Cannabis-Infused Beer Market Synopsis

Cannabis-Infused Beer Market Size Was Valued at USD 408 Million in 2023, and is Projected to Reach USD 2726.86 Million by 2032, Growing at a CAGR of 23.5% From 2024-2032.

Cannabis-infused beer, also known as cannabis beer or THC beer, is an alcoholic beverage containing cannabinoids like THC and CBD from the cannabis plant. It combines alcohol and cannabis effects, offering a unique sensory experience with varying flavors and aromas. The potency and effects can vary based on dosage and individual tolerance. However, legal restrictions may apply to the production and sale of cannabis-infused beer in specific jurisdictions.

- Cannabis-infused beer, also known as cannabis beer or cannabis-infused beverages, is a new product that combines the effects of cannabis with the refreshing qualities of beer. It offers recreational consumption, social enjoyment, relaxation, and stress relief benefits due to the presence of cannabinoids like THC and CBD. It also provides a non-alcoholic alternative to alcohol, offering a similar social experience. Customized formulations can be created to cater to different preferences and needs.

- The regulatory landscape surrounding cannabis-infused beverages is crucial, as laws and regulations vary by region, and some jurisdictions may be legal for recreational or medicinal use, while others may be subject to strict regulations or outright bans. Some proponents believe cannabis-infused beer could have potential medical applications, particularly for conditions like pain, inflammation, anxiety, and insomnia.

- Cannabis-infused beers offer unique flavor profiles, with hints of herbal, earthy, or floral notes. They are popular for health and wellness trends, offering potential health benefits like relaxation and stress relief. They also serve as an alternative to traditional alcohol, providing a way to unwind and socialize without negative side effects. Legalization and regulation in many regions have facilitated the production and sale of cannabis-infused products, including beer.

- Craft beer culture has created a fertile ground for innovation in the brewing industry, with many experimenting with cannabis-infused beers to differentiate themselves. Cannabis tourism is on the rise in regions where cannabis consumption is legal, offering tourists a unique way to experience local culture and indulge in legal cannabis products. As the stigma surrounding cannabis use diminishes, social acceptance of cannabis-infused products is expected to grow.

Cannabis-Infused Beer Market Trend Analysis

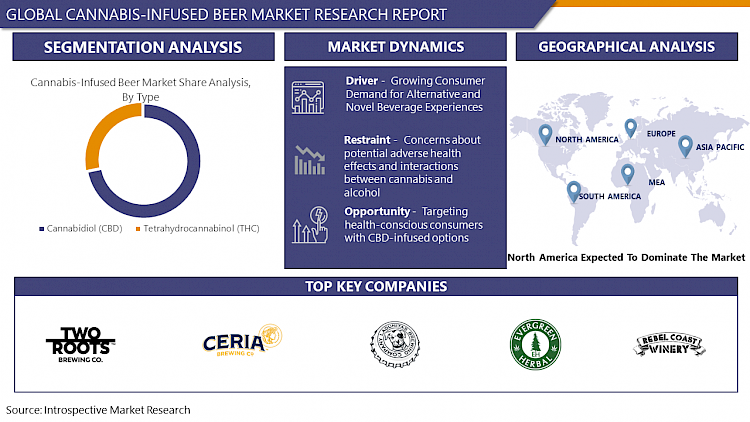

Growing Consumer Demand for Alternative and Novel Beverage Experiences

- Cannabis-infused beer is driven by the growing demand for alternative and novel beverage experiences, driven by changing consumer preferences, lifestyle choices, and evolving trends in the beverage industry. Younger demographics are seeking unique and innovative options, while traditional alcoholic beverages like beer and wine face competition from craft beer, hard seltzers, and non-alcoholic drinks. Cannabis-infused beer offers a distinctive product category that appeals to adventurous consumers.

- Consumers are also drawn to exploring new flavors, ingredients, and consumption experiences, with CBD-infused beverages offering relaxation and stress relief without intoxication. The craft beer movement has reshaped the beer industry by emphasizing quality, creativity, and experimentation, with many craft brewers exploring the incorporation of cannabis into their beer recipes. As cannabis legalization in various jurisdictions becomes more permissive, brewers and beverage companies are investing in research, development, and marketing to meet consumer demand. Overall, cannabis-infused beer is a promising alternative to traditional alcoholic beverages.

Restraints

Concerns about potential adverse health effects and interactions between cannabis and alcohol

- Cannabis-infused beer may have adverse health effects due to its psychoactive compounds, such as THC, which can affect cognitive function and mood. Excessive consumption may pose risks to respiratory health, liver damage, obesity, and addiction.

- Cannabis and alcohol have the potential for abuse and addiction, and combining them may increase the risk of dependence. Cannabis and alcohol can interact synergistically, leading to increased impairment and cognitive dysfunction.

- Impaired driving is another concern, as both substances impair driving ability, reaction times, and judgment. Combining cannabis and alcohol may exacerbate health risks, such as cardiovascular effects and liver damage.

- Chronic use of both substances can contribute to long-term health issues like heart disease, liver cirrhosis, and mental health disorders. Limited research on the specific interactions between cannabis and alcohol makes it challenging to fully understand the potential risks and benefits of consuming these products.

Opportunity Line Here

Targeting health-conscious consumers with CBD-infused options

- Cannabis-infused beer presents a unique opportunity for breweries to cater to health-conscious consumers seeking alternative beverages. The legalization of cannabis for medicinal and recreational purposes in many regions presents a burgeoning market for cannabis-infused products.

- Health-conscious consumers are increasingly seeking products that offer functional benefits and align with their wellness goals. CBD, a non-psychoactive compound derived from cannabis, is associated with potential health benefits like stress relief, relaxation, and pain management.

- As concerns about alcohol consumption and its associated health risks continue to rise, CBD-infused beer offers a beverage with potentially relaxing or mood-enhancing effects without the intoxicating properties of alcohol.

- Breweries can target niche markets within the broader beer and cannabis industries, such as health and wellness enthusiasts, fitness-minded individuals, and those interested in alternative or holistic remedies.

Challenges

Evolving regulatory frameworks regarding cannabis and alcohol integration

- Integrating cannabis and alcohol in products like cannabis-infused beer requires navigating the requirements and regulations of both regulatory bodies, which can be challenging. As the legal landscape surrounding cannabis continues to shift globally, companies in this space must grapple with complex and often conflicting regulations governing the production, distribution, and consumption of both cannabis and alcohol. Complicating matters further are the divergent approaches taken by alcohol and cannabis control boards, each with its own set of mandates and priorities.

- The regulatory fragmentation poses significant hurdles for breweries and beverage companies seeking to develop and market cannabis-infused beer products, requiring them to carefully navigate a maze of compliance requirements and regulatory uncertainties. However, concerns about public health and safety, such as the potential for impaired driving and overconsumption, underscore the importance of establishing clear guidelines and standards for the responsible integration of cannabis and alcohol in beverage products. Furthermore, the evolving regulatory landscape presents a formidable challenge for the cannabis-infused beer industry, requiring collaboration between industry stakeholders, regulators, and policymakers to address complex legal and public health.

Cannabis-Infused Beer Market Segment Analysis:

Cannabis-Infused Beer Market Segmented based on type, distribution channel.

By Type, Cannabidiol (CBD) segment is expected to dominate the market during the forecast period

- Cannabidiol is gaining popularity due to its perceived health and wellness benefits, such as reducing anxiety, alleviating pain, and promoting relaxation. Its non-psychoactive properties make it appealing to a broader audience, including those hesitant to consume THC-infused products. CBD is legal in many jurisdictions where THC is prohibited or tightly regulated, allowing breweries and beverage companies to develop and market CBD-infused beer products without facing the same regulatory challenges.

- CBD-infused products are more widely accessible and available in various retail channels, contributing to its broader market reach. Regulatory frameworks governing CBD-infused products are generally less stringent than those for THC-infused products, creating a more favorable business environment for breweries and beverage companies. Consumer preferences for CBD-infused beverages have driven market demand and product development, leading to breweries incorporating CBD into their beer formulations.

By Distribution Channel, Indirect Sales segment held the largest share of 51.6% in 2023

- The cannabis-infused beer market is experiencing growth through indirect sales, which include retail stores, online platforms, and wholesalers. These channels allow cannabis-infused products to reach a wider audience, enabling breweries and beverage companies to reach a wider audience. Retail partnerships with retail chains, specialty stores, and convenience stores also contribute to product visibility and accessibility.

- Indirect sales also offer a streamlined approach to regulatory compliance, as breweries can offload some responsibilities related to age verification, product labeling, and distribution logistics. They also enable breweries to reach new demographics and geographic regions that may be underserved by direct sales. Consumer convenience is another advantage of indirect sales, as consumers can browse a wide selection of products, compare prices, and make purchases at their convenience. Moreover, indirect sales provide opportunities for breweries to increase brand awareness and visibility through strategic marketing initiatives.

Cannabis-Infused Beer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the cannabis-infused beer market due to several factors, such as the legalization of cannabis in the US and Canada for medicinal and recreational purposes provides a conducive environment for the development, production, and sale of cannabis-infused products, including beer. the established cannabis industry in North America, particularly Canada, with experienced growers, processors, and retailers, facilitates the production and distribution of cannabis-infused beer.

- The thriving craft beer culture in North America, with consumers open to trying new and innovative beer products, makes North America a prime market for cannabis-infused beer. North America's relatively high consumer awareness and acceptance of cannabis products, influenced by years of advocacy and media coverage, make them more receptive to cannabis-infused beverages like beer. North America's market size and growth potential, combined with a large population, high disposable income, and changing attitudes toward cannabis consumption.

Cannabis-Infused Beer Market Top Key Players:

- Constellation Brands (US)

- Molson Coors Beverage Company (US)

- Cannabiniers (US)

- Dixie Brands Inc. (US)

- Cannabinoid Creations (US)

- Coalition Brewing Co. (US)

- Ceria Beverages (US)

- Two Roots Brewing Co. (US)

- Lagunitas Brewing Company (Heineken-owned) (US)

- Keith Villa's CERIA Brewing Co. (US)

- Evergreen Herbal (US)

- Rebel Coast Winery (US)

- Mirth Provisions (US)

- Leafbuyer Technologies, Inc. (US)

- Green Thumb Industries Inc. (US)

- Canopy Growth Corporation (Canada)

- Canopy Rivers Inc. (Canada)

- Tilray Inc. (Canada)

- The Supreme Cannabis Company (Canada)

- CannTrust Holdings Inc. (Canada)

- Province Brands of Canada (Canada)

- Aurora Cannabis Inc. (Canada)

- The Green Organic Dutchman Holdings Ltd. (TGOD) (Canada)

- Hexo Corp (Canada)

- Blaze Life Holdings (BLH) (California)

- Heineken (Netherlands), and other major players

Key Industry Developments in the Cannabis-Infused Beer Market:

- In February 2023, DeltaBev, the world's largest cannabis beverage manufacturing facility, is partnered with CannTrust Holdings Inc. as its first production partner. The 45,000-square-foot facility, located in Los Angeles' San Fernando Valley, offers advanced processing and packaging capabilities.

- In March 2023, announced that the South African Competition Tribunal approved its offer to acquire control of Distell Group Holdings Limited. The decision marks the final regulatory approval, following those received from the Namibia Competition Commission, the Common Market of Eastern & and Southern Africa, and all other relevant jurisdictions. It paves the way for the creation of a regional African beverage champion.

- In August 2022, Tilray Brands, Inc. a leading global cannabis-lifestyle and consumer packaged goods company, announced that the Company entered into a definitive agreement to acquire eight beer and beverage brands from Anheuser-Busch. Tilray Brands Fueling Tilray’s Future in the U.S. Craft Beer Industry.

|

Global Cannabis-Infused Beer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

408 Mn |

|

Forecast Period 2024-32 CAGR: |

23.5 % |

Market Size in 2032: |

2726.86 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CANNABIS-INFUSED BEER MARKET BY TYPE (2017-2032)

- CANNABIS-INFUSED BEER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TETRAHYDROCANNABINOL (THC)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TETRAHYDROCANNABINOL (THC)

- CANNABIS-INFUSED BEER MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- CANNABIS-INFUSED BEER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIRECT SALES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDIRECT SALES

- ONLINE CHANNELS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Cannabis-Infused Beer Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CONSTELLATION BRANDS (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MOLSON COORS BEVERAGE COMPANY (US)

- CANNABINIERS (US)

- DIXIE BRANDS INC. (US)

- CANNABINOID CREATIONS (US)

- COALITION BREWING CO. (US)

- CERIA BEVERAGES (US)

- TWO ROOTS BREWING CO. (US)

- LAGUNITAS BREWING COMPANY (HEINEKEN-OWNED) (US)

- KEITH VILLA'S CERIA BREWING CO. (US)

- EVERGREEN HERBAL (US)

- REBEL COAST WINERY (US)

- MIRTH PROVISIONS (US)

- LEAFBUYER TECHNOLOGIES, INC. (US)

- GREEN THUMB INDUSTRIES INC. (US)

- CANOPY GROWTH CORPORATION (CANADA)

- CANOPY RIVERS INC. (CANADA)

- TILRAY INC. (CANADA)

- THE SUPREME CANNABIS COMPANY (CANADA)

- CANNTRUST HOLDINGS INC. (CANADA)

- PROVINCE BRANDS OF CANADA (CANADA)

- AURORA CANNABIS INC. (CANADA)

- THE GREEN ORGANIC DUTCHMAN HOLDINGS LTD. (TGOD) (CANADA)

- HEXO CORP (CANADA)

- BLAZE LIFE HOLDINGS (BLH) (CALIFORNIA)

- HEINEKEN (NETHERLANDS)

- COMPETITIVE LANDSCAPE

- GLOBAL CANNABIS-INFUSED BEER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Cannabis-Infused Beer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

408 Mn |

|

Forecast Period 2024-32 CAGR: |

23.5 % |

Market Size in 2032: |

2726.86 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CANNABIS-INFUSED BEER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CANNABIS-INFUSED BEER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CANNABIS-INFUSED BEER MARKET COMPETITIVE RIVALRY

TABLE 005. CANNABIS-INFUSED BEER MARKET THREAT OF NEW ENTRANTS

TABLE 006. CANNABIS-INFUSED BEER MARKET THREAT OF SUBSTITUTES

TABLE 007. CANNABIS-INFUSED BEER MARKET BY TYPE

TABLE 008. ALCOHOLIC MARKET OVERVIEW (2016-2028)

TABLE 009. NON-ALCOHOLIC MARKET OVERVIEW (2016-2028)

TABLE 010. CANNABIS-INFUSED BEER MARKET BY COMPONENT

TABLE 011. TETRAHYDROCANNABINOL (THC) MARKET OVERVIEW (2016-2028)

TABLE 012. CANNABIDIOL (CBD) MARKET OVERVIEW (2016-2028)

TABLE 013. CANNABIS-INFUSED BEER MARKET BY DISTRIBUTION CHANNEL

TABLE 014. DIRECT SALES MARKET OVERVIEW (2016-2028)

TABLE 015. INDIRECT SALES MARKET OVERVIEW (2016-2028)

TABLE 016. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA CANNABIS-INFUSED BEER MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA CANNABIS-INFUSED BEER MARKET, BY COMPONENT (2016-2028)

TABLE 019. NORTH AMERICA CANNABIS-INFUSED BEER MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 020. N CANNABIS-INFUSED BEER MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE CANNABIS-INFUSED BEER MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE CANNABIS-INFUSED BEER MARKET, BY COMPONENT (2016-2028)

TABLE 023. EUROPE CANNABIS-INFUSED BEER MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 024. CANNABIS-INFUSED BEER MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC CANNABIS-INFUSED BEER MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC CANNABIS-INFUSED BEER MARKET, BY COMPONENT (2016-2028)

TABLE 027. ASIA PACIFIC CANNABIS-INFUSED BEER MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 028. CANNABIS-INFUSED BEER MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA CANNABIS-INFUSED BEER MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA CANNABIS-INFUSED BEER MARKET, BY COMPONENT (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA CANNABIS-INFUSED BEER MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 032. CANNABIS-INFUSED BEER MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA CANNABIS-INFUSED BEER MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA CANNABIS-INFUSED BEER MARKET, BY COMPONENT (2016-2028)

TABLE 035. SOUTH AMERICA CANNABIS-INFUSED BEER MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 036. CANNABIS-INFUSED BEER MARKET, BY COUNTRY (2016-2028)

TABLE 037. ANHEUSER-BUSCH INBEV (BELGIUM): SNAPSHOT

TABLE 038. ANHEUSER-BUSCH INBEV (BELGIUM): BUSINESS PERFORMANCE

TABLE 039. ANHEUSER-BUSCH INBEV (BELGIUM): PRODUCT PORTFOLIO

TABLE 040. ANHEUSER-BUSCH INBEV (BELGIUM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. HEINEKEN (NETHERLANDS): SNAPSHOT

TABLE 041. HEINEKEN (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 042. HEINEKEN (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 043. HEINEKEN (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CERIA BREWING COMPANY (US): SNAPSHOT

TABLE 044. CERIA BREWING COMPANY (US): BUSINESS PERFORMANCE

TABLE 045. CERIA BREWING COMPANY (US): PRODUCT PORTFOLIO

TABLE 046. CERIA BREWING COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. TWO ROOTS BREWING CO (US): SNAPSHOT

TABLE 047. TWO ROOTS BREWING CO (US): BUSINESS PERFORMANCE

TABLE 048. TWO ROOTS BREWING CO (US): PRODUCT PORTFOLIO

TABLE 049. TWO ROOTS BREWING CO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CANOPY GROWTH CORPORATION (CANADA): SNAPSHOT

TABLE 050. CANOPY GROWTH CORPORATION (CANADA): BUSINESS PERFORMANCE

TABLE 051. CANOPY GROWTH CORPORATION (CANADA): PRODUCT PORTFOLIO

TABLE 052. CANOPY GROWTH CORPORATION (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. NEW BELGIUM BREWING COMPANY (US): SNAPSHOT

TABLE 053. NEW BELGIUM BREWING COMPANY (US): BUSINESS PERFORMANCE

TABLE 054. NEW BELGIUM BREWING COMPANY (US): PRODUCT PORTFOLIO

TABLE 055. NEW BELGIUM BREWING COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. GREEN TIMES BREWING (UK): SNAPSHOT

TABLE 056. GREEN TIMES BREWING (UK): BUSINESS PERFORMANCE

TABLE 057. GREEN TIMES BREWING (UK): PRODUCT PORTFOLIO

TABLE 058. GREEN TIMES BREWING (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. HUMBOLDT BREWING COMPANY (US): SNAPSHOT

TABLE 059. HUMBOLDT BREWING COMPANY (US): BUSINESS PERFORMANCE

TABLE 060. HUMBOLDT BREWING COMPANY (US): PRODUCT PORTFOLIO

TABLE 061. HUMBOLDT BREWING COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. LONG TRAIL BREWING COMPANY (US): SNAPSHOT

TABLE 062. LONG TRAIL BREWING COMPANY (US): BUSINESS PERFORMANCE

TABLE 063. LONG TRAIL BREWING COMPANY (US): PRODUCT PORTFOLIO

TABLE 064. LONG TRAIL BREWING COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. COALITION BREWING COMPANY LTD (UK): SNAPSHOT

TABLE 065. COALITION BREWING COMPANY LTD (UK): BUSINESS PERFORMANCE

TABLE 066. COALITION BREWING COMPANY LTD (UK): PRODUCT PORTFOLIO

TABLE 067. COALITION BREWING COMPANY LTD (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. HEMPER (US): SNAPSHOT

TABLE 068. HEMPER (US): BUSINESS PERFORMANCE

TABLE 069. HEMPER (US): PRODUCT PORTFOLIO

TABLE 070. HEMPER (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FLYING DOG BREWERY (US): SNAPSHOT

TABLE 071. FLYING DOG BREWERY (US): BUSINESS PERFORMANCE

TABLE 072. FLYING DOG BREWERY (US): PRODUCT PORTFOLIO

TABLE 073. FLYING DOG BREWERY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KEEF BRAND (US): SNAPSHOT

TABLE 074. KEEF BRAND (US): BUSINESS PERFORMANCE

TABLE 075. KEEF BRAND (US): PRODUCT PORTFOLIO

TABLE 076. KEEF BRAND (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. DUPETIT NATURAL PRODUCTS GMBH (GERMANY): SNAPSHOT

TABLE 077. DUPETIT NATURAL PRODUCTS GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 078. DUPETIT NATURAL PRODUCTS GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 079. DUPETIT NATURAL PRODUCTS GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CANNABIS-INFUSED BEER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CANNABIS-INFUSED BEER MARKET OVERVIEW BY TYPE

FIGURE 012. ALCOHOLIC MARKET OVERVIEW (2016-2028)

FIGURE 013. NON-ALCOHOLIC MARKET OVERVIEW (2016-2028)

FIGURE 014. CANNABIS-INFUSED BEER MARKET OVERVIEW BY COMPONENT

FIGURE 015. TETRAHYDROCANNABINOL (THC) MARKET OVERVIEW (2016-2028)

FIGURE 016. CANNABIDIOL (CBD) MARKET OVERVIEW (2016-2028)

FIGURE 017. CANNABIS-INFUSED BEER MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 018. DIRECT SALES MARKET OVERVIEW (2016-2028)

FIGURE 019. INDIRECT SALES MARKET OVERVIEW (2016-2028)

FIGURE 020. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA CANNABIS-INFUSED BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE CANNABIS-INFUSED BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC CANNABIS-INFUSED BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA CANNABIS-INFUSED BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA CANNABIS-INFUSED BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cannabis-Infused Beer Market research report is 2024-2032.

Constellation Brands (US), Molson Coors Beverage Company (US), Cannabiniers (US), Dixie Brands Inc. (US), Cannabinoid Creations (US), Coalition Brewing Co. (US), Ceria Beverages (US), Two Roots Brewing Co. (US), Lagunitas Brewing Company (Heineken-owned) (US), Keith Villa's CERIA Brewing Co. (US), Evergreen Herbal (US), Rebel Coast Winery (US), Mirth Provisions (US), Leafbuyer Technologies, Inc. (US), Green Thumb Industries Inc. (US), Canopy Growth Corporation (Canada), Canopy Rivers Inc. (Canada), Tilray Inc. (Canada), The Supreme Cannabis Company (Canada), CannTrust Holdings Inc. (Canada), Province Brands of Canada (Canada), Aurora Cannabis Inc. (Canada), The Green Organic Dutchman Holdings Ltd. (TGOD) (Canada), Hexo Corp (Canada), Blaze Life Holdings (BLH) (California), Heineken (Netherlands), and Other Major Players.

The Cannabis-Infused Beer Market is segmented into Type, Distribution Channel, and region. By Type, the market is categorized into Tetrahydrocannabinol (THC), Cannabidiol (CBD). Distribution Channel, the market is categorized into Direct Sales, Indirect Sales, and Online Channels. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The cannabis-infused beer market refers to the segment of the beverage industry focused on producing beers infused with cannabis or its derivatives, such as THC (tetrahydrocannabinol) and CBD (cannabidiol). These beverages offer consumers an alternative way to consume cannabis, combining the effects of alcohol and cannabis in a single product. The market is relatively niche and evolving, with companies experimenting with different formulations, flavors, and branding strategies to appeal to consumers. Regulatory challenges, including varying legal frameworks for cannabis and alcohol, as well as concerns about public health and safety, impact the growth and development of this market.

Cannabis-Infused Beer Market Size Was Valued at USD 408 Million in 2023, and is Projected to Reach USD 2726.86 Million by 2032, Growing at a CAGR of 23.5% From 2024-2032.