Ticagrelor Market Synopsis:

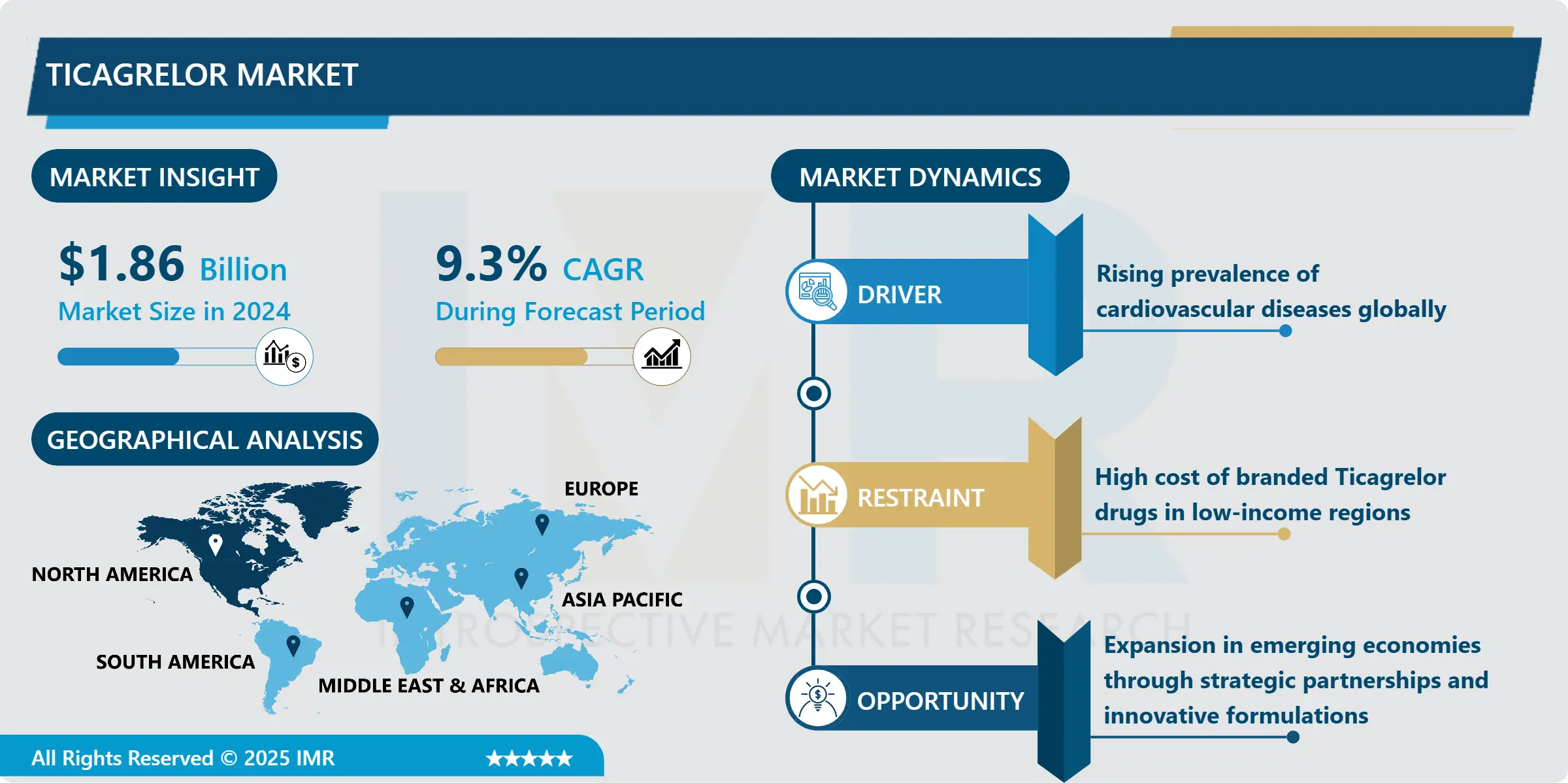

Ticagrelor Market Size Was Valued at USD 1.86 Billion in 2024, and is Projected to Reach USD 4.95 Billion by 2035, Growing at a CAGR of 9.3% From 2025-2035.

Ticagrelor is an antiplatelet agent in the P2Y12 receptor antagonist class approved for use in patients with ACS, MI, or those to undergo PCI. The drug functions by reducing platelet aggregation, which will decrease the rate of thrombotic cardiovascular related incidences. Market demand for Ticagrelor has grown due to evidenced effectiveness and increasing incidences of cardiovascular illnesses worldwide and increased product adoption in new economies. With healthcare systems turning towards prevention, the Ticagrelor market will remain steady in its growth, due to technological adaptations in pharmaceutical chemical structures, as well as the expansion of access into the developing world.

Ticagrelor Market has gained a vast scale over the last decade as a result of the growing prevalence of cardiovascular diseases which are known to be the leading causes of death in the world. Comparing to other diseases, Ischemic heart disease is one of the major reasons for death in the worldwide according to WHO and that is why there is a need to have an efficient antiplatelet therapy in the healthcare industry such as Ticagrelor. The drug has been developed to meet these needs due to identification by the pharmaceutical firms and healthcare facilities hence high rate of adoption of the drug in the hospitals and clinics. Moreover, constant clinical trials and availability of the generic product has also lead to enhanced market growth due to increased affordability.

Second of all, the market driven by factors such as government support and increasing geriatric population have vulnerabilities to cardiovascular diseases. High income markets such as North America and Europe are already developed markets for Ticagrelor owing to having high healthcare spend, followed by Asia Pacific due to growing health consciousness, population growth, shifting from rural to urban areas and improvements in healthcare facilities. It is characterized by innovation, increased strategic partnerships and heavy marketing to clinch a share in the market.

Ticagrelor Market Trend Analysis:

Growing Demand for Low-Dose Options

- The tendency towards low-dose antiplatelet regimes is now striking the Ticagrelor market as its key trend. Doctors are now prescribing 60 mg Ticagrelor to patients who may not be at a high risk of cardiovascular events thus emphasizing on long term compliance with no many side effects. This dosage segment, especially has risen within the area of secondary prevention of atherothrombotic events in stable coronary artery disease patients. Patient compliance is boosted with the increased use of 60 mg formulations while the practice is another indicator that the healthcare industry is moving towards the use of individualized dosing regimens. Since the pharma major players are focusing heavily on this segment, the 60 mg market segment will continue to dominate throughout the forecast period.

Advancing Cardiovascular Therapeutics

- The Ticagrelor market has much potential as has been highlighted as cardiovascular therapeutics remain to develop over time. This leads to the increase in prevalence rate for cardiovascular diseases associated to lifestyle such as obesity, hypertension and diabetes among others and consequently increase demand of efficient antiplatelet drugs. Also, the governments and the healthcare providers of the emerging economices offer great market opportunity to the key players, as the healthcare sector pays attention to the improvement of the cardiac care infrastructure. Another factor of entry mode is that large associations of pharmaceuticals can opt for regional distributors to enter markets that are not so demanding. Further, advances in the formulation and delivery of a product can provide a significant boost to the growth of the market by fulfilling unmet requirements which include extended release formulations.

Ticagrelor Market Segment Analysis:

Ticagrelor Market is Segmented on the basis of Dosage, Application, End-User, and Region

By Dosage, 60 mg segment is expected to dominate the market during the forecast period

- Among the two dosage formats of Ticagrelor, it is the 60 mg intake that has established the market leadership due to the effectiveness of the substance in decreasing the threat of major cardiovascular incidents in people with diagnosed coronary artery illness. It is most popular for the continuation phase of maintenance therapy just because it is paedagagically well-tolerated and you know convenient. Practitioners globally embrace this dosing pattern based on guidelines that support the use of this product in secondary prevention for stable patients.

- One of the ingredients that have helped the 60 mg segment to grow so fast is the aspect of safety concerning the efficiency of the dossier. The proposed dosing offers fewer bleeding complications if compared to other doses, and therefore is suitable for more extensive population. The launch more effective formulations and active clinical research in the market is likely to continue to help maintain the 60 mg segment as market leader in the coming year.

By Application, Acute Coronary Syndromes segment expected to held the largest share

- Of the featured sub-segments, the Acute Coronary Syndromes (ACS) segment should cannabalise the largest share in the Ticagrelor market since this is a dangerous condition that is set to increase in occurrence across the globe. Ticagrelor’s place in the prevention of recurrent cardiovascular events has quite firmly established ticagrelor as one of the key components of the targeted treatment of ACS. The segment is backed by good clinical evidence especially in applying Ticagrelor in dual antiplatelet therapy be it with aspirin.

- The high market share of the ACS segment is further enhanced by growing knowledge and understanding about the advantages of the drugs by the health care practitioners especially in terms of the speed of onset and efficacy compared to conventional antiplatelet agents. Since these risk factors remain prevalent within the global population into the future, the overall need for Ticagrelor in the management of ACS is predicted to increase, which will further consolidate this segment’s position in the global market.

Ticagrelor Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America had the maximum proportion in the Ticagrelor market share in 2023 as it is the region having advanced healthcare infrastructure, high cardiovascular diseases incidence rate, and improved adoption of novel pharmaceuticals. The regional market is headed by the United States of America due to awareness spread campaigns, early diagnose rate, and reimbursements for antiplatelet drugs. Also, efforts made in regard to research and development by leading pharmaceutical companies coupled with early release of new formulations have continued to improve the sales position of the region. Europe closely follows, however, the Asia-Pacific to demonstrate a significantly promise outlook for development based on the growth of healthcare expenditure and increasing availability of access to cardiovascular healthcare.

Active Key Players in the Ticagrelor Market

- AstraZeneca (UK)

- Bayer AG (Germany)

- Boehringer Ingelheim (Germany)

- Bristol-Myers Squibb (USA)

- Cadila Pharmaceuticals (India)

- Cipla Ltd. (India)

- Dr. Reddy's Laboratories (India)

- GlaxoSmithKline (UK)

- Johnson & Johnson (USA)

- Lupin Ltd. (India)

- Merck & Co. (USA)

- Mylan N.V. (USA)

- Novartis AG (Switzerland)

- Sanofi (France)

- Teva Pharmaceuticals (Israel)

- Other Active Players

|

Ticagrelor Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.86 Billion |

|

Forecast Period 2025-35 CAGR: |

9.3% |

Market Size in 2035: |

USD 4.95 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ticagrelor Market by Dosage (2018-2035)

4.1 Ticagrelor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 60 mg

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 90 mg

Chapter 5: Ticagrelor Market by Application (2018-2035)

5.1 Ticagrelor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Acute Coronary Syndromes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heart Surgeries

Chapter 6: Ticagrelor Market by End User (2018-2035)

6.1 Ticagrelor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Centers

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ticagrelor Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASTRAZENECA (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAYER AG (GERMANY)

7.4 BOEHRINGER INGELHEIM (GERMANY)

7.5 BRISTOL-MYERS SQUIBB (USA)

7.6 CADILA PHARMACEUTICALS (INDIA)

7.7 CIPLA LTD. (INDIA)

7.8 DR. REDDY'S LABORATORIES (INDIA)

7.9 GLAXOSMITHKLINE (UK)

7.10 JOHNSON & JOHNSON (USA)

7.11 LUPIN LTD. (INDIA)

7.12 MERCK & CO. (USA)

7.13 MYLAN N.V. (USA)

7.14 NOVARTIS AG (SWITZERLAND)

7.15 SANOFI (FRANCE)

7.16 TEVA PHARMACEUTICALS (ISRAEL)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Ticagrelor Market By Region

8.1 Overview

8.2. North America Ticagrelor Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Dosage

8.2.4.1 60 mg

8.2.4.2 90 mg

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Acute Coronary Syndromes

8.2.5.2 Heart Surgeries

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals and Clinics

8.2.6.2 Ambulatory Centers

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ticagrelor Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Dosage

8.3.4.1 60 mg

8.3.4.2 90 mg

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Acute Coronary Syndromes

8.3.5.2 Heart Surgeries

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals and Clinics

8.3.6.2 Ambulatory Centers

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ticagrelor Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Dosage

8.4.4.1 60 mg

8.4.4.2 90 mg

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Acute Coronary Syndromes

8.4.5.2 Heart Surgeries

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals and Clinics

8.4.6.2 Ambulatory Centers

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ticagrelor Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Dosage

8.5.4.1 60 mg

8.5.4.2 90 mg

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Acute Coronary Syndromes

8.5.5.2 Heart Surgeries

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals and Clinics

8.5.6.2 Ambulatory Centers

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ticagrelor Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Dosage

8.6.4.1 60 mg

8.6.4.2 90 mg

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Acute Coronary Syndromes

8.6.5.2 Heart Surgeries

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals and Clinics

8.6.6.2 Ambulatory Centers

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ticagrelor Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Dosage

8.7.4.1 60 mg

8.7.4.2 90 mg

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Acute Coronary Syndromes

8.7.5.2 Heart Surgeries

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals and Clinics

8.7.6.2 Ambulatory Centers

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Ticagrelor Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.86 Billion |

|

Forecast Period 2025-35 CAGR: |

9.3% |

Market Size in 2035: |

USD 4.95 Billion |

|

Segments Covered: |

By Dosage |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||