Thermal Scanners Market Synopsis

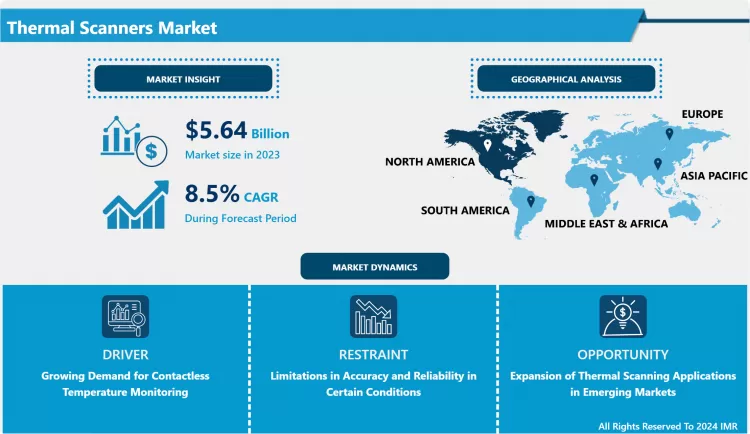

Thermal Scanners Market Size is Valued at USD 5.64 Billion in 2023, and is Projected to Reach USD 10.83 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

The thermal scanners industry describes the business of designing, producing, and distributing equipment used to create visual images that represent temperature using emitted infrared radiation. Fever detecting devices are common in the healthcare industry, surveillance devices in the security industry and temperature monitoring devices in industries. Fixed thermal scanners can also be used in mounted and portable forms, depending with the situation where it is needed.

- A key reason that continues to fuel the global demand for thermal scanners is the need for contactless temperature checking triggered more by the pandemic. In different sectors including airport, hospital and retail outlets thermal scanners are being used to determine people who may be experiencing high body temperatures thus reducing the spread of the virus. Increased emphasis on health screening systems serves as a major drive for investments in thermal scanning products and services to drive market growth.

- Also, the increasing use of industrial automation in manufacturing industries augmented by the need for thermal scanners to undertake predictive maintenance has also boosted the market’s growth. Logistics organisations are now applying thermal imaging as one of the ways of keeping check on the temperatures of equipment with a view of nipping any likely failure from growing into a major problem that could lead to more instance of equipment down time. This approach to maintenance provides the best return By making operations more efficient and safer, thermal scanning technology used in industries is highly encouraged.

Thermal Scanners Market Trend Analysis

Integration of artificial intelligence (AI) and machine learning capabilities

- One recent improvement on the thermal scanners market is the incorporation of artificial intelligence and machine learning to thermal imaging cameras. These advance technologies make a way to increase the accuracy rate of infrared sensors and prevent false alarms resulting in more efficiencies of the thermal scanners. While integrating AI, thermal scanners can process a large quantity of thermal data at the same time, which can help organizations to take the faster and accurate decisions related to thermal data.

- There is also another main trend linked to the increasing adoption of the portable handheld thermal scanners. New improved mini-sized devices can be hand-carried and used in different conditions for thermal scrutiny. This trend is especially noticeable in fields like construction, when it is necessary to inspect the infrastructure, or in healthcare facilities, in which fast and compact temperature scanning is necessary.

Invest in healthcare infrastructure and enhance security measures, the demand for thermal scanning solutions

- A leading factor revealed in the recent research and development of thermal scanners is that it has a high demand in the emerging markets, which provides promising business opportunities for manufacturers and suppliers. Since countries are putting their resources in applications of healthcare and improving security standards, the use of thermal scanning solutions is likely to increase. Also, local industries operating in transportation and logistics sectors are gradually admiring the necessity of temperature surveillance for product quality and adequate sanitary and epidemiological requirements, which broadens the market opportunities within those territories.

- Furthermore, the thermal scanning industry is characterized by continuous technological changes including the emergence of multi-spectral scan and advanced sensor, which unlock potential for new products and distinct variations. Businesses that have priorities for Research and developing new thermal scanning solutions with more features they will be able to look for the market share and fulfill the requirement of the users.

Thermal Scanners Market Segment Analysis:

Thermal Scanners Market Segmented on the basis of Product Type, Technology, Application and End User.

By Product Type, Fixed Thermal Scanners segment is expected to dominate the market during the forecast period

- The thermal scanners market by product type can be bifurcated into fixed thermal scanners, handheld thermal scanners, and smartphone thermal scanners. Thermographic scanners are generally static or mounted and used for security or safety purposes depending on their location, for instance, at building’s entrance or industrial settings where they constantly survey thermal fluctuations. The advantages of this type of thermal scanners include portability of the device and convenient use of thermal imaging in various settings making this type of scanners suitable for on-site temperature checks in healthcare, construction, maintenance, and other industries. Smartphone thermal scanners avail the thermal scanning capability to the mobile phone to make it easy to access and use for temperature checking away from any fixed location; hence, the versatility of thermal scanning technology.

By Application, Healthcare segment held the largest share in 2024

- The thermal scanners market has been categorized based on the application into the following sub-sectors: Healthcare Thermal Scanners Industrial Thermal Scanners Security & Surveillance Thermal Scanners Automotive Thermal Scanners Building Automation Thermal Scanners Food Safety Thermal Scanners In healthcare, thermal scanners tend to be used in screening patients, to have their body temperate increased being a sign of either a fever or an illness. The industrial sector uses thermal camera for normal temperature checks of bodies of equipments to prevent them from overheating. In security and surveillance, these devices improve security stability by sensing intrusion or potential danger through temperature sensing. In cars, thermal scanners are used to measure parts of automobiles or to make sure that passengers are safe. In building automation thermal scans are used for energy conservation and control of comfort levels, while in food processing and handling the scanners are used for monitoring temperature of foods in order to avoid spoilage and non-compliance with health standards. As indicated by the Thermal Scanners market report, this diverse range of applications gives an insight into the flexibility and importance of this equipment in a number of industries.

Thermal Scanners Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is setting the tone for the thermal scanners market right now owing to the extensive usage of hi-tech solutions and well-developed healthcare systems. Concern with health and safety, especially following the outbreak of COVID-19, has necessitated an investment in thermal imaging technologies in the region across many industries. Many developed industries in North America such as Healthcare, transportation, & manufacturing sectors have started incorporating Thermal Scanners into temperature control applications, monitoring systems, surveillance services, and equipment maintenance categories, making the North American market dominant in the global thermal scanner market.

- In addition, the identified key players operating in the North American thermal scanners market and the ongoing research and development activities, all contribute towards the region’s competitiveness. Business people are always trying to develop and launch better thermal scanning technologies to meet present needs and prepare for future expansion. Therefore, North America is forecasted to continue its supremacy in the thermal scanners market in the subsequent years.

Active Key Players in the Thermal Scanners Market

- FLIR Systems (United States)

- Axis Communications (Sweden)

- Honeywell International Inc. (United States)

- Testo AG (Germany)

- Infrared Cameras Inc. (United States)

- Optris GmbH (Germany)

- Seek Thermal, Inc. (United States)

- Raytek (United States)

- Bosch Security Systems (Germany)

- Dali Technology (China)

- Others

|

Global Thermal Scanners Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.50 % |

Market Size in 2032: |

USD 10.83 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermal Scanners Market by Product Type (2018-2032)

4.1 Thermal Scanners Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed Thermal Scanners

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Handheld Thermal Scanners

4.5 Smartphone Thermal Scanners

Chapter 5: Thermal Scanners Market by Technology (2018-2032)

5.1 Thermal Scanners Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Infrared Thermal Scanners

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ultraviolet Thermal Scanners

Chapter 6: Thermal Scanners Market by Application (2018-2032)

6.1 Thermal Scanners Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Healthcare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial

6.5 Security and Surveillance

6.6 Automotive

6.7 Building Automation

6.8 Food Safety

6.9 End user

6.10 Government

6.11 Healthcare Institutions

6.12 Manufacturing Facilities

6.13 Commercial Buildings

6.14 Transportation and Logistics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Thermal Scanners Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 FLIR SYSTEMS (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AXIS COMMUNICATIONS (SWEDEN)

7.4 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.5 TESTO AG (GERMANY)

7.6 INFRARED CAMERAS INC. (UNITED STATES)

7.7 OPTRIS GMBH (GERMANY)

7.8 SEEK THERMAL INC. (UNITED STATES)

7.9 RAYTEK (UNITED STATES)

7.10 BOSCH SECURITY SYSTEMS (GERMANY)

7.11 DALI TECHNOLOGY (CHINA)

7.12 OTHERS

Chapter 8: Global Thermal Scanners Market By Region

8.1 Overview

8.2. North America Thermal Scanners Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Fixed Thermal Scanners

8.2.4.2 Handheld Thermal Scanners

8.2.4.3 Smartphone Thermal Scanners

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Infrared Thermal Scanners

8.2.5.2 Ultraviolet Thermal Scanners

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Healthcare

8.2.6.2 Industrial

8.2.6.3 Security and Surveillance

8.2.6.4 Automotive

8.2.6.5 Building Automation

8.2.6.6 Food Safety

8.2.6.7 End user

8.2.6.8 Government

8.2.6.9 Healthcare Institutions

8.2.6.10 Manufacturing Facilities

8.2.6.11 Commercial Buildings

8.2.6.12 Transportation and Logistics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Thermal Scanners Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Fixed Thermal Scanners

8.3.4.2 Handheld Thermal Scanners

8.3.4.3 Smartphone Thermal Scanners

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Infrared Thermal Scanners

8.3.5.2 Ultraviolet Thermal Scanners

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Healthcare

8.3.6.2 Industrial

8.3.6.3 Security and Surveillance

8.3.6.4 Automotive

8.3.6.5 Building Automation

8.3.6.6 Food Safety

8.3.6.7 End user

8.3.6.8 Government

8.3.6.9 Healthcare Institutions

8.3.6.10 Manufacturing Facilities

8.3.6.11 Commercial Buildings

8.3.6.12 Transportation and Logistics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Thermal Scanners Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Fixed Thermal Scanners

8.4.4.2 Handheld Thermal Scanners

8.4.4.3 Smartphone Thermal Scanners

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Infrared Thermal Scanners

8.4.5.2 Ultraviolet Thermal Scanners

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Healthcare

8.4.6.2 Industrial

8.4.6.3 Security and Surveillance

8.4.6.4 Automotive

8.4.6.5 Building Automation

8.4.6.6 Food Safety

8.4.6.7 End user

8.4.6.8 Government

8.4.6.9 Healthcare Institutions

8.4.6.10 Manufacturing Facilities

8.4.6.11 Commercial Buildings

8.4.6.12 Transportation and Logistics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Thermal Scanners Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Fixed Thermal Scanners

8.5.4.2 Handheld Thermal Scanners

8.5.4.3 Smartphone Thermal Scanners

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Infrared Thermal Scanners

8.5.5.2 Ultraviolet Thermal Scanners

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Healthcare

8.5.6.2 Industrial

8.5.6.3 Security and Surveillance

8.5.6.4 Automotive

8.5.6.5 Building Automation

8.5.6.6 Food Safety

8.5.6.7 End user

8.5.6.8 Government

8.5.6.9 Healthcare Institutions

8.5.6.10 Manufacturing Facilities

8.5.6.11 Commercial Buildings

8.5.6.12 Transportation and Logistics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Thermal Scanners Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Fixed Thermal Scanners

8.6.4.2 Handheld Thermal Scanners

8.6.4.3 Smartphone Thermal Scanners

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Infrared Thermal Scanners

8.6.5.2 Ultraviolet Thermal Scanners

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Healthcare

8.6.6.2 Industrial

8.6.6.3 Security and Surveillance

8.6.6.4 Automotive

8.6.6.5 Building Automation

8.6.6.6 Food Safety

8.6.6.7 End user

8.6.6.8 Government

8.6.6.9 Healthcare Institutions

8.6.6.10 Manufacturing Facilities

8.6.6.11 Commercial Buildings

8.6.6.12 Transportation and Logistics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Thermal Scanners Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Fixed Thermal Scanners

8.7.4.2 Handheld Thermal Scanners

8.7.4.3 Smartphone Thermal Scanners

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Infrared Thermal Scanners

8.7.5.2 Ultraviolet Thermal Scanners

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Healthcare

8.7.6.2 Industrial

8.7.6.3 Security and Surveillance

8.7.6.4 Automotive

8.7.6.5 Building Automation

8.7.6.6 Food Safety

8.7.6.7 End user

8.7.6.8 Government

8.7.6.9 Healthcare Institutions

8.7.6.10 Manufacturing Facilities

8.7.6.11 Commercial Buildings

8.7.6.12 Transportation and Logistics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Thermal Scanners Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.50 % |

Market Size in 2032: |

USD 10.83 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Thermal Scanners Market research report is 2024-2032.

FLIR Systems (United States), Axis Communications (Sweden), Honeywell International Inc. (United States), Testo AG (Germany), Infrared Cameras Inc. (United States), Optris GmbH (Germany), Seek Thermal, Inc. (United States), Raytek (United States), Bosch Security Systems (Germany), Dali Technology (China). and Other Major Players.

The Thermal Scanners Market is segmented into by Product Type (Fixed Thermal Scanners, Handheld Thermal Scanners, Smartphone Thermal Scanners), By Technology (Infrared Thermal Scanners, Ultraviolet Thermal Scanners), By Application (Healthcare, Industrial, Security and Surveillance, Automotive, Building Automation, Food Safety), End-User (Government, Healthcare Institutions, Manufacturing Facilities, Commercial Buildings, Transportation and Logistics). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The thermal scanners industry describes the business of designing, producing, and distributing equipment used to create visual images that represent temperature using emitted infrared radiation. Fever detecting devices are common in the healthcare industry, surveillance devices in the security industry and temperature monitoring devices in industries. Fixed thermal scanners can also be used in mounted and portable forms, depending with the situation where it is needed.

Thermal Scanners Market Size is Valued at USD 5.64 Billion in 2023, and is Projected to Reach USD 10.83 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.