Wireless Speakers Market Synopsis

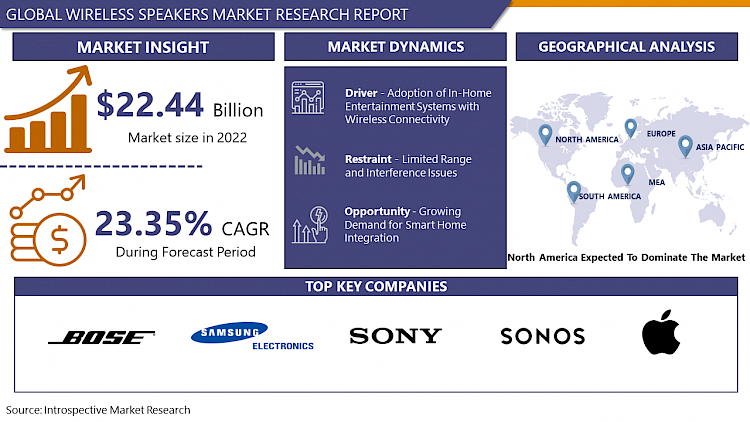

Global Wireless Speakers Market Size Was Valued at USD 22.44 Billion in 2022 and is Projected to Reach USD 120.26 Billion by 2030, Growing at a CAGR of 23.35% From 2023-2030.

Wireless speakers are audio devices that employ wireless technologies such as Bluetooth or Wi-Fi to establish connections and stream audio content from source devices like smartphones, tablets, or computers. These portable or stationary speakers eliminate the requirement for physical cables, offering users flexibility in placement and convenience in experiencing high-quality audio across different settings.

- Wireless speakers have become essential to contemporary audio experiences, offering versatile applications and numerous advantages. These portable devices are widely utilised in home entertainment systems, enabling users to effortlessly stream music, podcasts, and other audio content from their smartphones or tablets. The absence of tangled wires contributes to the aesthetic appeal of living spaces, fostering a clutter-free environment.

- The flexibility of wireless connectivity, often facilitated through Bluetooth technology, ensures seamless pairing with various devices, promoting a user-friendly experience. Furthermore, the emergence of smart speakers with voice control features extends their utility, enabling users to interact with virtual assistants, control smart home devices, and access information hands-free. The key advantages include convenient placement, portability, and the capability to create multi-room audio setups, revolutionizing how individuals engage with audio content in both personal and social contexts.

Wireless Speakers Market Trend Analysis:

Adoption of In-Home Entertainment Systems with Wireless Connectivity

- The substantial growth of the wireless speaker market is significantly propelled by the increasing adoption of in-home entertainment systems with wireless connectivity. As consumers increasingly desire immersive audio experiences within their residences, the incorporation of wireless speakers into home entertainment setups has emerged as a defining trend. This integration extends to home theatre systems, allowing users to enjoy the cinematic sound without the limitations of wired connections. Leveraging the convenience of wireless connectivity, often facilitated through Bluetooth or Wi-Fi, users can strategically position speakers throughout the room, enhancing the overall audio experience.

- Additionally, the ascent of smart homes and the interconnected nature of contemporary entertainment systems contribute to the market's expansion. Wireless speakers seamlessly integrate into smart home ecosystems, empowering users to control audio playback through voice commands or mobile apps. This convergence of wireless technology and smart home integration aligns with the evolving preferences of tech-savvy consumers who prioritize convenience, flexibility, and a streamlined entertainment experience.

- The market also benefits from the trend of establishing multi-room audio environments within homes. Wireless speakers enable users to synchronize audio playback across different rooms, creating a cohesive and immersive audio atmosphere. This capability, coupled with the simplicity of setup and operation, positions wireless speakers as indispensable elements in the evolving landscape of in-home entertainment, fostering sustained market growth as consumers continue to invest in sophisticated audio solutions for their living spaces.

Growing Demand for Smart Home Integration

- The wireless speakers market is experiencing significant growth opportunities driven by the increasing demand for smart home integration. As smart home ecosystems become more prevalent, consumers are seeking seamless connectivity and interoperability among their devices. Wireless speakers, equipped with smart features and compatibility with virtual assistants like Amazon Alexa and Google Assistant, address this demand by becoming essential components of interconnected home environments. This convergence enables users to control audio playback, adjust settings, and integrate wireless speakers into broader smart home automation scenarios, enhancing convenience and creating a cohesive user experience.

- The opportunity extends beyond voice-controlled functionalities to the potential for collaboration with other smart devices. As smart homes evolve, wireless speakers can serve as central hubs for managing various connected devices, providing a unified control point for lighting, thermostats, and security systems. This integration enhances the value proposition of wireless speakers, positioning them as multifunctional devices within the broader smart home landscape.

- Moreover, the expansion of 5G technology and the Internet of Things (IoT) further amplifies the opportunity for smart home integration. The high-speed, low-latency connectivity offered by 5G networks enhances the performance of wireless speakers, enabling seamless interactions with other smart devices and cloud-based services. Manufacturers can capitalize on this trend by developing and marketing wireless speakers that seamlessly integrate with emerging smart home technologies, meeting the growing demand for interconnected and intelligent living spaces.

Wireless Speakers Market Segment Analysis:

Wireless Speakers Market is Segmented based on Type, Application, End-User and Distribution Channel.

By Type, Bluetooth segment is expected to dominate the market during the forecast period

- The Bluetooth segment is set to lead the wireless speakers market, maintaining its position as the most widely adopted and versatile wireless connectivity technology. Speakers equipped with Bluetooth offer users the convenience of pairing with a diverse range of devices, including smartphones, tablets, and laptops, making them highly accessible to a broad consumer base. The straightforward Bluetooth pairing process and its compatibility with various operating systems contribute to its widespread use in the market.

- Furthermore, Bluetooth technology has evolved to support advanced features such as high-quality audio streaming, low energy consumption, and extended range, solidifying its dominance. As consumers prioritize ease of use and seamless integration with their portable devices, Bluetooth-enabled wireless speakers remain the preferred choice, propelling the growth of this market segment. The prevalence and continuous enhancements in Bluetooth technology position it as a key driver in shaping the trajectory of the wireless speakers market.

By Distribution channel, the Online segment held the largest share of 53.19% in 2022

- The online segment has established its dominance in the wireless speakers market, holding the largest share due to the transformative influence of e-commerce on consumer purchasing patterns. Online platforms offer consumers a convenient and extensive marketplace to explore, compare, and purchase wireless speakers from various brands and models. The ease of browsing customer reviews, comparing specifications, and accessing a wide array of choices contributes significantly to the online segment's prevalence.

- Moreover, the ascent of online retail giants, specialized electronics stores, and dedicated e-commerce platforms has substantially expanded the reach and accessibility of wireless speakers. With the added convenience of doorstep delivery and often enticing discounts, consumers are increasingly turning to online channels to meet their audio equipment needs. The dominance of the online segment reflects the ongoing shift toward digital shopping experiences and the convenience-driven preferences of consumers in the wireless speakers market.

Wireless Speakers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is set to lead the wireless speakers market, driven by a combination of technological advancements, high consumer demand, and a well-established infrastructure. The region, characterized by a robust ecosystem of technology enthusiasts and early adopters, has experienced widespread integration of smart home devices, including wireless speakers. Its inclination toward cutting-edge audio solutions, coupled with the popularity of streaming services, positions North America as a pivotal market for wireless speakers.

- Prominent players in the audio technology industry often debut their latest products in North America, capitalizing on the region's receptive consumer base. The prevalence of home entertainment systems, along with a cultural emphasis on premium audio experiences, further contributes to the expected dominance of North America in the wireless speakers market.

Key Players Covered in Wireless Speakers Market:

- Bose Corporation (U.S.)

- Apple Inc. (U.S.)

- Harman International (U.S.)

- Sonos, Inc. (US)

- Masimo (US)

- VOXX International Corp. (US)

- Supersonic (U.S.)

- Jawbone (U.S.)

- Braven (U.S.)

- Denon Electronics (U.S.)

- Beats Electronics (U.S.)

- Logitech International S.A. (Switzerland)

- Bang & Olufsen (Denmark)

- Bowers & Wilkins (UK)

- Koninklijke Philips N.V. (Netherland)

- Sennheiser (Germany)

- Huawei Investment & Holding Co., Ltd. (China)

- Sony Corporation (Japan)

- Panasonic Holdings Corporation (Japan)

- Pioneer Corporation (Japan)

- JVC Kenwood (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics (South Korea)

- Creative Technology (Singapore), and Other Major Players.

Key Industry Developments in the Wireless Speakers Market:

- In June 2022, Bose launched its latest Bluetooth speaker in India as part of its Soundlink series. The Bose Soundlink Flex is estimated to be 7.9 inches wide, 2.1 inches deep, and 3.6 inches tall and weighs slightly more than one pound. The speaker has a tough design, and it is equipped with the company's proprietary Bose PositionIQ technology, which is said to automatically detect the speaker's orientation and deliver better audio playback.

- In May 2023, – Sony announced the new SRS-XV800, a speaker built to party with loud and clear sound. Whether hosting an epic party or enjoying a favourite movie or TV show, this speaker provides a powerful, room-filling sound.

|

Global Wireless Speakers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

23.35% |

Market Size in 2030: |

USD 120.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WIRELESS SPEAKERS MARKET BY TYPE (2016-2030)

- WIRELESS SPEAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLUETOOTH

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WI-FI

- VOICE-ENABLED SPEAKERS

- NFC

- AIRPLAY

- WIRELESS SPEAKERS MARKET BY APPLICATION (2016-2030)

- WIRELESS SPEAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOME AUDIO

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PORTABLE SPEAKERS

- OUTDOOR AND ADVENTURE SPEAKERS

- WIRELESS SPEAKERS MARKET BY END-USER (2016-2030)

- WIRELESS SPEAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- WIRELESS SPEAKERS MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- WIRELESS SPEAKERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE RETAIL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFFLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wireless Speakers Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BOSE CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- APPLE INC. (U.S.)

- HARMAN INTERNATIONAL (U.S.)

- SONOS, INC. (U.S.)

- MASIMO (U.S.)

- VOXX INTERNATIONAL CORP. (U.S.)

- SUPERSONIC (U.S.)

- JAWBONE (U.S.)

- BRAVEN (U.S.)

- DENON ELECTRONICS (U.S.)

- BEATS ELECTRONICS (U.S.)

- LOGITECH INTERNATIONAL S.A. (SWITZERLAND)

- BANG & OLUFSEN (DENMARK)

- BOWERS & WILKINS (UK)

- KONINKLIJKE PHILIPS N.V. (NETHERLAND)

- SENNHEISER (GERMANY)

- HUAWEI INVESTMENT & HOLDING CO., LTD. (CHINA)

- SONY CORPORATION (JAPAN)

- PANASONIC HOLDINGS CORPORATION (JAPAN)

- PIONEER CORPORATION (JAPAN)

- JVC KENWOOD (JAPAN)

- SAMSUNG ELECTRONICS CO., LTD. (SOUTH KOREA)

- LG ELECTRONICS (SOUTH KOREA)

- CREATIVE TECHNOLOGY (SINGAPORE)

- COMPETITIVE LANDSCAPE

- GLOBAL WIRELESS SPEAKERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wireless Speakers Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

23.35% |

Market Size in 2030: |

USD 120.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wireless Speakers Market research report is 2023-2030.

Bose Corporation (U.S.), Apple Inc. (U.S.), Harman International (U.S.), Sonos, Inc. (US), Masimo (US), VOXX International Corp. (US),Supersonic (U.S.),Jawbone (U.S.),Braven (U.S.),Denon Electronics (U.S.),Beats Electronics (U.S.),Logitech International S.A. (Switzerland),Bang & Olufsen (Denmark),Bowers & Wilkins (UK),Koninklijke Philips N.V. (Netherland),Sennheiser (Germany),Huawei Investment & Holding Co., Ltd. (China),Sony Corporation (Japan),Panasonic Holdings Corporation (Japan),Pioneer Corporation (Japan),JVC Kenwood (Japan),Samsung Electronics Co., Ltd. (South Korea),LG Electronics (South Korea),Creative Technology (Singapore), and Other Major Players

The Wireless Speakers Market is segmented into Type, Application, End-User Distribution Channel and region. By Type, the market is categorized into Bluetooth, Wi-Fi, Voice-enabled Speakers, NFC, and Airplay. By Application, the market is categorized Home Audio, Portable Speakers, and Outdoor and Adventure Speakers. By End-User, the market is categorized into Residential and Commercial. By Distribution Channel the market is categorized into Online Retail and Offline Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wireless speakers are audio devices that employ wireless technologies such as Bluetooth or Wi-Fi to establish connections and stream audio content from source devices like smartphones, tablets, or computers. These speakers, whether portable or stationary, eliminate the requirement for physical cables, offering users flexibility in placement and convenience in experiencing high-quality audio across different settings.

Global Wireless Speakers Market Size Was Valued at USD 22.44 Billion in 2022 and is Projected to Reach USD 120.26 Billion by 2030, Growing at a CAGR of 23.35% From 2023-2030.