White Goods Market Synopsis

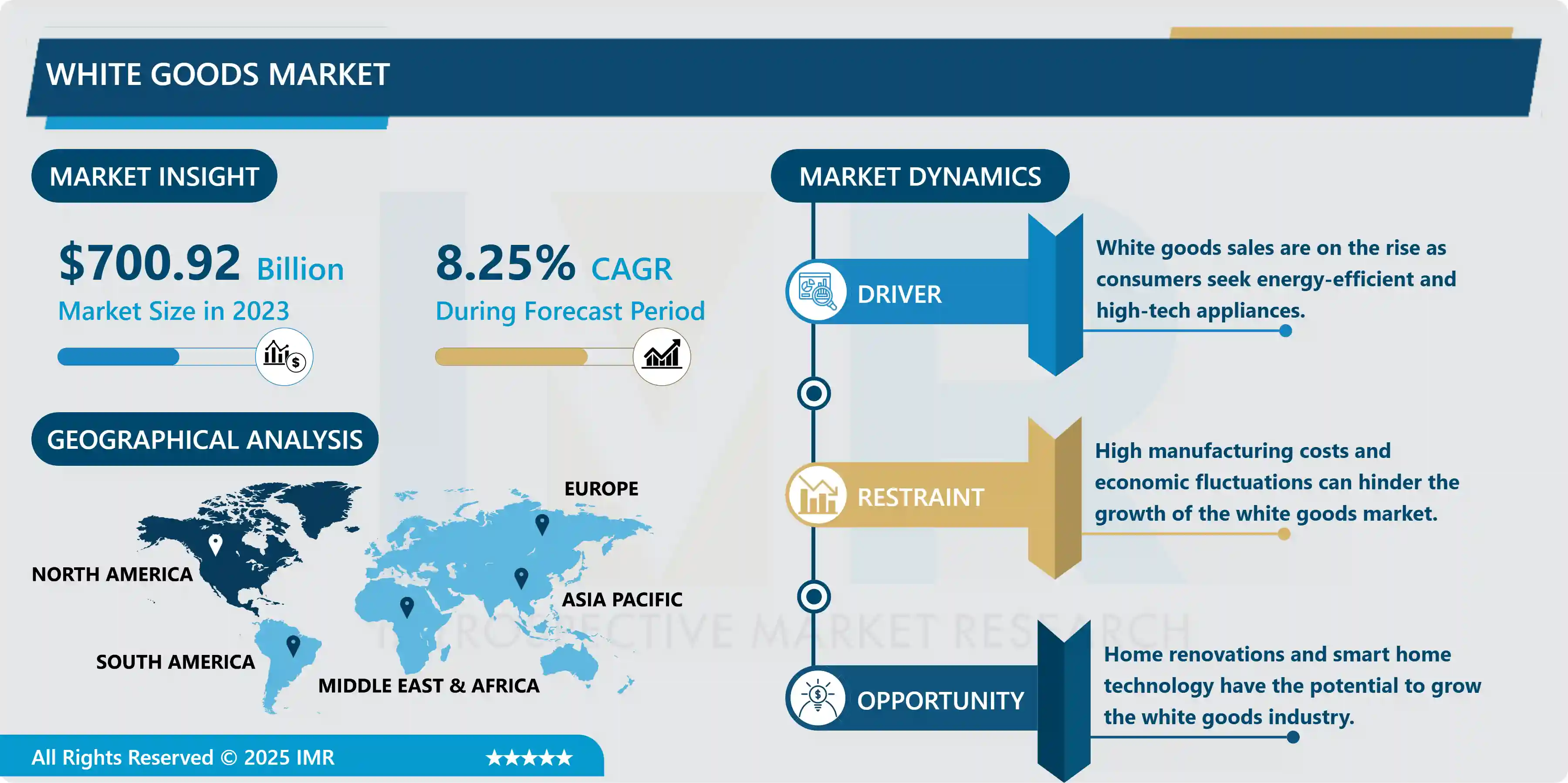

White Goods Market Size is Valued at USD 700.92 Billion in 2023 and is Projected to Reach USD 1,321.57 Billion by 2032, Growing at a CAGR of 8.25% From 2024-2032.

The white goods market, which includes major household appliances such as refrigerators, washing machines, dishwashers, and ovens, is undergoing consistent development as a result of the increasing demand for energy-efficient and modern home appliances among consumers. The market is expanding as a result of technological advancements, such as smart appliances that offer enhanced energy efficiency and connectivity capabilities. The increasing emphasis on domestic convenience and automation, along with the rise in disposable incomes and urbanization, are further stimulating the market. Furthermore, stringent regulatory standards and sustainability trends are driving continuous innovation and enhanced market competitiveness in the white goods sector, compelling manufacturers to create eco-friendly products.

The white goods market is characterized by the white or neutral colors of main household appliances, such as refrigerators, washing machines, dishwashers, and air conditioners. The market has experienced significant development as a result of the increasing demand for energy-efficient, modern appliances and technological advancements. Innovations like smart appliances with IoT connectivity and energy-saving features have significantly impacted consumer preferences in the past, leading to increased market penetration. Furthermore, the demand for white goods is on the rise in emerging economies due to urbanization and increasing disposable incomes as households invest in upgrading their home appliances.

Consumers' changing lifestyles and the increasing emphasis on sustainability also influence the market. In order to satisfy regulatory requirements and mitigate environmental concerns, manufacturers are emphasizing energy-efficient models and eco-friendly designs. Both global and regional competitors influence the competitive dynamics in the white goods market. Companies are endeavouring to distinguish themselves by offering competitive pricing, superior customer service, and technological advancements. As a result, the market remains dynamic, constantly evolving to enhance the functionality, convenience, and sustainability of household appliances.

White Goods Market Trend Analysis

Smart Appliances Integration

- The inclusion of smart appliances is one notable trend that is reshaping the white goods market. Household appliances are becoming more sentient and interconnected as a result of the widespread adoption of Internet of Things (IoT) technology.

- Remote control, real-time diagnostics, and energy efficiency monitoring are now available in smart refrigerators, washing machines, and ovens. This integration improves user convenience, enables more effective management of home energy consumption, and offers valuable data insights, thereby increasing consumer demand for these advanced products.

- In the white products market, smart appliances are becoming a significant driver as they continue to evolve. Manufacturers are making substantial investments in the development of interconnected appliances that provide seamless integration with other smart home systems.

- We anticipate this transition to stimulate market expansion, as consumers seek to enhance their residences with state-of-the-art technology that streamlines daily activities and enhances overall efficiency. The trend toward digital appliances is transforming the white goods market, creating a more dynamic and technology-driven environment.

Sustainability and Energy Efficiency

- There is an increasing trend in the white goods market to integrate energy efficiency and sustainability into product design and fabrication. Eco-friendly appliances that not only reduce energy consumption but also minimize environmental impact are becoming increasingly popular among consumers.

- The increased awareness of climate change and the desire for a more sustainable lifestyle have prompted manufacturers to develop energy-efficient technologies, including advanced compressors, digital thermostats, and low-energy lighting systems. These factors are driving the shift. Consequently, energy ratings and eco-certifications have become critical factors that influence consumer purchasing decisions.

- Additionally, the white goods sector is expanding its sustainability initiatives to include sustainable production practices, the use of recyclable materials, and energy efficiency. Manufacturers are committing to circular economy models that encourage the reuse and recycling of components, thereby reducing waste and extending the lifecycle of products.

- This dedication to sustainability, which not only satisfies regulatory requirements but also correlates with the increasing expectations of consumers for environmentally responsible products, shapes the future of the white goods market.

White Goods Market Segment Analysis:

White Goods Market Segmented on the basis of By Product, Distribution Channel and End-User

By Product, Air Conditioner segment is expected to dominate the market during the forecast period

- The white goods market is a collection of household appliances that are intended to improve the quality of daily life. These appliances include air conditioners, refrigerators, laundry machines, dishwashers, microwave ovens, and other essential items. The market's expansion is influenced by the distinct contributions of each product category.

- Air conditioners and refrigerators are essential for the preservation of food and the convenience of homes, which is why they are in high demand in a variety of climates. Dishwashers and washing machines provide convenience in home maintenance, while microwave appliances enable rapid meal preparation, thereby accommodating contemporary lifestyles that prioritize efficiency.

- Technological advancements, evolving consumer preferences, and rising disposable incomes are all factors that impact the white products market. The increasing predilection for environmentally friendly and high-performance appliances is a result of the ongoing influence of innovations in energy efficiency, smart home integration, and enhanced features on consumer choices. Consequently, the white goods market is anticipated to grow in response to the persistent demand for convenience and enhanced domestic living standards.

Distribution Channel, Supermarket and Hypermarket segment held the largest share in 2024

- Numerous platforms, including supermarkets and hypermarkets, specialty stores, retail stores, e-commerce, and other channels, distribute the white products market. Supermarkets and hypermarkets provide a diverse selection of white goods, allowing customers to conveniently peruse a variety of product options in a single location.

- In contrast, specialty stores offer a more narrowly focused selection of white goods, frequently accompanied by personalized service and expert advice. Retail stores continue to play a significant role by providing consumers with hands-on experiences with products, which can enhance their confidence in their purchasing decisions.

- The ease of comparison of prices and features, as well as the convenience of online purchasing, have propelled e-commerce to become a prominent distribution network for white goods. The proliferation of online platforms has broadened the market's reach, enabling consumers to access a more extensive selection of products and capitalize on competitive pricing.

- The presence of alternative distribution channels, such as direct-to-consumer sales and home appliance rental services, further enriches the dynamic landscape of the white goods market, catering to the diverse preferences and requirements of consumers.

White Goods Market Regional Insights:

North America is expected to dominate the white goods market and grow rapidly in the coming years.

- North America is expected to dominate the white products market and experience substantial growth in the years ahead, as a result of a number of critical factors. The region's robust retail infrastructure, high disposable incomes, and firm economic foundation all contribute to an increase in consumer spending on household appliances.

- Furthermore, the introduction of smart appliances and technological advancements is fueling the demand for energy-efficient and connected solutions. North America's emphasis on home automation and innovation in product features further supports the market's expansion.

- The white goods market in North America is also experiencing growth as a result of the ongoing construction and home renovation projects, which are driving the demand for modern and enhanced appliances.

- Consumers are increasingly investing in energy-efficient products that are consistent with environmentally friendly practices in response to the increasing emphasis on sustainable living. North America is well-positioned to maintain its leading position and capitalize on the expanding market opportunities in white goods as manufacturers continue to innovate and meet evolving consumer preferences.

Active Key Players in the White Goods Market

- Friedr. Dick GmbH & Co (Germany)

- GLOBAL APPLIANCES USA (U.S.)

- KAI USA LTD (U.S.)

- Kiya corp. (Japan)

- M.A.C. Knife (U.S.)

- Messermeister (Germany)

- Victorinox AG (Switzerland)

- Anker Innovation Technology Co., Ltd. (China)

- Samsung Electronics Co., Ltd (South Korea)

- Shenzhen Proscenic Technology Co. Ltd. (China)

- Neato Robotics, Inc. (U.S.)

- Cecotec Innovaciones S.L. (Spain)

- L.G. Electronics Inc (South Korea)

- Dyson Limited (U.K.)

- Panasonic Corporation (Japan)

- Sharp Corporation (U.S.)

- Others

|

White Goods Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 700.92 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.25% |

Market Size in 2032: |

USD 1,321.57 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: White Goods Market by Product (2018-2032)

4.1 White Goods Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Air Conditioner

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Refrigerator

4.5 Washing Machine

4.6 Dishwasher

4.7 Microwave Oven

4.8 Others

Chapter 5: White Goods Market by End-User (2018-2032)

5.1 White Goods Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

Chapter 6: White Goods Market by Distribution Channel (2018-2032)

6.1 White Goods Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarket and Hypermarket

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Store

6.5 Retail Store

6.6 E-commerce

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 White Goods Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 FRIEDR. DICK GMBH & CO (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GLOBAL APPLIANCES USA (U.S.)

7.4 KAI USA LTD (U.S.)

7.5 KIYA CORP. (JAPAN)

7.6 M.A.C. KNIFE (U.S.)

7.7 MESSERMEISTER (GERMANY)

7.8 VICTORINOX AG (SWITZERLAND)

7.9 ANKER INNOVATION TECHNOLOGY COLTD. (CHINA)

7.10 SAMSUNG ELECTRONICS COLTD (SOUTH KOREA)

7.11 SHENZHEN PROSCENIC TECHNOLOGY CO. LTD. (CHINA)

7.12 NEATO ROBOTICS INC. (U.S.)

7.13 CECOTEC INNOVACIONES S.L. (SPAIN)

7.14 L.G. ELECTRONICS INC (SOUTH KOREA)

7.15 DYSON LIMITED (U.K.)

7.16 PANASONIC CORPORATION (JAPAN)

7.17 SHARP CORPORATION (U.S.)

7.18 OTHERS

7.19

Chapter 8: Global White Goods Market By Region

8.1 Overview

8.2. North America White Goods Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Air Conditioner

8.2.4.2 Refrigerator

8.2.4.3 Washing Machine

8.2.4.4 Dishwasher

8.2.4.5 Microwave Oven

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size by End-User

8.2.5.1 Residential

8.2.5.2 Commercial

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarket and Hypermarket

8.2.6.2 Specialty Store

8.2.6.3 Retail Store

8.2.6.4 E-commerce

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe White Goods Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Air Conditioner

8.3.4.2 Refrigerator

8.3.4.3 Washing Machine

8.3.4.4 Dishwasher

8.3.4.5 Microwave Oven

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size by End-User

8.3.5.1 Residential

8.3.5.2 Commercial

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarket and Hypermarket

8.3.6.2 Specialty Store

8.3.6.3 Retail Store

8.3.6.4 E-commerce

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe White Goods Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Air Conditioner

8.4.4.2 Refrigerator

8.4.4.3 Washing Machine

8.4.4.4 Dishwasher

8.4.4.5 Microwave Oven

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size by End-User

8.4.5.1 Residential

8.4.5.2 Commercial

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarket and Hypermarket

8.4.6.2 Specialty Store

8.4.6.3 Retail Store

8.4.6.4 E-commerce

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific White Goods Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Air Conditioner

8.5.4.2 Refrigerator

8.5.4.3 Washing Machine

8.5.4.4 Dishwasher

8.5.4.5 Microwave Oven

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size by End-User

8.5.5.1 Residential

8.5.5.2 Commercial

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarket and Hypermarket

8.5.6.2 Specialty Store

8.5.6.3 Retail Store

8.5.6.4 E-commerce

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa White Goods Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Air Conditioner

8.6.4.2 Refrigerator

8.6.4.3 Washing Machine

8.6.4.4 Dishwasher

8.6.4.5 Microwave Oven

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size by End-User

8.6.5.1 Residential

8.6.5.2 Commercial

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarket and Hypermarket

8.6.6.2 Specialty Store

8.6.6.3 Retail Store

8.6.6.4 E-commerce

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America White Goods Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Air Conditioner

8.7.4.2 Refrigerator

8.7.4.3 Washing Machine

8.7.4.4 Dishwasher

8.7.4.5 Microwave Oven

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size by End-User

8.7.5.1 Residential

8.7.5.2 Commercial

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarket and Hypermarket

8.7.6.2 Specialty Store

8.7.6.3 Retail Store

8.7.6.4 E-commerce

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

White Goods Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 700.92 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.25% |

Market Size in 2032: |

USD 1,321.57 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||