Bio-CNG Market Synopsis

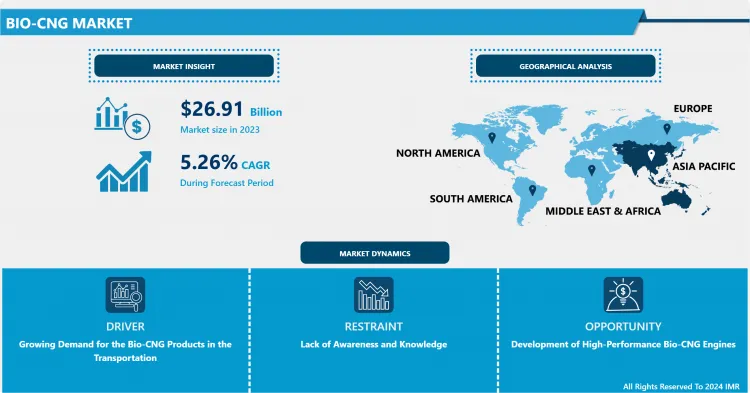

The Bio-CNG Market was valued at USD 26.91 Billion in 2023 and is projected to reach USD 42.69 Billion by 2032, growing at a CAGR of 5.26% from 2024 to 2032.

Bio-CNG, or Bio-Compressed Natural Gas, is a renewable and environmentally friendly fuel derived from organic waste through anaerobic digestion. This process produces biogas, primarily methane, which is then upgraded and compressed as a clean alternative to traditional fossil fuels.

The need for Bio-CNG as a cleaner fuel substitute for conventional fuels is driven by the growing emphasis on environmental sustainability worldwide and the pressing need to cut carbon emissions. Globally, governments are enacting laws and incentives that promote the use of renewable energy sources, fostering an atmosphere favorable to the bio-CNG industry's growth.

Technological innovations are driving the growth of the Bio-CNG market, enhancing efficiency and reducing costs. Advancements in production processes, purification techniques, and storage methods make Bio-CNG a competitive option and open new avenues for market players. Integrating cutting-edge technologies ensures that Bio-CNG remains a viable solution in the renewable energy landscape.

The Bio-CNG market is growing due to cross-sector collaborations and evolving regulatory landscapes. Agriculture, waste management, and energy sectors are working together to create comprehensive value chains. Consulting firms and compliance services help businesses navigate complex regulations and ensure environmental standards. These factors, combined with research and development investments, position the market for continuous expansion and success in meeting sustainable energy needs.

Bio-CNG Market Trend Analysis

Growing Demand for the Bio-CNG in Transportation

- The increasing demand for Bio-CNG in transportation is driven by environmental sustainability awareness, emission regulations, and rising fuel price volatility. Businesses and consumers are exploring more stable and cost-effective energy sources, making Bio-CNG a viable option in the transportation sector.

- Technological advancements in Bio-CNG production and distribution are increasing its appeal in the transportation sector. Innovations in purification processes and storage methods improve efficiency and availability. Integrating Bio-CNG infrastructure into existing systems offers a seamless transition for fleets adopting sustainable practices. These technological strides meet the demand for cleaner transportation and contribute to the growth of the Bio-CNG market.

- The Bio-CNG market is growing due to government policies, subsidies, and regulatory frameworks. These incentives encourage investment in Bio-CNG infrastructure, addressing waste management challenges and providing a renewable energy source. The waste-to-energy concept also gains traction. Collaborative efforts and ongoing research and development activities contribute to the market's steady growth, ensuring Bio-CNG remains a sustainable solution in the evolving energy landscape.

Development of High-Performance Bio-CNG Engines

- The Bio-CNG market is growing due to the development of high-performance Bio-CNG engines. Technological advancements in engine design and efficiency enhance vehicle performance, optimizing power output and minimizing environmental impact. Automotive manufacturers invest in research to create engines specifically tailored for Bio-CNG, benefiting from increased reliability and efficiency.

- The development of Bio-CNG engines is aligned with the sustainable transportation trend, as it offers a practical solution for transitioning fleets towards cleaner alternatives. This aligns with the growing demand for sustainable transportation solutions, creating a substantial market opportunity for manufacturers and developers investing in advanced engine technologies.

- High-performance Bio-CNG engines offer environmental benefits and economic viability, as fuel efficiency and cost-effectiveness are key factors in adopting alternative fuels. The development of optimized engines enhances appeal for environmentally conscious consumers and positions Bio-CNG as a financially attractive choice for businesses and transportation fleets.

Bio-CNG Market Segment Analysis:

Bio-CNG Market Segmented based on Feedstock, Technology, Application, and Distribution Mode.

By Feedstock, Municipal Solid Waste segment is expected to dominate the market during the forecast period

- The Municipal Solid Waste (MSW) segment is expected to dominate the Bio-CNG market due to the growing focus on waste management and sustainability, which encourages the use of organic waste like food scraps and agricultural residues as feedstock for Bio-CNG production, making it an ideal choice for waste reduction.

- The MSW segment, which generates a significant amount of organic waste daily, is a key player in the Bio-CNG market due to its consistent availability of feedstock. This ensures a steady supply chain for producers, contributing to its dominance. As governments prioritize waste-to-energy initiatives, the MSW segment is poised to drive sustainable growth in the Bio-CNG market.

By Technology, the Anaerobic Digestion segment held the largest share of 48.93% in 2023

- The Anaerobic Digestion (AD) segment dominates the Bio-CNG market due to its efficient and versatile method of breaking down organic materials into methane-rich biogas. This process, which uses diverse organic feedstocks like agricultural residues and organic waste, is widely adopted due to its versatility and widespread adoption.

- Anaerobic digestion is a key technology in the Bio-CNG market due to its compatibility with various organic waste sources, ensuring a consistent feedstock supply and optimizing resource utilization. It aligns with the global push for cleaner energy solutions and is known for its efficiency, adaptability, and environmental sustainability, making it a dominant player in the industry.

Bio-CNG Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region dominates the bio-CNG market, which has emerged as a significant driver of its growth and development. Demand for Bio-CNG has increased in Asia Pacific nations due to rising environmental awareness and a push for sustainable energy solutions. The region's recognized leadership in the bio-CNG market is largely due to the active investment made by both governments and businesses in renewable energy sources.

- The Asia Pacific region's extensive agricultural sector is a major factor propelling the expansion of the Bio-CNG market in the area. Bio-compressed natural gas is made possible by an abundance of organic waste derived from agriculture. The bio-CNG market gains substantial momentum as nations in the Asia-Pacific region aggressively enact policies that encourage the use of renewable energy sources. As a result of this proactive strategy, the area is positioned to lead the global bioenergy landscape.

- Moreover, the increasing recognition of the environmental impacts associated with traditional fuels in the Asia Pacific region has instigated a fundamental shift towards cleaner alternatives, such as Bio-CNG. The presence of supportive regulatory frameworks, coupled with escalating investments in infrastructure, continues to drive the prominence of the Asia Pacific in the Bio-CNG market. As the region persistently prioritizes sustainable practices, it is anticipated to sustain its crucial role in shaping the trajectory of the Bio-CNG market in the foreseeable future.

Bio-CNG Market Top Key Players:

- Clean Energy Fuels (U.S.)

- Verbio SE (Germany)

- Shell (Netherlands)

- Neste (Finland)

- IFPEN (France)

- Biokraft International AB (Sweden)

- IndianOil-Adani Gas Pvt. Ltd. (IOAGPL) (India)

- Green Elephant (India)

- Carbon Masters India Pvt (India)

- Primove Engineering Pvt. Ltd. (India)

- Bharat Biogas Energy Ltd. (India)

- Mahindra Bio-LNG Ltd (India)

- Radix Lifespaces (India), and Other Major Players

Key Industry Developments in the Bio-CNG Market:

- In November 2024, Mushroom World Group inaugurated Madhya Pradesh's first Napier Grass-based Bio-CNG plant, marking a significant advancement in renewable energy. With an initial production capacity of 3,000 kg per day, scaling to 12,000 kg, this facility aims to reduce carbon emissions and empower local farmers by providing a stable, low-maintenance crop. The project, led by Shri Vijay Sagar Ji, aligns with India’s green energy goals and promotes sustainable development and economic benefits for rural communities.

- In April 2023, Mercuria acquired UK-based Roadgas. Mercuria Clean Energy Investments B.V. ("MCEI") and Pretoria Energy Group ("Pretoria") announce the acquisition of the entire share capital of Nottingham-based Roadgas Limited ("Roadgas"). Roadgas owns and operates several bio-CNG and bio-LNG stations in the United Kingdom, and the acquisition will provide a new gas-fueling partner for fleet managers looking to decarbonize their operations.

- In October 2022, Verbio SE launched its first and India’s largest BioCNG plant in Punjab, producing compressed biogas (CBG/BioCNG) from agricultural residues, primarily paddy stubble normally burnt by farmers after the paddy harvest. This is the first, largest and only plant of its kind in India and Asia. It will consume 100,000 tonnes of agricultural residues per year, and will have a production capacity of 33 TPD (tonnes per day) of BioCNG (CBG) and 650 TPD (tonnes per day) of bio-manure.

|

Global Bio-CNG Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.26% |

Market Size in 2032: |

USD 42.69 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Distribution Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bio-CNG Market by Feedstock (2018-2032)

4.1 Bio-CNG Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Livestock Manure

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sewage Sludge

4.5 Crop Residue

4.6 Energy Crops

4.7 Municipal Solid Waste

Chapter 5: Bio-CNG Market by Technology (2018-2032)

5.1 Bio-CNG Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anaerobic Digestion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gasification

5.5 Pyrolysis

Chapter 6: Bio-CNG Market by Application (2018-2032)

6.1 Bio-CNG Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Transportation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Power Generation

6.5 Commercial

6.6 Industrial

Chapter 7: Bio-CNG Market by Distribution Mode (2018-2032)

7.1 Bio-CNG Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pipeline Injection

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Compressed Natural

7.5 Gas Liquified Natural Gas

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bio-CNG Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SIKA AG(US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MAPEI SPA (US)

8.4 MBCC GROUP (US)

8.5 DOW (US)

8.6 RPM INTERNATIONAL INC (US)

8.7 GCP APPLIED TECHNOLOGIES (US)

8.8 ASHLAND INC (US)

8.9 HB FULLER COMPANY (US)

8.10 THE 3M COMPANY (US)

8.11 MOMENTIVE PERFORMANCE MATERIALS (US)

8.12 FRANKLIN INTERNATIONAL (US)

8.13 GCP APPLIED TECHNOLOGIES INC. (US)

8.14 SELENA GROUP (POLAND)

8.15 COVESTRO AG(GERMANY)

8.16 HENKEL AG & CO. KGAA (GERMANY)

8.17 LANXESS AG (GERMANY)

8.18 WACKER CHEMIE AG(GERMANY)

8.19 HUNTSMAN CORPORATION (GERMANY

8.20 CHEMBOND CHEMICALS LIMITED (INDIA)

8.21 CHRYSO GROUP(INDIA)

8.22 AKZO NOBEL NV(NETHERLANDS)

8.23 ARKEMA (FRANCE)

8.24 FOSROC (UK)

8.25 CEMENTAID INTERNATIONAL LTD (AUSTRALIA)

8.26 COMMIX LTD (UAE)

Chapter 9: Global Bio-CNG Market By Region

9.1 Overview

9.2. North America Bio-CNG Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Feedstock

9.2.4.1 Livestock Manure

9.2.4.2 Sewage Sludge

9.2.4.3 Crop Residue

9.2.4.4 Energy Crops

9.2.4.5 Municipal Solid Waste

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Anaerobic Digestion

9.2.5.2 Gasification

9.2.5.3 Pyrolysis

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Transportation

9.2.6.2 Power Generation

9.2.6.3 Commercial

9.2.6.4 Industrial

9.2.7 Historic and Forecasted Market Size by Distribution Mode

9.2.7.1 Pipeline Injection

9.2.7.2 Compressed Natural

9.2.7.3 Gas Liquified Natural Gas

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bio-CNG Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Feedstock

9.3.4.1 Livestock Manure

9.3.4.2 Sewage Sludge

9.3.4.3 Crop Residue

9.3.4.4 Energy Crops

9.3.4.5 Municipal Solid Waste

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Anaerobic Digestion

9.3.5.2 Gasification

9.3.5.3 Pyrolysis

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Transportation

9.3.6.2 Power Generation

9.3.6.3 Commercial

9.3.6.4 Industrial

9.3.7 Historic and Forecasted Market Size by Distribution Mode

9.3.7.1 Pipeline Injection

9.3.7.2 Compressed Natural

9.3.7.3 Gas Liquified Natural Gas

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bio-CNG Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Feedstock

9.4.4.1 Livestock Manure

9.4.4.2 Sewage Sludge

9.4.4.3 Crop Residue

9.4.4.4 Energy Crops

9.4.4.5 Municipal Solid Waste

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Anaerobic Digestion

9.4.5.2 Gasification

9.4.5.3 Pyrolysis

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Transportation

9.4.6.2 Power Generation

9.4.6.3 Commercial

9.4.6.4 Industrial

9.4.7 Historic and Forecasted Market Size by Distribution Mode

9.4.7.1 Pipeline Injection

9.4.7.2 Compressed Natural

9.4.7.3 Gas Liquified Natural Gas

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bio-CNG Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Feedstock

9.5.4.1 Livestock Manure

9.5.4.2 Sewage Sludge

9.5.4.3 Crop Residue

9.5.4.4 Energy Crops

9.5.4.5 Municipal Solid Waste

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Anaerobic Digestion

9.5.5.2 Gasification

9.5.5.3 Pyrolysis

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Transportation

9.5.6.2 Power Generation

9.5.6.3 Commercial

9.5.6.4 Industrial

9.5.7 Historic and Forecasted Market Size by Distribution Mode

9.5.7.1 Pipeline Injection

9.5.7.2 Compressed Natural

9.5.7.3 Gas Liquified Natural Gas

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bio-CNG Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Feedstock

9.6.4.1 Livestock Manure

9.6.4.2 Sewage Sludge

9.6.4.3 Crop Residue

9.6.4.4 Energy Crops

9.6.4.5 Municipal Solid Waste

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Anaerobic Digestion

9.6.5.2 Gasification

9.6.5.3 Pyrolysis

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Transportation

9.6.6.2 Power Generation

9.6.6.3 Commercial

9.6.6.4 Industrial

9.6.7 Historic and Forecasted Market Size by Distribution Mode

9.6.7.1 Pipeline Injection

9.6.7.2 Compressed Natural

9.6.7.3 Gas Liquified Natural Gas

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bio-CNG Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Feedstock

9.7.4.1 Livestock Manure

9.7.4.2 Sewage Sludge

9.7.4.3 Crop Residue

9.7.4.4 Energy Crops

9.7.4.5 Municipal Solid Waste

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Anaerobic Digestion

9.7.5.2 Gasification

9.7.5.3 Pyrolysis

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Transportation

9.7.6.2 Power Generation

9.7.6.3 Commercial

9.7.6.4 Industrial

9.7.7 Historic and Forecasted Market Size by Distribution Mode

9.7.7.1 Pipeline Injection

9.7.7.2 Compressed Natural

9.7.7.3 Gas Liquified Natural Gas

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bio-CNG Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.26% |

Market Size in 2032: |

USD 42.69 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Distribution Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||