Global Automotive Rear Seat Entertainment Market Overview

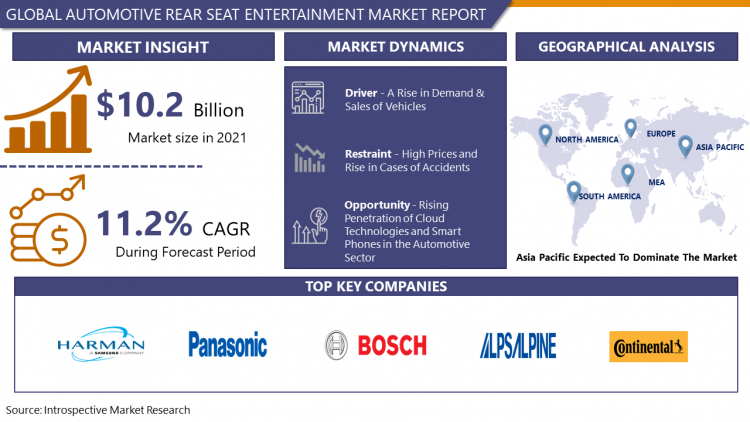

Global Automotive Rear Seat Entertainment Market was valued at USD 10.2 Billion in 2021 and is expected to reach USD 21.45 Billion by the year 2028, at a CAGR of 11.2%.

Automotive Rear Seat Entertainment systems act as a differentiation tool and are scheduled to extend the trend in mid-segment cars. The wide application of this system includes entertainment, location-based services, navigational services (GPS), internet (games, sports scores, surfing, social networking, movies, traffic conditions, weather forecast, etc.), communication functions such as making and receiving calls via smartphone integration and value-added services.

The global automotive entertainment systems market has been poised for swift growth since the advent of the 21st century, appropriate to the early adopters and innovators' adoption of these sophisticated systems. Entertainment systems predominantly rear-seat entertainment systems, MP3 players, and satellite radio are rapidly surfacing into a preference attribute of today's automobile system elucidation. The automotive entertainment industry is foreseen to witness a surge in the number of new entrants to get a piece of the nascent market. Although the Automotive Rear Seat Entertainment market is still in the preliminary stage, major market collaborators pushing the growth of the market during forecasted period.

Market Dynamics and Factors:

Drivers

Rising penetration of cloud technologies and smartphones in the automotive sector.

Cloud technology is being used in a variety of ways in automobiles. Cars will be able to interact with one another through the cloud to avoid accidents and update traffic information and maps. The use of cloud technology in automobiles is not new, but it is rapidly growing due to collaboration and partnerships between the automotive sector and software companies. Volvo gives its customers a fantastic illustration of how cloud services are applied to a car for significant purposes other than enjoyment. The user may operate the car using a smartphone and the Volvo On-Call software and cloud-based services. The smartphone may then be used to unlock and start the vehicle using a digital key. It can also produce and distribute temporary digital keys to the driver's family and friends when they need to share the car, remotely pre-heat or pre-cool the cabin, provide route directions, or check the fuel level. Another example of cloud technology combined with infotainment systems is Ford Motor Company's partnership with Microsoft Azure to create Ford Services Network, which provides automated software solutions. I2V also known as Invisible-to-Visible is a future Nissan Intelligent Mobility technology that combines the real and virtual worlds. It lets drivers "see the unseen" by merging data from sensors outside and within the car with data from the cloud. This includes what is further down the road, behind a building, or around the corner.

Restraints

Automotive Rear Seat Entertainment systems also including Infotainment services such as navigation, satellite radio, vehicle diagnostics, Wi-Fi hotspot, roadside assistance, and live traffic data require an annual subscription. Initially, those services start with a free trial, grow accustomed to these conveniences, and are chargeable later on. Although the price of the basic subscription is not much, it can add up over time. Furthermore, the upgrade of software and subscription models requires additional costs as well. For instance, Audi Connect PLUS, including Wi-Fi hotspot, online radio, and Amazon Music, costs around USD 10 a month while unlimited data is USD 25 per month, on the other hand, the next version, the Audi Connect PRIME, which includes Amazon Alexa, natural voice recognition, Google Earth, traffic information, traffic light information, myAudi Destinations, and parking information costs around USD 199 for 6 months and USD 499 for 18 months.

Opportunities

New value streams will develop as the automotive Rear Seat Entertainment ecosystem are expected to expands. Potential business prospects that will attract new entrants to the market. Cloud-managed platforms will enable the distribution of over-the-top (OTT) content such as Netflix, Disney+, and Hulu in the vehicle. For automobile owners' comfort and monetization, IoT, analytics, and intuitive mobile apps and solutions will have greater opportunities. Conveniences such as grocery shopping or booking a table at a restaurant or coffee shop while on the road will be part of the new value stream options. Click analytics will aid in the comprehension of use trends as well as the collecting of data for targeted advertising. An example of the expanding RSE ecosystem is Amazon Fire OS integration. Companies are progressing with ambitious plans to capture the RSE market through Fire OS which is a customized version of Android running on Amazon's flagship devices. Amazon is expanding its Fire TV program to automakers and has announced partnerships with BMW and Fiat Chrysler Automotive. Amazon's focus has been enabling a living-room experience in the car, including support for Alexa, a touchscreen interface, and offline playback features specially designed to improve user experience.

Challenges

Despite significant advancements in in-vehicle entertainment technology, cybersecurity remains a significant problem. Each component of in-vehicle infotainment, including hardware, software, mobile applications, and Bluetooth, is vulnerable to hackers. Amico, a car privacy and cybersecurity advocate, alerted the Automotive Information Sharing and Analysis Center (Auto-ISAC), an industry-run group that shares and analyses intelligence on potential cybersecurity threats. Amico spent months working with Auto-ISAC to educate those who were affected to understand how an attacker may gain access to data contained in automotive infotainment systems. There have been several situations where cybersecurity has caused a problem. For example, in the case of Chrysler's Jeep, two researchers were able to hack into a Jeep, resulting in the software being upgraded in 1.4 million cars. Similarly, the Tesla S and Nissan Leaf are examples of in-vehicle entertainment systems that are vulnerable to hacks.

Market Segmentation

By Component, Headrest Display dominates the component segment in Automotive Rear Seat Entertainment Market. Headrest monitors are positioned in the back of the front seat headrests for rear-seat passengers to observe. The screen is, of course, restricted by the size of the headrest, which is often 5" or 7". The most often fitted back seat entertainment systems in manufactured automobiles are headrest monitors, which are typically provided by OEMs. In comparison to folding devices, the integrated screen in the headrest of the seat gives simple accessibility, longer life, and attractiveness to the interiors. Thus, it presents as a growth driving factor for Automotive Rear Seat Entertainment Market.

By Operating System, Android is dominating the operating system segment in Automotive Rear Seat Entertainment Market. Currently, Android users are dominating the market. Android has over 2.8 billion active users, it has a global market share of 75 percent. Android holds over 85% market share in Brazil, India, Indonesia, Turkey, and Vietnam. Easy user interface and multi-connectivity with various IoT devices, easy transfer of data, and larger consumer base put android as the best operating system to integrate into the automobile rear-seat entertainment market. The brands like Qualcomm and its automobile cockpit platform enable high-performance functions with cloud technology integration allowing high-tech automotive rear-seat entertainment solutions which are driving the market.

By Sales Channels, Aftermarket segment is dominating the Automotive Rear Seat Entertainment Market. Because aftermarket items are less expensive than OEM ones, many buyers are likely to choose the latter. As manufacturers install entertainment systems in the factory, aftermarket items are expected to enjoy a significant increase in product exposure, resulting in increased product awareness. There are many aftermarket players which provide high-quality components and products such as Pioneer, Herman, and Continental AG. Automotive customization is a growing industry that has a massive market including after-market rear-seat entertainment systems with custom modification. This attracts a large customer base and therefore pushes the growth of the Automotive Rear Seat Entertainment Market.

Players Covered in Automotive Rear Seat Entertainment market are :

- Harman International

- Panasonic Corporation

- Alps Alpine Co Ltd

- Robert Bosch GmbH

- Continental AG

- JVC-Kenwood

- Delphi

- Denso

- Alpine

- Pioneer and others major players.

Regional Analysis of Automotive Rear Seat Entertainment Market

The Asia Pacific is dominating the Automotive Rear Seat Entertainment Market. Due to its largest car sales over the last decade, China occupies a substantial portion of the Asia-Pacific automotive sector among Asia-Pacific countries. Due to automakers' increasing focus on new energy vehicles (NEV), the country is expected to continue to have favorable vehicle sales over the projection period. The country's need for infotainment systems is being driven by the change from simple audio systems to touchscreen infotainment systems that enable numerous functions like navigation, Apple CarPlay, Android Auto, telematics, and so on. According to the China Automobile Dealers Association, the country's luxury automobile dealers sold 277,000 vehicles in April 2020, a rise of 11.1 percent over April 2019. In April 2020, luxury automobile sales accounted for 18.7% of the market, a 3.6 percent increase over April 2019 and a 0.4 percent gain over the market share in March 2020. ONE, a smart electric luxury SUV, was unveiled by CHJ Automotive, a Chinese electric vehicle manufacturer. A four-screen infotainment system with a smart speaker system is included in the car. The ONE has a dual-chip system and a dual-system structure, as well as an Android automotive compatible system and a Qualcomm Xiao Long 820A-class CPU.

North America is expected to be the fastest-growing region in Automotive Rear Seat Entertainment Market. The large size of the market in the region is mainly due to large-scale domestic manufacturing, due to the government initiative toward disruptive technologies and technological innovation in informatics. The emergence of information technology and the increased usage of IoT in automotive applications have added new dimensions in the manner of conducting business operations in this region. Many automobile manufacturers from the US such as Tesla, Ford, and Corvette enabling the rear headrest screen for passenger entertainment and multi utilities. The combination of IoT, Cloud Technology, and entertainment sets in the car can allow doing the various task from the back. Tesla Model X, 2, and S include an entertainment module at back without disturbing the design. The large customer base of such vehicles is used for family mobility vehicles which makes it ideal to install such entertainment systems. Therefore, rising demand from family-based customers is driving the Automotive Rear Seat Entertainment Market in North America.

Key Developments of Automotive Rear Seat Entertainment Market

- January 2022, BMW set to launch Theatre Screen with Amazon Fire TV built-in Theatre mode turns vehicle fund into cinema lounge with 31-inch ultra-wide display with resolution up to 8K.

- August 2021, for both the Flying Spur and the Bentayga, Bentley is adding a new rear-seat entertainment system. The newest linked technology is available with Bentley Rear Entertainment, which combines a highly adaptable system with class-leading Naim for Bentley audio.

- January 2021, Qualcomm's 4th Generation Snapdragon Automotive Cockpit Platforms revolutionize the digital cockpit. The latest generation of the Adreno GPU is optimized for high performance, low power graphics, video, and display processing units on 4th generation platforms, which can render multiple high-resolution displays and provide vehicle occupants with superior 3D graphic visualization to enjoy premium entertainment content across multiple displays.

Covid19 Impact on Automotive Rear Seat Entertainment Market

The COVID-19 epidemic has had a significant impact on the automobile industry's whole supply chain. Raw material providers were impacted by the production and logistical stop. The pandemic hampered the industry's overall development in 2020 and early 2021, as major automakers including Fiat, Volkswagen, PSA Group, General Motors, and BMW were forced to halt production. Because the expansion of the in-car entertainment system industry is strongly tied to vehicle manufacturing, this situation influenced the market, particularly in European and North American nations. According to the European Automobile Manufacturers Association, the pandemic had a significant influence on Europe's automobile sector. In 2020, the passenger automobile market in the area will have shrunk by 23.7 percent to 9.9 million units. This is a decrease of 3 million units from the previous year. Vehicle exports in Europe fell in 2020 as well, with the EU exporting passenger cars worth USD 130 billion from January to November last year, about USD 24.9 billion less than the previous year. The United States saw a 19 percent reduction in automobile production in 2020, somewhat more than the global average; it produced a total of 8,822,399 passenger cars and commercial vehicles. As lockdown restrictions are being put at ease, a gradual recovery is expected in the automotive market which can reflect on the growth of the Automotive Rear Seat Entertainment Market.

|

Global Automotive Rear Seat Entertainment Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 10.2 Bn. |

|

Forecast Period 2022-28 CAGR: |

11.2% |

Market Size in 2028: |

USD 21.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Operating System |

|

||

|

By Sales Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Operating System

3.3 By Sales Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Automotive Rear Seat Entertainment Market by Type

5.1 Automotive Rear Seat Entertainment Market Overview Snapshot and Growth Engine

5.2 Automotive Rear Seat Entertainment Market Overview

5.3 Infotainment/Display Unit

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Infotainment/Display Unit: Grographic Segmentation

5.4 Overhead Control Panel

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Overhead Control Panel: Grographic Segmentation

5.5 Telematics Control Unit

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Telematics Control Unit: Grographic Segmentation

5.6 Headrest Display

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Headrest Display: Grographic Segmentation

Chapter 6: Automotive Rear Seat Entertainment Market by Operating System

6.1 Automotive Rear Seat Entertainment Market Overview Snapshot and Growth Engine

6.2 Automotive Rear Seat Entertainment Market Overview

6.3 Android

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Android: Grographic Segmentation

6.4 Linux

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Linux: Grographic Segmentation

6.5 QNX

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 QNX: Grographic Segmentation

6.6 IOS

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 IOS: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Automotive Rear Seat Entertainment Market by Sales Channels

7.1 Automotive Rear Seat Entertainment Market Overview Snapshot and Growth Engine

7.2 Automotive Rear Seat Entertainment Market Overview

7.3 OEM

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 OEM: Grographic Segmentation

7.4 Aftermarket

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Aftermarket: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Automotive Rear Seat Entertainment Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Automotive Rear Seat Entertainment Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Automotive Rear Seat Entertainment Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 HARMAN INTERNATIONAL

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 PANASONIC CORPORATION

8.4 ALPS ALPINE CO LTD

8.5 ROBERT BOSCH GMBH

8.6 CONTINENTAL AG

8.7 JVC-KENWOOD

8.8 DELPHI

8.9 DENSO

8.10 ALPINE

8.11 PIONEER

8.12 OTHER MAJOR PLAYERS

Chapter 9: Global Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Infotainment/Display Unit

9.2.2 Overhead Control Panel

9.2.3 Telematics Control Unit

9.2.4 Headrest Display

9.3 Historic and Forecasted Market Size By Operating System

9.3.1 Android

9.3.2 Linux

9.3.3 QNX

9.3.4 IOS

9.3.5 Others

9.4 Historic and Forecasted Market Size By Sales Channels

9.4.1 OEM

9.4.2 Aftermarket

Chapter 10: North America Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Infotainment/Display Unit

10.4.2 Overhead Control Panel

10.4.3 Telematics Control Unit

10.4.4 Headrest Display

10.5 Historic and Forecasted Market Size By Operating System

10.5.1 Android

10.5.2 Linux

10.5.3 QNX

10.5.4 IOS

10.5.5 Others

10.6 Historic and Forecasted Market Size By Sales Channels

10.6.1 OEM

10.6.2 Aftermarket

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Infotainment/Display Unit

11.4.2 Overhead Control Panel

11.4.3 Telematics Control Unit

11.4.4 Headrest Display

11.5 Historic and Forecasted Market Size By Operating System

11.5.1 Android

11.5.2 Linux

11.5.3 QNX

11.5.4 IOS

11.5.5 Others

11.6 Historic and Forecasted Market Size By Sales Channels

11.6.1 OEM

11.6.2 Aftermarket

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Infotainment/Display Unit

12.4.2 Overhead Control Panel

12.4.3 Telematics Control Unit

12.4.4 Headrest Display

12.5 Historic and Forecasted Market Size By Operating System

12.5.1 Android

12.5.2 Linux

12.5.3 QNX

12.5.4 IOS

12.5.5 Others

12.6 Historic and Forecasted Market Size By Sales Channels

12.6.1 OEM

12.6.2 Aftermarket

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Infotainment/Display Unit

13.4.2 Overhead Control Panel

13.4.3 Telematics Control Unit

13.4.4 Headrest Display

13.5 Historic and Forecasted Market Size By Operating System

13.5.1 Android

13.5.2 Linux

13.5.3 QNX

13.5.4 IOS

13.5.5 Others

13.6 Historic and Forecasted Market Size By Sales Channels

13.6.1 OEM

13.6.2 Aftermarket

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Automotive Rear Seat Entertainment Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Infotainment/Display Unit

14.4.2 Overhead Control Panel

14.4.3 Telematics Control Unit

14.4.4 Headrest Display

14.5 Historic and Forecasted Market Size By Operating System

14.5.1 Android

14.5.2 Linux

14.5.3 QNX

14.5.4 IOS

14.5.5 Others

14.6 Historic and Forecasted Market Size By Sales Channels

14.6.1 OEM

14.6.2 Aftermarket

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Automotive Rear Seat Entertainment Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 10.2 Bn. |

|

Forecast Period 2022-28 CAGR: |

11.2% |

Market Size in 2028: |

USD 21.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Operating System |

|

||

|

By Sales Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET COMPETITIVE RIVALRY

TABLE 005. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET BY TYPE

TABLE 008. INFOTAINMENT/DISPLAY UNIT MARKET OVERVIEW (2016-2028)

TABLE 009. OVERHEAD CONTROL PANEL MARKET OVERVIEW (2016-2028)

TABLE 010. TELEMATICS CONTROL UNIT MARKET OVERVIEW (2016-2028)

TABLE 011. HEADREST DISPLAY MARKET OVERVIEW (2016-2028)

TABLE 012. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET BY OPERATING SYSTEM

TABLE 013. ANDROID MARKET OVERVIEW (2016-2028)

TABLE 014. LINUX MARKET OVERVIEW (2016-2028)

TABLE 015. QNX MARKET OVERVIEW (2016-2028)

TABLE 016. IOS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET BY SALES CHANNELS

TABLE 019. OEM MARKET OVERVIEW (2016-2028)

TABLE 020. AFTERMARKET MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY OPERATING SYSTEM (2016-2028)

TABLE 023. NORTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY SALES CHANNELS (2016-2028)

TABLE 024. N AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY OPERATING SYSTEM (2016-2028)

TABLE 027. EUROPE AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY SALES CHANNELS (2016-2028)

TABLE 028. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY OPERATING SYSTEM (2016-2028)

TABLE 031. ASIA PACIFIC AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY SALES CHANNELS (2016-2028)

TABLE 032. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY OPERATING SYSTEM (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY SALES CHANNELS (2016-2028)

TABLE 036. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY OPERATING SYSTEM (2016-2028)

TABLE 039. SOUTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY SALES CHANNELS (2016-2028)

TABLE 040. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET, BY COUNTRY (2016-2028)

TABLE 041. HARMAN INTERNATIONAL: SNAPSHOT

TABLE 042. HARMAN INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 043. HARMAN INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 044. HARMAN INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. PANASONIC CORPORATION: SNAPSHOT

TABLE 045. PANASONIC CORPORATION: BUSINESS PERFORMANCE

TABLE 046. PANASONIC CORPORATION: PRODUCT PORTFOLIO

TABLE 047. PANASONIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ALPS ALPINE CO LTD: SNAPSHOT

TABLE 048. ALPS ALPINE CO LTD: BUSINESS PERFORMANCE

TABLE 049. ALPS ALPINE CO LTD: PRODUCT PORTFOLIO

TABLE 050. ALPS ALPINE CO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 051. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 052. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 053. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CONTINENTAL AG: SNAPSHOT

TABLE 054. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 055. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 056. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. JVC-KENWOOD: SNAPSHOT

TABLE 057. JVC-KENWOOD: BUSINESS PERFORMANCE

TABLE 058. JVC-KENWOOD: PRODUCT PORTFOLIO

TABLE 059. JVC-KENWOOD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. DELPHI: SNAPSHOT

TABLE 060. DELPHI: BUSINESS PERFORMANCE

TABLE 061. DELPHI: PRODUCT PORTFOLIO

TABLE 062. DELPHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DENSO: SNAPSHOT

TABLE 063. DENSO: BUSINESS PERFORMANCE

TABLE 064. DENSO: PRODUCT PORTFOLIO

TABLE 065. DENSO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ALPINE: SNAPSHOT

TABLE 066. ALPINE: BUSINESS PERFORMANCE

TABLE 067. ALPINE: PRODUCT PORTFOLIO

TABLE 068. ALPINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PIONEER: SNAPSHOT

TABLE 069. PIONEER: BUSINESS PERFORMANCE

TABLE 070. PIONEER: PRODUCT PORTFOLIO

TABLE 071. PIONEER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY TYPE

FIGURE 012. INFOTAINMENT/DISPLAY UNIT MARKET OVERVIEW (2016-2028)

FIGURE 013. OVERHEAD CONTROL PANEL MARKET OVERVIEW (2016-2028)

FIGURE 014. TELEMATICS CONTROL UNIT MARKET OVERVIEW (2016-2028)

FIGURE 015. HEADREST DISPLAY MARKET OVERVIEW (2016-2028)

FIGURE 016. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY OPERATING SYSTEM

FIGURE 017. ANDROID MARKET OVERVIEW (2016-2028)

FIGURE 018. LINUX MARKET OVERVIEW (2016-2028)

FIGURE 019. QNX MARKET OVERVIEW (2016-2028)

FIGURE 020. IOS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY SALES CHANNELS

FIGURE 023. OEM MARKET OVERVIEW (2016-2028)

FIGURE 024. AFTERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA AUTOMOTIVE REAR SEAT ENTERTAINMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Automotive Rear Seat Entertainment Market research report is 2022-2028.

Harman International, Panasonic Corporation, Alps Alpine Co Ltd, Robert Bosch GmbH, Continental AG, JVC-Kenwood, Delphi, Denso, Alpine, Pioneer, and Other Major Players.

Automotive Rear Seat Entertainment Market is segmented into Type, Operating System, Sales Channels and region. By Type, the market is categorized into Infotainment/Display Unit, Overhead Control Panel, Telematics Control Unit, and Headrest Display. By Operating System, the market is categorized into Android, Linux, QNX, IOS, Others. By Sales Channels, the market is categorized into OEM, Aftermarket. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Automotive Rear Seat Entertainment systems act as a differentiation tool and are scheduled to extend the trend in mid-segment cars. The wide application of this system includes entertainment, location-based services, navigational services (GPS), internet (games, sports scores, surfing, social networking, movies, traffic conditions, weather forecast, etc.), communication functions such as making and receiving calls via smartphone integration and value-added services.

Global Automotive Rear Seat Entertainment Market was valued at USD 10.2 Billion in 2021 and is expected to reach USD 21.45 Billion by the year 2028, at a CAGR of 11.2%.