Antifreeze Proteins Market Synopsis

Antifreeze Proteins Market Size Was Valued at USD 9.84 Million in 2023, and is Projected to Reach USD 71.68 Million by 2030, Growing at a CAGR of 32.8% From 2024-2030.

Antifreeze proteins (AFPs) are naturally occurring substances found in certain organisms, such as fish, plants, insects, and microorganisms. These proteins help the organisms survive in extremely cold environments by preventing the formation of ice crystals within their cells and tissues. AFPs work by binding to ice crystals and inhibiting their growth, thereby lowering the freezing point of the organism's bodily fluids. This ability to prevent ice formation or growth is crucial for the survival of organisms living in icy environments, as it helps prevent cellular damage caused by freezing temperatures.

- Antifreeze proteins (AFPs) have numerous applications in various fields, including cryopreservation, food industry, agriculture, biotechnology, and cosmetics. They can preserve biological materials at low temperatures, extending their viability and improving the quality and texture of frozen foods. They can also be used in agriculture to protect crops from frost damage, increasing yields and food security. In biotechnology and biomedicine, AFPs stabilize proteins and enzymes at low temperatures, improving the storage and transportation of sensitive biopharmaceuticals and diagnostic reagents.

- Antifreeze proteins also be used in cosmetics to formulate anti-aging creams and skincare products, preventing ice crystal formation in skin cells. In material science, AFPs have inspired the development of biomimetic materials with antifreeze properties, which could be used in ice-repellent coatings, cryogenic engineering, and cold environment construction. AFPs have potential applications in medicine, food industry, biotechnology, agriculture, and cosmetics.

- Antifreeze proteins help prevent ice formation and damage during freezing and thawing processes, improving cell and tissue viability. They can enhance the quality and shelf life of frozen foods by inhibiting ice crystal formation. AFPs also protect cells and proteins from freezing and thawing damage, making them valuable in biotechnological processes like recombinant protein production and genetic preservation. They can also protect crops from frost damage by reducing ice formation in plant tissues. AFPs could also improve the stability and texture of skincare products.

Antifreeze Proteins Market Trend Analysis

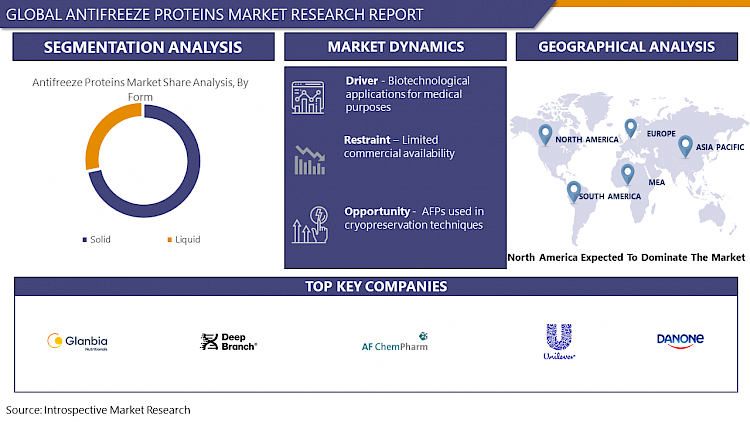

Biotechnological Applications for Medical Purposes

- Antifreeze proteins (AFPs) are proteins found in certain organisms, particularly those living in extremely cold environments, that protect them from the harmful effects of ice formation and low temperatures. These proteins work by binding to ice crystals, inhibiting their growth, and preventing the formation of large ice masses that could damage cells and tissues.

- In recent years, there has been growing interest in the biotechnological applications of AFPs for medical purposes. Key drivers include cryopreservation, organ transplantation, biopharmaceuticals, tissue engineering, and cold storage of biological samples. Cryopreservation is a process of preserving cells, tissues, or organs at low temperatures for extended periods, improving viability and survival rates.

- Organ transplantation extends the preservation time of organs outside the body, increasing the availability of viable donor organs and improving transplant outcomes. AFPs also have potential applications in tissue engineering and regenerative medicine, enhancing the preservation and viability of engineered tissues and organs. Cold storage of biological samples, such as blood, cells, and tissues, can be enhanced by minimizing freeze-thaw damage, improving the integrity and quality of stored samples.

Restraint

Limited Commercial Availability

- The commercialization of antifreeze proteins (AFPs) faces several challenges due to their limited availability in nature and the difficulty in mass-producing them artificially. These naturally occurring substances, found in organisms like fish, insects, and plants, help them survive in freezing environments by preventing ice crystal formation.

- However, their commercialization is hindered by limited natural sources, complex molecular structures, regulatory hurdles related to safety, efficacy, and environmental impact, high production costs, and intellectual property issues. Despite these challenges, AFPs have potential applications in food preservation, medicine, and cryopreservation. Therefore, they remain a valuable resource for researchers and companies in the field.

Opportunity

AFPs Used in Cryopreservation Techniques

- Antifreeze Proteins (AFPs) offer a promising opportunity in cryopreservation techniques, which involve preserving biological materials at ultra-low temperatures to maintain their viability for extended periods. AFPs, naturally occurring proteins found in certain organisms, protect cells and tissues from freezing damage by binding to ice crystals and inhibiting their growth.

- AFPs also enhance cell viability, particularly for delicate samples like stem cells and tissues for transplantation. AFPs can be used in cryopreservation solutions or coatings, allowing for the preservation of a wider range of biological materials under varied conditions.

- AFPs have potential applications in biomedical and biotechnological fields, such as organ transplantation, genetic material preservation, and low-temperature pharmaceutical storage. AFPs also offer economic and environmental benefits, reducing resource consumption and cost savings by enhancing storage and transportation processes for biological materials.

Challenge

Face Regulatory Hurdles, Particularly Regarding Their Safety for Use in Food and Medical

- Antifreeze proteins (AFPs) face significant regulatory challenges, particularly in their safety for use in food and medical applications. These include safety concerns, such as allergic reactions or health effects, and obtaining approval from agencies like the FDA or EFSA.

- AFPs may also be considered novel foods due to their unconventional nature, requiring comprehensive safety assessments before market approval. Clear labeling is necessary for AFP-containing items to inform consumers and enable informed choices. Medical device regulations vary depending on the intended use, such as cryopreservation or organ transplantation.

- Ethical considerations regarding sourcing, production methods, and potential health impact are also considered. Regulatory agencies may also evaluate the environmental impact of AFPs, particularly if they are derived from GMOs or have the potential to affect ecosystems.

Antifreeze Proteins Market Segment Analysis:

Antifreeze Proteins Market Segmented based on type, form, source, and end-users.

By Type, Type I AFPs segment is expected to dominate the market during the forecast period

- Antifreeze proteins (AFPs) are essential for organisms to survive in cold environments by preventing ice crystal formation. Type I AFPs are expected to dominate the market due to their widespread application, versatility, and commercial viability. They are effective in preventing ice formation and improving the stability of biological materials like food products, organs for transplantation, and pharmaceuticals.

- They also have the potential to enhance the quality and shelf life of perishable goods, reduce refrigeration costs, and improve medical treatments. Significant investment and research have led to advancements in understanding their structure, function, and potential applications. Additionally, Type I AFPs may already have or are nearing regulatory approval for use in certain industries, facilitating their adoption and commercialization.

By Form, Solid Segment Held the Largest Share of 62.5% in 2023

- The solid segment in the antifreeze proteins market is dominated by its wide range of applications, longer shelf life, ease of formulation, increased stability, and cost-effectiveness. These proteins are preferred in industries like food, medical, and cosmetics due to their stability and ease of handling.

- Solid AFP have a longer shelf life, making them suitable for storage and distribution. They can be easily formulated into various products, making them attractive for manufacturers. They also exhibit greater stability under various environmental conditions, ensuring consistent performance in temperature-sensitive applications.

Antifreeze Proteins Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, is home to numerous research institutions, universities, and biotechnology companies that are actively involved in the study and development of antifreeze proteins. These institutions contribute to advancements in understanding the properties and applications of antifreeze proteins, driving innovation in the field.

- The region boasts a strong presence in the biotechnology industry, with a robust ecosystem supporting the development and commercialization of biotech products. This infrastructure provides a conducive environment for the production and distribution of antifreeze proteins for various applications, including cryopreservation, food processing, and medical technologies.

- North America's diverse industries, including healthcare, food and beverage, and cosmetics, have a growing need for antifreeze proteins in various applications. However, the food industry utilizes antifreeze proteins to enhance the quality and shelf life of frozen food products. North America has well-established regulatory frameworks governing the use of biotechnological products, ensuring safety and efficacy standards are met.

Antifreeze Proteins Market Top Key Players:

- Selleck Chemicals (US)

- AFChemPharm (US)

- A/F Protein Inc. (Canada)

- Sirona Biochem Corp. (Canada)

- ProtoKinetix Inc. (Canada)

- Unilever (UK)

- Deep Branch (UK)

- Groupe Danone (France)

- Glanbia Nutritionals (Ireland)

- Qingdao BZ-Oligo Biotech Co., Ltd. (China)

- Nichirei Corporation (Japan)

- Kaneka Corporation (Japan), and other major players

Key Industry Developments in the Antifreeze Proteins Market:

- In February 2024, Sirona Biochem Launched GlycoProteMimTM in Early 2025. Vancouver, British Columbia. Sirona Biochem Corp. also known as Sirona, is excited to share a new milestone in its journey. Dr. Deliencourt-Godefroy unveils Sirona’s ambitious plans to introduce its innovative anti-aging product, GlycoProteMimTM, to the markets of North America and Europe in early 2025.

- In May 2021, Unilever announced that it will partner with food-tech company ENOUGH to bring new plant-based meat products to market. Enough’s technology uses a unique zero-waste fermentation process to grow a high-quality protein. Natural fungi are fed with renewable feedstock, such as wheat and corn. This produces ABUNDA® mycoprotein, a complete food ingredient containing all essential amino acids as well as being high in dietary fiber.

|

Global Antifreeze Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

9.84 Mn |

|

Forecast Period 2024-30 CAGR: |

32.8% |

Market Size in 2030: |

71.68 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ANTIFREEZE PROTEINS MARKET BY TYPE (2017-2030)

- ANTIFREEZE PROTEINS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TYPE I AFPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TYPE II AFPS

- ICE-NUCLEATING PROTEINS

- ANTIFREEZE GLYCOPROTEIN

- ANTIFREEZE PROTEINS MARKET BY FORM (2017-2030)

- ANTIFREEZE PROTEINS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- ANTIFREEZE PROTEINS MARKET BY SOURCE (2017-2030)

- ANTIFREEZE PROTEINS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FISH

- INSECT

- ANTIFREEZE PROTEINS MARKET BY END-USER (2017-2030)

- ANTIFREEZE PROTEINS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETICS

- FOOD

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Antifreeze Proteins Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SELLECK CHEMICALS (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AFCHEMPHARM (US)

- A/F PROTEIN INC. (CANADA)

- SIRONA BIOCHEM CORP. (CANADA)

- PROTOKINETIX INC. (CANADA)

- UNILEVER (UK)

- DEEP BRANCH (UK)

- GROUPE DANONE (FRANCE)

- GLANBIA NUTRITIONALS (IRELAND)

- QINGDAO BZ-OLIGO BIOTECH CO., LTD. (CHINA)

- NICHIREI CORPORATION (JAPAN)

- KANEKA CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL ANTIFREEZE PROTEINS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Antifreeze Proteins Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

9.84 Mn |

|

Forecast Period 2024-30 CAGR: |

32.8% |

Market Size in 2030: |

71.68 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Source |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANTIFREEZE PROTEINS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANTIFREEZE PROTEINS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANTIFREEZE PROTEINS MARKET COMPETITIVE RIVALRY

TABLE 005. ANTIFREEZE PROTEINS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANTIFREEZE PROTEINS MARKET THREAT OF SUBSTITUTES

TABLE 007. ANTIFREEZE PROTEINS MARKET BY TYPE

TABLE 008. TYPE I MARKET OVERVIEW (2016-2028)

TABLE 009. TYPE III MARKET OVERVIEW (2016-2028)

TABLE 010. ANTIFREEZE GLYCOPROTEINS MARKET OVERVIEW (2016-2028)

TABLE 011. ANTIFREEZE PROTEINS MARKET BY SOURCE

TABLE 012. FISH MARKET OVERVIEW (2016-2028)

TABLE 013. PLANTS MARKET OVERVIEW (2016-2028)

TABLE 014. INSECTS MARKET OVERVIEW (2016-2028)

TABLE 015. ANTIFREEZE PROTEINS MARKET BY APPLICATION

TABLE 016. MEDICAL MARKET OVERVIEW (2016-2028)

TABLE 017. FOOD MARKET OVERVIEW (2016-2028)

TABLE 018. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ANTIFREEZE PROTEINS MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA ANTIFREEZE PROTEINS MARKET, BY SOURCE (2016-2028)

TABLE 021. NORTH AMERICA ANTIFREEZE PROTEINS MARKET, BY APPLICATION (2016-2028)

TABLE 022. N ANTIFREEZE PROTEINS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE ANTIFREEZE PROTEINS MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE ANTIFREEZE PROTEINS MARKET, BY SOURCE (2016-2028)

TABLE 025. EUROPE ANTIFREEZE PROTEINS MARKET, BY APPLICATION (2016-2028)

TABLE 026. ANTIFREEZE PROTEINS MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC ANTIFREEZE PROTEINS MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC ANTIFREEZE PROTEINS MARKET, BY SOURCE (2016-2028)

TABLE 029. ASIA PACIFIC ANTIFREEZE PROTEINS MARKET, BY APPLICATION (2016-2028)

TABLE 030. ANTIFREEZE PROTEINS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ANTIFREEZE PROTEINS MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ANTIFREEZE PROTEINS MARKET, BY SOURCE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ANTIFREEZE PROTEINS MARKET, BY APPLICATION (2016-2028)

TABLE 034. ANTIFREEZE PROTEINS MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA ANTIFREEZE PROTEINS MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA ANTIFREEZE PROTEINS MARKET, BY SOURCE (2016-2028)

TABLE 037. SOUTH AMERICA ANTIFREEZE PROTEINS MARKET, BY APPLICATION (2016-2028)

TABLE 038. ANTIFREEZE PROTEINS MARKET, BY COUNTRY (2016-2028)

TABLE 039. NICHIREI CORPORATION: SNAPSHOT

TABLE 040. NICHIREI CORPORATION: BUSINESS PERFORMANCE

TABLE 041. NICHIREI CORPORATION: PRODUCT PORTFOLIO

TABLE 042. NICHIREI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. KANEKA CORPORATION: SNAPSHOT

TABLE 043. KANEKA CORPORATION: BUSINESS PERFORMANCE

TABLE 044. KANEKA CORPORATION: PRODUCT PORTFOLIO

TABLE 045. KANEKA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. A/F PROTEIN INC.: SNAPSHOT

TABLE 046. A/F PROTEIN INC.: BUSINESS PERFORMANCE

TABLE 047. A/F PROTEIN INC.: PRODUCT PORTFOLIO

TABLE 048. A/F PROTEIN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SIRONA BIOCHEM: SNAPSHOT

TABLE 049. SIRONA BIOCHEM: BUSINESS PERFORMANCE

TABLE 050. SIRONA BIOCHEM: PRODUCT PORTFOLIO

TABLE 051. SIRONA BIOCHEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. UNILEVER: SNAPSHOT

TABLE 052. UNILEVER: BUSINESS PERFORMANCE

TABLE 053. UNILEVER: PRODUCT PORTFOLIO

TABLE 054. UNILEVER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. PROTOKINETIX: SNAPSHOT

TABLE 055. PROTOKINETIX: BUSINESS PERFORMANCE

TABLE 056. PROTOKINETIX: PRODUCT PORTFOLIO

TABLE 057. PROTOKINETIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SHANGHAI YU TAO INDUSTRIAL: SNAPSHOT

TABLE 058. SHANGHAI YU TAO INDUSTRIAL: BUSINESS PERFORMANCE

TABLE 059. SHANGHAI YU TAO INDUSTRIAL: PRODUCT PORTFOLIO

TABLE 060. SHANGHAI YU TAO INDUSTRIAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KODERA HERB GARDEN: SNAPSHOT

TABLE 061. KODERA HERB GARDEN: BUSINESS PERFORMANCE

TABLE 062. KODERA HERB GARDEN: PRODUCT PORTFOLIO

TABLE 063. KODERA HERB GARDEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. BEIJING HUACHENG JINKE TECHNOLOGY: SNAPSHOT

TABLE 064. BEIJING HUACHENG JINKE TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 065. BEIJING HUACHENG JINKE TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 066. BEIJING HUACHENG JINKE TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 067. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 068. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 069. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANTIFREEZE PROTEINS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANTIFREEZE PROTEINS MARKET OVERVIEW BY TYPE

FIGURE 012. TYPE I MARKET OVERVIEW (2016-2028)

FIGURE 013. TYPE III MARKET OVERVIEW (2016-2028)

FIGURE 014. ANTIFREEZE GLYCOPROTEINS MARKET OVERVIEW (2016-2028)

FIGURE 015. ANTIFREEZE PROTEINS MARKET OVERVIEW BY SOURCE

FIGURE 016. FISH MARKET OVERVIEW (2016-2028)

FIGURE 017. PLANTS MARKET OVERVIEW (2016-2028)

FIGURE 018. INSECTS MARKET OVERVIEW (2016-2028)

FIGURE 019. ANTIFREEZE PROTEINS MARKET OVERVIEW BY APPLICATION

FIGURE 020. MEDICAL MARKET OVERVIEW (2016-2028)

FIGURE 021. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 022. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ANTIFREEZE PROTEINS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ANTIFREEZE PROTEINS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ANTIFREEZE PROTEINS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ANTIFREEZE PROTEINS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ANTIFREEZE PROTEINS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Antifreeze Proteins Market research report is 2024-2030.

Selleck Chemicals (US), AFChemPharm (US), A/F Protein Inc. (Canada), Sirona Biochem Corp. (Canada), ProtoKinetix Inc. (Canada), Unilever (UK), Deep Branch (UK), Groupe Danone (France), Glanbia Nutritionals (Ireland), Qingdao BZ-Oligo Biotech Co., Ltd. (China), Nichirei Corporation (Japan), Kaneka Corporation (Japan), and Other Major Players.

The Antifreeze Proteins Market is segmented into Type, Form, Source, End User, and region. By Type, the market is categorized into Type I AFPs, Type II AFPs, Ice-Nucleating Proteins, and Antifreeze Glycoprotein. By Form, the market is categorized into Solid and liquid. By Source, the market is categorized into Fish, Plants, and Insects. By End User, the market is categorized into Medical, Cosmetics, Food, and Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Antifreeze Proteins Market refers to the global industry involved in the production, distribution, and commercialization of proteins that exhibit antifreeze properties. These proteins are naturally found in certain organisms, such as fish, plants, and insects, and they enable these organisms to survive in freezing environments by preventing ice crystal formation or growth. In the market, antifreeze proteins are utilized in various applications, including cryopreservation of cells and tissues, frozen food storage, cosmetics, and medical technologies. The market is driven by the increasing demand for cryopreservation techniques, advancements in biotechnology research, and the expanding applications of antifreeze proteins across different industries. Major players in the market include biotechnology companies, research institutions, and manufacturers catering to diverse industrial sectors.

Antifreeze Proteins Market Size Was Valued at USD 9.84 Million in 2023, and is Projected to Reach USD 71.68 Million by 2030, Growing at a CAGR of 32.8% From 2024-2030.