Battery Management System Market Synopsis

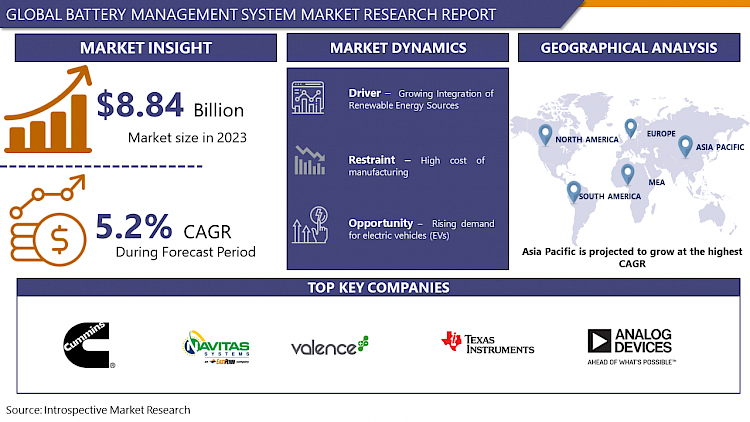

Battery Management System Market Size Was Valued at USD 8.84 Billion in 2023, and is Projected to Reach USD 13.95 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

The global Battery Management System (BMS) market continues to exhibit robust growth driven by the increasing adoption of electric vehicles (EVs) and renewable energy storage systems. The proliferation of EVs, spurred by stringent emission regulations and growing environmental awareness, has significantly propelled the demand for BMS to ensure the efficient management and performance of batteries. Moreover, the escalating deployment of renewable energy sources like solar and wind necessitates sophisticated BMS solutions to enhance the reliability and longevity of energy storage systems.

Technological advancements such as the integration of artificial intelligence (AI) and machine learning algorithms into BMS have further augmented market growth by enabling predictive maintenance and optimizing battery performance. The expanding applications of BMS beyond automotive and energy sectors, including consumer electronics and medical devices, are widening the market scope.

- Battery management focuses on ensuring that batteries in portable devices are used efficiently. This includes handling tasks like charging the battery properly and safeguarding it against misuse. Power management involves regulating power distribution throughout the system and minimizing power consumption by individual components. This can involve making hardware and software adjustments to reduce energy usage, such as lowering clock speeds or turning off unused parts of the system.

- Energy management aims to maximize the efficiency of energy conversions within a system and manage energy storage effectively. For instance, techniques like zero-voltage and zero-current switching can be applied to reduce energy losses in systems like Switched-Mode Power Supplies, improving overall energy transfer efficiency from the main power source to the battery.

Battery Management System Market Trend Analysis

Growing Integration of Renewable Energy Sources

- The integration of renewable energy sources like solar and wind power has led to a sporadic energy generation pattern, which often doesn't align with peak energy demand periods. This mismatch creates a demand for energy storage solutions to store excess energy generated during off-peak times and supply it during peak demand periods. Consequently, the battery management system market is witnessing a surge in demand as it plays a crucial role in managing and optimizing the performance of batteries used in energy storage systems.

- The growing adoption of renewable energy sources, maintaining grid stability and reliability becomes paramount. Renewable energy systems are inherently variable due to factors like weather conditions, making grid management more challenging. Battery management systems help in stabilizing the grid by providing frequency regulation, voltage support, and peak shaving capabilities. As a result, the market for battery management systems is experiencing significant growth as utilities and grid operators seek reliable solutions to integrate renewable energy sources seamlessly into the grid.

Rising demand for electric vehicles (EVs)

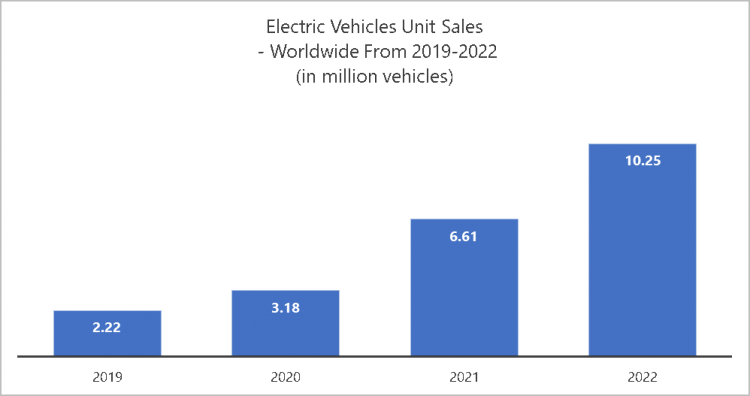

- The increasing adoption of electric vehicles (EVs) worldwide is driving significant growth opportunities for the battery management system (BMS) market. As consumers and governments prioritize sustainability and reduce carbon emissions, the demand for electric vehicles continues to rise. This surge in EV adoption necessitates efficient battery management systems to monitor and control the performance of batteries, ensuring optimal safety, reliability, and longevity of EV powertrains.

- Electric vehicles rely entirely on battery packs for their power source, making battery performance a critical factor in EV functionality and user experience. Battery management systems play a crucial role in optimizing battery performance by managing factors such as charging and discharging rates, temperature control, and cell balancing. As consumers seek longer driving ranges, faster charging times, and increased reliability from their EVs, the demand for advanced battery management systems that can deliver these benefits continues to grow.

- The IEA Stated Policies Scenario (STEPS), the global outlook for the share of electric car sales based on existing policies and firm objectives has increased to 35% in 2030, up from less than 25% in the previous outlook. In the projections, China retains its position as the largest market for electric cars with 40% of total sales by 2030 in the STEPS. The United States doubles its market share to 20% by the end of the decade as recent policy announcements drive demand, while Europe maintains its current 25% share.

- As per given Graph shows, the burgeoning electric vehicles industry is leading to a commensurate rise in the Battery Management System (BMS) Market. As the adoption of electric vehicles accelerates globally, the demand for effective battery management systems grows in tandem. These systems are essential for maintaining the performance, safety, and lifespan of electric vehicle batteries, underscoring their pivotal role in the expanding electric vehicle landscape.

Battery Management System Market Segment Analysis:

Battery Management System Market is Segmented into type, application, and end-users.

By Type, the motive battery segment is expected to dominate the market during the forecast period

- The motive battery segment's dominance in the Battery Management System (BMS) market can be attributed to its wide array of applications across various industries. Motive batteries are commonly used in electric vehicles (EVs), forklifts, and other mobility solutions, which are experiencing rapid growth due to increasing environmental concerns and governmental regulations favoring clean energy.

- EV adoption globally, the demand for efficient battery management systems to monitor, control, and optimize battery performance becomes crucial. motive batteries are also utilized in renewable energy storage systems, such as solar and wind power installations, further driving the need for advanced BMS solutions to ensure optimal energy utilization and prolonged battery lifespan. This combination of expanding applications and the necessity for sophisticated battery management solutions position the motive battery segment as a key player in the BMS market.

By Battery Type, Lithium-ion (Li-ion) segment held the largest share of 39% in 2022

- Li-ion batteries have gained widespread adoption across various industries due to their high energy density, long cycle life, and lightweight nature, making them an ideal choice for portable electronics, electric vehicles (EVs), and renewable energy storage systems. As a result, the demand for efficient BMS solutions to manage and optimize the performance of Li-ion batteries has surged.

- Advancements in Li-ion battery technology, including enhanced safety features and improved charging capabilities, have further bolstered their popularity in the market. These advancements have required sophisticated BMS solutions, capable of monitoring various battery parameters, ensuring safe operation, and prolonging battery life. Consequently, the Li-ion segment has emerged as the leading revenue contributor in the BMS market, reflecting the growing demand for efficient energy storage solutions across diverse applications.

Battery Management System Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region's dominance in the Battery Management System (BMS) market can be attributed to several factors, particularly its role as a manufacturing hub for electric vehicles (EVs). Nations like China, Japan, and South Korea are at the forefront of EV production, significantly contributing to the demand for traction batteries. These countries host major automotive manufacturers that have invested heavily in the development and production of electric vehicles, creating a robust ecosystem for traction battery manufacturing.

- The Asia-Pacific region to promote the adoption of electric vehicles. This includes financial incentives, subsidies, and favorable regulatory frameworks, which have accelerated the growth of the electric vehicle market and, consequently, the traction battery market. Additionally, the region is actively investing in research and development, driving innovation in battery technology. This commitment to advancing battery capabilities, improving energy density, and reducing costs has given manufacturers in the region a competitive edge.

Battery Management System Market Top Key Players:

- Storage Battery Systems LLC (United States)

- Elithion Inc. (United States)

- Cummins Inc. (United States)

- Navitas Systems (United States)

- Valence Technology, Inc. (United States)

- Texas Instruments (United States)

- Analog Devices, Inc. (United States)

- Eberspächer (Germany)

- Leclanché SA (Switzerland)

- Lithium Balance A/S (Denmark)

- Panasonic Holdings Corporation (Japan)

- LG Energy Solution, Ltd. (South Korea)

- Delta Electronics (Taiwan)

- Contemporary Amperex Technology Co., Limited (CATL) (China)

- BYD Company Ltd. (China)

- Contemporary Amperex Technology Co., Ltd. (China)

- Guoxuan Hi-Tech Co., Ltd. (China)

- Sunwoda Electronic Co., Ltd. (China)

- CALB (China)

- Tianjin Lishen Battery Joint-Stock Co., Ltd. (China)

- Starway Battery (China)

- SVOLT Energy Technology Co., Ltd. (China) And Other Major Players.

Key Industry Developments in the Battery Management System Market:

- In January 2023, Texas Instruments Incorporated had launched a pair of highly precise EV battery monitoring ICs, which were expected to allow for greater EV ranges. The company released the BQ79718-Q1 battery cell monitor IC and BQ79731-Q1 battery pack monitor IC as part of its battery management systems (BMS) portfolio, aiming to maximize the driving range of electric vehicles (EVs).

- In May 2023, Sensata Technologies, Inc. had launched the c-BMS24X, a new compact Battery Management System (BMS) that addressed market needs for industrial applications, low voltage electric vehicles, and energy storage systems. The c-BMS24X utilized advanced software functionality that enabled improvements in vehicle range, uptime, battery health, and performance in applications up to 24 cells in series and 2000 amps, such as energy storage systems (ESS), scooters, 3-wheelers, forklifts, and AGVs.

- In June 2022, Renesas Electronics Corporation, a leading provider of innovative semiconductor solutions, had launched an AUTOSAR-compliant complex device driver (CDD) software module for automotive battery management systems (BMS) in electric vehicles (EVs). The new software worked in combination with Renesas' ISL78714 Li-Ion battery management IC to accelerate the design and performance of next-generation systems.

|

Global Battery Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 13.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Topology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BATTERY MANAGEMENT SYSTEM MARKET BY TYPE (2017-2032)

- BATTERY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOTIVE BATTERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STATIONARY BATTERY

- BATTERY MANAGEMENT SYSTEM MARKET BY BATTERY TYPE (2017-2032)

- BATTERY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LITHIUM-ION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEAD-ACID

- NICKEL-BASED

- SOLID-STATE

- FLOW BATTERY

- BATTERY MANAGEMENT SYSTEM MARKET BY TOPOLOGY (2017-2032)

- BATTERY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CENTRALIZED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISTRIBUTED

- MODULAR

- BATTERY MANAGEMENT SYSTEM MARKET BY APPLICATION (2017-2032)

- BATTERY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL

- RENEWABLE ENERGY

- TELECOMMUNICATIONS

- MILITARY AND DEFENSE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BATTERY MANAGEMENT SYSTEM Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- STORAGE BATTERY SYSTEMS LLC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ELITHION INC. (UNITED STATES)

- CUMMINS INC. (UNITED STATES)

- NAVITAS SYSTEMS (UNITED STATES)

- VALENCE TECHNOLOGY, INC. (UNITED STATES)

- TEXAS INSTRUMENTS (UNITED STATES)

- ANALOG DEVICES, INC. (UNITED STATES)

- EBERSPÄCHER (GERMANY)

- LECLANCHÉ SA (SWITZERLAND)

- LITHIUM BALANCE A/S (DENMARK)

- PANASONIC HOLDINGS CORPORATION (JAPAN)

- LG ENERGY SOLUTION, LTD. (SOUTH KOREA)

- DELTA ELECTRONICS (TAIWAN)

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED (CATL) (CHINA)

- BYD COMPANY LTD. (CHINA)

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD. (CHINA)

- GUOXUAN HI-TECH CO., LTD. (CHINA)

- SUNWODA ELECTRONIC CO., LTD. (CHINA)

- CALB (CHINA)

- TIANJIN LISHEN BATTERY JOINT-STOCK CO., LTD. (CHINA)

- STARWAY BATTERY (CHINA)

- SVOLT ENERGY TECHNOLOGY CO., LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL BATTERY MANAGEMENT SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Battery Type

- Historic And Forecasted Market Size By Topology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Battery Management System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 13.95 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Topology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Battery Management System Market research report is 2024-2032.

Storage Battery Systems LLC (United States), Elithion Inc. (United States), Cummins Inc. (United States), Navitas Systems (United States), Valence Technology, Inc. (United States), Texas Instruments (United States), Analog Devices, Inc. (United States), Eberspächer (Germany), Leclanché SA (Switzerland), Lithium Balance A/S (Denmark), Panasonic Holdings Corporation (Japan), LG Energy Solution, Ltd. (South Korea), Delta Electronics (Taiwan), Contemporary Amperex Technology Co., Limited (CATL) (China), BYD Company Ltd. (China), Contemporary Amperex Technology Co., Ltd. (China), Guoxuan Hi-Tech Co., Ltd. (China), Sunwoda Electronic Co., Ltd. (China), CALB (China), Tianjin Lishen Battery Joint-Stock Co., Ltd. (China), Starway Battery (China), SVOLT Energy Technology Co. and Other Major Players.

The Battery Management System Market is segmented into Type, Battery Type, Topology, Application, and region. By Type, the market is categorized into Motive Battery and Stationary Battery. By Battery Type, the market is categorized into Lithium-ion, Lead-acid, Nickel-based, Solid-state, and Flow battery. By Topology, the market is categorized into Centralized, Distributed, and Modular. By Application, the market is categorized into Automotive, Industrial, Renewable Energy, Telecommunications, Military and Defense, and Other applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The basic task of a Battery Management System (BMS) is to ensure that optimum use is made of the energy inside the battery powering the portable product and that the risk of damage inflicted upon the battery is minimized. This is achieved by monitoring and controlling the battery’s charging and discharging process.

Battery Management System Market Size Was Valued at USD 8.84 Billion in 2023, and is Projected to Reach USD 13.95 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.