Acrylic Sheet Surface Protection Films Market Synopsis

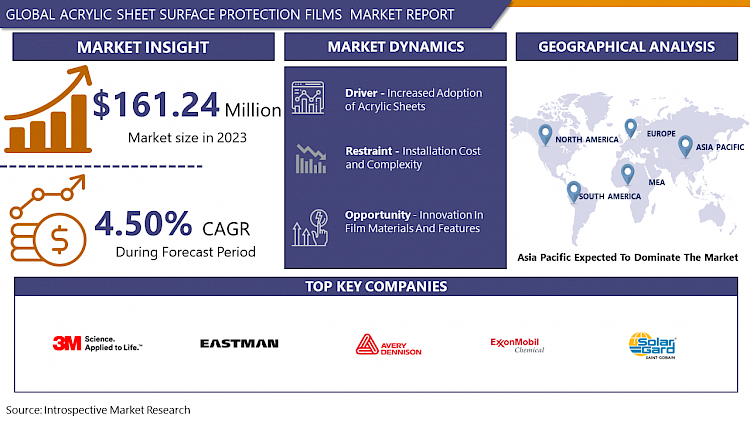

The global Acrylic Sheet Surface Protection Films Market Size Was Valued at USD 161.24 Million in 2023 and is Projected to Reach USD 239.62 Million by 2032, Growing at a CAGR of 4.50% From 2024-2032.

Acrylic Sheet Surface Protection Films are protective layers applied to acrylic surfaces to prevent scratches, abrasions, and environmental damage. Made from polyethylene or polypropylene, they are used in construction, automotive, and electronics industries. They come in various thicknesses, adhesive types, and transparency levels, catering to different application needs.

- Acrylic Sheet Surface Protection Films offer a range of benefits, playing a vital role across diverse industries. They serve as an effective shield, preventing scratches, abrasions, and environmental elements from compromising the quality and appearance of acrylic surfaces. With varied thicknesses, adhesive options, and transparency levels, these films are adaptable to different applications. The construction, automotive, electronics, and furniture sectors particularly benefit from the protection these films provide during manufacturing, transportation, and handling processes.

- Market trends reflect an increasing demand for environmentally friendly protection films, prompting manufacturers to explore materials with reduced ecological impact. Factors such as heightened construction and automotive activities contribute to the rising need for acrylic sheet protection films. Ongoing advancements, including UV resistance and improved chemical properties in film manufacturing, are further propelling market expansion. Geographically, the market is expanding globally, with Asia-Pacific emerging as a key player due to rapid industrialization. As industries prioritize surface preservation, the acrylic sheet protection films market is poised for continual growth, driven by ongoing innovation and evolving consumer preferences

Acrylic Sheet Surface Protection Films Market Trend Analysis:

Increased Adoption of Acrylic Sheets

- The widespread adoption of acrylic sheets in various industries is a key catalyst for the increased demand and usage of Acrylic Sheet Surface Protection Films. Acrylic sheets are favored for their remarkable clarity, lightweight properties, and versatility in applications like construction, automotive, electronics, and furniture manufacturing. As industries increasingly acknowledge the aesthetic and functional advantages of acrylic surfaces, the necessity for reliable protection becomes more apparent.

- Acrylic Sheet Surface Protection Films function as a shield, safeguarding acrylic sheets from scratches, abrasions, and environmental factors, thus preserving their pristine appearance and structural integrity during handling, transportation, and manufacturing processes. The escalating adoption of acrylic sheets, fueled by their visual appeal and practical benefits, directly augments the market for protective films. This symbiotic relationship sees the growth of one market segment propelling the demand for complementary protection films, contributing to the overall advancement and widespread integration of these materials across diverse industrial sectors.

Innovation in film materials and features

- The opportunities for Acrylic Sheet Surface Protection Films are abundant with the ongoing innovation in film materials and features. Advancements in materials technology allow for the creation of films that boast superior qualities, including heightened durability, improved transparency, and increased resistance to environmental elements. This opens doors for the development of films that surpass basic protection, incorporating features such as anti-static attributes, antimicrobial coatings, or even self-healing capabilities. These innovations not only broaden the scope of applications for acrylic sheet protection films but also address specific industry needs.

- Manufacturers can seize opportunities to set their products apart by offering films with unique and advanced features, meeting the dynamic requirements of diverse sectors. The prospect lies in providing customizable films that tackle specific challenges, such as compatibility with different surfaces or residue-free removal. Furthermore, in response to the escalating emphasis on sustainability, there is an opportunity to innovate and produce eco-friendly films, aligning with the increasing demand for environmentally conscious solutions in the surface protection industry.

Acrylic Sheet Surface Protection Films Market Segment Analysis:

Acrylic Sheet Surface Protection Films Market Segmented on the basis of Film Type, Thickness, Adhesive Type and End-Use Industry.

By Film Type, Polyester (PET) segment is expected to dominate the market during the forecast period

- The anticipated dominance of the Polyester (PET) segment in the Acrylic Sheet Surface Protection Films market throughout the forecast period is attributed to several key factors. Polyester films excel in providing exceptional clarity, robust tensile strength, and resistance to chemicals, rendering them highly suitable for surface protection applications. Their effectiveness in shielding against scratches, abrasions, and environmental elements has led to widespread adoption across diverse industries.

- Furthermore, Polyester films showcase outstanding dimensional stability, ensuring a snug fit to the contours of acrylic surfaces. This adaptability makes them well-suited for various applications in construction, automotive, electronics, and furniture sectors. The durability and optical clarity of Polyester films not only enhance the visual aesthetics of acrylic sheets but also position them as an optimal choice for surface protection without compromising on appearance.

- Industries increasingly prioritizing top-tier protective solutions, the Polyester (PET) segment is poised for prominence, driven by its superior material characteristics and alignment with the stringent requirements of acrylic surface protection.

By End-Use Industry, Construction & Building segment is expected to dominate the market during the forecast period

- During the forecast period, the Construction & Building segment is anticipated to lead the Acrylic Sheet Surface Protection Films market, driven by various factors. The global surge in construction activities, characterized by extensive infrastructure projects and real estate development, significantly contributes to the heightened demand for these films. Acrylic sheets, widely employed in construction for applications like windows, facades, and interior surfaces, necessitate effective protective solutions.

- Moreover, the Construction & Building industry places a premium on surface aesthetics, making the preservation of acrylic sheet appearance a critical requirement during transportation, handling, and construction phases. Acrylic Sheet Surface Protection Films emerge as a reliable solution by preventing scratches, abrasions, and environmental damage, ensuring the impeccable condition of acrylic surfaces. Additionally, as sustainability gains prominence in construction practices, the appeal of eco-friendly acrylic sheet protection films aligns seamlessly with evolving preferences in the sector. In essence, the dominance of the Construction & Building segment underscores the essential role of surface protection films in maintaining the integrity of acrylic components within this thriving industry.

Acrylic Sheet Surface Protection Films Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to lead the Acrylic Sheet Surface Protection Films market throughout the forecast period, driven by several pivotal factors. Rapid industrialization and urban development are key contributors, as they fuel heightened demand for construction materials, electronics, and automotive components industries where surface protection films play a crucial role.

- The substantial manufacturing activities in countries like China and India, coupled with a growing emphasis on maintaining aesthetic appeal and product quality, further propel the adoption of acrylic sheet protection films. Economic expansion and a surge in construction initiatives amplify this trend. Moreover, changing consumer preferences, strict safety regulations, and an expanding middle-class population collectively contribute to the region's prominence in shaping the trajectory of the Acrylic Sheet Surface Protection Films market.

Acrylic Sheet Surface Protection Films Market Top Key Players:

- 3M (US)

- Eastman (US)

- Avery Dennison (US)

- ExxonMobil Chemical (US)

- ZAGG (US)

- OtterBox (US)

- XPEL (US)

- Solar Gard (Saint-Gobain) (US)

- BELKIN (US)

- Argotec (US)

- Tech Armor (US)

- MOSHI (US)

- XtremeGuard (US)

- Halo Screen Protector Film (US)

- PowerSupport (US)

- intelliARMOR (US)

- Crystal Armor (US)

- Spigen (US)

- BodyGuardz (US)

- Orafol (Germany)

- Hexis Graphics (Hexis SA) (France)

- Air-J (South Korea)

- Nitto (Japan), and Other Major Players.

Key Industry Developments in the Acrylic Sheet Surface Protection Films Market:

- In February 2022, Berlin-based Pro Dis Gmbh, A Subsidiary of Polifilm Protection, Is Expanding Its Business in Key Areas. Polifilm Protection, A Producer of Protective Films, Has Partnered with A Sales Specialist for Markets in Central, South-Eastern, And Eastern Europe.

- In February 2023, Eastman Chemical Company announced it had acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region.

|

Global Acrylic Sheet Surface Protection Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 161.24 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 239.62 Mn. |

|

Segments Covered: |

By Film Type |

|

|

|

By Thickness |

|

||

|

By Adhesive Type |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY FILM TYPE (2017-2032)

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYESTER (PET)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYVINYL CHLORIDE (PVC)

- POLYETHYLENE (PE)

- POLYPROPYLENE (PP)

- FLUOROPOLYMERS (PTFE, ETFE)

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY THICKNESS (2017-2032)

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- UP TO 25 MICRONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 25 TO 50 MICRONS

- ABOVE 50 MICRONS

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY ADHESIVE TYPE (2017-2032)

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WATER-BASED ADHESIVES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOLVENT-BASED ADHESIVES

- ACRYLIC-BASED ADHESIVES

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY END-USER INDUSTRY (2017-2032)

- ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION & BUILDING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- ELECTRONICS

- FURNITURE & HOME DÉCOR

- LIGHT AND SIGNAGE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Acrylic Sheet Surface Protection Films Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- EASTMAN (US)

- AVERY DENNISON (US)

- EXXONMOBIL CHEMICAL (US)

- ZAGG (US)

- OTTERBOX (US)

- XPEL (US)

- SOLAR GARD (SAINT-GOBAIN) (US)

- BELKIN (US)

- ARGOTEC (US)

- TECH ARMOR (US)

- MOSHI (US)

- XTREMEGUARD (US)

- HALO SCREEN PROTECTOR FILM (US)

- POWERSUPPORT (US)

- INTELLIARMOR (US)

- CRYSTAL ARMOR (US)

- SPIGEN (US)

- BODYGUARDZ (US)

- ORAFOL (GERMANY)

- HEXIS GRAPHICS (HEXIS SA) (FRANCE)

- AIR-J (SOUTH KOREA)

- NITTO (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Film Type

- Historic And Forecasted Market Size By Thickness

- Historic And Forecasted Market Size By Adhesive Type

- Historic And Forecasted Market Size By End-User Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Acrylic Sheet Surface Protection Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 161.24 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.50 % |

Market Size in 2032: |

USD 239.62 Mn. |

|

Segments Covered: |

By Film Type |

|

|

|

By Thickness |

|

||

|

By Adhesive Type |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET COMPETITIVE RIVALRY

TABLE 005. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET THREAT OF SUBSTITUTES

TABLE 007. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY TYPE

TABLE 008. PE MARKET OVERVIEW (2016-2028)

TABLE 009. LDPE MARKET OVERVIEW (2016-2028)

TABLE 010. PP MARKET OVERVIEW (2016-2028)

TABLE 011. PVC MARKET OVERVIEW (2016-2028)

TABLE 012. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET BY APPLICATION

TABLE 013. AUTOMOTIVE AND TRANSPORT MARKET OVERVIEW (2016-2028)

TABLE 014. BUILDING AND CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 015. LIGHT AND SIGNAGE MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY APPLICATION (2016-2028)

TABLE 018. N ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY APPLICATION (2016-2028)

TABLE 021. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY APPLICATION (2016-2028)

TABLE 024. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY APPLICATION (2016-2028)

TABLE 027. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY APPLICATION (2016-2028)

TABLE 030. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET, BY COUNTRY (2016-2028)

TABLE 031. 3M: SNAPSHOT

TABLE 032. 3M: BUSINESS PERFORMANCE

TABLE 033. 3M: PRODUCT PORTFOLIO

TABLE 034. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. EASTMAN: SNAPSHOT

TABLE 035. EASTMAN: BUSINESS PERFORMANCE

TABLE 036. EASTMAN: PRODUCT PORTFOLIO

TABLE 037. EASTMAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. AVERY DENISON: SNAPSHOT

TABLE 038. AVERY DENISON: BUSINESS PERFORMANCE

TABLE 039. AVERY DENISON: PRODUCT PORTFOLIO

TABLE 040. AVERY DENISON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. EXXONMOBIL CHEMICAL: SNAPSHOT

TABLE 041. EXXONMOBIL CHEMICAL: BUSINESS PERFORMANCE

TABLE 042. EXXONMOBIL CHEMICAL: PRODUCT PORTFOLIO

TABLE 043. EXXONMOBIL CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ZAGG: SNAPSHOT

TABLE 044. ZAGG: BUSINESS PERFORMANCE

TABLE 045. ZAGG: PRODUCT PORTFOLIO

TABLE 046. ZAGG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. OTTERBOX: SNAPSHOT

TABLE 047. OTTERBOX: BUSINESS PERFORMANCE

TABLE 048. OTTERBOX: PRODUCT PORTFOLIO

TABLE 049. OTTERBOX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. NITTO: SNAPSHOT

TABLE 050. NITTO: BUSINESS PERFORMANCE

TABLE 051. NITTO: PRODUCT PORTFOLIO

TABLE 052. NITTO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. XPEL: SNAPSHOT

TABLE 053. XPEL: BUSINESS PERFORMANCE

TABLE 054. XPEL: PRODUCT PORTFOLIO

TABLE 055. XPEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SOLAR GARD (SAINT-GOBAIN): SNAPSHOT

TABLE 056. SOLAR GARD (SAINT-GOBAIN): BUSINESS PERFORMANCE

TABLE 057. SOLAR GARD (SAINT-GOBAIN): PRODUCT PORTFOLIO

TABLE 058. SOLAR GARD (SAINT-GOBAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ORAFOL: SNAPSHOT

TABLE 059. ORAFOL: BUSINESS PERFORMANCE

TABLE 060. ORAFOL: PRODUCT PORTFOLIO

TABLE 061. ORAFOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BELKIN: SNAPSHOT

TABLE 062. BELKIN: BUSINESS PERFORMANCE

TABLE 063. BELKIN: PRODUCT PORTFOLIO

TABLE 064. BELKIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ARGOTEC: SNAPSHOT

TABLE 065. ARGOTEC: BUSINESS PERFORMANCE

TABLE 066. ARGOTEC: PRODUCT PORTFOLIO

TABLE 067. ARGOTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TECH ARMOR: SNAPSHOT

TABLE 068. TECH ARMOR: BUSINESS PERFORMANCE

TABLE 069. TECH ARMOR: PRODUCT PORTFOLIO

TABLE 070. TECH ARMOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. MOSHI: SNAPSHOT

TABLE 071. MOSHI: BUSINESS PERFORMANCE

TABLE 072. MOSHI: PRODUCT PORTFOLIO

TABLE 073. MOSHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. HEXIS GRAPHICS (HEXIS SA): SNAPSHOT

TABLE 074. HEXIS GRAPHICS (HEXIS SA): BUSINESS PERFORMANCE

TABLE 075. HEXIS GRAPHICS (HEXIS SA): PRODUCT PORTFOLIO

TABLE 076. HEXIS GRAPHICS (HEXIS SA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. XTREMEGUARD: SNAPSHOT

TABLE 077. XTREMEGUARD: BUSINESS PERFORMANCE

TABLE 078. XTREMEGUARD: PRODUCT PORTFOLIO

TABLE 079. XTREMEGUARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. HALO SCREEN PROTECTOR FILM: SNAPSHOT

TABLE 080. HALO SCREEN PROTECTOR FILM: BUSINESS PERFORMANCE

TABLE 081. HALO SCREEN PROTECTOR FILM: PRODUCT PORTFOLIO

TABLE 082. HALO SCREEN PROTECTOR FILM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. POWERSUPPORT: SNAPSHOT

TABLE 083. POWERSUPPORT: BUSINESS PERFORMANCE

TABLE 084. POWERSUPPORT: PRODUCT PORTFOLIO

TABLE 085. POWERSUPPORT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. INTELLIARMOR: SNAPSHOT

TABLE 086. INTELLIARMOR: BUSINESS PERFORMANCE

TABLE 087. INTELLIARMOR: PRODUCT PORTFOLIO

TABLE 088. INTELLIARMOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. CRYSTAL ARMOR: SNAPSHOT

TABLE 089. CRYSTAL ARMOR: BUSINESS PERFORMANCE

TABLE 090. CRYSTAL ARMOR: PRODUCT PORTFOLIO

TABLE 091. CRYSTAL ARMOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SPIGEN: SNAPSHOT

TABLE 092. SPIGEN: BUSINESS PERFORMANCE

TABLE 093. SPIGEN: PRODUCT PORTFOLIO

TABLE 094. SPIGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. AIR-J: SNAPSHOT

TABLE 095. AIR-J: BUSINESS PERFORMANCE

TABLE 096. AIR-J: PRODUCT PORTFOLIO

TABLE 097. AIR-J: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. BODYGUARDZ: SNAPSHOT

TABLE 098. BODYGUARDZ: BUSINESS PERFORMANCE

TABLE 099. BODYGUARDZ: PRODUCT PORTFOLIO

TABLE 100. BODYGUARDZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY TYPE

FIGURE 012. PE MARKET OVERVIEW (2016-2028)

FIGURE 013. LDPE MARKET OVERVIEW (2016-2028)

FIGURE 014. PP MARKET OVERVIEW (2016-2028)

FIGURE 015. PVC MARKET OVERVIEW (2016-2028)

FIGURE 016. ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY APPLICATION

FIGURE 017. AUTOMOTIVE AND TRANSPORT MARKET OVERVIEW (2016-2028)

FIGURE 018. BUILDING AND CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 019. LIGHT AND SIGNAGE MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA ACRYLIC SHEET SURFACE PROTECTION FILMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Acrylic Sheet Surface Protection Films Market research report is 2024-2032.

3M (US), Eastman (US), Avery Dennison (US), ExxonMobil Chemical (US), ZAGG (US), OtterBox (US), XPEL (US), Solar Gard (Saint-Gobain) (US), BELKIN (US), Argotec (US), Tech Armor (US), MOSHI (US), XtremeGuard (US), Halo Screen Protector Film (US), PowerSupport (US), intelliARMOR (US), Crystal Armor (US), Spigen (US), BodyGuardz (US), Orafol (Germany), Hexis Graphics (Hexis SA) (France), Air-J (South Korea), Nitto (Japan) and Other Major Players.

The Acrylic Sheet Surface Protection Films Market is segmented into Film Type, Thickness, Adhesive Type, End-User Industry, and region. By Film Type, the market is categorized into Polyester (PET), Polyvinyl chloride (PVC), Polyethylene (PE), Polypropylene (PP) and Fluoropolymers (PTFE, ETFE). By Thickness, the market is categorized into Up to 25 Microns, 25 to 50 Microns, and Above 50 Microns. By Adhesive Type, the market is categorized into Water-based Adhesives, Solvent-based Adhesives, and Acrylic-based Adhesives. By End-Use Industry, the market is categorized into Construction & Building, Automotive, Electronics, Furniture & Home Décor and Light and Signage. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Acrylic Sheet Surface Protection Films are protective layers applied to acrylic surfaces to prevent scratches, abrasions, and environmental damage. Made from polyethylene or polypropylene, they are used in construction, automotive, and electronics industries. They come in various thicknesses, adhesive types, and transparency levels, catering to different application needs.

The global Acrylic Sheet Surface Protection Films Market Size Was Valued at USD 161.24 Million in 2023 and is Projected to Reach USD 239.62 Million by 2032, Growing at a CAGR of 4.50% From 2024-2032.