Global Urban Air Mobility Market Overview

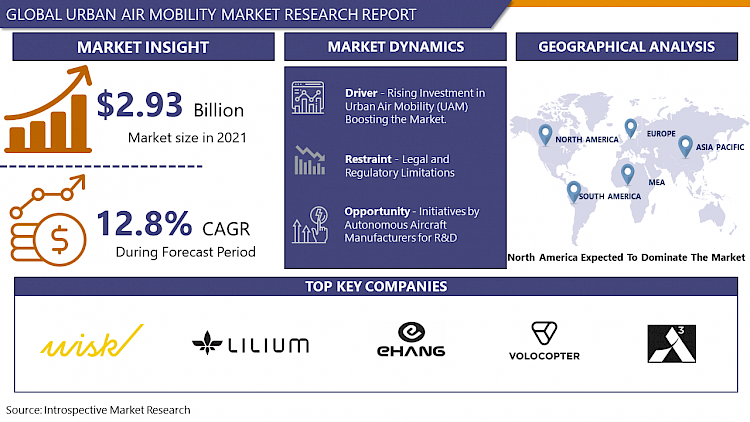

The Global Urban Air Mobility Market size is expected to grow from USD 3.32 billion in 2022 to USD 8.94 billion by 2030, at a CAGR of 13.2% during the forecast period (2023-2030).

The market for on-demand and automated passenger or cargo-carrying air transportation services around cities and metropolitan regions is known as the urban air mobility (UAM) market. Globally, rising traffic congestion difficulties, particularly in bigger cities, are driving the need for speedier intracity transit choices. The notion of urban air mobility is gaining traction in this area. The urban air mobility business is seeing a lot of R&D investment, with several start-ups and aerospace companies considering it as a high-growth market. As a result, such factors are projected to fuel the market's expansion throughout the forecast period.

There may be considerable time savings because the UAM is a safe and efficient air transportation system where passenger-carrying air taxis operate over populous regions. Furthermore, the UAM's air taxis are largely electric or fuel-cell powered. As a result, they contribute to the reduction of pollutants in the atmosphere. Many businesses are making major investments in this area, which is projected to accelerate technical improvements in the market in the long term, once UAM systems are put into commercial use, the market is expected to grow exponentially.

Market Dynamics and Factors For Urban Air Mobility:

Drivers

Rising investment in Urban Air Mobility (UAM) boosting the market.

Ground transportation networks are being pushed to their limits by rising urbanization and traffic congestion. Adding a third dimension to urban air mobility has the potential to create a transportation system that is quicker, cleaner, safer, and more connected. Autonomous aerial vehicles and flying automobiles are no longer science fiction, with research and experiments being carried out all over the world. With over USD 1 billion invested in the first few months of 2020, the UAM industry, which is still in its early stages, has seen substantial development. Toyota's USD 590.0 million investment in Joby Aviation and Guangzhou EHang Intelligent Technology Co. Ltd's USD 650.0 million IPO valuation is the two most prominent investments. The Federal Aviation Administration (FAA) also collaborates with over 15 eVTOL aircraft manufacturers. Uber Air, Guangzhou EHang Intelligent Technology Co. Ltd, Volocopter GmbH, Joby Aviation, and Lilium GmbH all expect to start commercial passenger operations within the next three to five years. The use of autonomous drones in urban air mobility is expected to deliver benefits such as less pollution, faster travel times, and less strain on existing transportation infrastructure. Increased traffic congestion in densely populated areas is one of the key factors driving this market's rise. Increased road traffic in metropolitan areas causes long traffic jams, resulting in wasted travel time.

Restraints

For increased reach and flexibility, all nations adopting urban air transportation must overcome political, economic, social, technological, and legal constraints. The market operation should be economically scaled to fit activities with strong demand and minimal fixed costs. Governments, research institutes, industries, and universities must all make major contributions. In recent years, several companies have created and tested enabling elements of the UAM concept, such as vertical take-off landing capability vehicle prototypes, operational ideas, and potential business models. While the convergence of several factors may make UAM possible, legal and regulatory limitations may limit its adoption.

Opportunities

The primary goal of urban air mobility is to make intracity transit more convenient while also alleviating the load on current urban mobility alternatives. The majority of autonomous aircraft manufacturers are currently in the research and development phase, leaving only a few players to deploy their autonomous aircraft for intracity transportation due to the limited availability of high-powered, lightweight lithium-ion batteries and the infrastructure required to set up charging points for these batteries. The Lilium Jet is an electric vertical take-off and landing jet with a cruising speed of 300 km/h and a range of 300 km designed by Lilium (Germany). The corporation intends to use this plane for intracity travel at first, and then for interstate travel shortly. Pipistrel, Bell, Hyundai Motors, Volocopter, and EHang are among the companies planning to build autonomous aircraft for intracity transportation. After gaining societal approval, passenger drones are expected to be deployed for intercity air transportation by 2030.

Challenges

Several firms have created and tested enabling parts of the UAM idea in recent years, including prototypes of vertical take-off landing capability vehicles, operating concepts, and prospective business models. While the convergence of multiple elements may enable UAM, legal and regulatory constraints may prevent it from becoming popular. Technology advances at a breakneck speed, outpacing regulation. Urban air mobility, like previous disruptive technologies, has yet to reach a stage where innovation is not hindered and the public is sufficiently safeguarded by federal, state, and municipal governments. In terms of safety and privacy, as well as certain legal impediments, urban air mobility operations offer fresh and real issues that may deter the usage of such technology. These legal impediments, however, are followed by collaborative initiatives like the UAS Integration Pilot Program, FAA Rulemaking Committees, the UAM Grand Challenge, and others that enable the alignment of technology and policy, allowing for more complicated operations.

Market Segmentation

By Type, the Piloted segment is dominating the Air Mobility (UAM) Market. The piloted segment of this market is having the largest urban air mobility market share in the global market. This growth is attributed to the increasing deployment of advanced eVTOL systems for commercial and military aircraft in the market currently. The demand for personalized chartered plane service in urban cities has grown in the past five years. Cities like New York, London, Hong Kong are the major financial cities in the world. A top key executive from companies prefers to roam in the city with urban mobility vehicles Therefore, demand for private pilot personnel is high which reflects on the growth of the segment in the Urban Air Mobility (UAM) Market.

By Application, Transport is expected to be dominating the Urban Air Mobility (UAM) Market. Because Air Taxis may fly in numerous pre-defined layers of air, one above the other, and so minimize traffic congestion in one specific way, the technology employed in Urban Air Mobility (UAM) is highly promising in decreasing traffic. Another benefit of UAM is that it requires less infrastructure. Unlike vehicles and trains, the Air Taxi does not require any road or railroad infrastructure to function. Therefore, an affordable UAM is expected to be a revolutionary shift towards urban commutation. The most basic need is landing and take-off stations, for which a rooftop of a building would be a perfect location. Currently, many corporate headquarters are being constructed with their helipad which is convenient for a company to fly off-key executives to save time. Therefore, Urban transportation usage is likely to grow during the forecasted period.

Players Covered in Urban Air Mobility market are :

- Wisk (US)

- Lilium (Germany)

- Ehang (China.)

- Volocopter (Germany)

- Airbus A Cubed (US) and other major players.

Regional Analysis of Urban Air Mobility (UAM) Market

North America is dominating the Urban Air Mobility (UAM) Market. The Boeing Company's presence has also aided in creating a good climate for the sector, as the business is heavily investing in producing prototypes for evaluation. The U.S. is leading the way in North America in terms of adopting this modern mode of transportation. Many American start-ups are collaborating to develop and apply these technologies on a local level. A roadmap for getting the UAM into commercial use will be laid out over the next 5-6 years. The rising air traffic among residents of major North American cities fuels the adoption of air taxis and airport shuttle services. Furthermore, last-mile and freight services are likely to be widely provided with eVTOL aircraft in the U.S., positively impacting the market growth in North America.

Europe is going to witness the fastest growth during the forecast period. Though there have been developments worldwide, most of these innovations have been concentrated in Europe. The U.K., Germany, and France are investing heavily in urban air mobility technology. The presence of Airbus S.A.S has also aided in creating a favorable atmosphere for this sector, as these businesses are investing heavily in producing prototypes for evaluation. For example, Airbus has been researching ways to use the most recent technology breakthroughs in electric propulsion systems for powering UAMs since 2014. As a result, the Airbus Urban Mobility business was established in 2018 to speed the integration of such breakthrough technology into the UAM solutions that the company aspires to provide. Airbus began researching new capabilities as part of the Vertex project in April 2021, intending to achieve completely autonomous flight in its Flightlab demonstrator by 2023.

Key Developments of Urban Air Mobility (UAM) Market

- May 2021, NASA's advanced air mobility project, the Aeronautics Research Mission Directorate National Campaign 2 for Advanced Air Mobility (AAM) for Community Planning and Integration, was awarded to ANRA Technologies. The firm would provide UAM services to build passenger drones and other advanced air transportation technologies as part of this initiative.

- March 2021, Eve Urban Air Mobility Solutions, Inc. (Eve) has announced a collaboration with EmbraerX's Beacon maintenance coordination technology, which will be part of Eve's service and support capabilities. Eve will rely on Beacon's multi-sided platform, which connects and synchronizes industry resources, the aftermarket supply chain, and aviation professionals to maintain planes flying more agile and efficient.

Covid19 Impact on Urban Air Mobility (UAM) Market

The COVID-19 pandemic has had devastating effects on several industry verticals globally. To constrain the number of cases and slow the coronavirus spread, various public health guidelines were implemented in different countries across the globe. COVID-19 protocols range from declaring national emergency states, enforcing stay-at-home orders, closing nonessential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders. The ability of Robo advisers to minimize irrational behavior and bad & impulsive decision-making during a pandemic contributes significantly to the worldwide market's growth. With the growing vaccination rate, governments are uplifting the protocols to give a boost to the stagnant economy. The pandemic has had a significant impact on the aviation industry, and because most of the key participants in the Urban Air Mobility (UAM) sector are either directly or indirectly connected to the aviation sector, the epidemic has had a rippling effect on the UAM sector. Like other industries, Urban Air Mobility Market has experienced a slowdown the growth, however, the market is expected to bounce back as restrictions are being lifted by governments across the globe.

|

Global Urban Air Mobility Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.2 % |

Market Size in 2030: |

USD 8.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Urban Air Mobility Market by Type

5.1 Urban Air Mobility Market Overview Snapshot and Growth Engine

5.2 Urban Air Mobility Market Overview

5.3 Autonomous

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Autonomous: Grographic Segmentation

5.4 Piloted

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Piloted: Grographic Segmentation

Chapter 6: Urban Air Mobility Market by Application

6.1 Urban Air Mobility Market Overview Snapshot and Growth Engine

6.2 Urban Air Mobility Market Overview

6.3 Passenger

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Passenger: Grographic Segmentation

6.4 Transport

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Transport: Grographic Segmentation

6.5 Freight

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Freight: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Urban Air Mobility Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Urban Air Mobility Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Urban Air Mobility Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 WISK

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 LILIUM

7.4 EHANG

7.5 VOLOCOPTER

7.6 AIRBUS A CUBED

7.7 OTHER MAJOR PLAYERS

Chapter 8: Global Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Autonomous

8.2.2 Piloted

8.3 Historic and Forecasted Market Size By Application

8.3.1 Passenger

8.3.2 Transport

8.3.3 Freight

Chapter 9: North America Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Autonomous

9.4.2 Piloted

9.5 Historic and Forecasted Market Size By Application

9.5.1 Passenger

9.5.2 Transport

9.5.3 Freight

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Autonomous

10.4.2 Piloted

10.5 Historic and Forecasted Market Size By Application

10.5.1 Passenger

10.5.2 Transport

10.5.3 Freight

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Autonomous

11.4.2 Piloted

11.5 Historic and Forecasted Market Size By Application

11.5.1 Passenger

11.5.2 Transport

11.5.3 Freight

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Autonomous

12.4.2 Piloted

12.5 Historic and Forecasted Market Size By Application

12.5.1 Passenger

12.5.2 Transport

12.5.3 Freight

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Urban Air Mobility Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Autonomous

13.4.2 Piloted

13.5 Historic and Forecasted Market Size By Application

13.5.1 Passenger

13.5.2 Transport

13.5.3 Freight

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Urban Air Mobility Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.2 % |

Market Size in 2030: |

USD 8.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. URBAN AIR MOBILITY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. URBAN AIR MOBILITY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. URBAN AIR MOBILITY MARKET COMPETITIVE RIVALRY

TABLE 005. URBAN AIR MOBILITY MARKET THREAT OF NEW ENTRANTS

TABLE 006. URBAN AIR MOBILITY MARKET THREAT OF SUBSTITUTES

TABLE 007. URBAN AIR MOBILITY MARKET BY TYPE

TABLE 008. AUTONOMOUS MARKET OVERVIEW (2016-2028)

TABLE 009. PILOTED MARKET OVERVIEW (2016-2028)

TABLE 010. URBAN AIR MOBILITY MARKET BY APPLICATION

TABLE 011. PASSENGER MARKET OVERVIEW (2016-2028)

TABLE 012. TRANSPORT MARKET OVERVIEW (2016-2028)

TABLE 013. FREIGHT MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA URBAN AIR MOBILITY MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA URBAN AIR MOBILITY MARKET, BY APPLICATION (2016-2028)

TABLE 016. N URBAN AIR MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE URBAN AIR MOBILITY MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE URBAN AIR MOBILITY MARKET, BY APPLICATION (2016-2028)

TABLE 019. URBAN AIR MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC URBAN AIR MOBILITY MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC URBAN AIR MOBILITY MARKET, BY APPLICATION (2016-2028)

TABLE 022. URBAN AIR MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA URBAN AIR MOBILITY MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA URBAN AIR MOBILITY MARKET, BY APPLICATION (2016-2028)

TABLE 025. URBAN AIR MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA URBAN AIR MOBILITY MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA URBAN AIR MOBILITY MARKET, BY APPLICATION (2016-2028)

TABLE 028. URBAN AIR MOBILITY MARKET, BY COUNTRY (2016-2028)

TABLE 029. WISK: SNAPSHOT

TABLE 030. WISK: BUSINESS PERFORMANCE

TABLE 031. WISK: PRODUCT PORTFOLIO

TABLE 032. WISK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. LILIUM: SNAPSHOT

TABLE 033. LILIUM: BUSINESS PERFORMANCE

TABLE 034. LILIUM: PRODUCT PORTFOLIO

TABLE 035. LILIUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. EHANG: SNAPSHOT

TABLE 036. EHANG: BUSINESS PERFORMANCE

TABLE 037. EHANG: PRODUCT PORTFOLIO

TABLE 038. EHANG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. VOLOCOPTER: SNAPSHOT

TABLE 039. VOLOCOPTER: BUSINESS PERFORMANCE

TABLE 040. VOLOCOPTER: PRODUCT PORTFOLIO

TABLE 041. VOLOCOPTER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. AIRBUS A CUBED: SNAPSHOT

TABLE 042. AIRBUS A CUBED: BUSINESS PERFORMANCE

TABLE 043. AIRBUS A CUBED: PRODUCT PORTFOLIO

TABLE 044. AIRBUS A CUBED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 045. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 046. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 047. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. URBAN AIR MOBILITY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. URBAN AIR MOBILITY MARKET OVERVIEW BY TYPE

FIGURE 012. AUTONOMOUS MARKET OVERVIEW (2016-2028)

FIGURE 013. PILOTED MARKET OVERVIEW (2016-2028)

FIGURE 014. URBAN AIR MOBILITY MARKET OVERVIEW BY APPLICATION

FIGURE 015. PASSENGER MARKET OVERVIEW (2016-2028)

FIGURE 016. TRANSPORT MARKET OVERVIEW (2016-2028)

FIGURE 017. FREIGHT MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA URBAN AIR MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE URBAN AIR MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC URBAN AIR MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA URBAN AIR MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA URBAN AIR MOBILITY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Urban Air Mobility Market research report is 2023-2030.

Wisk (US), Lilium (Germany), Ehang (China.), Volocopter (Germany), Airbus A Cubed (US), and other major players.

The Urban Air Mobility Market is segmented into Type, Application, and region. By Type, the market is categorized into Autonomous, Piloted. By Application, the market is categorized into Passenger, Transport, Freight. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The market for on-demand and automated passenger or cargo-carrying air transportation services around cities and metropolitan regions is known as the urban air mobility (UAM) market.

The Global Urban Air Mobility Market size is expected to grow from USD 3.32 billion in 2022 to USD 8.94 billion by 2030, at a CAGR of 13.2% during the forecast period (2023-2030).