Albumin Market Synopsis

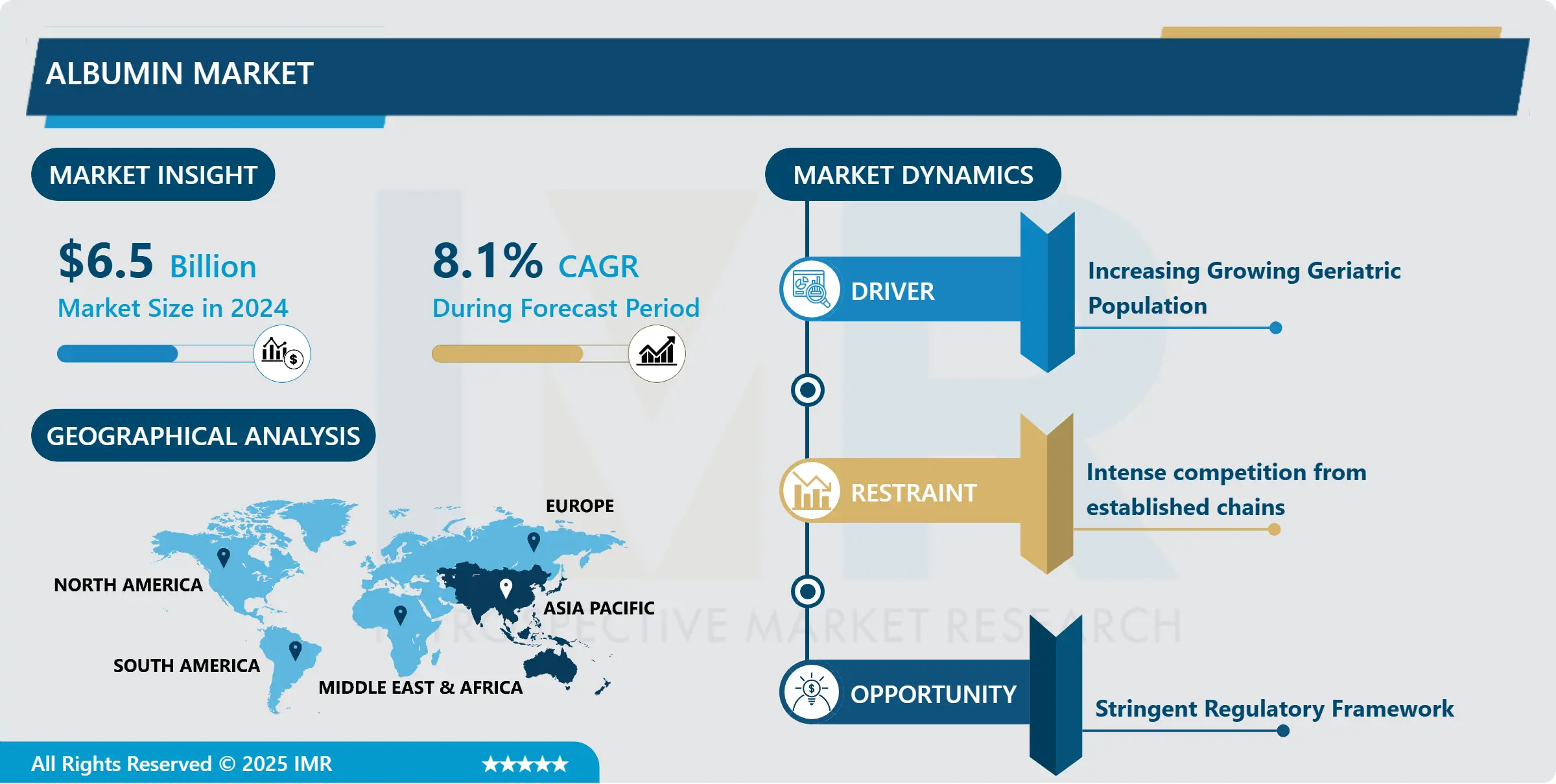

Albumin Market Size Was Valued at USD 6.5 Billion in 2024, and is Projected to Reach USD 15.31 Billion by 2035, Growing at a CAGR of 8.1% From 2025-2035.

Albumin is a protein found in the blood plasma that plays a crucial role in maintaining the body's fluid balance and transporting various substances, such as hormones, drugs, and fatty acids. It's primarily produced by the liver and contributes significantly to the regulation of osmotic pressure in the blood, helping to prevent fluid from leaking out of blood vessels. Due to its properties, albumin has diverse applications in medicine and research.

In the medical field, albumin is commonly used as a plasma expander to treat conditions like hypovolemia (low blood volume) or shock. Its ability to increase blood volume swiftly makes it valuable in emergency situations. Additionally, albumin finds application in drug delivery systems, stabilizing and delivering medications. In research, it serves as a standard protein for various biochemical studies, including electrophoresis and protein assays.

As for market trends, albumin continues to be in demand across pharmaceutical and research sectors. The market growth is influenced by the rising incidence of diseases requiring albumin-based treatments, such as liver diseases and burns. Furthermore, advancements in biotechnology have led to the development of recombinant albumin, providing a more stable and cost-effective alternative to human serum albumin, driving its market expansion. Additionally, ongoing research exploring albumin's potential in targeted drug delivery and as a biomarker for various diseases contributes to its increasing relevance and demand in the healthcare industry.

Albumin Market Trend Analysis

Growing Geriatric Population

- As demographics shift and life expectancy rises, there's a parallel increase in age-related health concerns. Elderly individuals commonly encounter conditions such as chronic kidney diseases, liver disorders, and various chronic ailments where maintaining adequate albumin levels becomes crucial for managing these health issues effectively.

- The physiological changes in older adults often lead to decreased albumin levels in the body, resulting in conditions such as hypoalbuminemia. Consequently, there's a heightened demand for albumin-based therapies to address these deficiencies and related complications among the elderly.

- Moreover, the aging population experiences a higher incidence of conditions requiring albumin supplementation, such as severe burns or trauma, where albumin's role in fluid management and tissue repair becomes vital for recovery.

- With the global demographic landscape leaning toward an increasingly older population, the demand for albumin-based treatments is anticipated to surge correspondingly. This demographic shift underscores the importance of albumin in managing health concerns prevalent among the elderly, solidifying its position as a critical component in addressing various age-related medical conditions.

Research and Development Initiatives

- Ongoing R&D endeavours focus on uncovering novel uses for albumin beyond its conventional roles. Scientists are investigating its efficacy in targeted drug delivery systems, where albumin serves as a carrier for therapeutic molecules, enhancing drug stability and bioavailability while reducing side effects. Additionally, researchers are exploring albumin's potential in regenerative medicine, tissue engineering, and wound healing due to its unique properties that support cell growth and tissue repair.

- Moreover, studies aim to establish albumin's role as a biomarker for various diseases, potentially revolutionizing diagnostic methods. By identifying specific albumin patterns or levels associated with certain health conditions, researchers strive to develop diagnostic tools for early disease detection and monitoring.

- Collaborations between academia, pharmaceutical companies, and research institutions foster an environment conducive to breakthrough discoveries, paving the way for innovative albumin-based therapies and applications. The cumulative effect of these R&D initiatives not only broadens the understanding of albumin's capabilities but also presents opportunities for the development of new treatment modalities, driving market expansion and offering promising avenues for healthcare advancement.

Albumin Market Segment Analysis:

Albumin Market Segmented on the basis of type and application.

By Type, Human Serum Albumin segment is expected to dominate the market during the forecast period

- The Human Serum Albumin (HSA) segment is poised to maintain its dominance in the albumin market throughout the forecast period. HSA, derived from human blood plasma, holds a significant share due to its extensive usage in various therapeutic applications, including treating hypoalbuminemia, shock, burns, and liver diseases.

- The reliability and efficacy of HSA in clinical settings, coupled with its long-standing approval and acceptance, contribute to its sustained dominance. Its ability to efficiently manage conditions where maintaining or restoring adequate albumin levels is crucial reinforces its market position.

- Furthermore, while recombinant albumin variants are emerging and gaining attention due to their advantages in stability and cost-effectiveness, HSA remains the primary choice for many medical applications. Its established safety profile and widespread availability continue to drive its prominence, indicating that HSA will likely continue as the leading segment in the albumin market during the projected period.

By Application, Therapeutics segment held the largest market share of 42% in 2024

- In the albumin market, the Therapeutics segment has consistently commanded the largest market share due to the extensive and varied therapeutic applications of albumin. Albumin serves as a vital component in treating a spectrum of medical conditions, contributing significantly to this segment's dominance.

- Therapeutically, albumin finds widespread use in managing hypoalbuminemia, a condition characterized by low levels of albumin in the blood, often associated with chronic illnesses like liver diseases, kidney disorders, and malnutrition. Additionally, its role as a plasma expander in emergency situations such as shock and trauma further solidify its position within the therapeutics segment.

- The versatility of albumin in these therapeutic applications, coupled with its ability to address critical medical needs like maintaining blood volume and providing essential proteins, underscores its prominence in this segment. As a result, the Therapeutics segment continues to hold the largest market share, reflecting the indispensability of albumin in various crucial medical treatments and therapies.

Albumin Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to emerge as the dominant force in the albumin market over the forecast period. Several factors contribute to this projected dominance, including increasing healthcare expenditure, rising prevalence of chronic diseases requiring albumin-based therapies, and expanding access to healthcare services across the region.

- Countries in the Asia Pacific are witnessing a significant rise in the geriatric population, leading to a higher incidence of age-related conditions where albumin plays a crucial role in treatment. Moreover, advancements in healthcare infrastructure, along with a growing focus on research and development initiatives, are propelling the demand for albumin-based therapies in the region.

- Furthermore, the presence of key market players focusing on expanding their presence and investing in the Asia Pacific region, along with favorable government initiatives and policies, contributes to the anticipated dominance. As a result, the Asia Pacific region is expected to lead the albumin market during the forecast period, driven by increasing healthcare needs, expanding healthcare infrastructure, and a growing emphasis on innovative medical solutions.

Albumin Market Top Key Players:

- Albumedix Ltd. (UK)

- Albumin Bioscience(US)

- Biotest AG (Germany)

- CSL Behring (US)

- Grifols International SA (Spain)

- HiMedia Laboratories Pvt. Ltd. (India)

- InVitria (US)

- Medxbio Pte. Ltd. (Singapore)

- MilliporeSigma (US)

- Octapharma AG (Switzerland)

- RayBiotech Inc. (Georgia)

- Seracare Life Sciences Inc. (the US)

- Akron Biotech (US)

- Bristol-Myers Squibb Company (US) and Other Major Players

Key Industry Developments in the Albumin Market:

- In July 2023, Kedrion Biopharma announced that China's National Institutes for Food and Drug Control (NIFDC) had approved BPL's human Albumin product for release into the Chinese market for therapeutic use.

- In July 2023, Grifols S.A., a leading manufacturer of plasma-derived medicines, announced the phase 3 completion of PRECIOSA to determine the potential of long-term albumin-based treatment with Grifols S.A.’s Albutein. The clinical study aims to increase the survival time of patients suffering from decompensated cirrhosis and ascites until a suitable transplant is available.

- In December 2022, CSL opened a new plasma fractionation facility in Australia to fractionate human plasma to treat haemophilia, immune system problems, burns, and other life-threatening medical conditions. This move allowed Australia to step forward in medicine by introducing a plasma fractionation plant capable of producing nine million litres of plasma per year.

|

Global Albumin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.1 % |

Market Size in 2035: |

USD 15.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Albumin Market by Type (2018-2035)

4.1 Albumin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Human Serum Albumin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bovine Serum Albumin

4.5 Recombinant Albumin

Chapter 5: Albumin Market by Application (2018-2035)

5.1 Albumin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Therapeutics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drug Formulation & Vaccines

5.5 Component of Media

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Albumin Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HONEYWELL INTERNATIONAL INC.(U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NORTHROP GRUMMAN CORPORATION (U.S.)

6.4 SAFRAN (FRANCE)

6.5 THALES GROUP (FRANCE)

6.6 RAYTHEON TECHNOLOGIES CORPORATION (U.S.)

6.7 GENERAL ELECTRIC COMPANY (U.S.)

6.8 TELEDYNE TECHNOLOGIES INC. (U.S.)

6.9 VECTORNAV TECHNOLOGIES

6.10 LLC (U.S.)

6.11 PARKER-HANNIFIN CORPORATION (U.S.)

6.12 TRIMBLE NAVIGATION LTD. (U.S.)

6.13 GLADIATOR TECHNOLOGIES INC. (U.S.)

6.14 IXBLUE SAS (FRANCE)

6.15 L3HARRIS TECHNOLOGIES INC. (U.S.)

6.16 MEMSIC INC. (U.S.)

6.17 ADVANCED NAVIGATION (AUSTRALIA)

6.18 COLLINS AEROSPACE (U.S.)

6.19 KVH INDUSTRIES INC. (U.S.)

Chapter 7: Global Albumin Market By Region

7.1 Overview

7.2. North America Albumin Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Human Serum Albumin

7.2.4.2 Bovine Serum Albumin

7.2.4.3 Recombinant Albumin

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Therapeutics

7.2.5.2 Drug Formulation & Vaccines

7.2.5.3 Component of Media

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Albumin Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Human Serum Albumin

7.3.4.2 Bovine Serum Albumin

7.3.4.3 Recombinant Albumin

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Therapeutics

7.3.5.2 Drug Formulation & Vaccines

7.3.5.3 Component of Media

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Albumin Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Human Serum Albumin

7.4.4.2 Bovine Serum Albumin

7.4.4.3 Recombinant Albumin

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Therapeutics

7.4.5.2 Drug Formulation & Vaccines

7.4.5.3 Component of Media

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Albumin Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Human Serum Albumin

7.5.4.2 Bovine Serum Albumin

7.5.4.3 Recombinant Albumin

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Therapeutics

7.5.5.2 Drug Formulation & Vaccines

7.5.5.3 Component of Media

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Albumin Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Human Serum Albumin

7.6.4.2 Bovine Serum Albumin

7.6.4.3 Recombinant Albumin

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Therapeutics

7.6.5.2 Drug Formulation & Vaccines

7.6.5.3 Component of Media

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Albumin Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Human Serum Albumin

7.7.4.2 Bovine Serum Albumin

7.7.4.3 Recombinant Albumin

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Therapeutics

7.7.5.2 Drug Formulation & Vaccines

7.7.5.3 Component of Media

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Albumin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2025-35 CAGR: |

8.1 % |

Market Size in 2035: |

USD 15.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||