Arthritis Therapeutic Market Synopsis

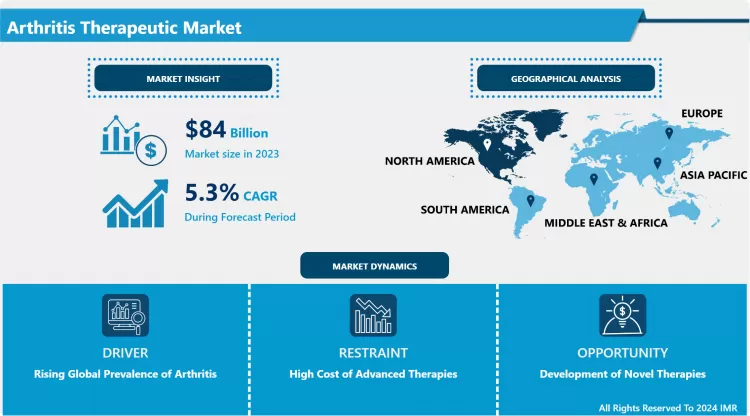

Arthritis Therapeutic Market Size Was Valued at USD 84.0 Billion in 2023, and is Projected to Reach USD 133.7 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.

Arthritis therapeutics market, therefore, encompasses all the viable strategies in arresting the debilitating effects of the numerous forms of arthritis, a disease that involves inflammation in the joint area thereby bringing in cartilage discomfort which includes pain to the joints and freezer like stiffness. Pharmaceutical market, biologics, pain therapy, and surgeries or therapies aimed at providing exquisite quality of life to arthritis patients fall under this market. These include rheumatoid arthritis, osteoarthritis, psoriatic arthritis and ankylosing spondylitis; there is a rising trend towards targeted biologic and disease modifying anti-rheumatic drugs with capacity for both symptomatic relief and disease modifying effects.

- The arthritis therapeutics market has therefore experienced rapid growth in the recent past due to increased elderly population in the world and increasing prevalence of arthritis related diseases. Arthritis is one of the world’s most common diseases with over 350 million people suffering from it and so, treatments for it are becoming popular. Pharmaceutical is leading the therapeutic options and is spearheaded by biologics and disease modifying anti-rheumatic drugs (DMARDs) as their therapeutic goal is to alter disease progress and joint destruction. There is active research occurring where companies are trying to devise new chemistry drugs and treatments which aim to address the irritation processes more selectively and so avoid side-effects. Recent research on molecular biology and immunotherapy has produced new targeted therapies that, for arthritis and particularly rheumatoid arthritis – which affects 1.3% of the world’s population – are dramatically changing treatment courses.

- The market is further bolstered by greater education on the disease, diagnosis, and access to health care services.. Through health campaigns, government and healthcare systems around the world are encouraging people to seek treatment early if they are diagnosed with arthritis or at least seek treatment before the conditions worsen and lead to serious consequences. Also, the use of telemedicine, and other digital innovations has amplified the accessibility of arthritis treatment since patients can get consultations from practitioners and have access to numerous forms of treatment from the comfort of their homes. These factors are all driving the arthritis therapeutics market and the segment is expected to grow highly in the future ten years.

Arthritis Therapeutic Market Trend Analysis

Biologics Revolutionizing Arthritis Treatment

- A major emerging trend that has been identified within the arthritis therapeutics market is the focus on the development of those products, which are based on biological substances and the related biosimilars.. These have revolutionized the care of inflammatory arthritis illnesses, rheumatoid arthritis and psoriatic arthritis in particular, since these are mostly directed against pro-inflammatory cytokines and other components of the immune system that cause the disease. TNF inhibitors IL- 6 inhibitors and JAK inhibitors are some examples of biologic agents that work very well for patients who fail conventional DMARDs. Further, there are evidences that Biosimilar competition, lower cost substitutes of Biologic drugs have been made accessible to such population in areas where earlier cost was a barrier. Organizations in the sector expect the demand and development of biologics and biosimilars to increase due to extension of players in the industry and the availability of better structures which support approval of new biologic drugs.

Emerging Markets and Unmet Medical Needs

- The most significant potential in the arthritis therapeutics market relates to the increased coverage in rapidly developing, albeit somewhat less developed, healthcare markets. With the increase in middle-class people and the continuous growth of healthcare in Asia-Pacific and Latin America and other developing regions, there is likely to be high market demand by people in favour of modern arthritis treatment. In these regions many patients are currently under-served; either they cannot access specialized cardiologists or they cannot afford biologic therapies due to their high cost. In the case of untapped regions, pharmacos need not necessarily go for expensive drugs to make huge profits because biosimilars are cost effective enough solutions that they can capture more of these markets. Also, new treatment opportunities are still required for chronic pathologies such as osteoarthritis that require safe and more disease-modifying drugs. This represents a significant business opportunity for R&D investment because thematic areas and new classes of drugs are being developed to fill the existing clinical voids.

Arthritis Therapeutic Market Segment Analysis:

Arthritis Therapeutic Market Segmented on the basis of type and application.

By Type, Non-steroidal Anti-inflammatory Drugs (NSAIDs) segment is expected to dominate the market during the forecast period

- Due to its common usage and effectiveness for pain and inflammation relief in arthritis related conditions the Non-steroidal Anti-Inflammatory Drug (NSAIDs) segment is expected to lead consumption in the arthritis therapeutics market throughout the forecast period.. Ibuprofen, naproxen, and diclofenac – are the most popular in both physicians’ choice and concerning patients preferences Since such medications like NSAIDs offer relatively fast pain relief and require no extra administrations. DUE to its cheap price and availability, NSAIDs are prescribed most often for patients with arthritis, specifically osteoarthritis and rheumatoid arthritis.

- Further research and development studies on new formulations and combinations of NSAIDs are being carried out in the hope of improving their therapeutic values, hence better patients compliance.. Due to the understanding by clinicians and patients in regard to NSAIDs and their effectiveness in chronic pain management, this group will remain a market leader even as newer analytics enter the field. Furthermore, the increased focus on pain control especially in conditions like chronic arthritis underlines more importance of NSAIDs in patients’ management worldwide.

By Application, Rheumatoid Arthritis segment expected to held the largest share

- Rheumatoid arthritis is expected to dominate the arthritis therapeutics market in the coming years because of the increasing incidences of the conditions and the impact it has on afflicted patients.. RA is a significant global health problem that causes chronic pain, joint damage, and disability in millions of sufferers who have no access to treatment. Thanks to the changes in the disease awareness and the availability of improved forms of treatment, the incidence of COPD has gone up, thus driving the market growth in this segment. Various therapeutic interventions such as NSAIDs, DMARDs and biologic agents are available targeting RA and hence targeting this disease facilitates personalization of therapy that may lead to enhanced patients’ prognosis.

- Also, focused therapies and biosimilar products have contributed to the availability and efficacy of treatments, which are the major factors propelling the market growth and enhancement of rheumatoid arthritis segment.. As research advances, new strategies of treatment may be developed to cope with this multifactorial disease, and Rheumatoid arthritis still remains a priority in the arthritis treatment field.

Arthritis Therapeutic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America particularly remains the largest market for arthritis therapeutics in the year 2023 because of the following reasons.. The healthcare infrastructure is well developed in the region, patients are well informed and there is increased access to innovative products such as Biologic’s and Biosimilar’s thereby fueling the growth of the market. Among the leading countries of this market it is possible to note the U.S., as most of the top drugmakers are located there, there are numerous R&D activities, and high health care expenses. It is said that North America is currently attracting 40-45% of the arthritis therapeutics market share globally. Added to this is a favorable reimbursement policies, high incidences of arthritis related ailments, and steady advancement in treatment procedures. Though Europe also accounts for a large market share, the U.S. still holds a dominant position for this specific industry as new research for discovering drugs and treatment regimens for arthritis is still underway, predicted to influence the future of arthritis care around the world.

Active Key Players in the Arthritis Therapeutic Market

- AbbVie Inc. (USA)

- Amgen Inc. (USA)

- Astellas Pharma Inc. (Japan)

- Biogen Inc. (USA)

- Bristol-Myers Squibb (USA)

- Eli Lilly and Company (USA)

- GlaxoSmithKline plc (UK)

- Horizon Therapeutics plc (Ireland)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Roche Holding AG (Switzerland)

- Sanofi S.A. (France)

- UCB S.A. (Belgium) and Other Active Players

|

Global Arthritis Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 84.0 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 133.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Arthritis Therapeutic Market by Type (2018-2032)

4.1 Arthritis Therapeutic Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Disease Modified Anti-rheumatoid Drugs (DMARDs)

4.5 Biologics

4.6 Others

Chapter 5: Arthritis Therapeutic Market by Application (2018-2032)

5.1 Arthritis Therapeutic Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Rheumatoid Arthritis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Osteoarthritis

5.5 Psoriatic Arthritis

5.6 Ankylosing Spondylitis

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Arthritis Therapeutic Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBVIE INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMGEN INC. (USA)

6.4 ASTELLAS PHARMA INC. (JAPAN)

6.5 BIOGEN INC. (USA)

6.6 BRISTOL-MYERS SQUIBB (USA)

6.7 ELI LILLY AND COMPANY (USA)

6.8 GLAXOSMITHKLINE PLC (UK)

6.9 HORIZON THERAPEUTICS PLC (IRELAND)

6.10 JOHNSON & JOHNSON (USA)

6.11 MERCK & COINC. (USA)

6.12 NOVARTIS AG (SWITZERLAND)

6.13 PFIZER INC. (USA)

6.14 ROCHE HOLDING AG (SWITZERLAND)

6.15 SANOFI S.A. (FRANCE)

6.16 UCB S.A. (BELGIUM)

Chapter 7: Global Arthritis Therapeutic Market By Region

7.1 Overview

7.2. North America Arthritis Therapeutic Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.2.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.2.4.3 Biologics

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Rheumatoid Arthritis

7.2.5.2 Osteoarthritis

7.2.5.3 Psoriatic Arthritis

7.2.5.4 Ankylosing Spondylitis

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Arthritis Therapeutic Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.3.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.3.4.3 Biologics

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Rheumatoid Arthritis

7.3.5.2 Osteoarthritis

7.3.5.3 Psoriatic Arthritis

7.3.5.4 Ankylosing Spondylitis

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Arthritis Therapeutic Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.4.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.4.4.3 Biologics

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Rheumatoid Arthritis

7.4.5.2 Osteoarthritis

7.4.5.3 Psoriatic Arthritis

7.4.5.4 Ankylosing Spondylitis

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Arthritis Therapeutic Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.5.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.5.4.3 Biologics

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Rheumatoid Arthritis

7.5.5.2 Osteoarthritis

7.5.5.3 Psoriatic Arthritis

7.5.5.4 Ankylosing Spondylitis

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Arthritis Therapeutic Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.6.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.6.4.3 Biologics

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Rheumatoid Arthritis

7.6.5.2 Osteoarthritis

7.6.5.3 Psoriatic Arthritis

7.6.5.4 Ankylosing Spondylitis

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Arthritis Therapeutic Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

7.7.4.2 Disease Modified Anti-rheumatoid Drugs (DMARDs)

7.7.4.3 Biologics

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Rheumatoid Arthritis

7.7.5.2 Osteoarthritis

7.7.5.3 Psoriatic Arthritis

7.7.5.4 Ankylosing Spondylitis

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Arthritis Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 84.0 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 133.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

AbbVie Inc. (USA), Amgen Inc. (USA), Astellas Pharma Inc. (Japan), Biogen Inc. (USA), Bristol-Myers Squibb (USA) and Other Major Players.

The Arthritis Therapeutic Market is segmented into Type, Application and region. By Type, the market is categorized into Non-steroidal Anti-inflammatory Drugs (NSAIDs), Disease Modified Anti-rheumatoid Drugs (DMARDs), Biologics, Others. By Application, the market is categorized into Rheumatoid Arthritis, Osteoarthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Arthritis therapeutics market, therefore, encompasses all the viable strategies in arresting the debilitating effects of the numerous forms of arthritis, a disease that involves inflammation in the joint area thereby bringing in cartilage discomfort which includes pain to the joints and freezer like stiffness. Pharmaceutical market, biologics, pain therapy, and surgeries or therapies aimed at providing exquisite quality of life to arthritis patients fall under this market. These include rheumatoid arthritis, osteoarthritis, psoriatic arthritis and ankylosing spondylitis; there is a rising trend towards targeted biologic and disease modifying anti-rheumatic drugs with capacity for both symptomatic relief and disease modifying effects.

Arthritis Therapeutic Market Size Was Valued at USD 84.0 Billion in 2023, and is Projected to Reach USD 133.7 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.