Bipolar Disorder Market Synopsis

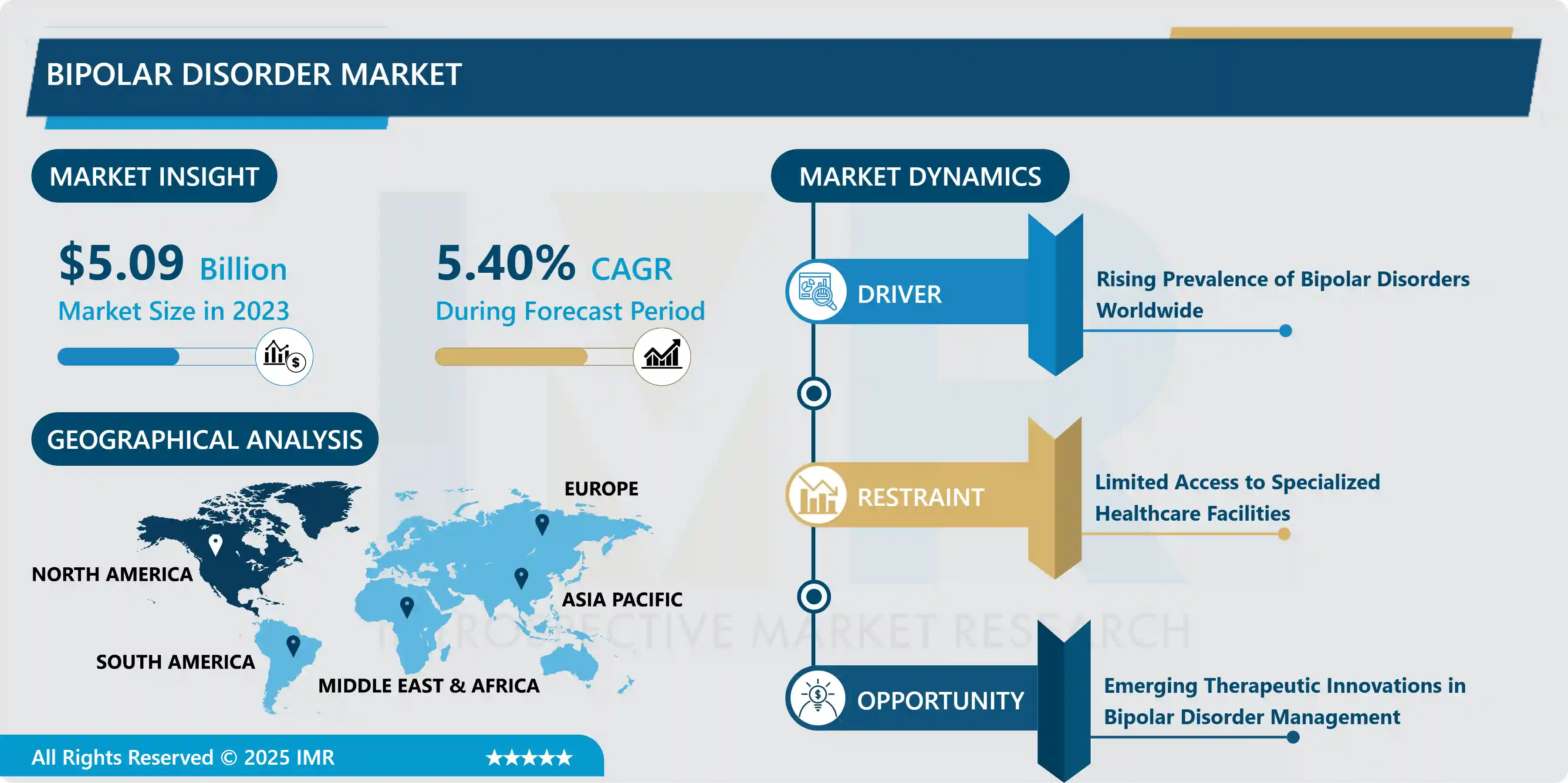

Bipolar Disorder Market Size is Valued at USD 5.09 Billion in 2023, and is Projected to Reach USD 8.18 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

The Bipolar Disorder Market includes the bipolar disorder products, services, and therapies that can be prescribed for the treatment of bipolar disorder which is a mental disorder that causes fluctuating mood swings between mania and depression. This market comprises of the drugs like mood stabilizers, antipsychotics, and antidepressants and the non-pharmacological treatment like psychotherapy, CBT, and ECT. It is classified based on the drug class, treatment type, patient category, sales channel, end consumer, and region, with dedicated research and development towards enhancing the disease’s quality of life and optimizing the control of the condition.

The market for bipolar disorder is therefore fueled by the rising rates of the disease, enhance awareness of mental health disorders, and the demand for suitable treatments. Bipolar disorder is estimated to affect 45 million people worldwide by the World Health Organization and puts a lot of burdens on healthcare systems. Enhancements in diagnostic procedures and the discovery of the underlying mechanisms of the disorder have resulted in earlier diagnosis and more accurate identification of the condition and thus the need for adequate pharmaceutical and non-pharmaceutical management methods. Also, the increasing concern for mental health and the reduction of stigma surrounding psychiatric disorders are making people go for treatment, which in turn increases the market.

The other major factor is the ongoing discovery of new therapies and medicines in the market. The pharmaceutical industries are developing a lot of funds on research and development to bring new and effective drugs with less or no side effects. The emergence of targeted therapies such as ‘personalized medicine’ and the use of digital platforms for tracking and managing the disorder are also driving the market. In addition, the policies from governments and more favourable reimbursement policies across several regions are encouraging patients to get treatment hence enlarging the market. Strategic alliances and joint ventures between the market players to diversify and complement the product offerings and to increase geographical presence are also adding to the impressive growth of the market.

Bipolar Disorder Market Trend Analysis

Advancements in Bipolar Disorder Treatment, Navigating the Expanding Market

- The Bipolar Disorder market is on the rise because of awareness and early diagnosis of the condition. The increasing rates of mental illnesses together with enhanced scientific developments have made bipolar disorder more comprehensible and manageable. This entails the invention of better drugs and an increasing appreciation of non-drug interventions like CBT and ECT. Also, the distribution of these treatments through hospital and retail pharmacies, and through online platforms, has ensured that these treatments are within the reach of patients anywhere in the world.

- Market growth is as a result of technological enhancement and innovation in the development of drugs. Newer mood stabilizers, antipsychotics, and combination therapies are helping the patients and reducing the side effects of conventional treatments. In addition, the continuing trend of personalized medicine and targeted therapy is likely to improve the outcomes of treatment regimens. The market is also receiving support from the government policies and grants for the development of mental health facilities and programs. However, there are some issues that may still hinder the market progress including the social rejection of those with mental health disorders and expensive health costs. However, constant progresses in the mental health awareness and the continual decreasing of prejudice related to mental illness are likely to open new opportunities for market participants in the following years.

Rising Demand and New Horizons in the Bipolar Disorder Market

- The Bipolar Disorder Market is highly promising due to the rising incidence of the disorder globally. Diagnostic procedures have improved and the society has become more sensitive to mental health problems, thus early diagnosis and better identification of mental disorders puts pressure on the system to develop efficient methods of managing the patients. Also, the advancement in digital health technology and telemedicine has also enhanced the management and follow-up of bipolar disorder in areas with poor access to care. This trend is expected to foster the growth of the market for new therapeutic solutions and integrated bipolar disorder patient care.

- In addition, the pharmaceutical industry is experiencing a growth in research and development in the discovery of new molecules to treat bipolar disorders. Organizations are capitalizing on research to come up with better drugs, better in terms of effectiveness and side effects in response to the demand of patients. Industry, academia, and clinicians are working together to drive forward research and development and to create new opportunities for therapeutic development. With mental health being a trending issue in the world today, there will be a great market opportunity for bipolar disorder treatment that is more advanced, personal and easily accessible to the patients, whether by the existing players or the new entrants.

Bipolar Disorder Market Segment Analysis:

Bipolar Disorder Market Segmented on the basis of type, By Drug Class, Treatment, and end-users.

By Type, Bipolar I Disorder segment is expected to dominate the market during the forecast period

- The Bipolar Disorder Market is divided into several sub types that have different clinical features and treatment requirements. Bipolar I Disorder is major depressive disorder with severe manic episodes, which may be followed by depressive episodes. This type usually needs a lot of medication and supervision because of the high probability of significant fluctuations in mood and potential for hospitalization. Bipolar II Disorder also has hypomanic episodes, which are still different from manic episodes in Bipolar I but involves major depressive episodes. This type may be difficult to diagnose because the hypomanic episodes can be easily confused with the periods of increased efficiency or even normal mood.

By Treatment, Pharmacological Treatment segment held the largest share in 2024

- The management of bipolar disorder includes the use of medications as well as other modalities of treatment. Medications include mood stabilizers, antipsychotics, antidepressants, and occasionally benzodiazepines to control episodes of mood swings and stabilize the mood. These are prescribed depending on the type and intensity of the symptoms, to target and regulate the manic, hypomanic, and depressive episodes.

- These methods include psychotherapy, CBT, psychoeducation, family therapy, and ECT that are helpful in the augmentative therapy, coping with stress, and improving the quality of the treatment process. Combining pharmacological and non-pharmacological treatment strategies is essential in managing bipolar disorder by targeting the various aspects of the patient’s needs, and improving their well-being in the long run.

Bipolar Disorder Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North America bipolar disorder market is well developed with strong healthcare facilities and research and development activities which contribute to better treatment options and awareness programs. The market for the region is driven by the increased number of bipolar disorder cases especially in the United States and Canada due to better diagnosis techniques and increased awareness programs. Pharmaceutical treatments such as mood stabilizers and antipsychotics are more common with a majority of large pharmaceutical firms investing in research and development of new drugs and therapies.

- Eleven and eight hospital pharmacies and clinics are distribution outlets that make medication and therapeutic services easily available. The market continues to be supported by clinical research and partnership initiatives in improving treatment efficacy and patients’ quality of life across the adult, pediatric, and geriatric populations.

Active Key Players in the Bipolar Disorder Market

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- AstraZeneca plc (United Kingdom)

- GSK plc (United Kingdom)

- Pfizer Inc. (United States)

- Eli Lilly and Company (United States)

- Johnson & Johnson (United States)

- AbbVie Inc. (United States)

- Novartis AG (Switzerland)

- Allergan plc (Ireland)

- Lundbeck A/S (Denmark)

- Others

|

Bipolar Disorder Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 8.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Treatment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bipolar Disorder Market by Type (2018-2032)

4.1 Bipolar Disorder Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bipolar I Disorder

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bipolar II Disorder

4.5 Cyclothymic Disorder

4.6 Mixed Features

4.7 Rapid Cycling

Chapter 5: Bipolar Disorder Market by Drug Class (2018-2032)

5.1 Bipolar Disorder Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mood Stabilizers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Antipsychotics

5.5 Antidepressants

5.6 Benzodiazepines

Chapter 6: Bipolar Disorder Market by Treatment (2018-2032)

6.1 Bipolar Disorder Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmacological Treatment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-Pharmacological Treatment

Chapter 7: Bipolar Disorder Market by End User (2018-2032)

7.1 Bipolar Disorder Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinics

7.5 Home Care Settings

7.6 Rehabilitation Centers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bipolar Disorder Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 OTSUKA PHARMACEUTICAL COLTD. (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ASTRAZENECA PLC (UNITED KINGDOM)

8.4 GSK PLC (UNITED KINGDOM)

8.5 PFIZER INC. (UNITED STATES)

8.6 ELI LILLY AND COMPANY (UNITED STATES)

8.7 JOHNSON & JOHNSON (UNITED STATES)

8.8 ABBVIE INC. (UNITED STATES)

8.9 NOVARTIS AG (SWITZERLAND)

8.10 ALLERGAN PLC (IRELAND)

8.11 LUNDBECK A/S (DENMARK)

8.12 OTHERS

8.13

Chapter 9: Global Bipolar Disorder Market By Region

9.1 Overview

9.2. North America Bipolar Disorder Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Bipolar I Disorder

9.2.4.2 Bipolar II Disorder

9.2.4.3 Cyclothymic Disorder

9.2.4.4 Mixed Features

9.2.4.5 Rapid Cycling

9.2.5 Historic and Forecasted Market Size by Drug Class

9.2.5.1 Mood Stabilizers

9.2.5.2 Antipsychotics

9.2.5.3 Antidepressants

9.2.5.4 Benzodiazepines

9.2.6 Historic and Forecasted Market Size by Treatment

9.2.6.1 Pharmacological Treatment

9.2.6.2 Non-Pharmacological Treatment

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Hospitals

9.2.7.2 Clinics

9.2.7.3 Home Care Settings

9.2.7.4 Rehabilitation Centers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bipolar Disorder Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Bipolar I Disorder

9.3.4.2 Bipolar II Disorder

9.3.4.3 Cyclothymic Disorder

9.3.4.4 Mixed Features

9.3.4.5 Rapid Cycling

9.3.5 Historic and Forecasted Market Size by Drug Class

9.3.5.1 Mood Stabilizers

9.3.5.2 Antipsychotics

9.3.5.3 Antidepressants

9.3.5.4 Benzodiazepines

9.3.6 Historic and Forecasted Market Size by Treatment

9.3.6.1 Pharmacological Treatment

9.3.6.2 Non-Pharmacological Treatment

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Hospitals

9.3.7.2 Clinics

9.3.7.3 Home Care Settings

9.3.7.4 Rehabilitation Centers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bipolar Disorder Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Bipolar I Disorder

9.4.4.2 Bipolar II Disorder

9.4.4.3 Cyclothymic Disorder

9.4.4.4 Mixed Features

9.4.4.5 Rapid Cycling

9.4.5 Historic and Forecasted Market Size by Drug Class

9.4.5.1 Mood Stabilizers

9.4.5.2 Antipsychotics

9.4.5.3 Antidepressants

9.4.5.4 Benzodiazepines

9.4.6 Historic and Forecasted Market Size by Treatment

9.4.6.1 Pharmacological Treatment

9.4.6.2 Non-Pharmacological Treatment

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Hospitals

9.4.7.2 Clinics

9.4.7.3 Home Care Settings

9.4.7.4 Rehabilitation Centers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bipolar Disorder Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Bipolar I Disorder

9.5.4.2 Bipolar II Disorder

9.5.4.3 Cyclothymic Disorder

9.5.4.4 Mixed Features

9.5.4.5 Rapid Cycling

9.5.5 Historic and Forecasted Market Size by Drug Class

9.5.5.1 Mood Stabilizers

9.5.5.2 Antipsychotics

9.5.5.3 Antidepressants

9.5.5.4 Benzodiazepines

9.5.6 Historic and Forecasted Market Size by Treatment

9.5.6.1 Pharmacological Treatment

9.5.6.2 Non-Pharmacological Treatment

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Hospitals

9.5.7.2 Clinics

9.5.7.3 Home Care Settings

9.5.7.4 Rehabilitation Centers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bipolar Disorder Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Bipolar I Disorder

9.6.4.2 Bipolar II Disorder

9.6.4.3 Cyclothymic Disorder

9.6.4.4 Mixed Features

9.6.4.5 Rapid Cycling

9.6.5 Historic and Forecasted Market Size by Drug Class

9.6.5.1 Mood Stabilizers

9.6.5.2 Antipsychotics

9.6.5.3 Antidepressants

9.6.5.4 Benzodiazepines

9.6.6 Historic and Forecasted Market Size by Treatment

9.6.6.1 Pharmacological Treatment

9.6.6.2 Non-Pharmacological Treatment

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Hospitals

9.6.7.2 Clinics

9.6.7.3 Home Care Settings

9.6.7.4 Rehabilitation Centers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bipolar Disorder Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Bipolar I Disorder

9.7.4.2 Bipolar II Disorder

9.7.4.3 Cyclothymic Disorder

9.7.4.4 Mixed Features

9.7.4.5 Rapid Cycling

9.7.5 Historic and Forecasted Market Size by Drug Class

9.7.5.1 Mood Stabilizers

9.7.5.2 Antipsychotics

9.7.5.3 Antidepressants

9.7.5.4 Benzodiazepines

9.7.6 Historic and Forecasted Market Size by Treatment

9.7.6.1 Pharmacological Treatment

9.7.6.2 Non-Pharmacological Treatment

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Hospitals

9.7.7.2 Clinics

9.7.7.3 Home Care Settings

9.7.7.4 Rehabilitation Centers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Bipolar Disorder Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 8.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Drug Class |

|

||

|

By Treatment |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||