Adult Meal Replacement Market Synopsis

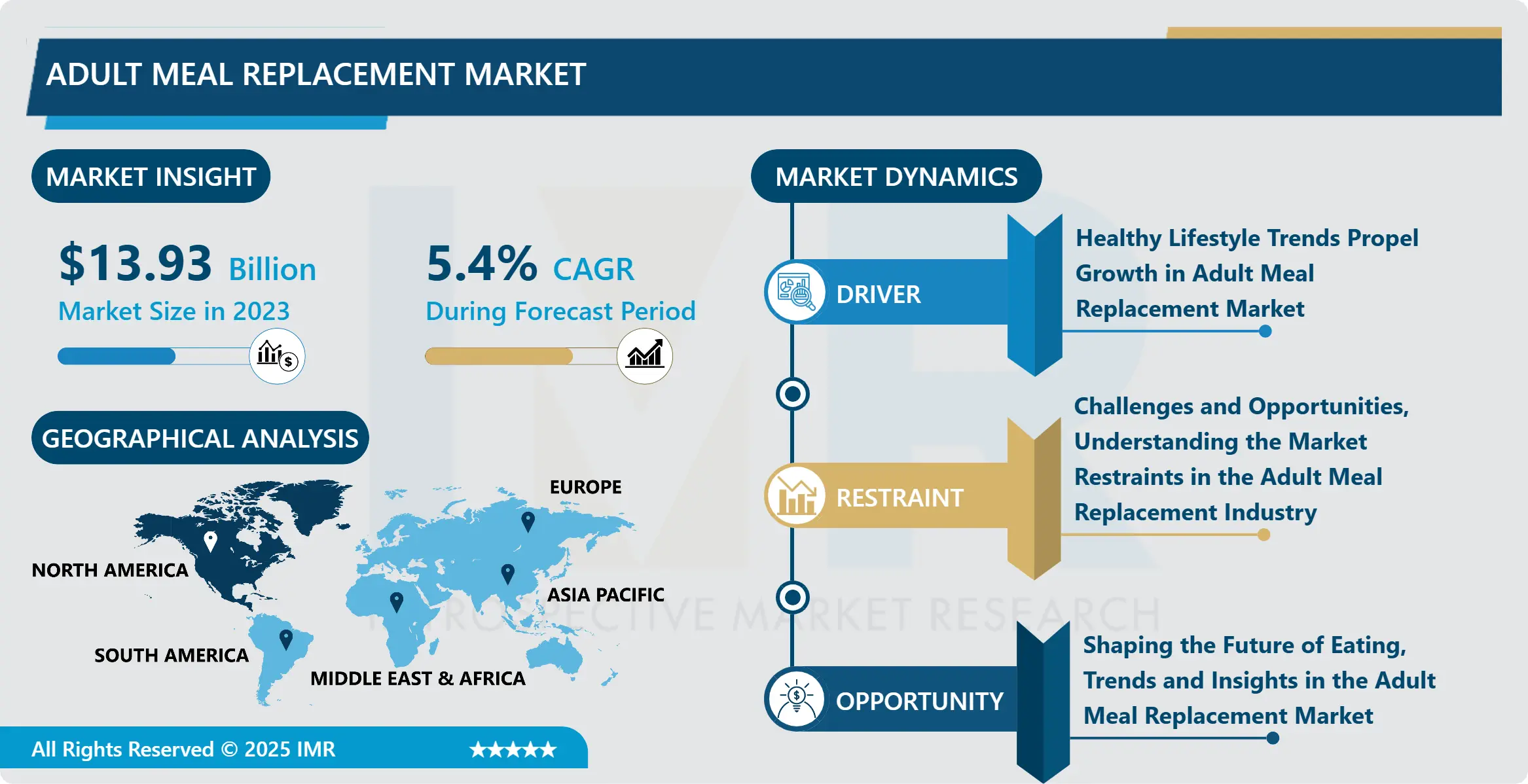

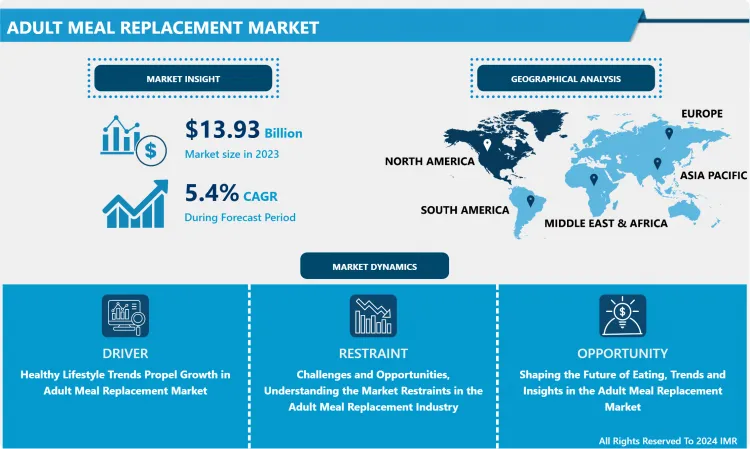

Adult Meal Replacement Market Size is Valued at USD 13.93 Billion in 2023, and is Projected to Reach USD 21.22 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032.

The market segmentation of the Adult Meal Replacement Market includes ready-to-drink beverages including shakes, bars, and powdered products that replace normal meals. Such foods are usually researched to contain vitamins, minerals and other food products that can substitute normal meals. Thus, they are especially favored by people with a number of urgent matters and a desire to provide their body with all necessary nutrients. The market concern is primarily motivated by factors like elevated health awareness, the fast pace of life, and meal replacement solutions.

Market for adult meal replacement has been on the rise and they are deemed to rise even more in the near future due to factors like; health aware and conscious, time constraints, convenience. It can be noted that consumers are desperately searching for flexible and healthy dishes which can become an equivalent to traditional ones, particularly in large cities where people often do not have enough time to prepare a meal.

Furthermore, recent global events such as the COVID-19 pandemic have also stimulated additional trends of meal replacements for adults as they look for easy and safer options than going to the grocery stores and getting groceries. Consequently, there has been a significant increase in the stocks of these products online as well as the retail shops necessarily stocking a wide range of options available for the consumers. Therefore, it can be stated that the adult meal replacement market will remain in its growth in the following years and all companies, including newcoming to the market, have the best chance to introduce new products and broaden the existing company’s meal replacement product portfolio.

Adult Meal Replacement Market Trend Analysis

Emerging Trends in the Adult Meal Replacement Market, Personalization and Clean Label Focus

- The latest trends in the adult meal replacement market include the consumption of personalized foods and convenience due to the increasing number of working people and mainly due to the changed perception of people towards their health. The demand for meals that supplement the other meals of the day and sometimes the only means of satisfying the nutritional needs of the consumers has pushed consumers to look for meals that addresses the dietary needs of the consumers most effectively. This trend has led to the increase in the market of ready-to-modify dietary supplements for weight loss, including meal replacement, shakes, bars, and powder.

- The concept of clean label and analyse is another major shift observed in the global adult meal replacement industry. People are developing culinary intolerance for undesirable additives, folds, and GMOs and are willing to replace meals with healthy and purified cocktails. To address consumers’ increasing concern for healthy food manufacturers are developing products derived from natural, organic, non–GMO ingredients and labeling them on exterior to capture the attention of careful clients.

Balancing Busy Lifestyles, The Role of Adult Meal Replacements

- The market for adult meal replacements has the prospects to expand because of a shift in the diet, development of awareness of health, and product availability. After reviewing data collected from different markets, it was evident that this particular market segment entails products such as shakes, bars, and powders that are useful in offering nutritional values and dropping extra pounds. Due to the increasing number of activities that people engage in, meal replace products are easily available because they act like ready, easily available and healthy meals.

- A major factor that has been seen to fuel this market is the population of the working people, who are likely to prefer eating healthy foods in an easy to prepare packaging. Further, flexibility in the consumption levels has remained high in several regions, which has increased the affordability of these products among consumers. Another key development among manufacturers is new product development, new flavours and types of soda, products to suit different tastes of people and other special dietary considerations. Moreover, adult meal replacement is set to grow due to rising health-conscious population, benevolent for key manufacturers and new comers in the market.

Adult Meal Replacement Market Segment Analysis:

Adult Meal Replacement Market Segmented on the basis of Product type, Formulation, Flavour)

By Product Type, Ready-to-drink (RTD) beverages segment is expected to dominate the market during the forecast period

- There is a variety of product types in the market, and each segment of its consumers targets different suitable meal replacement products. The benefits of Ready To Drink (RtD) beverages is that these drinks are portable and can be consumed when one is on the move hence can supplement ones dietary needs. Another easily transportable product type encompasses powdered products which can easily be taken with water, milk or any preferred beverage making it easy to prepare depending on the consumer’s preferences in order to arrive at a perfect meal replacement. High protein bars are easy to carry which makes them suitable for use by people who need a quick snack or are in between meals but lack time to prepare a proper meal. However, these are not the only products in the market, there are others like the cookies, soups, and shakes for meals replacement that has made it possible for the consumer to have a number of choices from which to make their selection based on their personal preferences and nutrition needs.

By Formulation, Organic segment held the largest share in 2024

- Concerning formulation, the major brands that operate in the segment of adult meal replacement, are organically and inorganically formulated. Organic meal replacements do not contain ingredients which grew from plants, crops or animals that were treated with chemical pesticides, herbicides or fertilizer. It targets customers who want natural and green labels/products. Within non-organic meal replacements there could be ingredients from GE crops and may include synthetically produced additives or preservatives. These products are different from their conventional counterparts as they meet different consumer preferences, with organic foods believed to be healthier than their non-organic counterparts but may be costly than the latter.

Adult Meal Replacement Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North America adult meal replacement market has been growing and it has several drivers namely stressing on health, tight schedules and the need to addr ess nutritional needs through convenience food and beverages. The market scope entails a tremendously broad portfolio of products that is made up of ready to drink beverages, powders, bars, and supplements that suit various dietary habits and needs in consideration.

- Current strategies are seeing market players in North America particularly engaging in product differentiation as well as marketing techniques in a bid to increase their market share. These companies are also diversifying their marketing Various networks and channels in order to extend markets for such products. Also, there is a propagandist of individualized nutrition that forms the creation of individual meal replacement.

- Some of the threats unique to the market include; High risks from regulations as well as competition from similar convenience food markets. While, due to, raising consciousness regarding health among the masses, the North America adult meal replacement business is poised to grow further in the next several years.

Active Key Players in the Adult Meal Replacement Market

- Abbott Laboratories (US)

- Glanbia (Ireland)

- Amway (US)

- Herbalife Nutrition (US)

- Nestle (Switzerland)

- Atkins (US)

- Huel (UK)

- Kellogg Co. (US)

- Skin Enterprises Inc. (US)

- USANA Health Sciences Inc. (US)

- Others

|

Adult Meal Replacement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.93 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 21.22 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Formulation |

|

||

|

By Flavour |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Adult Meal Replacement Market by Product Type (2018-2032)

4.1 Adult Meal Replacement Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ready-to-drink (RTD) beverages

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Powdered products

4.5 Protein bars

4.6 Others

Chapter 5: Adult Meal Replacement Market by Formulation (2018-2032)

5.1 Adult Meal Replacement Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-organic

Chapter 6: Adult Meal Replacement Market by Flavour (2018-2032)

6.1 Adult Meal Replacement Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Vanilla

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Chocolate

6.5 Strawberry

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Adult Meal Replacement Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GLANBIA (IRELAND)

7.4 AMWAY (US)

7.5 HERBALIFE NUTRITION (US)

7.6 NESTLE (SWITZERLAND)

7.7 ATKINS (US)

7.8 HUEL (UK)

7.9 KELLOGG CO. (US)

7.10 SKIN ENTERPRISES INC. (US)

7.11 USANA HEALTH SCIENCES INC. (US)

7.12 OTHERS

Chapter 8: Global Adult Meal Replacement Market By Region

8.1 Overview

8.2. North America Adult Meal Replacement Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Ready-to-drink (RTD) beverages

8.2.4.2 Powdered products

8.2.4.3 Protein bars

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Formulation

8.2.5.1 Organic

8.2.5.2 Non-organic

8.2.6 Historic and Forecasted Market Size by Flavour

8.2.6.1 Vanilla

8.2.6.2 Chocolate

8.2.6.3 Strawberry

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Adult Meal Replacement Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Ready-to-drink (RTD) beverages

8.3.4.2 Powdered products

8.3.4.3 Protein bars

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Formulation

8.3.5.1 Organic

8.3.5.2 Non-organic

8.3.6 Historic and Forecasted Market Size by Flavour

8.3.6.1 Vanilla

8.3.6.2 Chocolate

8.3.6.3 Strawberry

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Adult Meal Replacement Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Ready-to-drink (RTD) beverages

8.4.4.2 Powdered products

8.4.4.3 Protein bars

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Formulation

8.4.5.1 Organic

8.4.5.2 Non-organic

8.4.6 Historic and Forecasted Market Size by Flavour

8.4.6.1 Vanilla

8.4.6.2 Chocolate

8.4.6.3 Strawberry

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Adult Meal Replacement Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Ready-to-drink (RTD) beverages

8.5.4.2 Powdered products

8.5.4.3 Protein bars

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Formulation

8.5.5.1 Organic

8.5.5.2 Non-organic

8.5.6 Historic and Forecasted Market Size by Flavour

8.5.6.1 Vanilla

8.5.6.2 Chocolate

8.5.6.3 Strawberry

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Adult Meal Replacement Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Ready-to-drink (RTD) beverages

8.6.4.2 Powdered products

8.6.4.3 Protein bars

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Formulation

8.6.5.1 Organic

8.6.5.2 Non-organic

8.6.6 Historic and Forecasted Market Size by Flavour

8.6.6.1 Vanilla

8.6.6.2 Chocolate

8.6.6.3 Strawberry

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Adult Meal Replacement Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Ready-to-drink (RTD) beverages

8.7.4.2 Powdered products

8.7.4.3 Protein bars

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Formulation

8.7.5.1 Organic

8.7.5.2 Non-organic

8.7.6 Historic and Forecasted Market Size by Flavour

8.7.6.1 Vanilla

8.7.6.2 Chocolate

8.7.6.3 Strawberry

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Adult Meal Replacement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.93 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.40 % |

Market Size in 2032: |

USD 21.22 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Formulation |

|

||

|

By Flavour |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||