Telecom Enterprise Services Market Synopsis

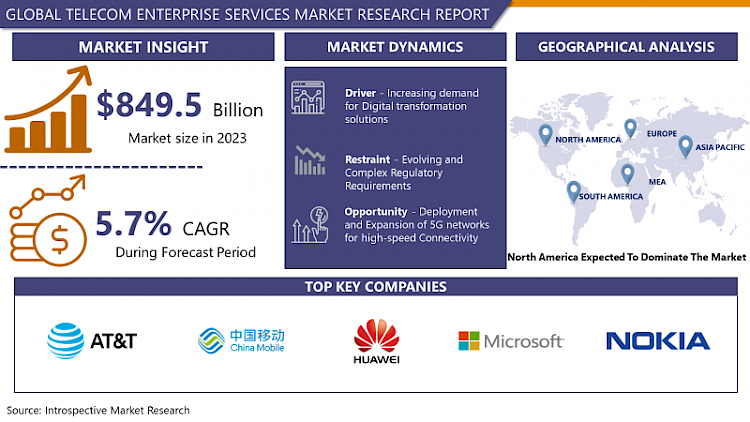

Telecom Enterprise Services Market Size Was Valued at USD 849.5 Billion in 2023, and is Projected to Reach USD 1399.1 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

Telecom Enterprise Services Market is a segment that is focused on providingvoice, data and networking services to businesses. The growth of this market is the digital transformation that is demands globally. The leaders of the key market players AT&T, Verizon, Vodafone market a number of services for different industries from health to finance. Cloud-based platforms and services, smart home and industrial technologies, and information security will be particularly vital due to growing focus on enhanced productivity and safety.

Some of the developments that promise to shape the market’s future include newly introduced technologies like 5G, which ensure faster communication and support for new functionalities, for instance, edge computing. But problems such as legislation and the use of information still exist. In general, the Telecom Enterprise Services Market is a perfect platform for all providers to introduce new services and advance the current business landscape while taking into account the challenges of doing business in a world that is increasingly interconnected.

- A key feature that is being studied as part of the telecom enterprise services market is the development of cloud-based solutions. Cloud services are being considered for businesses owing to factors like scalability and flexibility of the business and cost-effectiveness of the services. Telecom firms are developing horizontally by providing cloud services such as application, storage and computing over the cloud aimed at meeting enterprise demands.

- With the constant evolution of cyber issues and their increased intensity, ensuring cybersecurity for the company has become one of the priority questions for any business, regardless of its scale. With many methods of cyber attacks today, the telecom companies are trying to sell the security services for their clients which may provide the threat detection, the secured network, the encrypted data, and so on. The combination with artificial intelligence and machine learning further improves the effectiveness of these cybersecurity measures.

- SDN and NFV are the disruptive technologies that are bringing megatrends in the telecom industry by promoting greater network flexibility, capacity, and efficiency. Telecom operators and service providers are adopting the SDN and NFV technologies to simplify their network operations and operations and reduce the time to market for new services. SDN/NFV telecom network providers are developing shared infrastructures that can deliver end-to-end dynamic customer services on-demand similar to SaaS models.

Telecom Enterprise Services Market Trend Analysis

Increased competition increasing the market growth.

- Rivalry forces telecom firms to be competitive, to implement new technology, and to develop unique products and services for the market. It creates a desire for improvement and results in the creation of enhanced telecom solutions that are optimal for addressing business needs.

- It may be in the form of top-notch tech advancement, quicker accessibility, or even more client fulfilment; these telecom providers anticipate competing and outshining their opponents consequently growing the market for all.

- Stiff competition leads to a reduction in the prices offered by telecom providers for business, hence providing more competitive services. Affordability also enables more companies including small and medium sized businesses (SMBs) to adopt these superior services for advanced telecom offerings.

- This affordability contributes to the higher usage of telecom enterprise services and hence improves market expansion.

- Telecom firms are forced to look for new ventures and expand their operations to other geographical locations because of stiff competition. Through penetration into virgin markets or identification of underserved sectors/providers, telecom companies can expand their revenue base and boost overall market development.

- This is the expansion strategy where the company defines its services according to the expectations and wants of individual customers in the market thereby increasing consumption of telecom enterprise services.

- In a market environment where competition is intense, telecom providers are committed to ensuring that they provide the most effective services and experience to their clients. This focus on service excellence translates into enhanced reliability, performance, and responsiveness, which are three of the most important decision elements in the choice of telecom partner by businesses.

- As a consequence, enterprises and businesses are more willing and keener to invest in telecom enterprise services offered by providers who are known and recognized for the quality of their offerings and service satisfaction which also helps in the overall growth of the market.

Technological advancements increase the Market trend for Telecom Enterprise Services Market.

- The implementation of the 5G technology would be a significant technological shift in the telecom enterprise services market. One of the greatest advantages of 5G is the faster data transfer rates, increased latency, and expanded channel capacity associated with it.

- This allows telecom providers to provide a new set of premium services for businesses with increased performance, including AR, VR, or IoT applications, real-time data analysis, etc. Such increased demand for these competitive services is the key market growth factor and has also revolutionized the way of doing business and how companies communicate with clients.

- Another area that is transforming the telecom enterprise services universe involves edge computing. The key feature of edge computing is that it helps to involve computing resources in the process much closer to the source of the data, which contributes to the reduction of latency and improves the work of the application and the service.

- Telecom providers are increasingly utilizing edge computing to offer edge-based solutions designed specifically for businesses such as CDN, IoT edge platforms, and edge analytics. This is fueling the uptake of telecom enterprise services and creating avenues for telecom players to generate additional revenue in other traditionally non-core industries like manufacturing, healthcare and retail among others.

- Artificial intelligence and machine language influences in the telecom enterprise services sector Artificial intelligence and machine language will play a major role in the telecom enterprise services sector Artificial intelligence and machine language in the telecom enterprise services sector

- The impact of artificial intelligence and machine language on the telecom enterprise services sector Telecom service providers are using AI and ML models for auto-optimization of their networks, enhancing customer experiences, and recognizing security breaches in real-time.

- Such sophisticated functions not only streamline day-to-day processes but also contribute to the increased attractiveness of telecommunication services for businesses, which is one of the core factors for the segment’s development and higher market share.

- IT as a service technology such as SDN & NFV are the promising trend in the telecom enterprise services market because of the flexibility by the technology solution. Telecom providers continue to enhance capabilities of their SDN and NFV platforms to provide more and more virtualized services – from basic VPN and SD-WAN to virtualized security services and DDoS protection.

- This overall trend of increasing software influence over the development of the networks underpins the market’s expansion and the faster and more powerful revenue streams that businesses are able to generate to meet the changing needs of their customers.

Telecom Enterprise Services Market Segment Analysis:

Telecom Enterprise Services Market is segmented on the basis of Solution, End-user and Revenue Stream

By Solution, Data/Internet Service segment is expected to dominate the market during the forecast period

- The traditional voice communication remains one of the core services for business communications offering the business participants in the technology reliable voice calling, conferencing and voice mail for both internal and external communications.

- Such services provide fast connectivity through data and internet, which are essential for enhancing business processes, securing access to necessary applications, big data transfers, and the interaction of different points located at a distance.

- Mobility and wireless solutions provide the mobility and the flexibility to the business, including mobile workforce management, device management and connecting the mobile workforce to the applications required for higher productivity.

- Managed services comprise the overall administration of the technology infrastructure consisting of network, security, performance management, and other services for IT outsourcing goals to enable organizations to concentrate on primary functions.

- Cloud services involve various solutions that could fall under IaaS, PaaS, and SaaS with the potential to reference businesses’ ability to access computing resources, storage, and applications for increased agility and cost savings on cloud platforms.

By End-user, SMEs segment held the largest share in 2023

- SME telecom services concentrate on three key themes of affordability, scalability, and simplicity. Such businesses normally do not have complex and sophisticated operations that demand expensive and advanced technologies for their work; at the same time they are constantly expanding and demand sufficiently expandable solutions. Telecoms providers have service bundles providing the minimum required voice and data facilities, cloud hosted applications, and managed services according to SME finances and manpower availability.

- Corporate clients require sophisticated, scalable, and flexible communication systems, which can meet the needs of a highly structured and distributed organization. Telecom providers provide integrated services like enhanced voice and data with high bandwidth, leased line services, security managed services, and infrastructure as a service and platform as a service.

- These are solutions that aim to satisfy large businesses and organizations with high performance, reliability and security as well as the ability to offer them the need for adaptability in the future. Also, enterprise corporate clients can enjoy additional account management and support services to guarantee telecom solution integration and future optimization.

Telecom Enterprise Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America has a well-established telecom infrastructure that features large-scale fiber optic systems, sophisticated wireless technologies, and the broad application of the Internet. This forms a strong telecom backbone that facilitates the provision of quality telecom services to businesses across the region.

the region is characterized by the presence of advanced and emerging telecoms and technology solution providers who are innovators in their field. The telecom enterprise services market in North America is evolving owing to the advancements in solutions like 5G and edge computing as well as technologies like artificial intelligence which are catering to the needs of business enterprises for their digitalization.

There are many large organizations located in North America within a number of different industries such as financial, healthcare, manufacturing, and technology. These enterprises have significant telecom service demands and present a challenge to service providers to develop solutions as they need to be reliable, scalable, and secure. The telecom providers in North America give to these demands by providing the extensive services contain with advanced services regarding the necessity of the large enterprises.

Nevertheless, North American market is still rather young and highly competitive, with numerous telecom providers struggling for customers. It breeds competition, which in turn leads to investors pumping up infrastructure facilities for the region and launching of new and better services to cement their dominance in the telecom enterprise services market.

Active Key Players in the Telecom Enterprise Services Market

- AT&T INC. (USA)

- China Mobile Limited (China)

- Huawei Technologies Co., Ltd. (China)

- Microsoft Corporation (USA)

- Nokia Corporation (Finland)

- TELEFONAKTIEBOLAGET LM ERICSSON (Sweden)

- Thales Group (France)

- Verizon Communications Inc. (USA)

- Vodafone Group Plc. (United Kingdom)

- ZTE Corporation (China)

- Other key players

|

Global FM Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 849.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 1399.1 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By End-user |

|

||

|

By Revenue Stream |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Nokia Corporation (Finland), TELEFONAKTIEBOLAGET LM ERICSSON (Sweden), Thales Group (France), Verizon Communications Inc. (USA), Vodafone Group Plc. (United Kingdom), ZTE Corporation (China) and Other key players |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TELECOM ENTERPRISE SERVICES MARKET BY SOLUTION (2017-2032)

- TELECOM ENTERPRISE SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VOICE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DATA/INTERNET SERVICE

- WIRELESS/MOBILITY

- MANAGED SERVICES

- CLOUD SERVICE

- TELECOM ENTERPRISE SERVICES MARKET BY END-USER (2017-2032)

- TELECOM ENTERPRISE SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- TELECOM ENTERPRISE SERVICES MARKET BY REVENUE STREAM (2017-2032)

- TELECOM ENTERPRISE SERVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MASTER AGENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CARRIERS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Telecom Enterprise Services Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AT&T INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CHINA MOBILE LIMITED (CHINA)

- HUAWEI TECHNOLOGIES CO., LTD. (CHINA)

- MICROSOFT CORPORATION (USA)

- NOKIA CORPORATION (FINLAND)

- TELEFONAKTIEBOLAGET LM ERICSSON (SWEDEN)

- THALES GROUP (FRANCE)

- VERIZON COMMUNICATIONS INC. (USA)

- VODAFONE GROUP PLC. (UNITED KINGDOM)

- ZTE CORPORATION (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL TELECOM ENTERPRISE SERVICES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Revenue Stream

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global FM Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 849.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.7% |

Market Size in 2032: |

USD 1399.1 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By End-user |

|

||

|

By Revenue Stream |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Nokia Corporation (Finland), TELEFONAKTIEBOLAGET LM ERICSSON (Sweden), Thales Group (France), Verizon Communications Inc. (USA), Vodafone Group Plc. (United Kingdom), ZTE Corporation (China) and Other key players |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TELECOM ENTERPRISE SERVICES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TELECOM ENTERPRISE SERVICES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TELECOM ENTERPRISE SERVICES MARKET COMPETITIVE RIVALRY

TABLE 005. TELECOM ENTERPRISE SERVICES MARKET THREAT OF NEW ENTRANTS

TABLE 006. TELECOM ENTERPRISE SERVICES MARKET THREAT OF SUBSTITUTES

TABLE 007. TELECOM ENTERPRISE SERVICES MARKET BY TYPE

TABLE 008. PERSONAL SERVICE MARKET OVERVIEW (2016-2028)

TABLE 009. ENTERPRISE SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. TELECOM ENTERPRISE SERVICES MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA TELECOM ENTERPRISE SERVICES MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA TELECOM ENTERPRISE SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 016. N TELECOM ENTERPRISE SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE TELECOM ENTERPRISE SERVICES MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE TELECOM ENTERPRISE SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 019. TELECOM ENTERPRISE SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC TELECOM ENTERPRISE SERVICES MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC TELECOM ENTERPRISE SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 022. TELECOM ENTERPRISE SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA TELECOM ENTERPRISE SERVICES MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA TELECOM ENTERPRISE SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 025. TELECOM ENTERPRISE SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA TELECOM ENTERPRISE SERVICES MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA TELECOM ENTERPRISE SERVICES MARKET, BY APPLICATION (2016-2028)

TABLE 028. TELECOM ENTERPRISE SERVICES MARKET, BY COUNTRY (2016-2028)

TABLE 029. AT&T: SNAPSHOT

TABLE 030. AT&T: BUSINESS PERFORMANCE

TABLE 031. AT&T: PRODUCT PORTFOLIO

TABLE 032. AT&T: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. VERIZON: SNAPSHOT

TABLE 033. VERIZON: BUSINESS PERFORMANCE

TABLE 034. VERIZON: PRODUCT PORTFOLIO

TABLE 035. VERIZON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. CHINA MOBILE LTD: SNAPSHOT

TABLE 036. CHINA MOBILE LTD: BUSINESS PERFORMANCE

TABLE 037. CHINA MOBILE LTD: PRODUCT PORTFOLIO

TABLE 038. CHINA MOBILE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. VODAPHONE GROUP: SNAPSHOT

TABLE 039. VODAPHONE GROUP: BUSINESS PERFORMANCE

TABLE 040. VODAPHONE GROUP: PRODUCT PORTFOLIO

TABLE 041. VODAPHONE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. SPRINT: SNAPSHOT

TABLE 042. SPRINT: BUSINESS PERFORMANCE

TABLE 043. SPRINT: PRODUCT PORTFOLIO

TABLE 044. SPRINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. T-MOBILE: SNAPSHOT

TABLE 045. T-MOBILE: BUSINESS PERFORMANCE

TABLE 046. T-MOBILE: PRODUCT PORTFOLIO

TABLE 047. T-MOBILE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CENTURYLINK: SNAPSHOT

TABLE 048. CENTURYLINK: BUSINESS PERFORMANCE

TABLE 049. CENTURYLINK: PRODUCT PORTFOLIO

TABLE 050. CENTURYLINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. FRONTIER COMMUNICATIONS: SNAPSHOT

TABLE 051. FRONTIER COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 052. FRONTIER COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 053. FRONTIER COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. WINDSTREAM HOLDINGS: SNAPSHOT

TABLE 054. WINDSTREAM HOLDINGS: BUSINESS PERFORMANCE

TABLE 055. WINDSTREAM HOLDINGS: PRODUCT PORTFOLIO

TABLE 056. WINDSTREAM HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SOFTBANK CORP: SNAPSHOT

TABLE 057. SOFTBANK CORP: BUSINESS PERFORMANCE

TABLE 058. SOFTBANK CORP: PRODUCT PORTFOLIO

TABLE 059. SOFTBANK CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ERICSSON: SNAPSHOT

TABLE 060. ERICSSON: BUSINESS PERFORMANCE

TABLE 061. ERICSSON: PRODUCT PORTFOLIO

TABLE 062. ERICSSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BHARTI AIRTEL: SNAPSHOT

TABLE 063. BHARTI AIRTEL: BUSINESS PERFORMANCE

TABLE 064. BHARTI AIRTEL: PRODUCT PORTFOLIO

TABLE 065. BHARTI AIRTEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. CHINA UNICOM: SNAPSHOT

TABLE 066. CHINA UNICOM: BUSINESS PERFORMANCE

TABLE 067. CHINA UNICOM: PRODUCT PORTFOLIO

TABLE 068. CHINA UNICOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. TELEFONICA: SNAPSHOT

TABLE 069. TELEFONICA: BUSINESS PERFORMANCE

TABLE 070. TELEFONICA: PRODUCT PORTFOLIO

TABLE 071. TELEFONICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ORANGE: SNAPSHOT

TABLE 072. ORANGE: BUSINESS PERFORMANCE

TABLE 073. ORANGE: PRODUCT PORTFOLIO

TABLE 074. ORANGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. AMERICA MOVIL: SNAPSHOT

TABLE 075. AMERICA MOVIL: BUSINESS PERFORMANCE

TABLE 076. AMERICA MOVIL: PRODUCT PORTFOLIO

TABLE 077. AMERICA MOVIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY TYPE

FIGURE 012. PERSONAL SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. ENTERPRISE SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA TELECOM ENTERPRISE SERVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Telecom Enterprise Services Market research report is 2024-2032.

AT&T INC. (USA), China Mobile Limited (China), Huawei Technologies Co., Ltd. (China), Microsoft Corporation (USA), Nokia Corporation (Finland), TELEFONAKTIEBOLAGET LM ERICSSON (Sweden), Thales Group (France), Verizon Communications Inc. (USA), Vodafone Group Plc. (United Kingdom), ZTE Corporation (China) and Other key players

The Telecom Enterprise Services is segmented into by Solution (Voice, Data/Internet Service, Wireless/Mobility, Managed Services, Cloud Service) By End-user (SMEs, Large Enterprises) By Revenue Stream (Master Agent, Carriers, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Telecom Enterprise Services Market refers to the sector within the telecommunications industry that focuses on providing a wide array of services tailored specifically for businesses and enterprises. These services typically include voice communication, data connectivity, cloud computing, managed network solutions, cybersecurity, and related services. Telecom enterprise services aim to support the communication, networking, and information technology needs of businesses, helping them to enhance productivity, streamline operations, and improve efficiency. This market is driven by the increasing demand for advanced communication and networking solutions by businesses of all sizes, as they seek to stay competitive in today's digital landscape.

Telecom Enterprise Services Market Size Was Valued at USD 849.5 Billion in 2023 and is Projected to Reach USD 1399.1 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.