely coated by a black bean puree.

- In Sept 2023, The University of Warwick celebrates the successful harvest of "GODIVA" and ‘OLIVIA’ – two novel dry beans inspired by local cultural history. University of Warwick have been working on ways to help UK farmers better serve public health using seed, soil and British sunshine. GODIVA is a blonde-coloured dry bean similar in size to a red kidney bean and named after the historical Coventry noblewoman, Lady Godiva. OLIVIA is a black bean named after a character from Shakespeare’s Twelfth Night.

|

Global Canned Black Beans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1010.93 Mn |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 1539.74 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Canned Black Beans Market by Product Type (2018-2032)

4.1 Canned Black Beans Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wet Beans

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dry Beans

Chapter 5: Canned Black Beans Market by Distribution Channel (2018-2032)

5.1 Canned Black Beans Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarket and Hypermarket

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Online Sales

5.6 Others

Chapter 6: Canned Black Beans Market by Packaging Type (2018-2032)

6.1 Canned Black Beans Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Metal Cans

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pouches

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Canned Black Beans Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BUSH BROTHERS & COMPANY (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GOYA FOODS INC. (UNITED STATES)

7.4 CONAGRA BRANDS INC. (UNITED STATES)

7.5 EDEN FOODS INC. (UNITED STATES)

7.6 LA PREFERIDA INC. (UNITED STATES)

7.7 TRUITT BROTHERS INC. (UNITED STATES)

7.8 WESTBRAE NATURAL (UNITED STATES)

7.9 KUNER'S FOODS (UNITED STATES)

7.10 DEL MONTE FOODS INC. (UNITED STATES)

7.11 AMY'S KITCHEN INC. (UNITED STATES)

7.12 HEINZ (UNITED STATES)

7.13 BUSH'S BEST (UNITED STATES)

7.14 JACK DANIEL'S (UNITED STATES)

7.15 WHOLE FOODS MARKET (UNITED STATES)

7.16 LA COSTEÑA (MEXICO)

7.17 LA SIERRA (MEXICO)

7.18 LA GLORIA (MEXICO)

7.19 FRIOSA (MEXICO)

7.20 PRIMO FOODS (SYDNEY)

7.21 BONDUELLE GROUP (FRANCE)

7.22 LA DORIA (ITALY)

7.23 SANMARTÍN (SPAIN)

7.24 LA ASTURIANA (SPAIN)

7.25 CIRIO (ITALY)

7.26 PRINCES GROUP (UNITED KINGDOM)

Chapter 8: Global Canned Black Beans Market By Region

8.1 Overview

8.2. North America Canned Black Beans Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Wet Beans

8.2.4.2 Dry Beans

8.2.5 Historic and Forecasted Market Size by Distribution Channel

8.2.5.1 Supermarket and Hypermarket

8.2.5.2 Convenience Stores

8.2.5.3 Online Sales

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Packaging Type

8.2.6.1 Metal Cans

8.2.6.2 Pouches

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Canned Black Beans Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Wet Beans

8.3.4.2 Dry Beans

8.3.5 Historic and Forecasted Market Size by Distribution Channel

8.3.5.1 Supermarket and Hypermarket

8.3.5.2 Convenience Stores

8.3.5.3 Online Sales

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Packaging Type

8.3.6.1 Metal Cans

8.3.6.2 Pouches

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Canned Black Beans Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Wet Beans

8.4.4.2 Dry Beans

8.4.5 Historic and Forecasted Market Size by Distribution Channel

8.4.5.1 Supermarket and Hypermarket

8.4.5.2 Convenience Stores

8.4.5.3 Online Sales

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Packaging Type

8.4.6.1 Metal Cans

8.4.6.2 Pouches

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Canned Black Beans Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Wet Beans

8.5.4.2 Dry Beans

8.5.5 Historic and Forecasted Market Size by Distribution Channel

8.5.5.1 Supermarket and Hypermarket

8.5.5.2 Convenience Stores

8.5.5.3 Online Sales

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Packaging Type

8.5.6.1 Metal Cans

8.5.6.2 Pouches

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Canned Black Beans Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Wet Beans

8.6.4.2 Dry Beans

8.6.5 Historic and Forecasted Market Size by Distribution Channel

8.6.5.1 Supermarket and Hypermarket

8.6.5.2 Convenience Stores

8.6.5.3 Online Sales

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Packaging Type

8.6.6.1 Metal Cans

8.6.6.2 Pouches

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Canned Black Beans Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Wet Beans

8.7.4.2 Dry Beans

8.7.5 Historic and Forecasted Market Size by Distribution Channel

8.7.5.1 Supermarket and Hypermarket

8.7.5.2 Convenience Stores

8.7.5.3 Online Sales

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Packaging Type

8.7.6.1 Metal Cans

8.7.6.2 Pouches

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Canned Black Beans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1010.93 Mn |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 1539.74 Mn |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||