Breast Implants Market Synopsis

Breast Implants Market Size Was Valued at USD 2.96 Billion in 2023 and is Projected to Reach USD 6.16 Billion by 2032, Growing at a CAGR of 9.6% From 2024-2032.

The breast implant market, a vital segment of the healthcare and cosmetic surgery industry, focuses on the manufacturing, distribution, and surgical implantation of medical devices used to enhance or reconstruct the female breast.

- These devices, constructed with silicone gel or saline solution encased in a silicone shell, serve both aesthetic and reconstructive purposes and have experienced notable growth due to changing beauty standards, increased awareness, advancements in technology, and expanding disposable incomes. This market's evolution is marked by ongoing research and development to address safety concerns and regulatory challenges, ensuring its continued prominence in the field of cosmetic and reconstructive surgery.

- The breast implant market has witnessed significant growth due to increasing awareness and acceptance of cosmetic procedures, changing beauty standards, and advancements in implant technology. The market encompasses a range of product offerings, including silicone and saline-filled implants, which are available in various shapes, sizes, and textures to cater to individual preferences and medical needs. The demand for breast implants is often influenced by factors like body image concerns, self-esteem, and cultural norms.

- Market growth in the breast implant industry is further driven by factors such as rising disposable incomes, greater accessibility to plastic surgery, and the expansion of the global beauty and wellness sector. It is important to note that the market is not without controversy, as safety concerns, potential health risks, and regulatory issues have periodically impacted its growth. These factors make it essential for manufacturers, healthcare professionals, and regulatory authorities to collaborate in ensuring the safety and efficacy of breast implants, which will be crucial in sustaining the market's growth in the future.

Breast Implants Market Trend Analysis

Rising Awareness of Breast Augmentation Procedures

- Increased awareness is largely attributed to a growing emphasis on body image and self-esteem, fuelled by social media and celebrity culture. As individuals seek to enhance their physical appearance and confidence, breast augmentation procedures have gained popularity as a means to achieve desired aesthetic results. The widespread availability of information and patient testimonials on the internet has further contributed to the heightened awareness of these procedures, making them more accessible and understandable for potential patients.

- Advancements in medical technology and surgical techniques have made breast augmentation procedures safer and more effective. This, in turn, has increased the confidence of potential patients in the outcomes and reduced the apprehension associated with surgical interventions. With improved results, quicker recovery times, and minimized risks, more individuals are inclined to consider breast augmentation as a viable option for achieving their aesthetic goals. This has driven the demand for breast implants and expanded the market.

- The medical community's efforts in educating both patients and healthcare professionals about breast augmentation procedures have played a pivotal role in raising awareness. Medical associations and organizations have developed comprehensive guidelines and recommendations, ensuring that patients are well-informed about the options, risks, and benefits of breast augmentation.

Growing Prevalence of Breast Cancer

- Breast implants have become increasingly popular for breast augmentation and reconstruction purposes. This rise in breast implant procedures has led to a larger population at risk. Additionally, certain types of breast implants, especially those with textured surfaces, have been associated with a higher risk of developing a rare type of lymphoma known as Breast Implant-Associated Anaplastic Large Cell Lymphoma (BIA-ALCL).

- Healthcare and medical technology perspective, this growing prevalence of breast cancer in breast implant recipients offers opportunities for advancements in early detection and prevention. Healthcare providers can focus on developing more effective screening protocols for this specific patient population, enabling early diagnosis and improved outcomes.

- This trend can encourage research into the development of safer and more biocompatible breast implant materials and technologies, reducing the risks associated with these procedures. It also highlights the importance of ongoing patient education, informed consent, and thorough follow-up care. In this context, the rise in breast cancer prevalence among breast implant recipients serves as a catalyst for healthcare professionals and researchers to improve patient care and outcomes in this specific area of breast health.

Breast Implants Market Segment Analysis:

Breast Implants Market Segmented based on type, application, and end-users.

By Type, Silicone Implants segment is expected to dominate the market during the forecast period

- Silicone implants are renowned for providing a remarkably natural appearance and texture, closely resembling the feel of natural breast tissue. The gel-like consistency of silicone contributes to a realistic aesthetic, making them highly sought after by individuals aiming for a genuine and aesthetically pleasing outcome in their breast augmentation procedures.

- Silicone implants are perceived as having a softer and more natural touch, significantly contributing to increased levels of patient satisfaction. The flexibility and suppleness of silicone allow for comfortable and lifelike movement, thereby enhancing the overall patient experience. This characteristic is pivotal in achieving high patient satisfaction levels, fostering positive word-of-mouth recommendations, and subsequently driving the demand for silicone implants.

By Application, Cosmetic Surgery segment held the largest share of 78.9% in 2022

- The dominance of the cosmetic surgery segment in the breast implants market is primarily driven by the widespread popularity of breast augmentation procedures. Breast augmentation consistently ranks as one of the most sought-after cosmetic surgeries globally, contributing significantly to the overall demand for breast implants. The desire for enhanced breast appearance and symmetry fuels the continuous growth of this segment.

- There is a noticeable increase in public awareness regarding the benefits and accessibility of breast augmentation procedures. Information dissemination through various channels, including social media, educational campaigns, and celebrity endorsements, has played a pivotal role in educating the public about the options available for breast enhancement. This heightened awareness directly correlates with an upsurge in the number of individuals considering and opting for cosmetic surgery, particularly breast augmentation.

Breast Implants Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America stands as the largest market for breast implants, and this leadership is underpinned by a convergence of factors that collectively contribute to its market dominance. The foremost driver of this trend is the robust demand for breast augmentation surgeries within the region. Fueled by the influence of regional entertainment industries and a heightened sense of self-awareness among women, the demand for these cosmetic procedures has significantly increased. This cultural and societal emphasis on aesthetics and body image has created a consistent and substantial market for breast implants in North America.

- The United States, in particular, plays a pivotal role in the region's dominance of the breast implant market. The country boasts an unparalleled demand for cosmetic surgeries and procedures, with breast augmentation emerging as a frontrunner. As evidenced by the 2020 American Society of Plastic Surgeons report, the United States witnessed a staggering 193,073 breast augmentation procedures that year, firmly establishing it as a key contributor to the region's market supremacy. The cultural significance placed on physical appearance and the availability of advanced medical technologies further fuel this demand in the U.S.

- Additionally, the prevalence of breast cancer in North America serves as a critical factor in driving the market for breast implants. The region, encompassing the United States, Canada, and Mexico, has experienced a notable increase in breast cancer cases. In 2020, as reported by GLOBOCAN, the United States alone recorded 253,465 new cases. The imperative for breast reconstruction post-mastectomy further propels the demand for breast implants, making North America a central hub for these life-changing medical interventions.

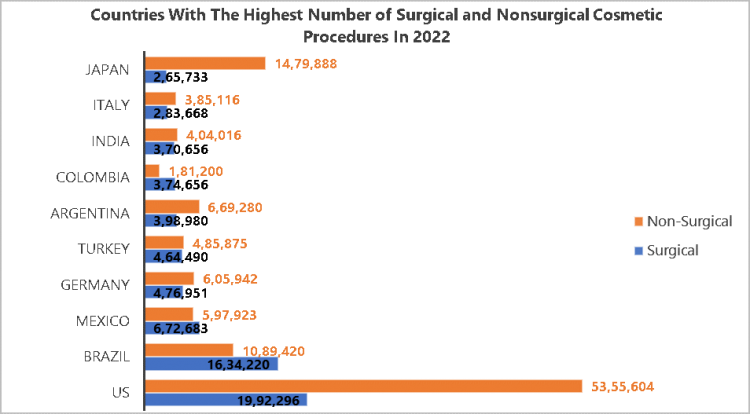

- As per given graph shows the dominance of breast implants in the United States' cosmetic procedures aligns with the overarching trend depicted in the provided graph, showcasing the highest numbers of both surgical and nonsurgical cosmetic interventions. This trend can be attributed to interconnected factors driving the popularity of breast augmentation procedures. societal standards of beauty and body aesthetics have evolved, contributing to an increased emphasis on body positivity and self-expression. Breast augmentation procedures, such as implants, are often chosen by individuals seeking to enhance their physical appearance and achieve a desired silhouette, aligning with prevailing beauty ideals.

Breast Implants Market Top Key Players:

- Mentor Worldwide LLC (U.S.)

- Sientra Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Ideal Implant Incorporated (U.S.)

- RTI Surgical Inc. (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Establishment Labs Holdings Inc. (U.S.)

- Allergan (Ireland)

- GC Aesthetics (Ireland)

- Polytech Health & Aesthetics GmbH (Germany)

- Sebbin SAS (France)

- Arion Laboratories (France)

- Groupe Sebbin SAS (France)

- CEREPLAS (France)

- Laboratoires Arion (France)

- POLYTECH Health & Aesthetics GmbH (Germany)

- Hans Biomed Co. Ltd. (South Korea)

- Shanghai Kangning Medical Supplies Ltd. (China)

- G&G Biotechnology Ltd. (China)

- Guangzhou Wanhe Plastic Materials Co., Ltd. (China)

- Shanghai Kangning Medical Device Co., Ltd. (China)

- Wanhe Plastic Materials Co., Ltd. (China)

Key Industry Developments in the Breast Implants Market:

- In November 2023, RTI Surgical, a major player in the medical device field, secured Investigational Device Exemption (IDE) approval from the U.S. Food and Drug Administration (FDA) for conducting a clinical study. This signifies advancements and potential future offerings in the breast implant arena, though details on the specific technology under investigation haven't been disclosed yet.

- In October 2022, GC anesthetics received CE approval for the micro-textured anatomical breast implant LUNA XT, which was approved under the new European Medical Device Regulation (MDR).

|

Breast Implants Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

|

CAGR (2024-2032): |

7.8% |

Market Size in 2032: |

USD 6.16 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Application |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BREAST IMPLANTS MARKET BY TYPE (2016-2030)

- BREAST IMPLANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SILICONE IMPLANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FORM-STABLE IMPLANTS

- SALINE IMPLANTS

- STRUCTURED SALINE IMPLANTS

- BREAST IMPLANTS MARKET BY APPLICATION (2016-2030)

- BREAST IMPLANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RECONSTRUCTIVE SURGERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETIC SURGERY

- BREAST IMPLANTS MARKET BY END USERS (2016-2030)

- BREAST IMPLANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETOLOGY CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BREAST IMPLANTS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MENTOR WORLDWIDE LLC (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SIENTRA INC. (U.S.)

- JOHNSON & JOHNSON (U.S.)

- IDEAL IMPLANT INCORPORATED (U.S.)

- RTI SURGICAL INC. (U.S.)

- ZIMMER BIOMET HOLDINGS, INC. (U.S.)

- ESTABLISHMENT LABS HOLDINGS INC. (U.S.)

- ALLERGAN (IRELAND)

- GC AESTHETICS (IRELAND)

- POLYTECH HEALTH & AESTHETICS GMBH (GERMANY)

- SEBBIN SAS (FRANCE)

- ARION LABORATORIES (FRANCE)

- GROUPE SEBBIN SAS (FRANCE)

- CEREPLAS (FRANCE)

- LABORATOIRES ARION (FRANCE)

- POLYTECH HEALTH & AESTHETICS GMBH (GERMANY)

- HANS BIOMED CO. LTD. (SOUTH KOREA)

- SHANGHAI KANGNING MEDICAL SUPPLIES LTD. (CHINA)

- G&G BIOTECHNOLOGY LTD. (CHINA)

- GUANGZHOU WANHE PLASTIC MATERIALS CO., LTD. (CHINA)

- SHANGHAI KANGNING MEDICAL DEVICE CO., LTD. (CHINA)

- WANHE PLASTIC MATERIALS CO., LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL BREAST IMPLANTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Breast Implants Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

|

CAGR (2024-2032): |

7.8% |

Market Size in 2032: |

USD 6.16 Bn. |

|

|

Segments Covered: |

By Type |

|

|

|

|

By Application |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Breast Implants Market research report is 2024-2032.

Mentor Worldwide LLC (U.S.), Sientra Inc. (U.S.), Johnson & Johnson (U.S.), Ideal Implant Incorporated (U.S.), RTI Surgical Inc. (U.S.), Zimmer Biomet Holdings, Inc. (U.S.), Establishment Labs Holdings Inc. (U.S.), Allergan (Ireland), GC Aesthetics (Ireland), Polytech Health & Aesthetics GmbH (Germany), Sebbin SAS (France), Arion Laboratories (France), Groupe Sebbin SAS (France), CEREPLAS (France), Laboratoires Arion (France), POLYTECH Health & Aesthetics GmbH (Germany), Hans Biomed Co. Ltd. (South Korea), Shanghai Kangning Medical Supplies Ltd. (China), G&G Biotechnology Ltd. (China), Guangzhou Wanhe Plastic Materials Co., Ltd. (China), Shanghai Kangning Medical Device Co., Ltd. (China), Wanhe Plastic Materials Co., Ltd. (China), and Other Major Players.

The Breast Implants Market is segmented into Type, Application, End-user, and region. By Type, the market is categorized into Silicone Implants, Form-stable Implants, Saline Implants, and Structured Saline Implants. By Application, the market is categorized into Reconstructive Surgery and Cosmetic Surgery. By End-user, the market is categorized into Hospital and Cosmetology Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The breast implant market, a vital segment of the healthcare and cosmetic surgery industry, focuses on the manufacturing, distribution, and surgical implantation of medical devices used to enhance or reconstruct the female breast. these devices, constructed with silicone gel or saline solution encased in a silicone shell, serve both aesthetic and reconstructive purposes and have experienced notable growth due to changing beauty standards, increased awareness, advancements in technology, and expanding disposable incomes. This market's evolution is marked by ongoing research and development to address safety concerns and regulatory challenges, ensuring its continued prominence in the field of cosmetic and reconstructive surgery.

Breast Implants Market Size Was Valued at USD 2.96 Billion in 2023, and is Projected to Reach USD 6.16 Billion by 2032, Growing at a CAGR of 9.6% From 2024-2032.