Avionics Market Synopsis

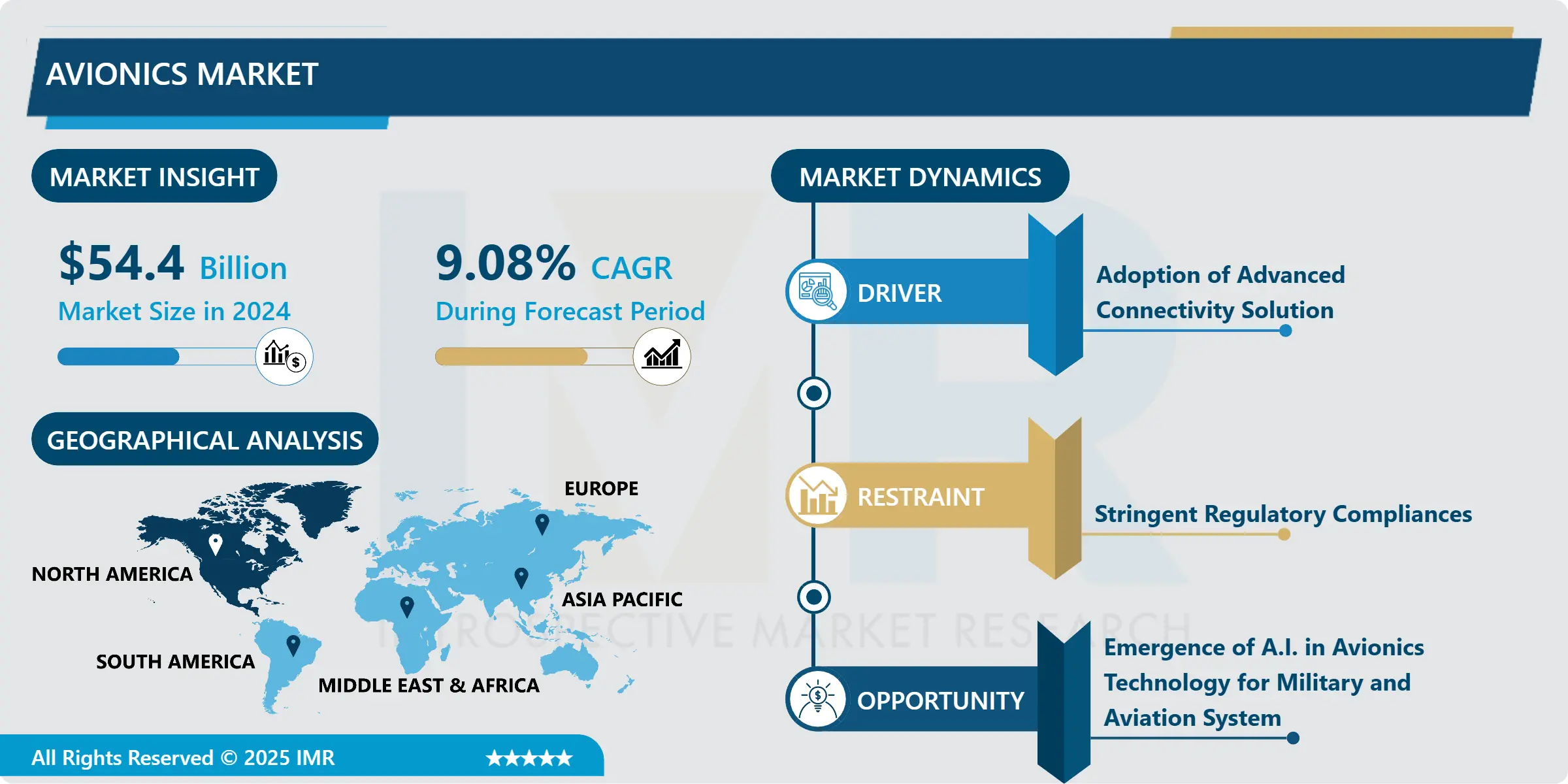

Avionics Market Size Was Valued at USD 54.4 Billion in 2024, and is Projected to Reach USD 109.03 Billion by 2032, Growing at a CAGR of 9.08% From 2025-2032.

Avionics (a blend of aviation and electronics) are the electronic systems used on aircraft. Avionic systems include communications, navigation, the display and management of multiple systems, and the hundreds of systems that are fitted to aircraft to perform individual functions. These can be as simple as a searchlight for a police helicopter or as complicated as the tactical system for an airborne early warning platform.

Every modern aircraft, spacecraft, and artificial satellite uses electronic systems of varying types to perform a range of functions pertinent to their purpose and mission. Generally, the more complex the craft or mission is, the more complicated the electronic systems are that they employ. Commercial airliners, helicopters, military fighter jets, unmanned aerial vehicles (UAV), business jets, and spacecraft all use avionics - to provide services, carry out missions, make new discoveries, track and report performance measures, and operate within established safety parameters.

The most advanced avionics systems also integrate multiple functions to improve performance, simplify maintenance, and contain costs. The avionics market makes growth through the technological advancements, the integration of connectivity solutions, the gradual shift towards electric and hybrid aircraft, and increasing focus on autonomous systems. Additionally, the demand for real-time data analytics, predictive maintenance, and enhanced cybersecurity in avionics systems will shape the future of the market.

The avionics market is subject to rigorous safety standards and regulations imposed by aviation authorities worldwide. Compliance with these standards is essential for avionics manufacturers, ensuring the reliability, durability, and performance of their products. Regulatory bodies such as the FAA, EASA, and others closely monitor avionics technologies to ensure airworthiness and passenger safety.

Avionics Market Trend Analysis

Avionics Market Growth Drivers- Adoption of Advanced Connectivity Solution

- Advanced connectivity solutions, such as satellite-based systems and high-speed internet connectivity, facilitate seamless communication between aircraft, ground control, and other aircraft in flight. This enhances operational efficiency, enables real-time data exchange, and improves overall situational awareness. The integration of connectivity solutions onboard aircraft improves the passenger experience. By offering in-flight Wi-Fi, passengers can stay connected, access entertainment content, and work during their flights. This connectivity trend has become increasingly important for airlines as it enhances customer satisfaction and opens up new revenue streams through value-added services.

- Advanced connectivity enables the transfer of large volumes of data from aircraft to ground stations in real-time. This data includes flight parameters, engine health monitoring, weather information, and sensor data. Airlines and maintenance operators can analyse this data to perform predictive maintenance, optimize operations, and improve aircraft performance. Connectivity solutions contribute to enhanced safety and security in aviation. Real-time data transmission allows for immediate monitoring of flight parameters, enabling faster response to emergency situations.

- With advanced connectivity solutions, aircraft systems can be remotely monitored, allowing for predictive maintenance and early fault detection. This reduces aircraft downtime, enhances maintenance planning, and improves overall fleet efficiency. Connectivity solutions play a vital role in improving flight operations and air traffic management. Real-time data exchange enables precise navigation, efficient route planning, and optimization of flight paths, resulting in fuel savings, reduced emissions, and smoother air travel.

Avionics Market Opportunity- Emergence of A.I. in Avionics Technology for Military and Aviation System

- AI enables the development of autonomous systems, including unmanned aerial vehicles (UAVs) and drones. These systems offer opportunities for various military applications such as surveillance, reconnaissance, and tactical operations without putting human lives at risk.AI algorithms can process vast amounts of data and provide real-time analysis, improving decision-making capabilities for military avionics. This enables faster and more accurate assessments of situations, threat detection, target identification, and mission planning.

- AI-based flight control systems can enhance the manoeuvrability, stability, and safety of military aircraft. These systems can adapt to different flight conditions, optimize performance, and assist pilots in complex situations, leading to improved capabilities and mission success. AI can support cognitive electronic warfare systems that analyse and counter adversary signals. By leveraging AI algorithms, avionics can quickly identify, classify, and respond to potential threats, enhancing overall situational awareness and survivability.

- AI-powered predictive maintenance systems can monitor aircraft components and systems, detecting anomalies and predicting failures in advance. This allows for proactive maintenance scheduling, reducing downtime and increasing mission readiness. AI can play a crucial role in enhancing avionics cybersecurity. AI algorithms can analyse network traffic, identify potential threats, and quickly respond to cybersecurity incidents, protecting military avionics from cyber-attacks.

Avionics Market Segment Analysis:

Avionics Market is segmented on the basis of Fit, Platform, Systems, and Region.

By Platform, Commercial Aviation Segment Is Expected to Dominate the Market During the Forecast Period

- The commercial aviation sector encompasses a vast number of aircraft operated by airlines worldwide. The sheer size of the commercial aircraft fleet creates a substantial demand for avionics systems, including flight control systems, navigation systems, communication systems, and cockpit displays. Commercial aviation is at the forefront of adopting advanced avionics technologies. To enhance safety, efficiency, and passenger experience, commercial airlines invest in state-of-the-art avionics systems. Examples of advanced avionics technologies in commercial aviation include fly-by-wire systems, advanced autopilots, and enhanced situational awareness tools.

- Commercial aviation is subject to stringent safety regulations set by aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Compliance with these regulations necessitates the integration of advanced avionics systems to ensure aircraft safety and performance, contributing to the dominance of the commercial aviation segment in the avionics market.

- Commercial airlines are continuously striving to improve fuel efficiency and reduce operational costs. Avionics systems play a crucial role in achieving these goals. Advanced flight management systems, weather radar, and predictive maintenance capabilities offered by avionics systems help optimize flight routes, reduce fuel consumption, and enhance operational efficiency. The commercial aviation sector caters to the growing global air travel demand. As air travel continues to increase, the need for efficient and reliable avionics systems also rises.

- In 2023, the global operating commercial aircraft fleet consisted of 60% narrowbody jets, 20% widebody jets, 11% regional jets, and 8% turboprops. This distribution reflects the predominant use of narrowbody jets in commercial aviation due to their efficiency and versatility for short to medium-haul flights, while widebody jets are crucial for long-haul international routes.

By Systems, Navigation Segment Held the Largest Share In 2024

- Navigation systems are vital for aircraft operations, ensuring accurate positioning, route planning, and guidance during flight. The navigation segment includes various systems such as Inertial Navigation Systems (INS), Global Navigation Satellite Systems (GNSS), and Navigation Display Units (NDU). Navigation systems play a crucial role in ensuring the safety and efficiency of aircraft during all flight phases. These systems enable pilots to determine their aircraft's position, monitor and follow predefined flight paths, and navigate through adverse weather conditions.

- The navigation segment encompasses avionics systems that aid in flight planning and management. These systems assist in optimizing flight routes, considering factors such as weather, airspace restrictions, and fuel efficiency. They provide pilots with real-time navigational data, ensuring efficient and smooth flight operations. The navigation segment continues to evolve with advancements in technology.

- RNAV and RNP systems allow aircraft to navigate using defined waypoints and routes within a specified accuracy level. These systems provide flexibility in flight planning and enable more direct routes, reducing travel time, fuel consumption, and emissions. RNAV and RNP systems have become standard in modern avionics, highlighting the importance of the navigation segment.

Avionics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America has a robust defence sector with significant investments in military aircraft and avionics technologies. The United States, in particular, has a large defence budget, driving the demand for advanced avionics systems for military applications. This focus on defence strengthens North America's position in the avionics market. This region has a long-standing history and presence of renowned aerospace companies such as Boeing, Lockheed Martin, and Northrop Grumman. These companies have strong capabilities in avionics technology development and manufacturing, contributing to the region's dominance.

- North America is a major hub for aircraft manufacturing. Leading commercial aircraft manufacturers like Boeing and Airbus have significant operations in the region, with a large portion of the global aircraft production taking place there. Avionics systems are integral components of these aircraft, giving North America a dominant position in the avionics market. The region houses several leading research and development organizations, academic institutions, and technology-based companies specializing in avionics. This concentration of expertise fosters innovation and drives advancements in avionics technologies, enabling North American companies to provide cutting-edge solutions.

- North America has a strong demand for advanced avionics systems both in the commercial and military sectors. The region hosts some of the busiest air travel hubs and airline operators, driving the need for efficient and modern avionics solutions. The demand also extends to defence applications, with North American militaries requiring sophisticated avionics for aircraft operation and mission capabilities.

Avionics Market Active Players

- Honeywell Aerospace (USA)

- Thales Group (France)

- Collins Aerospace (USA)

- Garmin Ltd. (USA)

- Raytheon Technologies Corporation (USA)

- L3Harris Technologies (USA)

- BAE Systems (UK)

- General Electric Aviation (USA)

- Safran (France)

- Northrop Grumman Corporation (USA)

- Leonardo S.p.A. (Italy)

- Esterline Technologies Corporation (USA)

- Panasonic Avionics Corporation (USA)

- Diehl Aerospace (Germany)

- Universal Avionics Systems Corporation (USA)

- Cobham plc (UK)

- Elbit Systems Ltd. (Israel)

- Safran Electronics & Defence) (France)

- Curtiss-Wright Corporation (USA)

- Honeywell Aerospace UK (UK)

- Avidyne Corporation (USA)

- Dynon Avionics (USA)

- Aspen Avionics (USA)

- Lufthansa Technik (Germany)

- Textron Aviation (subsidiary of Textron Inc.) (USA)

- Moog Inc. (USA)

- FLIR Systems (USA) other active players.

|

Global Avionics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 54.4 Billion |

|

Forecast Period 2024-32 CAGR: |

9.08 % |

Market Size in 2032: |

USD 109.03 Billion |

|

Segments Covered: |

By Fit |

|

|

|

By Platform |

|

||

|

By Systems |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Honeywell Aerospace (USA), Thales Group (France), Rockwell Collins (now Collins Aerospace) (USA), Garmin Ltd. (OUSA), Raytheon Technologies Corporation (USA), and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Avionics Market by Fit (2018-2032)

4.1 Avionics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Line Fit

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Retrofit

Chapter 5: Avionics Market by Platform (2018-2032)

5.1 Avionics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Commercial Aviation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Military Aviation

5.5 General Aviation

5.6 Special Mission Aviation

Chapter 6: Avionics Market by Systems (2018-2032)

6.1 Avionics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial Aviation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Navigation

6.5 Electronic Flight Displays

6.6 Flight Management

6.7 Power and Data Management

6.8 Others {Payload and Mission

6.9 Traffic and Collision Management

6.10 Weather Detection}

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Avionics Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HONEYWELL AEROSPACE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 THALES GROUP (FRANCE)

7.4 COLLINS AEROSPACE (USA)

7.5 GARMIN LTD. (USA)

7.6 RAYTHEON TECHNOLOGIES CORPORATION (USA)

7.7 L3HARRIS TECHNOLOGIES (USA)

7.8 BAE SYSTEMS (UK)

7.9 GENERAL ELECTRIC AVIATION (USA)

7.10 SAFRAN (FRANCE)

7.11 NORTHROP GRUMMAN CORPORATION (USA)

7.12 LEONARDO S.P.A. (ITALY)

7.13 ESTERLINE TECHNOLOGIES CORPORATION (USA)

7.14 PANASONIC AVIONICS CORPORATION (USA)

7.15 DIEHL AEROSPACE (GERMANY)

7.16 UNIVERSAL AVIONICS SYSTEMS CORPORATION (USA)

7.17 COBHAM PLC (UK)

7.18 ELBIT SYSTEMS LTD. (ISRAEL)

7.19 SAFRAN ELECTRONICS & DEFENCE) (FRANCE)

7.20 CURTISS-WRIGHT CORPORATION (USA)

7.21 HONEYWELL AEROSPACE UK (UK)

7.22 AVIDYNE CORPORATION (USA)

7.23 DYNON AVIONICS (USA)

7.24 ASPEN AVIONICS (USA)

7.25 LUFTHANSA TECHNIK (GERMANY)

7.26 TEXTRON AVIATION (SUBSIDIARY OF TEXTRON INC.) (USA)

7.27 MOOG INC. (USA)

7.28 FLIR SYSTEMS (USA)

Chapter 8: Global Avionics Market By Region

8.1 Overview

8.2. North America Avionics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Fit

8.2.4.1 Line Fit

8.2.4.2 Retrofit

8.2.5 Historic and Forecasted Market Size by Platform

8.2.5.1 Commercial Aviation

8.2.5.2 Military Aviation

8.2.5.3 General Aviation

8.2.5.4 Special Mission Aviation

8.2.6 Historic and Forecasted Market Size by Systems

8.2.6.1 Commercial Aviation

8.2.6.2 Navigation

8.2.6.3 Electronic Flight Displays

8.2.6.4 Flight Management

8.2.6.5 Power and Data Management

8.2.6.6 Others {Payload and Mission

8.2.6.7 Traffic and Collision Management

8.2.6.8 Weather Detection}

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Avionics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Fit

8.3.4.1 Line Fit

8.3.4.2 Retrofit

8.3.5 Historic and Forecasted Market Size by Platform

8.3.5.1 Commercial Aviation

8.3.5.2 Military Aviation

8.3.5.3 General Aviation

8.3.5.4 Special Mission Aviation

8.3.6 Historic and Forecasted Market Size by Systems

8.3.6.1 Commercial Aviation

8.3.6.2 Navigation

8.3.6.3 Electronic Flight Displays

8.3.6.4 Flight Management

8.3.6.5 Power and Data Management

8.3.6.6 Others {Payload and Mission

8.3.6.7 Traffic and Collision Management

8.3.6.8 Weather Detection}

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Avionics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Fit

8.4.4.1 Line Fit

8.4.4.2 Retrofit

8.4.5 Historic and Forecasted Market Size by Platform

8.4.5.1 Commercial Aviation

8.4.5.2 Military Aviation

8.4.5.3 General Aviation

8.4.5.4 Special Mission Aviation

8.4.6 Historic and Forecasted Market Size by Systems

8.4.6.1 Commercial Aviation

8.4.6.2 Navigation

8.4.6.3 Electronic Flight Displays

8.4.6.4 Flight Management

8.4.6.5 Power and Data Management

8.4.6.6 Others {Payload and Mission

8.4.6.7 Traffic and Collision Management

8.4.6.8 Weather Detection}

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Avionics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Fit

8.5.4.1 Line Fit

8.5.4.2 Retrofit

8.5.5 Historic and Forecasted Market Size by Platform

8.5.5.1 Commercial Aviation

8.5.5.2 Military Aviation

8.5.5.3 General Aviation

8.5.5.4 Special Mission Aviation

8.5.6 Historic and Forecasted Market Size by Systems

8.5.6.1 Commercial Aviation

8.5.6.2 Navigation

8.5.6.3 Electronic Flight Displays

8.5.6.4 Flight Management

8.5.6.5 Power and Data Management

8.5.6.6 Others {Payload and Mission

8.5.6.7 Traffic and Collision Management

8.5.6.8 Weather Detection}

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Avionics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Fit

8.6.4.1 Line Fit

8.6.4.2 Retrofit

8.6.5 Historic and Forecasted Market Size by Platform

8.6.5.1 Commercial Aviation

8.6.5.2 Military Aviation

8.6.5.3 General Aviation

8.6.5.4 Special Mission Aviation

8.6.6 Historic and Forecasted Market Size by Systems

8.6.6.1 Commercial Aviation

8.6.6.2 Navigation

8.6.6.3 Electronic Flight Displays

8.6.6.4 Flight Management

8.6.6.5 Power and Data Management

8.6.6.6 Others {Payload and Mission

8.6.6.7 Traffic and Collision Management

8.6.6.8 Weather Detection}

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Avionics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Fit

8.7.4.1 Line Fit

8.7.4.2 Retrofit

8.7.5 Historic and Forecasted Market Size by Platform

8.7.5.1 Commercial Aviation

8.7.5.2 Military Aviation

8.7.5.3 General Aviation

8.7.5.4 Special Mission Aviation

8.7.6 Historic and Forecasted Market Size by Systems

8.7.6.1 Commercial Aviation

8.7.6.2 Navigation

8.7.6.3 Electronic Flight Displays

8.7.6.4 Flight Management

8.7.6.5 Power and Data Management

8.7.6.6 Others {Payload and Mission

8.7.6.7 Traffic and Collision Management

8.7.6.8 Weather Detection}

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Avionics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 54.4 Billion |

|

Forecast Period 2024-32 CAGR: |

9.08 % |

Market Size in 2032: |

USD 109.03 Billion |

|

Segments Covered: |

By Fit |

|

|

|

By Platform |

|

||

|

By Systems |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Honeywell Aerospace (USA), Thales Group (France), Rockwell Collins (now Collins Aerospace) (USA), Garmin Ltd. (OUSA), Raytheon Technologies Corporation (USA), and Other Active Players. |

||