Global Automotive eCall Market Overview

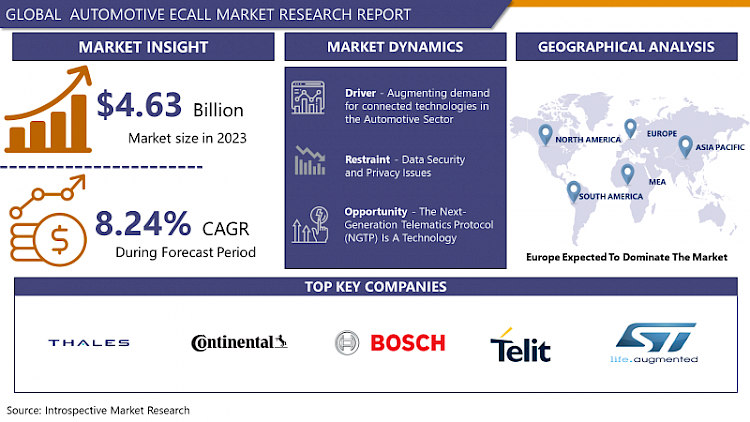

The Global Automotive eCall Market Size Was Valued at USD 4.63 Billion In 2023 And Is Projected to Reach USD 9.44 Billion By 2032, Growing at A CAGR of 8.24% From 2024 To 2032.

An automotive emergency call system is an "in-vehicle" emergency call system that allows communication lines to be established in the event of a vehicle accident or malfunction. This system includes both an automated and manual e-calling mechanism, as well as a voice response that is sent to the emergency service provider via an automated call to an emergency number. The automatic call is triggered by particular events, such as a vehicle breakdown, the activation of airbags, or a vehicle collision. A manual e-calling system is also available, in which automobiles are equipped with a manual button that allows the occupant to dial an emergency number in the event of an accident or if the vehicle's system fails. The growing demand for automobile emergency call (eCall) systems can be ascribed to a need for increased vehicle safety. Several automakers, including Ford Motors, Toyota, Volkswagen, Volvo, Audi, and BMW, have integrated the automobile emergency call system into various models. Reduced COMPLEXITY of an all-in-one test solution delivering multiple automated tests of all relevant eCall frequencies from GNSS to mobile communication standards is significant for vehicle eCall. Reduced COST of a single solution that complies with a variety of international eCall compliance criteria (such as eCall, ERA-GLONASS). Safe INVESTMENT in a solution that allows you to execute testing on today's mobile infrastructure, tomorrow's next-generation LTE-based eCall (NG eCall), and even the future 5G. Consumer demand for safety services is prompting automakers to install eCall systems, or emergency call systems, in their vehicles, boosting the global automotive emergency call system market.

Market Dynamics And Factors Of Automotive eCall Market

Drivers:

The growing demand for connected technologies in the automotive industry, as well as increased demand from a growing fleet of autonomous vehicles and a growing global electric vehicle fleet and manufacturing, are all contributing to the market's growth. Increased urbanization, demographic changes, an improvement in the standard of living, and an increase in disposable money are the primary drivers of vehicle sales and manufacturing worldwide. Rising traffic congestion and a high rate of road accidents are growing consumer safety concerns and increasing their desire for increased car safety and security features, resulting in a significant demand for these systems around the world. Furthermore, automakers are implementing these systems in vehicles in response to increased driver and passenger safety concerns, as well as to reduce road fatalities and give prompt assistance to injured persons. FORD, for example, has implemented one of the existing versions in its Ecosports SUV. According to Ford, the technology is a vehicle-based, no-cost, no-subscription call-for-help system that sends a voice message straight to emergency operators, signaling that the airbags have been deployed or the fuel pump shut-off has been triggered and opens the line for hands-free contact. The Emergency Assistance system is controlled by Ford's Sync system, which is a voice-activated, hands-free communications and entertainment package for smartphones and digital media players that allows the driver to make and receive calls as well as listen to music. The Sync system connects to the driver's phone via Bluetooth and begins working as soon as the driver enters the vehicle. In the event of an accident, the Sync system's hands-free phone capabilities link the driver to India's emergency service number 108. As a result, these benefits are projected to propel the automobile ECall market forward over the forecast period.

Restraints:

Due to the obvious COVID-19 epidemic, growth in the automotive eCall industry is expected to be limited in 2020. The automotive industry has been hit particularly hard by the epidemic, since statewide lockdowns and stopped economic activities around the world have resulted in a sharp drop in car manufacturing. According to the European Automobile Manufacturers Association, factory closures in the European Union (EU) have resulted in output losses of 2,446,344 cars as of June 2020. Furthermore, supply chain interruptions have led automobile manufacturers to halt production. Hyundai and Kia, for example, shut several assembly lines in South Korea in February 2020, while Nissan said that it will cease manufacturing in Japan. These negative incidents will certainly have an impact on the adoption of automobile eCall this year.

Opportunities:

The Next-generation Telematics Protocol (NGTP) is a technology that intends to bring greater flexibility and scalability to the automobile industry to enable better connectivity and integration of data and services while integrating with the ECall system for improved connectivity. As a result, the automotive ECall market is projected to have attractive potential over the forecast period.

Segmentation Analysis Of Automotive eCall Market

By type, the Automatic type of eCall segment is anticipated to grab the largest revenue of the automotive eCall market over the forecast period. Since March 31, all new automobile models sold in the EU contain eCall, an automated emergency call system that notifies emergency services in the case of a collision. According to research, eCall would reduce emergency service response times by 50% in rural areas and 40% in metropolitan areas. This is a sophisticated in-car safety system that includes an automated calling device that alerts emergency services if the vehicle is engaged in a collision or accident. Currently, only autos are required to use the system, and it will be many years before the bulk of vehicles is covered. Recent advancements in Advanced Mobile Location technology, on the other hand, may make it easier for other road users to receive emergency assistance sooner. In January, Apple revealed that the latest version of their phone operating system, iOS, would support AML. When a call is placed, the system provides location data to emergency services automatically. In 2016, the system was released for Android phones. It only works in locations where emergency call centers are set up to receive the information. Austria, Belgium, Estonia, Finland, Ireland, Lithuania, and the United Kingdom are among the EU countries that have fully implemented the technology. In addition to the United States, eight additional countries are working on implementation.

By vehicle type, the passenger car segment holds the major market share in 2020. Growing urbanization, industrial expansion, rapid demographic growth, and rising disposable income have all contributed to an increase in vehicle production and sales around the world. The industry is growing due to the increased adoption of technologically advanced technologies like infotainment and telematics by automobile manufacturers.

By installation, third party service (TPS) eCall segment is expected to capture a significant market share over the forecast period. Third-party service providers (such as car manufacturers, car clubs, insurance providers, and so on) are also allowed to provide 'Third Party Service Provider' variants of eCall (as long as the vehicle user can revert to 112-eCall at any time, or whenever the third-party system is not operational), and EN 16102 ensures that the information provided to assist providers is consistent with that provided to 112-eCall, and provides specifications for the assistance providers.

Regional Analysis Of Automotive eCall Market

Europe to hold a maximum market share of the automotive emergency call market. The automotive emergency call system market in Europe is being driven by an increase in the installation of eCall systems in automobiles as a result of government legislation and organizations in the region, including the European Commission. The European Commission, for example, has ordered that all automakers install eCall systems in new vehicles and vans beginning in 2018. Furthermore, the automobile emergency call system market in Europe is being propelled by a growing trend of joint ventures between manufacturers and emergency service providers.

Due to increased public awareness about vehicle safety as well as improved government laws covering road, passenger, and driver safety, North America owns the second-largest proportion of the global market. Furthermore, the presence of well-known automakers in the region is projected to help the industry.

Due to massive expansion in vehicle production and sales, Asia Pacific is predicted to be the major shareholder in the global market over the forecast period. The automobile sector in developing economies like India and China has been growing at a rapid pace. Furthermore, rising disposable incomes, increased urbanization, and improved living standards have fueled the expansion of automobiles in this region. The emerging countries in this region have seen a rapid increase in the ownership of passenger automobiles with built-in telematics systems in recent years. Because of the importance of safety improvements and changing customer desires, sophisticated automobile technologies are being developed and used.

Players Covered in Automotive eCall Market are:

- Thales Group(France)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Telit (U.K.)

- STMicroelectronics(Switzerland)

- u-blox (Switzerland)

- Visteon Corporation (U.S.)

- Texas Instruments Incorporated. (U.S.)

- Valeo (France) and other major players.

Key Industry Developments in Automotive eCall Market

- In December 2023, Applus and Rohde & Schwarz integrated eCall test services in the EMC environments. The company integrated eCall analysis capabilities into various electromagnetic compatibility test chamber setups.

- In August 2023 – VESOS, a European eCall startup company, announced its partnership with the Surrey and Warwickshire government departments to initiate trials of automotive eCalls systems in the area. In the event of collision TeCall system developed by VESOS would provide detailed information about the vehicles involved to the fire service, police, paramedics, and highway operators, almost instantly.

|

Global Automotive eCall Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 4.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.24% |

Market Size in 2032: |

USD 9.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type

|

|

||

|

By Installation |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Vehicle Type

3.3 By Installation

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Automotive eCall Market by Type

4.1 Automotive eCall Market Overview Snapshot and Growth Engine

4.2 Automotive eCall Market Overview

4.3 Automatic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Automatic: Grographic Segmentation

4.4 Manual

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Manual: Grographic Segmentation

Chapter 5: Automotive eCall Market by Vehicle Type

5.1 Automotive eCall Market Overview Snapshot and Growth Engine

5.2 Automotive eCall Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Cars: Grographic Segmentation

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Grographic Segmentation

Chapter 6: Automotive eCall Market by Installation

6.1 Automotive eCall Market Overview Snapshot and Growth Engine

6.2 Automotive eCall Market Overview

6.3 Third Party Service (TPS) eCall

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Third Party Service (TPS) eCall: Grographic Segmentation

6.4 Standard eCall

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Standard eCall: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Automotive eCall Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Automotive eCall Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Automotive eCall Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 THALES GROUP (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 CONTINENTAL AG (GERMANY)

7.4 ROBERT BOSCH GMBH (GERMANY)

7.5 TELIT (U.K.)

7.6 STMICROELECTRONICS (SWITZERLAND)

7.7 U-BLOX (SWITZERLAND)

7.8 VISTEON CORPORATION (U.S.)

7.9 TEXAS INSTRUMENTS INCORPORATED. (U.S.)

7.10 VALEO (FRANCE)

Chapter 8: Global Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Automatic

8.2.2 Manual

8.3 Historic and Forecasted Market Size By Vehicle Type

8.3.1 Passenger Cars

8.3.2 Commercial Vehicles

8.4 Historic and Forecasted Market Size By Installation

8.4.1 Third Party Service (TPS) eCall

8.4.2 Standard eCall

Chapter 9: North America Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Automatic

9.4.2 Manual

9.5 Historic and Forecasted Market Size By Vehicle Type

9.5.1 Passenger Cars

9.5.2 Commercial Vehicles

9.6 Historic and Forecasted Market Size By Installation

9.6.1 Third Party Service (TPS) eCall

9.6.2 Standard eCall

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Automatic

10.4.2 Manual

10.5 Historic and Forecasted Market Size By Vehicle Type

10.5.1 Passenger Cars

10.5.2 Commercial Vehicles

10.6 Historic and Forecasted Market Size By Installation

10.6.1 Third Party Service (TPS) eCall

10.6.2 Standard eCall

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Automatic

11.4.2 Manual

11.5 Historic and Forecasted Market Size By Vehicle Type

11.5.1 Passenger Cars

11.5.2 Commercial Vehicles

11.6 Historic and Forecasted Market Size By Installation

11.6.1 Third Party Service (TPS) eCall

11.6.2 Standard eCall

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Automatic

12.4.2 Manual

12.5 Historic and Forecasted Market Size By Vehicle Type

12.5.1 Passenger Cars

12.5.2 Commercial Vehicles

12.6 Historic and Forecasted Market Size By Installation

12.6.1 Third Party Service (TPS) eCall

12.6.2 Standard eCall

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Automotive eCall Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Automatic

13.4.2 Manual

13.5 Historic and Forecasted Market Size By Vehicle Type

13.5.1 Passenger Cars

13.5.2 Commercial Vehicles

13.6 Historic and Forecasted Market Size By Installation

13.6.1 Third Party Service (TPS) eCall

13.6.2 Standard eCall

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Automotive eCall Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 4.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.24% |

Market Size in 2032: |

USD 9.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type

|

|

||

|

By Installation |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUTOMOTIVE ECALL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUTOMOTIVE ECALL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUTOMOTIVE ECALL MARKET COMPETITIVE RIVALRY

TABLE 005. AUTOMOTIVE ECALL MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUTOMOTIVE ECALL MARKET THREAT OF SUBSTITUTES

TABLE 007. AUTOMOTIVE ECALL MARKET BY TYPE

TABLE 008. AUTOMATIC MARKET OVERVIEW (2016-2028)

TABLE 009. MANUAL MARKET OVERVIEW (2016-2028)

TABLE 010. AUTOMOTIVE ECALL MARKET BY VEHICLE TYPE

TABLE 011. PASSENGER CARS MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 013. AUTOMOTIVE ECALL MARKET BY INSTALLATION

TABLE 014. THIRD PARTY SERVICE (TPS) ECALL MARKET OVERVIEW (2016-2028)

TABLE 015. STANDARD ECALL MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA AUTOMOTIVE ECALL MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA AUTOMOTIVE ECALL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 018. NORTH AMERICA AUTOMOTIVE ECALL MARKET, BY INSTALLATION (2016-2028)

TABLE 019. N AUTOMOTIVE ECALL MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE AUTOMOTIVE ECALL MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE AUTOMOTIVE ECALL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 022. EUROPE AUTOMOTIVE ECALL MARKET, BY INSTALLATION (2016-2028)

TABLE 023. AUTOMOTIVE ECALL MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC AUTOMOTIVE ECALL MARKET, BY TYPE (2016-2028)

TABLE 025. ASIA PACIFIC AUTOMOTIVE ECALL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 026. ASIA PACIFIC AUTOMOTIVE ECALL MARKET, BY INSTALLATION (2016-2028)

TABLE 027. AUTOMOTIVE ECALL MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA AUTOMOTIVE ECALL MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA AUTOMOTIVE ECALL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA AUTOMOTIVE ECALL MARKET, BY INSTALLATION (2016-2028)

TABLE 031. AUTOMOTIVE ECALL MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA AUTOMOTIVE ECALL MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA AUTOMOTIVE ECALL MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 034. SOUTH AMERICA AUTOMOTIVE ECALL MARKET, BY INSTALLATION (2016-2028)

TABLE 035. AUTOMOTIVE ECALL MARKET, BY COUNTRY (2016-2028)

TABLE 036. THALES GROUP (FRANCE): SNAPSHOT

TABLE 037. THALES GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 038. THALES GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 039. THALES GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. CONTINENTAL AG (GERMANY): SNAPSHOT

TABLE 040. CONTINENTAL AG (GERMANY): BUSINESS PERFORMANCE

TABLE 041. CONTINENTAL AG (GERMANY): PRODUCT PORTFOLIO

TABLE 042. CONTINENTAL AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ROBERT BOSCH GMBH (GERMANY): SNAPSHOT

TABLE 043. ROBERT BOSCH GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 044. ROBERT BOSCH GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 045. ROBERT BOSCH GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. TELIT (U.K.): SNAPSHOT

TABLE 046. TELIT (U.K.): BUSINESS PERFORMANCE

TABLE 047. TELIT (U.K.): PRODUCT PORTFOLIO

TABLE 048. TELIT (U.K.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. STMICROELECTRONICS (SWITZERLAND): SNAPSHOT

TABLE 049. STMICROELECTRONICS (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 050. STMICROELECTRONICS (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 051. STMICROELECTRONICS (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. U-BLOX (SWITZERLAND): SNAPSHOT

TABLE 052. U-BLOX (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 053. U-BLOX (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 054. U-BLOX (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. VISTEON CORPORATION (U.S.): SNAPSHOT

TABLE 055. VISTEON CORPORATION (U.S.): BUSINESS PERFORMANCE

TABLE 056. VISTEON CORPORATION (U.S.): PRODUCT PORTFOLIO

TABLE 057. VISTEON CORPORATION (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TEXAS INSTRUMENTS INCORPORATED. (U.S.): SNAPSHOT

TABLE 058. TEXAS INSTRUMENTS INCORPORATED. (U.S.): BUSINESS PERFORMANCE

TABLE 059. TEXAS INSTRUMENTS INCORPORATED. (U.S.): PRODUCT PORTFOLIO

TABLE 060. TEXAS INSTRUMENTS INCORPORATED. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VALEO (FRANCE): SNAPSHOT

TABLE 061. VALEO (FRANCE): BUSINESS PERFORMANCE

TABLE 062. VALEO (FRANCE): PRODUCT PORTFOLIO

TABLE 063. VALEO (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUTOMOTIVE ECALL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUTOMOTIVE ECALL MARKET OVERVIEW BY TYPE

FIGURE 012. AUTOMATIC MARKET OVERVIEW (2016-2028)

FIGURE 013. MANUAL MARKET OVERVIEW (2016-2028)

FIGURE 014. AUTOMOTIVE ECALL MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 015. PASSENGER CARS MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 017. AUTOMOTIVE ECALL MARKET OVERVIEW BY INSTALLATION

FIGURE 018. THIRD PARTY SERVICE (TPS) ECALL MARKET OVERVIEW (2016-2028)

FIGURE 019. STANDARD ECALL MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA AUTOMOTIVE ECALL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE AUTOMOTIVE ECALL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC AUTOMOTIVE ECALL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA AUTOMOTIVE ECALL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA AUTOMOTIVE ECALL MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Automotive eCall Market research report is 2024-2032.

Thales Group (France), Continental AG (Germany),Robert Bosch GmbH (Germany), Telit (U.K.)and other major players.

The Automotive eCall market is segmented into By Type, Vehicle Type, Installation Region. Automotive eCall Market is segmented by By Type (Automatic, Manual), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Installation (Third-party service (TPS) eCall, Standard eCall), By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

An automotive emergency call system is an "in-vehicle" emergency call system that allows communication lines to be established in the event of a vehicle accident or malfunction. This system includes both an automated and manual e-calling mechanism, as well as a voice response that is sent to the emergency service provider via an automated call to an emergency number.

The Global Automotive eCall Market Size Was Valued at USD 4.63 Billion In 2023 And Is Projected to Reach USD 9.44 Billion By 2032, Growing at A CAGR of 8.24% From 2024 To 2032.