Active Implantable Medical Devices Market Synopsis

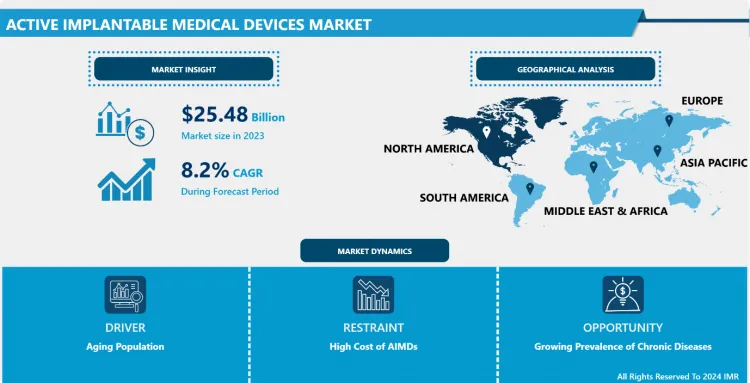

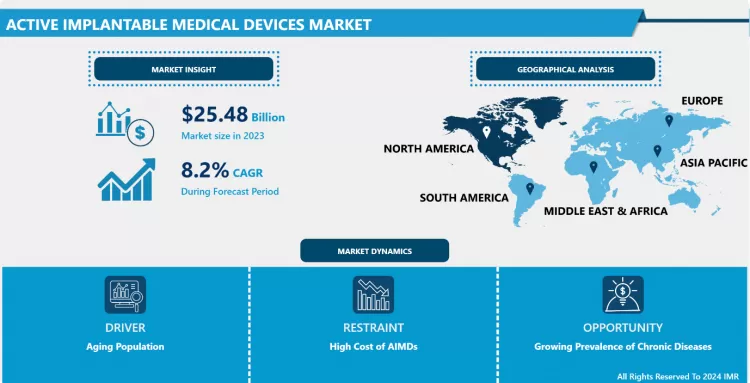

Active Implantable Medical Devices Market Size Was Valued at USD 25.48 Billion in 2023, and is Projected to Reach USD 33.76 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.

AIMD thus means a medically required device that involves its complete or partial incorporation into the human body or implanted surgically into a natural opening with the aid of a source of electrical energy to perform its operations. They are mainly employed for controlling, assessing and treating numerous diseases such as cardiovascular and neurological diseases, hearing loss etc.

- Growth Opportunities in the Active Implantable Medical Devices Market This market is growing rapidly following increased technological advances, a growing geriatric world population, as well as a higher number of chronic diseases, such as cardiovascular disorders and neurological conditions. AIMDs are essential for treating diseases because they are less invasive and provide patients with long-term solutions for their conditions. In addition, the awareness of the benefits of AIMDs, improved healthcare infrastructure, and better access to healthcare facilities encourages demand, especially in developed and emerging economies.

- A few of the key devices in the market are pacemakers and ICDs, which have been widely used for cardiac-related diseases to moderate heartbeats and prevent sudden cardiac death thereafter. Neurostimulators and implantable hearing devices like cochlear implants have become weapons of first resort for managing neurological disorders and hearing disabilities.

- Further, the development of AIMDs integrating such advanced technologies as AI, wireless communication and miniaturization is improved for making even more efficient, better personalized, and easier to use. In turn, product innovation that includes remote capabilities of monitoring patients resulted in physician tracking their devices and patient health data in real time, generating better outcomes in patients and lower hospitalization rates.

Active Implantable Medical Devices Market Trend Analysis

Technological Advancements in AIMDs

- The main driving force for the future of the Active Implantable Medical Devices market is technological advancement that includes the integration of AI, wireless communication, and improved power sources. These lead to making AIMDs more functional and safer and friendly to use in a more efficient way. For example, algorithms driven by AI help in the usage of pacemakers and ICDs for the better prediction of cardiac events with timely intervention and improvement of patient outcomes.

- In addition, wireless technologies allow the follow-up of real-time performance of their devices and patients' health data through connected platforms; health care providers make informed decisions. Such advances thus promote better care for patients and reduce healthcare costs through minimal readmissions of patients to hospitals and subsequent visitations.

Growing Prevalence of Chronic Diseases

- Raising epidemic levels of chronic diseases, especially heart and neurological disorders, has provided the AIMD market with an immense opportunity to take over the market. As the global population is growing older, heart failure, arrhythmia, and neurodegenerative diseases such as Parkinson's disease are increasingly developing, and active implantable devices promise a long-term solution towards the management of such conditions, making their use almost indispensable in today's medical field.

- There also exists a growing market for AIMDs in emerging markets in Asia and Latin America, which is witnessing tremendous growth due to enhanced health care access and improvements in infrastructure in those regions. Further, as more attention is given to managing chronic diseases with increased health care spending, such regions are becoming exciting expansion prospects for manufacturers in reaching newer patient populations.

Active Implantable Medical Devices Market Segment Analysis:

Active Implantable Medical Devices Market is segmented on the basis of product type, application and end user.

By Product Type, Implantable Cardioverter Defibrillators (ICDs) segment is expected to dominate the market during the forecast period

- AIMD's product-type market has classified a variety of products to fulfill specific medical requirements. The largest market share is held by pacemakers and Implantable Cardioverter Defibrillators or ICDs. These devices are needed by patients having arrhythmias or heart failure; they have a critical role in managing a heart and preventing such potentially fatal conditions as cardiac arrest.

- In managing neurostimulators for neurological disorders such as Parkinson's disease and chronic pain, adoption is also expected to rise. The demand for non-invasive neurology treatment will fuel innovation in this space, while the implantable hearing devices market, including cochlear implants, will also increase with hearing loss due to aging populations.

By Application, Cardiac segment expected to held the largest share

- The AIMD market can be segmented by application as follows cardiac, neurological, hearing impairment, and others. Cardiac applications dominate the market through their share because cardiovascular diseases are highly prevalent, and AIMDs are a critical part of a lot of heart related treatments. Devices like pacemakers and ICDs have established their position as a treatment for patients suffering from arrhythmias and other heart conditions. As such, the cardiac segment is going to be one of the main growth contributors to this market.

- Neurostimulation products also witness considerable growth due to applications in neurological. The former includes products that provide treatments for chronic pain, epilepsy, and movement disorders. The hearing impairment market is gaining traction due to the increased deployment of implantable hearing devices for more severe cases of hearing loss. Other applications such as respiratory and urological add to the diversified nature and feasibility of this market for further increases.

Active Implantable Medical Devices Market Regional Insights:

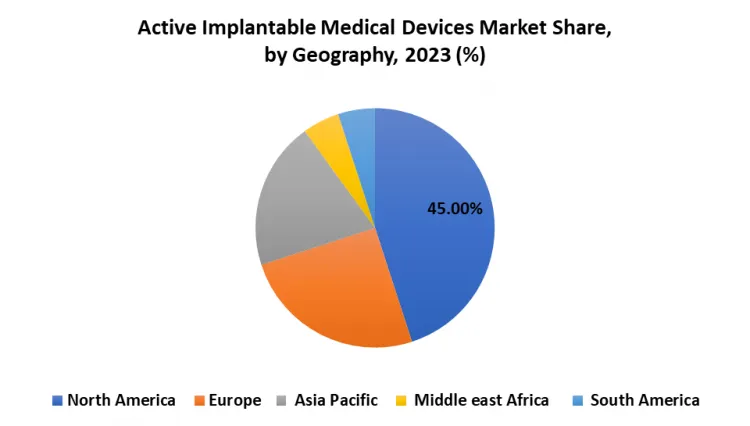

North America is Expected to Dominate the Market Over the Forecast period

- North America has been the core region for AIMD, primarily due to the region's advanced healthcare infrastructure, vast healthcare spending, and high usage of innovative medical technologies. It also boasts a sound and favorable reimbursement policy and regulatory setting that have impacted the market favorably. Also, the prevalence of chronic diseases has been relatively high in this region, in particular cardiovascular and neurological conditions, which represent the largest proportion of AIMD needs.

- Market leadership by United States North America has another very important reason for its market leadership, as most of the global leaders of AIMD are headquartered in the USA. Also, a significant investment in healthcare research and development has led to an ageing population, further increasing the growth of the market in the North American region. Hence, North America is expected to maintain its leadership in the AIMD market due to the continuous advancement in technology and growing health care requirements in this region.

Active Key Players in the Active Implantable Medical Devices Market

- Medtronic (Ireland)

- Abbott Laboratories (USA)

- Boston Scientific (USA)

- Cochlear Ltd. (Australia)

- Sonova Holding AG (Switzerland)

- LivaNova PLC (UK)

- BIOTRONIK SE & Co. KG (Germany)

- Nurotron Biotechnology Co., Ltd. (China)

- Nevro Corp. (USA)

- Axonics, Inc. (USA)

- MicroPort Scientific Corporation (China)

- Stryker Corporation (USA), Other key Players.

Key Industry Developments in the Active Implantable Medical Devices Market:

- In March 2024, Stryker completed its acquisition of SERF SAS, a France-based joint replacement company. Katherine Truppi, President of Stryker's Joint Replacement division, highlighted that this move enhances its global portfolio and commitment to orthopaedic excellence, expressing enthusiasm for the future collaboration with the SERF SAS team.

- In August 2022, Medtronic plc introduced an investigational extravascular implantable cardioverter defibrillator (EV ICD) system with the lead positioned under the breastbone, outside of the heart and veins. This system achieved a defibrillation success rate of 98.7% and met its safety endpoints in a global clinical trial.

- In February 2022, Abbott launched patient implants of its dual-chamber leadless pacemaker system as part of the AVEIR DR i2i pivotal clinical study. This investigational aveir dual-chamber leadless pacemaker marks a significant technological advancement in leadless pacing and is the first of its kind to be implanted globally within the pivotal trial.

|

Global Active Implantable Medical Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.48 Billion |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 33.76 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Active Implantable Medical Devices Market by Product Type (2018-2032)

4.1 Active Implantable Medical Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pacemakers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Implantable Cardioverter Defibrillators (ICDs)

4.5 Neurostimulators

4.6 Ventricular Assist Devices (VADs)

4.7 Implantable Hearing Devices

4.8 Other Active Implantable Devices

Chapter 5: Active Implantable Medical Devices Market by Application (2018-2032)

5.1 Active Implantable Medical Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiac

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neurological

5.5 Hearing Impairment

5.6 Others

Chapter 6: Active Implantable Medical Devices Market by End User (2018-2032)

6.1 Active Implantable Medical Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers (ASCs)

6.5 Specialized Clinics

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Active Implantable Medical Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (USA)

7.4 BOSTON SCIENTIFIC (USA)

7.5 COCHLEAR LTD. (AUSTRALIA)

7.6 SONOVA HOLDING AG (SWITZERLAND)

7.7 LIVANOVA PLC (UK)

7.8 BIOTRONIK SE & CO. KG (GERMANY)

7.9 NUROTRON BIOTECHNOLOGY COLTD. (CHINA)

7.10 NEVRO CORP. (USA)

7.11 AXONICS INC. (USA)

7.12 MICROPORT SCIENTIFIC CORPORATION (CHINA)

7.13 STRYKER CORPORATION (USA)

7.14 OTHER KEY PLAYERS.

Chapter 8: Global Active Implantable Medical Devices Market By Region

8.1 Overview

8.2. North America Active Implantable Medical Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Pacemakers

8.2.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.2.4.3 Neurostimulators

8.2.4.4 Ventricular Assist Devices (VADs)

8.2.4.5 Implantable Hearing Devices

8.2.4.6 Other Active Implantable Devices

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cardiac

8.2.5.2 Neurological

8.2.5.3 Hearing Impairment

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers (ASCs)

8.2.6.3 Specialized Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Active Implantable Medical Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Pacemakers

8.3.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.3.4.3 Neurostimulators

8.3.4.4 Ventricular Assist Devices (VADs)

8.3.4.5 Implantable Hearing Devices

8.3.4.6 Other Active Implantable Devices

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cardiac

8.3.5.2 Neurological

8.3.5.3 Hearing Impairment

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers (ASCs)

8.3.6.3 Specialized Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Active Implantable Medical Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Pacemakers

8.4.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.4.4.3 Neurostimulators

8.4.4.4 Ventricular Assist Devices (VADs)

8.4.4.5 Implantable Hearing Devices

8.4.4.6 Other Active Implantable Devices

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cardiac

8.4.5.2 Neurological

8.4.5.3 Hearing Impairment

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers (ASCs)

8.4.6.3 Specialized Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Active Implantable Medical Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Pacemakers

8.5.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.5.4.3 Neurostimulators

8.5.4.4 Ventricular Assist Devices (VADs)

8.5.4.5 Implantable Hearing Devices

8.5.4.6 Other Active Implantable Devices

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cardiac

8.5.5.2 Neurological

8.5.5.3 Hearing Impairment

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers (ASCs)

8.5.6.3 Specialized Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Active Implantable Medical Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Pacemakers

8.6.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.6.4.3 Neurostimulators

8.6.4.4 Ventricular Assist Devices (VADs)

8.6.4.5 Implantable Hearing Devices

8.6.4.6 Other Active Implantable Devices

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cardiac

8.6.5.2 Neurological

8.6.5.3 Hearing Impairment

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers (ASCs)

8.6.6.3 Specialized Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Active Implantable Medical Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Pacemakers

8.7.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.7.4.3 Neurostimulators

8.7.4.4 Ventricular Assist Devices (VADs)

8.7.4.5 Implantable Hearing Devices

8.7.4.6 Other Active Implantable Devices

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cardiac

8.7.5.2 Neurological

8.7.5.3 Hearing Impairment

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers (ASCs)

8.7.6.3 Specialized Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Active Implantable Medical Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.48 Billion |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 33.76 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Active Implantable Medical Devices Market research report is 2024-2032.

Medtronic (Ireland),Abbott Laboratories (USA), Boston Scientific (USA), Cochlear Ltd. (Australia), Sonova Holding AG (Switzerland), LivaNova PLC (UK), BIOTRONIK SE & Co. KG (Germany), Nurotron Biotechnology Co., Ltd. (China), and Other Major Players.

The Active Implantable Medical Devices Market is segmented into Product Type, Application, End User and region. By Product Type, the market is categorized into Pacemakers, Implantable Cardioverter Defibrillators (ICDs), Neurostimulators, Ventricular Assist Devices (VADs), Implantable Hearing Devices, Other. By Application, the market is categorized into Cardiac, Neurological, Hearing Impairment, Others. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

AIMD thus means a medically required device that involves its complete or partial incorporation into the human body or implanted surgically into a natural opening with the aid of a source of electrical energy to perform its operations. They are mainly employed for controlling, assessing and treating numerous diseases such as cardiovascular and neurological diseases, hearing loss etc.

Active Implantable Medical Devices Market Size Was Valued at USD 25.48 Billion in 2023, and is Projected to Reach USD 33.76 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.