Global Abrasives Market Overview

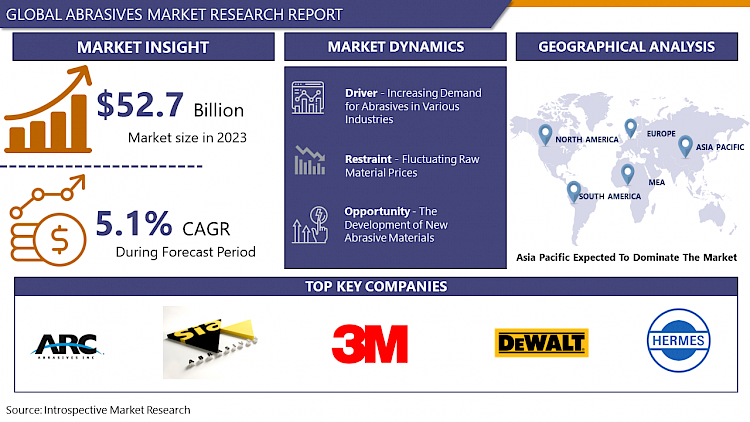

Global Abrasives Market size is expected to grow from USD 52.7 Billion in 2023 to USD 82.46 Billion by 2032, at a CAGR of 5.1% during the forecast period (2024–2032).

-

Abrasives refer to materials or substances used for grinding, polishing, or smoothing surfaces through the process of abrasion. Abrasion involves the wearing away or removal of material from a solid surface by friction or rubbing. Abrasives are typically hard and often consist of minerals, ceramics, or synthetic materials with sharp edges.

-

Abrasive materials are widely used in construction to cut, shape, and smooth concrete, stone, and other materials. In the automotive industry, they help in grinding, polishing, and finishing car parts. Super abrasives like diamond and cubic boron nitride (CBN) have emerged as game-changers due to their exceptional hardness, durability, and thermal stability. The increasing demand for high-performance grinding tools, particularly in the automotive and aerospace sectors, fuels the growth of super abrasives.

-

Manufacturers are developing eco-friendly abrasives that reduce environmental impact, using recycled materials, minimizing energy consumption, and adopting eco-friendly bonding agents. Coated abrasives, where abrasive grains are bonded to a flexible backing material, are gaining popularity due to their versatility and durability. Bonded abrasives continue to play a crucial role in demanding applications due to their strength, precision, and ability to withstand harsh conditions. Technological advancements are revolutionizing the abrasive industry, leading to more efficient, precise, and versatile abrasives. New manufacturing techniques, robotics, and automation are optimizing abrasive applications in various industries.

Abrasives Market Trend Analysis:

Increasing Demand for Abrasives in Various Industries

-

Abrasives are crucial tools in various industries, such as manufacturing, construction, and automotive, for tasks such as grinding, polishing, finishing, and shaping materials. As these industries grow, demand for abrasives is expected to increase. Super abrasives, like diamond and cubic boron nitride, are in high demand in the automotive and aerospace industries due to their durability and ability to grind and polish difficult materials.

-

In the automotive industry, abrasive buffing compounds are used to polish and shine painted surfaces, creating a deep, reflective gloss that enhances the vehicle's aesthetic appeal and protects paint from environmental damage. Abrasives are used in grinding, polishing, and deburring processes on various materials, including metals, plastics, ceramics and rubber.

-

Abrasives are also essential in the construction industry and can be used for shaping and finishing concrete structures and preparing surfaces for painting and coating. Their ability to remove material, smooth surfaces, and polish finishes makes them indispensable tools for achieving desired aesthetics and functionality in buildings and infrastructure projects.

The development of New Abrasive Materials

-

The abrasives market is experiencing significant growth due to the development of new materials that enhance performance, address industry needs, improve cost-effectiveness, and consider environmental aspects, driving innovation.

-

New abrasive materials offer several advantages over traditional ones. They are more effective, durable, and precise, allowing for faster and more efficient removal of material. They also last longer, saving time and money. They are used to create more accurate and consistent results, making them a more cost-effective and efficient alternative.

-

Materials such as Super abrasives, like diamond and cubic boron nitride, are harder and more durable than traditional abrasives, making them ideal for high precision and wear resistance Coated abrasives, bonded to backing materials like paper or cloth, are becoming increasingly popular due to their durability and versatility.

-

Bonded abrasives Materials bonded to materials like resin or rubber are also becoming popular due to their durability and versatility. Nano-abrasives, made up of particles less than 100 nanometers, are still in their early stages of development but have the potential to be even more effective than traditional abrasives. New abrasive materials are leading to improved products, increased productivity, and reduced environmental impact, as they can be used more efficiently and effectively.

Abrasives Market Segment Analysis:

Abrasives Market Segmented on the basis of Product Type, Material and End-User.

By Product Type, Bonded segment is expected to dominate the market during the forecast Period

-

Bonded abrasives are versatile and durable tools suitable for various industrial applications, including grinding, cutting, polishing, and deburring. They withstand high temperatures, pressure, and wear, making them ideal for demanding industrial tasks.

-

Their high material removal rates enable efficient machining processes, reducing machining time and improving overall productivity. Bonded abrasives also offer precise grinding and finishing capabilities, achieving desired surface finishes and dimensional tolerances. They come in various forms and sizes, catering to diverse machining needs and uses in the market.

Abrasives Market Regional Insights:

Asia-Pacific is expected to dominate the Market over the Forecast period

-

The Asia-Pacific region is experiencing rapid industrialization and manufacturing expansion, particularly in countries like China, India, Vietnam and other major countries. Rapid growth is witnessed in sectors like automotive, aerospace, electronics, and construction, leading to an increasing demand for abrasives.

-

Abrasives are essential tools for grinding, polishing, and finishing components and products in these industries. The growing population and consumer goods demand in the region are driving the demand for consumer goods like household appliances, electronic devices, and automobiles. Infrastructure development and construction in the region are also driving demand for abrasives. Government initiatives and support, such as tax incentives, infrastructure development plans, and technological advancements, are encouraging investments in manufacturing and related industries, further fueling the demand for abrasives.

-

The Asia Pacific region has a large pool of skilled labour and lower labour costs compared to developed regions, making it attractive for establishing manufacturing facilities and using abrasives in production processes. These factors contribute to the dominance of the Asia Pacific region in the abrasives market.

Key Players Covered in Abrasives Market:

-

3M (U.S)

-

ARC Abrasive (U.S)

-

Dewalt (U.S)

-

Hermes Abrasives (U.S)

-

Noritake Coated Abrasive (U.S)

-

Osborn (U.S)

-

Walter Surface Technologies (U.S)

-

Weiler (U.S)

-

Saint-Gobain (U.S)

-

United SteeAbrasives (U.S)

-

Bosch/sia Abrasives (Switzerland)

-

Klingspor (Germany)

-

Mirka (Finland)

-

Pferd (Germany)

-

SAIT ABRASIVI (Italy)

-

Zhengzhou KINGSHARK Abrasives (China)

-

Nihon Kenshi (Japan)

-

Tailin Abrasives (Philippines), and Other Major Players

Key Industry Developments in the Abrasives Market:

- In October 2023, Tyrolit Group announced the acquisition of Acme Holding Company, a U.S.-based abrasives manufacturer located in Michigan. It is a move to integrate the business portfolio of grinding with specialty abrasives solutions. This makes Michigan manufacturing facility company’s seventh facility in the U.S. and will prove to be influential in vital industries such as foundry, steel, and rail.

- In December 2023, Saint-Gobain announced a partnership with Dedeco Abrasive Products, a specialty abrasives manufacturer, where Saint-Gobain would market Dedeco’s sunburst abrasive line. This partnership aligns with the company’s comprehensive goal of delivering abrasive solutions.

|

Global Abrasives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 52.7 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.1% |

Market Size in 2032: |

USD 82.46 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ABRASIVES MARKET BY PRODUCT TYPE (2017-2032)

- ABRASIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BONDED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COATED

- SUPER

- ABRASIVES MARKET BY MATERIAL (2017-2032)

- ABRASIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SYNTHETIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NATURAL

- ABRASIVES MARKET BY END-USER (2017-2032)

- ABRASIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- METAL FABRICATION

- MACHINERY

- AEROSPACE

- ELECTRICAL & ELECTRONICS EQUIPMENT

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Abrasives Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M (U.S)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ARC ABRASIVE (U.S)

- DEWALT (U.S)

- HERMES ABRASIVES (U.S)

- NORITAKE COATED ABRASIVE (U.S)

- OSBORN (U.S)

- WALTER SURFACE TECHNOLOGIES (U.S)

- WEILER (U.S)

- SAINT-GOBAIN (U.S)

- UNITED STEEABRASIVES (U.S)

- BOSCH/SIA ABRASIVES (SWITZERLAND)

- KLINGSPOR (GERMANY)

- MIRKA (FINLAND)

- PFERD (GERMANY)

- SAIT ABRASIVI (ITALY)

- ZHENGZHOU KINGSHARK ABRASIVES (CHINA)

- NIHON KENSHI (JAPAN)

- TAILIN ABRASIVES (PHILIPPINES)

- COMPETITIVE LANDSCAPE

- GLOBAL ABRASIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Abrasives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 52.7 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.1% |

Market Size in 2032: |

USD 82.46 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ABRASIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ABRASIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ABRASIVES MARKET COMPETITIVE RIVALRY

TABLE 005. ABRASIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ABRASIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. ABRASIVES MARKET BY TYPE

TABLE 008. COATED ABRASIVES MARKET OVERVIEW (2016-2028)

TABLE 009. NONWOVEN ABRASIVES MARKET OVERVIEW (2016-2028)

TABLE 010. FOAM ABRASIVES MARKET OVERVIEW (2016-2028)

TABLE 011. BONDED ABRASIVES MARKET OVERVIEW (2016-2028)

TABLE 012. ABRASIVES MARKET BY APPLICATION

TABLE 013. AUTOMOBILE INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 014. WOOD INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 015. METAL INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 016. COMPOSITES INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 017. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA ABRASIVES MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA ABRASIVES MARKET, BY APPLICATION (2016-2028)

TABLE 021. N ABRASIVES MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE ABRASIVES MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE ABRASIVES MARKET, BY APPLICATION (2016-2028)

TABLE 024. ABRASIVES MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC ABRASIVES MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC ABRASIVES MARKET, BY APPLICATION (2016-2028)

TABLE 027. ABRASIVES MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA ABRASIVES MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA ABRASIVES MARKET, BY APPLICATION (2016-2028)

TABLE 030. ABRASIVES MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA ABRASIVES MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA ABRASIVES MARKET, BY APPLICATION (2016-2028)

TABLE 033. ABRASIVES MARKET, BY COUNTRY (2016-2028)

TABLE 034. 3M: SNAPSHOT

TABLE 035. 3M: BUSINESS PERFORMANCE

TABLE 036. 3M: PRODUCT PORTFOLIO

TABLE 037. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. SAINT-GOBAIN: SNAPSHOT

TABLE 038. SAINT-GOBAIN: BUSINESS PERFORMANCE

TABLE 039. SAINT-GOBAIN: PRODUCT PORTFOLIO

TABLE 040. SAINT-GOBAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. DEWALT: SNAPSHOT

TABLE 041. DEWALT: BUSINESS PERFORMANCE

TABLE 042. DEWALT: PRODUCT PORTFOLIO

TABLE 043. DEWALT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. PFERD: SNAPSHOT

TABLE 044. PFERD: BUSINESS PERFORMANCE

TABLE 045. PFERD: PRODUCT PORTFOLIO

TABLE 046. PFERD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. WEILER: SNAPSHOT

TABLE 047. WEILER: BUSINESS PERFORMANCE

TABLE 048. WEILER: PRODUCT PORTFOLIO

TABLE 049. WEILER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. HERMES ABRASIVES: SNAPSHOT

TABLE 050. HERMES ABRASIVES: BUSINESS PERFORMANCE

TABLE 051. HERMES ABRASIVES: PRODUCT PORTFOLIO

TABLE 052. HERMES ABRASIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MIRKA: SNAPSHOT

TABLE 053. MIRKA: BUSINESS PERFORMANCE

TABLE 054. MIRKA: PRODUCT PORTFOLIO

TABLE 055. MIRKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. KLINGSPOR: SNAPSHOT

TABLE 056. KLINGSPOR: BUSINESS PERFORMANCE

TABLE 057. KLINGSPOR: PRODUCT PORTFOLIO

TABLE 058. KLINGSPOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ARC ABRASIVE: SNAPSHOT

TABLE 059. ARC ABRASIVE: BUSINESS PERFORMANCE

TABLE 060. ARC ABRASIVE: PRODUCT PORTFOLIO

TABLE 061. ARC ABRASIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BOSCH/SIA ABRASIVES: SNAPSHOT

TABLE 062. BOSCH/SIA ABRASIVES: BUSINESS PERFORMANCE

TABLE 063. BOSCH/SIA ABRASIVES: PRODUCT PORTFOLIO

TABLE 064. BOSCH/SIA ABRASIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OSBORN: SNAPSHOT

TABLE 065. OSBORN: BUSINESS PERFORMANCE

TABLE 066. OSBORN: PRODUCT PORTFOLIO

TABLE 067. OSBORN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. WALTER SURFACE TECHNOLOGIES: SNAPSHOT

TABLE 068. WALTER SURFACE TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 069. WALTER SURFACE TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 070. WALTER SURFACE TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SAIT ABRASIVI: SNAPSHOT

TABLE 071. SAIT ABRASIVI: BUSINESS PERFORMANCE

TABLE 072. SAIT ABRASIVI: PRODUCT PORTFOLIO

TABLE 073. SAIT ABRASIVI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NIHON KENSHI: SNAPSHOT

TABLE 074. NIHON KENSHI: BUSINESS PERFORMANCE

TABLE 075. NIHON KENSHI: PRODUCT PORTFOLIO

TABLE 076. NIHON KENSHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. UNITED STEEABRASIVES: SNAPSHOT

TABLE 077. UNITED STEEABRASIVES: BUSINESS PERFORMANCE

TABLE 078. UNITED STEEABRASIVES: PRODUCT PORTFOLIO

TABLE 079. UNITED STEEABRASIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. NORITAKE COATED ABRASIVE: SNAPSHOT

TABLE 080. NORITAKE COATED ABRASIVE: BUSINESS PERFORMANCE

TABLE 081. NORITAKE COATED ABRASIVE: PRODUCT PORTFOLIO

TABLE 082. NORITAKE COATED ABRASIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. TAILIN ABRASIVES: SNAPSHOT

TABLE 083. TAILIN ABRASIVES: BUSINESS PERFORMANCE

TABLE 084. TAILIN ABRASIVES: PRODUCT PORTFOLIO

TABLE 085. TAILIN ABRASIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. ZHENGZHOU KINGSHARK ABRASIVES: SNAPSHOT

TABLE 086. ZHENGZHOU KINGSHARK ABRASIVES: BUSINESS PERFORMANCE

TABLE 087. ZHENGZHOU KINGSHARK ABRASIVES: PRODUCT PORTFOLIO

TABLE 088. ZHENGZHOU KINGSHARK ABRASIVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ABRASIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ABRASIVES MARKET OVERVIEW BY TYPE

FIGURE 012. COATED ABRASIVES MARKET OVERVIEW (2016-2028)

FIGURE 013. NONWOVEN ABRASIVES MARKET OVERVIEW (2016-2028)

FIGURE 014. FOAM ABRASIVES MARKET OVERVIEW (2016-2028)

FIGURE 015. BONDED ABRASIVES MARKET OVERVIEW (2016-2028)

FIGURE 016. ABRASIVES MARKET OVERVIEW BY APPLICATION

FIGURE 017. AUTOMOBILE INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 018. WOOD INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 019. METAL INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. COMPOSITES INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 021. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA ABRASIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE ABRASIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC ABRASIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA ABRASIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA ABRASIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024–2032.

3M (U.S), ARC Abrasive (U.S), Dewalt (U.S), Hermes Abrasives (U.S), Noritake Coated Abrasive (U.S), Osborn (U.S), Walter Surface Technologies (U.S.),Weiler (U.S), Saint-Gobain (U.S), United SteeAbrasives (U.S), Bosch/sia Abrasives (Switzerland), Klingspor (Germany), Mirka (Finland), Pferd (Germany), SAIT ABRASIVI (Italy), Zhengzhou KINGSHARK Abrasives (China), Nihon Kenshi (Japan), Tailin Abrasives (Philippines), and Other Major Players

The Abrasives Market is segmented into Product Type, Material, End-Users, and region. By Product Type, the market is categorized into Bonded, Coated and Super. By Material, the market is categorized into Synthetic and Natural. By End-Users, the market is categorized into Automotive, Metal fabrication, Machinery, Aerospace and Electrical & electronics equipment. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Abrasives refer to materials or substances used for grinding, polishing, or smoothing surfaces through the process of abrasion. Abrasion involves the wearing away or removal of material from a solid surface by friction or rubbing. Abrasives are typically hard and often consist of minerals, ceramics, or synthetic materials with sharp edges.

Global Abrasives Market size is expected to grow from USD 52.7 Billion in 2023 to USD 82.46 Billion by 2032, at a CAGR of 5.1% during the forecast period (2024–2032).