Winglets Market Synopsis

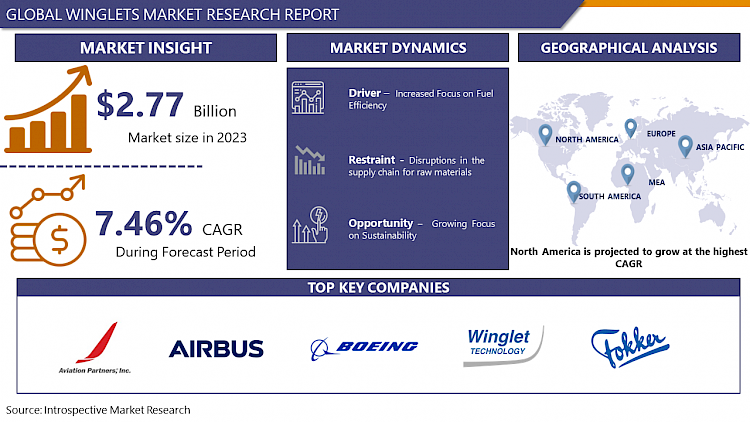

Winglets Market Size Was Valued at USD 2.77 Billion in 2023 and is Projected to Reach USD 5.29 Billion by 2032, Growing at a CAGR of 7.46% From 2024-2032.

The aviation sector is seeing a major increase in the use of winglets, and aerodynamic attachments on airplane wings, designed to improve performance and efficiency. The increase is mainly caused by higher fuel costs and the need to cut expenses, forcing airlines to look for ways to save on fuel. Additionally, strict environmental regulations are driving the demand for sustainable alternatives, which are in line with the industry's goals for sustainability. As the need for long-haul flights continues to grow, there is a greater emphasis on using fuel-efficient aircraft like winglets. Airlines are choosing to install winglets on new aircraft in addition to upgrading their current fleets, showing an increasing preference for using them. Progress in winglet design and materials continues to enhance performance gains, with ongoing retrofit programs playing a role in expanding the market. The potential for the winglet industry looks bright, thanks to the development of new, eco-friendly airplanes, the increasing need for global air travel, and the shared goal of sustainability among airlines and regulators.

- The primary function of winglets is to curtail induced resistance, preventing the mixing of airflows from the soffit and extrados by addressing the pressure differential between them. This mitigation strategy is crucial in averting the formation of wingtip eddies during flight, subsequently reducing drag and enhancing overall aircraft efficiency.

- During critical flight phases such as takeoff and landing, winglets prove instrumental in diminishing the hazards posed by high-speed wingtip vortices. These vortices, capable of reaching speeds up to 90 kilometers per hour, pose a threat to lighter aircraft conducting later takeoff or landing maneuvers. By strategically reducing the size of vortices through gradual airflow contact, winglets contribute significantly to lowering aerodynamic drag, resulting in tangible fuel consumption reductions.

- In the aviation industry, where fuel efficiency is paramount, major manufacturers like Airbus and Boeing prioritize the integration of winglet technology as a key element in optimizing the performance and efficiency of contemporary aircraft, aligning with the overarching objective of fuel conservation.

Winglets Market Trend Analysis

Increased Focus on Fuel Efficiency

- The aviation industry's concerted efforts to enhance fuel-efficiency, driven by both cost considerations and sustainability goals, present a significant opportunity for the winglets market. According to McKinsey's analysis, carriers achieved a remarkable 39 percent reduction in fuel consumption per passenger-kilometer between 2005 and 2019, showcasing a compound annual growth rate of approximately 3.4 percent per year. This impressive improvement is attributed in part to fleet upgrades, constituting 43 percent of the overall gains during the analyzed period.

- The data underscores the pivotal role of advanced aircraft technologies in achieving fuel efficiency objectives, with the latest-generation aircraft proving to be 15 to 20 percent more fuel-efficient than their predecessors. As the aviation sector grapples with the challenge of being one of the fastest-growing sources of greenhouse gas emissions, the industry's focus on meeting fuel-efficiency goals set by the International Civil Aviation Organization (ICAO) becomes paramount. The lag in achieving these goals for new aircraft types in the 2020- and 2030 time frames by more than a decade creates a compelling opportunity for technologies that contribute to fuel efficiency, including winglets.

- Winglets, with their proven capability to reduce aerodynamic drag and enhance overall fuel efficiency, align seamlessly with the aviation industry's pursuit of curbing emissions. The need for technical measures, such as improvements in airframes and engines, complements the role of winglets in achieving sustainability objectives. As the sector seeks comprehensive solutions to address its environmental impact, the increased focus on fuel efficiency emerges as a major opportunity for the winglets market, positioning these aerodynamic enhancements as essential components in the ongoing transformation of the aviation industry toward a more sustainable and efficient future.

- The surge in aircraft deliveries, propelled by fleet modernization initiatives such as InterGlobe Aviation Ltd.'s substantial receipt of 18 aircrafts in Q4 2022, underscores a heightened emphasis on aviation expansion. Concurrently, aggressive production strategies by aviation giants like Airbus, increasing air freight demand, and the conversion of passenger planes into freight carriers by Boeing signify a robust industry trajectory. This upswing is notably fueled by the establishment of new airlines globally. Against this backdrop, the aircraft winglet market is experiencing substantial growth, as the aviation sector places an increased focus on fuel efficiency. This imperative is evident in the industry's concerted efforts to enhance production rates, adapt existing aircraft, and explore diverse avenues, thereby affirming winglets as instrumental components for achieving optimal fuel performance in commercial aviation.

Growing Focus on Sustainability

- The escalating concern over the aviation sector's significant contribution to greenhouse gas (GHG) emissions has propelled a growing focus on sustainability, emerging as a pivotal driver of the winglets market. As the aviation industry grapples with the challenge of tripling carbon dioxide (CO2) emissions from international flights by 2050, it faces a critical need to meet fuel-efficiency goals set by the International Civil Aviation Organization (ICAO). The sector's lag in achieving these goals, with a deviation of over a decade for new aircraft types, underscores the urgency for impactful solutions to curb emissions.

- In 2022, aviation accounted for 2% of global energy-related CO2 emissions, marking a significant and growing environmental footprint. The sector's rapid expansion, outpacing other modes of transportation, further magnifies the imperative to adopt measures that promote sustainability. The pivotal role of winglets becomes evident in this context, as these aerodynamic enhancements offer a tangible and effective means of reducing aerodynamic drag, optimizing fuel efficiency, and mitigating emissions. With technical measures such as low-emission fuels, airframe and engine improvements, operational optimization, and demand restraint solutions deemed essential to achieving sustainability goals, the integration of winglets emerges as a critical component in the industry's pursuit of net-zero emissions by 2050. As aviation strives to align with more stringent environmental benchmarks, the winglets market stands as a strategic enabler for enhancing overall sustainability in air travel.

- The aviation industry's commitment to reducing its carbon footprint is underscored by the challenging statistics, including an almost 800 Mt CO2 emission level in 2022, equivalent to 80% of the pre-pandemic level. With emissions intensity per passenger km and the expected demand increase by 2050 also in focus, the adoption of winglets stands out as a viable and impactful solution in the broader context of achieving sustainable aviation practices.

- The escalating focus on sustainability within the aviation industry, driven by regulatory bodies' stringent measures to curb fuel consumption and emissions, presents a significant opportunity for the winglets market. Regulatory pressure, emphasizing the reduction of carbon dioxide (CO2) and nitrogen oxide (NOx) emissions, compels aircraft manufacturers and operators to enhance efficiency. Winglets, exemplified by Boeing's blended winglets, demonstrate a compelling solution, improving takeoff performance and enabling deeper thrust de-rates on models such as the 737, 757, and 767. With lift-induced drag contributing up to 40% of total drag during cruise and 80–90% during take-off and climb, winglets play a pivotal role in reducing aerodynamic drag. The installation of active winglets by Tamarack in April 2022 at Aiken South Carolina Transformation Center underscores their potential, offering fuel savings of up to 33%, ensuring smoother and safer flights, and aligning with sustainability goals, thereby reducing emissions.

Winglets Market Segment Analysis:

Winglets Market Segmented based on aircraft type, winglet type, fit, and end-use.

By Aircraft Type, the Commercial Aircraft segment is expected to dominate the market during the forecast period

- The Commercial Aircraft segment is poised to dominate the winglet market throughout the forecast period, primarily driven by the escalating market share of narrow-body aircraft. The increasing presence of low-cost carriers on a global scale has propelled narrow-body aircraft to contribute more than half of the market's revenue share. This surge is further fueled by the surging demand for air travel within emerging economies such as India and China, coupled with the continuous improvement in airline revenue passenger kilometers (RPK).

- With RPK anticipated to represent approximately 36% of the global air passenger market in 2022, the commercial aviation sector, particularly the narrow-body aircraft category, is expected to witness sustained growth, solidifying its dominance in the winglet market. This trend underscores the critical role of winglet technologies in enhancing the fuel efficiency and overall performance of commercial aircraft, aligning with the evolving dynamics of the global aviation landscape.

By Winglet Type, Blended Winglets segment held the largest market share of 25.4% in 2022

- The Blended type segment is anticipated to assert dominance in the winglet market throughout the forecast period, capturing a substantial 25.4% market share by 2029. This prevalence is attributed to widespread adoption by prominent aircraft manufacturers such as Boeing, Gulfstream Aerospace Corporation, and Falcon. Notably, these winglets find extensive application as standard equipment in aircraft models like the Boeing 737-900ER, contributing significantly to the aviation industry's sustainability goals. The utilization of Blended winglets plays a pivotal role in the reduction of CO2 emissions and the enhancement of overall airplane fuel economy.

- Furthermore, the accessibility of retrofit services provided by various authorized service providers globally adds momentum to the adoption of Blended winglets during the projection period. This underscores the segment's pivotal role in addressing environmental concerns and advancing the aviation sector's commitment to sustainable practices.

Winglets Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is anticipated to assert dominance in the winglet market over the forecast period, leveraging its mature aviation sector and robust defense industry. The region boasts a significant number of established aircraft manufacturers, facilitating a conducive environment for innovation and development. The defense sector, in particular, benefits from substantial government investments in research and development, leading to the procurement of advanced fighter planes, helicopters, and various aircraft from local companies.

- Moreover, North America's aviation sector is set to witness further growth, fueled by increased focus on enhancing private airport infrastructure and positive regulatory developments. These factors collectively contribute to a thriving aviation landscape, positioning North America at the forefront of the winglet market. The region's mature and technologically advanced aerospace industry is expected to play a pivotal role in driving the adoption of winglet technologies, aligning with the evolving needs and advancements in the global aviation domain.

Winglets Market Top Key Players:

- Aviation Partners (USA)

- Airbus (France)

- Boeing (USA)

- Winglet Technology, LLC (USA)

- Fokker Technologies (Netherlands)

- GKN Aerospace (UK)

- RUAG Group (Switzerland)

- Tamarack Aerospace Group (USA)

- Friedrichshafen AG (Germany)

- Wing Aviation (USA)

- Vortex Aviation (USA)

- LoPresti Aviation (USA)

- Global Wings (USA)

- Hutchinson Aerospace & Industry (France)

- TTF Aerospace (USA)

- Wingman Aviation (USA)

- FACC AG (Austria)

- Blended Winglet Systems (USA)

- Aeronautical Engineers, Inc. (USA)

- Lockheed Martin Corporation (USA)

- MTU Aero Engines AG (Germany)

- Gulfstream Aerospace (USA)

- Embraer (Brazil) and Other Major Players

Key Industry Developments in the Winglets Market:

- In November 2023, Embraer, a Brazilian global aerospace company, signed a Memorandum of Understanding (MoU) with the Netherlands Industries for Defence & Security (NIDV) during the 34th NIDV Exhibition for Defense and Security (NEDS 2023). This MoU signifies a crucial step in the strategic partnership between Embraer and the Netherlands, focusing on collaborative efforts related to the C-390 Millennium and A-29 Super Tucano for Defense and security initiatives.

- In April 2023, Ducommun Incorporated, a US-based engineering and manufacturing company that provides services to the aerospace, defense, industrial, and medical industries, acquired BLR Aerospace LLC for an undisclosed amount. With this acquisition, the Ducommun Incorporated company's portfolio of engineered goods is further strengthened by BLR's product offerings, which also contribute extremely significant aftermarket revenue. BLR Aerospace LLC is a US-based company that manufactures winglets and specializes in providing aerospace solutions and modifications.

- In July 2023, Airbus intensifies its wing technology trials to develop a successor to its popular A320 series, aiming for longer, lighter, and more sustainable wings with folding wingtips. The inauguration of a wing technology plant in southwest England by British Industry Minister Nusrat Ghani marks a significant step in this endeavor. However, cost reduction remains a challenge amidst the technological race with Boeing.

|

Global Winglets Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.77Bn. |

|

Forecast Period 2024-32 CAGR: |

7.46% |

Market Size in 2032: |

USD 5.29Bn. |

|

Segments Covered: |

By Aircraft Type |

|

|

|

By Winglet type |

|

||

|

By Fit |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WINGLETS MARKET BY AIRCRAFT TYPE (2017-2032)

- WINGLETS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NARROW BODY AIRCRAFT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WIDE BODY AIRCRAFT

- REGIONAL JET AIRCRAFT

- WINGLETS MARKET BY WINGLET TYPE (2017-2032)

- WINGLETS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SHARKLETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPLIT SCIMITAR WINGLETS

- WINGTIP FENCES

- BLENDED WINGLETS

- WINGLETS MARKET BY FIT (2017-2032)

- WINGLETS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LINE FIT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETROFIT

- WINGLETS MARKET BY END USE (2016-2030)

- WINGLETS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CIVIL AIRCRAFT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MILITARY AIRCRAFT

- COMMERCIAL AND CARGO AIRCRAFT

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- WINGLETS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AVIATION PARTNERS (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BOEING (USA)

- WINGLET TECHNOLOGY, LLC (USA)

- FOKKER TECHNOLOGIES (NETHERLANDS)

- GKN AEROSPACE (UK)

- RUAG GROUP (SWITZERLAND)

- TAMARACK AEROSPACE GROUP (USA)

- FRIEDRICHSHAFEN AG (GERMANY)

- WING AVIATION (USA)

- VORTEX AVIATION (USA)

- LOPRESTI AVIATION (USA)

- GLOBAL WINGS (USA)

- HUTCHINSON AEROSPACE & INDUSTRY (FRANCE)

- TTF AEROSPACE (USA)

- WINGMAN AVIATION (USA)

- FACC AG (AUSTRIA) AND OTHER MAJOR PLAYERS

- BLENDED WINGLET SYSTEMS (USA)

- AERONAUTICAL ENGINEERS, INC. (USA)

- LOCKHEED MARTIN CORPORATION (USA)

- MTU AERO ENGINES AG (GERMANY)

- GULFSTREAM AEROSPACE (USA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL WINGLETS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Aircraft Type

- Historic And Forecasted Market Size By Winglet Type

- Historic And Forecasted Market Size By Fit

- Historic And Forecasted Market Size By End Use

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Winglets Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.77Bn. |

|

Forecast Period 2024-32 CAGR: |

7.46% |

Market Size in 2032: |

USD 5.29Bn. |

|

Segments Covered: |

By Aircraft Type |

|

|

|

By Winglet type |

|

||

|

By Fit |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Winglets Market research report is 2024-2032.

Aviation Partners (USA), Boeing (USA), Winglet Technology, LLC (USA), Fokker Technologies (Netherlands), GKN Aerospace (UK), RUAG Group (Switzerland), Tamarack Aerospace Group (USA), Friedrichshafen AG (Germany), Wing Aviation (USA), Vortex Aviation (USA), LoPresti Aviation (USA), Global Wings (USA), Hutchinson Aerospace & Industry (France), TTF Aerospace (USA), Wingman Aviation (USA), FACC AG (Austria) and Other Major Players, Blended Winglet Systems (USA), Aeronautical Engineers, Inc. (USA), Lockheed Martin Corporation (USA), MTU Aero Engines AG (Germany), Gulfstream Aerospace (USA) and Other Major Players.

The Winglets Market is segmented into Aircraft Type, Winglet type, Fit, End Use, and region. By Aircraft Type, the market is categorized into Narrow Body Aircraft, Wide Body Aircraft, and Regional Jet Aircraft. By Winglet type, the market is categorized into Sharklets, Split Scimitar Winglets, Wingtip Fences, and Blended Winglets. By Fit, the market is categorized into Line fit and retrofit. By End Use, the market is categorized into Civil Aircraft, Military Aircraft, Commercial, and Cargo Aircraft. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Winglets serve as integral aerodynamic enhancements aimed at optimizing aircraft performance, particularly in the context of mitigating aerodynamic drag. Positioned vertically at the wingtips, these appendages play an essential role in extending cruising range, enhancing fuel efficiency, and ultimately resulting in cost savings for aviation operations.

Winglets Market Size Was Valued at USD 2.77 Billion in 2023 and is Projected to Reach USD 5.29 Billion by 2032, Growing at a CAGR of 7.46% From 2024-2032.