Global 3D Mapping and 3D Modelling Market Overview

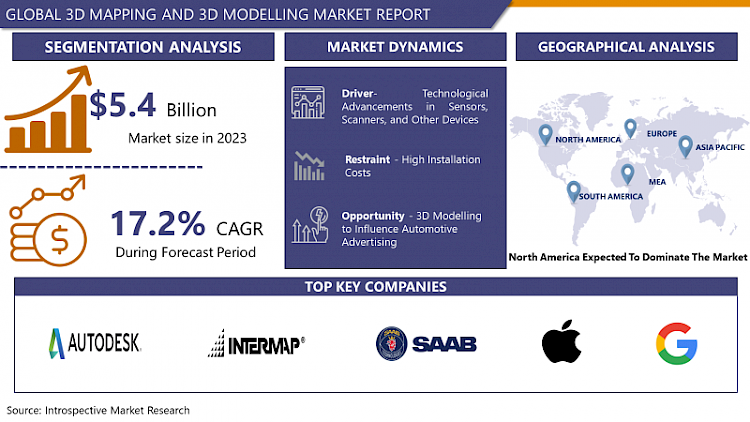

The 3D Mapping and 3D Modelling Market Size Was Valued at USD 5.4 Billion in 2023, and is Projected to Reach USD 22.53 Billion by 2032, Growing at a CAGR of 17.2 % From 2024-2032.

3D mapping and modeling is a technology that allows a viewer to examine a 3D simulation in virtual reality, giving them a realistic experience. It has been widely utilized in the gaming and video entertainment sectors for creating action sequences that allow spectators to feel as if they are in the actual location. Due to an increase in the need for 3D animation in smartphone gaming and other applications, as well as the video entertainment industry's desire to provide a better viewing experience, the market for 3D mapping and 3D modeling has developed significantly in recent years.

3D mapping and 3D modeling are widely utilized in a variety of industries, including automotive, healthcare, building and construction, and defense, to mention a few. AI technology is expected to stimulate the spread of 3D technology due to the efficiency it provides to 3D maps. Technological improvements and the widespread availability of 3D equipment such as sensors, scanners, and other GPS components are estimated to fuel the 3D mapping and 3D modeling market. In addition, 3D geographic data that can be incorporated into existing mobile apps and smartphones is likely to drive the market's growth.

Key Factors and Market Dynamics of 3D Mapping and 3D Modelling market:

Drivers

Realistic and Easy

Users can more realistically display or describe products using 3D modeling. For designers, this 3D modeling technique is simple and easy. Designers can analyze the project from several angles before concluding all of the important aspects. They can also make changes before the prototype is built. Physical models are crucial, but 3D models provide designers with the quickest means to identify project flaws. In addition, 3D modeling allows architects to focus more on the creative process. Architects may save a lot of time and money in the prototype development process, and they can observe how minor design changes will affect the outcome. With modern housing methods, there has been a tremendous demand for customized architecture thus, propelling the growth of the 3D mapping and 3D modeling market during the forecast period.

Technological advancements in sensors, scanners, and other devices

Collection of data and analytics play an important role in 3D mapping and 3D modeling. In the past, due to a lack of proper devices, or systems, it was a difficult task to collect data. The development of 3D content has grown in popularity since the introduction of 3D technology viewing. It has resulted in the invention of several 3D mapping technologies that can map 3D content in the surrounding environment. The technology is making its way into mobile devices including smartphones, tablets, and notebooks. It was possible to model 3D content with the available cloud points using 2D photos, allowing maps to be more realistic and users to have a more accurate view of the objects. 3D scanners, 3D sensors, and other acquisition devices aid in the gathering of 3D data thus, giving a boost to the development of the 3D mapping and 3D modeling market.

Restraints

High installation costs

3D mapping and 3D modeling utilize highly advanced devices for the collection of devices. These high-tech devices such as cameras, sensors, software, and other digital equipment are highly-priced. In addition, to utilize this equipment, the company requires a highly skilled individual thus adding up to the total cost. Along with providing the user with HD quality 3D content, an enhanced customer experience is also essential. To do this, additional costs for obtaining 3D content data from acquisition devices such as scanners and lasers are required thus, hampering the development of the 3D mapping and 3D modeling market during the projected timeframe.

Opportunities

3D Modelling to Influence Automotive Advertising

The automobile industry is a continuously developing industry, with new model launches each year. For instance, if an automobile company plans to release a new car, it can create curiosity in the minds of potential customers by using 3D modeling to build prototypes. The prototype would appear more realistic and provide clients with a better picture of what the car will deliver. Moreover, 3D modeling has advanced to such a great extent that automotive and vehicle design will soon be paperless. Engineers and automobile designers have utilized 3D modeling to produce cars that are more efficient, elegant, and enable low-cost productivity. With the usage of 3D modeling, the product designer or engineer can not only visualize the product but also animate and rigorously test it before it is manufactured as a physical object. Thus, the growing adoption of innovative designing and manufacturing techniques is expected to create a lucrative opportunity for the market players.

Market Segmentation For 3D Mapping And Modelling:

By type, the 3D mapping segment is anticipated to have the highest share of the 3D mapping and 3D modeling market over the forecast period. Projection mapping or video mapping are other terms for 3D mapping. Spatial augmented reality is a term that many people use to describe 3D mapping. 3D mapping helps in profiling objects in three dimensions to map the objects in the real world. The growing popularity of 3D maps as well as the utilization of projection mapping in automotive and real estate has stimulated the development of this segment.

By end-user, the building & construction segment is estimated to lead the development of the 3D mapping and 3D modeling market. Better lead times, costing, stability, and safety are all advantages of 3D modeled construction projects. The technology allows architects and designers to explore and be more creative. Drone technology, in combination with 3D modeling, may also be utilized to constantly monitor ongoing building activities. Furthermore, rather than using traditional physical architectural models, the architectural and construction business employs 3D modeling to demonstrate proposed landscapes and buildings. Furthermore, 3D modeling can be used to create 3D worksites ranging from simple single-story houses to complicated architectural designs thus, strengthening the growth of the segment.

Players Covered in 3D Mapping and 3D Modelling market are :

- Autodesk

- Apple Inc

- SAAB

- Intermap Technologies

- Cybercity 3D

- ESRI

- Topcon Corporation

- Trimble

- Airbus Defence and Space

- Foundry

- Pixologic

- NewTek Inc

- Blender Foundation

- 3D-Coat

- MAXON Computer GmbH

- Softree

- Bentley Systems Incorporated and other major players.

Regional Analysis of 3D Mapping and 3D Modelling market:

The North American region is anticipated to dominate the 3D mapping and 3D modeling market. The growth in this region is attributed to the highly advanced equipment being incorporated into the production and designing of utilities. The manufacturing industry is supported by 3D modeling in a variety of ways, from conceptualization to reverse engineering. 3D modeling is utilized to assist in the prefabrication of parts. It is also being used to improve the design of manufactured goods and to help get products to market quickly. Furthermore, the presence of prominent service providers and the usage of 3D mapping and 3D modeling in the construction industry will bolster the growth of the market in this region.

The European region is anticipated to have the second-highest share of the 3D mapping and 3D modeling market over the forecasted timeframe. Building and construction industry is the most prominent factor stimulating the development of the market. Geolocation and building models of construction sites, buildings, and structures are aided by 3D mapping, allowing architects to design, plan, and manage site logistics. For instance, Zmapping, a London-based firm, develops some of the most extensive and accurate context 3D city models for architects, municipal governments, and master planners. 3D mapping and 3D modeling are also utilized in the automotive industry to design and visualize vehicles even before they are manufactured. The European automotive industry is huge and the adoption of 3D modeling by car manufacturers is expected to support the growth of the market.

The 3D mapping and 3D modeling market in the Asia-Pacific region are anticipated to develop at the highest CAGR due to the rise in the adoption rate. Industries such as healthcare, government, defense, and construction are the major contributors to the growth of the market. In the healthcare sector, the usage of 3D modeling is mostly employed for the development of 3D models of human organs. Some organizations have already built 3D models of human hearts, and many more are scheduled to emerge shortly. To improve surgical success, most human organ transplants will be shaped and printed in 3D thus, supporting the expansion of the 3D mapping and 3D modeling market in this region.

Recent Industry Developments in the 3D Mapping and 3D Modelling market:

-

In October 2023: Bentley Systems and Infotech joined forces to pioneer digital advancements in transportation project delivery. This strategic collaboration aims to revolutionize design-to-construction workflows, elevate data quality, and enhance communication across departments of transportation. By integrating cutting-edge technologies, the initiative seeks to optimize project outcomes and streamline processes within the transportation sector, setting new standards for efficiency and effectiveness.

-

In November 2023 - Cadence and Autodesk Forge Collaborative Alliance to Enhance Smart Product Design. Cadence Allegro X and OrCAD X now seamlessly integrate with Autodesk Fusion, streamlining PCB 3D modeling for design and manufacturing industries. This partnership underscores a trend of strategic alliances driving market expansion and innovation.

- In October 2021, on suitable models, Volvo Active Control's semi-autonomous digging functionality on the Dig Assist suite of tools from Volvo CE can now be utilized with Topcon 3D-MC software. Topcon and Volvo have raised the bar in excavation activities by delivering excavation precision in a fraction of the time and automating the digging process.

- In March 2021, Bentley Systems announced that in association with investors led by Accel-KKR, the company has made a definitive agreement to acquire Seequent—a leader in geological and geophysical modeling software. This acquisition will expand the capabilities of infrastructure digital twins in terms of assistance in the identification and mitigation of environmental concerns, as well as increasing resilience and sustainability.

|

Global 3D Mapping and 3D Modelling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2% |

Market Size in 2032: |

USD 22.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By End User

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: 3D Mapping and 3D Modelling Market by Type

5.1 3D Mapping and 3D Modelling Market Overview Snapshot and Growth Engine

5.2 3D Mapping and 3D Modelling Market Overview

5.3 3D Mapping

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 3D Mapping: Grographic Segmentation

5.4 3D Modelling

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 3D Modelling: Grographic Segmentation

Chapter 6: 3D Mapping and 3D Modelling Market by End User

6.1 3D Mapping and 3D Modelling Market Overview Snapshot and Growth Engine

6.2 3D Mapping and 3D Modelling Market Overview

6.3 Building & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Building & Construction: Grographic Segmentation

6.4 Healthcare

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare: Grographic Segmentation

6.5 Automotive

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Automotive: Grographic Segmentation

Chapter 7: 3D Mapping and 3D Modelling Market by Application

7.1 3D Mapping and 3D Modelling Market Overview Snapshot and Growth Engine

7.2 3D Mapping and 3D Modelling Market Overview

7.3 Projection-Mapping

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Projection-Mapping: Grographic Segmentation

7.4 Maps & Navigation

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Maps & Navigation: Grographic Segmentation

7.5 Texture Mapping

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Texture Mapping: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 3D Mapping and 3D Modelling Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 3D Mapping and 3D Modelling Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 3D Mapping and 3D Modelling Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AUTODESK

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 APPLE INC.

8.4 GOOGLE

8.5 SAAB

8.6 INTERMAP TECHNOLOGIES

8.7 CYBERCITY 3D

8.8 ESRI

8.9 TOPCON CORPORATION

8.10 TRIMBLE

8.11 AIRBUS DEFENCE & SPACE

8.12 FOUNDRY

8.13 PIXOLOGIC

8.14 NEWTEK INC.

8.15 BLENDER FOUNDATION

8.16 3D-COAT

8.17 MAXON COMPUTER GMBH

8.18 SOFTREE

8.19 BENTLEY SYSTEMS INCORPORATED

8.20 OTHER MAJOR PLAYERS

Chapter 9: Global 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 3D Mapping

9.2.2 3D Modelling

9.3 Historic and Forecasted Market Size By End User

9.3.1 Building & Construction

9.3.2 Healthcare

9.3.3 Automotive

9.4 Historic and Forecasted Market Size By Application

9.4.1 Projection-Mapping

9.4.2 Maps & Navigation

9.4.3 Texture Mapping

Chapter 10: North America 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 3D Mapping

10.4.2 3D Modelling

10.5 Historic and Forecasted Market Size By End User

10.5.1 Building & Construction

10.5.2 Healthcare

10.5.3 Automotive

10.6 Historic and Forecasted Market Size By Application

10.6.1 Projection-Mapping

10.6.2 Maps & Navigation

10.6.3 Texture Mapping

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 3D Mapping

11.4.2 3D Modelling

11.5 Historic and Forecasted Market Size By End User

11.5.1 Building & Construction

11.5.2 Healthcare

11.5.3 Automotive

11.6 Historic and Forecasted Market Size By Application

11.6.1 Projection-Mapping

11.6.2 Maps & Navigation

11.6.3 Texture Mapping

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 3D Mapping

12.4.2 3D Modelling

12.5 Historic and Forecasted Market Size By End User

12.5.1 Building & Construction

12.5.2 Healthcare

12.5.3 Automotive

12.6 Historic and Forecasted Market Size By Application

12.6.1 Projection-Mapping

12.6.2 Maps & Navigation

12.6.3 Texture Mapping

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 3D Mapping

13.4.2 3D Modelling

13.5 Historic and Forecasted Market Size By End User

13.5.1 Building & Construction

13.5.2 Healthcare

13.5.3 Automotive

13.6 Historic and Forecasted Market Size By Application

13.6.1 Projection-Mapping

13.6.2 Maps & Navigation

13.6.3 Texture Mapping

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America 3D Mapping and 3D Modelling Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 3D Mapping

14.4.2 3D Modelling

14.5 Historic and Forecasted Market Size By End User

14.5.1 Building & Construction

14.5.2 Healthcare

14.5.3 Automotive

14.6 Historic and Forecasted Market Size By Application

14.6.1 Projection-Mapping

14.6.2 Maps & Navigation

14.6.3 Texture Mapping

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global 3D Mapping and 3D Modelling Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2% |

Market Size in 2032: |

USD 22.53 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. 3D MAPPING AND 3D MODELLING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. 3D MAPPING AND 3D MODELLING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. 3D MAPPING AND 3D MODELLING MARKET COMPETITIVE RIVALRY

TABLE 005. 3D MAPPING AND 3D MODELLING MARKET THREAT OF NEW ENTRANTS

TABLE 006. 3D MAPPING AND 3D MODELLING MARKET THREAT OF SUBSTITUTES

TABLE 007. 3D MAPPING AND 3D MODELLING MARKET BY TYPE

TABLE 008. 3D MAPPING MARKET OVERVIEW (2016-2028)

TABLE 009. 3D MODELLING MARKET OVERVIEW (2016-2028)

TABLE 010. 3D MAPPING AND 3D MODELLING MARKET BY END USER

TABLE 011. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 012. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 013. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 014. 3D MAPPING AND 3D MODELLING MARKET BY APPLICATION

TABLE 015. PROJECTION-MAPPING MARKET OVERVIEW (2016-2028)

TABLE 016. MAPS & NAVIGATION MARKET OVERVIEW (2016-2028)

TABLE 017. TEXTURE MAPPING MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY END USER (2016-2028)

TABLE 020. NORTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY APPLICATION (2016-2028)

TABLE 021. N 3D MAPPING AND 3D MODELLING MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE 3D MAPPING AND 3D MODELLING MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE 3D MAPPING AND 3D MODELLING MARKET, BY END USER (2016-2028)

TABLE 024. EUROPE 3D MAPPING AND 3D MODELLING MARKET, BY APPLICATION (2016-2028)

TABLE 025. 3D MAPPING AND 3D MODELLING MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC 3D MAPPING AND 3D MODELLING MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC 3D MAPPING AND 3D MODELLING MARKET, BY END USER (2016-2028)

TABLE 028. ASIA PACIFIC 3D MAPPING AND 3D MODELLING MARKET, BY APPLICATION (2016-2028)

TABLE 029. 3D MAPPING AND 3D MODELLING MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA 3D MAPPING AND 3D MODELLING MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA 3D MAPPING AND 3D MODELLING MARKET, BY END USER (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA 3D MAPPING AND 3D MODELLING MARKET, BY APPLICATION (2016-2028)

TABLE 033. 3D MAPPING AND 3D MODELLING MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY END USER (2016-2028)

TABLE 036. SOUTH AMERICA 3D MAPPING AND 3D MODELLING MARKET, BY APPLICATION (2016-2028)

TABLE 037. 3D MAPPING AND 3D MODELLING MARKET, BY COUNTRY (2016-2028)

TABLE 038. AUTODESK: SNAPSHOT

TABLE 039. AUTODESK: BUSINESS PERFORMANCE

TABLE 040. AUTODESK: PRODUCT PORTFOLIO

TABLE 041. AUTODESK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. APPLE INC.: SNAPSHOT

TABLE 042. APPLE INC.: BUSINESS PERFORMANCE

TABLE 043. APPLE INC.: PRODUCT PORTFOLIO

TABLE 044. APPLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GOOGLE: SNAPSHOT

TABLE 045. GOOGLE: BUSINESS PERFORMANCE

TABLE 046. GOOGLE: PRODUCT PORTFOLIO

TABLE 047. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SAAB: SNAPSHOT

TABLE 048. SAAB: BUSINESS PERFORMANCE

TABLE 049. SAAB: PRODUCT PORTFOLIO

TABLE 050. SAAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. INTERMAP TECHNOLOGIES: SNAPSHOT

TABLE 051. INTERMAP TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 052. INTERMAP TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 053. INTERMAP TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CYBERCITY 3D: SNAPSHOT

TABLE 054. CYBERCITY 3D: BUSINESS PERFORMANCE

TABLE 055. CYBERCITY 3D: PRODUCT PORTFOLIO

TABLE 056. CYBERCITY 3D: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. ESRI: SNAPSHOT

TABLE 057. ESRI: BUSINESS PERFORMANCE

TABLE 058. ESRI: PRODUCT PORTFOLIO

TABLE 059. ESRI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TOPCON CORPORATION: SNAPSHOT

TABLE 060. TOPCON CORPORATION: BUSINESS PERFORMANCE

TABLE 061. TOPCON CORPORATION: PRODUCT PORTFOLIO

TABLE 062. TOPCON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. TRIMBLE: SNAPSHOT

TABLE 063. TRIMBLE: BUSINESS PERFORMANCE

TABLE 064. TRIMBLE: PRODUCT PORTFOLIO

TABLE 065. TRIMBLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. AIRBUS DEFENCE & SPACE: SNAPSHOT

TABLE 066. AIRBUS DEFENCE & SPACE: BUSINESS PERFORMANCE

TABLE 067. AIRBUS DEFENCE & SPACE: PRODUCT PORTFOLIO

TABLE 068. AIRBUS DEFENCE & SPACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. FOUNDRY: SNAPSHOT

TABLE 069. FOUNDRY: BUSINESS PERFORMANCE

TABLE 070. FOUNDRY: PRODUCT PORTFOLIO

TABLE 071. FOUNDRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. PIXOLOGIC: SNAPSHOT

TABLE 072. PIXOLOGIC: BUSINESS PERFORMANCE

TABLE 073. PIXOLOGIC: PRODUCT PORTFOLIO

TABLE 074. PIXOLOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. NEWTEK INC.: SNAPSHOT

TABLE 075. NEWTEK INC.: BUSINESS PERFORMANCE

TABLE 076. NEWTEK INC.: PRODUCT PORTFOLIO

TABLE 077. NEWTEK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BLENDER FOUNDATION: SNAPSHOT

TABLE 078. BLENDER FOUNDATION: BUSINESS PERFORMANCE

TABLE 079. BLENDER FOUNDATION: PRODUCT PORTFOLIO

TABLE 080. BLENDER FOUNDATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. 3D-COAT: SNAPSHOT

TABLE 081. 3D-COAT: BUSINESS PERFORMANCE

TABLE 082. 3D-COAT: PRODUCT PORTFOLIO

TABLE 083. 3D-COAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. MAXON COMPUTER GMBH: SNAPSHOT

TABLE 084. MAXON COMPUTER GMBH: BUSINESS PERFORMANCE

TABLE 085. MAXON COMPUTER GMBH: PRODUCT PORTFOLIO

TABLE 086. MAXON COMPUTER GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. SOFTREE: SNAPSHOT

TABLE 087. SOFTREE: BUSINESS PERFORMANCE

TABLE 088. SOFTREE: PRODUCT PORTFOLIO

TABLE 089. SOFTREE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. BENTLEY SYSTEMS INCORPORATED: SNAPSHOT

TABLE 090. BENTLEY SYSTEMS INCORPORATED: BUSINESS PERFORMANCE

TABLE 091. BENTLEY SYSTEMS INCORPORATED: PRODUCT PORTFOLIO

TABLE 092. BENTLEY SYSTEMS INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 093. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 094. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 095. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY TYPE

FIGURE 012. 3D MAPPING MARKET OVERVIEW (2016-2028)

FIGURE 013. 3D MODELLING MARKET OVERVIEW (2016-2028)

FIGURE 014. 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY END USER

FIGURE 015. BUILDING & CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 016. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 017. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 018. 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY APPLICATION

FIGURE 019. PROJECTION-MAPPING MARKET OVERVIEW (2016-2028)

FIGURE 020. MAPS & NAVIGATION MARKET OVERVIEW (2016-2028)

FIGURE 021. TEXTURE MAPPING MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA 3D MAPPING AND 3D MODELLING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the 3D Mapping and 3D Modelling Market research report is 2024-2032.

Autodesk, Apple Inc, Google, SAAB, Intermap Technologies, Cybercity 3D, ESRI,Topcon Corporation, Trimble, Airbus Defence and Space, Foundry, Pixologic, NewTek Inc, Blender Foundation, 3D-Coat,MAXON Computer GmbH, Softree, Bentley Systems Incorporated, and Other Major Players.

3D Mapping and 3D Modelling Market is segmented into Type, End-User, Application and region. By Type, the market is categorized into 3D Mapping, 3D Modelling. By End-User, the market is categorized into Building & Construction, Healthcare, and Automotive. By Application, the market is categorized into Projection-Mapping, Maps & Navigation, and Texture Mapping. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

3D mapping and modeling is a technology that allows a viewer to examine a 3D simulation in virtual reality, giving them a realistic experience. It has been widely utilized in the gaming and video entertainment sectors for creating action sequences that allow spectators to feel as if they are in the actual location.

The 3D Mapping and 3D Modelling Market Size Was Valued at USD 5.4 Billion in 2023, and is Projected to Reach USD 22.53 Billion by 2032, Growing at a CAGR of 17.2 % From 2024-2032.