Tonic Water Market Synopsis

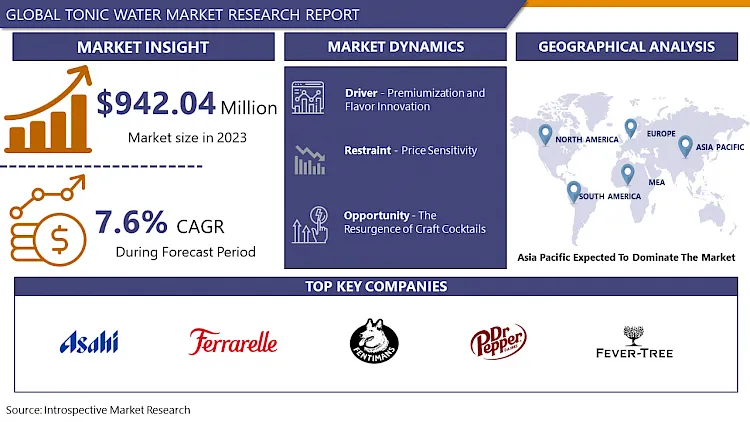

Tonic Water Market Size Was Valued at USD 942.04 million in 2023 and is Projected to Reach USD 1821.29 million by 2032, Growing at a CAGR of 7.60% From 2024-2032.

Tonic water is a carbonated soft drink that contains quinine. Tonic water, which was once used as a malaria preventative, now has a much-reduced quinine level and is eaten for its unique bitter flavor, though it is commonly sweetened nowadays. It's popular in mixed cocktails, especially gin and tonics.

Medicinal quinine was suggested to British officials and troops in early nineteenth-century India and other tropical areas of the British Empire, where it was blended with soda and sugar to conceal its bitter taste, creating tonic water. In 1858, the first commercial tonic water was created. The British blended their medical quinine tonic with gin and other ingredients to make the bitter medication more palatable in British colonial India, and the mixed drink gin and tonic was born. The sweet combination made sense because soldiers in India were already given a gin ration.

Tonic water is available as a plain as well as a flavored drink. Tonic water today has a significantly reduced quinine level and is used for its characteristic bitter flavor. It's popular in mixed cocktails, especially tonic and gin. Side effects of tonic water use include diarrhoea, vomiting, nausea, stomach pains, and anxiety. Tonic water, which contains mostly quinine, is a popular carbonated beverage. Tonic water is made up of a variety of substances, including herbs, sugars, and spices, with quinine being the most important of them all. Quinine provides several health advantages and is used to treat several serious illnesses, including babesiosis and malaria. Growing disposable income and a better level of life are two important factors propelling the tonic water market forward. Continuous product innovation is also a big element propelling the Tonic water market forward.

Tonic Water Market Trend Analysis

Premiumization and Flavor Innovation

- In recent years, the tonic water market has seen a significant transformation, largely driven by premiumization and flavor innovation. This evolution stems from shifting consumer preferences, with a heightened demand for sophisticated and unique drinking experiences.

- Premiumization within the tonic water segment involves a focus on high-quality ingredients, artisanal craftsmanship, and elevated taste profiles. Brands are leveraging this trend by incorporating premium botanicals, natural sweeteners, and even exotic elements sourced from diverse regions worldwide. These elements aim to offer consumers a refined and luxurious tonic water experience, elevating the traditional mixer into a standalone beverage of choice.

- Simultaneously, flavor innovation plays a pivotal role in captivating consumers' attention and diversifying product offerings. Tonic water manufacturers are constantly experimenting with innovative flavor combinations, straying from the conventional quinine taste to introduce fruity, herbal, spicy, or floral notes. This infusion of diverse flavors not only caters to evolving consumer palates but also enhances versatility, making tonic water a versatile companion for various spirits and cocktails.

- The convergence of premiumization and flavor innovation has revitalized the tonic water market, appealing to a broad spectrum of consumers seeking sophistication, uniqueness, and a memorable drinking experience. As this trend continues to flourish, it reshapes the perception of tonic water from a mere mixer to a premium and indulgent beverage in its own right.

The Resurgence of Craft Cocktails

- The resurgence of craft cocktails has redefined the appreciation for nuanced flavors, sparking a renewed interest in tonic water. Once a mere mixer, tonic water has evolved from its humble origins into a pivotal component of craft cocktails, contributing depth and complexity.

- Craft cocktails emphasize quality ingredients and inventive combinations, making tonic water an essential player due to its ability to complement and elevate spirits. The revival of classic cocktails like the gin and tonic has propelled the demand for high-quality tonics, prompting artisanal producers to craft variations using natural ingredients and unique flavor profiles.

- Beyond its traditional role as a carbonated mixer, tonic water now embodies creativity, offering diverse options such as flavored tonics infused with botanicals, spices, or citrus elements. Its versatility allows mixologists to experiment, creating bespoke cocktails that cater to individual tastes.

- Additionally, the growing interest in healthier alternatives has led to the production of low-sugar or organic tonic waters, meeting the demands of health-conscious consumers without compromising on taste.

- The resurgence of craft cocktails has elevated tonic water from a supporting role to a star ingredient, showcasing its adaptability, diverse flavors, and ability to transform a drink into a multisensory experience, marking its renaissance in the world of mixology.

Tonic Water Market Segment Analysis:

Tonic Water Market Segmented on the basis of product type, packaging type, application, and distribution channel.

By Type, Flavored segment is expected to dominate the market during the forecast period

- Based on the product type, the flavored type segment is expected to register the highest tonic water market revenue over the estimated period. Premium spirits have established a solid following among consumers, who are ready to pay more for unique, inventive goods. In this product area, companies are also introducing innovative naturally flavored water to meet the demands of customers who are concerned about their diets and taste preferences.

- SodaStream, for example, sells naturally flavored diet tonics with no calories. Skilled bartenders may also use flavored tonics to mix a specific spirit with a tonic that complements its flavor character. Spirit-tonic combos like this are a whole part of the menu at certain bars: Gin-and-tonic menus at Whitechapel, Sable in Chicago, and Cooks & Soldiers in Atlanta all explore the format through inventive taste profiles and regional interpretations.

By Packaging Type, Bottles segment held the largest market share of 71% in 2022

- Based on the packaging type, the bottles segment is anticipated to register the largest tonic water market revenue during the forecast period. When it comes to food and beverage packaging, there's no need to be concerned about flavors fading in a bottle. It is the most common and conventional method. Bottles come in a variety of sizes and materials. Glass bottles are becoming increasingly popular. Because glass is an impermeable material that keeps air and other liquids out, glass bottles do not affect the flavor or freshness of the product. T

- he packaging of tonic water is a critical step in the manufacture and distribution of this beverage. External circumstances, such as heat, do not influence the substance or shape of the glass, unlike plastics, which can melt and degrade product quality. As a consequence, food and beverage products packaged in glass keep their freshness for a long time. Glass bottles also maintain the package's inner temperature, preventing spoiling. These reasons are propelling the segment's market growth.

Tonic Water Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region is expected to register significant market growth throughout the forecast period. In nations like India, China, and Indonesia, the consumption of various types of spirits such as gin, whiskey, vodka, and rum has been steadily expanding. The region's demand for tonic water is being fueled by an increase in the use of various forms of alcohol. In comparison to North America and Europe,

- Asian countries with strong gin consumption, such as the Philippines, do not typically utilize alcoholic mixers. Furthermore, due to fast urbanization and rising disposable incomes, the area is a developing market with significant potential during the projected period, which is likely to stimulate leisure spending in bars and other similar establishments. The expanding economic position of the region, as well as the increasing availability of tonic water in regional supermarkets, indicate a strong demand for tonic water.

Tonic Water Market Top Key Players:

- Asahi Group Holdings, Ltd. (Japan)

- Cg Roxane Llc (U.S.)

- Dr Pepper/Seven Up Inc (U.S.)

- Fentimans(U.K.)

- Ferrarelle (Italy)

- Fever-Tree (U.K.)

- Gerolsteiner Brunnen Gmbh & Co. Kg (Germany)

- Hansen Beverage (U.S.)

- Keurig Dr Pepper Inc. (U.S.)

- Lacroix Beverages Inc. (U.S.)

- Mountain Valley Spring Water (U.S.)

- Nestlé A.G. (Switzerland)

- Pepsico (U.S.)

- Q Mixers (U.S.)

- Reignwood Investments Uk Ltd (U.K.)

- Sanpellegrino (Italy)

- Tempo Beverage Ltd (Israel)

- The Coca-Cola Company (U.S.)

- White Rock Products Corporation (U.S.)

- Zevia (U.S.) and Other Major Players

Key Industry Developments in the Tonic Water Market:

- In October 2023, Global Brands, a leading independent drinks company and beverage distributor in the United Kingdom, was pleased to announce that its pioneering tonic water and mixer brand, Franklin & Sons, had secured a variety of placements in key retail locations across the United States.

- In May 2023, SAVVY is collaborating with Japanese beauty honey brand HACCI in May and June to present two innovative honey beverages. Handcrafted by SAVVY’s Head Mixologist, Ms Pauline Rose Torres Escolano, the BEE-MINE and HONEYLICIOUS offer guests a refined experience with its tantalising aromas and refreshing sweetness.

|

Global Tonic Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 942.04 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.60% |

Market Size in 2032: |

USD 1821.29 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tonic Water Market by Product Type (2018-2032)

4.1 Tonic Water Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Flavored

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Flavored Drinks

Chapter 5: Tonic Water Market by Packaging Type (2018-2032)

5.1 Tonic Water Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bottles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cans

Chapter 6: Tonic Water Market by Application (2018-2032)

6.1 Tonic Water Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Consumption

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Alcoholic Drinks

Chapter 7: Tonic Water Market by Distribution Channel (2018-2032)

7.1 Tonic Water Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hypermarket/Supermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Stores

7.5 Retail Stores

7.6 Online Sales

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Tonic Water Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BROADCOM(AVAGO)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MEDIATEK(RALINK)

8.4 INTEL(LANTIQ)

8.5 QUALCOMM(IKANOS)

8.6 NXP(FREESCALE)

8.7 CAVIUM

8.8 SCKIPIO

8.9 TEXAS INSTRUMENTS AND OTHER MAJOR PLAYERS.

8.10 REALTEK

8.11 MARVELL TECHNOLOGY GROUP LTD

8.12 INFINEON TECHNOLOGIES AG

8.13 SIGMA DESIGNS INC

8.14 ZYXEL COMMUNICATIONS CORP

Chapter 9: Global Tonic Water Market By Region

9.1 Overview

9.2. North America Tonic Water Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Flavored

9.2.4.2 Non-Flavored Drinks

9.2.5 Historic and Forecasted Market Size by Packaging Type

9.2.5.1 Bottles

9.2.5.2 Cans

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Direct Consumption

9.2.6.2 Alcoholic Drinks

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Hypermarket/Supermarket

9.2.7.2 Specialty Stores

9.2.7.3 Retail Stores

9.2.7.4 Online Sales

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Tonic Water Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Flavored

9.3.4.2 Non-Flavored Drinks

9.3.5 Historic and Forecasted Market Size by Packaging Type

9.3.5.1 Bottles

9.3.5.2 Cans

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Direct Consumption

9.3.6.2 Alcoholic Drinks

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Hypermarket/Supermarket

9.3.7.2 Specialty Stores

9.3.7.3 Retail Stores

9.3.7.4 Online Sales

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Tonic Water Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Flavored

9.4.4.2 Non-Flavored Drinks

9.4.5 Historic and Forecasted Market Size by Packaging Type

9.4.5.1 Bottles

9.4.5.2 Cans

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Direct Consumption

9.4.6.2 Alcoholic Drinks

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Hypermarket/Supermarket

9.4.7.2 Specialty Stores

9.4.7.3 Retail Stores

9.4.7.4 Online Sales

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Tonic Water Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Flavored

9.5.4.2 Non-Flavored Drinks

9.5.5 Historic and Forecasted Market Size by Packaging Type

9.5.5.1 Bottles

9.5.5.2 Cans

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Direct Consumption

9.5.6.2 Alcoholic Drinks

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Hypermarket/Supermarket

9.5.7.2 Specialty Stores

9.5.7.3 Retail Stores

9.5.7.4 Online Sales

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Tonic Water Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Flavored

9.6.4.2 Non-Flavored Drinks

9.6.5 Historic and Forecasted Market Size by Packaging Type

9.6.5.1 Bottles

9.6.5.2 Cans

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Direct Consumption

9.6.6.2 Alcoholic Drinks

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Hypermarket/Supermarket

9.6.7.2 Specialty Stores

9.6.7.3 Retail Stores

9.6.7.4 Online Sales

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Tonic Water Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Flavored

9.7.4.2 Non-Flavored Drinks

9.7.5 Historic and Forecasted Market Size by Packaging Type

9.7.5.1 Bottles

9.7.5.2 Cans

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Direct Consumption

9.7.6.2 Alcoholic Drinks

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Hypermarket/Supermarket

9.7.7.2 Specialty Stores

9.7.7.3 Retail Stores

9.7.7.4 Online Sales

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Tonic Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 942.04 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.60% |

Market Size in 2032: |

USD 1821.29 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||