Almond Milk Market Synopsis

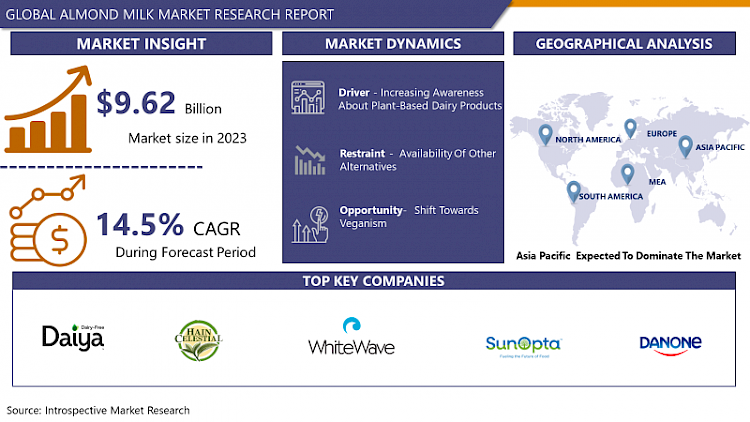

Almond Milk Market Size Was Valued at USD 9.62 Billion in 2023 and is Projected to Reach USD 32.54 Billion by 2032, Growing at a CAGR of 14.5% From 2024-2032.

Almond milk is a plant-based alternative to dairy milk, known for its watery texture and nutty flavor. Made from almonds, some varieties are flavored to resemble cow's milk. It is free from cholesterol and lactose, and low in saturated fat.

- Almond milk is nutritious and low in calories, making it a healthy choice for many. Unsweetened almond milk has the added benefit of not raising blood sugar levels, making it suitable for those monitoring their glucose intake.

- Being dairy-free, almond milk is a great alternative for those with lactose intolerance or dairy allergies. Additionally, enriched almond milk contains added nutrients that can help strengthen bones.

- This plant-based milk may also contribute to heart health by potentially reducing the risk of heart disease. Furthermore, enriched almond milk is a good source of vitamin D, supporting overall health and wellness.

- Depending on the brand, almond milk can be an excellent source of various minerals, including phosphorus, manganese, iron, and copper. These nutrients contribute to its appeal as a nutritious alternative to dairy milk.

- Nutritionally, an 8-ounce (1 cup) serving of unsweetened almond milk contains 40 calories, 1 gram of protein, 3 grams of fat, 2 grams of carbohydrates, 1 gram of fiber, and no sugar. In contrast, a 1-cup serving of sweetened almond milk has 73 calories, 1 gram of protein, 3 grams of fat, 10.5 grams of carbohydrates, 1 gram of fiber, and 10 grams of sugar.

- Almond milk offers several nutritional benefits such as low calories, low fats, and no cholesterol. It is relatively low in calories compared to cow's milk and naturally low in saturated fat, making it beneficial for calorie-conscious consumers and heart health. Almond milk is naturally lactose-free which provides a dairy-free alternative for those seeking to avoid lactose or have dairy-related dietary restrictions.

- In the 2022/23 world tree nut production, almonds lead with 27 metric tons, followed by walnuts at 22 metric tons, and cashews at 20 metric tons. Pistachios and hazelnuts have moderate production levels at 14 and 11 metric tons respectively. Other tree nuts collectively contribute 6 metric tons. This data indicates almonds as the top-selling nut, likely due to their versatility and health benefits. Businesses can capitalize on the popularity of almonds by focusing on marketing and distribution strategies. Additionally, there's potential for growth in markets for pistachios and hazelnuts, offering opportunities for targeted investment and expansion.

Almond Milk Market Trend Analysis

Increasing Awareness About Plant-Based Dairy Products

- There is a growing shift towards plant-based diets driven due to factors such as health consciousness, environmental concerns, and ethical considerations. As a plant-based product, almond milk is gaining popularity in the market. Many individuals are lactose intolerant or have milk allergies, and seek dairy alternatives. Almond milk offers a lactose-free and dairy-free option which contributes to its demand.

- It is perceived as a healthier choice compared to cow's milk due to its natural properties like low calories, cholesterol-free, and low in saturated fat. It can be used as a milk substitute which provides a versatile range of applications. Advertising campaigns, social media presence, and collaborations with influencers and health experts have played a crucial role in spreading awareness about the potential nutritional benefits of almond milk and generating consumer interest in almond milk.

Opportunity

Shift Towards Veganism

- Many individuals are embracing veganism due to concerns about their health and the environment which significantly opens up an opportunity for plant-based products including almond milk. Veganism involves avoiding the consumption of animal products, including dairy milk. Vegan diets are associated with various health benefits such as lower risks of heart disease, obesity, and certain types of cancer. Veganism reduces the environmental impact of animal agriculture.

- Manufacturers are introducing different flavours, formulations, and packaging options for almond milk to cater to the diverse preferences of the vegan market. This increased availability and variety of almond milk products enhance consumer choice. The expansion in retail presence for vegan products makes it easier for consumers to access almond milk. The food service establishments can cater to a broader customer base by offering almond milk as a vegan-friendly choice.

Almond Milk Market Segment Analysis:

Almond Milk Market Segmented on the basis of type, form, application, and distribution channel

By Type, Flavoured Segment Is Expected to Dominate the Market During the Forecast Period

By type, there are three segments such as unsweetened, sweetened and flavoured. Among these, the flavoured segment is expected to dominate the market during the forecast period.

- Flavoured almond milk offers a wide range of taste options with flavours such as chocolate, vanilla, strawberry, and matcha. These flavours provide a refreshing and flavourful twist to traditional almond milk helping to attract not only health-conscious consumers but also those seeking a flavourful alternative to dairy milk or other plant-based milk. Flavoured almond milk has gained popularity among younger consumers who typically seek innovative and exciting food and beverage options.

- The vibrant and unique flavours offered in the flavoured almond milk are preferred by many consumers for experimentation. Flavoured almond milk can be used in smoothies, oatmeal, baked goods, coffee drinks, and other creative recipes to give them a flavourful touch. Manufacturers can offer low-sugar or natural sweeteners for consumers with low sugar intake. The ability of flavoured almond milk to offer a delightful experience while providing a plant-based and healthier alternative mainly contributes to its growing demand.

By Form, Liquid Segment Held the Largest Share In 2023

By form, there are four segments such as liquid, powder, frozen, and concentrate. Among these, the liquid segment held the largest share in 2023.

- Liquid almond milk is a versatile product that can be used in various culinary applications and dietary requirements serving as a vegan-friendly dairy milk alternative. The liquid almond milk segment is offered in a wide range of flavours and formulation options which can cater to different consumer preferences. It is readily available and requires minimal preparation can be used straight from the carton as a milk substitute in beverages, cereals, smoothies, and other applications, providing a convenience factor.

- The neutral taste of liquid almond milk makes it a suitable ingredient in savoury and sweet dishes. The manufacturers are focusing on the liquid segment due to its ease of manufacturing, packaging, storage, and distribution. The greater production capacity helps reduce production costs and leads to lower prices for the liquid almond milk product. Overall, its convenience, versatility, diversity, and growing consumer awareness contribute to the demand for almond milk

Almond Milk Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is experiencing rapid urbanization and changing lifestyle patterns with an increase in disposable income which results in the adoption of Western dietary habits and embracing plant-based alternatives like almond milk. Consumers are becoming more conscious of their dietary choices, seeking healthier alternatives to conventional dairy milk with its nutritional profile and potential health benefits. Almond milk aligns with these trends which increases its popularity among consumers.

- The Asia Pacific region is witnessing a significant increase in the vegan population who exclude animal products, including dairy milk. Almond milk, being plant-based and vegan-friendly, caters to the dietary preferences of these consumers. The well-established distribution chain which focuses on plant-based products ensures the easy availability and accessibility of almond milk. Also, the awareness through social platforms influences the growth of the market positively.

Almond Milk Market Active Players

- Daiya Foods Inc. (Canada)

- Hain Celestial Group (USA)

- Whitewave Foods (USA)

- Sunopta Inc. (Canada)

- Danone (France)

- Nestle (Switzerland)

- Blue Diamond Growers (USA)

- Galaxy Nutritional Foods, Inc. (USA)

- Tofutti Brands Inc (USA)

- Califia Farms LLC (USA)

- Earth's Own Food Company Inc. (Canada)

- Hiland Dairy Foods (USA)

- Malk Organics LLC (USA)

- Pacific Foods of Oregon LLC (USA)

- Sanitarium Health and Wellbeing Company (Australia)

- The WhiteWave Foods Company (USA)

- Alpro (Belgium)

- Pacific Foods (United States)

- Califia Farms (United States)

- Good Karma Foods (United States)

- Rude Health (United Kingdom)

- Almond Breeze (United States)

- Plenish (United Kingdom)

- Provamel (Belgium)

- So Delicious Dairy Free (United States)

- Mooala (United States)

- Urban Platter (India)

- Epigamia (India)

- Raw Pressery (India)

- Plantaway (India) and Other Active Players.

Key Industry Developments in the Almond Milk Market:

- In April 2024, Califia Farms launched its new Cookies ‘N Crème Almond Creamer, combining smooth almond milk with the indulgent flavour of cookies and cream ice cream. It offers the delicious and nostalgic flavour of cookies and cream ice cream paired with almond milk.

- In May 2024, The Laughing Cow, a USA company, announced the launching of plant-based spreadable cheese product nationwide in 2025. This cheese is using almond milk to create a creamy texture in a garlic and herb flavour.

|

Global Almond Milk Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.5 % |

Market Size in 2032: |

USD 32.54 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- PORTER’S FIVE FORCES ANALYSIS

MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

-

-

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

-

- ALMOND MILK MARKET BY TYPE (2017-2032)

- ALMOND MILK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- UNSWEETENED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- SWEETENED

- FLAVOURED

- ALMOND MILK MARKET BY FORM (2017-2032)

- ALMOND MILK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIQUID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POWDER

- FROZEN

- CONCENTRATE

- ALMOND MILK MARKET BY APPLICATION (2017-2032)

- ALMOND MILK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEVERAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREAL & BREAKFAST

- COOKING AND BAKING

- DAIRY ALTERNATIVES

- NUTRIENT SUPPLEMENT

- ALMOND MILK MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- ALMOND MILK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL STORES

- ONLINE STORES

- HEALTH FOOD STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- ALMOND MILK Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DAIYA FOODS INC. (CANADA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HAIN CELESTIAL GROUP (USA)

- WHITEWAVE FOODS (USA)

- SUNOPTA INC. (CANADA)

- DANONE (FRANCE)

- NESTLE (SWITZERLAND)

- BLUE DIAMOND GROWERS (USA)

- GALAXY NUTRITIONAL FOODS, INC. (USA)

- TOFUTTI BRANDS INC (USA)

- CALIFIA FARMS LLC (USA)

- EARTH'S OWN FOOD COMPANY INC. (CANADA)

- HILAND DAIRY FOODS (USA)

- MALK ORGANICS LLC (USA)

- PACIFIC FOODS OF OREGON LLC (USA)

- SANITARIUM HEALTH AND WELLBEING COMPANY (AUSTRALIA)

- THE WHITEWAVE FOODS COMPANY (USA)

- ALPRO (BELGIUM)

- PACIFIC FOODS (UNITED STATES)

- CALIFIA FARMS (UNITED STATES)

- GOOD KARMA FOODS (UNITED STATES)

- RUDE HEALTH (UNITED KINGDOM)

- ALMOND BREEZE (UNITED STATES)

- PLENISH (UNITED KINGDOM)

- PROVAMEL (BELGIUM)

- SO DELICIOUS DAIRY FREE (UNITED STATES)

- MOOALA (UNITED STATES)

- URBAN PLATTER (INDIA)

- EPIGAMIA (INDIA)

- RAW PRESSERY (INDIA)

- PLANTAWAY (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL ALMOND MILK MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Almond Milk Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.5 % |

Market Size in 2032: |

USD 32.54 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Almond Milk Market research report is 2024-2032.

Daiya Foods Inc. (Canada), Hain Celestial Group (USA), Whitewave Foods (USA), Sunopta Inc. (Canada), Danone (France), and Other Active Players.

The Almond Milk Market is segmented into Type, Form, Application, Distribution Channel and region. By Type, the market is categorized into Unsweetened, Sweetened, Flavored. By Form, the market is categorized into Liquid, Powder, Frozen, Concentrate. By Application, the market is categorized into Beverage, Cereal & Breakfast, Cooking and Baking, Dairy Alternatives, Nutritional Supplement. By Distribution Channel, the market is categorized into Supermarkets, Retail Stores, Online Stores, Health Food Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Almond milk is a plant-based beverage made from ground almonds and water which has a nutty flavor. This milk is mainly preferred by vegan consumers. It is a popular dairy milk alternative with a creamy texture.

Almond Milk Market Size Was Valued at USD 9.62 Billion in 2023 and is Projected to Reach USD 32.54 Billion by 2032, Growing at a CAGR of 14.5% From 2024-2032.