Brain Supplement Market Synopsis

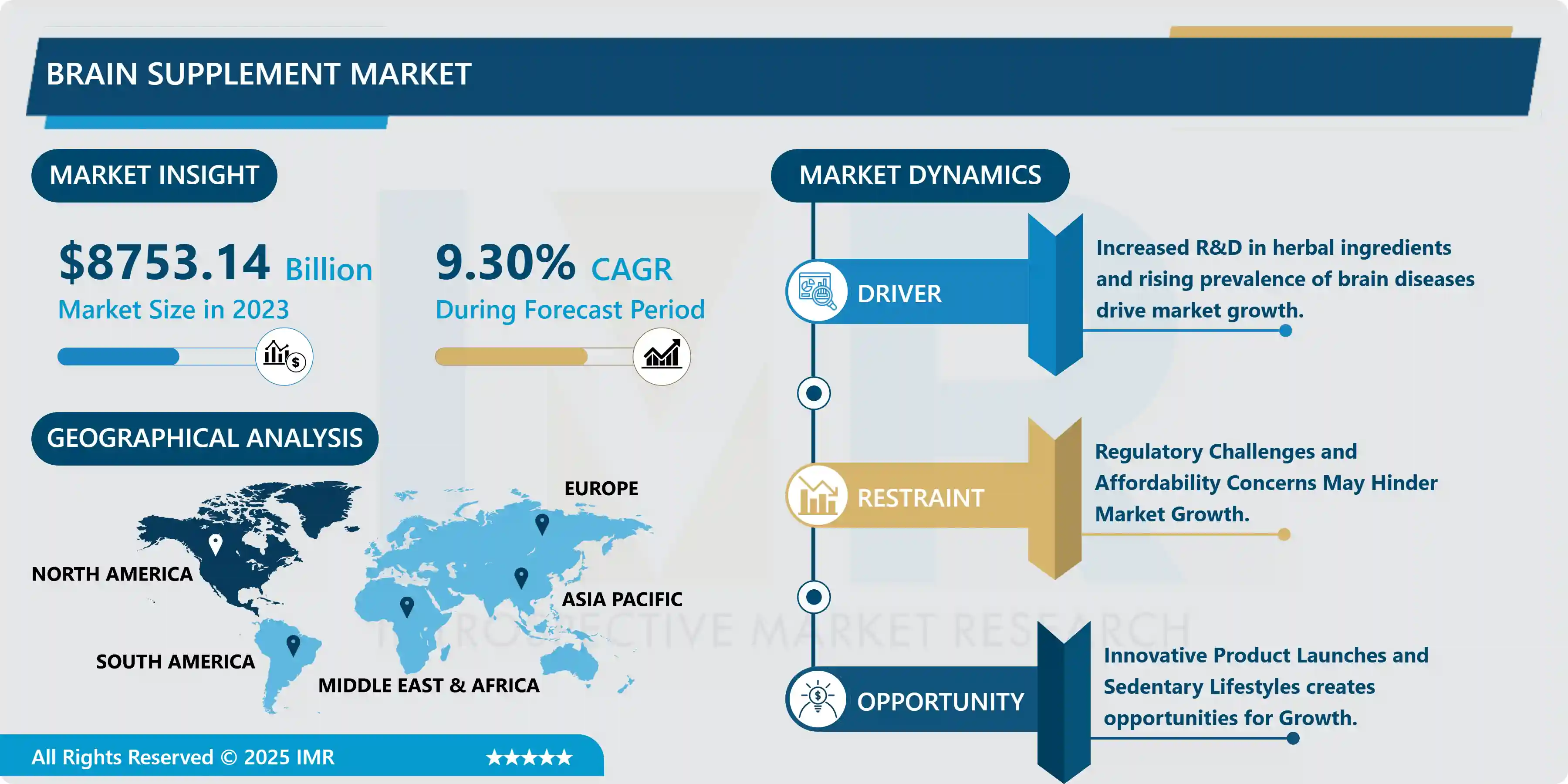

Brain Supplement Market Size Was Valued at USD 8753.14 Million in 2023 and is Projected to Reach USD 19487.02 Million by 2032, Growing at a CAGR of 9.3% From 2024-2032.

The market for brain supplements, sometimes referred to as nootropics or cognitive improvement, is made up of goods intended to boost memory, concentration, creativity, and general brain health. Numerous substances, including vitamins, minerals, amino acids, botanicals, and other natural or synthetic compounds, can be found in these supplements. Most people who reach the age of 55 can benefit from taking a daily supplement – or, better yet, a combination formula - because achieving an adequate level of nutrients for memory and focus can be tricky. Nonetheless, your brain still needs fuel. Here are the three main reasons why you may need a brain supplement: Our bodies lose their ability to absorb nutrients as we age, Medical or lifestyle reasons, Medical or lifestyle reasons.

In May 2022, WHO Member States adopted the Intersectoral global action plan on epilepsy and other neurological disorders 2022–2031. This action plan aims to improve the care, recovery, well-being, and participation of people living with neurological disorders across the life-course while reducing associated mortality, morbidity, and disability associated with neurological conditions. In the context of Universal Health Coverage and the UN Sustainable Development Goals and in line with WHO’s existing mandates for conditions affecting the brain such as autism spectrum disorder, epilepsy, and dementia, WHO’s brain health work is focused on promoting optimal brain development, cognitive health and well-being across the life course.

The World Health Organization (WHO) reported in September 2021 that some 280 million people worldwide, of all ages, were depressed. Anxiety disorders are among the most prevalent mental ailments in the United States. In October 2022, the Anxiety & Depression Association of America issued an article stating that 40 million adults in the United States, or 19.1% of the adult population, suffer from anxiety. Shortly, it is anticipated that growing knowledge about mental health disorders will expand the range of applications for supplements supporting brain health. These medications are also used to treat hyperactivity and Parkinson's disease, among other age- and cognitive-related diseases. It is anticipated that growing awareness of mental health and cognitive development will contribute to the expansion of brain health.

Brain Supplement Market Trend Analysis

The most emerging trend is the growing demand for natural, holistic brain health supplements.

- With more people realizing the value of cognitive function for overall well-being, there is a growing demand for supplements that improve memory, concentration, and mental clarity. The market for brain health supplements is growing significantly globally, with older adults, in particular, looking for products to support cognitive function and mitigate age-related decline. The need for supplements that enhance memory, focus, and mental clarity is rising as more individuals become aware of the importance of cognitive function for general well-being.

- The demand for goods that promote cognitive function and lessen age-related decline is particularly high among older persons, who are driving a large portion of the global market growth for supplements linked to brain health. Through partnerships, acquisitions, and mergers, the market is also growing. One example of this tendency is the acquisition of PreCon Health by Thorne, which demonstrates how strategic growth can improve product offers. The introduction of new products like Neuratech's Boost and Calm, which offer specific nootropics for attention, energy, stress relief, and sleep, is propelling market expansion.

- The public's awareness of brain health has increased due to the rising prevalence of brain diseases like Parkinson's and Alzheimer's, which has raised demand for supplements meant to prevent or slow cognitive problems. These items were first promoted to older baby boomers, but they are now also marketed to millennials, who are always under pressure to increase productivity. Overall, the brain health supplements market is poised for continued expansion due to growing consumer awareness, scientific progress, and strategic industry developments.

Opportunity

Innovative Product Launches and Sedentary Lifestyles creates opportunities for Growth

- The market for brain supplements is expanding rapidly thanks to new product introductions and product advancements from leading competitors. To meet the growing demand for cognitive enhancement, companies are launching novel, clinically-verified supplements. For instance, in the United States, Reckitt Benckiser Group plc introduced "Neuriva" in February 2019. The goal of this supplement is to enhance brain function. It is based on a proprietary coffee bean extract. In addition to the product, the company created a mobile application that provides customized brain training regimens, increasing user involvement and the overall efficacy of the product. These kinds of innovations serve an expanding customer base that is looking for practical and efficient cognitive assist solutions. People are more likely to look for supplements that help lessen the negative effects of stress, sleep deprivation, and bad diets on cognitive health as modern lifestyles become more sedentary and stressful.

- The market for brain supplements designed to improve mental clarity, focus, and general brain function is enormously expanded by this change in lifestyle. the desire of the elderly population to preserve cognitive function and fend off age-related deterioration boosts the industry. The market's reach is increased by the creation of supplements aimed at this group as well as younger customers seeking to improve mental and physical performance. The market for brain supplements is poised for expansion due to a number of factors, including the introduction of novel products, the development of helpful technology like companion applications, and the growing desire to counteract the detrimental impacts of contemporary lifestyles. Businesses that prioritize ingredients supported by research and customized solutions.

Brain Supplement Market Segment Analysis:

The Brain Supplement Market is Segmented based on ingredient, form, products, applications, age group, Distribution Channels, and regions.

By Application, Memory Enhancement Segment Is Expected To Dominate The Market During The Forecast Period

- The market for supplements for brain health is divided into segments such as anxiety, sleep and recovery, longevity & anti-aging, mood & depression, memory enhancement, attention & focus, and anxiety. Given the high incidence of degenerative illnesses in the elderly, the memory improvement market is anticipated to grow to a dominant position. The necessity for memory enhancers among students who are competing academically drove this segment's greatest market share. Furthermore, the growing demand for supplements containing natural and herbal extracts is anticipated to fuel market expansion. Over 55 million people worldwide are estimated to have dementia, and that number is expected to increase to 78 million by 2030 and 139 million by 2050, according to new WHO research.

- Since Alzheimer's disease accounts for almost 70% of dementia cases, there is a growing need and awareness for supplements that supportmemory. The need for brain health supplements is increased by the busy lifestyles of millennials, which include adventure sports, social gatherings, and part-time employment that need mental alertness. The Organization for Economic Co-operation and Development notes that a change in consumer lifestyles is shown by the rising incidence of part-time employment in nations including Germany, Italy, France, and Austria.

- It is anticipated that this shift will lead to a rise in the market for supplements that improve memory. The demand for memory enhancers has also increased due to increased academic competitiveness and pressure on working folks. The use of memory-enhancing supplements is driven by the aging population, especially in the United States, Germany, France, and Japan, where illnesses like Alzheimer's disease are common. It is estimated that 12.7 million Americans 65 years of age and older would have Alzheimer's dementia by 2050. In general, it is projected that shifting consumer behaviors and growing consciousness regarding cognitive health will enhance the market demand for supplements related to brain health.

By Distribution Channel, Pharmacies & Drugstores Segment Held The Largest Share In 2023

- The distribution channels for the brain health supplement market are drug stores, internet retailers, and supermarkets & hypermarkets. Because brain supplements are widely available in drug shops, this market segment is anticipated to grow during the forecast period. For example, Neuratech, an Australian health start-up, highlighted the importance of drug stores in the distribution of these goods when it introduced two brain supplements, Calm (a stress and sleep nootropic) and Boost (a focus and energy nootropic). By merging their online and in-store platforms, pharmacies are strengthening their market position and giving customers a smooth purchasing experience. This meets the increasing need for convenience by offering choices like online ordering with in-store pickup.

- Drug stores are also adding more natural and herbal supplements to their product lines for brain health, appealing to health-conscious consumers. These supplements include ginkgo biloba, omega-3 fatty acids, and adaptogenic herbs. The growing number of internet users and improvements in healthcare technology are expected to fuel the online retailer's segment's strong growth throughout the projection period.

- Customers find online platforms appealing since they provide a large selection of products and the ease of home delivery. Overall, the rise of online retailers reflects shifting consumer preferences and technical improvements, even if drug stores are expected to remain dominant due to their established presence and expanded product offers. In response to the growing demand for cognitive health goods, both channels are anticipated to have a major impact on the market expansion for brain health supplements.

Brain Supplement Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period in 2023

- Because of growing concerns about cognitive health and increased health consciousness, particularly among young people, the market for brain health supplements has taken off in North America. According to a June 2019 survey conducted by the American Association of Retired Persons (AARP), many Americans 50 years of age and over take brain health supplements as a way to prevent cognitive deterioration. With a more than 40% market share in 2021, North America dominated the market for supplements for brain health. The U.S. National Library of Medicine reported in April 2020 that over 75% of adults in the country used nutritional supplements, including ones for brain health.

- It is anticipated that this tendency will persist because of the established healthcare system, increased knowledge of neural problems, and an increase in the incidence of brain illnesses. The aging population, which includes many older persons who want to preserve cognitive function, further supports the market. The Alzheimer's Association projects that by 2050, 12.7 million Americans 65 years of age and older will have Alzheimer's dementia. The market is expected to rise due to the growing trend of dietary supplements being consumed by people of all ages, as reported by the Council for Responsible Nutrition (CRN) in 2021.

- In general, increased worries about cognitive health, a strong healthcare system, and a large number of market participants are responsible for North America's leadership in the brain health supplement business, while comparable trends in the Asia Pacific are driving the region's quick rise.

Brain Supplement Market Top Key Players:

- Pfizer Inc. (USA)

- GNC Holdings Inc. (USA)

- HVMN Inc. (USA)

- Onnit Labs LLC (USA)

- Neuriva (Reckitt Benckiser Group plc) (UK)

- NOW Foods (USA)

- Jarrow Formulas (USA)

- Natrol LLC (USA)

- Nature’s Way Products, LLC (USA)

|

Brain Supplement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

8753.14 Billion |

|

Forecast Period 2024-32 CAGR: |

9.3% |

Market Size in 2032: |

19487.02 Billion |

|

Segments Covered: |

By Ingredient |

|

|

|

|

By Form |

|

|

|

|

By Application |

|

|

|

|

By Product |

|

|

|

|

By Age Group |

|

|

|

|

Distribution Channel |

|

|

|

|

By Region |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Amcor plc - Australia, Berry Global Group, Inc. - United States, Ball Corporation - United States, Crown Holdings, Inc. - Pfizer Inc. (USA), GNC Holdings Inc. (USA), HVMN Inc. (USA), Onnit Labs LLC (USA), Neuriva (Reckitt Benckiser Group plc) (UK), NOW Foods (USA), Jarrow Formulas (USA), Natrol LLC (USA), Nature’s Way Products, LLC (USA) and other major players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Brain Supplement Market by Ingredient (2018-2032)

4.1 Brain Supplement Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Herbal Extract

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vitamins & Minerals

4.5 Natural Molecules

Chapter 5: Brain Supplement Market by Form (2018-2032)

5.1 Brain Supplement Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Capsules/Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Powder

5.5 Drinks

5.6 Gummy

Chapter 6: Brain Supplement Market by Application (2018-2032)

6.1 Brain Supplement Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Memory Enhancement

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mood & Depression

6.5 Attention & Focus

6.6 Longevity & Anti-Aging

6.7 Sleep & Recovery

6.8 Stress & Anxiety

Chapter 7: Brain Supplement Market by Product (2018-2032)

7.1 Brain Supplement Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Prescribed

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Over-the-counter

Chapter 8: Brain Supplement Market by Age Group (2018-2032)

8.1 Brain Supplement Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Children

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Teens

8.5 Adults

8.6 Distribution Channel

8.7 Health Food Stores

8.8 Pharmacies & Drugstores

8.9 Professional Healthcare Practitioners

8.10 Nutrition Stores

8.11 Healthcare Professionals

8.12 Online Retailers

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Brain Supplement Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PFIZER INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 GNC HOLDINGS INC. (USA)

9.4 HVMN INC. (USA)

9.5 ONNIT LABS LLC (USA)

9.6 NEURIVA (RECKITT BENCKISER GROUP PLC) (UK)

9.7 NOW FOODS (USA)

9.8 JARROW FORMULAS (USA)

9.9 NATROL LLC (USA)

9.10 NATURE’S WAY PRODUCTS

9.11 LLC (USA)

9.12 THORNE RESEARCH INC. (USA)

9.13 PURE ENCAPSULATIONS

9.14 LLC (USA)

9.15 LIFE EXTENSION (USA)

9.16 NORDIC NATURALS INC. (USA)

9.17 HERBALIFE NUTRITION LTD. (USA)

9.18 MIND LAB PRO (OPTI-NUTRA LTD.) (UK)

9.19 BLACKMORES LTD. (AUSTRALIA)

9.20 SWISSE WELLNESS (AUSTRALIA)

9.21 JAMIESON WELLNESS INC. (CANADA)

9.22 SANOFI (FRANCE)

9.23 BAYER AG (GERMANY)

9.24 NESTLÉ HEALTH SCIENCE (SWITZERLAND)

9.25 HORPHAG RESEARCH (FRANCE)

9.26 COGNIZIN (KYOWA HAKKO BIO COLTD.) (JAPAN)

9.27 DAIICHI SANKYO COLTD. (JAPAN)

9.28 NOOTROBOX (HVMN) (USA)

9.29 NEURIVA (SCHIFF VITAMINS) (USA)

9.30 BRAINMD HEALTH (USA)

9.31 HEALTHYCELL (USA)

9.32 PREVAGEN (QUINCY BIOSCIENCE) (USA)

9.33 NEURATECH (AUSTRALIA) OTHERS ARE MAJOR PLAYERS.

Chapter 10: Global Brain Supplement Market By Region

10.1 Overview

10.2. North America Brain Supplement Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Ingredient

10.2.4.1 Herbal Extract

10.2.4.2 Vitamins & Minerals

10.2.4.3 Natural Molecules

10.2.5 Historic and Forecasted Market Size by Form

10.2.5.1 Capsules/Tablets

10.2.5.2 Powder

10.2.5.3 Drinks

10.2.5.4 Gummy

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Memory Enhancement

10.2.6.2 Mood & Depression

10.2.6.3 Attention & Focus

10.2.6.4 Longevity & Anti-Aging

10.2.6.5 Sleep & Recovery

10.2.6.6 Stress & Anxiety

10.2.7 Historic and Forecasted Market Size by Product

10.2.7.1 Prescribed

10.2.7.2 Over-the-counter

10.2.8 Historic and Forecasted Market Size by Age Group

10.2.8.1 Children

10.2.8.2 Teens

10.2.8.3 Adults

10.2.8.4 Distribution Channel

10.2.8.5 Health Food Stores

10.2.8.6 Pharmacies & Drugstores

10.2.8.7 Professional Healthcare Practitioners

10.2.8.8 Nutrition Stores

10.2.8.9 Healthcare Professionals

10.2.8.10 Online Retailers

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Brain Supplement Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Ingredient

10.3.4.1 Herbal Extract

10.3.4.2 Vitamins & Minerals

10.3.4.3 Natural Molecules

10.3.5 Historic and Forecasted Market Size by Form

10.3.5.1 Capsules/Tablets

10.3.5.2 Powder

10.3.5.3 Drinks

10.3.5.4 Gummy

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Memory Enhancement

10.3.6.2 Mood & Depression

10.3.6.3 Attention & Focus

10.3.6.4 Longevity & Anti-Aging

10.3.6.5 Sleep & Recovery

10.3.6.6 Stress & Anxiety

10.3.7 Historic and Forecasted Market Size by Product

10.3.7.1 Prescribed

10.3.7.2 Over-the-counter

10.3.8 Historic and Forecasted Market Size by Age Group

10.3.8.1 Children

10.3.8.2 Teens

10.3.8.3 Adults

10.3.8.4 Distribution Channel

10.3.8.5 Health Food Stores

10.3.8.6 Pharmacies & Drugstores

10.3.8.7 Professional Healthcare Practitioners

10.3.8.8 Nutrition Stores

10.3.8.9 Healthcare Professionals

10.3.8.10 Online Retailers

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Brain Supplement Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Ingredient

10.4.4.1 Herbal Extract

10.4.4.2 Vitamins & Minerals

10.4.4.3 Natural Molecules

10.4.5 Historic and Forecasted Market Size by Form

10.4.5.1 Capsules/Tablets

10.4.5.2 Powder

10.4.5.3 Drinks

10.4.5.4 Gummy

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Memory Enhancement

10.4.6.2 Mood & Depression

10.4.6.3 Attention & Focus

10.4.6.4 Longevity & Anti-Aging

10.4.6.5 Sleep & Recovery

10.4.6.6 Stress & Anxiety

10.4.7 Historic and Forecasted Market Size by Product

10.4.7.1 Prescribed

10.4.7.2 Over-the-counter

10.4.8 Historic and Forecasted Market Size by Age Group

10.4.8.1 Children

10.4.8.2 Teens

10.4.8.3 Adults

10.4.8.4 Distribution Channel

10.4.8.5 Health Food Stores

10.4.8.6 Pharmacies & Drugstores

10.4.8.7 Professional Healthcare Practitioners

10.4.8.8 Nutrition Stores

10.4.8.9 Healthcare Professionals

10.4.8.10 Online Retailers

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Brain Supplement Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Ingredient

10.5.4.1 Herbal Extract

10.5.4.2 Vitamins & Minerals

10.5.4.3 Natural Molecules

10.5.5 Historic and Forecasted Market Size by Form

10.5.5.1 Capsules/Tablets

10.5.5.2 Powder

10.5.5.3 Drinks

10.5.5.4 Gummy

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Memory Enhancement

10.5.6.2 Mood & Depression

10.5.6.3 Attention & Focus

10.5.6.4 Longevity & Anti-Aging

10.5.6.5 Sleep & Recovery

10.5.6.6 Stress & Anxiety

10.5.7 Historic and Forecasted Market Size by Product

10.5.7.1 Prescribed

10.5.7.2 Over-the-counter

10.5.8 Historic and Forecasted Market Size by Age Group

10.5.8.1 Children

10.5.8.2 Teens

10.5.8.3 Adults

10.5.8.4 Distribution Channel

10.5.8.5 Health Food Stores

10.5.8.6 Pharmacies & Drugstores

10.5.8.7 Professional Healthcare Practitioners

10.5.8.8 Nutrition Stores

10.5.8.9 Healthcare Professionals

10.5.8.10 Online Retailers

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Brain Supplement Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Ingredient

10.6.4.1 Herbal Extract

10.6.4.2 Vitamins & Minerals

10.6.4.3 Natural Molecules

10.6.5 Historic and Forecasted Market Size by Form

10.6.5.1 Capsules/Tablets

10.6.5.2 Powder

10.6.5.3 Drinks

10.6.5.4 Gummy

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Memory Enhancement

10.6.6.2 Mood & Depression

10.6.6.3 Attention & Focus

10.6.6.4 Longevity & Anti-Aging

10.6.6.5 Sleep & Recovery

10.6.6.6 Stress & Anxiety

10.6.7 Historic and Forecasted Market Size by Product

10.6.7.1 Prescribed

10.6.7.2 Over-the-counter

10.6.8 Historic and Forecasted Market Size by Age Group

10.6.8.1 Children

10.6.8.2 Teens

10.6.8.3 Adults

10.6.8.4 Distribution Channel

10.6.8.5 Health Food Stores

10.6.8.6 Pharmacies & Drugstores

10.6.8.7 Professional Healthcare Practitioners

10.6.8.8 Nutrition Stores

10.6.8.9 Healthcare Professionals

10.6.8.10 Online Retailers

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Brain Supplement Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Ingredient

10.7.4.1 Herbal Extract

10.7.4.2 Vitamins & Minerals

10.7.4.3 Natural Molecules

10.7.5 Historic and Forecasted Market Size by Form

10.7.5.1 Capsules/Tablets

10.7.5.2 Powder

10.7.5.3 Drinks

10.7.5.4 Gummy

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Memory Enhancement

10.7.6.2 Mood & Depression

10.7.6.3 Attention & Focus

10.7.6.4 Longevity & Anti-Aging

10.7.6.5 Sleep & Recovery

10.7.6.6 Stress & Anxiety

10.7.7 Historic and Forecasted Market Size by Product

10.7.7.1 Prescribed

10.7.7.2 Over-the-counter

10.7.8 Historic and Forecasted Market Size by Age Group

10.7.8.1 Children

10.7.8.2 Teens

10.7.8.3 Adults

10.7.8.4 Distribution Channel

10.7.8.5 Health Food Stores

10.7.8.6 Pharmacies & Drugstores

10.7.8.7 Professional Healthcare Practitioners

10.7.8.8 Nutrition Stores

10.7.8.9 Healthcare Professionals

10.7.8.10 Online Retailers

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Brain Supplement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

8753.14 Billion |

|

Forecast Period 2024-32 CAGR: |

9.3% |

Market Size in 2032: |

19487.02 Billion |

|

Segments Covered: |

By Ingredient |

|

|

|

|

By Form |

|

|

|

|

By Application |

|

|

|

|

By Product |

|

|

|

|

By Age Group |

|

|

|

|

Distribution Channel |

|

|

|

|

By Region |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Amcor plc - Australia, Berry Global Group, Inc. - United States, Ball Corporation - United States, Crown Holdings, Inc. - Pfizer Inc. (USA), GNC Holdings Inc. (USA), HVMN Inc. (USA), Onnit Labs LLC (USA), Neuriva (Reckitt Benckiser Group plc) (UK), NOW Foods (USA), Jarrow Formulas (USA), Natrol LLC (USA), Nature’s Way Products, LLC (USA) and other major players. |

||