Thermal Imaging Systems Market Synopsis

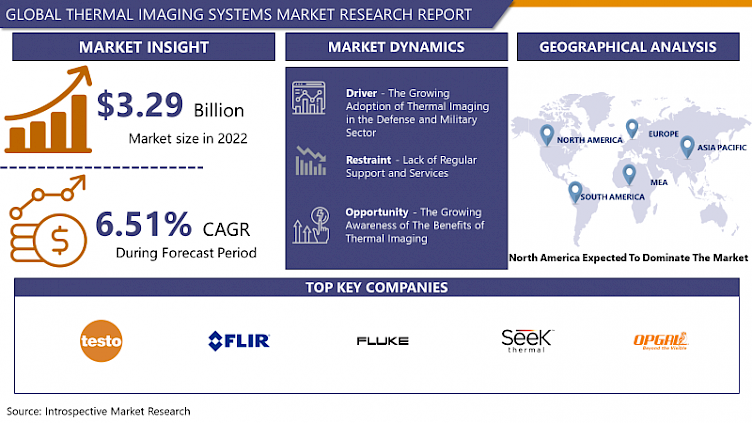

Global Thermal Imaging Systems Market Size Was Valued at USD 3.29 Billion in 2022, and is Projected to Reach USD 5.45 Billion by 2030, Growing at a CAGR of 6.51% From 2023-2030

Thermal imaging systems utilize specialized sensors to detect and capture infrared radiation emitted by objects, generating images reflecting temperature variations. These systems convert thermal energy into visible images, facilitating the identification of heat signatures across various fields including surveillance, medical diagnostics, and industrial inspections.

- Thermal imaging systems are widely utilized across various sectors due to their versatility and efficacy. In surveillance, these systems improve visibility in low-light conditions and detect intruders or potential threats based on body heat signatures. In medical diagnostics, thermal imaging aids in identifying abnormalities in blood flow, inflammation, or other physiological conditions, facilitating early disease detection and monitoring. Additionally, in industrial inspections, thermal imaging helps detect equipment malfunctions, identify overheating components, and optimize energy efficiency by pinpointing areas of heat loss in buildings or machinery.

- they provide non-contact and non-invasive temperature measurements, making them suitable for sensitive environments or with delicate subjects, such as in medical applications. Moreover, thermal imaging offers real-time data visualization, enabling immediate analysis and decision-making in scenarios ranging from firefighting operations to building inspections. Furthermore, these systems operate effectively in challenging conditions like smoke, fog, or darkness, enhancing their utility in critical situations.

- With industries emphasizing efficiency, safety, and automation, the demand for thermal imaging systems is projected to increase significantly. Advances in sensor technology, image processing algorithms, and integration capabilities will expand the application areas of thermal imaging. Continued developments will lead to more compact, affordable, and user-friendly systems, driving adoption across various industries and sectors.

Thermal Imaging Systems Market Trend Analysis:

The Growing Adoption of Thermal Imaging in the Defense and Military Sector

- The rise in thermal imaging technology adoption within the defense and military sectors significantly propels the expansion of the thermal imaging systems market. Military operations heavily depend on thermal imaging for reconnaissance, surveillance, and target acquisition, granting critical visibility advantages in diverse operational settings, including low-light conditions and harsh weather. Thermal imaging empowers military personnel to detect and recognize potential threats more efficiently, thereby enhancing situational awareness and mission effectiveness.

- Furthermore, advancements in thermal imaging technology have spurred the creation of lightweight and portable systems, seamlessly integrated into military gear such as drones, helmets, and weapon sights. These compact thermal imaging solutions offer increased mobility and adaptability, providing soldiers with enhanced capabilities for navigation, target acquisition, and battlefield awareness. The ongoing investment by the military in modernizing equipment and bolstering soldier capabilities continues to fuel the demand for thermal imaging systems in defense applications.

- Moreover, escalating global security challenges, encompassing terrorism, border tensions, and asymmetric warfare, further drive the widespread adoption of thermal imaging technology by defense and military entities worldwide. Governments prioritize enhancing defense capabilities and upgrading armed forces, fostering a steady increase in demand for thermal imaging systems. This emphasizes the pivotal role played by the defense and military sectors in driving growth and fostering innovation within the thermal imaging systems market.

The Growing Awareness of The Benefits of Thermal Imaging

- The rising recognition of thermal imaging's benefits offers a significant growth opportunity for the market of thermal imaging systems. With industries in various sectors gaining awareness of the advantages provided by thermal imaging technology, there's a growing inclination towards integrating these systems into their operations. Thermal imaging offers valuable insights into temperature variations, enabling improved safety, efficiency, and cost-effectiveness across a spectrum of applications, from building inspections to electrical maintenance.

- Furthermore, advancements in thermal imaging technology have enhanced accessibility and user-friendliness, further driving adoption. Businesses are realizing the potential for enhanced performance and productivity through the deployment of thermal imaging solutions, leading to an increased demand for tailored applications that meet specific industry requirements. For instance, in the automotive sector, thermal imaging aids in the early detection of faults in engines and exhaust systems, facilitating proactive maintenance and minimizing downtime.

- Moreover, the emergence of new markets and the expansion of existing ones contribute to the growing opportunities for thermal imaging systems. Industries such as healthcare, agriculture, and environmental monitoring are increasingly turning to thermal imaging for disease detection, crop management, and ecological research. This growing awareness and utilization of thermal imaging underscore its versatility and potential across various sectors, driving market expansion and fostering ongoing innovation in thermal imaging systems.

Thermal Imaging Systems Market Segment Analysis:

Thermal Imaging Systems Market Segmented on the basis of Product Type, Technology, and Application

By Technology, Microbolometers segment is expected to dominate the market during the forecast period

- The Microbolometers segment is expected to lead the growth of the Thermal Imaging Systems Market. These sensors, renowned for their sensitivity to infrared radiation, play a crucial role in capturing thermal images with precision and accuracy. As industries in sectors like defense, automotive, and aerospace increasingly depend on thermal imaging for diverse applications, the demand for microbolometers is set to rise sharply. Their capability to detect temperature variances and convert them into digital images renders them indispensable in surveillance, medical diagnostics, and industrial inspections.

- Moreover, advancements in technology have resulted in the creation of more efficient and economical microbolometers, further driving their dominance in the market. With ongoing improvements in resolution, sensitivity, and integration capabilities, microbolometers offer superior performance compared to alternative sensor technologies. Consequently, they are preferred by manufacturers and end-users alike, stimulating the expansion of the Thermal Imaging Systems Market and cementing the microbolometers segment's role as a principal growth catalyst.

By Application, Defense & Military segment held the largest share of 42.8% in 2022

- The dominant force behind the growth of the Thermal Imaging Systems Market is the Defense & Military segment. This sector, known for its stringent demands for advanced surveillance and target acquisition capabilities, has generated substantial demand for thermal imaging technology. With an increasing focus on modernizing military equipment and improving situational awareness, defense and military organizations worldwide have made significant investments in thermal imaging systems for reconnaissance, surveillance, and threat detection purposes.

- Moreover, the incorporation of thermal imaging technology into military platforms such as drones, aircraft, and soldier systems has further driven market expansion. These systems offer defense personnel enhanced visibility and operational efficiency in various challenging environments, including low-light conditions and adverse weather. The dominance of the Defense & Military segment in the Thermal Imaging Systems Market highlights the crucial role played by thermal imaging technology in strengthening national security and defense capabilities globally, leading to continuous innovation and advancements in the field.

Thermal Imaging Systems Market Regional Insights:

North America Expected to Dominate the Market Over the Forecast period

- North America is positioned to lead the Thermal Imaging Systems market's expansion. With a strong presence of major market players, innovators in technology, and a substantial defense budget, the region demonstrates a keen interest in adopting advanced thermal imaging solutions. Furthermore, the rising deployment of thermal imaging systems across sectors like defense, aerospace, automotive, and industrial applications fuels market growth in North America.

- Moreover, the region benefits from extensive research and development endeavors and government initiatives aimed at bolstering national security and public safety. These efforts contribute to the widespread adoption of thermal imaging technology in North America. Additionally, stringent regulations concerning safety and security standards drive demand for thermal imaging systems across various applications, further reinforcing North America's prominence as the primary region for Thermal Imaging Systems market growth.

Thermal Imaging Systems Market Top Key Players:

- Flir Systems Inc. (U.S.)

- Fluke Corporation (U.S.)

- Leonardo DRS (U.S.)

- Testo Inc. (U.S.)

- United Technologies (U.S.)

- Teledyne FLIR LLC (U.S.)

- L3Harris Technologies, Inc (U.S.)

- Seek Thermal Inc. (U.S.)

- Trijicon Inc. (U.S.)

- Raytheon Co. (U.S.)

- Bullard GmbH (Germany)

- Xenics (Belgium)

- Axis Communications AB (Sweden)

- BAE Systems plc (UK)

- Thermoteknix Systems (UK)

- HT Italia S.r.l. (Italy)

- Leonardo (Italy)

- Dali Technology Co., Ltd. (China)

- Zhejiang Dali Technology Co., Ltd. (China)

- Opgal Optronic Industries Ltd (Israel), and Other Major Players

Key Industry Developments in the Thermal Imaging Systems Market:

- In March 2022, Teledyne FLIR System Inc., Defense will provide thermal imaging equipment to the US Army. The FWS-I system will equip soldiers with infrared imaging in all weather and lighting conditions. Teledyne Technologies' Teledyne FLIR Defense has signed a new contract worth up to USD 500.2 million to provide advanced thermal imaging equipment to the United States Army.

- In May 2022, Trijicon Inc. released Q-LOC Technology Quick Release Mounts. Trijicon Inc., a global developer of revolutionary targeting solutions for the hunting, shooting, military, and law enforcement industries, has announced that Trijicon Q-LOC Technology quick-release mounts are now available in a variety of mounting systems to fit almost any optical platform. Trijicon red dots, thermal optics, and riflescopes all work with Q-LOC Technology.

|

Global Thermal Imaging Systems Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.29 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.51% |

Market Size in 2030: |

USD 5.45 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- THERMAL IMAGING SYSTEMS MARKET BY PRODUCT TYPE (2017-2030)

- THERMAL IMAGING SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CAMERAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SCOPES

- MODULES

- THERMAL IMAGING SYSTEMS MARKET BY TECHNOLOGY (2017-2030)

- THERMAL IMAGING SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MICROBOLOMETERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- QUANTUM WELL-INFRARED PHOTODETECTORS (QWIPS)

- UNCOOLED

- THERMAL IMAGING SYSTEMS MARKET BY APPLICATION (2017-2030)

- THERMAL IMAGING SYSTEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SECURITY & SURVEILLANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DEFENSE & MILITARY

- INDUSTRIAL

- MEDICAL

- SCIENTIFIC RESEARCH

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Thermal Imaging Systems Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- FLIR SYSTEMS INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FLUKE CORPORATION (U.S.)

- LEONARDO DRS (U.S.)

- TESTO INC. (U.S.)

- UNITED TECHNOLOGIES (U.S.)

- TELEDYNE FLIR LLC (U.S.)

- L3HARRIS TECHNOLOGIES, INC (U.S.)

- SEEK THERMAL INC. (U.S.)

- TRIJICON INC. (U.S.)

- RAYTHEON CO. (U.S.)

- BULLARD GMBH (GERMANY)

- XENICS (BELGIUM)

- AXIS COMMUNICATIONS AB (SWEDEN)

- BAE SYSTEMS PLC (UK)

- THERMOTEKNIX SYSTEMS (UK)

- HT ITALIA S.R.L. (ITALY)

- LEONARDO (ITALY)

- DALI TECHNOLOGY CO., LTD. (CHINA)

- ZHEJIANG DALI TECHNOLOGY CO., LTD. (CHINA)

- OPGAL OPTRONIC INDUSTRIES LTD (ISRAEL)

- COMPETITIVE LANDSCAPE

- GLOBAL THERMAL IMAGING SYSTEMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Thermal Imaging Systems Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.29 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.51% |

Market Size in 2030: |

USD 5.45 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. THERMAL IMAGING SYSTEMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. THERMAL IMAGING SYSTEMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. THERMAL IMAGING SYSTEMS MARKET COMPETITIVE RIVALRY

TABLE 005. THERMAL IMAGING SYSTEMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. THERMAL IMAGING SYSTEMS MARKET THREAT OF SUBSTITUTES

TABLE 007. THERMAL IMAGING SYSTEMS MARKET BY TYPE

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. THERMAL IMAGING SYSTEMS MARKET BY APPLICATION

TABLE 012. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA THERMAL IMAGING SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA THERMAL IMAGING SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 017. N THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE THERMAL IMAGING SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE THERMAL IMAGING SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 020. THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC THERMAL IMAGING SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC THERMAL IMAGING SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 023. THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA THERMAL IMAGING SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA THERMAL IMAGING SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 026. THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA THERMAL IMAGING SYSTEMS MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA THERMAL IMAGING SYSTEMS MARKET, BY APPLICATION (2016-2028)

TABLE 029. THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY (2016-2028)

TABLE 030. BAE SYSTEMS PLC.: SNAPSHOT

TABLE 031. BAE SYSTEMS PLC.: BUSINESS PERFORMANCE

TABLE 032. BAE SYSTEMS PLC.: PRODUCT PORTFOLIO

TABLE 033. BAE SYSTEMS PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. FLIR SYSTEMS: SNAPSHOT

TABLE 034. FLIR SYSTEMS: BUSINESS PERFORMANCE

TABLE 035. FLIR SYSTEMS: PRODUCT PORTFOLIO

TABLE 036. FLIR SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. L-3 COMMUNICATIONS HOLDINGS: SNAPSHOT

TABLE 037. L-3 COMMUNICATIONS HOLDINGS: BUSINESS PERFORMANCE

TABLE 038. L-3 COMMUNICATIONS HOLDINGS: PRODUCT PORTFOLIO

TABLE 039. L-3 COMMUNICATIONS HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ULIS S.A.S: SNAPSHOT

TABLE 040. ULIS S.A.S: BUSINESS PERFORMANCE

TABLE 041. ULIS S.A.S: PRODUCT PORTFOLIO

TABLE 042. ULIS S.A.S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. LOCKHEED MARTIN: SNAPSHOT

TABLE 043. LOCKHEED MARTIN: BUSINESS PERFORMANCE

TABLE 044. LOCKHEED MARTIN: PRODUCT PORTFOLIO

TABLE 045. LOCKHEED MARTIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. DRS TECHNOLOGIES INC.: SNAPSHOT

TABLE 046. DRS TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 047. DRS TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 048. DRS TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ELBIT SYSTEMS LTD.: SNAPSHOT

TABLE 049. ELBIT SYSTEMS LTD.: BUSINESS PERFORMANCE

TABLE 050. ELBIT SYSTEMS LTD.: PRODUCT PORTFOLIO

TABLE 051. ELBIT SYSTEMS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. RAYTHEON COMPANY: SNAPSHOT

TABLE 052. RAYTHEON COMPANY: BUSINESS PERFORMANCE

TABLE 053. RAYTHEON COMPANY: PRODUCT PORTFOLIO

TABLE 054. RAYTHEON COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SOFRADIR SAS: SNAPSHOT

TABLE 055. SOFRADIR SAS: BUSINESS PERFORMANCE

TABLE 056. SOFRADIR SAS: PRODUCT PORTFOLIO

TABLE 057. SOFRADIR SAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. THERMOTEKNIX SYSTEMS LTD.: SNAPSHOT

TABLE 058. THERMOTEKNIX SYSTEMS LTD.: BUSINESS PERFORMANCE

TABLE 059. THERMOTEKNIX SYSTEMS LTD.: PRODUCT PORTFOLIO

TABLE 060. THERMOTEKNIX SYSTEMS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY TYPE

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY APPLICATION

FIGURE 016. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA THERMAL IMAGING SYSTEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Thermal Imaging Systems Market research report is 2023-2030.

Flir Systems Inc. (U.S.), Fluke Corporation (U.S.), Leonardo DRS (U.S.), Testo Inc. (U.S.), United Technologies (U.S.), Teledyne FLIR LLC (U.S.), L3Harris Technologies, Inc (U.S.), Seek Thermal Inc. (U.S.), Trijicon Inc. (U.S.), Raytheon Co. (U.S.), Bullard GmbH (Germany), Xenics (Belgium), Axis Communications AB (Sweden), BAE Systems plc (UK), Thermoteknix Systems (UK), HT Italia S.r.l. (Italy), Leonardo (Italy), Dali Technology Co., Ltd. (China), Zhejiang Dali Technology Co., Ltd. (China), Opgal Optronic Industries Ltd (Israel), and Other Major Players.

The Thermal Imaging Systems Market is segmented into Product Type, Technology, Application, and region. By Product Type, the market is categorized into Cameras, Scopes, and Modules. By Technology, the market is categorized into Microbolometers, Quantum Well-Infrared Photodetectors (QWIPs), and Uncooled. By Application, the market is categorized into Security & Surveillance, Defense & Military, Industrial, Medical, and Scientific Research. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Thermal imaging systems utilize specialized sensors to detect and capture infrared radiation emitted by objects, generating images reflecting temperature variations. These systems convert thermal energy into visible images, facilitating the identification of heat signatures across various fields including surveillance, medical diagnostics, and industrial inspections.

Global Thermal Imaging Systems Market Size Was Valued at USD 3.29 Billion in 2022, and is Projected to Reach USD 5.45 Billion by 2030, Growing at a CAGR of 6.51% From 2023-2030