Ascites Market Synopsis

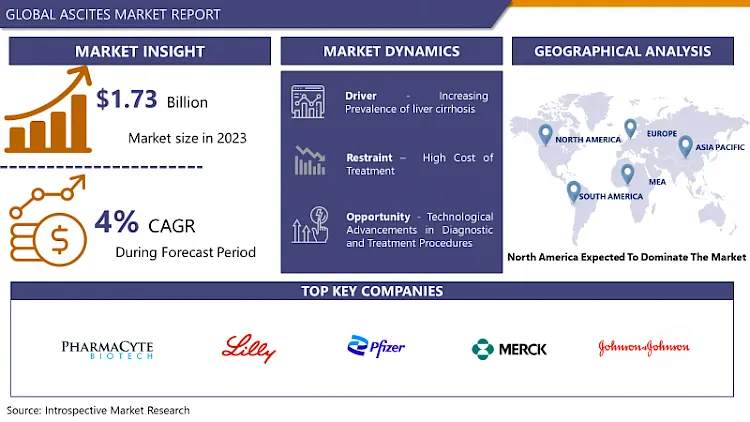

Ascites Market Size Was Valued at USD 1.73 Billion in 2023 and is Projected to Reach USD 2.46 Billion by 2032, Growing at a CAGR of 4% From 2024-2032.

The ascites market refers to the healthcare sector that addresses the diagnosis, treatment, and management of ascites, a condition characterized by the accumulation of fluid in the abdominal cavity.

This market includes pharmaceuticals, medical devices, and diagnostic tools aimed at alleviating the symptoms and underlying causes of ascites, often associated with liver cirrhosis, heart failure, or cancer. It is a critical area of focus for healthcare providers and pharmaceutical companies, as ascites can lead to serious complications and significantly impact patients' quality of life. Ongoing research and innovation continue to drive advancements in ascites management.

The global ascites market was witnessing growth due to the rising prevalence of conditions that can lead to ascites, including liver cirrhosis, heart failure, and certain cancers. Liver cirrhosis, often associated with excessive alcohol consumption and viral hepatitis, remains a significant contributor to ascites cases worldwide. With changing lifestyles and a global increase in obesity and alcohol consumption, the incidence of liver cirrhosis and, subsequently, ascites, was on the rise. This growing patient pool was a key driver for pharmaceutical companies and healthcare providers to invest in research, diagnosis, and treatment options for ascites.

The ascites market was benefiting from continuous technological advancements in diagnostic and therapeutic tools. Innovations in imaging techniques, such as ultrasound and MRI, were improving the early detection and monitoring of ascites. Moreover, minimally invasive procedures for ascites management, like paracentesis and trans jugular intrahepatic portosystemic shunt (TIPS), were becoming more efficient and safer for patients. These technological developments enhanced patient outcomes and led to a surge in the adoption of these methods, fostering market growth.

The aging global population, particularly in developed countries, was contributing to the growth of the ascites market. As people age, they become more susceptible to the conditions that cause ascites, such as cirrhosis and heart failure. Furthermore, improvements in healthcare infrastructure in emerging economies were increasing access to ascites diagnosis and treatment options.

Ascites Market Trend Analysis

Ascites Market Trend Analysis

Increasing Prevalence of Liver Cirrhosis

- Excessive alcohol consumption remains a primary contributor to the rising prevalence of liver cirrhosis. Chronic alcohol abuse can lead to alcoholic liver cirrhosis, which is characterized by the scarring of liver tissue. The global expansion of alcohol availability and changing drinking patterns have led to an increase in alcohol-related liver diseases. Additionally, unhealthy lifestyles marked by poor dietary choices, sedentary habits, and obesity have contributed to non-alcoholic fatty liver disease (NAFLD), which can progress to cirrhosis over time. The rise in these risk factors has driven the surge in cirrhosis cases.

- Chronic viral infections, particularly hepatitis B and hepatitis C, are significant factors in the increasing prevalence of liver cirrhosis. These viruses can cause persistent liver inflammation, leading to cirrhosis if left untreated. Despite efforts to control and vaccinate against hepatitis, many individuals worldwide remain unaware of their infection status, which allows the viruses to progress and contribute to the growing burden of cirrhosis cases.

- The aging population is another critical driver of the rising prevalence of liver cirrhosis. As people age, their liver function tends to decline, making them more susceptible to liver diseases. Individuals who may have engaged in risky behaviors earlier in life (such as heavy alcohol consumption) may develop cirrhosis as they age. With the global demographic shift toward an older population, there is an increased number of individuals at risk for liver cirrhosis, further exacerbating its prevalence.

Technological Advancements in Diagnostic and Treatment Procedures

- Technological innovations have led to more accurate and non-invasive diagnostic methods, such as advanced imaging techniques and biomarker analysis. Early detection of ascites allows for timely intervention and management, reducing the progression of the underlying conditions and improving patient outcomes. This presents an opportunity to enhance patient care and potentially reduce the economic burden of advanced disease management.

- Modern technology allows for a more personalized approach to treatment. The ability to precisely identify the cause and severity of ascites enables healthcare providers to tailor interventions to individual patient needs. Whether it's paracentesis, drug therapies, or surgical procedures, customization based on diagnostic insights can optimize the effectiveness of treatment, minimize side effects, and improve patient quality of life.

- Advancements in diagnostic and treatment procedures attract increased interest and investment from pharmaceutical companies, medical device manufacturers, and healthcare providers. This, in turn, fosters innovation and competition within the ascites market. As new technologies and therapies emerge, there is a potential for expanded market offerings, creating opportunities for companies to gain a competitive edge and contribute to improved patient care.

According to Statista Above Graph Shows That Medical Technology Is Growing, which directly contributes to the expansion of the ascites market. Advances in medical technology lead to more effective diagnostic tools, treatment options, and patient care within the ascites field, fostering its growth by improving early detection, treatment outcomes, and overall market innovation.

Ascites Market Segment Analysis:

Ascites Market Segmented on the basis of type, Diagnosis, Treatment, End-users, and Distribution Channel.

Transudative segment is expected to dominate the market during the forecast period

- The term "Transudative" refers to a specific type of fluid accumulation in the abdominal cavity known as ascites. Transudative ascites are characterized by the presence of clear, straw-colored fluid within the abdominal cavity. This type of ascites is primarily caused by non-inflammatory conditions, often related to systemic issues such as liver cirrhosis, heart failure, or hypoalbuminemia. The underlying mechanism behind transudative ascites is an imbalance in fluid and protein distribution in the body, leading to the accumulation of this clear fluid in the peritoneal cavity.

- The prevalence and management of transudative ascites is crucial for healthcare providers and pharmaceutical companies. Treatments and therapies for transudative ascites are often directed at addressing the root causes, such as managing liver disease or heart conditions.

Hospitals and Clinics segment held the largest share of 55% in 2022

- Hospitals and clinics are the primary healthcare institutions where patients suffering from ascites seek medical attention and treatment. Ascites are often a symptom of an underlying medical condition, such as liver cirrhosis or heart failure, which requires specialized medical care and diagnosis. Hospitals and clinics are equipped with state-of-the-art diagnostic facilities, medical professionals, and specialized departments, such as gastroenterology and hepatology, which are crucial for diagnosing and managing ascites effectively.

- The prevalence of ascites is often associated with chronic diseases, particularly liver diseases, and the aging population. As the global population continues to age and the incidence of chronic diseases rises, the demand for ascites-related healthcare services is also on the rise. Hospitals and clinics are well-equipped to handle the complex needs of patients with ascites, as they can provide integrated care through a multidisciplinary approach involving specialists in various fields.

Ascites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The region has a high prevalence of liver cirrhosis, which is one of the major underlying causes of ascites. Liver cirrhosis is often a consequence of chronic alcohol consumption and various liver diseases, and it can lead to the accumulation of fluid in the abdominal cavity, resulting in ascites. The lifestyle and dietary habits in North America have contributed to a higher incidence of liver cirrhosis, necessitating the need for diagnosis and management of ascites. This high prevalence of cirrhosis acts as a driver for the ascites market in the region, as healthcare providers and patients seek effective diagnostic and treatment solutions to manage this condition.

- North America's ascites market benefits from the presence of key market players and research institutions. The region is home to a robust healthcare and pharmaceutical industry with advanced research and development capabilities. This facilitates the development of innovative diagnostic tools, therapies, and medications for ascites management. The collaboration between research institutions and healthcare companies allows for the creation of cutting-edge technologies and treatment options, further enhancing the ascites market's growth.

- The increasing adoption of advanced diagnostic and treatment procedures in North America is contributing significantly to the market's expansion. As the healthcare landscape evolves, patients and healthcare providers are increasingly embracing advanced diagnostic techniques and treatment modalities for ascites. These include advanced imaging technologies, minimally invasive procedures, and novel medications that improve the accuracy of diagnosis and the effectiveness of treatment. The patient population in North America is often well-informed and proactive in seeking the latest medical innovations, further boosting the ascites market by driving the demand for these advanced solutions.

Ascites Market Top Key Players:

- PharmaCyte Biotech(USA)

- Eli Lilly and Company (USA)

- Pfizer (USA)

- Merck (USA)

- BioVie – USA

- Johnson & Johnson Private Limited (USA)

- BD (Becton, Dickinson and Company) (USA)

- GI Supply (USA)

- Mylan (USA)

- GE (General Electric) (USA)

- Boston Scientific (USA)

- Gilead Sciences Inc. (USA)

- Cook Medical (USA)

- Medtronic (USA)

- Baxter International (USA)

- Fresenius Medical Care (Germany)

- Bayer (Germany)

- B. Braun (Germany)

- Diaverum (Sweden)

- Vifor Pharma (Switzerland)

- Sequana Medical (Switzerland)

- Nikkiso (Japan)

- Otsuka Pharmaceutical (Japan)

- Asahi Kasei (Japan)

- Teva Pharmaceutical Industries (Israel)

- Trion Pharma (Turkey)

Key Industry Developments in the Ascites Market:

- In January 2024, Sequana Medical NV, a pioneer in fluid overload treatment for liver disease, heart failure, and cancer, announced the US FDA's acceptance of the Premarket Approval (PMA) application for its alfapump. This fully implantable, wirelessly charged device addresses recurrent or refractory ascites due to liver cirrhosis and received breakthrough device designation in 2019. The FDA's substantive review marks a significant milestone for Sequana Medical in advancing innovative healthcare solutions.

- In March 2022, Gilead Sciences announced that it had acquired Principia Biopharma, a company developing a new ascites treatment. The resources and expertise of Gilead Sciences are anticipated to expedite the treatment's introduction to the market, giving promise to patients suffering from this challenging condition.

- In September 2021, Johnson & Johnson announced a partnership with Arbutus Biopharma to develop and commercialize an ascites drug candidate. The agreement combines the assets of both companies, and it is anticipated that the partnership will result in significant market advancements.

|

Ascites Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.73 Bn. |

|

|

CAGR (2024-2032): |

4 % |

Market Size in 2032: |

USD 2.46 Bn. |

|

|

Segments Covered: |

by Type |

|

|

|

|

by Diagnosis |

|

|

||

|

by Treatment |

|

|

||

|

by End Users |

|

|

||

|

by Distribution Channel |

|

|

||

|

by Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ascites Market by Type (2018-2032)

4.1 Ascites Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transudative

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Exudative

Chapter 5: Ascites Market by Diagnosis (2018-2032)

5.1 Ascites Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ultrasound

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 CT Scan

5.5 MRI

5.6 Blood Test

5.7 Laparoscopy

5.8 Angiography

Chapter 6: Ascites Market by Treatment (2018-2032)

6.1 Ascites Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Medication

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Paracentesis

6.5 Surgery

Chapter 7: Ascites Market by End Users (2018-2032)

7.1 Ascites Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals and Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Homecare

7.5 Specialty Clinics

Chapter 8: Ascites Market by Distribution Channel (2018-2032)

8.1 Ascites Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospital Pharmacy

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retail Pharmacy

8.5 Online Pharmacies

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Ascites Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SMILEDIRECTCLUB (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DENTULU (US)

9.4 DENTALCHAT (US)

9.5 TELEDENTISTS (US)

9.6 THE TELEDENTISTS (US)

9.7 PATTERSON COMPANIES INC. (US)

9.8 HEALTHTAP (US)

9.9 ORTHOLIVE (US)

9.10 BEAM DENTAL (US)

9.11 DENTISTS ON DEMAND (US)

9.12 VIRTUAL DENTAL CARE (US)

9.13 ASTEETH (US)

9.14 TELEDENTISTRY.COM (US)

9.15 WALLY HEALTH (US)

9.16 TELADENT (US)

9.17 PROSOMNUS SLEEP TECHNOLOGIES (US)

9.18 SPEEDCONNECT (US)

9.19 HELLO TELEDENTISTRY (US)

9.20 DENTERACTIVE SOLUTIONS (US)

9.21 URGENTDENT (US)

9.22 ORALEYE (CANADA)

9.23 NET32 INC. (US)

9.24 TELEDENTISTRY SOLUTIONS (US)

9.25 AEROHEALTH (US)

9.26 VIVIDOCTOR (BELGIUM)

Chapter 10: Global Ascites Market By Region

10.1 Overview

10.2. North America Ascites Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Transudative

10.2.4.2 Exudative

10.2.5 Historic and Forecasted Market Size by Diagnosis

10.2.5.1 Ultrasound

10.2.5.2 CT Scan

10.2.5.3 MRI

10.2.5.4 Blood Test

10.2.5.5 Laparoscopy

10.2.5.6 Angiography

10.2.6 Historic and Forecasted Market Size by Treatment

10.2.6.1 Medication

10.2.6.2 Paracentesis

10.2.6.3 Surgery

10.2.7 Historic and Forecasted Market Size by End Users

10.2.7.1 Hospitals and Clinics

10.2.7.2 Homecare

10.2.7.3 Specialty Clinics

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Hospital Pharmacy

10.2.8.2 Retail Pharmacy

10.2.8.3 Online Pharmacies

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Ascites Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Transudative

10.3.4.2 Exudative

10.3.5 Historic and Forecasted Market Size by Diagnosis

10.3.5.1 Ultrasound

10.3.5.2 CT Scan

10.3.5.3 MRI

10.3.5.4 Blood Test

10.3.5.5 Laparoscopy

10.3.5.6 Angiography

10.3.6 Historic and Forecasted Market Size by Treatment

10.3.6.1 Medication

10.3.6.2 Paracentesis

10.3.6.3 Surgery

10.3.7 Historic and Forecasted Market Size by End Users

10.3.7.1 Hospitals and Clinics

10.3.7.2 Homecare

10.3.7.3 Specialty Clinics

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Hospital Pharmacy

10.3.8.2 Retail Pharmacy

10.3.8.3 Online Pharmacies

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Ascites Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Transudative

10.4.4.2 Exudative

10.4.5 Historic and Forecasted Market Size by Diagnosis

10.4.5.1 Ultrasound

10.4.5.2 CT Scan

10.4.5.3 MRI

10.4.5.4 Blood Test

10.4.5.5 Laparoscopy

10.4.5.6 Angiography

10.4.6 Historic and Forecasted Market Size by Treatment

10.4.6.1 Medication

10.4.6.2 Paracentesis

10.4.6.3 Surgery

10.4.7 Historic and Forecasted Market Size by End Users

10.4.7.1 Hospitals and Clinics

10.4.7.2 Homecare

10.4.7.3 Specialty Clinics

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Hospital Pharmacy

10.4.8.2 Retail Pharmacy

10.4.8.3 Online Pharmacies

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Ascites Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Transudative

10.5.4.2 Exudative

10.5.5 Historic and Forecasted Market Size by Diagnosis

10.5.5.1 Ultrasound

10.5.5.2 CT Scan

10.5.5.3 MRI

10.5.5.4 Blood Test

10.5.5.5 Laparoscopy

10.5.5.6 Angiography

10.5.6 Historic and Forecasted Market Size by Treatment

10.5.6.1 Medication

10.5.6.2 Paracentesis

10.5.6.3 Surgery

10.5.7 Historic and Forecasted Market Size by End Users

10.5.7.1 Hospitals and Clinics

10.5.7.2 Homecare

10.5.7.3 Specialty Clinics

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Hospital Pharmacy

10.5.8.2 Retail Pharmacy

10.5.8.3 Online Pharmacies

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Ascites Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Transudative

10.6.4.2 Exudative

10.6.5 Historic and Forecasted Market Size by Diagnosis

10.6.5.1 Ultrasound

10.6.5.2 CT Scan

10.6.5.3 MRI

10.6.5.4 Blood Test

10.6.5.5 Laparoscopy

10.6.5.6 Angiography

10.6.6 Historic and Forecasted Market Size by Treatment

10.6.6.1 Medication

10.6.6.2 Paracentesis

10.6.6.3 Surgery

10.6.7 Historic and Forecasted Market Size by End Users

10.6.7.1 Hospitals and Clinics

10.6.7.2 Homecare

10.6.7.3 Specialty Clinics

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Hospital Pharmacy

10.6.8.2 Retail Pharmacy

10.6.8.3 Online Pharmacies

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Ascites Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Transudative

10.7.4.2 Exudative

10.7.5 Historic and Forecasted Market Size by Diagnosis

10.7.5.1 Ultrasound

10.7.5.2 CT Scan

10.7.5.3 MRI

10.7.5.4 Blood Test

10.7.5.5 Laparoscopy

10.7.5.6 Angiography

10.7.6 Historic and Forecasted Market Size by Treatment

10.7.6.1 Medication

10.7.6.2 Paracentesis

10.7.6.3 Surgery

10.7.7 Historic and Forecasted Market Size by End Users

10.7.7.1 Hospitals and Clinics

10.7.7.2 Homecare

10.7.7.3 Specialty Clinics

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Hospital Pharmacy

10.7.8.2 Retail Pharmacy

10.7.8.3 Online Pharmacies

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Ascites Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.73 Bn. |

|

|

CAGR (2024-2032): |

4 % |

Market Size in 2032: |

USD 2.46 Bn. |

|

|

Segments Covered: |

by Type |

|

|

|

|

by Diagnosis |

|

|

||

|

by Treatment |

|

|

||

|

by End Users |

|

|

||

|

by Distribution Channel |

|

|

||

|

by Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||