Almond Protein Market Synopsis

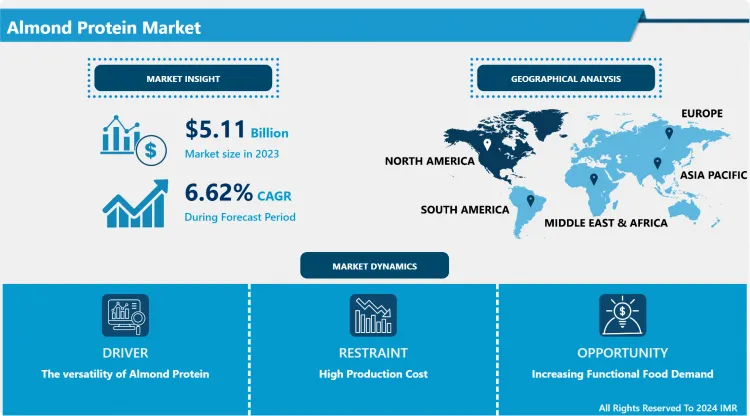

Almond Protein Market Size Was Valued at USD 5.11 Billion in 2023, and is Projected to Reach USD 9.10 Billion by 2032, Growing at a CAGR of 6.62% From 2024-2032.

Almond protein is plant protein that is obtained from almonds; it can be consumed in their powdered form or included in food products. Protein isolate is derived from almonds with the aid of different treatments and primarily wherein the unwanted fats and carbohydrates are initially eliminated to get the protein. Almond protein market has been growing at a high rate because of the advanced knowledge of plant protein diets and healthy protein sources. Commercial food and beverages usually have high protein-content in their nutritional value; almonds which are packed with protein, vitamins, and minerals offer rich almond protein for food and beverages. This trend is viable strong by the fact that there is increased consumption of vegan, vegetarian, and even flexitarian products where consumers look for plant-based protein to consume. Also, almond protein is known for its quality amino acid profile which should attract those who consume products with protein, dietary supplements, and athletes.

As for the application, the almond protein market is expanding in a several segments, such as in Food & Beverage, Nutraceuticals/Supplements, as well as in the Cosmetic Industry. In the food industry, almond protein gradually used in protein bars, shakes, and functional foods because of its flexibility and effectiveness for boosting the nutritional values of the products. The dietary supplements segment is also on the rise since consumers are always in search of easy means to boost their protein uptake. In addition, cosmetic industry involved almond protein in their product because almond protein has moisture and nutrition functions. Region wise, North America and Europe dominates the global almond protein market due to increasing concern of the consumers towards healthy nutritional food items such as plant protein. However the Asia-Pacific market is growing at a faster rate because of growth in disposable income and changing consumption patterns.

In conclusion, the almond protein has vast growth potential in the global market as new opportunities arise with trends in, product differentiation and up-and-coming market knowledge regarding plant protein consumption. Consumption of better and healthier ‘eco-friendly’ forms of nut proteins is becoming prominent in the world, and almonds specifically are prominent for offering a modern diet a healthy protein source in the face of a changing population base. It is for this reason that the future of this market will be informed by new developments in processing techniques and the emergence of new almond based protein products that seek to meet the new trends in the market.

Almond Protein Market Trend Analysis

Driving Growth in the Almond Protein Market

- Exploration of the almond protein market occurs as people are shifting toward understanding the nutritive value of the product, including protein content and essential amino acids. This increasing consciousness relates to the trend toward veganism and vegetarianism as well as the general understanding that the use of almond protein is preferable because of its universal applicability in various food and drink products. Almond protein fits into this market well as more and more people are looking to include plant-based proteins to their diet.

- In addition, the customers’ raft towards clean-label products and natural ingredients has a profound effect on their preferences for healthy alternatives to conventional animal proteins. Almond protein is right in line with this notion because it can be seen as a healthful product that is on par with what the current generation of consumers expects of the foods they consume. Therefore, manufactures are dedicating a lot of attention towards diversifying the almond protein offerings from powders, through bars and to the Ready to Drink beverages, thus addressing the growing trend for convenient and healthier foods.

Innovations and Sustainability Shaping the Almond Protein Market

- Recent advancements in the reformulation of almond products as well as in processing methods are strongly improving functional characteristics of almond protein, and as a result, its versatility in food and beverages industries. Almond protein is still a relatively new protein on the market, and the current production line is proactively expanding a wide range of products, from powders to bars to RTD [ready-to-drink] products, meeting the current growing trend of convenience and portability that is popular among consumers. This conversion underlines the increased tendencies of contemporary consumers’ active way of life where product readiness for immediate consumption is an essential criterion to choose foods with needed nutritional quality. The nature of the almond protein enables the product to be easily incorporated into smoothies, snack products, and meal replacement products for a broad range of demographic that have a preference for healthier foods.

- However, other than product development, electronic commerce centre, is also an innovation is changing the way consumer access the almond protein products. Online retailing channels have been enabling consumers to access a wider range of food products that are convenient to make almond protein choices that meet consumer’s preferences. However, analysing the development of the almond protein market, it was observed that sustainability factors are gaining higher importance among consumers. Most people are now preferring almond protein that has been gotten from environmentally friendly results with their buying habits. This concentration not only benefits the almond protein market by driving its development and expanding the market share but also prompts manufacturers to pay much more attention to the ecological issue, which is beneficial to the improvement of the global food environment.

Almond Protein Market Segment Analysis:

Almond Protein Market Segmented based on By Nature, By Application and By Distribution Channel

By Nature, Organic segment is expected to dominate the market during the forecast period

- The organic segment has shown a remarkable growth year by year and majorly due to the change in attitude of customers worldwide in the direction of healthy and environment friendly products. More people are urging to have a wholesome and chemical-free life hence the request for organically grown food, which does not incorporate use of chemical fertilizers, pesticides, or genetically modified organisms. The global bakery and confectionery industries are clear examples of this trend as customers prefer organic items in their products than the usual processed foods. Organic flours, natural sweeteners and whole grain foods for instance are reflected as people become more conscious about the foods they are taking and shift preference from quantity to quality.

- Additionally, the market knowledge of people about using organic personal care products is expanding because consumers are becoming more knowledgeable about the fact that such products are better for their skin and health. Food consumer demand for clear and truthful labeling on the source and process of production has been forcing most food brands to remove unfavourable additives and package natural products. With environmental problems and issues to do with health concerns going viral, consumers are certain to pursue organic products and services to the next level. This upward trend is in line with the general upward trend towards sustainability and wellness, hence the organic segment will continue to grow due to changes in consumer behavior in making the right decisions on their health and the health of the planet.

By Nature, Organic segment held the largest share in 2023

- The last online distribution channel has steadily shifted the way consumers shop, a shift that has been greatly magnified by the COVID-19 pandemic. Due to the availability of ordering commodities from the comfort of how home buying has increased since one can get a variety of commodities using a computer. They have forced not only a change in the way people shop but also in their opportunities to acquire different merchandise including organic and natural food products. Solutions associated with specialized e-commerce platforms and other platform-based subscription service mean extended and specific market opportunities to realize the potential of unique product platforms, which a consumer could not found in traditional setting and other merchandising channels.

- Besides, digital marketing techniques have been a great asset for the online shopping booming activities in targeting the appropriate market segment through ads and social media marketing. These strategies make it easier for companies to communicate with their target market with potential customers in real-time, thereby creating a tailored customer experience that reflects consumer ethics. Given the constant growth of the online purchases rate, it can be expected that e-sales will further strengthen their position as the primary distribution channels for organic, conventional, and specialty food. This evolution also reaffirms the need for such brands to get rid of their traditional marketing and distribution approaches to embrace new market needs occasioned by the advances in technology in the retail market.

Almond Protein Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America especially America is a massive market for almond proteins which is experiencing a steady uptake in growth due to change in customer’s trends in terms of their shifts to veganism/vegetarianism. This is closely affiliated with the move that consumers have been making to eat healthier foods, as well as the increase in demand for what is called clean label products that are associated with being healthier options. Recently, the consumer is highly aware of concern about their health because of an increase in diseases, and therefore consumers are demanding plant protein, especially almond protein because it is very beneficial and can be used in different areas. This is market need that the food and beverage sector in this region is keen on meeting, particularly emphasizing production of proteins enriched snacks and dietary supplements to suit the different needs of consumers, thus increasing the market potential.

- Secondly, growth of the almond protein market is backed by increased capital outlay by the major stakeholders for research on advanced products using almonds proteins. These companies are not only improving the nutritional value of their products but are also searching for innovative uses of almond protein across a wide array of food items, including protein bars, protein shakes and baked goods. This focus on innovation is necessary in the pursuit of transforming existing products to meet the special nutritional needs of the health-conscious consumer especially in terms of convenience, palatability, and protein content. Certainly, as the market unfolds, quality and sustainability aspects will also be dominant in consumers’ choice, thus, propelling almond protein into a place among the main focuses in the perspective of the North American health and wellness segment.

Active Key Players in the Almond Protein Market

- InovoBiologic Inc. (Canada)

- Celtic Sea Minerals (Ireland)

- Marigot Ltd. (U.K.)

- Maxicrop USA (U.S.)

- BioFlora, LLC (U.S.)

- Alesco S.r.l. (Italy)

- Humates And Seaweeds Pvt Ltd (India)

- HMHS Solutions Limited (U.K.)

- Sar Agrochemicals & Fertilizers Pvt. Ltd. (India)

- Noosh, Inc. (U.S.)

- BASF SE (Germany)

- BLUE DIAMOND GLOBAL INGREDIENTS DIVISION (U.S.) and Other Key Players

|

Almond Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 5.11 Bn. |

|

Forecast Period 2023-34 CAGR: |

6.62% |

Market Size in 2032: |

USD 9.10 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Almond Protein Market by Nature (2018-2032)

4.1 Almond Protein Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Conventional

Chapter 5: Almond Protein Market by Application (2018-2032)

5.1 Almond Protein Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bakery & Confectionary

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverages

5.5 Personal Care

Chapter 6: Almond Protein Market by Distribution Channel (2018-2032)

6.1 Almond Protein Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets

6.5 Convenience Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Almond Protein Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INOVOBIOLOGIC INC. (CANADA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CELTIC SEA MINERALS (IRELAND)

7.4 MARIGOT LTD. (U.K.)

7.5 MAXICROP USA (U.S.)

7.6 BIOFLORA

7.7 LLC (U.S.)

7.8 ALESCO S.R.L. (ITALY)

7.9 HUMATES AND SEAWEEDS PVT LTD (INDIA)

7.10 HMHS SOLUTIONS LIMITED (U.K.)

7.11 SAR AGROCHEMICALS & FERTILIZERS PVT. LTD. (INDIA)

7.12 NOOSH INC. (U.S.)

7.13 BASF SE (GERMANY)

7.14 BLUE DIAMOND GLOBAL INGREDIENTS DIVISION (U.S.) OTHER KEY PLAYERS

7.15

Chapter 8: Global Almond Protein Market By Region

8.1 Overview

8.2. North America Almond Protein Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Nature

8.2.4.1 Organic

8.2.4.2 Conventional

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Bakery & Confectionary

8.2.5.2 Beverages

8.2.5.3 Personal Care

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Online

8.2.6.2 Supermarkets

8.2.6.3 Convenience Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Almond Protein Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Nature

8.3.4.1 Organic

8.3.4.2 Conventional

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Bakery & Confectionary

8.3.5.2 Beverages

8.3.5.3 Personal Care

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Online

8.3.6.2 Supermarkets

8.3.6.3 Convenience Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Almond Protein Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Nature

8.4.4.1 Organic

8.4.4.2 Conventional

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Bakery & Confectionary

8.4.5.2 Beverages

8.4.5.3 Personal Care

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Online

8.4.6.2 Supermarkets

8.4.6.3 Convenience Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Almond Protein Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Nature

8.5.4.1 Organic

8.5.4.2 Conventional

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Bakery & Confectionary

8.5.5.2 Beverages

8.5.5.3 Personal Care

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Online

8.5.6.2 Supermarkets

8.5.6.3 Convenience Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Almond Protein Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Nature

8.6.4.1 Organic

8.6.4.2 Conventional

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Bakery & Confectionary

8.6.5.2 Beverages

8.6.5.3 Personal Care

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Online

8.6.6.2 Supermarkets

8.6.6.3 Convenience Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Almond Protein Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Nature

8.7.4.1 Organic

8.7.4.2 Conventional

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Bakery & Confectionary

8.7.5.2 Beverages

8.7.5.3 Personal Care

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Online

8.7.6.2 Supermarkets

8.7.6.3 Convenience Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Almond Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 5.11 Bn. |

|

Forecast Period 2023-34 CAGR: |

6.62% |

Market Size in 2032: |

USD 9.10 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

.webp)