Wealth Management Market

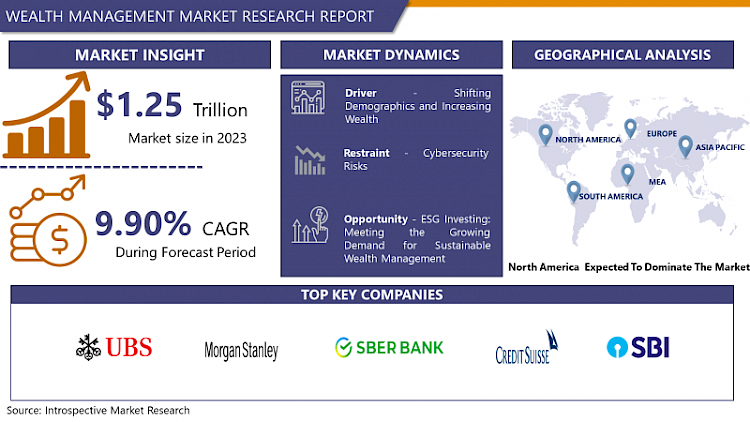

The Management Market Size Was Valued at USD 1,257.19 Billion in 2023 and is Projected to Reach USD 2,940.22 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.

Wealth Management is a firm that delivers financial solutions, including wealth planning, asset management, and other special services for families or corporations with large amounts of money. Wealth management aims to ensure that individuals, organizations, or companies achieve their financial goals and objectives regarding money, and also offer advice and possible solutions amidst challenges that arise in the management of financial resources. Contemplated wealth managers provide a wide range of services in relation to their clients’ individual needs, financial status and experiences, investment targets, and recuperative ability towards risks. Some are investment management, retirement planning services, wealth planning, tax advisory, estate planning, and risk management solutions.

- The wealth management market includes a greatly diversified and individualized set of financial services offering solutions for such clients as individuals and families aiming at preserving and increasing their wealth. This particular sector, particularly over the past few decades, has gone through a lot of changes and growth and this has largely been as a result of changes and fluctuations in global economic status, technological factors, and changes and demands from the clients.

- Another feature that helps to identify the market for wealth management is the emphasis on servicing individuals and offering individual recommendations and services. Wealth managers act as advisers with fiduciary responsibility towards their clients by actively engaging with them with a view of identifying their specific goals, risk appetite and investment profile so that an appropriate investment plan can be developed for them. This is especially important because too often clients’ financial situations and goals differ significantly from one another: some might be high earner growing their wealth, while others are seniors seeking to secure their retirement years.

- In the recent past, technology innovation has emerged as the leading solution when it comes to the remoulding of the wealth management industry. New technologies have increasingly made digital and or robo-advisors today possible and individuals with limited funds can easily invest and manage their wealth. They use code and computerization to offer investment knowledge and portfolio management, targeting more numerous and diverse clients; the youth being inclined towards applying technology.

- In addition, data analysis alongside artificial intelligence complement wealth management by enabling these entities to provide more effective investment strategies. Wealth managers can take advantage of big data and machine learning to analyze a large amount of information to study the market, to evaluate the opportunities of investment and to prepare an effective portfolio. The use of data helps wealth managers to understand potential changes in the market earlier and refine their strategies to meet the new needs of investors in the constantly developing financial market.

- Another significant development in the wealth management market is the increasing interest in sustainable and socially responsible investing (SRI), also known as ethical or green investment. Growing consciousness of ESG factors has resulted in investor interest in making conscious choices for investment portfolios as per his/her conscience. To meet this need, wealth managers have begun incorporating ESG factors into their portfolios and providing SRI financial products and management lets which allow clients to participate in organizations and ventures that are socially responsible.

- Global regulatory structures also play their part in the way wealth management industry is perceived and undertaken, given that most global regulators have tightened their regulatory standards and necessities in a bid to increase investor protection and prevent financial malpractice. The legal requirements are another factor that plays an important role in the management of wealth firms, as they have to meet various requirements set by the regulatory bodies to maintain compliance with the laws and implement these requirements into best practices.

- In the future, the prospects of the wealth management market remain high as new products of the financial industry, changes in the demographics of populations, and the development of technology lead to further evolution in the industry. In this way, it can be seen that by understanding and engaging with these changes, and incorporating them into their own practices and service portfolios, wealth managers can effectively meet and build on their clients’ needs and expectations in the present and into the future successfully.

Wealth Management Market Trend Analysis

Digital Transformation Reshaping Wealth Management

- Today, the process of digital transformation is altering the structure and the functioning of the processes of wealth management, and the way in which financial services are offered and sought. The evolving of new technologies like artificial intelligence, machine learning as well as blockchain technology are increasing the factors in redefining wealth management. These technologies assist conduct wealth management and allow financial advisors to set up tailored investment solutions, constant portfolio tracking, and predictive analytics to address clients’ emerging demands.

- Furthermore, digital transformations mean clients can access their wealth managers at their convenience and from any location. This shift towards digitalization is not only helping efficiency in their working along with cost cutting of the wealth management firms but also providing more access to everyone or any number of people to become the part of the wealth management services. Thereby, the overall LM tends to evolve through innovation, higher competition levels as well as value-added proposition reorientation towards unique individual customer needs and financial targets in the area of wealth management.

ESG Investing: Meeting the Growing Demand for Sustainable Wealth Management

- The ESG investing has emerged as one of the strategies in wealth management which fits eloquently to the fast-growing trend of sustainable investments. This is because due to ever rising concern in climate change, social issues and good corporate governance, investors are always in search of ways through which they can make their investment match with their set values. The concepts that are involved in ESG investing include the analysis of the performance of the various companies based on their scores in carbon emission, working culture, gender diversity, and other responsible leadership aspects.

- It also shows that consumers are looking for packages that align their self-interest with the self-interest of the firm but also the interest of society and the planet. Thus, knowledge concerning ESG is becoming increasingly popular among wealth management companies; doing so, firms find ways to create more portfolios that support both, the profit and environmental objectives. Despite relatively recent popularity, ESG is preparing to prime the future of wealth management as a move towards sustainable investment that enhances investors’ wealth while strengthening social and environmental success.

Wealth Management Market Segment Analysis:

Wealth Management Market Segmented based on Service , Advisory Type , Provider and End User

By Type, Financial Planning segment is expected to dominate the market during the forecast period

- Wealth management offers include a range of customized financial necessities to suit need, with a view to financial planning and wealth creation. It is the foundation of the advisory process, applying it to set goals, evaluate tolerance for risks, and develop bespoke campaigns. Pit as asset allocation, a pillar concept of wealth management, enhances portfolios by allocating investments across different classes of assets to achieve desired risk-adjusted returns. Authorization involves the active supervision of investment assets and modification of investment portfolios as they pertain to financial goals and asset evaluations, to verify that they continue on course.

- Another crucial area is estate planning – the process of providing for the orderly handing down of property to such person or persons as directed while at the same time achieving the least amount of fiscal burden through taxation and legal formalities. Finally, this legal form of taxation is essential in wealth management as it aims at utilizing different methods to ensure that taxes are minimally paid while at the same time meeting the customer needs. Altogether, these services create a strong base to assist one in the issues of wealth creation, protection, and transferring part of which constitutes the following.

By Advisory Type, Hybrid Advisory segment held the largest share in 2023

- There is a wide range of investment management services, and each has its peculiarities in serving the clients. Human advisory services on the other hand involve face-to-face help and direction from financial advisors, therefore a more ears on establishing wealth management. Clients have a possibility to interact directly with the service provider and get individual suggestions and recommendations; it is also comforting when they know that an AI-based decision was made by a person. While traditional advisory services involve an advisor who guides the client on what investments to make, robo advisory services, use computer based algorithms to offer automated investment advice which is set according to general parameters and risk tolerance levels. This method benefits several actors due to its efficiency; costs, access, and flexibility as it is effectively targeting IT-oriented investors for portfolio management.

- Integrated advisory services involve the use of both human and technology options, which offer the capacity to offer customized advices together with an assortment of commercially available items. This approach provides its wide range of clients with the opportunities for further diversification, reaching the highest level of scales, as well as varying from the direct cooperating with the experts to the rapid usage of the opportunities provided by modern innovative technologies. The variety of advisory models in the wealth management market is indicative of the need to address the necessity for people to have unique requirements and seek services meant to help them manage their assets according to their personality, risk tolerance, and investment objectives. The area of management of wealth in the future is expected to experience more advances particularly with the use of technology where several factors create both human and digital electronic affluence and efficiency towards guaranteeing efficient returns for clients.

Wealth Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Essentials of this north America dominance in the wealth management market over the forecast period are from the various factors which making this region as dominant in financial services. North America consists of the world’s most developed financial markets that host a highly populated population of Hi-Net individuals who are always in search of elite wealth management services. Furthermore, the region can boast of having a modern technology front and a inclination towards innovation that takes companies to create new solutions that would be suitable for clients’ needs. Efforts that ministers, lawmakers and regulatory authorities have put in placing investor protection and transparency at the centre of the systems also strengthen the market.

- Also, North America plays central role in the wealth management industry worldwide by attracting capital from the other parts of the world. As such, is well positioned to sustain its dominance in the global wealth management market, delivering significant value to investors who are in search of safety, improvement, and quality services on one hand, and those seeking to expand globally on the other.

Active Key Players in the Wealth Management Market

- UBS Group AG (Switzerland)

- Morgan Stanley Wealth Management (USA)

- SBERBANK (Russia)

- Credit Suisse (Switzerland)

- State Bank of India (India)

- Bank of America Global Wealth

- Investment Management (USA)

- J.P. Morgan Private Bank (USA)

- Citi Private Bank (USA)

- BNP Paribas Wealth Management (France)

- Goldman Sachs (USA)

- Charles Schwab (USA)

- Other Key Players

Key Industry Developments in the Wealth Management Market

- In November 2022, UBS AG launches the world’s first digital bond that is publicly traded and settled on both blockchain-based and traditional exchanges. This digital bond holds the same instrument structure, legal status and rating as that of traditional UBS AG senior unsecured note but this newly launched bond is the first ever digital bond by a banking institution globally that will be listed, traded and settled on a regulated digital exchange.

|

Global Wealth Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1,381.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 2,940.22 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Advisory Type |

|

||

|

By Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- WEALTH MANAGEMENT MARKET BY SERVICE (2017-2032)

- WEALTH MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SERVICEA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FINANCIAL PLANNING

- ASSET ALLOCATION

- ASSET MANAGEMENT

- ESTATE PLANNING

- TAX ACCOUNTING

- WEALTH MANAGEMENT MARKET BY ADVISORY TYPE (2017-2032)

- WEALTH MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HUMAN ADVISORY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ROBO ADVISORY

- HYBRID ADVISORY

- WEALTH MANAGEMENT MARKET BY PROVIDER (2017-2032)

- WEALTH MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BANKS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INVESTMENT MANAGEMENT FIRMS

- FINTECH ADVISORS

- OTHERS

- WEALTH MANAGEMENT MARKET BY END USER (2017-2032)

- WEALTH MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HIGH NET WORTH INDIVIDUALS (HNI’S)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSINESS INSTITUTIONS

- OTHER END USERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Wealth Management Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- UBS GROUP AG (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MORGAN STANLEY WEALTH MANAGEMENT (USA)

- SBERBANK (RUSSIA)

- CREDIT SUISSE (SWITZERLAND)

- STATE BANK OF INDIA (INDIA)

- BANK OF AMERICA GLOBAL WEALTH

- INVESTMENT MANAGEMENT (USA)

- J.P. MORGAN PRIVATE BANK (USA)

- CITI PRIVATE BANK (USA)

- BNP PARIBAS WEALTH MANAGEMENT (FRANCE)

- GOLDMAN SACHS (USA)

- CHARLES SCHWAB (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL WEALTH MANAGEMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Advisory Type

- Historic And Forecasted Market Size By Provider

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Wealth Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1,381.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.90% |

Market Size in 2032: |

USD 2,940.22 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Advisory Type |

|

||

|

By Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001: EXECUTIVE SUMMARY

TABLE 002. WEALTH MANAGEMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WEALTH MANAGEMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WEALTH MANAGEMENT MARKET COMPETITIVE RIVALRY

TABLE 005. WEALTH MANAGEMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. WEALTH MANAGEMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. WEALTH MANAGEMENT MARKET BY SERVICE

TABLE 008. FINANCIAL PLANNING MARKET OVERVIEW (2016-2028)

TABLE 009. ASSET ALLOCATION MARKET OVERVIEW (2016-2028)

TABLE 010. ASSET MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 011. ESTATE PLANNING MARKET OVERVIEW (2016-2028)

TABLE 012. TAX ACCOUNTING MARKET OVERVIEW (2016-2028)

TABLE 013. WEALTH MANAGEMENT MARKET BY ADVISORY TYPE

TABLE 014. HUMAN ADVISORY MARKET OVERVIEW (2016-2028)

TABLE 015. ROBO ADVISORY MARKET OVERVIEW (2016-2028)

TABLE 016. HYBRID ADVISORY MARKET OVERVIEW (2016-2028)

TABLE 017. WEALTH MANAGEMENT MARKET BY PROVIDER

TABLE 018. BANKS MARKET OVERVIEW (2016-2028)

TABLE 019. INVESTMENT MANAGEMENT FIRMS MARKET OVERVIEW (2016-2028)

TABLE 020. FINTECH ADVISORS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. WEALTH MANAGEMENT MARKET BY END USER

TABLE 023. HIGH NET WORTH INDIVIDUALS (HNI’S) MARKET OVERVIEW (2016-2028)

TABLE 024. BUSINESS INSTITUTIONS MARKET OVERVIEW (2016-2028)

TABLE 025. OTHER END USERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA WEALTH MANAGEMENT MARKET, BY SERVICE (2016-2028)

TABLE 027. NORTH AMERICA WEALTH MANAGEMENT MARKET, BY ADVISORY TYPE (2016-2028)

TABLE 028. NORTH AMERICA WEALTH MANAGEMENT MARKET, BY PROVIDER (2016-2028)

TABLE 029. NORTH AMERICA WEALTH MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 030: N WEALTH MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE WEALTH MANAGEMENT MARKET, BY SERVICE (2016-2028)

TABLE 032. EUROPE WEALTH MANAGEMENT MARKET, BY ADVISORY TYPE (2016-2028)

TABLE 033. EUROPE WEALTH MANAGEMENT MARKET, BY PROVIDER (2016-2028)

TABLE 034. EUROPE WEALTH MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 035. WEALTH MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC WEALTH MANAGEMENT MARKET, BY SERVICE (2016-2028)

TABLE 037. ASIA PACIFIC WEALTH MANAGEMENT MARKET, BY ADVISORY TYPE (2016-2028)

TABLE 038. ASIA PACIFIC WEALTH MANAGEMENT MARKET, BY PROVIDER (2016-2028)

TABLE 039. ASIA PACIFIC WEALTH MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 040. WEALTH MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA WEALTH MANAGEMENT MARKET, BY SERVICE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA WEALTH MANAGEMENT MARKET, BY ADVISORY TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA WEALTH MANAGEMENT MARKET, BY PROVIDER (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA WEALTH MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 045. WEALTH MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA WEALTH MANAGEMENT MARKET, BY SERVICE (2016-2028)

TABLE 047. SOUTH AMERICA WEALTH MANAGEMENT MARKET, BY ADVISORY TYPE (2016-2028)

TABLE 048. SOUTH AMERICA WEALTH MANAGEMENT MARKET, BY PROVIDER (2016-2028)

TABLE 049. SOUTH AMERICA WEALTH MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 050. WEALTH MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 051. UBS GROUP AG (SWITZERLAND): SNAPSHOT

TABLE 052. UBS GROUP AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 053. UBS GROUP AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 054. UBS GROUP AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MORGAN STANLEY WEALTH MANAGEMENT (USA): SNAPSHOT

TABLE 055. MORGAN STANLEY WEALTH MANAGEMENT (USA): BUSINESS PERFORMANCE

TABLE 056. MORGAN STANLEY WEALTH MANAGEMENT (USA): PRODUCT PORTFOLIO

TABLE 057. MORGAN STANLEY WEALTH MANAGEMENT (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057: SBERBANK (RUSSIA): SNAPSHOT

TABLE 058: SBERBANK (RUSSIA): BUSINESS PERFORMANCE

TABLE 059. SBERBANK (RUSSIA): PRODUCT PORTFOLIO

TABLE 060: SBERBANK (RUSSIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CREDIT SUISSE (SWITZERLAND): SNAPSHOT

TABLE 061. CREDIT SUISSE (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 062. CREDIT SUISSE (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 063. CREDIT SUISSE (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. STATE BANK OF INDIA (INDIA): SNAPSHOT

TABLE 064. STATE BANK OF INDIA (INDIA): BUSINESS PERFORMANCE

TABLE 065. STATE BANK OF INDIA (INDIA): PRODUCT PORTFOLIO

TABLE 066. STATE BANK OF INDIA (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BANK OF AMERICA GLOBAL WEALTH AND INVESTMENT MANAGEMENT (USA): SNAPSHOT

TABLE 067. BANK OF AMERICA GLOBAL WEALTH AND INVESTMENT MANAGEMENT (USA): BUSINESS PERFORMANCE

TABLE 068. BANK OF AMERICA GLOBAL WEALTH AND INVESTMENT MANAGEMENT (USA): PRODUCT PORTFOLIO

TABLE 069. BANK OF AMERICA GLOBAL WEALTH AND INVESTMENT MANAGEMENT (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. J.P. MORGAN PRIVATE BANK (USA): SNAPSHOT

TABLE 070. J.P. MORGAN PRIVATE BANK (USA): BUSINESS PERFORMANCE

TABLE 071. J.P. MORGAN PRIVATE BANK (USA): PRODUCT PORTFOLIO

TABLE 072. J.P. MORGAN PRIVATE BANK (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CITI PRIVATE BANK (USA): SNAPSHOT

TABLE 073. CITI PRIVATE BANK (USA): BUSINESS PERFORMANCE

TABLE 074. CITI PRIVATE BANK (USA): PRODUCT PORTFOLIO

TABLE 075. CITI PRIVATE BANK (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. BNP PARIBAS WEALTH MANAGEMENT (FRANCE): SNAPSHOT

TABLE 076. BNP PARIBAS WEALTH MANAGEMENT (FRANCE): BUSINESS PERFORMANCE

TABLE 077. BNP PARIBAS WEALTH MANAGEMENT (FRANCE): PRODUCT PORTFOLIO

TABLE 078. BNP PARIBAS WEALTH MANAGEMENT (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. GOLDMAN SACHS (USA): SNAPSHOT

TABLE 079. GOLDMAN SACHS (USA): BUSINESS PERFORMANCE

TABLE 080. GOLDMAN SACHS (USA): PRODUCT PORTFOLIO

TABLE 081. GOLDMAN SACHS (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. CHARLES SCHWAB (USA): SNAPSHOT

TABLE 082. CHARLES SCHWAB (USA): BUSINESS PERFORMANCE

TABLE 083. CHARLES SCHWAB (USA): PRODUCT PORTFOLIO

TABLE 084. CHARLES SCHWAB (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001: YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WEALTH MANAGEMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WEALTH MANAGEMENT MARKET OVERVIEW BY SERVICE

FIGURE 012. FINANCIAL PLANNING MARKET OVERVIEW (2016-2028)

FIGURE 013. ASSET ALLOCATION MARKET OVERVIEW (2016-2028)

FIGURE 014. ASSET MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 015. ESTATE PLANNING MARKET OVERVIEW (2016-2028)

FIGURE 016. TAX ACCOUNTING MARKET OVERVIEW (2016-2028)

FIGURE 017. WEALTH MANAGEMENT MARKET OVERVIEW BY ADVISORY TYPE

FIGURE 018. HUMAN ADVISORY MARKET OVERVIEW (2016-2028)

FIGURE 019. ROBO ADVISORY MARKET OVERVIEW (2016-2028)

FIGURE 020. HYBRID ADVISORY MARKET OVERVIEW (2016-2028)

FIGURE 021. WEALTH MANAGEMENT MARKET OVERVIEW BY PROVIDER

FIGURE 022. BANKS MARKET OVERVIEW (2016-2028)

FIGURE 023. INVESTMENT MANAGEMENT FIRMS MARKET OVERVIEW (2016-2028)

FIGURE 024. FINTECH ADVISORS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. WEALTH MANAGEMENT MARKET OVERVIEW BY END USER

FIGURE 027. HIGH NET WORTH INDIVIDUALS (HNI’S) MARKET OVERVIEW (2016-2028)

FIGURE 028. BUSINESS INSTITUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHER END USERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA WEALTH MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE WEALTH MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC WEALTH MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA WEALTH MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA WEALTH MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wealth Management Market research report is 2024-2032.

UBS Group AG (Switzerland), Morgan Stanley Wealth Management (USA),SBERBANK (Russia),Credit Suisse(Switzerland), State Bank of India (India), J.P. Morgan Private Bank (USA), Citi Private Bank (USA), and Other Major Players.

The Wealth Management Market is segmented into Service , Advisory Type , Provider, End User and Region. By Service , the market is categorized into Financial Planning, Asset Allocation, Asset Management, Estate Planning, Tax Accounting. By Advisory Type, the market is categorized into Human Advisory, Robo Advisory, Hybrid Advisory. By Provider , the market is categorized into Banks, Investment Management Firms, Fintech Advisors, Others. By End User , the market is categorized into High Net Worth Individuals (HNI’s), Business Institutions, Other End Users.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wealth management is the firm that delivers financial solutions, including wealth planning, asset management, and other special services for families or corporate with big amount of money. The aim of wealth management is to ensure that individuals, organizations or companies achieve their financial goals and objectives regarding money, and also offer advice and possible solutions amidst challenges that arise in the management of financial resources. Contemplated wealth managers provide a wide range of services in relation to their clients’ individual needs, financial status and experiences, investment targets, and recuperative ability towards risks. Some are investment management, retirement planning services, wealth planning, tax advisory, estate planning, and risk management solutions.

Wealth Management Market Size Was Valued at USD 1,257.19 Billion in 2023, and is Projected to Reach USD 2,940.22 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.