Global Wi-Fi Market Synopsis

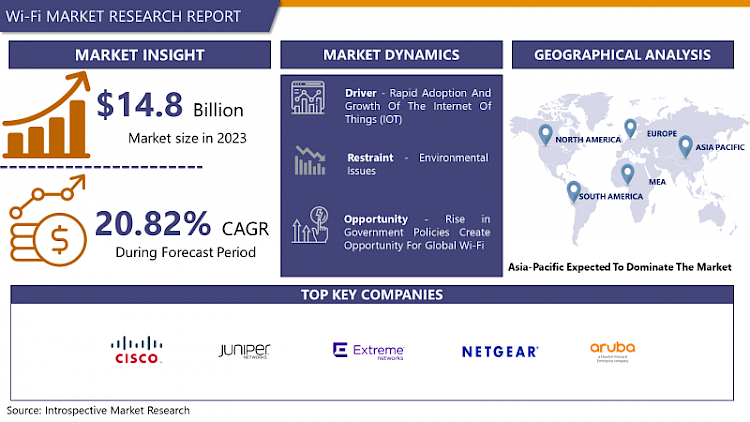

Global Wi-Fi Market size was valued at USD 14.8 billion in 2023 and is projected to reach USD 81.19 billion by 2032, growing at a CAGR of 20.82% from 2024 to 2032.

Wi-Fi, short for "Wireless Fidelity," is a wireless networking technology that enables devices such as smartphones, laptops, tablets, and more to connect to the internet or other local networks without the need for physical cables.

- It relies on radio waves to transmit data between devices and a wireless router or access point. Wi-Fi has become an integral part of modern life, providing the convenience of internet access in homes, businesses, public spaces, and even on the go.

- Wi-Fi networks operate on various frequency bands, including 2.4 GHz and 5 GHz, with the latter offering faster speeds and less interference. The technology supports multiple encryption and security protocols to protect data transmission and ensure privacy.

- Devices typically authenticate with a Wi-Fi network using a password or security key, and once connected, they can access the internet, share files, and communicate with other devices on the same network. The range of a Wi-Fi network can vary, with factors like signal strength, obstacles, and interference affecting its coverage area.

- In recent years, Wi-Fi technology has evolved to offer faster speeds, improved security, and broader coverage. The development of Wi-Fi 6 (802.11ax) and Wi-Fi 6E has significantly enhanced the performance and capacity of wireless networks, making them capable of handling the increasing demands of bandwidth-intensive applications like 4K video streaming, online gaming, and IoT (Internet of Things) devices.

- As Wi-Fi continues to evolve, it remains a crucial component of our interconnected world, enabling seamless communication and connectivity for a wide range of devices and applications.

Global Wi-Fi Market Trend Analysis

Rapid Adoption and Growth of the Internet of Things (IoT)

- The rapid adoption and growth of the Internet of Things (IoT) have indeed been significant drivers for the Wi-Fi market. IoT refers to the interconnected network of physical devices, vehicles, buildings, and other objects embedded with sensors, software, and connectivity capabilities that enable them to collect and exchange data over the internet. Wi-Fi technology plays a pivotal role in facilitating this exchange of data within the IoT ecosystem.

- One key reason for the symbiotic relationship between IoT and Wi-Fi is that Wi-Fi provides a robust, wireless communication infrastructure that is well-suited for connecting a multitude of IoT devices. These devices often require high-speed data transfer, low latency, and seamless connectivity, which Wi-Fi networks can deliver. As IoT devices become increasingly prevalent in various sectors, including smart homes, industrial automation, healthcare, and smart cities, the demand for reliable and high-performance Wi-Fi connectivity has surged.

- Moreover, Wi-Fi offers the advantage of being widely available and already integrated into many consumer and business environments. This pre-existing infrastructure has made it easier for IoT device manufacturers to build connectivity solutions that leverage Wi-Fi, reducing deployment costs and complexity. Additionally, the evolution of Wi-Fi standards, such as Wi-Fi 6 (802.11ax) and Wi-Fi 6E, has further enhanced its capacity, speed, and support for a massive number of IoT devices. The below mention graph shows that the increasing IoT Connected devices uses in the north America, china and Europe region thus the Wi-Fi market is increases in this region.

Government Initiatives for Smart City Projects

- Government initiatives aimed at developing smart cities have presented significant opportunities for the Wi-Fi market. Smart cities are urban areas that leverage advanced technologies to enhance the quality of life for residents, improve infrastructure efficiency, and promote sustainability. Wi-Fi plays a pivotal role in enabling the connectivity and data exchange needed for the myriad of smart city applications.

- One key aspect of smart cities is the deployment of Wi-Fi networks to provide widespread internet access to residents and visitors. Public Wi-Fi networks in parks, transportation hubs, and other public spaces offer free or affordable internet access, bridging the digital divide and increasing digital inclusion. Governments often invest in these networks as part of their smart city initiatives, creating opportunities for Wi-Fi infrastructure providers to expand their reach.

- Wi-Fi is essential for powering various smart city applications, including intelligent traffic management, public safety, environmental monitoring, and smart grid solutions. These applications rely on real-time data collection and analysis, which require robust and low-latency Wi-Fi connectivity. Government-backed smart city projects typically involve the installation of Wi-Fi access points and sensors throughout the urban landscape, fostering demand for Wi-Fi technology and services.

Global Wi-Fi Market Segment Analysis:

Global Wi-Fi Market Segmented on the basis of type, application, and end-users.

By Component, Hardware segment is expected to dominate the market during the forecast period

- Hardware refers to the physical components of a computer or electronic device that can be touched and seen. It includes a wide range of components, such as central processing units (CPUs), memory (RAM), storage devices (hard drives, SSDs), motherboards, graphics cards, power supplies, and input/output devices like monitors, keyboards, and mice.

- Hardware is the foundation upon which software operates, as it executes the instructions and processes data necessary for the functioning of applications and operating systems. In addition to personal computers, hardware is also found in smartphones, tablets, servers, networking equipment, and various other electronic devices, each tailored to their specific purposes and performance requirements.

- Hardware components work together to perform various tasks, with CPUs serving as the "brain" of a computer by executing instructions and performing calculations. Memory stores data and instructions for quick access, while storage devices retain data over longer periods.

By Density, High-Density segment held the largest share of 25% in 2022

- This segment's significance lies in its pivotal role across various sectors, where precision, compactness, and efficient material utilization are paramount. High-density materials, whether in electronics, construction, or automotive sectors, offer a remarkable advantage due to their ability to pack more functionality or strength into smaller spaces. This attribute makes them highly sought-after, enabling the creation of more powerful electronic devices, sturdy yet lightweight structures, and vehicles with enhanced performance.

- The 25% share held by the high-density segment underscores its widespread adoption and the confidence industries place in its capabilities. Its prominence speaks volumes about the increasing demand for materials that optimize space and resources without compromising on quality or performance.

Global Wi-Fi Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is experiencing a surging demand for Wi-Fi, primarily propelled by the widespread adoption of the Internet and the increasing dependence on smartphones. The region's advancement towards smart city initiatives, which prioritize widespread Wi-Fi accessibility to bolster healthcare and education services, is significantly contributing to market expansion. Additionally, heightened investments in various sectors such as transportation, public safety, utilities, and education projects are serving as positive catalysts for the Wi-Fi market in the region.

- In the forecast year he growth of 5G technology is expected to be gradual, with it coexisting alongside existing mobile broadband infrastructure. Within the Asia-Pacific region, China stands out for having one of the most extensive 5G networks. According to the Ministry of Industry and Information Technology, China had plans to erect over 600,000 5G base stations in the previous year.

- In addition to 5G, Wi-Fi is widely adopted for indoor applications across China. The country's thriving consumer electronics industry is expected to drive swift adoption of Wi-Fi technology in the foreseeable future. Notably, in November 2020, a China-based company named ZTE unveiled its inaugural Wi-Fi offering, the ZTE ZXV10 B860AV6. This product promises high-speed internet access, exceptional stability, and low latency. Furthermore, it supports Wi-Fi 6 transmission quality of service (QoS) solutions and offers a smart networking solution for comprehensive home connectivity.

Global Wi-Fi Market Top Key Players:

- Cisco (US)

- Juniper Networks (US)

- Extreme Networks (US)

- NETGEAR (US)

- Aruba (US)

- Fortinet (US)

- Casa Systems (US)

- Broadcom (US)

- Ubiquiti Networks (US)

- AT&T (US)

- Com Business (US)

- iPass (US)

- Cambium Networks (US)

- Ericsson (Sweden)

- LEVER Technology Group (UK)

- Redway Networks (UK)

- Orange Business Services (France)

- Alcatel-Lucent Enterprise (France)

- Vodafone (UK)

- Fon (Spain)

- Huawei (China)

- Panasonic (Japan)

- Fujitsu (Japan)

- D-Link Systems (Taiwan)

- Airtel (India)

- Superloop (Australia)

- Telstra (Australia)

Key Industry Developments in the Global Wi-Fi Market:

- In September 2023, Huawei introduced the Huawei Router 3B Pro with WiFi-7 capabilities, which can transfer a single file through both 2.4gHz and 5gHz channels to boost speed.

- In August 2023, US cellular and Ericsson collaborated to provide private wireless network solutions for various industry segments. This includes an initial focus on Industry 4.0 manufacturing, logistics, distribution and warehouse use cases, expanding into hospitals, Industrial Internet of Things (IIoT), ports, utilities, and airports.

- In May 2023, Extreme Networks introduced a variety of new solutions. It launched the AP3000 Wi-Fi 6E access point (AP) to meet enterprise-grade performance. Extreme also extended its Universal Switch series by introducing the 7520 and 7720 switches, custom-built for enterprise core and aggregation use cases, and 8820 switches, high-density, deep buffer switch routers designed for large enterprise networks.

|

Global Wi-Fi Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.82% |

Market Size in 2032: |

USD 81.19 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Density |

|

||

|

By Location Type |

|

||

|

By Organization Size |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WI-FI MARKET BY COMPONENT (2017-2032)

- WI-FI MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOLUTIONS

- SERVICES

- WI-FI MARKET BY DENSITY (2017-2032)

- WI-FI MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HI-DENSITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ENTERPRISE-CLASS

- WI-FI MARKET BY LOCATION TYPE (2017-2032)

- WI-FI MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDOOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OUTDOOR

- WI-FI MARKET BY ORGANIZATION SIZE (2017-2032)

- WI-FI MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMES

- WI-FI MARKET BY APPLICATIONS (2017-2032)

- WI-FI MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EDUCATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE AND LIFE SCIENCES

- TRANSPORTATION AND LOGISTICS

- MANUFACTURING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wi-Fi Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CISCO

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPANYB Juniper Networks

- Extreme Networks

- NETGEAR

- Aruba

- Fortinet

- Casa Systems

- Broadcom

- Ubiquiti Networks

- AT&T

- Com Business

- iPass

- Cambium Networks

- Ericsson

- LEVER Technology Group

- Redway Networks

- Orange Business Services

- Alcatel-Lucent Enterprise

- Vodafone

- Fon

- COMPETITIVE LANDSCAPE

- GLOBAL WI-FI MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Density

- Historic And Forecasted Market Size By Location Type

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Applications

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wi-Fi Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 14.8 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.82% |

Market Size in 2032: |

USD 81.19 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Density |

|

||

|

By Location Type |

|

||

|

By Organization Size |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WI-FI MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WI-FI MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WI-FI MARKET COMPETITIVE RIVALRY

TABLE 005. WI-FI MARKET THREAT OF NEW ENTRANTS

TABLE 006. WI-FI MARKET THREAT OF SUBSTITUTES

TABLE 007. WI-FI MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2030)

TABLE 009. SOLUTIONS MARKET OVERVIEW (2016-2030)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2030)

TABLE 011. WI-FI MARKET BY DENSITY

TABLE 012. HI-DENSITY MARKET OVERVIEW (2016-2030)

TABLE 013. ENTERPRISE-CLASS MARKET OVERVIEW (2016-2030)

TABLE 014. WI-FI MARKET BY LOCATION TYPE

TABLE 015. INDOOR MARKET OVERVIEW (2016-2030)

TABLE 016. OUTDOOR MARKET OVERVIEW (2016-2030)

TABLE 017. WI-FI MARKET BY ORGANIZATION SIZE

TABLE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2030)

TABLE 019. SMES MARKET OVERVIEW (2016-2030)

TABLE 020. WI-FI MARKET BY APPLICATIONS

TABLE 021. EDUCATION MARKET OVERVIEW (2016-2030)

TABLE 022. HEALTHCARE AND LIFE SCIENCES MARKET OVERVIEW (2016-2030)

TABLE 023. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2030)

TABLE 024. MANUFACTURING MARKET OVERVIEW (2016-2030)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 026. NORTH AMERICA WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 027. NORTH AMERICA WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 028. NORTH AMERICA WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 029. NORTH AMERICA WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 030. NORTH AMERICA WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 031. N WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 032. EASTERN EUROPE WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 033. EASTERN EUROPE WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 034. EASTERN EUROPE WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 035. EASTERN EUROPE WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 036. EASTERN EUROPE WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 037. WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 038. WESTERN EUROPE WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 039. WESTERN EUROPE WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 040. WESTERN EUROPE WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 041. WESTERN EUROPE WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 042. WESTERN EUROPE WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 043. WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 044. ASIA PACIFIC WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 045. ASIA PACIFIC WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 046. ASIA PACIFIC WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 047. ASIA PACIFIC WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 048. ASIA PACIFIC WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 049. WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 052. MIDDLE EAST & AFRICA WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 053. MIDDLE EAST & AFRICA WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 054. MIDDLE EAST & AFRICA WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 055. WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 056. SOUTH AMERICA WI-FI MARKET, BY COMPONENT (2016-2030)

TABLE 057. SOUTH AMERICA WI-FI MARKET, BY DENSITY (2016-2030)

TABLE 058. SOUTH AMERICA WI-FI MARKET, BY LOCATION TYPE (2016-2030)

TABLE 059. SOUTH AMERICA WI-FI MARKET, BY ORGANIZATION SIZE (2016-2030)

TABLE 060. SOUTH AMERICA WI-FI MARKET, BY APPLICATIONS (2016-2030)

TABLE 061. WI-FI MARKET, BY COUNTRY (2016-2030)

TABLE 062. CISCO (US): SNAPSHOT

TABLE 063. CISCO (US): BUSINESS PERFORMANCE

TABLE 064. CISCO (US): PRODUCT PORTFOLIO

TABLE 065. CISCO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. JUNIPER NETWORKS (US): SNAPSHOT

TABLE 066. JUNIPER NETWORKS (US): BUSINESS PERFORMANCE

TABLE 067. JUNIPER NETWORKS (US): PRODUCT PORTFOLIO

TABLE 068. JUNIPER NETWORKS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. HUAWEI (CHINA): SNAPSHOT

TABLE 069. HUAWEI (CHINA): BUSINESS PERFORMANCE

TABLE 070. HUAWEI (CHINA): PRODUCT PORTFOLIO

TABLE 071. HUAWEI (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ERICSSON (SWEDEN): SNAPSHOT

TABLE 072. ERICSSON (SWEDEN): BUSINESS PERFORMANCE

TABLE 073. ERICSSON (SWEDEN): PRODUCT PORTFOLIO

TABLE 074. ERICSSON (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. EXTREME NETWORKS (US): SNAPSHOT

TABLE 075. EXTREME NETWORKS (US): BUSINESS PERFORMANCE

TABLE 076. EXTREME NETWORKS (US): PRODUCT PORTFOLIO

TABLE 077. EXTREME NETWORKS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. NETGEAR (US): SNAPSHOT

TABLE 078. NETGEAR (US): BUSINESS PERFORMANCE

TABLE 079. NETGEAR (US): PRODUCT PORTFOLIO

TABLE 080. NETGEAR (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. ARUBA (US): SNAPSHOT

TABLE 081. ARUBA (US): BUSINESS PERFORMANCE

TABLE 082. ARUBA (US): PRODUCT PORTFOLIO

TABLE 083. ARUBA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. PANASONIC (JAPAN): SNAPSHOT

TABLE 084. PANASONIC (JAPAN): BUSINESS PERFORMANCE

TABLE 085. PANASONIC (JAPAN): PRODUCT PORTFOLIO

TABLE 086. PANASONIC (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ALCATEL-LUCENT ENTERPRISE (FRANCE): SNAPSHOT

TABLE 087. ALCATEL-LUCENT ENTERPRISE (FRANCE): BUSINESS PERFORMANCE

TABLE 088. ALCATEL-LUCENT ENTERPRISE (FRANCE): PRODUCT PORTFOLIO

TABLE 089. ALCATEL-LUCENT ENTERPRISE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. FORTINET (US): SNAPSHOT

TABLE 090. FORTINET (US): BUSINESS PERFORMANCE

TABLE 091. FORTINET (US): PRODUCT PORTFOLIO

TABLE 092. FORTINET (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. D-LINK SYSTEMS (TAIWAN): SNAPSHOT

TABLE 093. D-LINK SYSTEMS (TAIWAN): BUSINESS PERFORMANCE

TABLE 094. D-LINK SYSTEMS (TAIWAN): PRODUCT PORTFOLIO

TABLE 095. D-LINK SYSTEMS (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. LEVER TECHNOLOGY GROUP (UK): SNAPSHOT

TABLE 096. LEVER TECHNOLOGY GROUP (UK): BUSINESS PERFORMANCE

TABLE 097. LEVER TECHNOLOGY GROUP (UK): PRODUCT PORTFOLIO

TABLE 098. LEVER TECHNOLOGY GROUP (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. REDWAY NETWORKS (UK): SNAPSHOT

TABLE 099. REDWAY NETWORKS (UK): BUSINESS PERFORMANCE

TABLE 100. REDWAY NETWORKS (UK): PRODUCT PORTFOLIO

TABLE 101. REDWAY NETWORKS (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. CASA SYSTEMS (US): SNAPSHOT

TABLE 102. CASA SYSTEMS (US): BUSINESS PERFORMANCE

TABLE 103. CASA SYSTEMS (US): PRODUCT PORTFOLIO

TABLE 104. CASA SYSTEMS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. BROADCOM (US): SNAPSHOT

TABLE 105. BROADCOM (US): BUSINESS PERFORMANCE

TABLE 106. BROADCOM (US): PRODUCT PORTFOLIO

TABLE 107. BROADCOM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. UBIQUITI NETWORKS (US): SNAPSHOT

TABLE 108. UBIQUITI NETWORKS (US): BUSINESS PERFORMANCE

TABLE 109. UBIQUITI NETWORKS (US): PRODUCT PORTFOLIO

TABLE 110. UBIQUITI NETWORKS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. AIRTEL (INDIA): SNAPSHOT

TABLE 111. AIRTEL (INDIA): BUSINESS PERFORMANCE

TABLE 112. AIRTEL (INDIA): PRODUCT PORTFOLIO

TABLE 113. AIRTEL (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. ORANGE BUSINESS SERVICES (FRANCE): SNAPSHOT

TABLE 114. ORANGE BUSINESS SERVICES (FRANCE): BUSINESS PERFORMANCE

TABLE 115. ORANGE BUSINESS SERVICES (FRANCE): PRODUCT PORTFOLIO

TABLE 116. ORANGE BUSINESS SERVICES (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. AT&T (US): SNAPSHOT

TABLE 117. AT&T (US): BUSINESS PERFORMANCE

TABLE 118. AT&T (US): PRODUCT PORTFOLIO

TABLE 119. AT&T (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. COM BUSINESS (US): SNAPSHOT

TABLE 120. COM BUSINESS (US): BUSINESS PERFORMANCE

TABLE 121. COM BUSINESS (US): PRODUCT PORTFOLIO

TABLE 122. COM BUSINESS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. VODAFONE (UK): SNAPSHOT

TABLE 123. VODAFONE (UK): BUSINESS PERFORMANCE

TABLE 124. VODAFONE (UK): PRODUCT PORTFOLIO

TABLE 125. VODAFONE (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. IPASS (US): SNAPSHOT

TABLE 126. IPASS (US): BUSINESS PERFORMANCE

TABLE 127. IPASS (US): PRODUCT PORTFOLIO

TABLE 128. IPASS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. SUPERLOOP (AUSTRALIA): SNAPSHOT

TABLE 129. SUPERLOOP (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 130. SUPERLOOP (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 131. SUPERLOOP (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 131. TELSTRA (AUSTRALIA): SNAPSHOT

TABLE 132. TELSTRA (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 133. TELSTRA (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 134. TELSTRA (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 134. FUJITSU (JAPAN): SNAPSHOT

TABLE 135. FUJITSU (JAPAN): BUSINESS PERFORMANCE

TABLE 136. FUJITSU (JAPAN): PRODUCT PORTFOLIO

TABLE 137. FUJITSU (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 137. CAMBIUM NETWORKS (US): SNAPSHOT

TABLE 138. CAMBIUM NETWORKS (US): BUSINESS PERFORMANCE

TABLE 139. CAMBIUM NETWORKS (US): PRODUCT PORTFOLIO

TABLE 140. CAMBIUM NETWORKS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 140. FON (SPAIN): SNAPSHOT

TABLE 141. FON (SPAIN): BUSINESS PERFORMANCE

TABLE 142. FON (SPAIN): PRODUCT PORTFOLIO

TABLE 143. FON (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 143. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 144. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 145. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 146. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WI-FI MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WI-FI MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2030)

FIGURE 013. SOLUTIONS MARKET OVERVIEW (2016-2030)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2030)

FIGURE 015. WI-FI MARKET OVERVIEW BY DENSITY

FIGURE 016. HI-DENSITY MARKET OVERVIEW (2016-2030)

FIGURE 017. ENTERPRISE-CLASS MARKET OVERVIEW (2016-2030)

FIGURE 018. WI-FI MARKET OVERVIEW BY LOCATION TYPE

FIGURE 019. INDOOR MARKET OVERVIEW (2016-2030)

FIGURE 020. OUTDOOR MARKET OVERVIEW (2016-2030)

FIGURE 021. WI-FI MARKET OVERVIEW BY ORGANIZATION SIZE

FIGURE 022. LARGE ENTERPRISES MARKET OVERVIEW (2016-2030)

FIGURE 023. SMES MARKET OVERVIEW (2016-2030)

FIGURE 024. WI-FI MARKET OVERVIEW BY APPLICATIONS

FIGURE 025. EDUCATION MARKET OVERVIEW (2016-2030)

FIGURE 026. HEALTHCARE AND LIFE SCIENCES MARKET OVERVIEW (2016-2030)

FIGURE 027. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2030)

FIGURE 028. MANUFACTURING MARKET OVERVIEW (2016-2030)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 030. NORTH AMERICA WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. EASTERN EUROPE WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. WESTERN EUROPE WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. ASIA PACIFIC WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. MIDDLE EAST & AFRICA WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. SOUTH AMERICA WI-FI MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Global Wi-Fi Market research report is 2024-2032.

Cisco (US), Juniper Networks (US), Huawei (China), Ericsson (Sweden), Extreme Networks (US), NETGEAR (US), Aruba (US), Panasonic (Japan), Alcatel-Lucent Enterprise (France), Fortinet (US), D-Link Systems (Taiwan), LEVER Technology Group (UK), Redway Networks (UK), Casa Systems (US), Broadcom (US), Ubiquiti Networks (US), Airtel (India), Orange Business Services (France), AT&T (US), Com Business (US), Vodafone (UK), iPass (US), Super loop (Australia), Telstra (Australia), Fujitsu (Japan), Cambium Networks (US), and Fon (Spain)And Other Major Player and Other Major Players.

The Wi-Fi Market is segmented into Component, Density, Location Type, Organization Size, Applications, and region. By Component, the market is categorized into Hardware, Solutions, Services. By Density, the market is categorized into Hi-Density, Enterprise-Class. By Location Type, the market is, categorized into Indoor, Outdoor. By Organization Size, the market categorized into Large Enterprises, SMEs. By Applications, the market categorized into Education, Healthcare and Life Sciences, Transportation and Logistics, Manufacturing, Others By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wi-Fi, short for "Wireless Fidelity," is a wireless networking technology that enables devices such as smartphones, laptops, tablets, and more to connect to the internet or other local networks without the need for physical cables.

Global Wi-Fi Market size was valued at USD 14.8 billion in 2023 and is projected to reach USD 81.19 billion by 2032, growing at a CAGR of 20.82% from 2024 to 2032.