Automotive Radar Market Synopsis

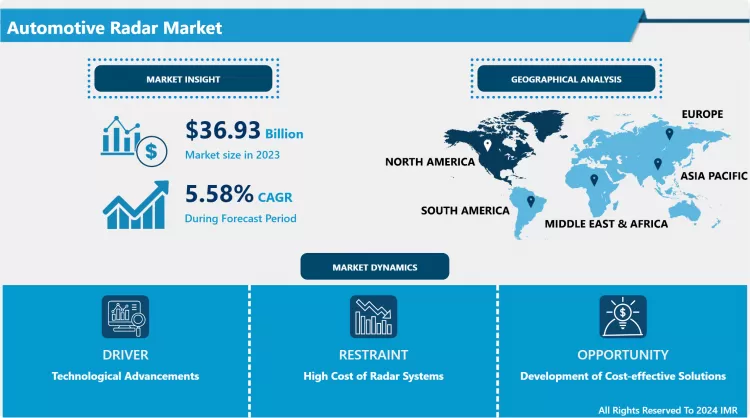

Automotive Radar Market Size is Valued at USD 36.93 Billion in 2024, and is Projected to Reach USD 57.02 Billion by 2032, Growing at a CAGR of 5.58% From 2024-2032.

The decal can be derived as the automotive radar market which is the market segment in the automotive industry that deals with manufacturing of radar for use in the automotive system for safety and convenience systems. This market includes short range radar systems, medium range radar systems as well long-range radar systems used in functions such as adaptive cruise control, collision avoidance systems, parking aid systems and blind spot detection systems. The market for automotive radars is rapidly expanding due to evolving radar technology, new safety standards, and the global trend of smart electric vehicles with level 2 and higher autonomy.

- The rising prominence of vehicle safety and rising cases of traffic accidents have encouraged the need for advanced driver assistance systems (ADAS) which rely on radar technology. Users are beginning to realize the value of safety aspects and manufacturers are tying high-end radar technologies to make cars safer and better. Besides, several global regulatory bodies are setting high safety measures, which has accelerated the use of radar systems on cars.

- The factor that has encouraged the expansion of the automotive radar market includes increased advancements in radar systems including the radar resolution, radar range, and radar accuracy. Features that have been developed such as adaptive cruise control and the newer generation automatic emergency braking and blind spot detection all in some way incorporate radar. Since most manufacturers are pursuing research and development, an innovation in features will improve vehicle safety and efficiency, which has a domino effect in the market demand.

Automotive Radar Market Trend Analysis

Increased Adoption of ADAS

- The shift towards higher scale integration of Advanced Driver Assistance Systems (ADAS) is shifting the dynamics of the automotive radar market. Manufacturers are seeking ways to incorporate a number of different sensor types, such as radar, LIDAR, and cameras to achieve a complete perception of the automobile’s environment. This trend is clearly evidenced in consumers’ desire for automobiles that possess safety applications from radar systems to guide the development process and to improve the functionality of such systems in market offerings.

- The autonomous vehicle is also recognized as another growing tendency that affects the automotive radar market. Since car makers embarked on working towards fully autonomous driving cars, the demand for radar systems that would be efficient in different environments has received emphasis. Such shift does not only put pressure on development of new radar technologies but also spearheads growth of other related industries, as companies join hands to produce better and more reliable autonomous systems.

Expansion in Emerging Markets

- It is identified that the automotive radar market comprises ample growth potential in the new generation markets. With improved economic standards, higher per capita income, and growing middle income earners in these regions – sales of vehicles also grow. Due to increased importance of road safety and environmental conservation by the various state governments, more new automobiles will be produced with enhanced safety features such as radar systems. This means that manufacturers have the chance of penetrating these markets and in the process increase its customer base.

- Producers are increasingly bearing the possibility to address the demand of the economical champions and create new cost-efficient radar arrangements. When there is competition in automotive industries, the development of low-cost radar systems that do not affect the quality and operations of the system can make more customers to be attracted. Through the development and efficient implementation of efficient strategies in their manufacturing lines, firms can afford to set relatively low prices for their products all the while incorporating the latest technologies in safety designs.

Automotive Radar Market Segment Analysis:

Automotive Radar Market Segmented on the basis Range, Technology, Application and End user.

By Range, long Range segment is expected to dominate the market during the forecast period

- Depending on the range in detecting an object, automotive radar systems exist in short-range, medium-range, and long-range domains. L Radar systems of short-range work up to a distance of 30 meters and are employed for applications such as parking aid and low-speed pre-crash safety. Short range radar sensors that work about 30 meters to 100 meters are typically used in ACC and other ACC-enhanced driver assistance systems. High-performing long-range radars can operate beyond the 100-meter limit and are important for HWY-CVA and general perception in the autonomous vehicle innovation process.

By Application, Adaptive Cruise Control (ACC) segment held the largest share in 2024

- By application, automotive radar systems find important uses in improving safety and comfort of automobiles as depicted below.. Radar based Adaptive Cruise Control (ACC) when drives, it controls the speed of the car and keeps a safe distance from the vehicle in front by using radar. Collision avoidance systems use radar technology to identify approaching objects and give signals or apply force to stop before a crash happens. Equipment such as parking assistance utilizes short range radar that assist in navigating more so in small areas due to object detection. blind spot detection which uses radar system it scans the areas beside and behind the vehicle, informing the drivers of other vehicles within the blind zones making driving safer during lane changing or while merging.

Automotive Radar Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is identified as the biggest region of the automotive radar market due to the presence of a number of automotive giants and concern for safety norms. The region is developing some of the most innovative ADAS technologies that receive enviable attention from auto manufacturers and tech giants. That is why, increasing popularity of electrification, and self-driving cars also contributes to the development of the radar technologies market, making North America a leading region in the automotive radar market. • Besides, the strong foundation, and the development of technologies in the North American market makes it easy to incorporate radars into vehicles. Emphasis on safety regulations. The region is home to some of the most advanced ADAS technologies, with significant investments in research and development from both automakers and technology companies. The growing trend of electrification and autonomous vehicles further supports the expansion of radar technologies, positioning North America as a leader in the automotive radar landscape.

- In addition, the robust infrastructure and technological advancements in North America facilitate the integration of radar systems into vehicles. The partnership between car makers & technology companies is driving innovation that is improving the future of radar systems. Since safety has emerged as an important concern for the customers and governing bodies, North American market is anticipated to retain its supremacy and steer the post-R&D course of automotive radar technology.

Active Key Players in the Automotive Radar Market

- Bosch (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Delphi Technologies (UK)

- Infineon Technologies (Germany)

- NXP Semiconductors (Netherlands)

- Texas Instruments (USA)

- Velodyne Lidar, Inc. (USA)

- Panasonic Corporation (Japan)

- ZF Friedrichshafen AG (Germany) and Others Active Players

|

Global Automotive Radar Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 36.93 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 57.02 Bn. |

|

Segments Covered: |

By Range |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Radar Market by Range (2018-2032)

4.1 Automotive Radar Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Short Range

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium Range

4.5 Long Range

Chapter 5: Automotive Radar Market by Technology (2018-2032)

5.1 Automotive Radar Market Snapshot and Growth Engine

5.2 Market Overview

5.3 FMCW (Frequency Modulated Continuous Wave)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pulsed Radar

Chapter 6: Automotive Radar Market by Application (2018-2032)

6.1 Automotive Radar Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Adaptive Cruise Control (ACC)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Collision Avoidance

6.5 Parking Assistance

6.6 Blind Spot Detection

Chapter 7: Automotive Radar Market by End User (2018-2032)

7.1 Automotive Radar Market Snapshot and Growth Engine

7.2 Market Overview

7.3 OEMs (Original Equipment Manufacturers)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Aftermarket

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Radar Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BOSCH (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CONTINENTAL AG (GERMANY)

8.4 DENSO CORPORATION (JAPAN)

8.5 DELPHI TECHNOLOGIES (UK)

8.6 INFINEON TECHNOLOGIES (GERMANY)

8.7 NXP SEMICONDUCTORS (NETHERLANDS)

8.8 TEXAS INSTRUMENTS (USA)

8.9 VELODYNE LIDAR INC. (USA)

8.10 PANASONIC CORPORATION (JAPAN)

8.11 ZF FRIEDRICHSHAFEN AG (GERMANY) OTHERS ACTIVE PLAYERS

Chapter 9: Global Automotive Radar Market By Region

9.1 Overview

9.2. North America Automotive Radar Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Range

9.2.4.1 Short Range

9.2.4.2 Medium Range

9.2.4.3 Long Range

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 FMCW (Frequency Modulated Continuous Wave)

9.2.5.2 Pulsed Radar

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Adaptive Cruise Control (ACC)

9.2.6.2 Collision Avoidance

9.2.6.3 Parking Assistance

9.2.6.4 Blind Spot Detection

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 OEMs (Original Equipment Manufacturers)

9.2.7.2 Aftermarket

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Radar Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Range

9.3.4.1 Short Range

9.3.4.2 Medium Range

9.3.4.3 Long Range

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 FMCW (Frequency Modulated Continuous Wave)

9.3.5.2 Pulsed Radar

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Adaptive Cruise Control (ACC)

9.3.6.2 Collision Avoidance

9.3.6.3 Parking Assistance

9.3.6.4 Blind Spot Detection

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 OEMs (Original Equipment Manufacturers)

9.3.7.2 Aftermarket

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Radar Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Range

9.4.4.1 Short Range

9.4.4.2 Medium Range

9.4.4.3 Long Range

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 FMCW (Frequency Modulated Continuous Wave)

9.4.5.2 Pulsed Radar

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Adaptive Cruise Control (ACC)

9.4.6.2 Collision Avoidance

9.4.6.3 Parking Assistance

9.4.6.4 Blind Spot Detection

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 OEMs (Original Equipment Manufacturers)

9.4.7.2 Aftermarket

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Radar Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Range

9.5.4.1 Short Range

9.5.4.2 Medium Range

9.5.4.3 Long Range

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 FMCW (Frequency Modulated Continuous Wave)

9.5.5.2 Pulsed Radar

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Adaptive Cruise Control (ACC)

9.5.6.2 Collision Avoidance

9.5.6.3 Parking Assistance

9.5.6.4 Blind Spot Detection

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 OEMs (Original Equipment Manufacturers)

9.5.7.2 Aftermarket

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Radar Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Range

9.6.4.1 Short Range

9.6.4.2 Medium Range

9.6.4.3 Long Range

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 FMCW (Frequency Modulated Continuous Wave)

9.6.5.2 Pulsed Radar

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Adaptive Cruise Control (ACC)

9.6.6.2 Collision Avoidance

9.6.6.3 Parking Assistance

9.6.6.4 Blind Spot Detection

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 OEMs (Original Equipment Manufacturers)

9.6.7.2 Aftermarket

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Radar Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Range

9.7.4.1 Short Range

9.7.4.2 Medium Range

9.7.4.3 Long Range

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 FMCW (Frequency Modulated Continuous Wave)

9.7.5.2 Pulsed Radar

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Adaptive Cruise Control (ACC)

9.7.6.2 Collision Avoidance

9.7.6.3 Parking Assistance

9.7.6.4 Blind Spot Detection

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 OEMs (Original Equipment Manufacturers)

9.7.7.2 Aftermarket

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automotive Radar Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 36.93 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.58 % |

Market Size in 2032: |

USD 57.02 Bn. |

|

Segments Covered: |

By Range |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Radar Market research report is 2024-2032.

Bosch (Germany), Continental AG (Germany), Denso Corporation (Japan), Delphi Technologies (UK), Infineon Technologies (Germany), NXP Semiconductors (Netherlands), Texas Instruments (USA), Velodyne Lidar, Inc. (USA), Panasonic Corporation (Japan), ZF Friedrichshafen AG (Germany) and Other Major Players.

The Automotive Radar Market is segmented into by Range (Short Range, Medium Range, Long Range), By Technology (FMCW (Frequency Modulated Continuous Wave), Pulsed Radar), by Application (Adaptive Cruise Control (ACC), Collision Avoidance, Parking Assistance, Blind Spot Detection), End-User (OEMs (Original Equipment Manufacturers), Aftermarket). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The decal can be derived as the automotive radar market which is the market segment in the automotive industry that deals with manufacturing of radar for use in the automotive system for safety and convenience systems. This market includes short range radar systems, medium range radar systems as well long-range radar systems used in functions such as adaptive cruise control, collision avoidance systems, parking aid systems and blind spot detection systems. The market for automotive radars is rapidly expanding due to evolving radar technology, new safety standards, and the global trend of smart electric vehicles with level 2 and higher autonomy.

Automotive Radar Market Size is Valued at USD 36.93 Billion in 2024, and is Projected to Reach USD 57.02 Billion by 2032, Growing at a CAGR of 5.58% From 2024-2032.