Elevator and Escalator Market Synopsis

The Global Market for Elevator and Escalator Estimated at USD 94.8 Billion In the Year 2023, is Projected to Reach A Revised Size of USD 174.29 Billion by 2032, Growing at A CAGR of 7.0% Over the Forecast Period 2024-2032.

An elevator is a sort of lift for rooms that may carry several people at once. It is utilized to transport people up and down between floors of a building. In contrast, escalators act as moving steps that transport passengers between a building's various floors. Patient data, luggage, etc. considered to be inter-floor transporters placed and used in commercial infrastructures, residential structures, and industrial settings, such as elevators, escalators, and associated moving walkways. The research report offers comprehensive insights into how sales are divided among product segments for new installations in newly constructed infrastructure projects, replacement or repaired products as part of maintenance activities, or the replacement of outdated solutions with cutting-edge technology under modernization operations.

The first passenger elevator was built in New York in 1857, but it was abandoned three years later after a rocky start. People were hesitant to use elevators as a mode of transportation at the time since they were only seen as a piece of industrial equipment. However, the introduction of high-rise structures and contemporary cities completely altered the elevator sector. Over 18 million elevators and escalators are now in use worldwide.

Elevator and escalator markets are expanding as a result of increased investment in residential and commercial infrastructure projects in both developing and developed economies. It is anticipated that the product will develop as more of the largest and tallest commercial structures are constructed in various regions. For instance, some of the urban projects to which manufacturers are keen to contribute are White Magnolia Tower, Raffles City, Xujiahui Center, One Manhattan West, and Lakhta Center. Additionally, it is anticipated that the market would develop as a consequence of manufacturers putting more emphasis on providing products with greater safety.

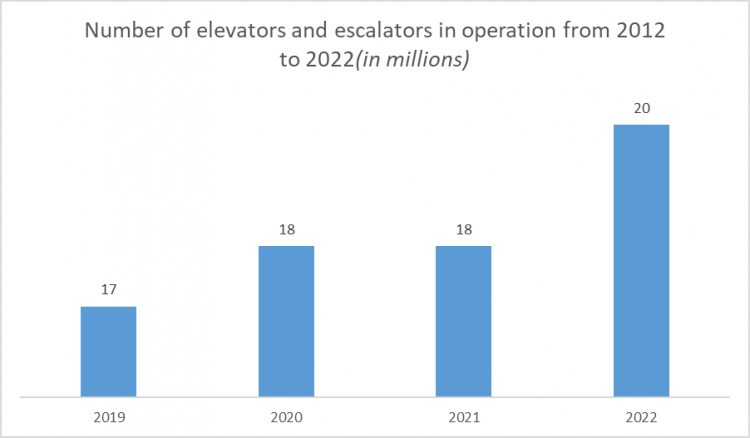

According to Statista, the above graph shows that the continuous increase in the total number of elevators and escalators in operation around the world indicates the ongoing urbanization and development of infrastructure in various regions. As of 2022, with over 20 million elevators and escalators in operation, it is evident that these vertical transportation systems have become an essential part of modern life, especially in densely populated urban areas.

The Elevator and Escalator Market Dyanamic:

Driver

Rapid Urbanization Across the Globe

- Quick urbanization across the globe has arisen as a crucial driver for the lift and elevator market, reshaping metropolitan scenes and changing the manner in which individuals move inside urban areas. Vertical solutions are urgently needed to meet the growing demand for space-saving living and working environments as urban populations grow. As a solution to the challenge of limited land availability in densely populated areas, tall buildings, characterized by high-rise structures and skyscrapers, have become emblematic of contemporary urbanization. With regards to fast urbanization, populace densification inside urban communities is a characterizing pattern.

- More individuals are congregating in metropolitan places, prompting expanded swarming and blockage. Accordingly, vertical development has picked up speed, permitting engineers to fabricate upwards to oblige a bigger number of inhabitants and organizations inside a restricted metropolitan impression. Lifts and elevators assume an imperative part in this upward versatility environment, giving effective transportation among floors and empowering consistent admittance to different conveniences and administrations situated inside tall structures.

- Besides, fast urbanization is interwoven with changing way of life inclinations and financial elements. Metropolitan regions draw in people looking for business amazing open doors, instructive establishments, and social conveniences, driving relocation from provincial to metropolitan regions. This metropolitan deluge powers interest for private and business spaces in tall structures, further highlighting the requirement for dependable vertical transportation frameworks. Lifts and elevators not just work with everyday drives and admittance to work environments yet additionally improve the general comfort and openness of metropolitan living. Besides, as states and confidential designers put resources into framework undertakings to help metropolitan development, lifts and elevators arise as essential parts of current metropolitan foundation.

Opportunity

Green Building Initiatives With growing emphasis on sustainability and energy efficiency

- lift and elevator market to line up with green structure drives. These frameworks are intended to upgrade energy utilization through elements like regenerative drives, Drove lighting, and reserve modes. By offering items that meet rigid energy productivity necessities, makers can engage earth cognizant clients and engineers trying to accomplish maintainability objectives in their structure projects. Besides, green structure certificate programs like Initiative in Energy and Ecological Plan (LEED) give a system to assessing the supportability of structures.

- Lift and elevator makers can foster items and arrangements that add to LEED focuses by utilizing supportable materials, decreasing energy utilization, and giving eco-accommodating plan choices. This arrangement with green structure guidelines upgrades the market allure of their items and separates them from contenders. Notwithstanding ecological advantages, energy-proficient lift and elevator frameworks offer expense reserve funds to building proprietors and administrators.

- Lift and elevator makers can use these motivations, for example, tax reductions, awards, and refunds for energy-proficient items, to empower reception and drive market interest for green structure agreeable arrangements. By lining up with government drives, producers can uphold maintainability objectives at both the neighborhood and worldwide levels while growing their market reach.

- In conclusion, the accentuation on maintainability and energy proficiency presents a convincing an open door for the lift and elevator market to enhance, create eco-accommodating arrangements, and add to a more feasible constructed climate. By offering energy-effective items, lessening ecological effect, and supporting reasonable structure rehearses, makers cannot just meet the developing necessities of the market yet in addition assume a critical part in tending to environmental change and advancing natural stewardship.

Segmentation Analysis of the Elevator and Escalator Market

Elevator and Escalator market segments cover the Product, business, and application. By Product, the Escalators segment is anticipated to dominate the Market over the Forecast period.

The market's fastest-growing category is anticipated to be escalators. The increased demand from commercial infrastructures, such as shopping centers, business parks, and others, is to blame for this. Additionally, the need for escalators and moving walkways is increasing as a result of the expanding aircraft infrastructure development. For instance, the $775 million redevelopment of Stansted Airport in the United Kingdom is anticipated to be finished by 2021. Furthermore, due to their widespread market penetration, the need for elevators is anticipated to expand steadily.

The escalator market is projected to be the fastest-growing category due to several factors. With the rapid urbanization and increasing construction of high-rise buildings in emerging economies, the demand for vertical transportation solutions is surging. Escalators offer a convenient and efficient way to move large numbers of people between different floors, making them a popular choice in malls, airports, and public transport hubs. Additionally, advancements in technology have led to energy-efficient and safer escalator models, further driving their adoption. As cities expand, the need for efficient transportation systems escalates, positioning escalators as a pivotal component in modern urban infrastructure, contributing to their remarkable growth in the market.

Regional Analysis of the Elevator and Escalator Market

Asia Pacific is expected to dominate the Market over the Forecast period.

The increasing demand from China and India is driving the market in the Asia Pacific region. Some of the driving forces behind the market include the simple accessibility of raw resources, low cost of labor, and a relatively strict regulatory structure in these emerging nations. China, India, and Japan are the three most important markets in the Asia Pacific, whereas the US is the biggest market in North America. The market for elevators and escalators in APAC is anticipated to be driven by the expanding use of these devices in the region's infrastructure, commercial, and residential sectors. During the forecast period, industrialization, a growing middle-class population, increasing disposable income, and shifting lifestyles are anticipated to fuel demand for elevators and escalators.

According to Statista, Due to the building industry's continued growth, it is anticipated that the global market for elevators would surpass 183 billion US dollars by 2026. China accounts for two-thirds of new installations globally, and the Asia-Pacific market has seen the strongest growth. Growth is mostly being driven by the region's rapid urbanization and preference for tall structures.

COVID-19 Impact Analysis on the Elevator and Escalator Market

A difficult and unprecedented global health disaster was caused by the COVID-19 epidemic. As a precaution, the majority of the major economies enforced a severe and sudden nationwide lockdown that restricted the region's financial activity. The labor-intensive and extremely unstable construction sector was severely impacted by the abrupt closure. This aspect also slowed down modernization and new building, which hindered sales and the growth of the global market. Reduced financial liquidity, uncertainty around public investments, and a gloomy outlook among established potential investors all contributed to a slowdown in market expansion. The manufacturing ecosystem's supply chain has been completely disrupted, and as a result, the market has degraded throughout many different locations. A temporary prohibition was required by numerous federal governments.

Top Key Players Covered in the Elevator and Escalator Market

- United Technologies (U.S.)

- Schindler (Switzerland)

- KONE CORPORATION (Finland)

- Hitachi, Ltd. (Japan)

- HYUNDAIELEVATOR CO., LTD. (South Korea)

- Mitsubishi Electric Corporation(Japan)

- Johnson Elevator Co., Ltd. (China)

- FUJITEC CO., LTD (Japan)

- Toshiba Corporation (Japan)

- Schindler Management Ltd. (Switzerland)

- ThyssenKrup AG (Germany)

- Sigma elevator company (Thailand)

- Electra Ltd (Israel)

- Gulf Elevator & Escalator Co, Ltd (Japan)

- Otis Elevator Company (US), and Other Major Players.

Key Industry Developments in the Elevator and Escalator Market

- In April 2024, Hitachi Energy revealed investments of over $1.5 billion to ramp up its global transformer manufacturing capacity to keep pace with the growing demand and support long-term plans and electrification efforts. The investments were intended to gradually expand the company's global transformer capacity by 2027 and were in addition to the $3 billion already announced to progress on the electrification of the energy system driven by the energy transition.

- In October 2023, KONE Corporation, a global leader in the elevator and escalator industry, completed the sale of its Russia operations to Russia-based S8 Capital diversified Holding. The transaction had been approved by the relevant authorities, and with the closing of the deal, KONE was fully divested from Russia. The value of the transaction was not disclosed. The sale of the business followed KONE's announcement in March 2022 to cease deliveries and not sign new orders due to Russia's military actions against Ukraine. In June of the same year, KONE revealed its plans to divest its business and operations. At the time of closing the deal, KONE had employed approximately 300 people in Russia, and the business accounted for less than 1% of KONE's global sales.

|

Global Elevator and Escalator Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 94.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.0 % |

Market Size in 2032: |

USD 174.29 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Business |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

TABLE OF CONTENT

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELEVATOR AND ESCALATOR MARKET BY PRODUCT (2016-2030)

- ELEVATOR AND ESCALATOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELEVATORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ESCALATORS

- MOVING WALKWAYS

- ELEVATOR AND ESCALATOR MARKET BY BUSINESS (2016-2030)

- ELEVATOR AND ESCALATOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NEW EQUIPMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MAINTENANCE

- MODERNIZATION

- ELEVATOR AND ESCALATOR MARKET BY APPLICATION (2016-2030)

- ELEVATOR AND ESCALATOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Elevator and Escalator Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- United Technologies (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Schindler (Switzerland)

- KONE CORPORATION (Finland)

- Hitachi, Ltd. (Japan)

- HYUNDAIELEVATOR CO., LTD. (South Korea)

- Mitsubishi Electric Corporation (Japan)

- Johnson Elevator Co., Ltd. (China)

- FUJITEC CO., LTD (Japan)

- Toshiba Corporation (Japan)

- Schindler Management Ltd. (Switzerland)

- ThyssenKrup AG (Germany)

- Sigma elevator company (Thailand)

- Electra Ltd (Israel)

- Gulf Elevator & Escalator Co, Ltd (Japan)

- Otis Elevator Company (US)

- COMPETITIVE LANDSCAPE

- GLOBAL ELEVATOR AND ESCALATOR MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By BUSINESS

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Elevator and Escalator Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 94.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.0 % |

Market Size in 2032: |

USD 174.29 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Business |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CONNECTED BUILDING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CONNECTED BUILDING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CONNECTED BUILDING MARKET COMPETITIVE RIVALRY

TABLE 005. CONNECTED BUILDING MARKET THREAT OF NEW ENTRANTS

TABLE 006. CONNECTED BUILDING MARKET THREAT OF SUBSTITUTES

TABLE 007. CONNECTED BUILDING MARKET BY PLATFORM

TABLE 008. DEVICE MARKET OVERVIEW (2016-2030)

TABLE 009. CONNECTIVITY MARKET OVERVIEW (2016-2030)

TABLE 010. APPLICATION MANAGEMENT MARKET OVERVIEW (2016-2030)

TABLE 011. CONNECTED BUILDING MARKET BY SERVICE

TABLE 012. BUSINESS PROCESS MANAGEMENT MARKET OVERVIEW (2016-2030)

TABLE 013. CUSTOMER ENGAGEMENT MARKET OVERVIEW (2016-2030)

TABLE 014. MAINTENANCE AND SUPPORT MARKET OVERVIEW (2016-2030)

TABLE 015. DEPLOYMENT AND INTEGRATION SERVICES MARKET OVERVIEW (2016-2030)

TABLE 016. CONNECTED BUILDING MARKET BY APPLICATION

TABLE 017. COMMERCIAL MARKET OVERVIEW (2016-2030)

TABLE 018. RESIDENTIAL MARKET OVERVIEW (2016-2030)

TABLE 019. NORTH AMERICA CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 020. NORTH AMERICA CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 021. NORTH AMERICA CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 022. N CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 023. EASTERN EUROPE CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 024. EASTERN EUROPE CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 025. EASTERN EUROPE CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 026. CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 027. WESTERN EUROPE CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 028. WESTERN EUROPE CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 029. WESTERN EUROPE CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 030. CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 031. ASIA PACIFIC CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 032. ASIA PACIFIC CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 033. ASIA PACIFIC CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 034. CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 038. CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 039. SOUTH AMERICA CONNECTED BUILDING MARKET, BY PLATFORM (2016-2030)

TABLE 040. SOUTH AMERICA CONNECTED BUILDING MARKET, BY SERVICE (2016-2030)

TABLE 041. SOUTH AMERICA CONNECTED BUILDING MARKET, BY APPLICATION (2016-2030)

TABLE 042. CONNECTED BUILDING MARKET, BY COUNTRY (2016-2030)

TABLE 043. ROCKWELL AUTOMATION: SNAPSHOT

TABLE 044. ROCKWELL AUTOMATION: BUSINESS PERFORMANCE

TABLE 045. ROCKWELL AUTOMATION: PRODUCT PORTFOLIO

TABLE 046. ROCKWELL AUTOMATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. INC. (US): SNAPSHOT

TABLE 047. INC. (US): BUSINESS PERFORMANCE

TABLE 048. INC. (US): PRODUCT PORTFOLIO

TABLE 049. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. JACOBS (US): SNAPSHOT

TABLE 050. JACOBS (US): BUSINESS PERFORMANCE

TABLE 051. JACOBS (US): PRODUCT PORTFOLIO

TABLE 052. JACOBS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TECH MAHINDRA LIMITED (INDIA): SNAPSHOT

TABLE 053. TECH MAHINDRA LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 054. TECH MAHINDRA LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 055. TECH MAHINDRA LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. INFOSYS LIMITED (INDIA): SNAPSHOT

TABLE 056. INFOSYS LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 057. INFOSYS LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 058. INFOSYS LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CAPGEMINI SERVICE SAS (FRANCE): SNAPSHOT

TABLE 059. CAPGEMINI SERVICE SAS (FRANCE): BUSINESS PERFORMANCE

TABLE 060. CAPGEMINI SERVICE SAS (FRANCE): PRODUCT PORTFOLIO

TABLE 061. CAPGEMINI SERVICE SAS (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. FUJITSU (JAPAN): SNAPSHOT

TABLE 062. FUJITSU (JAPAN): BUSINESS PERFORMANCE

TABLE 063. FUJITSU (JAPAN): PRODUCT PORTFOLIO

TABLE 064. FUJITSU (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BAIN & COMPANY (US): SNAPSHOT

TABLE 065. BAIN & COMPANY (US): BUSINESS PERFORMANCE

TABLE 066. BAIN & COMPANY (US): PRODUCT PORTFOLIO

TABLE 067. BAIN & COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. GENERAL ELECTRIC (US): SNAPSHOT

TABLE 068. GENERAL ELECTRIC (US): BUSINESS PERFORMANCE

TABLE 069. GENERAL ELECTRIC (US): PRODUCT PORTFOLIO

TABLE 070. GENERAL ELECTRIC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CONSTELLATION RESEARCH INC. (US): SNAPSHOT

TABLE 071. CONSTELLATION RESEARCH INC. (US): BUSINESS PERFORMANCE

TABLE 072. CONSTELLATION RESEARCH INC. (US): PRODUCT PORTFOLIO

TABLE 073. CONSTELLATION RESEARCH INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ENGHOUSE INTERACTIVE (US): SNAPSHOT

TABLE 074. ENGHOUSE INTERACTIVE (US): BUSINESS PERFORMANCE

TABLE 075. ENGHOUSE INTERACTIVE (US): PRODUCT PORTFOLIO

TABLE 076. ENGHOUSE INTERACTIVE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. CBT COMPANY (US): SNAPSHOT

TABLE 077. CBT COMPANY (US): BUSINESS PERFORMANCE

TABLE 078. CBT COMPANY (US): PRODUCT PORTFOLIO

TABLE 079. CBT COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. WIPRO LIMITED (INDIA): SNAPSHOT

TABLE 080. WIPRO LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 081. WIPRO LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 082. WIPRO LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BOSCH SOFTWARE INNOVATIONS GMBH (GERMANY): SNAPSHOT

TABLE 083. BOSCH SOFTWARE INNOVATIONS GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 084. BOSCH SOFTWARE INNOVATIONS GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 085. BOSCH SOFTWARE INNOVATIONS GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. INTEL CORPORATION (US): SNAPSHOT

TABLE 086. INTEL CORPORATION (US): BUSINESS PERFORMANCE

TABLE 087. INTEL CORPORATION (US): PRODUCT PORTFOLIO

TABLE 088. INTEL CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. IBM CORPORATION (US): SNAPSHOT

TABLE 089. IBM CORPORATION (US): BUSINESS PERFORMANCE

TABLE 090. IBM CORPORATION (US): PRODUCT PORTFOLIO

TABLE 091. IBM CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CONNECTED BUILDING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CONNECTED BUILDING MARKET OVERVIEW BY PLATFORM

FIGURE 012. DEVICE MARKET OVERVIEW (2016-2030)

FIGURE 013. CONNECTIVITY MARKET OVERVIEW (2016-2030)

FIGURE 014. APPLICATION MANAGEMENT MARKET OVERVIEW (2016-2030)

FIGURE 015. CONNECTED BUILDING MARKET OVERVIEW BY SERVICE

FIGURE 016. BUSINESS PROCESS MANAGEMENT MARKET OVERVIEW (2016-2030)

FIGURE 017. CUSTOMER ENGAGEMENT MARKET OVERVIEW (2016-2030)

FIGURE 018. MAINTENANCE AND SUPPORT MARKET OVERVIEW (2016-2030)

FIGURE 019. DEPLOYMENT AND INTEGRATION SERVICES MARKET OVERVIEW (2016-2030)

FIGURE 020. CONNECTED BUILDING MARKET OVERVIEW BY APPLICATION

FIGURE 021. COMMERCIAL MARKET OVERVIEW (2016-2030)

FIGURE 022. RESIDENTIAL MARKET OVERVIEW (2016-2030)

FIGURE 023. NORTH AMERICA CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. EASTERN EUROPE CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. WESTERN EUROPE CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. ASIA PACIFIC CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. MIDDLE EAST & AFRICA CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. SOUTH AMERICA CONNECTED BUILDING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Elevator and Escalator Market research report is 2024-2032.

United Technologies (U.S.), Schindler (Switzerland), Kone Corporation (Finland), Hitachi, Ltd. (Japan), Hyundaielevator Co., Ltd. (South Korea), Mitsubishi Electric Corporation (Japan), Johnson Elevator Co., Ltd. (China), Fujitec Co., Ltd (Japan), Toshiba Corporation (Japan), Schindler Management Ltd. (Switzerland), ThyssenKrup AG (Germany), Sigma elevator company (Thailand), Electra Ltd (Israel), Gulf Elevator & Escalator Co, Ltd (Japan), Otis Elevator Company (US), and Other Major Players.

The Elevator and Escalator Market is segmented into Product, Business, Application, and region. By Product, the market is categorized into Elevators, Escalators, and Moving Walkways. By Business, the market is categorized into New Equipment, Maintenance, and Modernization. By Application, the market is categorized into Residential, Commercial, and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An elevator is a sort of lift for rooms that may carry several people at once. It is utilized to transport people up and down between floors of a building. In contrast, escalators act as moving steps that transport passengers between a building's various floors. Patient data, luggage, etc. considered to be inter-floor transporters placed and used in commercial infrastructures, residential structures, and industrial settings, such as elevators, escalators, and associated moving walkways. The research report offers comprehensive insights into how sales are divided among product segments for new installations in newly constructed infrastructure projects, replacement or repaired products as part of maintenance activities, or the replacement of outdated solutions with cutting-edge technology under modernization operations.

The Global Market for Elevator and Escalator Estimated at USD 94.8 Billion In the Year 2023, is Projected to Reach A Revised Size of USD 174.29 Billion by 2032, Growing at A CAGR of 7.0% Over the Forecast Period 2024-2032.