Key Market Highlights:

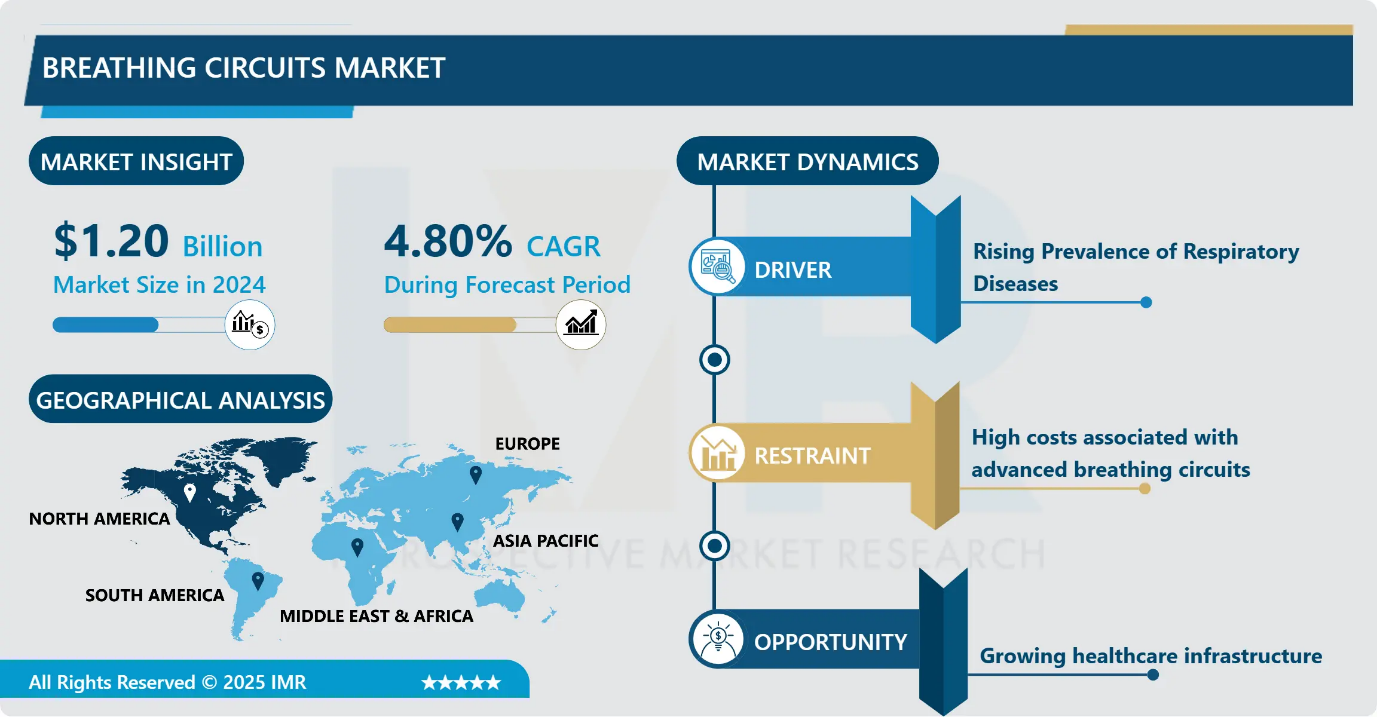

Breathing Circuits Market Size Was Valued at USD 1.20 Billion in 2024, and is Projected to Reach USD 1.92 Billion by 2035, Growing at a CAGR of 4.80% from 2025-2035.

- Market Size in 2024: USD 1.20 Billion

- Projected Market Size by 2035: USD 1.92 Billion

- CAGR (2025–2035): 4.80%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia Pacific

- By Product Type: The Closed breathing circuit segment is anticipated to lead the market by accounting for 38.66% of the market share throughout the forecast period.

- By Application: The Anaesthesia segment is expected to capture 33.26% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.47% of the market share during the forecast period.

- Active Players: Ambu A/S, Armstrong Medical Ltd., BD (Becton Dickinson and Company), Bio-Med Devices, Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare, Smiths Group Plc, Teleflex Incorporated, WilMarc LLC, and Other Active Players.

Breathing Circuits Market Synopsis:

The part of the medical devices that can regulate the respiratory or ventilating process of the patients under mechanical ventilation or anaesthesia receives other names, such as respiratory circuits, as well as ventilator circuits. They immediately target and maintain the parking function of the lung that would prevent the development of hypercarbia. The respiratory circuit typically consists of several key elements like tubing, connectors, filters, and open and close (valves) functions. The gases pass through the tubing, which connects him to the ventilator or the anaesthesia equipment.

Interconnectors allow the series assembly of components such as printed circuit board elements, and further provide medical professionals with quick access to different parts. Boosted utilize filters to remove impurities and particles from the inspired gases to provide an air of that is free from impurities for the patient. Two types of valve mechanisms participate in the motion dynamics of the gases inside the apparatus which eventually cause changes in tidal volume and inspiratory pressure. When these three constituents join; they compose the one that is closed or semi-closed system that keeps the patient undergoing medical procedures to get respiration support securely and efficiently. Breathing circuits figure prominently in modern health care setups for they deliver the much-needed life-sustaining help to patients wherever this is necessary

Breathing Circuits Market Dynamics and Trend Analysis:

Breathing Circuits Market Growth Driver- Rising Surgical and Critical-Care Workloads Elevating Demand for Breathing Circuits

- A major force driving the global breathing circuits market is the rising volume of surgical and critical-care interventions worldwide. Hospitals are handling a higher number of elective surgeries, emergency procedures, and complex cases that require dependable airway management and controlled ventilation. Alongside this, ICUs are experiencing sustained demand due to growing incidences of respiratory illnesses such as COPD, severe asthma, and postoperative respiratory insufficiency. Each of these clinical situations relies on safe, efficient breathing circuits to deliver precise gas flow, minimize infection risks, and ensure stable patient ventilation.

- This steady clinical load makes breathing circuits an indispensable consumable, with recurring replacement needs that directly strengthen market growth. As healthcare systems expand surgical capacity and invest in advanced anaesthesia and ventilation technologies, utilization of high-quality breathing circuits continues to rise positioning them as a critical component supporting modern perioperative and critical-care workflows.

Breathing Circuits Market Limiting Factor- Pricing Pressure and Commoditization Are Constraining Market Expansion

- A key limiting factor for the breathing circuits market is the persistent pricing pressure created by intense competition and product commoditization. Most breathing circuits especially standard disposable variants are viewed as routine consumables by hospitals, which pushes procurement teams to prioritize low-cost suppliers over differentiated features. This cost-focused purchasing environment reduces margins for manufacturers and limits their ability to invest in product innovation or premium offerings.

- Additionally, the presence of numerous regional and private-label producers further drives prices downward and makes it difficult for branded players to maintain value-based differentiation. As a result, even though clinical demand continues to grow, revenue expansion often lags because average selling prices remain flat or decline. This structural price sensitivity ultimately acts as a brake on overall market growth, restricting the commercial upside for advanced or specialized breathing circuit solutions.

Breathing Circuits Market Expansion Opportunity- Accelerating Shift Toward Disposable and Infection-Control-Optimized Circuits

- A major expansion opportunity in the breathing circuits market lies in the growing global shift toward disposable, infection-controlled, and safety-enhanced circuit systems. Hospitals and ambulatory centres are increasingly prioritizing single-use consumables to minimize cross-contamination risks, meet stricter hygiene protocols, and streamline sterilization workflows. This trend has strengthened post-COVID, with facilities now adopting higher-frequency circuit replacement policies and expanding their stocks of sterile, pre-assembled breathing circuits.

- Manufacturers that offer advanced disposables such as circuits with integrated filters, low-dead-space designs, and antimicrobial materials stand to capture significant incremental demand. Emerging markets, where infection-control guidelines are tightening and surgical volumes are climbing, present particularly strong headroom for growth. As healthcare providers continue modernizing anaesthesia and ventilation protocols, the transition to next-generation disposable circuits creates a scalable, recurring-revenue opportunity across both acute-care and outpatient settings.

Breathing Circuits Market Challenge and Risk- Supply Chain Vulnerabilities and Regulatory Compliance Risks

- A major challenge in the breathing circuits market is the sector’s vulnerability to supply chain disruptions and tightening regulatory standards. Breathing circuits depend on medical-grade plastics, connectors, and filtration components, many of which come from concentrated global suppliers. Any fluctuation in the availability or price of these raw materials caused by geopolitical tensions, logistics delays, or resin shortages can stall production and create cost instability for manufacturers.

- At the same time, regulatory agencies are imposing stricter requirements related to biocompatibility, sterility assurance, and environmental impact. Meeting these evolving compliance expectations demands continuous testing, documentation upgrades, and quality-system enhancements, all of which increase operational burden. For smaller or regionally focused manufacturers, the combined pressure of supply chain uncertainty and escalating regulatory oversight poses a significant risk, potentially affecting product continuity, market access, and long-term competitiveness.

Breathing Circuits Market Trend- Growing Adoption of Eco-Efficient and Low-Flow Anaesthesia Breathing Circuits

- A prominent trend shaping the breathing circuits market is the shift toward eco-efficient, low-flow anaesthesia circuits designed to reduce anaesthetic gas consumption and environmental impact. Hospitals are increasingly focusing on sustainability, driven by both cost pressures and institutional carbon-reduction goals. Low-flow and closed-circuit systems help significantly cut volatile anaesthetic use, lower greenhouse gas emissions, and enhance humidity and temperature control during procedures.

- Manufacturers are responding by developing optimized circuit designs with improved CO? absorbers, better leak resistance, and enhanced monitoring compatibility. These advanced circuits not only support greener operating rooms but also align with broader global initiatives for sustainable healthcare. As more clinical guidelines promote low-flow anaesthesia practices, the demand for high-efficiency breathing circuits continues to accelerate positioning this as one of the most influential and enduring trends in the market.

Breathing Circuits Market Segment Analysis:

Breathing Circuits Market is Segmented based on Product type, Application, End User, and Region

By Product Type, Closed Circuit segment is expected to dominate the market with around 38.66% share during the forecast period.

- Closed breathing circuits typically hold the market share among the three segments comprising breathing circuits: open breathings, semi-closed breathings -, and closed breathings. due to these huge advantages, doctors working in different clinical areas are impressed by the use of this closed loop/circuit. A notable benefit is the diminished likelihood of contamination and the transmission of infections.

- By sustaining a sealed system, closed circuits reduce exposure to environmental contaminants; this is especially critical in sterile surgical environments. This particular attribute not only serves to augment patient safety but also mitigates the strain on healthcare facilities through the reduction of healthcare-associated infections (HAIs) in frequency.

By Application, Anaesthesia segment is expected to dominate with close to 33.26% market share during the forecast period.

- The Anaesthesia segment holds the largest share of the Breathing Circuits Market, driven by the consistently high global volume of surgical procedures that require reliable airway management. Every operative case using inhalational or general anaesthesia depends on a breathing circuit to deliver precise gas mixtures, maintain ventilation, and ensure patient safety throughout the procedure. As healthcare systems expand surgical capacity particularly in orthopaedics, cardiology, oncology, and emergency care the demand for anaesthesia-compatible circuits continues to rise.

- Hospitals also maintain strict replacement protocols for anaesthesia circuits, creating steady, recurring consumption. The shift toward single-use, infection-controlled circuits in operating rooms further reinforces this segment’s dominance. Compared to other applications such as respiratory dysfunction or emergency transport, anaesthesia provides more predictable, high-volume utilization and stronger procurement budgets.

Breathing Circuits Market Regional Insights:

North America region is estimated to lead the market with around 31.47% share during the forecast period.

- The North American breathing circuit market is the top in the world in terms of many of the region’s boast factors like the highest adoption rates of new medical devices, technological strides, and high-quality healthcare. The Healthcare systems of the world in the U.S. and Canada outstand other healthcare organization in which healthcare system are strongly built up from hospital, clinic and other health sets. Through such things as patient safety, quality of care, and the latest technological innovations, these institutions deliberately build a smarter environment where advanced devices such as respiratory circuits are easily adopted for use.

- In North America, the leading research establishments and manufacturing of medical devices provide the real basis for the ongoing research along with the innovation in the respiratory care machine domain. Rather, the respondent’s insurers by making these newest breathing circuit technologies available to healthcare providers in the region that keeps North America as the market dominator.

Breathing Circuits Market Active Players:

- Ambu A/S (Denmark)

- Armstrong Medical Ltd. (United Kingdom)

- BD (Becton Dickinson and Company) (United States)

- Bio-Med Devices (United States)

- Drägerwerk AG & Co. KGaA (Germany)

- Fisher & Paykel Healthcare (New Zealand)

- Smiths Group Plc (United Kingdom)

- Teleflex Incorporated (United States)

- WilMarc LLC (United States)

- Other Active Players

Key Industry Developments in the Breathing Circuits Market:

- In April 2025, Dräger launched its Atlan® A100 / A100 XL anaesthesia workstation in India a new anaesthesia machine featuring a high-precision piston ventilator, “low- and minimal-flow” anaesthesia support, and a breathing system optimized for hygiene and efficient gas delivery

- In June 2024, BD completed the acquisition of the critical-care product group from Edwards Lifesciences for US$ 4.2 billion the group was rebranded as BD Advanced Patient Monitoring. This expands BD’s footprint into ICU/OR monitoring and connected-care solutions, which often operate alongside ventilation and breathing-circuit

Inside the Breathing Circuit: Technology, Clinical Importance, and the Future Ahead

- Breathing circuits are the core connecting system between a patient and a ventilator or anaesthesia machine. Technically, a circuit directs the flow of fresh gases oxygen, air, and anaesthetic agents while safely removing exhaled carbon dioxide through valves, filters, and absorbers.

- Modern circuits are designed with controlled resistance, minimal dead space, and precise airflow pathways to maintain stable tidal volumes and consistent gas exchange. Closed and semi-closed systems also integrate CO? absorbers that scrub exhaled gases, allowing low-flow anaesthesia and reducing the consumption of anaesthetic agents.

- Their importance lies in their role as the “lifeline interface.” Even the most advanced anaesthesia workstation or ventilator cannot function safely without a reliable circuit. A small leak, kink, or contaminated segment can compromise ventilation, increase infection risk, or destabilize patient physiology.

- For this reason, hospitals now prefer sterile, single-use circuits that offer consistency and minimize cross-contamination.

- Looking ahead, breathing circuits are shifting toward smarter, eco-efficient designs integrated sensors, antimicrobial materials, low-flow optimization, and sustainable polymers.

- With surgical volumes increasing and ICUs adopting more sophisticated ventilation strategies, circuits are evolving from basic consumables to engineered components that support safety, sustainability, and digital monitoring. This positions them as a high-value consumable in future perioperative and respiratory care.

|

Breathing Circuits Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.20 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.80 % |

Market Size in 2035: |

USD 1.92 Bn. |

|

Segments Covered: |

By Product type |

|

|

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Breathing Circuits Market by Product Type (2018-2035)

4.1 Breathing Circuits Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Open Breathing Circuits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Semi Open Breathing Circuits

4.5 Closed Breathing Circuits

Chapter 5: Breathing Circuits Market by Applications (2018-2035)

5.1 Breathing Circuits Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anaesthesia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Respiratory Dysfunction

5.5 Others

Chapter 6: Breathing Circuits Market by End User (2018-2035)

6.1 Breathing Circuits Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centres

6.5 Clinics

6.6 Home Care Settings

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Breathing Circuits Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 AMBU A/S (DENMARK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ARMSTRONG MEDICAL LTD. (UNITED KINGDOM)

7.4 BD (BECTON DICKINSON AND COMPANY) (UNITED STATES)

7.5 BIO-MED DEVICES (UNITED STATES)

7.6 DRÄGERWERK AG & CO. KGAA (GERMANY)

7.7 FISHER & PAYKEL HEALTHCARE (NEW ZEALAND)

7.8 SMITHS GROUP PLC (UNITED KINGDOM)

7.9 TELEFLEX INCORPORATED (UNITED STATES)

7.10 WILMARC LLC (UNITED STATES)

7.11 OTHER ACTIVE PLAYERS

Chapter 8: Global Breathing Circuits Market By Region

8.1 Overview

8.2. North America Breathing Circuits Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Breathing Circuits Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Breathing Circuits Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Breathing Circuits Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Breathing Circuits Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Breathing Circuits Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Breathing Circuits Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.20 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.80 % |

Market Size in 2035: |

USD 1.92 Bn. |

|

Segments Covered: |

By Product type |

|

|

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||