Biological Seed Treatment Market Synopsis

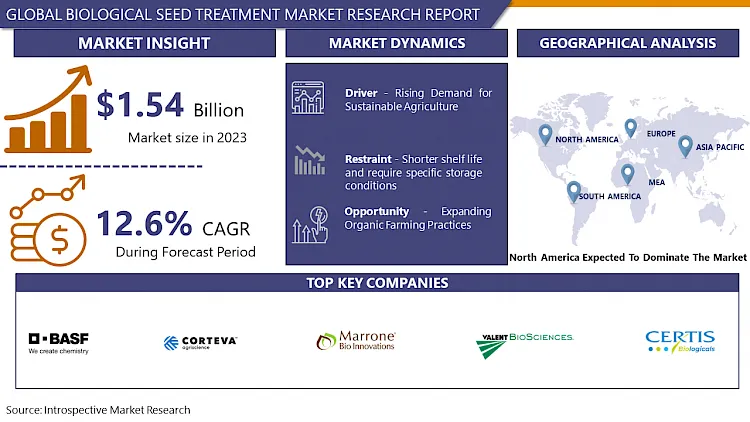

Biological Seed Treatment Market Size Was Valued at USD 1.73 Billion in 2024, and is Projected to Reach USD 4.47 Billion by 2032, Growing at a CAGR of 12.6% From 2025-2032.

Biological seed treatment involves the application of microorganisms, such as bacteria, fungi, or beneficial microbes, to seeds before planting to enhance their growth, health, and productivity. These microorganisms form symbiotic relationships with the plant roots, promoting nutrient uptake, disease resistance, and overall plant vigor. Biological seed treatments can help reduce the need for chemical pesticides and fertilizers, improve soil health, and contribute to sustainable agriculture practices.

Biological seed treatment is the application of microorganisms to seeds before planting to promote plant health, growth, and productivity. Common applications include disease suppression, enhanced nutrient uptake, stress tolerance, biocontrol of pests, and promotion of root growth. These treatments can suppress soil-borne pathogens, improve nutrient uptake, and promote stress tolerance. Some treatments contain beneficial microbes that act as natural enemies of plant pests, reducing the need for synthetic chemicals and promoting sustainable agriculture practices.

Biological seed treatments also stimulate root growth, leading to stronger, healthier root systems, improved nutrient and water uptake, and enhanced soil structure. They are considered more environmentally friendly than chemical pesticides and fertilizers, reducing chemical inputs, minimizing pesticide residues, and supporting biodiversity. Biological seed treatments are compatible with integrated pest management (IPM) strategies, aiming to minimize reliance on synthetic pesticides and promote sustainable practices.

The demand for biological alternatives in agricultural products is growing due to environmental concerns and chemical residues. Biological seed treatments, which use naturally occurring microorganisms or plant extracts, are seen as eco-friendly alternatives to synthetic chemical treatments. Regulatory restrictions on chemical pesticides are promoting the use of safer alternatives, driving the growth of the biological seed treatment market. Biological seed treatments not only protect seeds and seedlings from pests but also promote plant growth and development.

The growing preference for organic food products is driving the adoption of biological inputs, such as biological seed treatments, to manage pests and diseases without synthetic chemicals. Advancements in biotechnology, microbial technology, genomics, and formulation science have expanded the range of biological solutions available to farmers. Increased awareness among farmers about the benefits of biological seed treatments, facilitated by educational initiatives and information dissemination by manufacturers and agricultural organizations, has contributed to market growth.

Biological Seed Treatment Market Trend Analysis

Driver

Rising Demand for Sustainable Agriculture

- The growing awareness of environmental issues like soil degradation, water pollution, and biodiversity loss has led to a growing emphasis on sustainable agricultural practices. Biological seed treatments offer environmentally friendly alternatives to conventional chemical treatments, utilizing naturally occurring microorganisms to enhance plant health and productivity.

- These treatments reduce chemical dependency by utilizing beneficial microorganisms like bacteria, fungi, and beneficial insects, promoting natural pest and disease control while minimizing environmental contamination. Biological seed treatments can improve crop performance by enhancing nutrient uptake, and root development, and suppressing soil-borne pathogens and pests, leading to healthier plants and increased tolerance to environmental stresses.

- Governments and regulatory bodies are promoting sustainable agriculture practices through policies, incentives, and regulations. Consumer demand for environmentally friendly food products is increasing, leading to increased investment in research and development of biological seed treatment products.

Restraints

Shorter shelf life and require specific storage conditions

- The Biological Seed Treatment market faces challenges in storage and preservation due to limited shelf life, storage requirements, risk of contamination, transportation challenges, and regulatory compliance. Biological seed treatment products have a limited shelf life compared to chemical treatments due to their biological nature, which may degrade over time.

- Manufacturers and distributors must manage inventory to minimize wastage and ensure efficacy. Storage conditions, such as temperature, humidity, and light exposure, can impact the stability of active ingredients. Contamination can compromise product quality and efficacy, leading to crop damage or failure.

- Transportation challenges, such as temperature fluctuations, prolonged transit times, and inadequate packaging, can also affect shelf life. Regulatory compliance is crucial to maintaining safety and efficacy, and manufacturers and distributors must adhere to these regulations to avoid penalties or product recalls.

Opportunity

Expanding Organic Farming Practices

- The demand for organic food products is on the rise due to growing consumer awareness of health and environmental sustainability. Organic farming practices minimize synthetic chemicals and promote natural pest and disease control methods. Biological seed treatments, which use microorganisms like bacteria, fungi, and insects, can enhance crop resilience to stress, leading to better yields and quality.

- Unlike chemical pesticides and synthetic inputs, biological seed treatments pose minimal environmental risks and promote soil health, biodiversity, and ecological balance. Organic products command premium prices due to their perceived health benefits, environmental sustainability, and ethical production methods.

- Incorporating biological seed treatments into organic farming systems can help growers differentiate their products, meet consumer demand, and capture higher market prices. Research and innovation in biological seed treatment technologies are also driving growth in the market.

Challenges

Perception of Performance Variability

- The perception that biological seed treatments may yield inconsistent results compared to traditional chemical treatments is a major challenge. Farmers may experience variability in crop performance, pest and disease control, and overall yield enhancement, leading to skepticism about their effectiveness.

- The biological seed treatment industry faces challenges in standardizing products and processes due to variability in formulations, application methods, environmental conditions, and crop genetics. Limited understanding and education among farmers can further exacerbate concerns about performance variability.

- Despite advancements in technology, there is a need for robust research and data to demonstrate consistent performance across different crops, regions, and growing conditions. Risk aversion among farmers may also hinder adoption rates and market growth for biological treatments.

Biological Seed Treatment Market Segment Analysis:

Biological Seed Treatment Market Segmented based on Crop type, Function, and Region.

By Crop Type, Cereals and grains segment is expected to dominate the market during the forecast period

- Cereals and grains are essential for global food security, providing nutrition for humans and animals. The demand for these crops is growing due to population growth, changing dietary preferences, and increased livestock production. Biological products offer benefits like improved nutrient uptake, tolerance to abiotic stressors, and increased resistance to pests and diseases.

- The benefits contribute to improved crop yield, quality, and resilience. Regulatory pressures and consumer preferences for reduced chemical inputs and environmentally friendly agricultural practices are driving the adoption of biologicals in cereal and grain production. Biologicals align well with sustainable farming practices, promoting soil health, biodiversity, and ecosystem resilience.

- Research and development focus on cereals and grains companies is significant, with efforts to develop new microbial strains, biostimulants, and biopesticides. The extensive acreage devoted to cereal and grain production presents substantial market opportunities for agricultural biologicals.

By Function, the Seed Protection segment held the largest share in 2024

- Seed protection is a crucial aspect of agriculture, addressing challenges like disease and pest management. Biological seed treatments are used to protect seeds and seedlings from pathogens, pests, and other harmful organisms. These treatments are applied during germination and early growth stages, allowing growers to manage risks and establish healthier crops.

- Biological seed treatments offer a broad spectrum of protection against various pathogens, including fungi, bacteria, nematodes, and insect pests. They may contain beneficial microorganisms or natural compounds that suppress pathogens and pests while promoting plant growth. Regulatory support for safer and more sustainable agricultural practices drives the adoption of biological seed treatments in this segment.

- Biological seed treatments complement integrated pest management strategies by offering preventive measures that reduce reliance on synthetic pesticides and minimize pesticide resistance. Agricultural biological companies invest in research and development to innovate and expand their portfolio of biological seed treatments, contributing to market dominance.

Biological Seed Treatment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States and Canada, is a major producer of crops like corn, soybeans, wheat, and vegetables, leading to a significant market for agricultural inputs, including biological seed treatments. The region's technological advancements and research infrastructure drive these advancements.

- Regulatory pressures and consumer preferences for sustainable agriculture have led to restrictions on chemical pesticide use, increasing demand for biological alternatives. Regulatory support and incentives for sustainable farming practices further drive the adoption of biological seed treatments.

- Farmers in North America are increasingly aware of the benefits of biological seed treatments, with extension services, agricultural organizations, and industry stakeholders playing a crucial role in educating them. The region's well-developed agricultural input market and strong distribution networks facilitate the adoption of biological seed treatments. Biological seed treatments align with environmental stewardship and sustainability values in North American agriculture.

Biological Seed Treatment Market Top Key Players:

- BASF Corporation (US)

- Corteva Agriscience (US)

- Marrone Bio Innovations (US)

- Valent BioSciences LLC (US)

- Certis USA LLC (US)

- Indigo Agriculture (US)

- Precision Laboratories, LLC (US)

- Verdesian Life Sciences (US)

- Bioworks Inc. (US)

- Valent U.S.A. LLC (US)

- Marrone Organic Innovations (US)

- Bayer AG (Germany)

- Bayer CropScience (Germany)

- BASF SE (Germany)

- Plant Health Care plc (UK)

- Koppert Biological Systems (Netherlands)

- Italpollina S.p.A (Italy)

- Isagro S.p.A (Italy)

- Syngenta Group (Switzerland)

- Andermatt Biocontrol AG (Switzerland)

- Camson Bio Technologies Limited (India)

- UPL Limited (India)

- Novozymes A/S (Denmark)

- ADAMA Agricultural Solutions Ltd. (Israel)

- Rizobacter Argentina S.A. (Argentina)

- Other Active players

Key Industry Developments in the Biological Seed Treatment Market:

- In March 2024, Sumitomo Chemical Co., Ltd. and Valent BioSciences LLC announced that Pace International LLC (Pace) and its overseas operations became part of AgroFresh Solutions, Inc., a well-established leader in the postharvest solutions space. The decision to divest the Pace International business unit was part of Sumitomo Chemical’s strategic realignment efforts. Sumitomo Chemical and Valent BioSciences also planned to develop a strategic research collaboration with AgroFresh. Under this collaboration, Sumitomo Chemical and Valent BioSciences continued working together in developing innovative new postharvest solutions and bringing them to the market with AgroFresh’s global market access.

- In March 2023, Corteva Agriscience plans to launch Vorceed™ Enlist® corn products, allowing US farmers to access technology across Pioneer® seeds, Dairyland Seed®, and Brevant® seeds through the Corteva Horizon Network in areas with high corn rootworm pressure in the Corn Belt. company bring the next generation of corn seed innovation to help farmers protect their yields from corn rootworm pressure.

|

Global Biological Seed Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

1.73 Bn |

|

Forecast Period 2025-32 CAGR: |

12.6% |

Market Size in 2032: |

4.47 Bn |

|

Segments Covered: |

By Crop Type |

|

|

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biological Seed Treatment Market by Crop Type (2018-2032)

4.1 Biological Seed Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Oilseeds & Pulses

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cereals & Grains

4.5 Fruits & Vegetables

Chapter 5: Biological Seed Treatment Market by Function (2018-2032)

5.1 Biological Seed Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Seed Protection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Seed Enhancement

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Biological Seed Treatment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 JUST INC (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BIOCRAFT

6.4 IN (US)

6.5 EAT JUST (GOOD MEAT) (US)

6.6 UPSIDE FOODS (US)

6.7 BLUENALU (US)

6.8 FINLESS FOODS (US)

6.9 BALLETIC FOODS (US)

6.10 APPLETON MEATS (CANADA)

6.11 MOSA MEAT (NETHERLANDS)

6.12 MULTUS BIOTECHNOLOGY (UK)

6.13 HOXTON FARMS (UK)

6.14 MEATABLE (NETHERLANDS)

6.15 PEACE OF MEAT (BELGIUM)

6.16 OCHAKOV FOOD INGREDIENTS (RUSSIA)

6.17 HIGHERSTEAKS (UK)

6.18 GOURMEY (FRANCE)

6.19 NISSIN FOODS GROUP (JAPAN)

6.20 AVANT MEATS (CHINA)

6.21 CLEAR MEAT (INDIA)

6.22 BELIEVER MEATS (ISRAEL)

6.23 ALEPH FARMS (ISRAEL)

6.24 BIFTEK (TURKEY)

6.25 BIOBETTER LTD. (ISRAEL)

6.26 HEUROS (AUSTRALIA)

6.27 AND OTHER ACTIVE PLAYERS.

Chapter 7: Global Biological Seed Treatment Market By Region

7.1 Overview

7.2. North America Biological Seed Treatment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Crop Type

7.2.4.1 Oilseeds & Pulses

7.2.4.2 Cereals & Grains

7.2.4.3 Fruits & Vegetables

7.2.5 Historic and Forecasted Market Size by Function

7.2.5.1 Seed Protection

7.2.5.2 Seed Enhancement

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Biological Seed Treatment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Crop Type

7.3.4.1 Oilseeds & Pulses

7.3.4.2 Cereals & Grains

7.3.4.3 Fruits & Vegetables

7.3.5 Historic and Forecasted Market Size by Function

7.3.5.1 Seed Protection

7.3.5.2 Seed Enhancement

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Biological Seed Treatment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Crop Type

7.4.4.1 Oilseeds & Pulses

7.4.4.2 Cereals & Grains

7.4.4.3 Fruits & Vegetables

7.4.5 Historic and Forecasted Market Size by Function

7.4.5.1 Seed Protection

7.4.5.2 Seed Enhancement

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Biological Seed Treatment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Crop Type

7.5.4.1 Oilseeds & Pulses

7.5.4.2 Cereals & Grains

7.5.4.3 Fruits & Vegetables

7.5.5 Historic and Forecasted Market Size by Function

7.5.5.1 Seed Protection

7.5.5.2 Seed Enhancement

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Biological Seed Treatment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Crop Type

7.6.4.1 Oilseeds & Pulses

7.6.4.2 Cereals & Grains

7.6.4.3 Fruits & Vegetables

7.6.5 Historic and Forecasted Market Size by Function

7.6.5.1 Seed Protection

7.6.5.2 Seed Enhancement

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Biological Seed Treatment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Crop Type

7.7.4.1 Oilseeds & Pulses

7.7.4.2 Cereals & Grains

7.7.4.3 Fruits & Vegetables

7.7.5 Historic and Forecasted Market Size by Function

7.7.5.1 Seed Protection

7.7.5.2 Seed Enhancement

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Biological Seed Treatment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

1.73 Bn |

|

Forecast Period 2025-32 CAGR: |

12.6% |

Market Size in 2032: |

4.47 Bn |

|

Segments Covered: |

By Crop Type |

|

|

|

By Function |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||