Wood Moisture Tester Market Synopsis

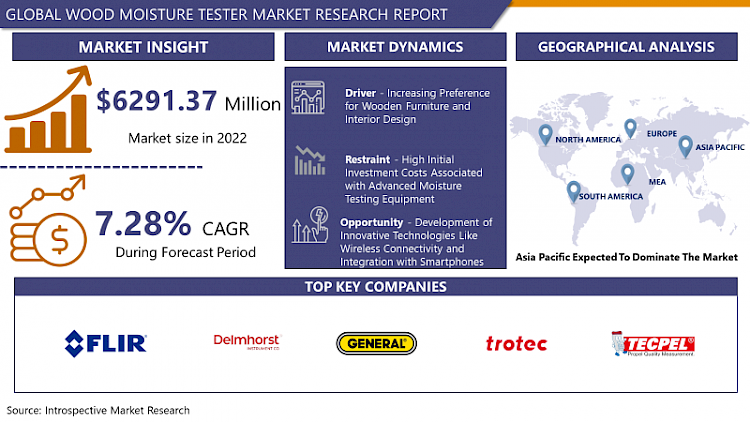

Global Wood Moisture Tester Market Size Was Valued at USD 6291.37 Million in 2022, and is Projected to Reach USD 11038.13 Million by 2030, Growing at a CAGR of 7.28% From 2023-2030.

A wood moisture tester is an instrument utilized for gauging the moisture content in wood materials. It commonly utilizes sensors or probes to identify the moisture levels existing in wood, delivering precise measurements for diverse applications like woodworking, construction, and furniture manufacturing.

- Wood moisture testers are utilized across diverse industries, notably woodworking, construction, and furniture manufacturing, to ensure the quality and longevity of wood products by precisely measuring moisture levels. In woodworking, these testers aid craftsmen in determining the optimal moisture content for different wood types, facilitating proper seasoning and preparation for various projects. Similarly, in construction, they assess the moisture content of structural lumber and building materials, mitigating issues like warping, mold formation, and structural instability caused by excessive moisture. Moreover, in furniture manufacturing, wood moisture testers are indispensable for verifying that wood used in crafting furniture is adequately dried, thereby averting defects and enhancing the lifespan of the final products.

- A primary advantage of wood moisture testers lies in their capacity to furnish accurate and dependable measurements, empowering users to make well-informed decisions regarding wood treatment and utilization. By precisely gauging the moisture content in wood, these testers prevent costly errors and uphold the quality and integrity of finished goods. Furthermore, they offer convenience and efficiency, permitting swift assessment of wood material moisture levels on-site without the necessity for laboratory analysis. This facilitates timely adjustments to wood processing and treatment procedures, thereby optimizing efficiency and productivity across woodworking, construction, and manufacturing operations.

- the future demand for wood moisture testers is projected to surge, driven by factors such as the continued expansion of woodworking, construction, and furniture manufacturing industries, alongside a heightened awareness of the significance of moisture control in wood products. As industries endeavor to enhance product quality, minimize waste, and reduce environmental impact, the requirement for precise and reliable wood moisture testing solutions will intensify. Additionally, advancements in technology are anticipated to yield more sophisticated and user-friendly wood moisture testers, further stimulating market demand. Ultimately, the wood moisture tester market is poised for sustained growth as industries prioritize quality control and operational efficiency in wood processing and manufacturing processes.

Wood Moisture Tester Market Trend Analysis:

Increasing Preference for Wooden Furniture and Interior Design

- The surging preference for wooden furniture and interior design emerges as a primary driver propelling the expansion of the Wood Moisture Tester Market. With consumers increasingly favoring wooden furniture and decor elements in interior design schemes, there's a heightened demand for durable, moisture-resistant wood products. Wood moisture testers play a pivotal role in ensuring the longevity and resilience of wooden furniture by precisely gauging the moisture levels in wood materials. By facilitating manufacturers and craftsmen in assessing moisture content and averting issues like warping and decay, these testers contribute to crafting high-caliber wooden furniture that meets the discerning standards of consumers.

- Furthermore, the escalating recognition of moisture control's significance in wooden furniture has driven the widespread adoption of wood moisture testers across the furniture manufacturing sector. Manufacturers strive to furnish furniture products capable of enduring diverse environmental conditions while preserving their aesthetic allure over time. Wood moisture testers empower manufacturers to make informed decisions in wood material selection and treatment, ensuring optimal moisture levels for augmented durability and performance. Consequently, the Wood Moisture Tester Market experiences substantial growth as furniture manufacturers prioritize quality assurance and seek dependable tools to cater to evolving market demands.

- Moreover, the trend toward sustainable and eco-friendly interior design practices has intensified the requirement for wood moisture testers. With an increased focus on employing responsibly sourced materials and minimizing environmental impact, furniture manufacturers and interior designers rely on these testers to certify the sustainability of their offerings. By averting moisture-related issues and extending the lifespan of wooden furniture, these testers promote sustainable design practices in alignment with consumers' preferences for eco-conscious products.

Development of Innovative Technologies Like Wireless Connectivity and Integration with Smartphones.

- The integration of cutting-edge technologies such as wireless connectivity and smartphone compatibility presents a significant growth opportunity for the Wood Moisture Tester Market. As wireless communication and smartphone technology continue to advance, there is vast potential to augment the functionality and accessibility of wood moisture testers. By incorporating wireless connectivity features, these devices facilitate seamless data transmission and real-time monitoring, empowering users to remotely access and analyze moisture readings using their smartphones or other smart devices.

- Additionally, smartphone integration provides users with added convenience and flexibility, enabling them to conveniently view moisture measurements, monitor trends, and receive notifications directly on their mobile devices. Through smartphone applications, wood moisture testers can furnish users with comprehensive insights and recommendations for effectively managing moisture levels. Moreover, smartphone integration simplifies data storage and sharing, allowing users to archive moisture readings, generate reports, and collaborate with colleagues or clients more efficiently.

- Furthermore, the integration of wood moisture testers with smartphones opens doors for advanced data analytics and predictive maintenance. By harnessing the capabilities of data analytics algorithms, these devices can scrutinize moisture trends and patterns over time, empowering users to anticipate potential issues and preemptively address them. Additionally, smartphone connectivity facilitates remote software updates and enhancements, ensuring users have access to the latest features and improvements. In summary, the development of innovative technologies like wireless connectivity and smartphone integration presents a compelling opportunity to broaden the application scope and enhance the functionalities of wood moisture testers across various industries.

Wood Moisture Tester Market Segment Analysis:

Wood Moisture Tester Market Segmented on the basis of Type, Technology, Application, and End-User

By Type, Portable segment is expected to dominate the market during the forecast period

- The Portable segment is positioned to spearhead the expansion of the Wood Moisture Tester Market. As demand surges for convenient solutions across sectors like construction, woodworking, and furniture manufacturing, portable wood moisture testers emerge as ideal options. These compact tools empower users to swiftly and effectively gauge moisture levels in wood materials, sans the need for cumbersome apparatus or intricate setups.

- Furthermore, portable wood moisture testers address the requirements of professionals operating in varied environments, spanning job sites, workshops, and remote locales. Their lightweight, handheld configuration ensures effortless transportation and utilization in diverse settings, facilitating prompt moisture assessments and immediate decision-making. With industries increasingly prioritizing efficiency and output, the Portable segment is poised to uphold its dominance in propelling the growth of the Wood Moisture Tester Market, providing users with portable, intuitive solutions tailored to their moisture testing exigencies.

By Technology, Digital segment held the largest share of 58.10% in 2022

- The Digital segment is positioned to uphold its dominance in propelling the expansion of the Wood Moisture Tester Market. As technology advances reshape the woodworking and construction sectors, digital wood moisture testers have emerged as indispensable tools for industry professionals. These devices utilize sophisticated digital sensors and display screens to deliver precise and reliable measurements of moisture levels in wood materials.

- Moreover, digital wood moisture testers offer users superior functionalities and capabilities in comparison to traditional analog models. They frequently incorporate digital displays that furnish clear and user-friendly moisture readings, along with supplementary features like data storage, logging, and analysis. The intuitive interface and ergonomic design of digital testers make them the preferred choice for professionals seeking efficiency and accuracy in moisture testing applications. With industries progressively embracing digitalization and automation, the Digital segment is anticipated to sustain its growth trajectory, providing innovative solutions to cater to the evolving demands of the Wood Moisture Tester Market.

Wood Moisture Tester Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is expected to lead the growth of the Wood Moisture Tester market, emerging as the primary region propelling its expansion. The region's swift urbanization, infrastructural advancements, and escalating construction undertakings, particularly in nations like China, India, and across Southeast Asia, are igniting the need for wood moisture testing apparatus. Furthermore, the flourishing woodworking and furniture manufacturing sectors in the region are amplifying this demand, contributing notably to market proliferation.

- Moreover, the mounting recognition of moisture regulation significance in wood materials, alongside stringent quality control mandates in construction ventures, is fostering the uptake of wood moisture testers across the Asia Pacific. As industries increasingly prioritize efficiency and excellence in woodworking and construction operations, the clamor for precise and dependable moisture testing solutions is anticipated to surge. Positioned at the vanguard of these trends, Asia Pacific is set to exert dominance over the Wood Moisture Tester market, presenting lucrative growth prospects for manufacturers and suppliers operating within the region.

Wood Moisture Tester Market Top Key Players:

- FLIR Systems, Inc (U.S.)

- Delmhorst Instrument Co. (U.S.)

- General Tools & Instruments LLC (U.S.)

- Wagner Meters (U.S.)

- Testo SE & Co. KGaA (Germany)

- Trotec GmbH (Germany)

- IMKO Micromodultechnik GmbH (Germany)

- Wohler (Germany)

- PCE Instruments UK Ltd. (UK)

- ELCOMETER LIMITED (UK)

- Brookhuis Applied Technologies (Netherlands)

- Sauermann (France)

- Proceq (Switzerland)

- Woodsense (Denmark)

- Schaller Messtechnik GmbH (Austria)

- Merlin Technology GmbH (Austria)

- Kewtech Instruments (China)

- Exotek Instruments (Taiwan)

- TECPEL Co., Ltd. (Taiwan), and Other Major Players

Key Industry Developments in the Wood Moisture Tester Market:

- In June 2021, Delmhorst Instrument Co. launched two pin-type moisture meters, the BDX-20 and BDX-30, as part of its Navigator series. Engineers conducted human factors reviews and usability testing to ensure high-quality meters. The BDX-20 and BDX-30 offer an ergonomic, premium feel, and an intuitive interface and display.

|

Global Wood Moisture Tester Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 6291.37 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.28% |

Market Size in 2030: |

USD 11038.13 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WOOD MOISTURE TESTER MARKET BY TYPE (2017-2030)

- WOOD MOISTURE TESTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PORTABLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PINLESS

- PIN-TYPE

- WOOD MOISTURE TESTER MARKET BY TECHNOLOGY (2017-2030)

- WOOD MOISTURE TESTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIGITAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANALOG

- WOOD MOISTURE TESTER MARKET BY APPLICATION (2017-2030)

- WOOD MOISTURE TESTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FURNITURE

- FLOORING

- WOODWORKING

- WOOD MOISTURE TESTER MARKET BY END-USER (2017-2030)

- WOOD MOISTURE TESTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wood Moisture Tester Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- FLIR SYSTEMS, INC (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DELMHORST INSTRUMENT CO. (U.S.)

- GENERAL TOOLS & INSTRUMENTS LLC (U.S.)

- WAGNER METERS (U.S.)

- TESTO SE & CO. KGAA (GERMANY)

- TROTEC GMBH (GERMANY)

- IMKO MICROMODULTECHNIK GMBH (GERMANY)

- WOHLER (GERMANY)

- PCE INSTRUMENTS UK LTD. (UK)

- ELCOMETER LIMITED (UK)

- BROOKHUIS APPLIED TECHNOLOGIES (NETHERLANDS)

- SAUERMANN (FRANCE)

- PROCEQ (SWITZERLAND)

- WOODSENSE (DENMARK)

- SCHALLER MESSTECHNIK GMBH (AUSTRIA)

- MERLIN TECHNOLOGY GMBH (AUSTRIA)

- KEWTECH INSTRUMENTS (CHINA)

- EXOTEK INSTRUMENTS (TAIWAN)

- TECPEL CO., LTD. (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL WOOD MOISTURE TESTER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wood Moisture Tester Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 6291.37 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.28% |

Market Size in 2030: |

USD 11038.13 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WOOD MOISTURE TESTER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WOOD MOISTURE TESTER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WOOD MOISTURE TESTER MARKET COMPETITIVE RIVALRY

TABLE 005. WOOD MOISTURE TESTER MARKET THREAT OF NEW ENTRANTS

TABLE 006. WOOD MOISTURE TESTER MARKET THREAT OF SUBSTITUTES

TABLE 007. WOOD MOISTURE TESTER MARKET BY TYPE

TABLE 008. DIGITAL MARKET OVERVIEW (2016-2028)

TABLE 009. ANALOG MARKET OVERVIEW (2016-2028)

TABLE 010. WOOD MOISTURE TESTER MARKET BY APPLICATION

TABLE 011. CONSTRUCTION MARKET OVERVIEW (2016-2028)

TABLE 012. FURNTITURE MARKET OVERVIEW (2016-2028)

TABLE 013. PAPER & PULP MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA WOOD MOISTURE TESTER MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA WOOD MOISTURE TESTER MARKET, BY APPLICATION (2016-2028)

TABLE 017. N WOOD MOISTURE TESTER MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE WOOD MOISTURE TESTER MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE WOOD MOISTURE TESTER MARKET, BY APPLICATION (2016-2028)

TABLE 020. WOOD MOISTURE TESTER MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC WOOD MOISTURE TESTER MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC WOOD MOISTURE TESTER MARKET, BY APPLICATION (2016-2028)

TABLE 023. WOOD MOISTURE TESTER MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA WOOD MOISTURE TESTER MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA WOOD MOISTURE TESTER MARKET, BY APPLICATION (2016-2028)

TABLE 026. WOOD MOISTURE TESTER MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA WOOD MOISTURE TESTER MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA WOOD MOISTURE TESTER MARKET, BY APPLICATION (2016-2028)

TABLE 029. WOOD MOISTURE TESTER MARKET, BY COUNTRY (2016-2028)

TABLE 030. NATIONAL CONTROLS: SNAPSHOT

TABLE 031. NATIONAL CONTROLS: BUSINESS PERFORMANCE

TABLE 032. NATIONAL CONTROLS: PRODUCT PORTFOLIO

TABLE 033. NATIONAL CONTROLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. METTLER TOLEDO: SNAPSHOT

TABLE 034. METTLER TOLEDO: BUSINESS PERFORMANCE

TABLE 035. METTLER TOLEDO: PRODUCT PORTFOLIO

TABLE 036. METTLER TOLEDO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. PCE DEUTSCHLAND GMBH: SNAPSHOT

TABLE 037. PCE DEUTSCHLAND GMBH: BUSINESS PERFORMANCE

TABLE 038. PCE DEUTSCHLAND GMBH: PRODUCT PORTFOLIO

TABLE 039. PCE DEUTSCHLAND GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DELMHORST INSTRUMENT CO.: SNAPSHOT

TABLE 040. DELMHORST INSTRUMENT CO.: BUSINESS PERFORMANCE

TABLE 041. DELMHORST INSTRUMENT CO.: PRODUCT PORTFOLIO

TABLE 042. DELMHORST INSTRUMENT CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. KETT US: SNAPSHOT

TABLE 043. KETT US: BUSINESS PERFORMANCE

TABLE 044. KETT US: PRODUCT PORTFOLIO

TABLE 045. KETT US: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. WAGNER METERS: SNAPSHOT

TABLE 046. WAGNER METERS: BUSINESS PERFORMANCE

TABLE 047. WAGNER METERS: PRODUCT PORTFOLIO

TABLE 048. WAGNER METERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LIGNOMAT USA LTD.: SNAPSHOT

TABLE 049. LIGNOMAT USA LTD.: BUSINESS PERFORMANCE

TABLE 050. LIGNOMAT USA LTD.: PRODUCT PORTFOLIO

TABLE 051. LIGNOMAT USA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GENERAL TOOLS & INSTRUMENTS LLC.: SNAPSHOT

TABLE 052. GENERAL TOOLS & INSTRUMENTS LLC.: BUSINESS PERFORMANCE

TABLE 053. GENERAL TOOLS & INSTRUMENTS LLC.: PRODUCT PORTFOLIO

TABLE 054. GENERAL TOOLS & INSTRUMENTS LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SCHALLER GMBH: SNAPSHOT

TABLE 055. SCHALLER GMBH: BUSINESS PERFORMANCE

TABLE 056. SCHALLER GMBH: PRODUCT PORTFOLIO

TABLE 057. SCHALLER GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. FLIR SYSTEMS (EXTECH INSTRUMENTS): SNAPSHOT

TABLE 058. FLIR SYSTEMS (EXTECH INSTRUMENTS): BUSINESS PERFORMANCE

TABLE 059. FLIR SYSTEMS (EXTECH INSTRUMENTS): PRODUCT PORTFOLIO

TABLE 060. FLIR SYSTEMS (EXTECH INSTRUMENTS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SPECTRUM TECHNOLOGIES INC.: SNAPSHOT

TABLE 061. SPECTRUM TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 062. SPECTRUM TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 063. SPECTRUM TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ACMAS TECHNOLOGIES (PVT) LTD.: SNAPSHOT

TABLE 064. ACMAS TECHNOLOGIES (PVT) LTD.: BUSINESS PERFORMANCE

TABLE 065. ACMAS TECHNOLOGIES (PVT) LTD.: PRODUCT PORTFOLIO

TABLE 066. ACMAS TECHNOLOGIES (PVT) LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. PROCEQ GROUP: SNAPSHOT

TABLE 067. PROCEQ GROUP: BUSINESS PERFORMANCE

TABLE 068. PROCEQ GROUP: PRODUCT PORTFOLIO

TABLE 069. PROCEQ GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WOOD MOISTURE TESTER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WOOD MOISTURE TESTER MARKET OVERVIEW BY TYPE

FIGURE 012. DIGITAL MARKET OVERVIEW (2016-2028)

FIGURE 013. ANALOG MARKET OVERVIEW (2016-2028)

FIGURE 014. WOOD MOISTURE TESTER MARKET OVERVIEW BY APPLICATION

FIGURE 015. CONSTRUCTION MARKET OVERVIEW (2016-2028)

FIGURE 016. FURNTITURE MARKET OVERVIEW (2016-2028)

FIGURE 017. PAPER & PULP MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA WOOD MOISTURE TESTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE WOOD MOISTURE TESTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC WOOD MOISTURE TESTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA WOOD MOISTURE TESTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA WOOD MOISTURE TESTER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wood Moisture Tester Market research report is 2023-2030.

FLIR Systems, Inc (U.S.), Delmhorst Instrument Co. (U.S.), General Tools & Instruments LLC (U.S.), Wagner Meters (U.S.), Testo SE & Co. KGaA (Germany), Trotec GmbH (Germany), IMKO Micromodultechnik GmbH (Germany), Wohler (Germany), PCE Instruments UK Ltd. (UK), ELCOMETER LIMITED (UK), Brookhuis Applied Technologies (Netherlands), Sauermann (France), Proceq (Switzerland), Woodsense (Denmark), Schaller Messtechnik GmbH (Austria), Merlin Technology GmbH (Austria), Kewtech Instruments (China), Exotek Instruments (Taiwan), TECPEL Co., Ltd. (Taiwan), and Other Major Players.

The Wood Moisture Tester Market is segmented into Type, Technology, Application, End-User, and region. By Type, the market is categorized into Portable, Pinless, and Pin-type. By Technology, the market is categorized into Digital and analog. By Application, the market is categorized into Construction, Furniture, Flooring, and Woodworking. By End-User, the market is categorized into Residential, Commercial, and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A wood moisture tester is an instrument utilized for gauging the moisture content in wood materials. It commonly utilizes sensors or probes to identify the moisture levels existing in wood, delivering precise measurements for diverse applications like woodworking, construction, and furniture manufacturing.

Global Wood Moisture Tester Market Size Was Valued at USD 6291.37 Million in 2022, and is Projected to Reach USD 11038.13 Million by 2030, Growing at a CAGR of 7.28% From 2023-2030