WiFi as a Service Market Synopsis

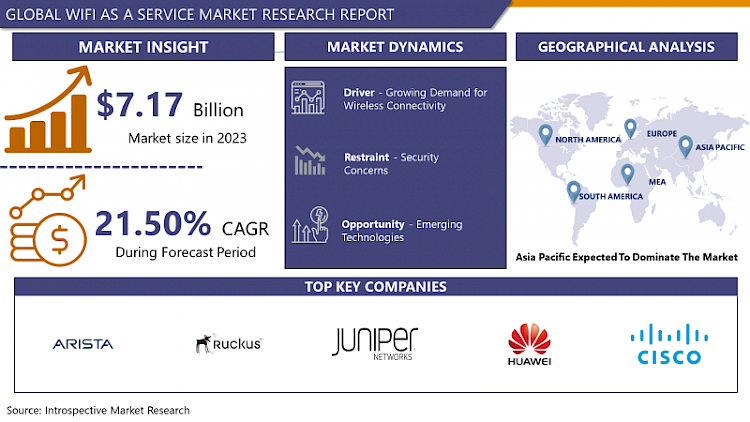

WiFi as a Service Market Size Was Valued at USD 7.17 Billion in 2023, and is Projected to Reach USD 41.36 Billion by 2032, Growing at a CAGR of 21.50% From 2024-2032.

The WiFi as a Service (WaaS) market may be defined here as being the market for wireless networking infrastructure and services that are delivered on a subscription basis to businesses and organizations, thus catering to their evolving needs for comprehensive, flexible, and fairly affordable networking hardware and services.

- WaaS solutions are geared towards different industries, including retail, hospitality, healthcare, and education sectors assuring their clients to optimize and advance the delivery of better customer services, increased operational performance, and the ability to meet the constantly changing demands of technology solutions. The said market is fueled by the need for mobility and Cloud services, together with the rise of the ‘Internet of Things’ which has made many organizations turn to third parties for the management of their WiFi.

- Currently, there is a very exciting acceleration in the WiFi as a Service (WaaS) market due to the constantly growing need to obtain access to reliable and consistent connectivity in various industries. This accelerated demand can be driven by several forces that are supporting the consumption of WaaS solutions.

- To begin with, over the recent past, more and more organizations have emphasized the need to leverage technology in their operations, thereby making WiFi solutions with the ability to support the growing operations with capacity, reliability, and relatively cheaper prices a must-have. Because most current WiFi applications and systems are based on traditional approaches the authorities of those systems and applications are very elaborate and, as a rule, need many investments in hardware as well as in operations costs for the constant check of the systems and frequently – upgrading. Unlike WaaS, SaaS comes as an easily subscribable service thus leaving the responsibility of the infrastructure behind networks, data, and storage among others with the provider while the organization enjoys the utility of the service. This helps businesses avoid the need to dedicate a lot of resources towards managing the network while also helping WaaS vendors provide the best performance obtainable.

- In addition, the growing popularity of portable computers and the emergence of a new form of work organization based on telecommuting has required more and versatile connectivity. Subscribers require employer-provided internet connectivity extending not only to business premises but also to the outside environment, other offices, and other shared facilities. WaaS solutions are now needed to support these continually emerging connectivity requirements as organizations seek to address the needs of a mobile workplace and enhance team collaboration in multi-site environments.

- Moreover, continuous developments in smart technologies combined with the proliferation of the Internet of Things (IoT) and the introduction of 5G networks shortly will contribute to the expansion of this industry. The enormous increase in internet-connected smart devices including smart sensors, smart wearables, smart industrial machines, self-driving cars, etc. is going to lead to the even more substantial demand for high-speed low latency WiFi networks. This means that WaaS offerings are particularly well placed to leverage this demand given that they provide the hardware and software infrastructure and SOPs that are requisite for the predominantly rich IoT ecosystems.

- In conclusion, the concepts of WiFi as a Service today are experiencing a period of extremely rapid growth, which is explained by the increase in the influence of several trends that have blended into one, including the steps made during the digital transformation of industries, the development of the concept of remote work, the rapid expansion of the IoT market, and the integration of the newest technologies, such as 5G. As the business world continues to appreciate the centrality of reliable connectivity as a source of competitive advantages and innovation, WaaS providers will stand ready to assume the task of leading the evolution of wireless networking. In conclusion, WaaS has become an inevitable trend today, owing to the need for connectivity in this digital era. By offering value-based, cost-effective, and performance-oriented solutions, WaaS vendors stand a better chance of satisfying the market’s demands in the modern era.

WiFi as a Service Market Trend Analysis

Embracing Subscription-Based Models for Enhanced Flexibility and Agility

- Subscription-based models with layers of professional services in the WaaS market mean a radical change for organizations. Older models of the company needed to invest in expensive and specific WiFi equipment and applications, which generally even entailed incurring extensive capital costs and commitments. However, the WaaS solutions available in Subscription models have opened up a variety for the organization, where they can now avail quality WiFi services without the constraint of capital-intensive investments. This pay-as-you-go model not only conforms to trends in a modern business where oPEX is preferred over CAPEX but also makes the WiFi solution more flexible and adaptable to the varying capacity needs of the organization. A company may require customers during a festival or event, which it may cover through additional subscriptions, which it may likely not require in the cooler months; thus, businesses may change subscription plans according to the seasonality of their activities, making the process cost-effective and efficient.

- Likewise, cost-based WaaS models foster closer client relationships and better adaptability in responding to emerging needs at both technological and business levels. Having said that as we live in a dynamic environment where things are frequent and ever-changing on the internet, the organization must always be ready to respond to different changes that the buyers will bring. By committing to WaaS services, businesses get connected with a vast of services and solutions for their need such as software upgrades, security updates, or even technical help. This is possible through the continuous partnership with WaaS providers, to help firms achieve better and more reliable WiFi performance, without having to head the management internally. Therefore, WaaS subscription-based models not only provide cost-efficient and flexible solutions but also make organizations free from managing non-strategic assets and help them achieve new opportunities and adapt to the market in their fields.

Transforming WiFi Management with Advanced Analytics

- In the realm of WiFi as a Service (WaaS), a significant trend gaining traction is the emphasis on leveraging advanced analytics and insights derived from WiFi networks. With the proliferation of connected devices and the exponential growth of data generated by these devices, service providers are harnessing technologies like artificial intelligence (AI) and machine learning (ML) to extract valuable insights from WiFi usage patterns, customer behavior, and network performance metrics. By employing sophisticated algorithms, WaaS providers can analyze vast amounts of data in real time, enabling businesses to gain a deeper understanding of how their WiFi infrastructure is utilized and how it impacts user experience.

- This data-driven approach to WiFi management offers multifaceted benefits. Firstly, it facilitates the optimization of WiFi performance by identifying areas of congestion, weak signal strength, or other network issues that may hinder user connectivity. By proactively addressing these issues, businesses can ensure a seamless and reliable WiFi experience for their customers and employees, thereby enhancing productivity and satisfaction. Moreover, the insights gleaned from WiFi analytics empower businesses to make informed decisions to improve the overall customer experience. Whether it's optimizing the layout of retail spaces based on foot traffic patterns, offering personalized promotions based on customer preferences and behavior, or enhancing venue operations based on real-time occupancy data, businesses can tailor their strategies to better meet the needs and expectations of their target audience. Overall, the integration of advanced analytics into WiFi management not only enhances network performance but also enables businesses to unlock new opportunities for innovation and differentiation in today's competitive landscape.

WiFi as a Service Market Segment Analysis:

WiFi as a Service Market is Segmented based on Solution, Service, Location Type, Organization Size, and Vertical.

By Solution, Access Points segment is expected to dominate the market during the forecast period

- APs turn out to be considered as the keystone in contemporary networking solutions with the market indicating about seven-figures worth of yearly sales influenced by the practically immovable presence of the devices within virtually every business and private setting. Wireless routers are small in size but mighty in function, as they act as key enablers that centralize the connection of wired networks to wireless applications. From densely populated offices to large factories and even common areas, APs are positioned right where connectivity happens, meaning managing connections and users to the requested resources. It continues to establish the fact as to how important they are in supporting the kind of digital change that is going mainstream across business operations and industries, and improving productivity as well as operational effectiveness.

- This explains the dominance of Access Points because not only they are widely used, but they also have numerous application experiences and capabilities for many networking points. Whether it is a dense urban environment where a city or town needs to be covered with Wi-Fi, an extensive campus with areas that need network connectivity, or IoT devices that need to support industrial environments, APs demonstrate extraordinary versatility in terms of needed performance. However, the new advancements in AP technology are boosting up innovation, beamforming, MU-MIMO, and even seamless roaming to offer better performance and user experience. As more and more companies depend on wireless as key enabling technology in their businesses, APs hold on as the fulcrum of most networks and take their position as the market’s most popular solution.

By Organization Size, Large Enterprises segment held the largest share in 2023

- Large businesses hold the status of colossuses in the wireless networking market: their enormous networks require efficient and highly scalable equipment, to which no wired contender could provide a worthy counterpart. These enterprises are spread across big geographic areas comprising numerous offices, campuses & facilities, all connected in complex networks. To fulfill the astounding requirements of such gigantic structures, large organizations are in search of wireless solutions that can easily fit with their ongoing network framework along with possessing the potential for the growth and expansion of their system as well. Furthermore, the vast number of users and devices connecting to their networks calls for devices to deliver the necessary performance to allow function without a decline in performance speed or reliability.

- Besides, managing large enterprise networks is a much more complicated task compared to, say, a small business network; the latter is going to need an enhanced set of functions and reliable management tools to enable it to operate even in the most intricate conditions. Using dynamic traffic management, and advanced security to enhance the delivery of mission-critical services together with complex multi-application support including Enterprise Resource Planning (ERP) systems, and real-time collaborations, Large enterprises benefit significantly from wireless networking technologies. Also, the centralized management and concomitant monitoring of the whole network topology is crucial for effectiveness and protection. By being significant players in the wireless networking market, large enterprise holds a lot of influence in leading the change required in the specified region, thereby strengthening their position as the market leader.

WiFi as a Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia Pacific region, the demand for WiFi as a Service (WaaS) solutions is not only burgeoning but also increasingly dominant, fueled by several key factors. Rapid urbanization across countries like China, India, and Japan has led to a surge in the establishment of commercial hubs, residential complexes, and public spaces, all of which require robust and reliable internet connectivity. As businesses strive to digitize their operations and offer seamless online experiences to customers, the need for high-speed WiFi networks has become paramount. Consequently, WaaS providers are witnessing a significant uptick in demand, especially in sectors such as retail, where the integration of digital technologies is revolutionizing the shopping experience, and manufacturing, where Industry 4.0 initiatives rely heavily on IoT devices and cloud-based applications. Transportation hubs, including airports and railway stations, are also increasingly turning to WaaS to enhance passenger experiences and optimize operations through real-time data analytics.

- Moreover, the dominance of WaaS in the Asia Pacific market is further cemented by the proliferation of mobile devices and the exponential growth of e-commerce and digital payment platforms. With a large population of tech-savvy consumers who rely on smartphones for various aspects of their daily lives, the demand for seamless connectivity is driving businesses to invest in advanced WiFi infrastructure. Retailers are leveraging WaaS solutions to offer personalized shopping experiences, while logistics companies are optimizing their supply chain operations through IoT-enabled tracking and monitoring systems. The rise of digital payments has also necessitated secure and reliable WiFi networks in brick-and-mortar stores, leading to increased adoption of WaaS solutions that can support the growing volume of online transactions. As such, WaaS providers in the Asia Pacific region are poised to continue dominating the market landscape, catering to the evolving needs of businesses and consumers alike in an increasingly connected world.

Active Key Players in the WiFi as a Service Market

- Cisco(US),

- Huawei Technologies Co. (China),

- CommScope Inc. (US),

- Aruba – a Hewlett Packard Enterprise Company (US),

- Extreme Networks (US),

- Singtel (Singapore),

- Rogers Communication (Canada),

- ADTRAN (US),

- Tata Communications (India),

- Axians (France),

- Fortinet (US),

- Juniper Networks (US),

- Alcatel-Lucent Enterprise (France),

- Telstra (Australia),

- Viasat (US),

- iPass (US),

- Arista (US),

- Ubiquiti (US),

- 4ipnet (Taiwan),

- Allied Telesis (Japan),

- LANCOM Systems (Germany),

- D-Link (Taiwan),

- Ruijie Networks (China),

- Datto (US),

- Superloop (Australia),

- Cambium Networks (US),

- Redway Networks (Buckinghamshire),

- Cucumber Tony (UK),

- Tanaza (Milano),

- Edgecore (Taiwan), and Other Key Players

Key Industry Developments in the WiFi as a Service Market:

- In March 2023, Cambium Networks launched a Wi-Fi 6/6E Tri-Band outdoor solution with future-proof performance for national government and defense markets. The XE3-4TN outdoor Wi-Fi 6/6E access point (AP) provides customers with complete flexibility in supporting the unlicensed 2.4, 5, and 6 GHz Wi-Fi bands

- In January 2023, CommScope announced that it has entered into the Wi-Fi 7 retail market with the launch of the SURFboard® G54 DOCSIS 3.1 quad-band Wi-Fi 7 cable modem. This flagship SURFboard G54 comes with significant enhancements in performance with the latest Wi-Fi 7 technology for its customers and service providers

|

Global WiFi as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.50% |

Market Size in 2032: |

USD 41.36 Bn. |

|

|

By Solution |

|

|

|

|

By Service |

|

|

|

Segments Covered: |

By Location Type |

|

|

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WIFI AS A SERVICE MARKET BY SOLUTION (2017-2032)

- WIFI AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACCESS POINTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WLAN CONTROLLERS

- WIFI AS A SERVICE MARKET BY SERVICE (2017-2032)

- WIFI AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PROFESSIONAL SERVICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANAGED SERVICES

- WIFI AS A SERVICE MARKET BY LOCATION TYPE (2017-2032)

- WIFI AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDOOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OUTDOOR

- WIFI AS A SERVICE MARKET BY ORGANIZATION SIZE (2017-2032)

- WIFI AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL AND MEDIUM-SIZED ENTERPRISES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- WIFI AS A SERVICE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CISCO(US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HUAWEI TECHNOLOGIES CO. (CHINA)

- COMMSCOPE INC. (US)

- ARUBA – A HEWLETT PACKARD ENTERPRISE COMPANY (US)

- EXTREME NETWORKS (US)

- SINGTEL (SINGAPORE)

- ROGERS COMMUNICATION (CANADA)

- ADTRAN (US)

- TATA COMMUNICATIONS (INDIA)

- AXIANS (FRANCE)

- FORTINET (US)

- JUNIPER NETWORKS (US)

- ALCATEL-LUCENT ENTERPRISE (FRANCE)

- TELSTRA (AUSTRALIA)

- VIASAT (US)

- IPASS (US)

- ARISTA (US)

- UBIQUITI (US)

- 4IPNET (TAIWAN)

- ALLIED TELESIS (JAPAN)

- LANCOM SYSTEMS (GERMANY)

- D-LINK (TAIWAN)

- RUIJIE NETWORKS (CHINA)

- DATTO (US)

- SUPERLOOP (AUSTRALIA)

- CAMBIUM NETWORKS (US)

- REDWAY NETWORKS (BUCKINGHAMSHIRE)

- CUCUMBER TONY (UK)

- TANAZA (MILANO)

- EDGECORE (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL WIFI AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Location Type

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global WiFi as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.17 Bn. |

|

Forecast Period 2024-32 CAGR: |

21.50% |

Market Size in 2032: |

USD 41.36 Bn. |

|

|

By Solution |

|

|

|

|

By Service |

|

|

|

Segments Covered: |

By Location Type |

|

|

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WIFI AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WIFI AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WIFI AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. WIFI AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. WIFI AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. WIFI AS A SERVICE MARKET BY SERVICE

TABLE 008. PROFESSIONAL SERVICE MARKET OVERVIEW (2016-2028)

TABLE 009. MANAGED SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. WIFI AS A SERVICE MARKET BY LOCATION

TABLE 011. INDOOR MARKET OVERVIEW (2016-2028)

TABLE 012. OUTDOOR MARKET OVERVIEW (2016-2028)

TABLE 013. WIFI AS A SERVICE MARKET BY INDUSTRY VERTICAL

TABLE 014. BFSI MARKET OVERVIEW (2016-2028)

TABLE 015. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 016. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 017. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA WIFI AS A SERVICE MARKET, BY SERVICE (2016-2028)

TABLE 020. NORTH AMERICA WIFI AS A SERVICE MARKET, BY LOCATION (2016-2028)

TABLE 021. NORTH AMERICA WIFI AS A SERVICE MARKET, BY INDUSTRY VERTICAL (2016-2028)

TABLE 022. N WIFI AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE WIFI AS A SERVICE MARKET, BY SERVICE (2016-2028)

TABLE 024. EUROPE WIFI AS A SERVICE MARKET, BY LOCATION (2016-2028)

TABLE 025. EUROPE WIFI AS A SERVICE MARKET, BY INDUSTRY VERTICAL (2016-2028)

TABLE 026. WIFI AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC WIFI AS A SERVICE MARKET, BY SERVICE (2016-2028)

TABLE 028. ASIA PACIFIC WIFI AS A SERVICE MARKET, BY LOCATION (2016-2028)

TABLE 029. ASIA PACIFIC WIFI AS A SERVICE MARKET, BY INDUSTRY VERTICAL (2016-2028)

TABLE 030. WIFI AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA WIFI AS A SERVICE MARKET, BY SERVICE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA WIFI AS A SERVICE MARKET, BY LOCATION (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA WIFI AS A SERVICE MARKET, BY INDUSTRY VERTICAL (2016-2028)

TABLE 034. WIFI AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA WIFI AS A SERVICE MARKET, BY SERVICE (2016-2028)

TABLE 036. SOUTH AMERICA WIFI AS A SERVICE MARKET, BY LOCATION (2016-2028)

TABLE 037. SOUTH AMERICA WIFI AS A SERVICE MARKET, BY INDUSTRY VERTICAL (2016-2028)

TABLE 038. WIFI AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 039. JUNIPER NETWORKS INC.: SNAPSHOT

TABLE 040. JUNIPER NETWORKS INC.: BUSINESS PERFORMANCE

TABLE 041. JUNIPER NETWORKS INC.: PRODUCT PORTFOLIO

TABLE 042. JUNIPER NETWORKS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. CISCO SYSTEM INC.: SNAPSHOT

TABLE 043. CISCO SYSTEM INC.: BUSINESS PERFORMANCE

TABLE 044. CISCO SYSTEM INC.: PRODUCT PORTFOLIO

TABLE 045. CISCO SYSTEM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HPE (ARUBA): SNAPSHOT

TABLE 046. HPE (ARUBA): BUSINESS PERFORMANCE

TABLE 047. HPE (ARUBA): PRODUCT PORTFOLIO

TABLE 048. HPE (ARUBA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. EXTREME NETWORKS: SNAPSHOT

TABLE 049. EXTREME NETWORKS: BUSINESS PERFORMANCE

TABLE 050. EXTREME NETWORKS: PRODUCT PORTFOLIO

TABLE 051. EXTREME NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HUAWEI TECHNOLOGIES CO. LTD.: SNAPSHOT

TABLE 052. HUAWEI TECHNOLOGIES CO. LTD.: BUSINESS PERFORMANCE

TABLE 053. HUAWEI TECHNOLOGIES CO. LTD.: PRODUCT PORTFOLIO

TABLE 054. HUAWEI TECHNOLOGIES CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. FORTINET: SNAPSHOT

TABLE 055. FORTINET: BUSINESS PERFORMANCE

TABLE 056. FORTINET: PRODUCT PORTFOLIO

TABLE 057. FORTINET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. RUCKUS NETWORKS: SNAPSHOT

TABLE 058. RUCKUS NETWORKS: BUSINESS PERFORMANCE

TABLE 059. RUCKUS NETWORKS: PRODUCT PORTFOLIO

TABLE 060. RUCKUS NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ARISTA NETWORKS: SNAPSHOT

TABLE 061. ARISTA NETWORKS: BUSINESS PERFORMANCE

TABLE 062. ARISTA NETWORKS: PRODUCT PORTFOLIO

TABLE 063. ARISTA NETWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. D-LINK CORPORATION: SNAPSHOT

TABLE 064. D-LINK CORPORATION: BUSINESS PERFORMANCE

TABLE 065. D-LINK CORPORATION: PRODUCT PORTFOLIO

TABLE 066. D-LINK CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TP-LINK: SNAPSHOT

TABLE 067. TP-LINK: BUSINESS PERFORMANCE

TABLE 068. TP-LINK: PRODUCT PORTFOLIO

TABLE 069. TP-LINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 070. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 071. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 072. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WIFI AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WIFI AS A SERVICE MARKET OVERVIEW BY SERVICE

FIGURE 012. PROFESSIONAL SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. MANAGED SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. WIFI AS A SERVICE MARKET OVERVIEW BY LOCATION

FIGURE 015. INDOOR MARKET OVERVIEW (2016-2028)

FIGURE 016. OUTDOOR MARKET OVERVIEW (2016-2028)

FIGURE 017. WIFI AS A SERVICE MARKET OVERVIEW BY INDUSTRY VERTICAL

FIGURE 018. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 019. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 020. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 021. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA WIFI AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE WIFI AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC WIFI AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA WIFI AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA WIFI AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the WiFi as a Service Market research report is 2024-2032.

Cisco(US), Huawei Technologies Co. (China), CommScope Inc. (US), Aruba – a Hewlett Packard Enterprise Company (US), Extreme Networks (US), Singtel (Singapore), Rogers Communication (Canada), ADTRAN (US), Tata Communications (India), Axians (France), Fortinet (US), Juniper Networks (US), Alcatel-Lucent Enterprise (France), Telstra (Australia), Viasat (US), iPass (US), Arista (US), Ubiquiti (US), 4ipnet (Taiwan), Allied Telesis (Japan), LANCOM Systems (Germany), D-Link (Taiwan), Ruijie Networks (China), Datto (US), Superloop (Australia), Cambium Networks (US), Redway Networks (Buckinghamshire), Cucumber Tony (UK), Tanaza (Milano), and Edgecore (Taiwan) and Other Major Players.

The WiFi as a Service Market is segmented into By Solutions, By Service, By Location Type, By Organization Size, By Vertical, and region. By Solution, the market is categorized into Access Points and WLAN Controllers. By Service, the market is categorized into Professional Services (Advisory and Implementation, Support and Maintenance, Training) and Managed Services. By Location Type, the market is categorized into Indoor and Outdoor. By Organization Size, the market is categorized into Large Enterprises and Small and Medium-Sized Enterprises. By Vertical, the market is categorized into Education, Retail, Travel and Hospitality, Healthcare and Life Sciences, Manufacturing, Banking, Financial Services, and Insurance, Service Providers, Transportation and Logistics, Government and Public Sector, and Other Verticals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The WiFi as a Service (WaaS) market may be defined here as being the market for wireless networking infrastructure and services that are delivered on a subscription basis to businesses and organizations, thus catering to their evolving needs for comprehensive, flexible, and fairly affordable networking hardware and services. Under this model, the role of service providers involves supplying and maintaining WiFi such as access points, controllers, and network and management software in which clients have an opportunity to connect to high-speed wireless internet at an agreed fee hence no need to buy any hardware while it is being provided by the service providers at an agreed fee avoiding regular maintenance expenses. WaaS solutions are geared towards different industries, including retail, hospitality, healthcare, and education sectors assuring their clients to optimize and advance the delivery of better customer services, increased operational performance, and the ability to meet the constantly changing demands of technology solutions. The said market is fueled by the need for mobility and Cloud services, together with the rise of the ‘Internet of Things’ which has made many organizations turn to third parties for the management of their WiFi.

WiFi as a Service Market Size Was Valued at USD 7.17 Billion in 2023, and is Projected to Reach USD 41.36 Billion by 2032, Growing at a CAGR of 21.50% From 2024-2032.