Global Automotive Keyless Entry System Market Overview

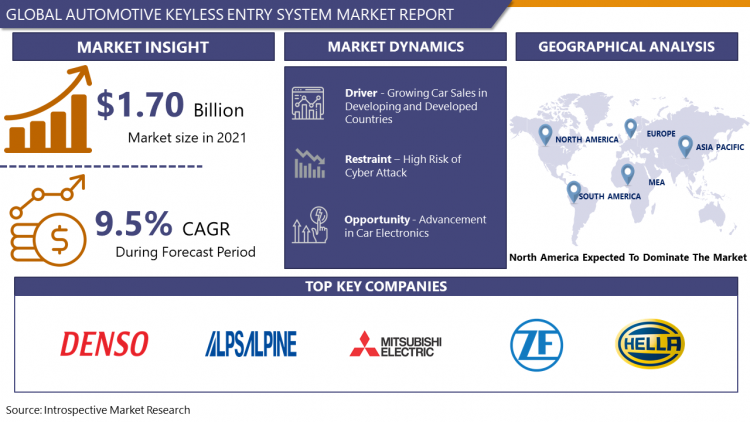

Global Automotive Keyless Entry System Market was valued at USD 1.70 Billion in 2021 and is expected to reach USD 3.21 Billion by the year 2028, at a CAGR of 9.5%.

The automobile keyless access system is an electronic lock that allows a vehicle's owner to obtain physical entry and unlock and lock the car without the need for a traditional mechanical key. The automotive keyless entry system secures access to the car by employing biometric scanning, electronic locks, radio frequency identification locks, and Bluetooth unlocking systems. The most popular method for gaining keyless entry into a car is to send a radio frequency signal from a distant transmitter to a control module/receiver in the vehicle. This radio frequency signal, or RF for short, is transferred to the automobile as an encrypted data stream. Furthermore, the global vehicle keyless access system business, particularly in Germany and the United States, is quickly expanding. Furthermore, rising vehicle sales in developing economies, the convenience of keyless entry systems, and increasing regulatory regulations focusing on vehicular safety are expected to drive demand for automotive keyless access systems throughout the projected period.

Market Dynamics and Factors:

Drivers

Growing car sales in developing and developed countries.

Growing car sales, as well as rising safety and security concerns, particularly in emerging nations, are the primary drivers of market expansion. Advanced applications for the keyless entry control system include safety features such as opening the tailgate, front and rear seat settings, tire pressure monitoring systems, automobile alarms, light control, and multimedia file storage. Additionally, strict automobile safety requirements such as the Canadian Motor Vehicle Safety Standards, the Bharat New Car Assessment Program (BNCAP), and the Federal Motor Vehicle Safety Standards are in place (FMVSS). As a result, the use of automotive keyless vehicle entry systems is predicted to increase, supporting market growth over the forecast period.

Rising installation of keyless entry systems in commercial vehicles.

The rising advancement in add-on technological features in commercial vehicles boosting the automotive keyless entry system market. The need for keyless entry systems in goods transport vehicles, as well as supply chain trucks and vans, provide a promising application. Many commercial vehicles are now installing keyless entry systems in the vehicle to easy and quick access while delivering the goods and services. Therefore, it is estimated to be boosting the automotive keyless entry system market.

Restraints

Over the last two decades, passenger automobiles and commercial vehicles have evolved from mechanical to electronically controlled machines. The data transfer between these keyless entry devices and the car is often powered by an RF or Bluetooth signal, which raises the danger of cyberattack. Furthermore, the customer finds it difficult to adjust to the keyless access system, and the cost of repair and maintenance is quite expensive; all of these primary concerns function as market restrictions.

Opportunities

With the advancement of car electronics, manufacturers were able to build the contemporary ignition system and convert it to a push-button system. This system is linked to an ignition system that uses signals from the key fob to turn on the car. Over the predicted period, such high-end systems will change the automobile sector. Keyless entry access systems are being significantly invested in by major automotive manufacturers. Many automotive manufacturers are introducing new models, as well as updated versions of existing ones, that have keyless entry access system technology. Renault, for example, introduced a new version of the Duster featuring keyless entry technology in March 2020. The remote engine start feature also allows activating the air conditioning before getting inside the car. Kia and Hyundai, two South Korean automakers, are investing in research and development for the Keyless Entry Access System. Kia introduced the Carnival with a keyless entry system in February 2020, while Hyundai introduced a new version of the Creta with a keyless entry system in March 2020.

Challenges

Although a keyless entry system provides convenience to owners of the vehicles to access the vehicles remotely, a certain challenging factor can affect the market adversely. The repair and replacement costs are relatively higher as the chips and sensors involved in the system are not cost-efficient at all. The biggest hurdle to getting keyless entry and starting with the vehicle is the pricing. If the keyless entry doesn't come with most of the vehicle, the aftermarket kit has to install special modules into the vehicle to enable the feature. The replacement can get pricey as well due to the unique nature of the transponder codes. Reprogramming a key fob is much pricier than re-cutting and re-coding a key.

Market Segmentation

By Product, Remote Keyless Entry Systems dominate the Automotive Keyless Entry System Market. Because of greater security, better access control, and high convenience, the RKES category dominates the market. End-users prefer it, and it's found in a wide range of automobiles, including budget and premium vehicles. Remote keyless entry is a car security access solution that uses digital keys stored on a mobile phone to operate. The app allows the user to access the car and start the engine. Passive keyless entry is an automobile security system that activates and unlocks the vehicle doors when a user with a key approaches the system's operation region around the vehicle. It also allows the start of a vehicle with only a push of a button and without having to be put into the vehicle. In addition, the segment's growth will be fueled by its lower cost than PKES and greater functionality over standard keys throughout the projection period.

By Application, Passenger cars are dominating in the application segment of the Automotive Keyless Entry System Market. The keyless entry feature in the passenger vehicle is a value-adding feature which allow allows convenience to the owner of the vehicle. Most of the brand's premium includes the keyless entry system. Rising automation in the passenger vehicles lures in the larger potential customers which demands the extra specifications and value-adding technologies in the car. Therefore, the automobile manufacturer is constantly investing in developing such technology which can add technological competitiveness to the market. A growing number of automobile owners can also boost the aftermarket automotive keyless entry systems.

Players Covered in Automotive Keyless Entry System market are :

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Continental AG

- ALPS ALPINE CO. LTD

- Mitsubishi Electric Corporation

- Valeo S.A

- Microchip Technology Inc

- Robert Bosch GmbH

- NXP Semiconductors and others major layers.

Regional Analysis of Automotive Keyless Entry System Market

North America is dominating the Automotive Keyless Entry System Market. Because of growing purchasing power parity (PPP), greater involvement of the area's main automotive businesses, and suitable technical infrastructure, the North American region generates higher demand for vehicle keyless entry systems. The OEMs and aftermarket options are equally adopted customers, especially in the United States and Canada. Furthermore, the United States, Mexico, and Canada account for the majority of the market's income. Furthermore, rising internet penetration and an increase in the number of smartphone users are propelling the automobile sector forward, further boosting market expansion.

Due to the implementation of severe safety requirements, rising penetration of expensive automobiles, and key companies such as Mitsubishi Electric, Continental AG, Alps Automotive Inc., and Denso Corporation, Asia Pacific is likely to emerge as the most profitable regional market. Over the projection period, rising markets such as India, Japan, South Korea, and China will fuel market expansion. Furthermore, with a CAGR of 12.4% between 2021 and 2028, Europe is predicted to become the second-fastest-growing industry in terms of growth. Furthermore, modern car safety features like intrusion alarms, theft assist, keyless entry, and others are being adopted by nations in the Rest of the World (RoW), which is fuelling the market's growth.

Key Developments of Automotive Keyless Entry System Market

- June 2021, HELLA launches digital car key with ultra-wideband technology, this new technology offers the greatest possible convenience using completely hands-free, smartphone-based vehicle access with the highest safety.

- March 2020, Secure Car Access Across Key Fobs, Smartphones, Smart Cards, and Other Mobile Devices with NXP Digital Key Solution. The solution improves automobile access ease by providing the safe foundation needed to allow additional features such as key sharing, multi-car access, and adjustable driving permissions.

Covid19 Impact on Automotive Keyless Entry System Market

The coronavirus pandemic forced countries into a brief state of lockdown, which hindered various industries and enterprises on a significant scale. The automobile sector is facing several issues, including a labor shortage and even supply chain disruptions. Furthermore, this has impacted the supply chain of global automakers, particularly those who rely on China for manufactured goods, components, or raw materials. Thus, the majority of the automotive manufacturers were pushed to work on limited capacity due to reduced demand from the passenger vehicle in the domestic sector. The majority of lower and medium-priced segment vehicles include a basic keyless entry system and for that segment the customer base is large. Due to lockdown and closed businesses, demand for vehicles from the general population has reduced significantly which directly reflected on the automotive keyless entry system market. On the other hand, the new norm of not touching surfaces may have a minor influence on market growth shortly.

|

Global Automotive Keyless Entry System Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.70 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.5% |

Market Size in 2028: |

USD 3.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Automotive Keyless Entry System Market by Type

5.1 Automotive Keyless Entry System Market Overview Snapshot and Growth Engine

5.2 Automotive Keyless Entry System Market Overview

5.3 Passive Keyless Entry Systems

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passive Keyless Entry Systems: Grographic Segmentation

5.4 Remote Keyless Entry Systems Fast

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Remote Keyless Entry Systems Fast: Grographic Segmentation

Chapter 6: Automotive Keyless Entry System Market by Application

6.1 Automotive Keyless Entry System Market Overview Snapshot and Growth Engine

6.2 Automotive Keyless Entry System Market Overview

6.3 Passenger Cars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Passenger Cars: Grographic Segmentation

6.4 Commercial Vehicles

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial Vehicles: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Automotive Keyless Entry System Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Automotive Keyless Entry System Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Automotive Keyless Entry System Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 DENSO CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 HELLA GMBH & CO. KGAA

7.4 ZF FRIEDRICHSHAFEN AG

7.5 CONTINENTAL AG

7.6 ALPS ALPINE CO. LTD

7.7 MITSUBISHI ELECTRIC CORPORATION

7.8 VALEO S.A

7.9 MICROCHIP TECHNOLOGY INC.

7.10 ROBERT BOSCH GMBH

7.11 NXP SEMICONDUCTORS

7.12 OTHER MAJOR LAYERS

Chapter 8: Global Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Passive Keyless Entry Systems

8.2.2 Remote Keyless Entry Systems Fast

8.3 Historic and Forecasted Market Size By Application

8.3.1 Passenger Cars

8.3.2 Commercial Vehicles

Chapter 9: North America Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Passive Keyless Entry Systems

9.4.2 Remote Keyless Entry Systems Fast

9.5 Historic and Forecasted Market Size By Application

9.5.1 Passenger Cars

9.5.2 Commercial Vehicles

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Passive Keyless Entry Systems

10.4.2 Remote Keyless Entry Systems Fast

10.5 Historic and Forecasted Market Size By Application

10.5.1 Passenger Cars

10.5.2 Commercial Vehicles

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Passive Keyless Entry Systems

11.4.2 Remote Keyless Entry Systems Fast

11.5 Historic and Forecasted Market Size By Application

11.5.1 Passenger Cars

11.5.2 Commercial Vehicles

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Passive Keyless Entry Systems

12.4.2 Remote Keyless Entry Systems Fast

12.5 Historic and Forecasted Market Size By Application

12.5.1 Passenger Cars

12.5.2 Commercial Vehicles

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Automotive Keyless Entry System Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Passive Keyless Entry Systems

13.4.2 Remote Keyless Entry Systems Fast

13.5 Historic and Forecasted Market Size By Application

13.5.1 Passenger Cars

13.5.2 Commercial Vehicles

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Automotive Keyless Entry System Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.70 Bn. |

|

Forecast Period 2022-28 CAGR: |

9.5% |

Market Size in 2028: |

USD 3.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET BY TYPE

TABLE 008. PASSIVE KEYLESS ENTRY SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 009. REMOTE KEYLESS ENTRY SYSTEMS FAST MARKET OVERVIEW (2016-2028)

TABLE 010. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET BY APPLICATION

TABLE 011. PASSENGER CARS MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 015. N AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 018. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 021. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 024. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 027. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 028. DENSO CORPORATION: SNAPSHOT

TABLE 029. DENSO CORPORATION: BUSINESS PERFORMANCE

TABLE 030. DENSO CORPORATION: PRODUCT PORTFOLIO

TABLE 031. DENSO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. HELLA GMBH & CO. KGAA: SNAPSHOT

TABLE 032. HELLA GMBH & CO. KGAA: BUSINESS PERFORMANCE

TABLE 033. HELLA GMBH & CO. KGAA: PRODUCT PORTFOLIO

TABLE 034. HELLA GMBH & CO. KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. ZF FRIEDRICHSHAFEN AG: SNAPSHOT

TABLE 035. ZF FRIEDRICHSHAFEN AG: BUSINESS PERFORMANCE

TABLE 036. ZF FRIEDRICHSHAFEN AG: PRODUCT PORTFOLIO

TABLE 037. ZF FRIEDRICHSHAFEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. CONTINENTAL AG: SNAPSHOT

TABLE 038. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 039. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 040. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ALPS ALPINE CO. LTD: SNAPSHOT

TABLE 041. ALPS ALPINE CO. LTD: BUSINESS PERFORMANCE

TABLE 042. ALPS ALPINE CO. LTD: PRODUCT PORTFOLIO

TABLE 043. ALPS ALPINE CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MITSUBISHI ELECTRIC CORPORATION: SNAPSHOT

TABLE 044. MITSUBISHI ELECTRIC CORPORATION: BUSINESS PERFORMANCE

TABLE 045. MITSUBISHI ELECTRIC CORPORATION: PRODUCT PORTFOLIO

TABLE 046. MITSUBISHI ELECTRIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. VALEO S.A: SNAPSHOT

TABLE 047. VALEO S.A: BUSINESS PERFORMANCE

TABLE 048. VALEO S.A: PRODUCT PORTFOLIO

TABLE 049. VALEO S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. MICROCHIP TECHNOLOGY INC.: SNAPSHOT

TABLE 050. MICROCHIP TECHNOLOGY INC.: BUSINESS PERFORMANCE

TABLE 051. MICROCHIP TECHNOLOGY INC.: PRODUCT PORTFOLIO

TABLE 052. MICROCHIP TECHNOLOGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 053. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 054. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 055. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. NXP SEMICONDUCTORS: SNAPSHOT

TABLE 056. NXP SEMICONDUCTORS: BUSINESS PERFORMANCE

TABLE 057. NXP SEMICONDUCTORS: PRODUCT PORTFOLIO

TABLE 058. NXP SEMICONDUCTORS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. OTHER MAJOR LAYERS: SNAPSHOT

TABLE 059. OTHER MAJOR LAYERS: BUSINESS PERFORMANCE

TABLE 060. OTHER MAJOR LAYERS: PRODUCT PORTFOLIO

TABLE 061. OTHER MAJOR LAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. PASSIVE KEYLESS ENTRY SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 013. REMOTE KEYLESS ENTRY SYSTEMS FAST MARKET OVERVIEW (2016-2028)

FIGURE 014. AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 015. PASSENGER CARS MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA AUTOMOTIVE KEYLESS ENTRY SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Automotive Keyless Entry System Market research report is 2022-2028.

DENSO CORPORATION, HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG, Continental AG, ALPS ALPINE CO. LTD, Mitsubishi Electric Corporation, Valeo S.A, Microchip Technology Inc, Robert Bosch GmbH, NXP Semiconductors, and Other Major Players.

Automotive Keyless Entry System Market is segmented into Type, Application, and region. By Type, the market is categorized into Passive Keyless Entry Systems, Remote Keyless Entry Systems Fast. By Application, the market is categorized into Passenger Cars, Commercial Vehicles. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The automobile keyless access system is an electronic lock that allows a vehicle's owner to obtain physical entry and unlock and lock the car without the need for a traditional mechanical key. The automotive keyless entry system secures access to the car by employing biometric scanning, electronic locks, radio frequency identification locks, and Bluetooth unlocking systems.

Global Automotive Keyless Entry System Market was valued at USD 1.70 Billion in 2021 and is expected to reach USD 3.21 Billion by the year 2028, at a CAGR of 9.5%.