Global Biorefinery Market Synopsis

The global biorefinery market size was valued at USD 145.11 billion in 2023 and to reach USD 278.42 billion by 2032, growing at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2032.

A biorefinery is a versatile facility that employs various technologies to convert biomass, such as agricultural residues, forestry waste, and algae, into a range of valuable products. Unlike conventional refineries that process fossil fuels, biorefineries focus on renewable and sustainable resources. They play a crucial role in the transition towards a more eco-friendly and circular economy.

At a biorefinery, biomass undergoes a series of processes like fermentation, distillation, and chemical conversion to yield a diverse array of products. These can include biofuels like ethanol and biodiesel, which serve as sustainable alternatives to gasoline and diesel. Additionally, biorefineries produce biochemicals, such as organic acids, enzymes, and bioplastics, which can replace their petroleum-based counterparts in numerous applications.

Moreover, biorefineries are capable of generating heat and power from the combustion of residual biomass, making them more self-sufficient and contributing to a reduced carbon footprint. The integration of biorefinery technologies also enables the recovery of valuable by-products, minimizing waste and maximizing resource utilization.

Biorefineries represent a pivotal component of the bio economy, fostering innovation and sustainable practices across various industries. They exemplify a shift towards harnessing nature's resources in a way that is both economically viable and environmentally responsible, offering a promising solution to global challenges related to energy security, climate change, and resource scarcity.

Global Biorefinery Market Analysis

Growing Demand for Cleaner Fuels

- The global shift towards cleaner fuels has gained unprecedented momentum in recent years, driven by mounting environmental concerns and the need to combat climate change. This surge in demand can be attributed to several key factors. Increasing awareness of the detrimental effects of fossil fuel combustion on air quality and greenhouse gas emissions has spurred governments, industries, and consumers to seek alternative, more sustainable energy sources. This has led to a surge in investments and research in renewable energy technologies, such as solar, wind, and hydroelectric power, as well as the development of advanced biofuels.

- Moreover, stricter environmental regulations and emissions targets set by governments worldwide have necessitated a transition towards cleaner fuels. This has prompted industries to explore and adopt technologies that reduce their carbon footprint, including the integration of electric vehicles, hydrogen-powered systems, and biofuel blends. The economic viability of cleaner fuels has also played a crucial role in their growing demand. Advances in technology have driven down the costs of production and implementation, making renewable energy sources increasingly competitive with traditional fossil fuels.

- Additionally, consumer preferences for eco-friendly products and services have catalyzed the demand for cleaner fuels. The rise of electric vehicles, coupled with a surge in sustainable transportation options, reflects this shift in consumer behavior.

Limitation on Feedstock Types

- Restrictions on feedstock types refer to limitations or regulations imposed on the specific materials or resources that can be used as inputs in a particular process or industry. These restrictions are often implemented for various reasons, including environmental, safety, economic, or regulatory concerns. For instance: in the biofuel production, there may be restrictions on the types of biomass that can be used as feedstock. This could be due to concerns about the environmental impact of certain feedstock sources, such as the potential for deforestation or competition with food crops.

- In chemical manufacturing, restrictions on feedstock types may be in place to ensure the safety of workers and the surrounding community. Certain chemicals or substances may be prohibited due to their hazardous nature or potential for misuse. Additionally, in industries like recycling and waste management, there may be restrictions on the types of materials that can be accepted for processing. This helps to maintain the quality of recycled materials and prevent contamination of the recycling stream.

Technological Innovation

- Technological innovation has revolutionized the field of biorefinery, driving sustainable solutions for a rapidly evolving world. A biorefinery is a facility that integrates biomass conversion processes to produce a range of valuable products, including biofuels, biochemicals, and biomaterials. Advanced technologies have significantly enhanced the efficiency and versatility of biorefineries.

- The development of advanced feedstock processing techniques. Breakthroughs in biomass pretreatment, such as steam explosion and enzymatic hydrolysis, have greatly improved the accessibility of sugars and other valuable components for downstream processing. This enables the utilization of a broader range of feedstocks, including agricultural residues, algae, and even municipal solid waste.

- Furthermore, novel fermentation and biocatalysts technologies have been instrumental in converting sugars and other biomass-derived compounds into high-value products. Engineered microorganisms and enzymes now play a crucial role in the efficient production of biofuels like ethanol, biodiesel, and renewable natural gas. Additionally, biorefineries are increasingly producing platform chemicals and specialty biochemicals, which find applications in various industries, from pharmaceuticals to plastics.

Global Biorefinery Market Segmentation Analysis:

Biorefinery Market segments cover the Product, Technology, and Application. By Product, the Non-energetic segment is anticipated to dominate the Market Over the Forecast period.

- Nonenergetic Segment encompasses a wide range of products including biochemicals, biomaterials, and bioproducts. Biochemicals include various compounds such as enzymes, organic acids, and platform chemicals. Biomaterials refer to materials derived from biomass that can be used as alternatives to conventional plastics or materials in various industries. Bioproducts could include a variety of consumer goods and industrial products made from renewable resources.

- By Technology, Industrial Biotechnology Biorefinery segment focuses on using biological processes and organisms to convert biomass into valuable products. It often involves the use of microorganisms like bacteria, yeast, or enzymes to produce biofuels, chemicals, and other materials. This segment has seen significant growth, particularly in the production of bio-based chemicals and materials.

Global Biorefinery Market Regional Analysis:

Asia- Pacific is expected to Dominate the Market over the Forecast period

- The Asia-Pacific region is endowed with diverse and abundant biomass resources, including agricultural residues, forest residues, and various types of organic waste. This provides a strong foundation for biorefinery operations. Economic Development and Industrialization many countries in the Asia-Pacific region are experiencing rapid economic development and urbanization. This has led to an increase in demand for energy, chemicals, and materials, which can be met through biorefining processes. Biomass Power Generation involves the conversion of biomass into electricity or heat. Biomass power plants have gained popularity in several Asia Pacific countries, particularly those with abundant agricultural and forestry resources. Asia- Pacific is one of the most prominent regions in biorefinery.

- Biofuels include bioethanol, biodiesel, and other advanced biofuels. With an increasing focus on sustainable and renewable energy sources, there has been a push for biofuels as an alternative to fossil fuels. Countries like Indonesia, Malaysia, Thailand, and India have been investing in biofuel production from feedstocks such as palm oil, sugarcane, and algae. Some countries in the region have implemented policies and regulations that encourage the development of bio-based industries. These policies may include incentives, subsidies, or mandates for the production and use of biofuels and bio-based products.

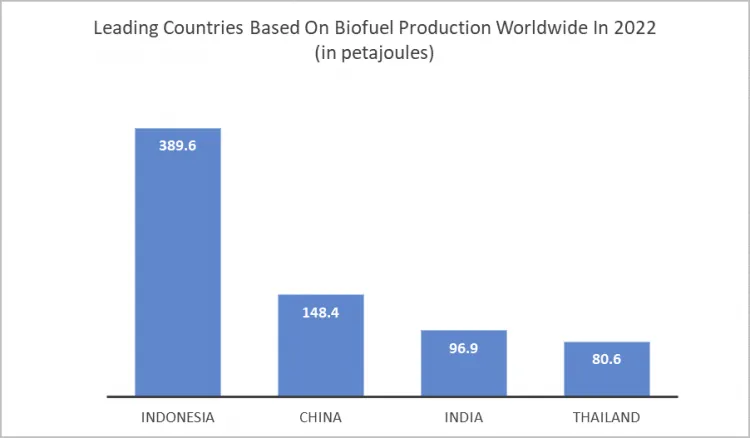

- Biofuel production is growing in Indonesia, China, India, and Thailand due to several key factors. These countries are among the world's most populous, leading to a high demand for energy. Biofuels offer a sustainable alternative to fossil fuels, aligning with global efforts to reduce carbon emissions and combat climate change. Additionally, these nations possess ample arable land and favorable climates for growing feedstock crops like sugarcane, corn, and palm oil, which are essential for biofuel production. Government policies and incentives also play a pivotal role, with subsidies, tax breaks, and renewable energy targets encouraging investment in the biofuel sector. The increasing awareness of environmental issues and the need for energy security further drive the growth of biofuel production in these regions.

Biorefinery Market Key Players:

- Valero (US)

- Renewable Energy Group (US)

- Neste (Finland)

- Total Energies (France)

- Vivergo Fuel (England)

- Borregard AS (Norway)

- Wilmar International Ltd. (Singapore)

- Godavari Biorefineries Ltd. (India)

- Sekab (Sweden)

- Cargill, Incorporated (US)

- Clariant (Switzerland)

- Abengoa (Spain)

- Green Plains (US)

- Honeywell International Inc. (U.S.)

- Chempolis (Finland)

- Sekab (Sweden)

- Ørsted A/S (Denmark)

- AB HOLDING SPA (Italy)

- Zea2 Bioworks (U.S.)

- UPM Global (Finland)

- BTS Biogas Srl/GmbH (Italy)

Key Industry Development of Biorefinery:

- In February 2022, Governor Greg Abbott announced that USA Bioenergy, through its subsidiary Texas Renewable Funds (TRF), will build a new $1.7 billion advanced biorefinery in Bon Wier, Texas. The biorefinery will convert one million green tons of wood waste into 34 million gallons annually of premium clean burning transportation fuel including Sustainable Aviation Fueal, Renewable Diesel, and Renewable Naphtha.

- In March 2020, Neste announced that it acquires Bunge Loders Croklaan's refinery plant in Rotterdam, the Netherlands. The completion of this acquisition was an important stepped forward in delivering on Neste’s global growth strategy in renewables. It allows us to accelerate the scaling up of our renewable raw material pretreatment capacity, which was an important driver for expanding the use of waste and residue feedstocks and increasing our feedstock flexibility.

|

Biorefinery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 145.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.1 % |

Market Size in 2032: |

USD 278.42 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biorefinery Market by Product (2018-2032)

4.1 Biorefinery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Energetic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nonenergetic

Chapter 5: Biorefinery Market by Technology (2018-2032)

5.1 Biorefinery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Physio-Chemical

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial Biotechnology

5.5 Thermochemical

5.6 Advanced Biorefinery

Chapter 6: Biorefinery Market by Application (2018-2032)

6.1 Biorefinery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Resins

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plastic Electricity

6.5 Body Care Products

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biorefinery Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PEPSICO (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 THE COCA-COLA COMPANY (USA)

7.4 RED BULL GMBH (AUSTRIA)

7.5 MONSTER BEVERAGE CORPORATION (USA)

7.6 ABBOTT LABORATORIES (USA)

7.7 GLAXOSMITHKLINE PLC (U.K.)

7.8 DANONE S.A. (FRANCE)

7.9 OTSUKA PHARMACEUTICAL COLTD. (JAPAN)

7.10 CLIF BAR & COMPANY (USA)

7.11 LIVON LABS (USA)

7.12 ULTIMA REPLENISHER (USA)

7.13 GU ENERGY LABS (USA)

7.14 SUNTORY HOLDINGS LIMITED (JAPAN)

7.15 BIOSTEEL (CANADA)

7.16 CYTOSPORT INC. (USA)

7.17 BODYARMOR (USA)

7.18 TAILWIND NUTRITION (USA)

7.19 SKRATCH LABS (USA)

7.20 NUUN & COMPANY (USA)

7.21 POWERBAR (USA)

Chapter 8: Global Biorefinery Market By Region

8.1 Overview

8.2. North America Biorefinery Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Energetic

8.2.4.2 Nonenergetic

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Physio-Chemical

8.2.5.2 Industrial Biotechnology

8.2.5.3 Thermochemical

8.2.5.4 Advanced Biorefinery

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Resins

8.2.6.2 Plastic Electricity

8.2.6.3 Body Care Products

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biorefinery Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Energetic

8.3.4.2 Nonenergetic

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Physio-Chemical

8.3.5.2 Industrial Biotechnology

8.3.5.3 Thermochemical

8.3.5.4 Advanced Biorefinery

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Resins

8.3.6.2 Plastic Electricity

8.3.6.3 Body Care Products

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biorefinery Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Energetic

8.4.4.2 Nonenergetic

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Physio-Chemical

8.4.5.2 Industrial Biotechnology

8.4.5.3 Thermochemical

8.4.5.4 Advanced Biorefinery

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Resins

8.4.6.2 Plastic Electricity

8.4.6.3 Body Care Products

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biorefinery Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Energetic

8.5.4.2 Nonenergetic

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Physio-Chemical

8.5.5.2 Industrial Biotechnology

8.5.5.3 Thermochemical

8.5.5.4 Advanced Biorefinery

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Resins

8.5.6.2 Plastic Electricity

8.5.6.3 Body Care Products

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biorefinery Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Energetic

8.6.4.2 Nonenergetic

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Physio-Chemical

8.6.5.2 Industrial Biotechnology

8.6.5.3 Thermochemical

8.6.5.4 Advanced Biorefinery

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Resins

8.6.6.2 Plastic Electricity

8.6.6.3 Body Care Products

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biorefinery Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Energetic

8.7.4.2 Nonenergetic

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Physio-Chemical

8.7.5.2 Industrial Biotechnology

8.7.5.3 Thermochemical

8.7.5.4 Advanced Biorefinery

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Resins

8.7.6.2 Plastic Electricity

8.7.6.3 Body Care Products

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Biorefinery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 145.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.1 % |

Market Size in 2032: |

USD 278.42 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||