Telecom Energy Management System Market Synopsis

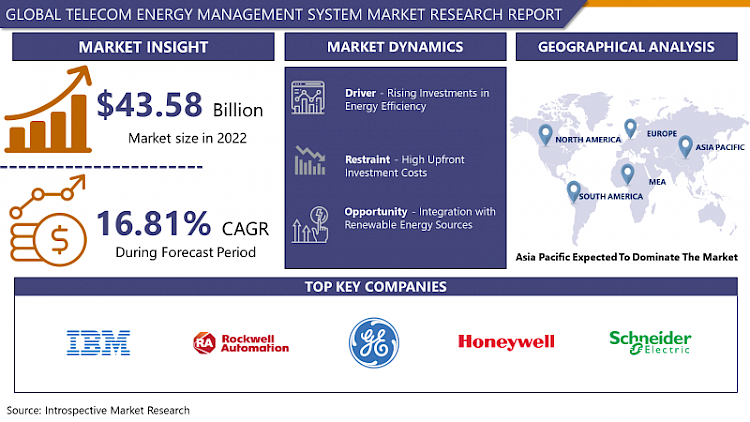

Global Telecom Energy Management System Market Size Was Valued at USD 43.58 Billion in 2022, and is Projected to Reach USD 151.05 Billion by 2030, Growing at a CAGR of 16.81% From 2023-2030

The Telecom Energy Management System (TEMS) is an all-encompassing solution crafted to oversee, regulate, and enhance energy usage within telecommunications infrastructure. Through the integration of cutting-edge monitoring technologies and energy-efficient strategies, TEMS aids telecom operators in mitigating energy expenses, diminishing carbon footprint, and upholding the dependability and eco-friendliness of their networks.

- Telecom Energy Management Systems (TEMS) streamline energy usage within the telecommunications sector by regulating power consumption across network infrastructure, thus lowering costs and environmental impact. These systems encompass applications for monitoring, analyzing, and optimizing energy usage in telecom facilities. By integrating with existing infrastructure, they provide real-time data on energy consumption, facilitating proactive adjustments for efficiency.

- TEMS provides several advantages. They identify and rectify energy wastage, enhancing cost savings. Through predictive analytics, they optimize energy usage, leading to reduced operational expenses. Moreover, TEMS contributes to sustainability efforts by minimizing the carbon footprint of telecom companies. By efficiently managing energy consumption, they assist in meeting environmental regulations and corporate social responsibility goals. Additionally, TEMS improves reliability by ensuring a consistent power supply, reducing downtime, and enhancing network performance.

- The future demand for TEMS is poised for significant growth due to the increasing global reliance on telecommunications and data services. There is escalating demand for energy-efficient infrastructure as telecom companies face pressure to reduce operational costs and environmental impact, thus driving the adoption of TEMS. Furthermore, with the rising prominence of renewable energy sources, TEMS will play a crucial role in integrating these sources into telecom networks efficiently. The market for TEMS is expected to expand rapidly, fueled by the dual imperatives of cost reduction and sustainability within the telecommunications industry.

Telecom Energy Management System Market Trend Analysis

Rising Investments in Energy Efficiency

- The Telecom Energy Management System (TEMS) market experiences significant growth due to increasing investments in energy efficiency. Companies acknowledge the necessity of optimizing energy usage to cut operational costs and reduce environmental impact. Consequently, they allocate substantial resources to implement TEMS solutions, aiming to streamline energy consumption across their telecommunications infrastructure.

- TEMS investments empower telecom companies to enhance cost savings by identifying and rectifying energy wastage. Through proactive monitoring and analysis, TEMS solutions optimize energy usage, resulting in reduced operational expenses. Leveraging predictive analytics, telecom operators make data-driven decisions to boost energy efficiency and decrease overall expenditure.

- Moreover, the emphasis on energy efficiency aligns with broader sustainability objectives, propelling the adoption of TEMS solutions. By minimizing the carbon footprint of telecom operations, TEMS contributes to environmental conservation efforts. This alignment with corporate social responsibility initiatives further encourages telecom companies to invest in TEMS, driving market growth. The increasing investments in energy efficiency highlight the significance of TEMS in the telecommunications sector, catalyzing its continuous expansion.

Integration with Renewable Energy Sources

- The Telecom Energy Management System (TEMS) market stands to benefit greatly from its integration with renewable energy sources. As sustainability gains prominence and companies prioritize reducing carbon footprints, telecom firms are actively seeking ways to incorporate renewable energy into their operations. TEMS solutions are pivotal in this endeavor, offering the essential infrastructure and tools required to efficiently manage and optimize energy usage from renewable sources within telecommunications networks.

- It allows telecom companies to diversify their energy sources, decreasing reliance on conventional, non-renewable sources like fossil fuels. This not only boosts energy security but also aids environmental conservation by curbing greenhouse gas emissions. Secondly, TEMS enables the effective utilization of renewable energy by dynamically adjusting energy consumption based on variables such as weather conditions and energy availability. This optimization maximizes the utilization of renewable energy sources, thereby enhancing sustainability and cost-effectiveness.

- Moreover, aligning with broader industry trends and government initiatives promoting renewable energy adoption, the integration with renewable energy sources is gaining momentum. As renewable energy technologies become more cost-effective and accessible, telecom companies are increasingly investing in renewable energy infrastructure. TEMS solutions facilitate this transition by offering the necessary monitoring, control, and optimization capabilities to manage renewable energy sources alongside traditional grid power effectively. The integration with renewable energy sources presents a significant opportunity for TEMS providers to cater to the rising demand for sustainable energy solutions in the telecommunications sector.

Telecom Energy Management System Market Segment Analysis:

Telecom Energy Management System Market Segmented on the basis of Component and Application.

By Component, Software segment is expected to dominate the market during the forecast period

- The Software segment is poised to lead the expansion of the Telecom Energy Management System (TEMS) market. This expectation stems from the increasing demand for sophisticated software solutions capable of effectively monitoring, analyzing, and optimizing energy usage within telecommunications infrastructure. TEMS software offers a wide range of features, such as real-time data monitoring, predictive analytics, and energy optimization algorithms, empowering telecom companies to efficiently manage their energy consumption and lower operational costs.

- Furthermore, the dominance of the Software segment is driven by the growing adoption of cloud-based TEMS solutions. Cloud-based software provides scalability, flexibility, and accessibility, allowing telecom operators to easily deploy and manage TEMS across their networks. Moreover, the integration of artificial intelligence and machine learning functionalities into TEMS software enhances its predictive analytics and optimization capabilities, driving further market growth. With telecom firms increasingly prioritizing energy efficiency and cost reduction, the demand for advanced TEMS software solutions is expected to rise significantly, cementing the Software segment's dominance in the market.

By Application, Energy Monitoring segment held the largest share of 52.22% in 2022

- The dominance of the Energy Monitoring segment has propelled the growth of the Telecom Energy Management System (TEMS) market, capturing the largest share. This supremacy is attributed to its pivotal role in facilitating effective monitoring and analysis of energy usage for telecom companies. Energy Monitoring solutions offer a comprehensive array of features, including real-time data monitoring, metering, and visualization tools, empowering telecom operators to analyze their energy consumption patterns and identify areas for improvement.

- Moreover, the Energy Monitoring segment's dominance is fueled by the increasing demand for energy-efficient solutions and regulatory compliance requirements. Telecom companies are increasingly investing in advanced monitoring solutions to track energy usage across their networks, aiming to reduce operational costs and minimize environmental impact. Additionally, the integration of Energy Monitoring solutions with other TEMS components, such as analytics and optimization tools, enhances their functionality, providing a holistic approach to energy management. As telecom firms continue to prioritize energy efficiency and sustainability, the Energy Monitoring segment is expected to uphold its leading position in driving the growth of the TEMS market.

Telecom Energy Management System Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to lead the expansion of the Telecom Energy Management System (TEMS) market, emerging as the primary hub for growth. This forecast is rooted in various factors, such as the rapid growth of the telecommunications sector across the region and the increasing emphasis on energy efficiency and sustainability. As the Asia Pacific region undergoes significant economic growth and urbanization, there is a parallel surge in demand for telecom services, necessitating efficient energy management solutions

- Moreover, government initiatives advocating for the adoption of renewable energy and the implementation of energy efficiency measures further propel the growth of the TEMS market in Asia Pacific. Countries within the region are enacting policies and regulations aimed at curbing carbon emissions and enhancing energy efficiency across diverse industries, including telecommunications. Additionally, the presence of key market players and technological advancements in TEMS solutions, particularly in nations like China, Japan, and India, contributes significantly to the Asia Pacific region's dominance in the Telecom Energy Management System market. With telecom companies in Asia Pacific prioritizing energy management and sustainability, the region is poised to sustain its leading position in driving the growth of the TEMS market.

Telecom Energy Management System Market Top Key Players:

- IBM Corporation (U.S.)

- Rockwell Automation, Inc. (U.S.)

- General Electric (U.S.)

- Johnson Controls (U.S.)

- Honeywell International (U.S.)

- Gridpoint (U.S.)

- C3.ai, Inc. (U.S.)

- Vertiv Co. (U.S.)

- Cummins Inc (U.S.)

- Siemens AG (Germany)

- Elster Energy (Germany)

- Eaton (Ireland)

- Schneider Electric SE (France)

- Huawei Technologies Co., Ltd (China), and Other Major Players

Key Industry Developments in the Telecom Energy Management System Market:

- In March 2023, Schneider Electric is constructing a 25,000 m2 smart factory in Dunavesce, Hungary, with a planned investment of EUR 40 million. The facility will increase capacity to meet increased demand as Europe moves towards energy transition and energy independence.

- In December 2023, Johnson Controls the global leader for smart, healthy, and sustainable buildings, announced it was named a leader in energy management software by independent industry analyst firm Verdantix.

|

Global Telecom Energy Management System Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 43.58 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.81% |

Market Size in 2030: |

USD 151.05 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TELECOM ENERGY MANAGEMENT SYSTEM MARKET BY COMPONENT (2017-2030)

- TELECOM ENERGY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SENSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONTROLLERS

- SOFTWARE

- TELECOM ENERGY MANAGEMENT SYSTEM MARKET BY APPLICATION (2017-2030)

- TELECOM ENERGY MANAGEMENT SYSTEM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENERGY MONITORING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REPORTING & ANALYTICS

- POWER OPTIMIZATION

- PREDICTIVE MAINTENANCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Telecom Energy Management System Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IBM CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ROCKWELL AUTOMATION, INC. (U.S.)

- GENERAL ELECTRIC (U.S.)

- JOHNSON CONTROLS (U.S.)

- HONEYWELL INTERNATIONAL (U.S.)

- GRIDPOINT (U.S.)

- C3.AI, INC. (U.S.)

- VERTIV CO. (U.S.)

- CUMMINS INC (U.S.)

- SIEMENS AG (GERMANY)

- ELSTER ENERGY (GERMANY)

- EATON (IRELAND)

- SCHNEIDER ELECTRIC SE (FRANCE)

- HUAWEI TECHNOLOGIES CO., LTD (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL TELECOM ENERGY MANAGEMENT SYSTEM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Telecom Energy Management System Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 43.58 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.81% |

Market Size in 2030: |

USD 151.05 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TELECOM ENERGY MANAGEMENT SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TELECOM ENERGY MANAGEMENT SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TELECOM ENERGY MANAGEMENT SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. TELECOM ENERGY MANAGEMENT SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. TELECOM ENERGY MANAGEMENT SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. TELECOM ENERGY MANAGEMENT SYSTEM MARKET BY TYPE

TABLE 008. SENSORS MARKET OVERVIEW (2016-2028)

TABLE 009. CONTROLLERS MARKET OVERVIEW (2016-2028)

TABLE 010. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. TELECOM ENERGY MANAGEMENT SYSTEM MARKET BY APPLICATION

TABLE 013. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 015. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 018. N TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 021. TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 024. TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 027. TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 030. TELECOM ENERGY MANAGEMENT SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 031. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 032. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 033. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 034. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. SIEMENS: SNAPSHOT

TABLE 035. SIEMENS: BUSINESS PERFORMANCE

TABLE 036. SIEMENS: PRODUCT PORTFOLIO

TABLE 037. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. HONEYWELL INTERNATIONAL: SNAPSHOT

TABLE 038. HONEYWELL INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 039. HONEYWELL INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 040. HONEYWELL INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ELSTER ENERGY: SNAPSHOT

TABLE 041. ELSTER ENERGY: BUSINESS PERFORMANCE

TABLE 042. ELSTER ENERGY: PRODUCT PORTFOLIO

TABLE 043. ELSTER ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. JOHNSON CONTROLS: SNAPSHOT

TABLE 044. JOHNSON CONTROLS: BUSINESS PERFORMANCE

TABLE 045. JOHNSON CONTROLS: PRODUCT PORTFOLIO

TABLE 046. JOHNSON CONTROLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. GRIDPOINT: SNAPSHOT

TABLE 047. GRIDPOINT: BUSINESS PERFORMANCE

TABLE 048. GRIDPOINT: PRODUCT PORTFOLIO

TABLE 049. GRIDPOINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. IBM: SNAPSHOT

TABLE 050. IBM: BUSINESS PERFORMANCE

TABLE 051. IBM: PRODUCT PORTFOLIO

TABLE 052. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. C3 ENERGY: SNAPSHOT

TABLE 053. C3 ENERGY: BUSINESS PERFORMANCE

TABLE 054. C3 ENERGY: PRODUCT PORTFOLIO

TABLE 055. C3 ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. SENSORS MARKET OVERVIEW (2016-2028)

FIGURE 013. CONTROLLERS MARKET OVERVIEW (2016-2028)

FIGURE 014. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 017. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 019. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA TELECOM ENERGY MANAGEMENT SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Telecom Energy Management System Market research report is 2023-2030.

IBM Corporation (U.S.), Rockwell Automation, Inc. (U.S.), General Electric (U.S.), Johnson Controls (U.S.), Honeywell International (U.S.), Gridpoint (U.S.), C3.ai, Inc. (U.S.), Vertiv Co. (U.S.), Cummins Inc (U.S.), Siemens AG (Germany), Elster Energy (Germany), Eaton (Ireland), Schneider Electric SE (France), Huawei Technologies Co., Ltd (China), and Other Major Players.

The Telecom Energy Management System Market is segmented into Component, Application, and region. By Component, the market is categorized into Sensors, Controllers, and Software. By Application, the market is categorized into Energy Monitoring, Reporting & Analytics, Power Optimization, and Predictive Maintenance. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Telecom Energy Management System (TEMS) is an all-encompassing solution crafted to oversee, regulate, and enhance energy usage within telecommunications infrastructure. Through the integration of cutting-edge monitoring technologies and energy-efficient strategies, TEMS aids telecom operators in mitigating energy expenses, diminishing carbon footprint, and upholding the dependability and eco-friendliness of their networks.

Global Telecom Energy Management System Market Size Was Valued at USD 43.58 Billion in 2022, and is Projected to Reach USD 151.05 Billion by 2030, Growing at a CAGR of 16.81% From 2023-2030.